With the four major banks reporting earnings in the past 48 hours, the song that hit the mark for this week’s note is “I’m an Accountant” (by Rocky Paterra). This has been trending on TikTok for several weeks:

I could empathize with this actor – who got tired of answering questions when people asked him “what do you do?” In our business, we say, “portfolio manager or securities analyst” and no one outside of finance knows what the hell we are talking about. I think Rocky got it right by keeping it simple and saying, “I’m an Accountant!”

So before we get thrown off course by the talking heads that say “banks are bad” because the market was down for a couple of days, let’s do some “accountant-like” things and actually look at the facts/numbers. The Cliff’s Notes version is that earnings results for the banks could not have been much better:

| Bank | EPS Actual | EPS Estimate | Revenue Actual | Revenue Estimate |

| JPM | $2.92 | $2.26 | $29.9B | $28.3B |

| C | $1.40 | $.93 | $17.3B | $17.2B |

| WFC | $.42 | $.45 | $18.86B | $17.98B |

| BAC | $.51 | $.49 | $20.45B | $20.8B |

|

Bank |

Credit Reserves Q3 2020 | Credit Reserves Q2 2020 | Book Value per share Q3 2020 | Book Value per share Q3 2019 |

| JPM | $611M | $10.47B | $79.08 | $75.24 |

| C | $314M | $7.9B | $84.48 | $81.02 |

| WFC | $769M | $9.53B | $38.99 | $40.48 |

| BAC | $1.4B | $5.1B | $28.33 | $26.96 |

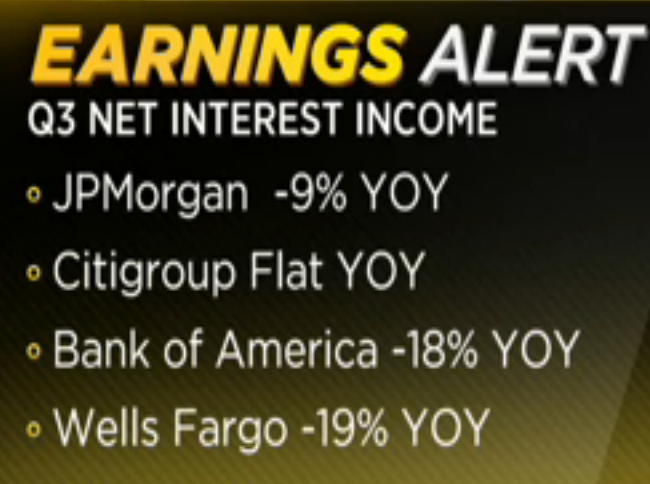

So while earnings and loan provisions largely beat expectations, net interest income remained under pressure. While this will flip overnight when the vaccine (or full treatment) is announced, for now, it is a pain point. No pain, no gain…

(Source: CNBC)

| Bank | Net Interest Margin Q3 2020 |

| JPM | 1.72% |

| C | 2.03% |

| WFC | 2.13% |

| BAC | 1.82% |

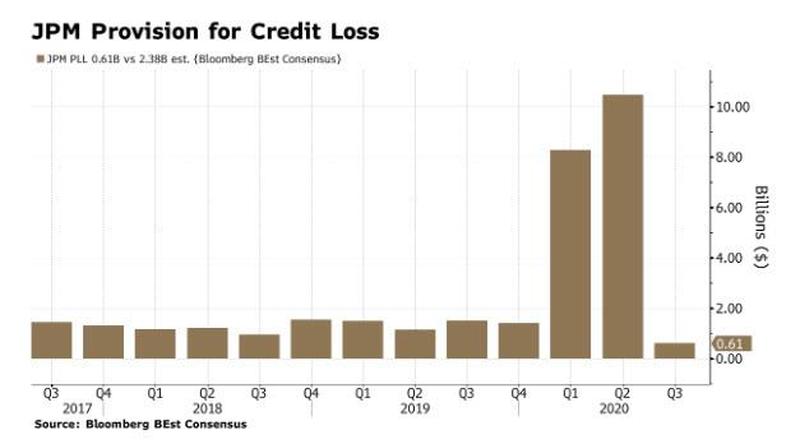

Reserve Releases

JP Morgan

JPM CEO Jamie Dimon said that if things keep improving, the bank was over-reserved by $10 billion: “A good, well-designed stimulus package will simply increase the chance of a better outcome,” he said. “If the better outcomes happen, we are over-reserved by $10bn.”

