Skip to content

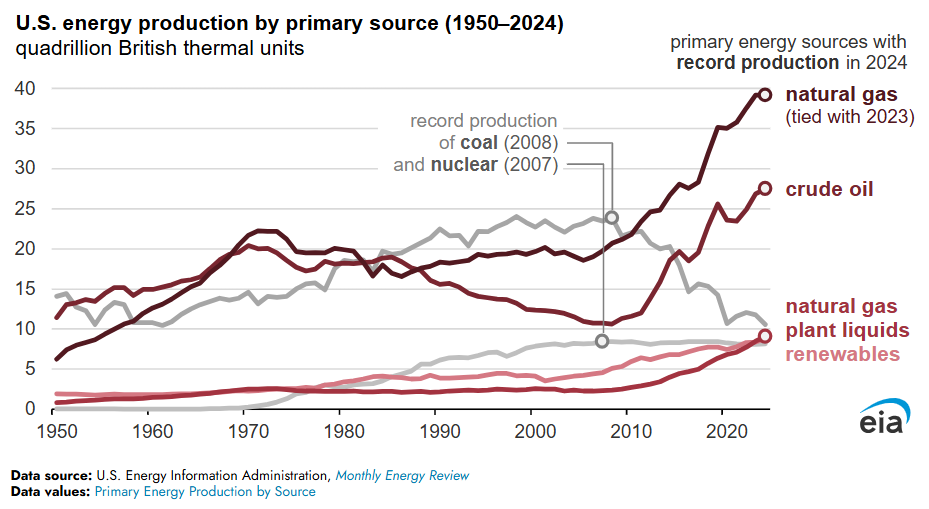

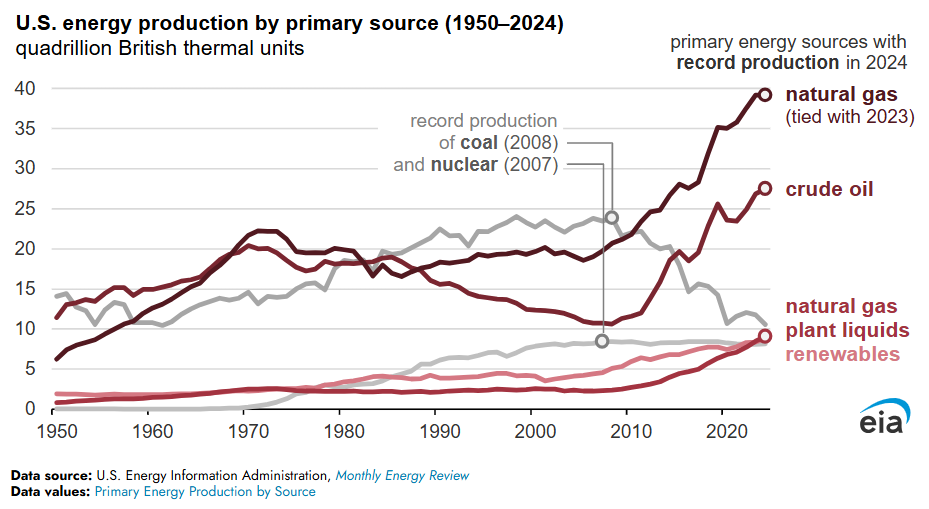

- In 2024, the United States produced more energy than ever before (eia.gov)

- The Tax Bill Will Raise Electricity Prices in a Power-Hungry Nation (barrons)

