Data Source: Bank of America

Each month, Bank of America conducts a survey of ~200 fund managers with ~$600B AUM. Here are the key takeaways from the survey published on May 19, 2020:

OUTLOOK:

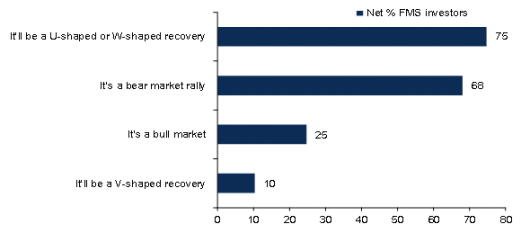

- Managers are worried that stocks are in a ‘bear market rally’ that could fade quickly in the face of a second wave of coronavirus infections.

- Managers still see the near-term “pain trade” – or the one that hurts the most market participants – is the market going higher from here.

- 68% of respondents said the current upturn is a ‘bear market rally” that is unlikely to hold.

- 10% beleive this is a V-shaped recovery.

- 75% beleive this is a U-shaped or W-shaped recovery.

- A net 38% of fund managers predicting the world economy will strengthen over the next 12 months.

- Most investors betting that global PMI data won’t reach the 50 (level that contraction flips to expansion) until November.

- Net 23% of investors believe ‘value’ will underperform ‘growth.” (last time this many FMS investors expected value to underperform growth was in December 2007)

- In a post Covid-19 world, investors say the biggest structural shift will be supply chain reshoring. (68%)

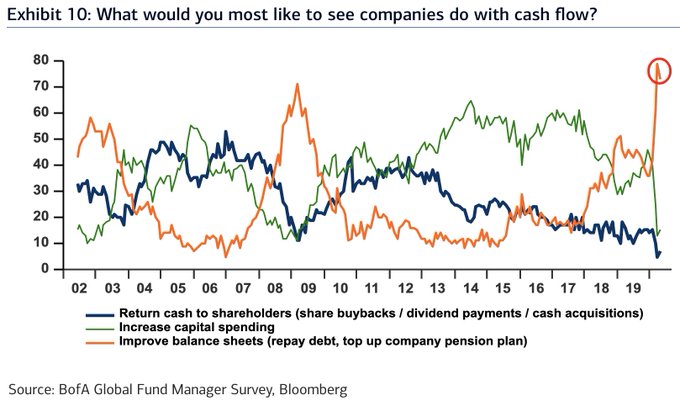

- Net 73 per cent of respondants want corporations to spend cash on improving their balance sheets, slightly down from last month but still above March 2009 levels. (net 73%)

- 15% want an increase in capex.

- 7% want cash to be returned to shareholders.

- 17% believe the Euro is undervalued.

- 43% believe the US dollar is overvalued.

SENTIMENT:

- BofA’s Bull & Bear Indicator is still pinned at zero (a contrary buy signal).

- The level of pessimism, BofA said, was the highest since December 2007.

- U.S. recovery is unlikely without a workable coronavirus vaccine.

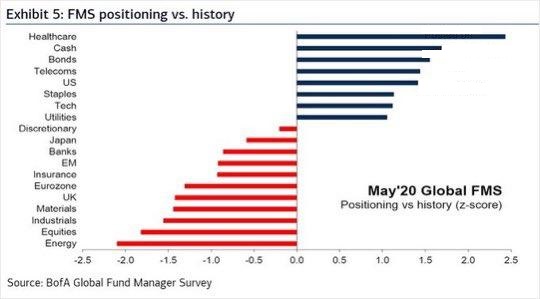

POSITIONING:

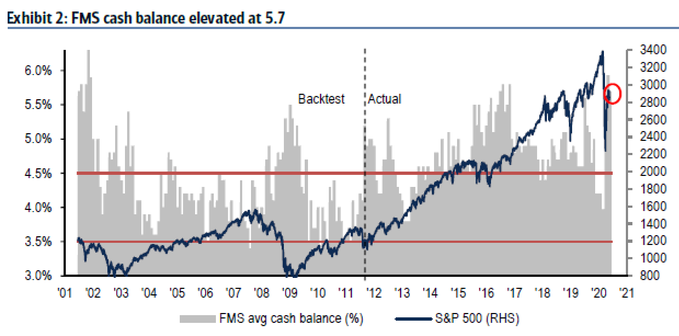

- Fund mangers are still heavy in cash (5.7% or total assets vs. 5.9% last month).