Citi

Citi CEO Michael Corbat, “Today, we are factoring in a downside scenario that is more adverse relative to our base case. For example, we are incorporating a more significant deterioration in U.S. GDP growth rates, which is now close to 9% lower than our base case in 2021 versus our second quarter outlook that was only 1% lower than the base case.

So all else being equal, if the management adjustment had not changed, we would have seen a reserve release of roughly $500 million in the quarter. Looking at the level of reserves we hold today, we believe that we’re well prepared for expected credit losses, having reserved for something worse than our base case. And given the lifetime nature of the CECL methodology and the conservative nature of our management adjustment, it is now more likely than not that we’ll see reserve releases and our ACL come down in 2021 to offset future losses as we continue to progress through the crisis, assuming our base case holds.”

Wells Fargo

“Over the long-term, (WFC CEO Scharf said) annual expenses can be $10 billion dollars lower, but pandemic-related costs like cleaning fees for enhanced technology systems have so far kept the bank from making meaningful progress in the short term.

Strong mortgage banking fees, higher equity markets, and declining sequential charge-offs positively impacted our results, while historically low interest rates reduced our net interest income and our expenses continued to remain elevated,” Scharf said.

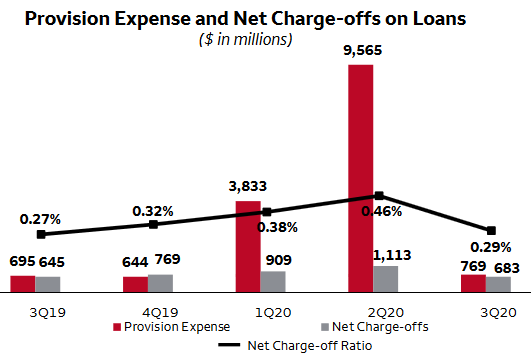

Bank of America

“Our consumer business earned $2.1 billion, as asset quality remained sound and spending rebounded,” BAC CEO Brian Moynihan said.

The bank set aside $1.4 billion to cover for credit losses in the third quarter, up from $0.8 billion last year, but below the $5.1 billion it put aside in the second quarter.

On the Wells Fargo $1.95T Asset Cap

On Wednesday afternoon (after earnings), Wilfred Frost of CNBC asked the key question of outgoing WFC CFO – John Shrewsberry, “When will the asset cap be lifted?” Here’s what he had to say:

- I didn’t expect it (the Asset Cap) to last this long but…

- Very Constructive engagement with the regulators.

- Everything that needs to be done is being done.

- My sense is that the company will work through it.

- It’s a different team today operating across the board on the issues that have to be improved for the asset cap to go away. (than when the aggressive practices were taking place)

OF NOTE: Shrewsberry – who just finished his last earnings call with the company today – was the last executive still around who was employed by WFC during the scandal. With his departure, there seems to be little logical argument to keep the asset cap in place.

On Wednesday morning (after earnings), Melissa Lee and David Faber of CNBC, talked to former WFC CEO – Richard Kovacevich. Here’s what he had to say:

- They (WFC) are working primarily on fixing the issues they have with the Federal Reserve (to remove the Asset Cap).

- I still am a shareholder. I think the turnaround will come.

- Net Interest Margin may have reached bottom here.

- VACCINE is the MOST IMPORTANT CATALYST for Bank Stocks as CERTAINTY = ECONOMIC TURNAROUND = MORE EMPLOYMENT = LOAN GROWTH.

- CECL (from FASB) – accounting change that requires banks to take 100% of expected losses as reserves UP FRONT, “absolutely makes no sense, increases the cyclicality of the banking industry (rather than reducing it). FASB making a very big mistake by forcing CECL accounting change on the banks, at any time, but particularly at this time of uncertainty.”

Richard makes an important point about the accounting change (CECL) that we’ve been talking about since this summer. This accounting change was particularly harmful to earnings in Q2 (less so in Q3). It reminds me of the last mistake that FASB made by voting in “mark to market” accounting rule FAS 157 in November 15, 2007.

FAS 157 destroyed the banks (and economy) over the next 12 months. Miraculously, the banks recovered overnight in Q1 of 2009 when the Financial Accounting Standards Board (FASB) voted on and approved new guidelines that would allow for the valuation to be based on a price that would be received in an orderly market rather than a forced liquidation, starting during the first quarter of 2009.

