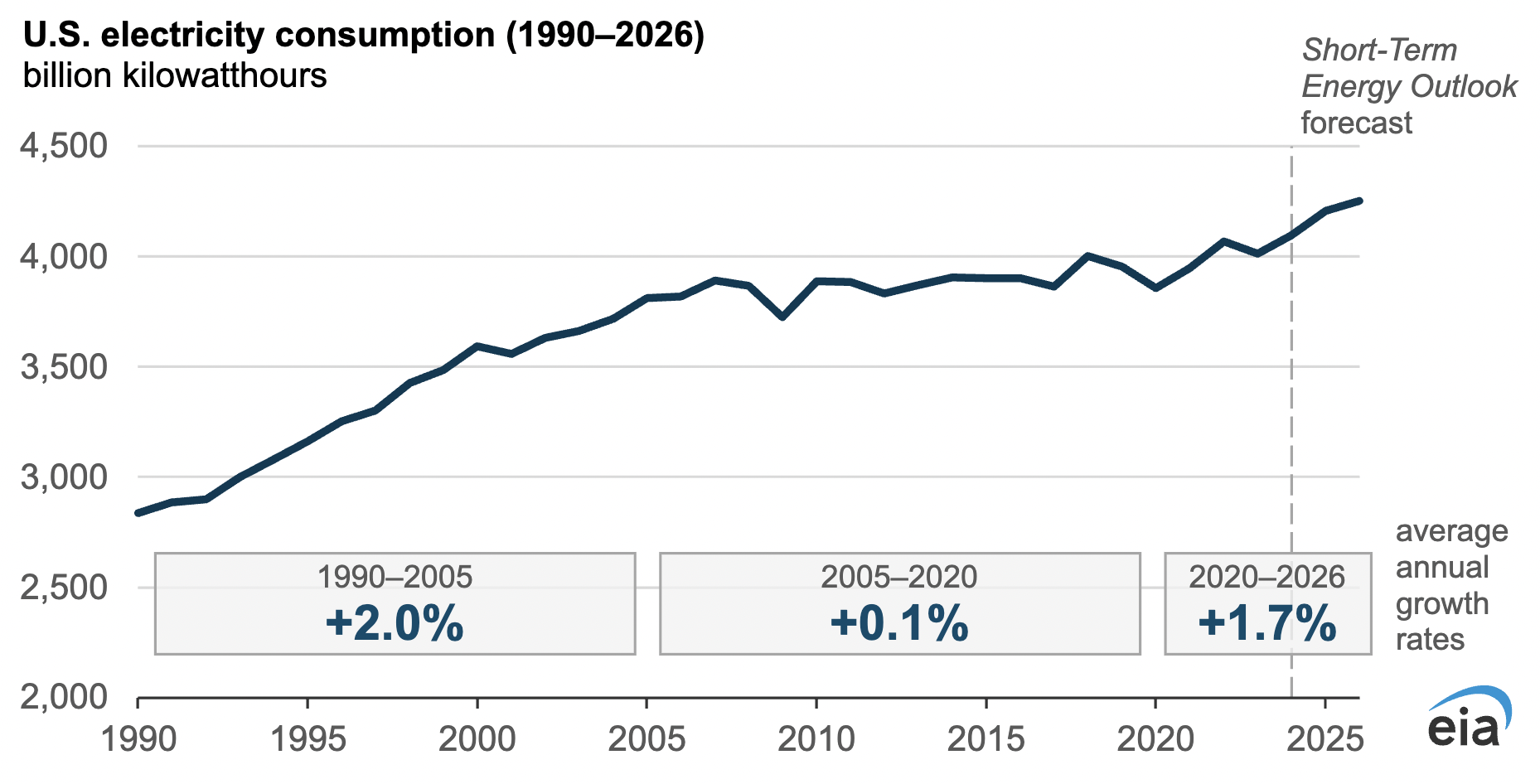

- After more than a decade of little change, U.S. electricity consumption is rising again (eia)

- Data Centers’ Hunger for Energy Could Raise All Electric Bills (nytimes)

- 13 Energy Stocks to Buy Even as Oil Prices Fall, According to Roundtable Pros (barrons)

- Builder Stocks Shrug Off Bad Construction Data. Mortgage Rates Matter More. (barrons)

- U.S. Housing Starts Ticked Up in April (wsj)

- Hedge Fund Insider Sees Dollar Rout as Biggest Players Eye Exit (bloomberg)

- What a Weaker US Dollar Means for the Economy (bloomberg)

- Businesses Made a Big Tax-Cut Request. Republicans Said Yes—and Then Some. (wsj)

- Value investing is poised to rise from the dead (reuters)

- There’s a big disconnect between US economic vibes and what the data actually says (marketsinsider)

- Elite CEOs Don’t Need Earnings Guidance (wsj)

- Why Small Cap Stocks Are Ready For A Rebound (forbes)

- Push To Exempt Treasuries From Liquidity Ratio Is Boon For Bond Rally (zerohedge)

- Here’s What Hedge Funds Bought And Sold In Q1: 13F Summary (zerohedge)

- Trump Says He’s Willing to Travel to China for Xi Meeting (bloomberg)

- Alibaba Earnings: Results In Line, With Cloud Business to Drive Growth (morningstar)

- Vietnam steps up talks with US to reduce hefty tariff (reuters)

- U.S. Credit Gets Downgraded by Moody’s, the Last Triple-A Rating (barrons)

- U.S. Won’t Prosecute Boeing Over 737 MAX Crashes, WSJ Reports (barrons)

Be in the know. 19 key reads for Saturday…