check back soon…

Category: What I’m Reading Today

Be in the know. 24 key reads for Friday…

- Treasury yields slip from 2024 highs even after Fed’s favored inflation report signals stalled progress (marketwatch)

- Ant Group adds 14 foreign payment apps in access boost for Hong Kong merchants (scmp)

- Hong Kong stocks hit 5-month peak after positive earnings surprises (scmp)

- Global funds build ‘significant exposure’ to Chinese stocks in mood shift: HSBC (scmp)

- Yellen confident U.S. inflation will continue to cool (marketwatch)

- Treasuries Gain as Traders Find Relief in Key Inflation Readings (bloomberg)

- High Borrowing Costs Have Some Democrats Urging Biden to Pressure the Fed (nytimes)

- Microsoft Cloud Strength Drives March-Quarter Beat (investors)

- How to Get a Meeting With the UAE’s $1.5 Trillion Man (bloomberg)

- Alphabet’s Market Value Poised to Overtake Nvidia’s (barrons)

- For Second City, Making People Laugh is a Serious Business (barrons)

- Google Sales Accelerate as Ad, Cloud Businesses Hold Up Amid Costly AI Push (wsj)

- Warren Buffett Built Berkshire. What Happens When He’s No Longer There? (barrons)

- ‘How Disney Built America’ Review: Mickey Mouse Mythology (wsj)

- Microsoft Earnings Jump on AI Demand (wsj)

- Pfizer Receives FDA Approval for Bleeding Disorder Treatment (barrons)

- This isn’t ‘some brink’ for the U.S. consumer despite concerning economic data, says TCW (marketwatch)

- After Friday’s inflation report, fed-funds futures show Fed rate cuts may begin in September (marketwatch)

- San Francisco Buyers Bring Its Luxury Housing Market Back to Life (wsj)

- The Dream of Fed Rate Cuts Is Slipping Away (wsj)

- Alphabet’s Revenue Jumps 15% to $80.5 Billion (nytimes)

- Billionaire ‘bond king’ Bill Gross tells investors to avoid tech and stick to value stocks (businessinsider)

- Consumer sentiment weakens in late April, University of Michigan survey says (marketwatch)

- EM Stocks on Track for Best Week Since July on US Tech Spillover (bloomberg)

Be in the know. 20 key reads for Thursday…

- Hong Kong stocks advance as fund positioning shows investors returning to China (scmp)

- Charlie Munger Explained If You Want To Become Rich, Stop Trying To Be ‘Intelligent’ And Aim For ‘Not Stupid’ Instead (yahoo)

- Alphabet Earnings: Ads and AI Are the 2 Things to Watch (barrons)

- Intel Earnings Day Is Here. Better PC Demand Could Provide a Boost. (barrons)

- Durable-goods orders get boost from autos and planes, but most manufacturers tread water (marketwatch)

- S. GDP Growth Disappoints as Consumers Pull Back (barrons)

- Opinion: U.S. dollar — and its No. 1 status — could become a casualty of economic war (marketwatch)

- For Beaten-Down Maker of Alzheimer’s Drug, Good Enough Will Do (wsj)

- Meta’s License to Spend on AI Gets Checked (wsj)

- TSMC in race with Intel over who can make the world’s fastest chips (scmp)

- Hermes Sees China Sales Jump, Defying Luxury Slowdown (bloomberg)

- Bullish Boeing Analyst Says ‘Didn’t Expect Things To Start Falling Apart In Midair:’ ‘If They Get It Right, It’s An Incredible Opportunity’ (benzinga)

- Japan feels inflation heat from Fed’s ‘higher for longer’ shift (ft)

- David Einhorn Sees ‘Compelling Values’ in ‘Broken Market’ (institutionalinvestor)

- Comcast Earnings Top Estimates on a Rise in Peacock Subscribers (barrons)

- Royal Caribbean Earnings Tick All the Boxes. The Stock Is Sailing Higher. (barrons)

- What Meta’s results may mean for Nvidia (marketwatch)