So, one could argue with great evidence that a FASB accounting change was instrumental in CAUSING the great financial crisis of 2008, and also instrumental in reversing it in Q1 2009 when they reversed their mistake.

PERHAPS, FASB should wake up, reverse their mistake with CECL and let $20-$30B of excess reserves come back to the “big 4 banks” as earnings RIGHT NOW versus prolonging another crisis that their accounting change helped to create.

What has Changed?

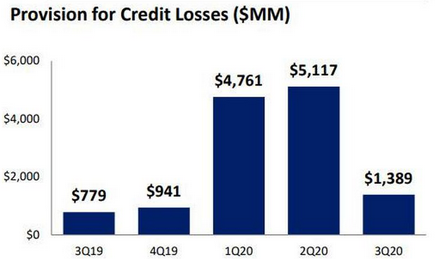

So what has changed between this week and last week as it relates to the Wells Fargo thesis? They not only beat on revenues, but took less credit reserves than even our most optimistic projections:

The Fleetwood Mac “Dreams” Stock Market (and Sentiment Results)…

The yield curve continues to steepen in a direction that historically presages a strong recovery for the Financials:

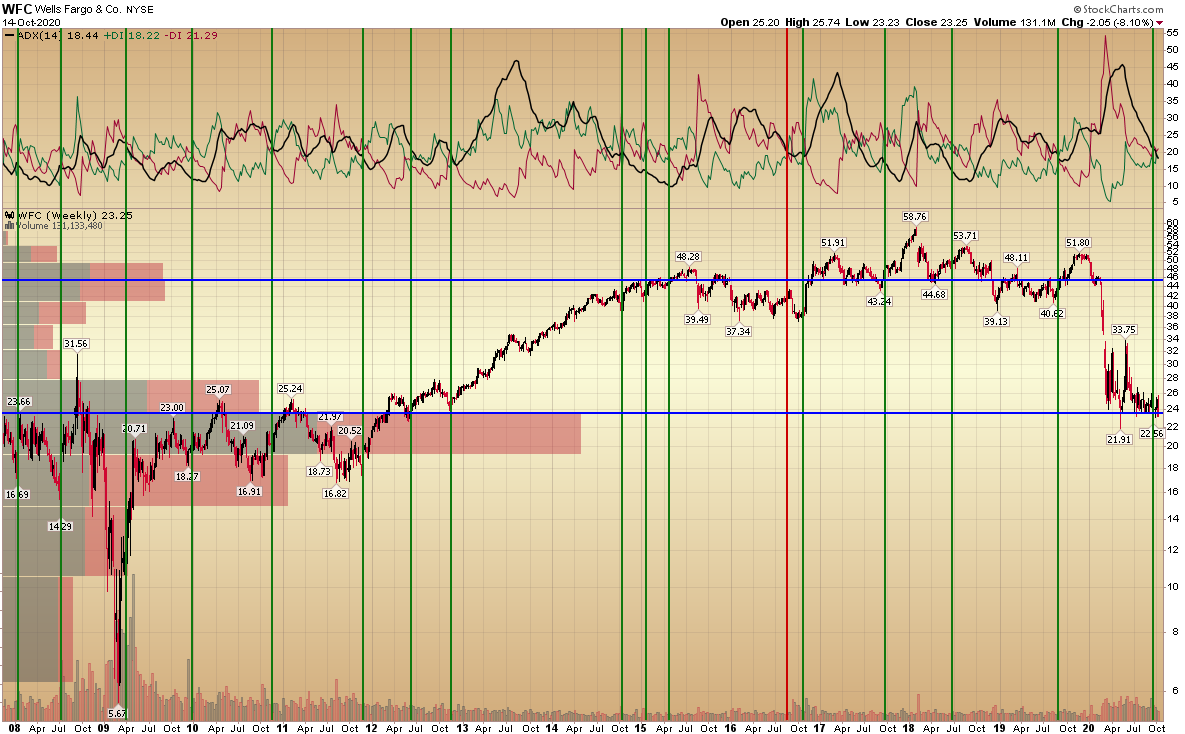

The long term outlook is still holding at support:

The Cobra Kai, “Sweep the Leg” low is still holding:

The Cobra Kai “Sweep The Leg” Stock Market (and Sentiment Results)…

Final Thoughts on Banks:

- 60% of the first stimulus checks were used for savings or paying down Debt (according to NBER study). This directly helped consumers and banks. IF there is a second check, it will directly effect banks. $300B in checks => ~$180B in deposits and debt reduction + reserve releases/earnings.

