~204 Managers overseeing ~$614B AUM responded to this month’s BofA survey.

OUTLOOK:

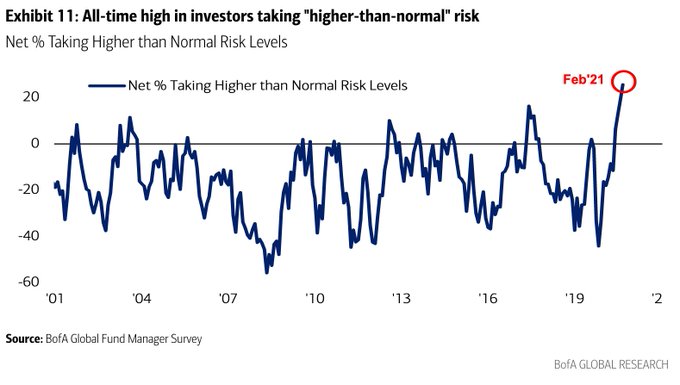

-A record net 25% of investors surveyed by the BofA this month are taking higher-than-normal risks.

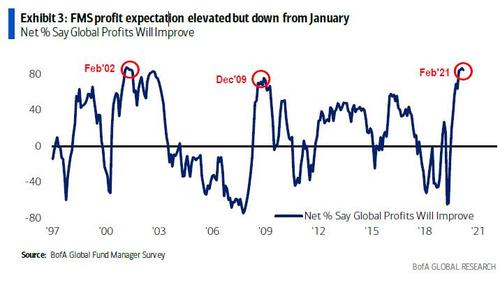

-84% of fund managers expecting global corporate profits to improve over the next 12 months.

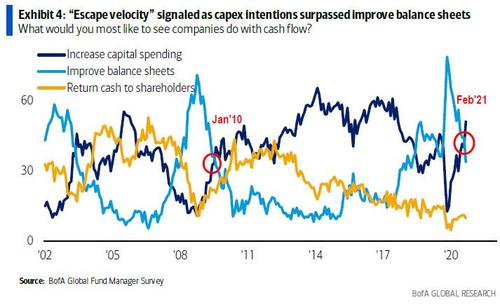

-For the first time in a year, investors say companies should focus on CAPEX spending over improving their balance sheets (first time since Jan 2020).

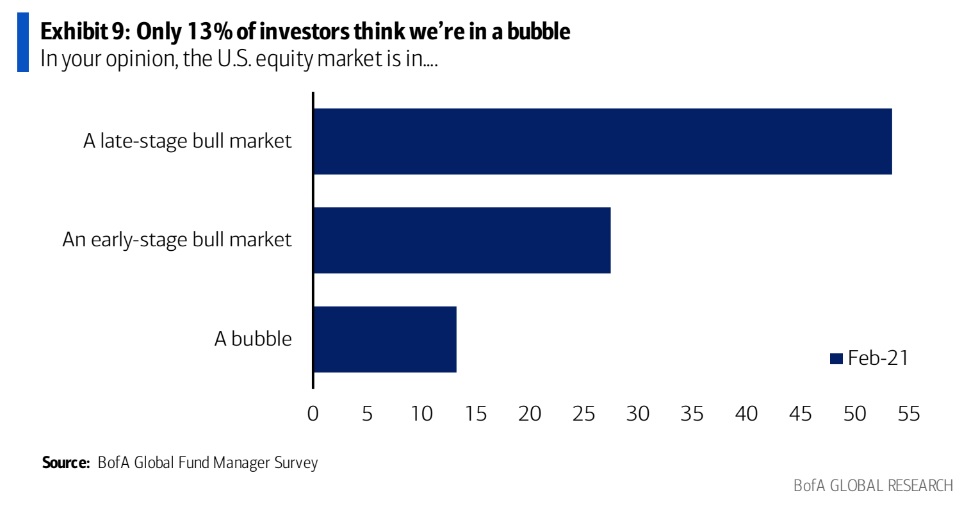

-27% see this as an early-stage bull market.

-53% see this as late-stage bull market.

-91% expect stronger economy in 2021 (highest ever).