- US Economy Slows and Inflation Jumps, Damping Soft-Landing Hopes (bloomberg)

- Why the AI Industry’s Thirst for New Data Centers Can’t Be Satisfied (wsj)

- Billionaire investor Howard Marks says AI’s impact doesn’t make it immune to a crash (businessinsider)

Be in the know. 15 key reads for Wednesday…

- Hong Kong’s Hang Seng hits 2024 high as traders warm to ‘un-investable’ China stocks (marketwatch)

- Expect Citigroup stock to double by the end of 2026, says Wells Fargo’s Mike Mayo (cnbc)

- Hong Kong stocks at five-month highs on corporate optimism as earnings pick up (scmp)

- Boeing reports better-than-feared quarter, says supply chain is stabilizing amid 737 Max crisis (cnbc)

- EV Woes Crushed This Lithium Stock. Now It Looks Ready to Rally. (barrons)

- (Leo Liu) emphasised that Alibaba Cloud would not do price cuts at a loss, describing it as positive behaviour with promising feedback from customers. (aastocks)

- Why China’s market slump is far from a crisis (ft)

- China Tells Brokers to Limit Exposure to ‘Snowball’ Derivatives (bloomberg)

- Tencent Shares Blow Past Magnificent Seven on China Tech Outlook (bloomberg)

- Durable-goods orders get boost from autos and planes, but most manufacturers tread water (marketwatch)

- “Bloomberg News is reporting that total Mainland China equity ETF buying by China’s sovereign wealth fund was at least $43 billion in Q1 2024 versus only $6.8 billion in the second half of 2023. The report does not touch on individual stock buying. Does this scenario sound familiar? Hopefully, Chinese stocks will follow the same path as Japanese stocks, i.e., higher!” (chinalastnight)

- JPMorgan CEO Dimon says US economy is booming (reuters)

- Biogen cost cuts drive profit beat, Alzheimer’s drug sales jump (yahoo)

- Florida’s Home Insurance Industry May Be Worse Than Anyone Realizes (bloomberg)

- Mercedes’ Electric G-Class Plays It Safe Amid Slacking EV Sales (bloomberg)

Be in the know. 25 key reads for Tuesday…

- Goldman Sachs says China stocks may rise by 40% on market reforms as UBS goes overweight on mainland, Hong Kong shares

- Hong Kong stocks surge most in 3 weeks as China’s support pledge lifts the mood (scmp)

- Citi Strategists Say Buy the Dip in Stocks on Solid Earnings (bloomberg)

- GM Raises Profit Outlook After Strong First-Quarter Earnings (wsj)

- Triumphant homeowners who spent millions on houses reveal how they took on squatters — and won (nypost)

- Billionaire’s new building to soar over Midtown for one very specific reason (nypost)

- JPMorgan warns stock market sell-off has ‘further to go’ (yahoo)

- PepsiCo’s first-quarter results beat as international demand drives growth (yahoo)

- How US shale keeps sheltering America from the next oil price surge (ft)

- Generative A.I. Arrives in the Gene Editing World of CRISPR (nytimes)

- Goldman’s Rubner Says the Pullback in US Stocks Is Not Over Yet (bloomberg)

- Apple’s China iPhone Sales Dive 19% in Worst Quarter Since 2020 (bloomberg)

- The UK Housing Market Has Turned a Corner (bloomberg)

- Google search boss warns employees of ‘new operating reality,’ urges them to speed up (cnbc)

- Goldman says we’re still in phase 1 of AI’s stock-market takeover. Here’s how they expect phases 2 through 4 to play out. (businessinsider)

- Goldman Sachs: These 30 stocks are primed to outperform in a strong economy since they’re investing heavily in future growth opportunities like artificial intelligence (businessinsider)

- Goldman Sachs: These 30 stocks are primed to outperform in a strong economy since they’re investing heavily in future growth opportunities like artificial intelligence (businessinsider)