- Reserve Requirement for banks was reduced from 10% to ZERO this Spring. Banks now have EVERY incentive to make as many loans to “main street” as possible.

- Fed has backstopped the credit markets as a buyer of corporate bonds. This helps companies refinance.

- TENS of BILLIONS of loan loss reserves will be coming back to banks (as earnings) in coming quarters as the economy continues to recover. This is NOT priced in. Betting against banks is betting against science.

- Wells Fargo alone has $20B in loan loss reserves, most of which will come back to the bottom line over the next 4-8 quarters. As former WFC CEO – Richard Kovacevich said, the VACCINE is the CATALYST for everything.

- As Warren Buffett always says, “In the short term the market is a ‘voting machine,’ but in the long term it is a ‘weighing machine.'” Emotional investors/traders may be voting against the inevitable turnaround in the “short term,” but in the “long term,” Wells Fargo will be back bigger, better and stronger than ever.

- The same folks selling the bottom in despair today, will be buying the it up 75-100%+ in euphoria – a year or two from now (or sooner).

GLOBAL FUND MANAGER SURVEY

On Tuesday we put out our summary of the monthly Bank of America “Global Fund Manager” Survey. Over 200 managers running >$600B AUM participated in October. You can review it here:

October Bank of America Global Fund Manager Survey Results (Summary)

Here were the key takeaways:

- Cyclical rotation that began in September and paused in early October is set to resume in Q4. (Banks and Energy will participate and lead) BofA: Michael Hartnett

- A net 39% of investors expect a credible Covid-19 vaccine to be announced in the first quarter.

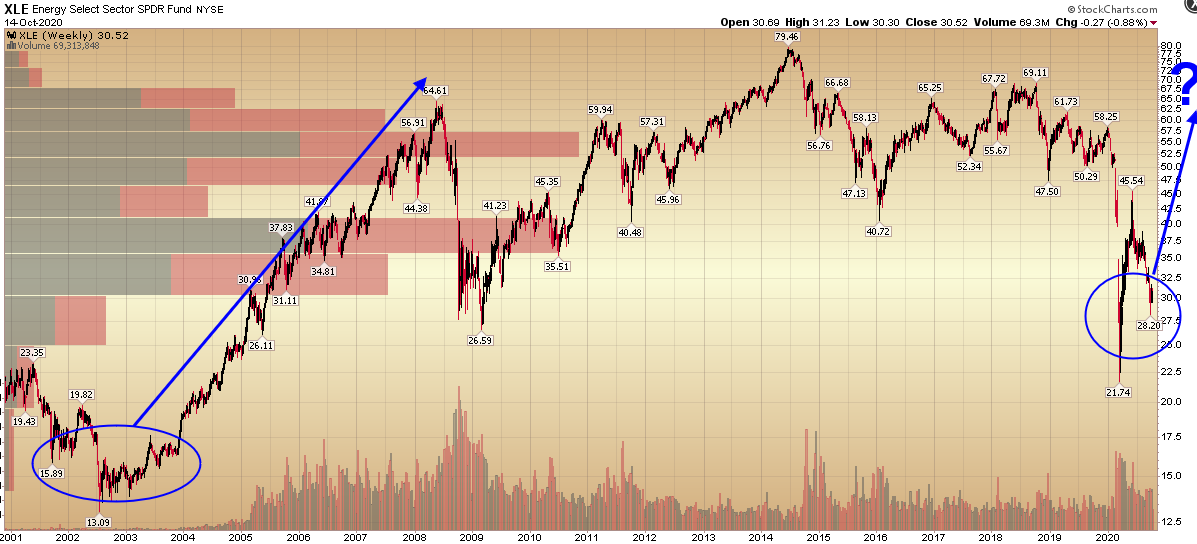

- Current Max Despair (before turn): Energy and Banks.

- Investors lowered their cash levels from 4.8% to 4.4%. When cash levels are above 5%, it indicates “fear” and when levels are below 4%, it indicates “greed.”

