Yesterday we heard from Chair Powell. His sole mission is to land the plane (unwind emergency policy) with no casualties, and he is well on track to do so. He’s the “Sully” of monetary policy:

Wikipedia, “On January 15, 2009, US Airways Flight 1549, an Airbus A320 on a flight from New York City’s LaGuardia Airport to Charlotte, North Carolina, struck a flock of birds shortly after take-off, losing all engine power. Unable to reach any airport for an emergency landing due to their low altitude, pilots Chesley “Sully” Sullenberger and Jeffrey Skiles glided the plane to a ditching in the Hudson River off Midtown Manhattan. All 155 people on board were rescued by nearby boats, with a few serious injuries.“

As anticipated, the weak jobs report and lighter than estimated inflation numbers (coupled with Delta) gave the Fed cover to punt the decision to November. Chair Powell stated in the press conference that the hurdle of “Substantial Further Progress” has been met on inflation, but has not been met on employment. He would need to see a “decent” employment report to make the move. The problem is the only one he will see before the November 2 meeting is the September jobs report. Due to the impact of Delta on confidence in the first half of September, this report MAY not meet his bar of “decent” OR “substantial further progress” as it relates to employment. Hence, they may punt to Dec 14-15 and implement in Q1 2022 (which has been our base case for some time).

On Friday I was on Fox Business – The Claman Countdown – with Liz Claman. Thanks to Liz and Ellie Terrett for having me on:

In this segment I made the case that any near term pullback should be limited to 3-5%. That has held true so far. Here were the key points from my show notes for the segment:

-When everyone’s looking for the same massive correction (10-20%) is usually when it doesn’t come. The stock market is designed to fool most of the people, most of the time. We think any pullbacks are contained to 3-5% at this stage until the Fed starts to take the punchbowl away early next year.

-Fed taper implementation announcement likely off table for next week as jobs report was weak and inflation came in lighter than estimates. However, they may signal that they are looking to Nov.

–10yr Treasury yield will climb into year-end in anticipation of taper as it did in 2013. Bernanke talked taper in May 2013 and announced implementation in December. 10yr yield went from 1.62% to ~3% in 7 months and PEAKED when they actually IMPLEMENTED it (sell the rumor, buy the news – bonds).

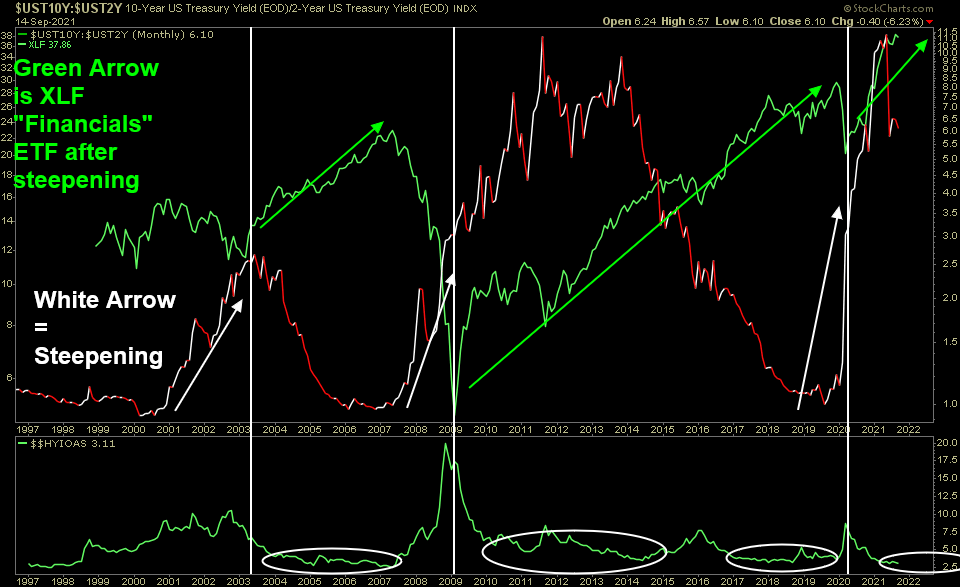

–Rising rates into year-end favors a move BACK to the re-opening trade. The ratio of Value to Growth performance is at an extreme low last seen right before the election (growth currently outperforming due to low 10-yr yield/Delta fears over summer).