- Goldman hasn’t given up on the stock-market rally, but is starting to get nervous (marketwatch)

- Why you shouldn’t be too quick to dump your stocks just yet (marketwatch)

- History says stock-market dips caused by geopolitical turmoil ‘should be bought, not sold’: BofA strategists (marketwatch)

- Boeing Slows Production of Its 787 Jet. Relax, It’s Not a Quality Problem. (barrons)

- Ford Doesn’t Have a Ferrari Division, but Ford Pro Could Be a Stock Catalyst (barrons)

- Ford Stock Soared Today for 1 Big Reason and 3 Smaller Ones (barrons)

- China Technology’s Outperformance vs. US Tech Since February Widens (chinalastnight)

- Big Tech Faces Earnings Test After Market Rout (wsj)

Be in the know. 12 key reads for Monday…

- Strategists Split on US Profit Outlook as Stocks Pull Back (bloomberg)

- Strong Earnings Will Give S&P 500 a Boost (bloomberg)

- Nike Shifts Course as Innovation Stalls and Rivals Gain Ground (wsj)

- The Golfer Who Can’t Stop Winning (wsj)

- Making a splash Top women’s golfer celebrates historic run with epic cannonball (nypost)

- How NYC’s reclusive retail kingpin sold billions in buildings to Gucci, Prada in mere days (nypost)

- Alphabet’s Cash Boom Is Raising Dividend Hopes on Wall Street (bloomberg)

- 5 reasons why the stock market’s multi-week sell-off will end soon, according to a Wall Street bull (businessinsider)

- Mega-cap tech earnings kick off this week. Here’s what Wall Street is looking out for. (businessinsider)

- Car dealers throw cold water on electric vehicles versus gas options: ‘I wouldn’t feel safe’ (foxbusiness)

- Hong Kong stocks soar after China’s market regulator support pledge (scmp)

- EU approves new antibiotic to tackle rise of superbugs (ft)

Be in the know. 25 key reads for Sunday…

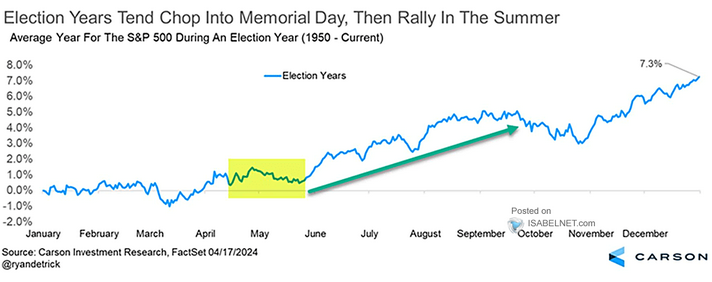

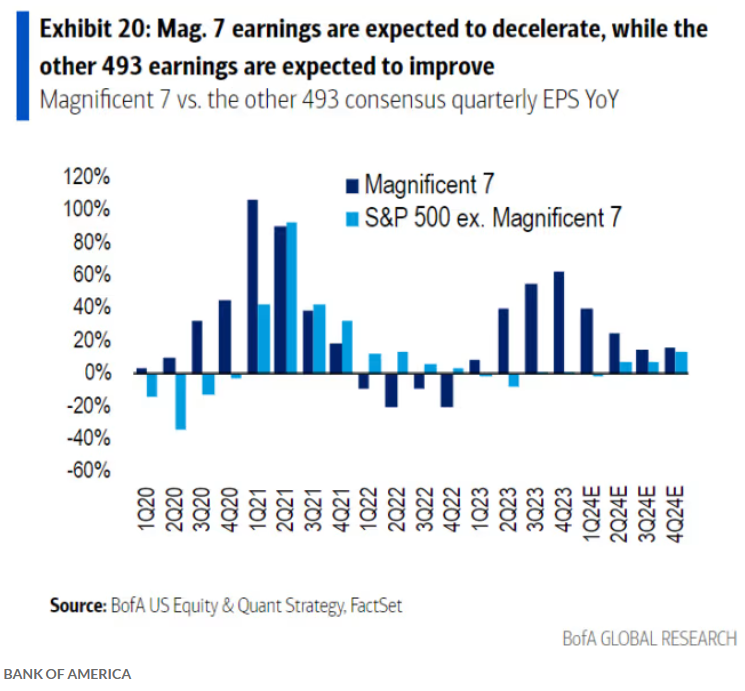

- This chart shows why the stock-market rally should broaden out later this year (marketwatch)