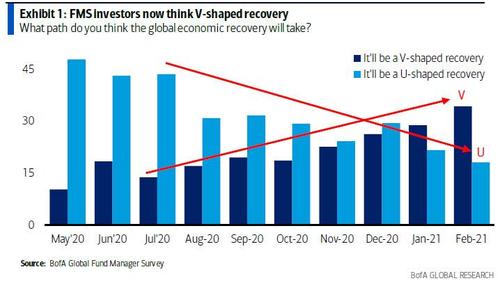

-V-shaped recovery is finally consensus view.

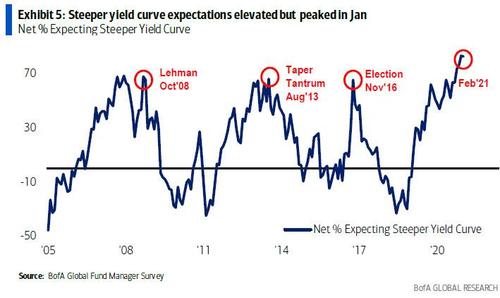

– CPI (inflation), EPS (earnings) & yield curve expectations all close to record highs.

SENTIMENT:

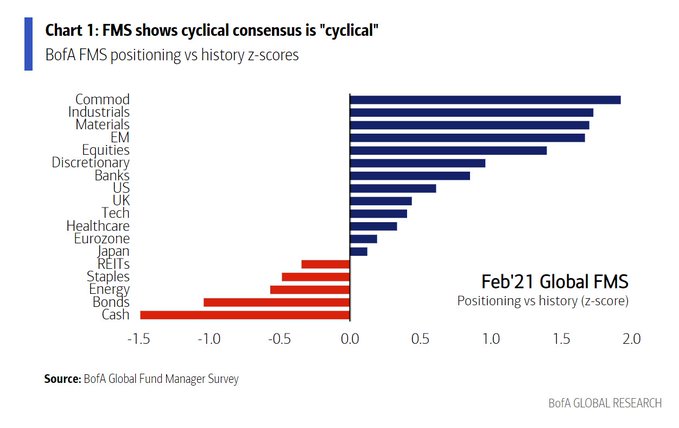

-Optimism on cyclical risk assets rose to the highest since 2011.

-Just 13% say that U.S. stocks are in a bubble.

-FMS sentiment on global growth at all-time high.

POSITIONING:

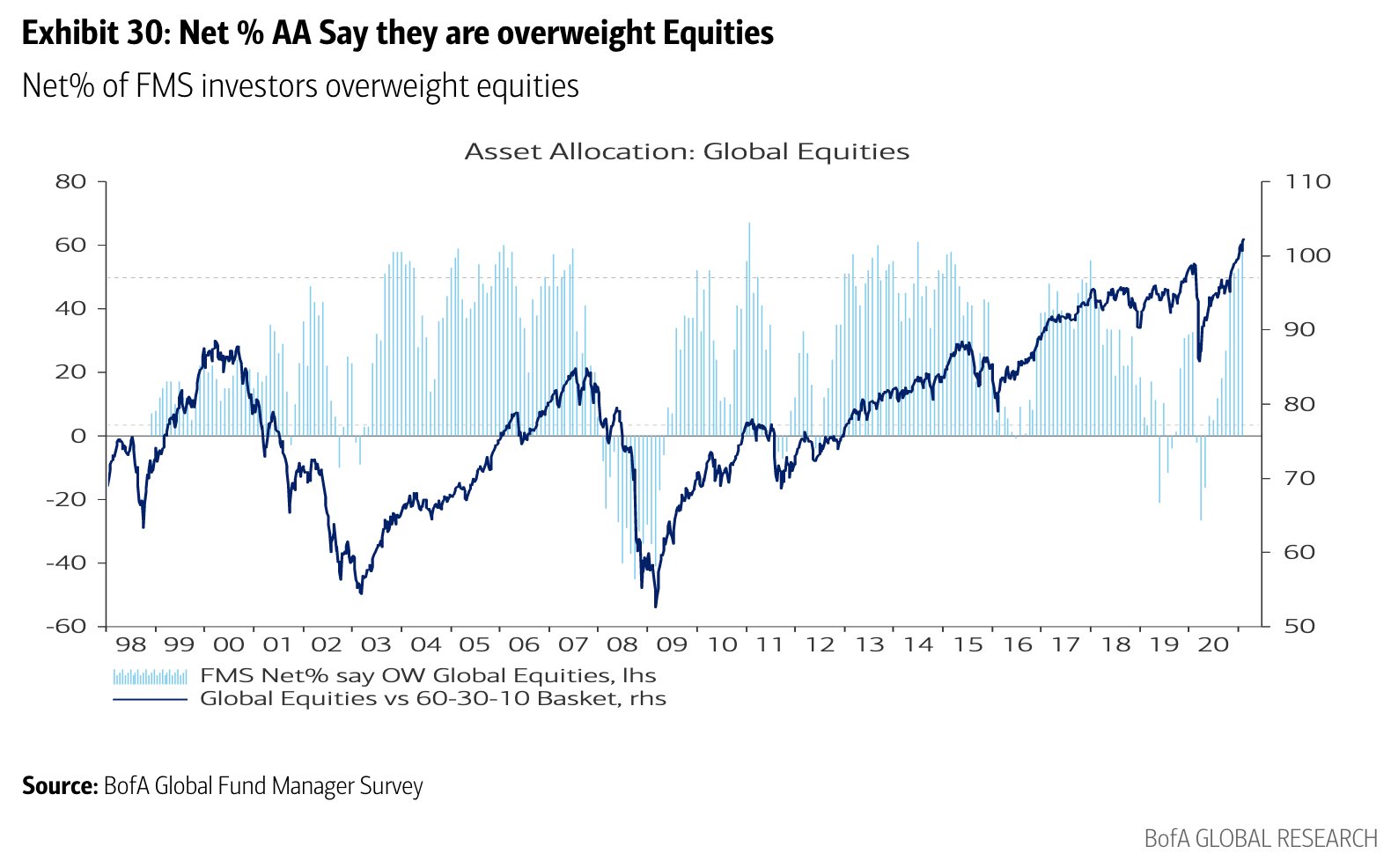

-Allocation to stocks and commodities at its highest since Feb 2011.