- Extremes: Largest short in energy in 20 years. Here’s what happened NEXT:

Now onto the shorter term view for the General Market:

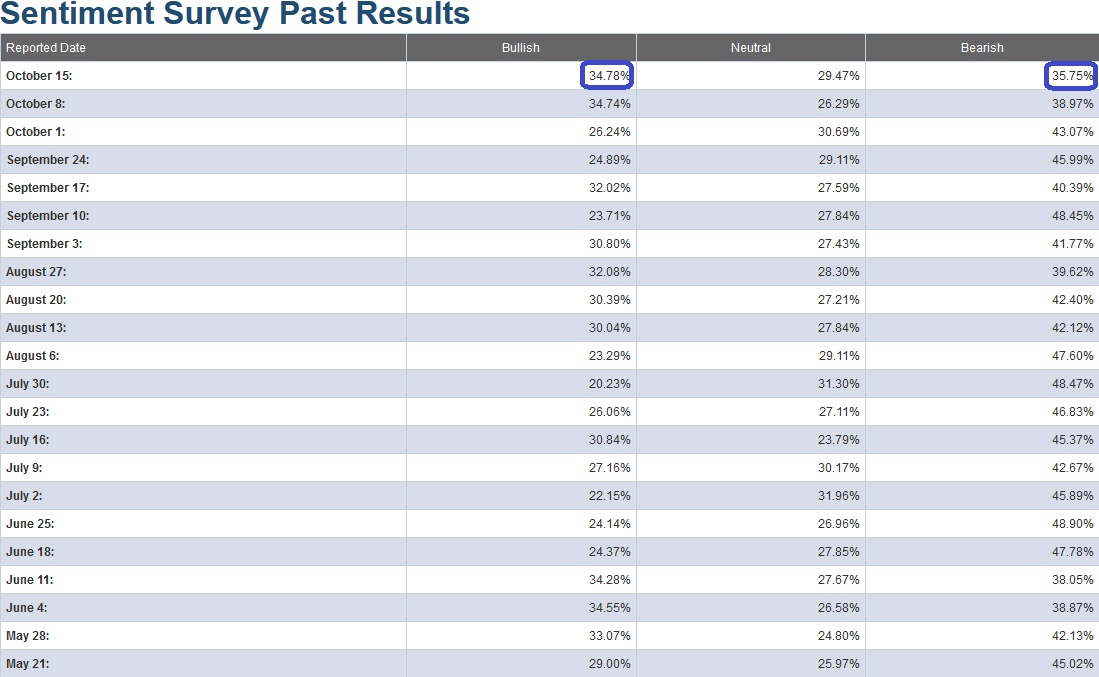

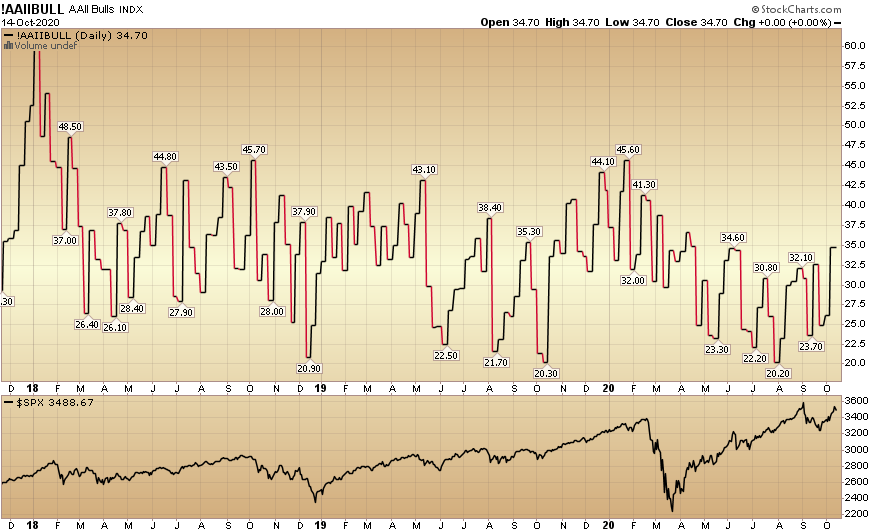

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) flat-lined to 34.78% from 34.74% last week. Bearish Percent fell to 35.75% from 38.97% last week. Enthusiasm is modestly present, but we have some rock to climb before hitting euphoria.

