Today some institution/fund purchased 20,216 contracts of April 35 strike calls (or the right to purchase 2,021,600 shares of EBAY at $35). This is a larger sized bet for this stock and contract as the open interest was 4,604 Continue reading “Unusual Options Activity”

Category: Unusual Options Activity

Unusual Options Activity

Today some institution/fund purchased 10,207 contracts of March $47.50 strike calls (or the right to purchase 1,020,700 shares of General Mills at $47.50). This is a larger sized bet for this stock and contract as the open Continue reading “Unusual Options Activity”

Unusual Options Activity

Today some institution/fund purchased 14,969 contracts of April $29 strike calls (or the right to purchase 1,496,900 shares of Bank of America BAC at $29). This is a larger sized bet for this stock and contract as the open Continue reading “Unusual Options Activity”

Unusual Options Activity

Today some institution/fund purchased 6,119 contracts of April $77.50 strike calls (or the right to purchase 611,900 shares of Gilead GILD at $77.50). This is a larger sized bet for this stock and contract as the open Continue reading “Unusual Options Activity”

Unusual Options Activity

Today some institution/fund purchased 10,068 contracts of April $8 strike calls (or the right to purchase 1,006,800 shares of Encana ECA at $8). This is a larger sized bet for this stock and contract as the open interest was just Continue reading “Unusual Options Activity”

Unusual Options Activity

Today some institution/fund purchased 25,025 contracts of March $29 strike calls (or the right to purchase 2,502,500 shares of JD.com at $29). This is a big bet for this stock and contract as the open interest was just Continue reading “Unusual Options Activity”

Unusual Options Activity

Today some institution/fund purchased 6,775 contracts of April $9 strike calls (or the right to purchase 677,500 shares of Callon Petroleum Co. CPE at $9). Continue reading “Unusual Options Activity”

Unusual Options Activity

Today some institution/fund purchased 8,930 contracts of March 15 strike calls (or the right to purchase 893,000 shares of Qualcomm at $60). This is a decent sized bet for this stock and contract as the open interest was just 2,329 prior to this purchase. Qualcomm QCOM reports earnings January 30.

Unusual Options Activity

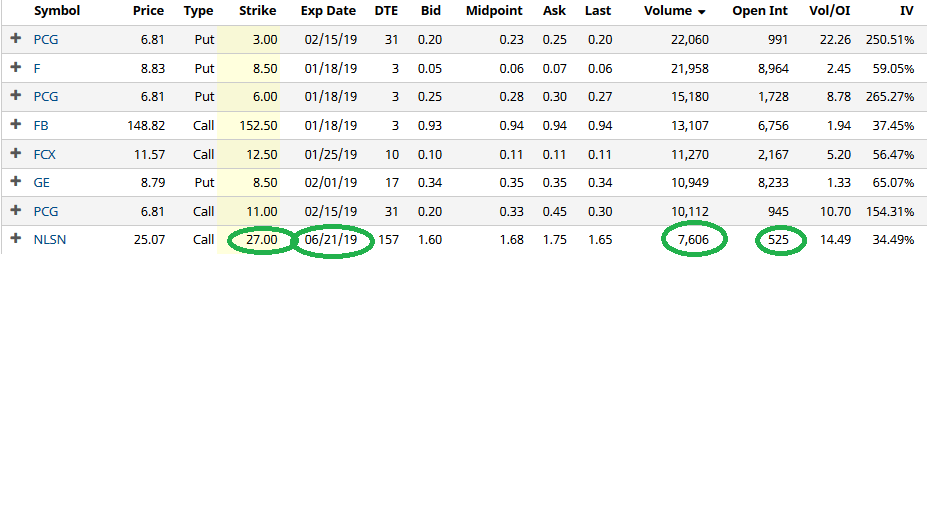

Today some institution/fund purchased 7,606 contracts of June 27 strike calls (or the right to purchase 760,600 shares of Starbucks at $27). This is a large sized bet for this stock and contract as the open interest was just 525 prior to this purchase. Nielsen NLSN reports in early February.

Unusual Options Activity

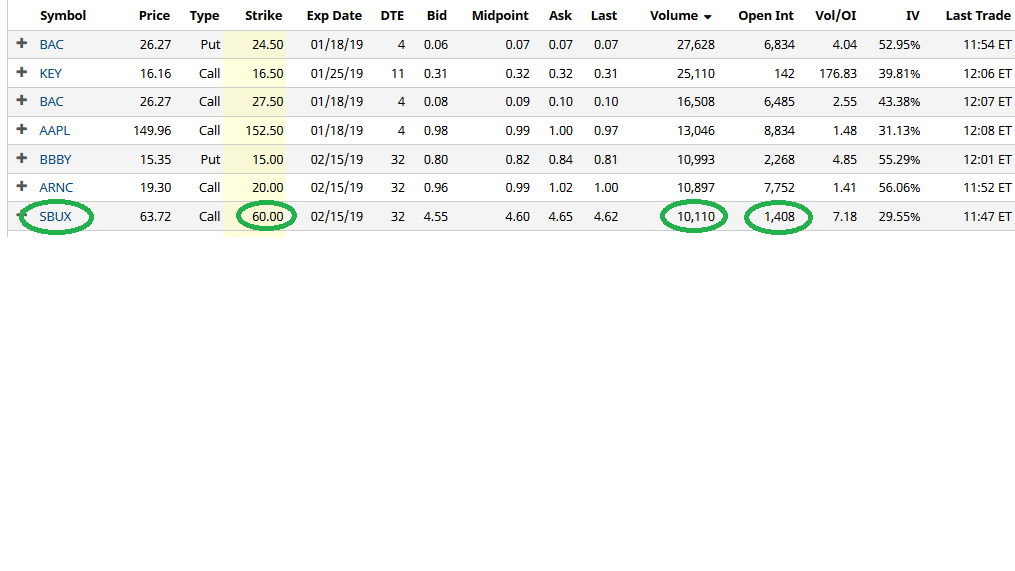

Today some institution/fund purchased 10,100 contracts of February $60 strike calls (or the right to purchase 1,010,000 shares of Starbucks at $60). This is a large sized bet for this stock and contract as the open interest was just 1,408 prior to this purchase. Starbucks $SBUX reports on 1/24/19.