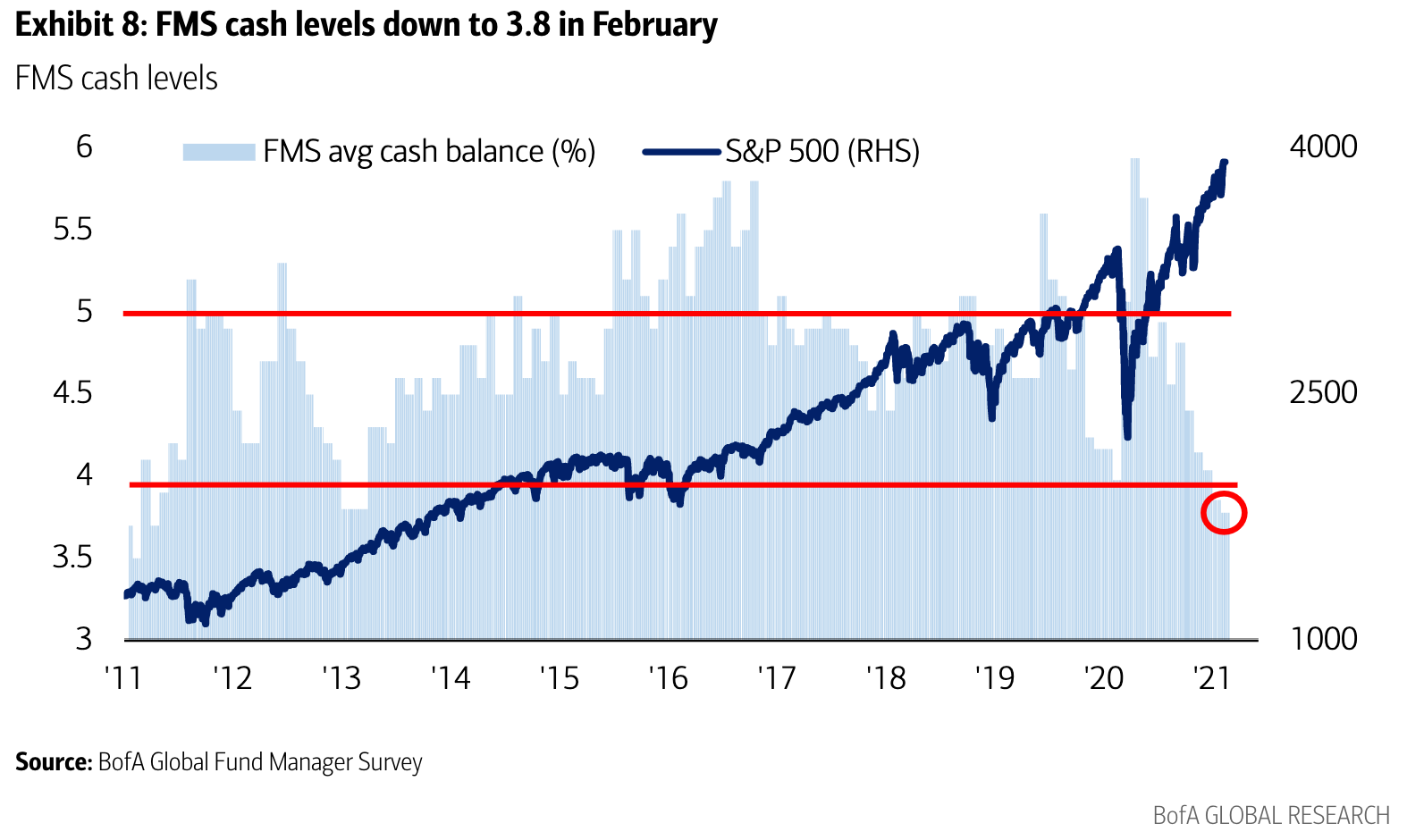

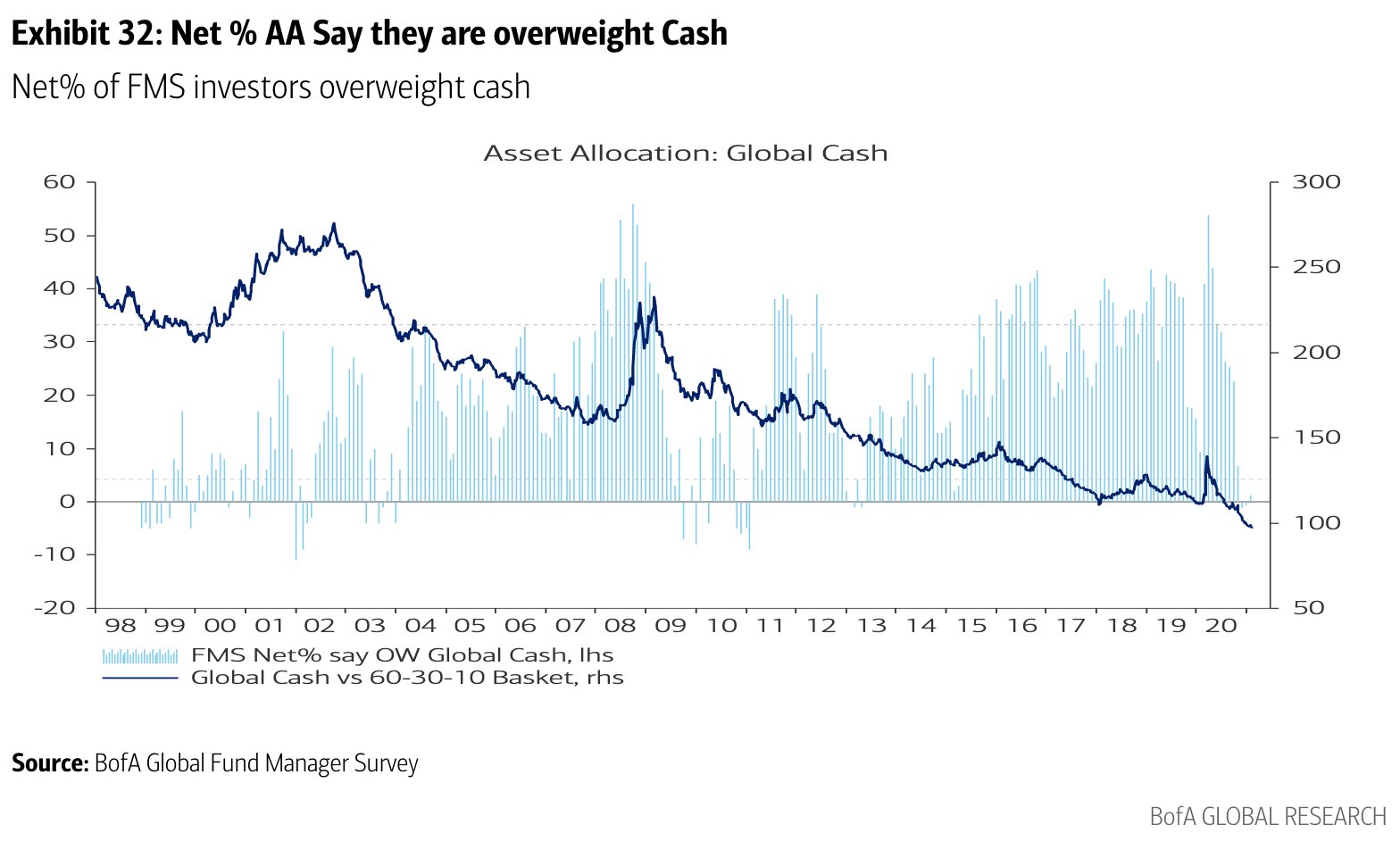

-Cash levels dropped to the lowest since March 2013 (3.8%). This was just before the Bernanke Taper Tantrum.

-Bond allocations dropped 3 percentage points to a 62% underweight (lowest since March 2018).

-Exposure to commodities and equities is at decade-highs.

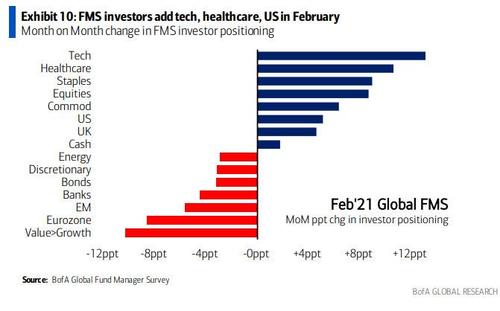

-Allocation to U.S. stocks increased 5 percentage points to net 9% overweight.

-Exposure to euro-area stocks dropped 9 points to net 20% overweight.

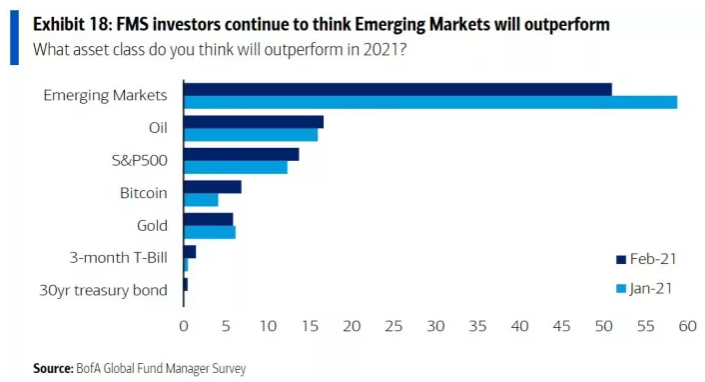

-Allocation to EM equities dropped 5 points to net 57% overweight, remaining the most-preferred region.

-Exposure to U.K. equities increased 5 points to 10% underweight, remaining the top regional underweight.