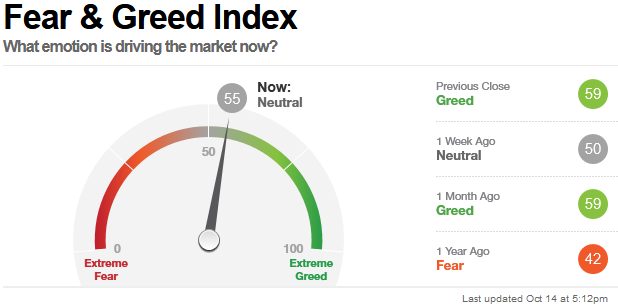

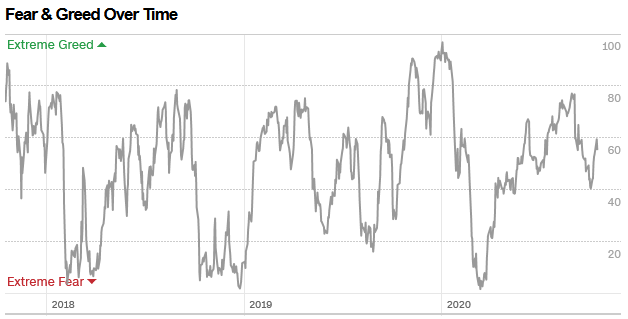

The CNN “Fear and Greed” Index ticked up from 51 last week to 55 this week. This indicator is still in the middle of the range. You can learn how this indicator is calculated and how it works here: (Video Explanation)

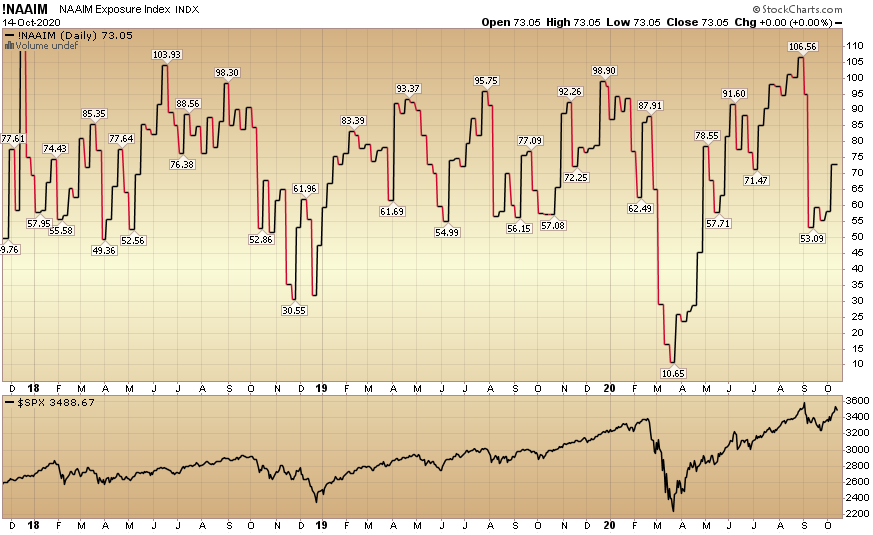

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped up from 58.25% equity exposure last week, to 73.05% this week.

Our message for this week:

As I have repeated for over a month, the catalyst for change (a continuation of the move into Cyclicals) will likely come from science at this point. Don’t bet against science.

As we saw last week – with President Trump’s record speed recovery from COVID – we could wake up any given morning with an announcement on full treatments, or a vaccine, and the game changes overnight.

In the mean time, we got a couple of short-term delays on the Lily and JNJ treatment/vaccine this week. The market doesn’t like that Congress failed miserably to get something done on the stimulus front. And finally, the election outlook and implications change daily. Expect more short term volatility.

As I’ve covered for the past two weeks, the “Stimulus Package” was nothing but a slow walk exercise to run down the clock into the Election.

Keep on alert for some possible unilateral action by President Trump. There is well over $300B (approved by Congress and unspent from the first CARES Act) that he may very well release to individuals and businesses in coming days. There is ample precedent and widespread public support to do so – as many people are still in need due to COVID: (Duke Law)

In the mean time, we are adding marginally to our core bank positions and selectively picking up highest quality energy names on weakness – with a 12 to 36 month view… Why? Because we did “the accounting” and the numbers make sense with a reasonable time horizon and a strong gut…