-What happened after it (Value:Growth) hit this level last October was the one of the BIGGEST out-performance periods for Value over Growth in history (Oct 2020 – May 2021). 10yr yield went from .76% to 1.73% in 5 months.

-We think the setup is similar and next week’s Fed rhetoric may be the catalyst. As such it’s time to trim some profits on Growth/Tech/Stay-At-Home, and increase exposure to Value, Cyclicals, Re-Opening as long-duration (tech) earnings become less valuable as rates rise.

-Two re-open plays we are looking to as Global Covid cases have started to come down are Cruises (CCL, NCLH) and Airlines (UAL, LUV).

Yesterday I was on Kitco News with David Lin. Thanks to David for having me on. This segment was taken right after the Fed announcement and press conference and goes into very comprehensive analysis on the Fed move, implications on the stock market – as well as updates on the China Evergrande developments.

In this segment I referenced the following tables and charts:

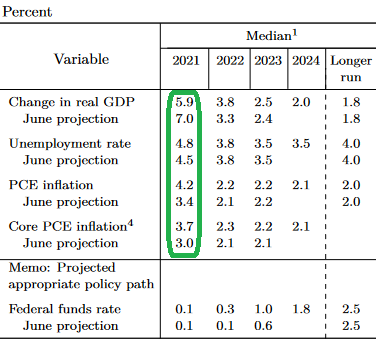

Fed Projections

Fed Projections

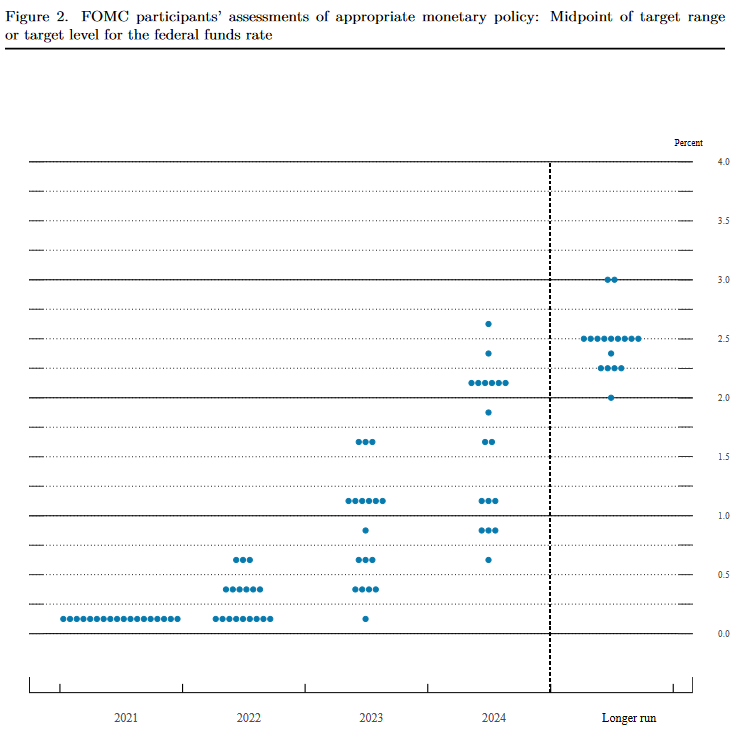

Dot Plot

Dot Plot

Here are the key points from my show notes:

Here are the key points from my show notes:

FED:

–Jobs Report and Inflation numbers gave Fed cover to punt to Nov.