- 30 Big Ideas from Seth Klarman’s Margin of Safety (Special Report) (niveshak)

- Belated March CPI analysis (scottgrannis)

- Higher Interest Rates Have Done Their Work. Start the Cuts. (barrons)

- S. natural gas trade will continue to grow with the startup of new LNG export projects (eis)

- House Passes Bill Banning TikTok Unless Chinese Owner Divests. Aid to Ukraine and Israel Is Approved. (barrons)

- Nvidia’s stock plunge leads ‘Magnificent Seven’ to historic weekly market-cap loss (marketwatch)

- Apple Has Been Left Behind in the AI Rally. Why It Might One Day Still Be the Big Winner (marketwatch)

- MasterCraft Boat, SentinelOne, and More Stocks See Action From Activist Investors (barrons)

- Alphabet, United Airlines, GE Vernova, and More Stocks Set to Climb (barrons)

- The Secret Retreats That Have CEOs, VIPs and Billionaires Jockeying for Invites (wsj)

- Wall Street Has Abandoned Wall Street (wsj)

- He Loves Speed, Hates Bureaucracy and Told Ferrari: Go Faster (wsj)

- These Home Sellers Are Done Waiting for the Fed to Lower Rates (wsj)

- Fed’s Preferred Inflation Gauge Is Set to Back Rate-Cut Patience (bloomberg)

- Tesla Cuts US Prices by $2,000 as Sales Slow, Inventories Swell (bloomberg)

- Reed Hastings shares the 3-word tactic that helped make Netflix a $240 billion company—it’s called ‘farming for dissent’ (cnbc)

- Report: Thanks to AI, China’s Data Centers Will Drink More Water Than All of South Korea by 2030 (futurism)

- Florida Is Not So Cheap Compared With New York These Days (bloomberg)

- Semiconductors (SMH) Could Be Rolling Over At Key Fibonacci Level, Says Joe Friday (kimblechartingsolutions)

- A contrarian take on the US inflation freakout (ft)

- A Legacy Structure Turns Cars Into Sculptures (forbes)

- Meet The Skydiving Billionaire With Sky-High Returns (forbes)

- 3 Easy Steps That Will Make You the Most Interesting Person in a Conversation (inc)

- T&C Hotel Awards 2024: The Best New Hotels on the Planet (townandcountrymag)

Be in the know. 5 key reads for Saturday…

- Ray Dalio Shares Investment, Career Insights (Columbia)

- Big Pharma Stocks Need a Rethink. Investors Keep Making the Same Mistake. (barrons)

- A 5-Star Dividend Stock to Buy With a 3.7% Yield (morningstar)

- The 10 Best Dividend Stocks (morningstar)

- Magnificent Seven Earnings Arrive With Stocks at Critical Moment (bloomberg)

Be in the know. 25 key reads for Friday…

- Nvidia Won AI’s First Round. Now the Competition Is Heating Up. (barrons)

- China’s Ant Group in talks to launch Alipay+ in Indonesia, says executive (reuters)

- Investors underestimating China’s middle class ‘tidal wave’: private equity CEO (scmp)

- The Cloud Giants Are Taking On Nvidia in AI Chips. Here’s Why—and How. (barrons)

- American Express Profit Rises as Cardholder Spending Jumps (barrons)

- Google consolidates teams with aim to create AI products faster (scmp)

- $4 Million Bugatti Bolide Hypercar That Can Reach 300 MPH Will Be Track-Only (barrons)