- Cash levels remain well above the 10-year average of 4.7% (contrarian buy signal).

- Bond allocation was the highest since July 2009.

- Holding record longs in healthcare stocks.

- Exposure to equities in May rose 10% to a net 16% underweight after hitting the lowest level since 2009 in April.

- Exposure to US equities remains overweight at net 24%.

- UK is the most underweight region at net 33% underweight.

- Eurozone equities are underweight (net 17%) – their lowest allocation since July 2012.

- Investors are short emerging markets for the first time since September 2018.

- Managers see value stocks as the worst group in the current climate. A net 23% expect the group to outperform their growth counterparts, the lowest level since December 2007.

- Investors are underweight cyclical assets (energy, industrials, Europe).

- Investors are overweight defensive assets (health care, cash, bonds).

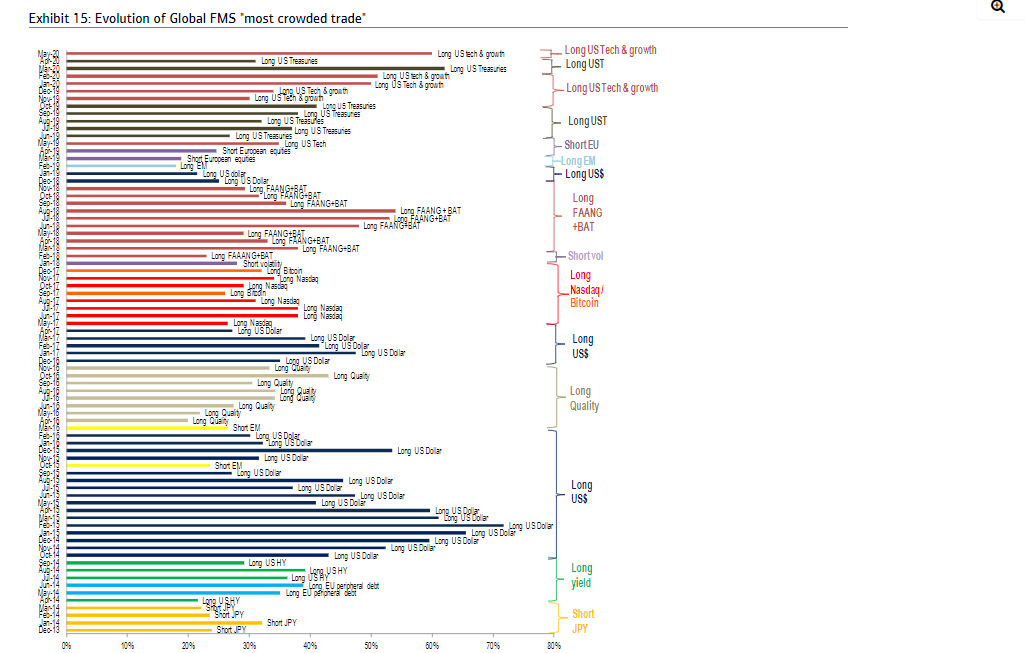

MOST CROWDED TRADE:

- U.S. tech and growth stocks.

BIGGEST TAIL RISKS:

1. Second wave of coronavirus in major world economies this year. (52%)

2. Permanently high unemployment. (15%)

3. Break-up of the European Union (11%)

UPSIDE CATALYSTS:

- Vaccine breakthrough would lead to “V” shaped recovery.

TOP STRUCTURAL CHANGES EXPECTED (Post-Covid World)

- Supply Chain Reshoring (68%)

- Rising protectionism. (44%)

- Higher Taxation. (42%)

- Modern Monetary Theory (24%)

- Other Possibilities: Debt exemptions, green energy, stagflation and universal basic income.