–Full Employment is top priority. Unemployment 5.2% now versus 3.5% (pre-pandemic). 8.4M people unemployed now vs. 5.7M (pre-pandemic)

–Rate Rises separate – likely early 2023.

-Fed Policy still immensely accommodative (after taper) – Dec-July = $660B > QE2.

-Powell counting on supply chain bottlenecks to ease and supply of labor to return.

Our sanguine view has not changed. Here’s why:

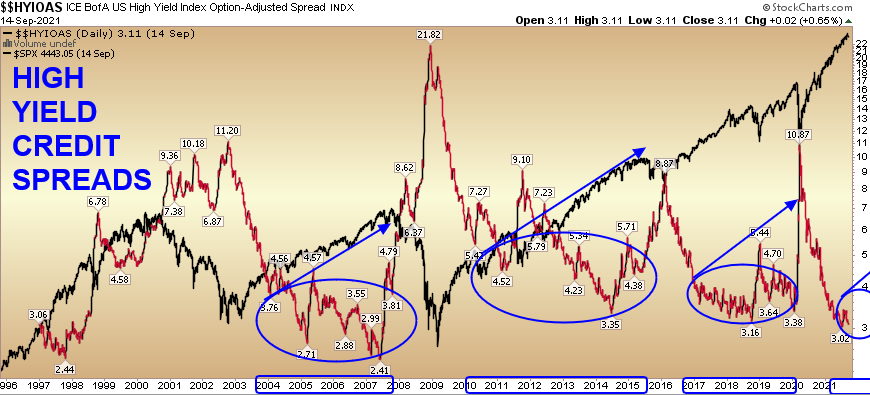

- High Yield Credit Spread contraction in EARLY DAYS: Debunking the idea that we are “due” for a 10-20% correction because of “valuations” (i.e. you don’t get a bear market [20% correction] without a recession, and you don’t get a recession without a yield curve inversion and a choke off of credit). While credit spreads are very compressed and credit conditions are as good as they’ve ever been, the loose conditions tend to persist for multiple years before blowing out once again. We are around one year into the credit cycle.

- CORPORATE BUYBACK ANNOUNCEMENTS: ~$760B already.

- Unyielding Liquidity: Assuming the Fed Announced a $15B Taper (per month) in November – to commence in December (I happen to think it will be punted until Q1 2022), it would still take until July 2022 to unwind the program, and over that period, ~$450B of additional liquidity would be pumped into the system (over and above the ~$4.2T pumped in since the pandemic). That figure excludes another ~$200-300B of principal and interest reinvestment (Total ~$650B)

- ~$4.5T in Money Market Funds (currently losing purchasing power on a daily basis due to inflation) – compares to $3T pre-pandemic.

- 2022 S&P 500 Earnings Estimates still too low. Just a hand full of months ago 2022 estimates were at ~$200. Today they are near $220. Considering where we are in the CAPEX cycle and Inventory Restocking, we think estimates can move up to ~$230 before the end of the year.

- Global Delta Cases rolling over with over 6B vaccines delivered so far.

- Travel holding up despite Delta, huge pent-up demand (for both leisure AND business) as case count continues to subside.

- Rotation: IF we follow the same pattern leading up to the taper implementation as we did in 2013, the 10-yr yield should approach ~2% by Q1 2022 – even if we have some short term fits and starts. This is supportive of those “re-opening” sectors that have taken a breather since Q2 (small-caps, emerging markets/commodities, value/cyclicals). Because of their (cyclicals, value, re-opening stocks) relative underweight in the general indices (to tech), we could see violent upside rallies in many stocks that have seen “summer swoons” (down ~20-30%) even without the general indices doing much. Mid-single digit gains for the general indices through year-end would be realistic, but some (re-opening) stocks that fell 20-30% from June-September due to delta could be up 20,30,40 and even 50%+ before year-end.

