I was doing my normal stock, earnings and sector research over the weekend and I came across this Exploration and Production Sector chart XOP (above). The 2007-2009 financial crisis was a “once in a generation” collapse similar to 1973-1974 and prior to that the Great Depression. The implication of this sector trading at 2009 levels today – is that Oil and Gas Exploration and Production stocks are “snake oil” as defined by Dictionary.com as: a product of little real worth or value that is promoted as the solution to a problem.

What problem does Oil & Gas solve? At present, oil and gas is to the global economy what blood and oxygen is to your heart. You shut off all of the spigots tomorrow and we immediately go into the dark ages (so there is real present value there). We can debate how long that will be the case moving forward, but we’ve basically doubled demand from 50 mb/day to 100 mb/day in the last fifty years.

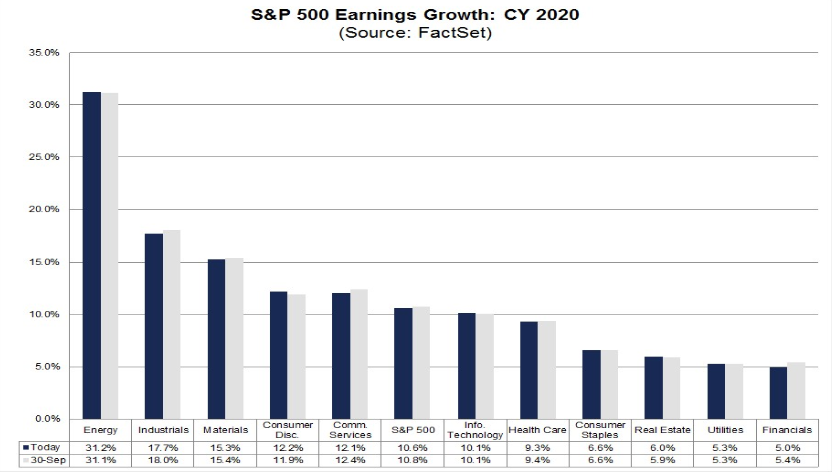

While it is common to see individual businesses trade down to crisis levels due to mismanagement, a deteriorating product or change in consumer preferences, it is uncommon to see a full sector trade down to “Depression Era” levels while the general economy is relatively strong (GDP ~2%, Employment Strong, 2020 EPS estimates still above +10.5% growth).

For a number of factors, portfolio managers won’t touch these stocks: environmental, sustainability, political, fundamental, de minimis weighting in S&P 500, etc – and maybe the most important reason of all – THEY ARE NOT WORKING RIGHT NOW. You would be amazed how quickly that sentiment can change once they start to run (politics be damned). But why would they run?

At the end of the day, we buy a business (or a piece of a business) for the cash we think it can return to us at some point in the future. If we think the business will grow fast we will pay more (higher multiple) for the future cash today, if we think it will grow at a modest pace – we will pay less (lower multiple).

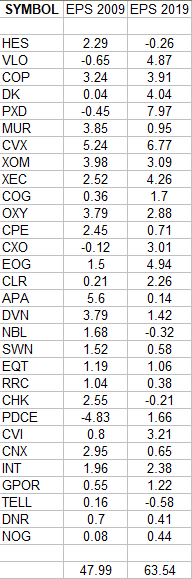

Secretary Mnuchin made an offhand comment at his press conference this week that, “the market is always right.” I figured I would take a look at the math and see if the market was in fact correct in this situation. Below are the top 30 weighted components of the XOP ETF (Exploration and Production) which have earnings comps from 2009:

So while the earnings growth of these 30 stocks has been anemic over this period (2009-2019), the cumulative earnings power of the top 30 weighted holdings in 2019 is 32.4% greater in 2019 than it was in 2009. Yet the price for this instrument traded as low as $20.74 during the financial crisis and as low as $20.38 this month. In other words, the top current weightings of XOP have 32.4% greater earnings power today than they did collectively in 2009.

The impetus for this article was a review of 2020 earnings estimates (which are still holding at +10.6% for 2020 – as of Friday). The consensus expectation is that Energy will lead the earnings recovery in 2020 with 31.2% earnings growth (see table below). So while you have 32.4% growth from 2009, but no effective change in price – add ~30%+ more of potential earnings power in 2020 – and yet this instrument is still trading at the “Depression Era” level price of 2009. It would be one thing if price was subdued with negative -30% EPS estimates for 2020, but when the opposite is true, you have to take a second look.

The most pessimistic sub-sector of the E&P stocks is Natural Gas. Billionaire owner of the Dallas Cowboys (Jerry Jones) recently made a $1.5B bet on the natural gas sector. He did the same thing in the 80’s when the E&P sector was out of favor. That’s how he made his stake to buy the Cowboys in the early 90’s.

Jerry Jones likens natural gas deal to Dallas Cowboys buy

To me it looks like the only snake oil being sold is the pessimism that this sector will never recover. While the consensus chases windmills (and renewables) like Don Quixote, these companies will continue to meet rising global demand for the lifeblood of our economy. Does that energy mix shift over time? Yes. Does it change overnight? Absolutely not…