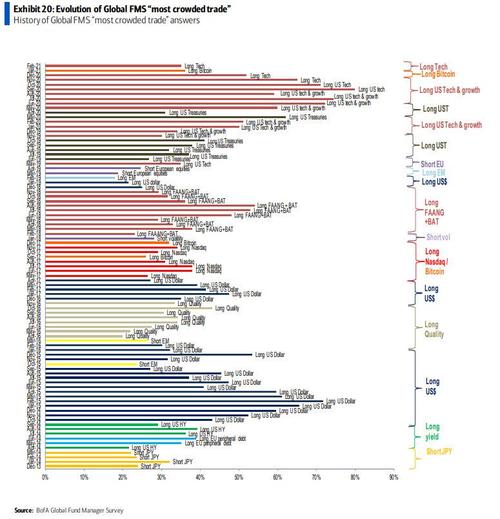

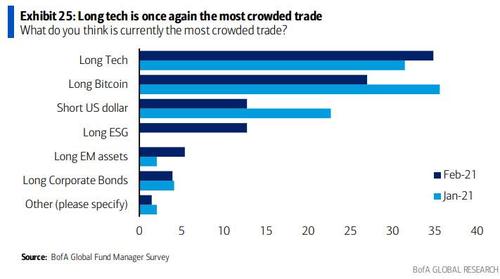

MOST CROWDED TRADES:

1. Long Tech Stocks. (35%)

2. Long Bitcoin. (27%)

3. Short U.S. dollar. (13%)

4. Long ESG.

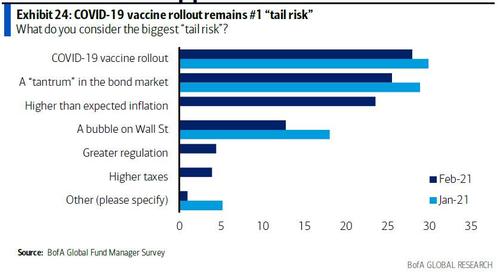

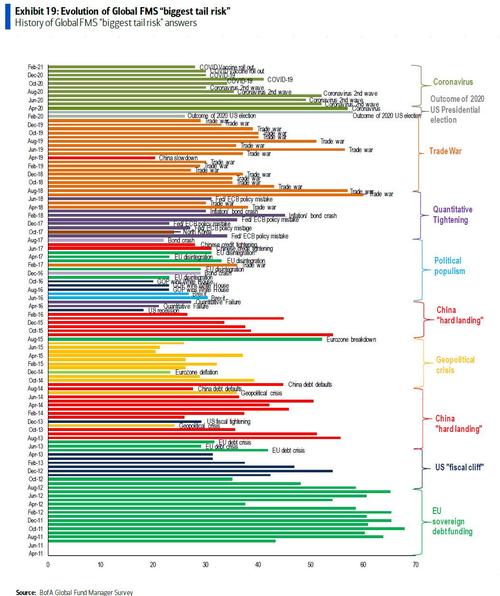

BIGGEST TAIL RISKS:

1. Vaccine Rollout. (28%)

2. Bond “tantrum.” (25%)

3. Inflation (24%)

BANK OF AMERICA COMMENTARY:

“After a record flood of money into equity funds, BofA strategists have warned that such exuberance may precede a correction.”

“The only reason to be bearish is … there is no reason to be bearish,” Bank of America chief investment strategist Michael Hartnett.

“BofA Bull & Bear Indicator 7.7.”

“Cyclicals: high exposure to commodities, EM, industrials, banks relative to past 10 years, but Jan wobble caused investors to top-up safety of growth exposure via tech health care, US stocks.”

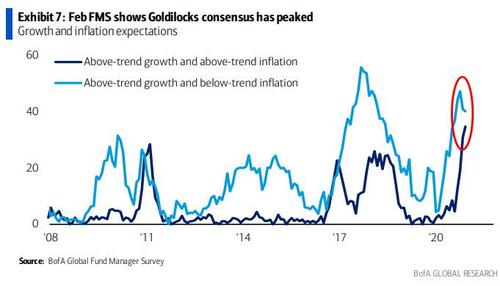

CONTRARIAN TRADES (Anti-Goldilocks) according to BofA commentary:

-Contrarian trades bubble move and/or big inflation in 2021 best played via FMS laggards (e.g. Energy & UK stocks).

-Conversely longs in EM, commodities, industrials most vulnerable to peak profits narrative.

-Either way consumer staples a smart contrarian accumulator in H1.