EVERGRANDE: Slow motion train wreck – stock down 90% in 14 months. MSCI China index has a 30-40% correction every 3-4 years (currently at ~33%)

– (Asia Markets) Deal that will see China Evergrande restructured into three separate entities is currently being finalized by the Chinese Communist Party and could be announced within days.

– State-owned enterprises will underpin the restructure, effectively transforming the property developer into a state-owned enterprise.

– The deal is being designed to protect Chinese nationals who have bought apartments from Evergrande, like the ones you see protesting on the streets and also those who have invested in Evergrande’s wealth management products.

– Thursday (September 23) deadline looms for a $83.5 million interest payment on a 5-year, USD denominated Evergrande bond. The bond’s initial issue size was around $2 billion.

– Evergrande also has to pay a $35.8 million coupon payment for a Shenzhen-traded 5.8% Sept 2025 bond. The company’s Hengda Real Estate unit has today said it will make that payment, but not word thus far on the USD bond commitments.

– Those exposed to Evergrande’s USD bonds and Evergrande shareholders are likely to be hardest hit by the China Evergrande deal.

– $850M in coupons due this year.

–Chinese Central Bank: 1) injected $14B into system overnight 2) Kept 1 and 5yr Loan Prime Rates steady 3) expected to initiate rate cut/easing next month.

Now onto the shorter term view for the General Market:

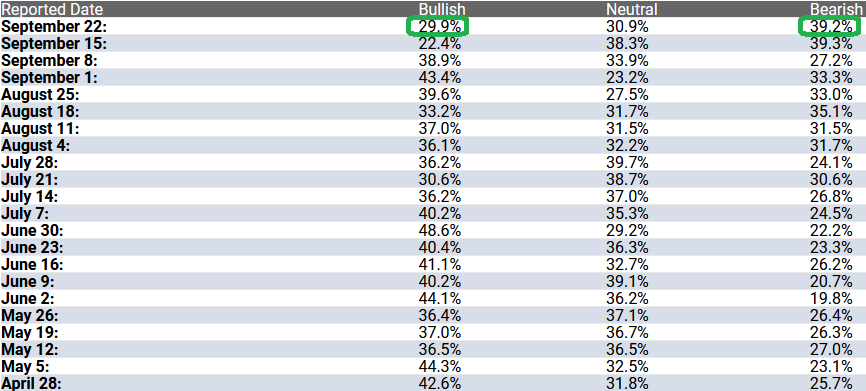

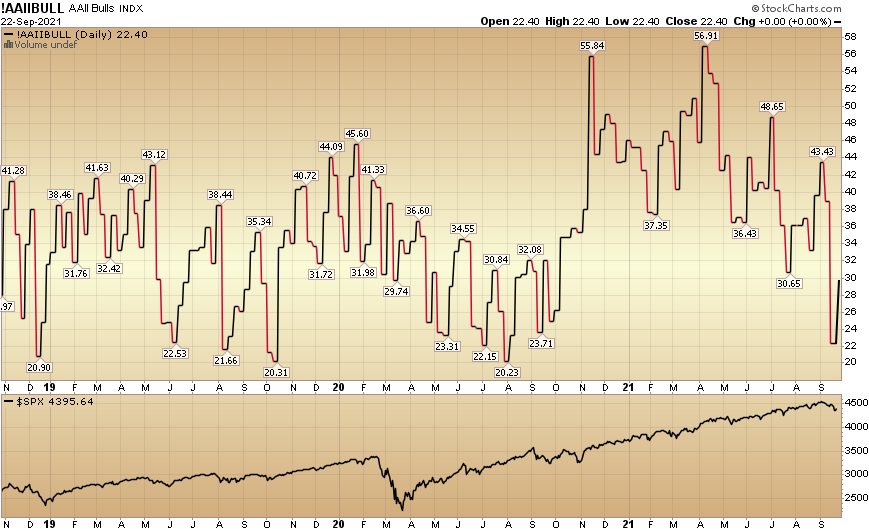

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) bounced off the lows to 29.9% this week from 22.4% last week. Bearish Percent flat-lined to 39.2% from 39.3% last week. Fear is still present at the retail level.