- Oil Prices Fall Back After Spike Following Israel Attack on Iran. Here’s Why. (barrons)

- This Chemicals Stock Is Ready to Power Higher. Clean Hydrogen Is Helping. (barrons)

- Five reasons the stock market’s ‘painful’ pullback may be nearing its end (marketwatch)

- Why buying stocks in this hot sector may turn out to be a money-losing bet (marketwatch)

- 3M may be poised to cut its dividend — and break with a 64-year tradition, says analyst (marketwatch)

- Nordstrom Says It Will Evaluate if Family Should Take Company Private (barrons)

- Israel Strikes Iran in Narrow Attack Amid Escalation Fears (wsj)

- Millennials Are Coming for Your Golf Communities (wsj)

- Ultra-rich put off buying yachts, jets in hope of massive Trump tax break if he wins (nypost)

- Is this the last stand for Connor McDavid, Leon Draisaitl and the Oilers? (theathletic)

- Everything we know about the Coyotes’ move to Utah: What went wrong? Will team name change? (theathletic)

- Banks Believe They Are Well-Prepared for Commercial Real Estate Fallout (wsj)

- Bridgewater Adds China Stocks (bloomberg)

- Is pickle juice good for you? Here’s what experts want you to know (usatoday)

- China Vows to Support Hong Kong IPOs to Bolster Hub Position (bloomberg)

- Yields fall as investors weigh economic data, Israel strike against Iran (cnbc)

- The world’s largest chipmaker just issued a warning that the industry’s red-hot growth could slow (businessinsider)

- JPMorgan warns of need for ‘reality check’ on phasing out fossil fuels (ft)

Be in the know. 12 key reads for Thursday…

- Billionaire Brad Jacobs: Meditation, thought experiments, and cognitive behavior therapy helped me succeed—and can do the same for you (fortune)

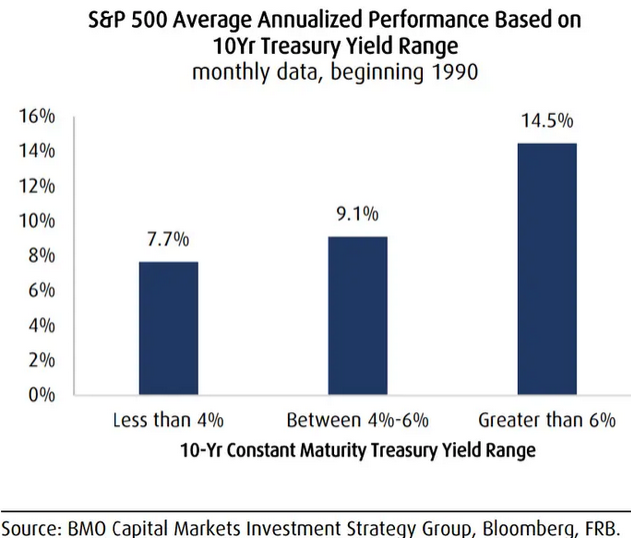

- BMO shares 4 charts showing why stock investors shouldn’t fear higher-for-longer interest rates (businessinsider)

- Alibaba has made dramatic changes to its corporate restructuring plan as founders Jack Ma and Joe Tsai return to the driver’s seat (scmp)

- Chip Giant TSMC Offers Reassurance—and a Warning (wsj)

- Inside Amazon’s Secret Operation to Gather Intel on Rivals (wsj)

- Buyers Are Back in Control as Luxury Home Sellers Slash Prices (wsj)

- China’s Youth Unemployment Level Remains Steady in March (bloomberg)

- High rates haven’t always been a problem for stocks (yahoo)

- Chinese and US firms collaborate on first global generative AI standards (scmp)

- Alibaba’s Taobao launches 3D-capable app for use on Apple’s Vision Pro headset (scmp)

- John Catsimatidis’ Red Apple Group taps energy exec to lead rollout of small nuclear reactors (nypost)

- How an Obscure Chinese Real Estate Start-Up Paved the Way to TikTok (nytimes)