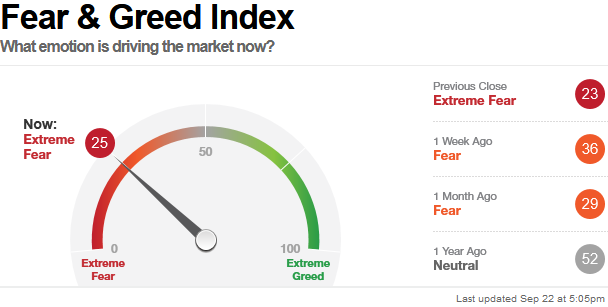

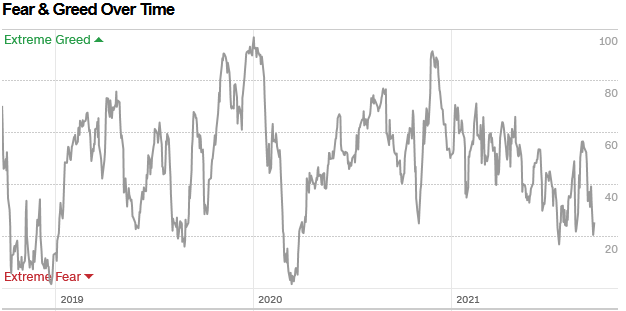

The CNN “Fear and Greed” Index declined from 38 last week to 25 this week. Fear is at/near an extreme. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” Index declined from 38 last week to 25 this week. Fear is at/near an extreme. You can learn how this indicator is calculated and how it works here: (Video Explanation)

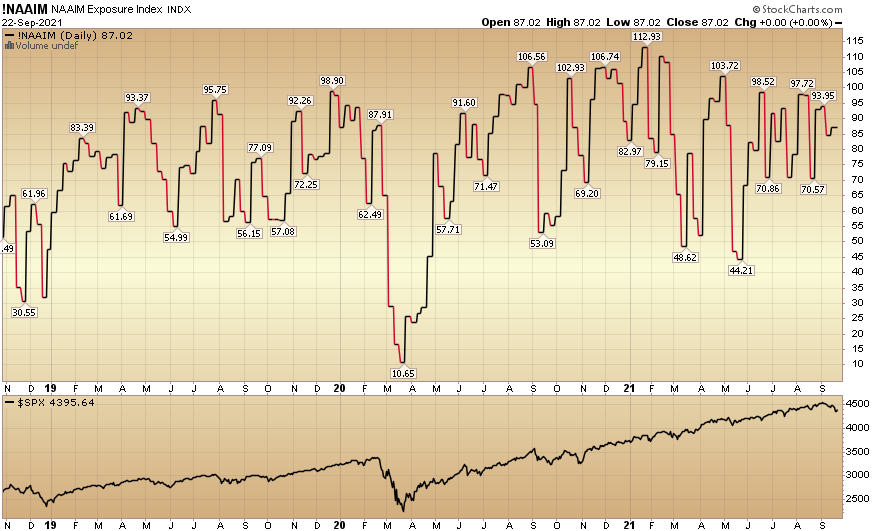

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 87.02% this week from 84.68% equity exposure last week.

As we said in previous notes, while everyone debated whether we were going to have a “September Swoon” or not, we took a step back and looked for sectors/stocks that have already had a “Summer Swoon” and bought (or added to) the quality stocks that were on sale. We’ll review some of them in this week’s podcast|videocast.

Chair Powell is attempting to orchestrate a “perfect landing” like Sully. So far his skillful telegraphing is laying the groundwork for a successful approach. Time will tell if he can pull it off, but so far, so good…