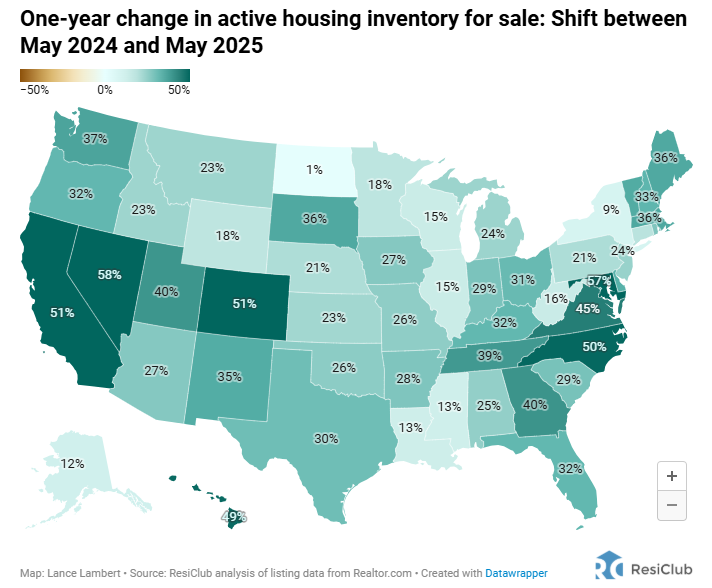

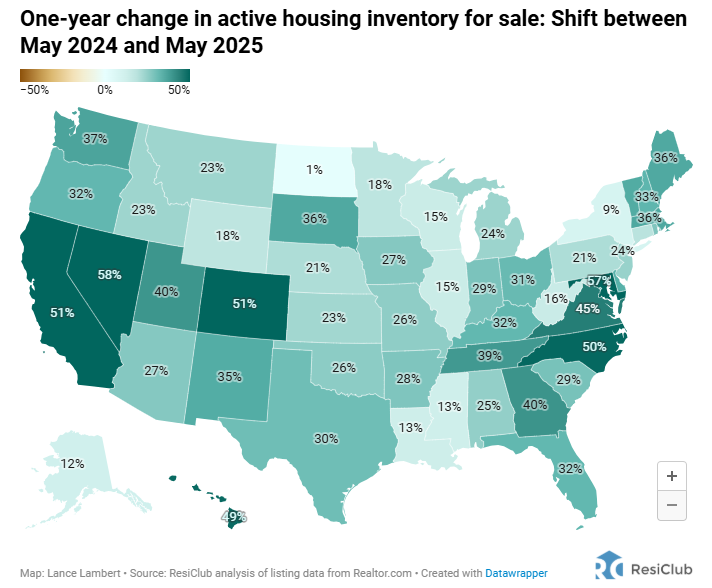

- More Homes Are Finally Hitting the Market, But Buyers Are Still Priced Out (wsj)

- 4 recent signs that US housing is becoming a buyer’s market (businessinsider)

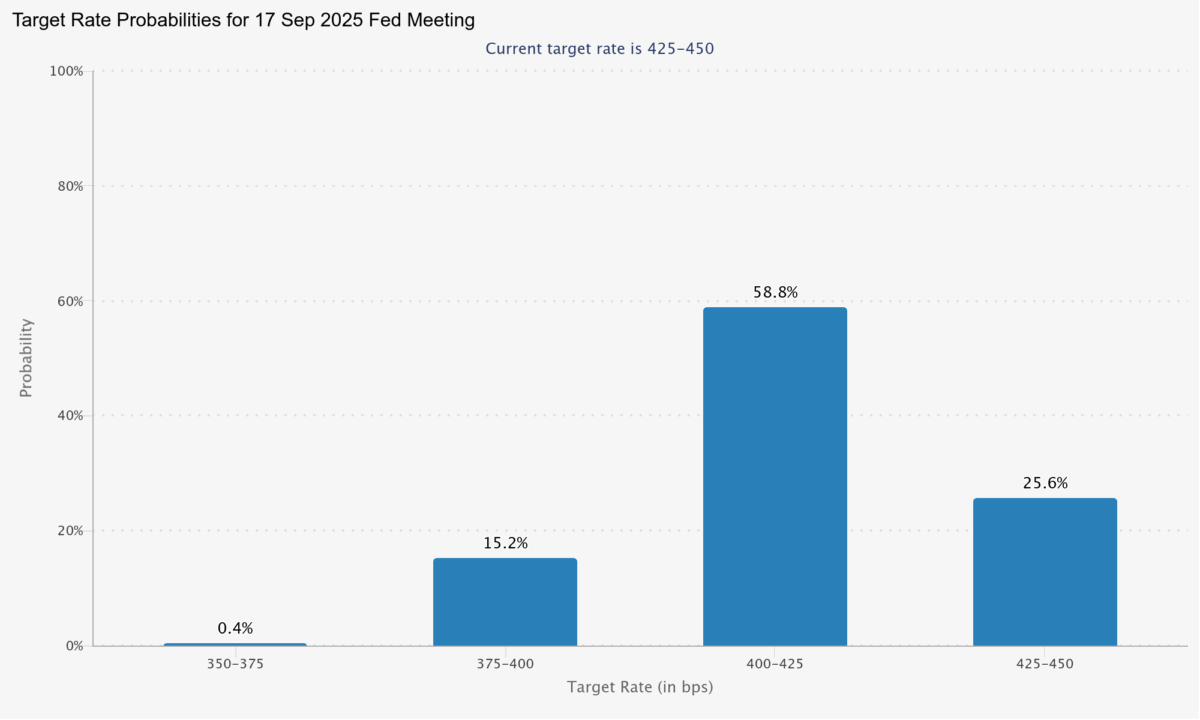

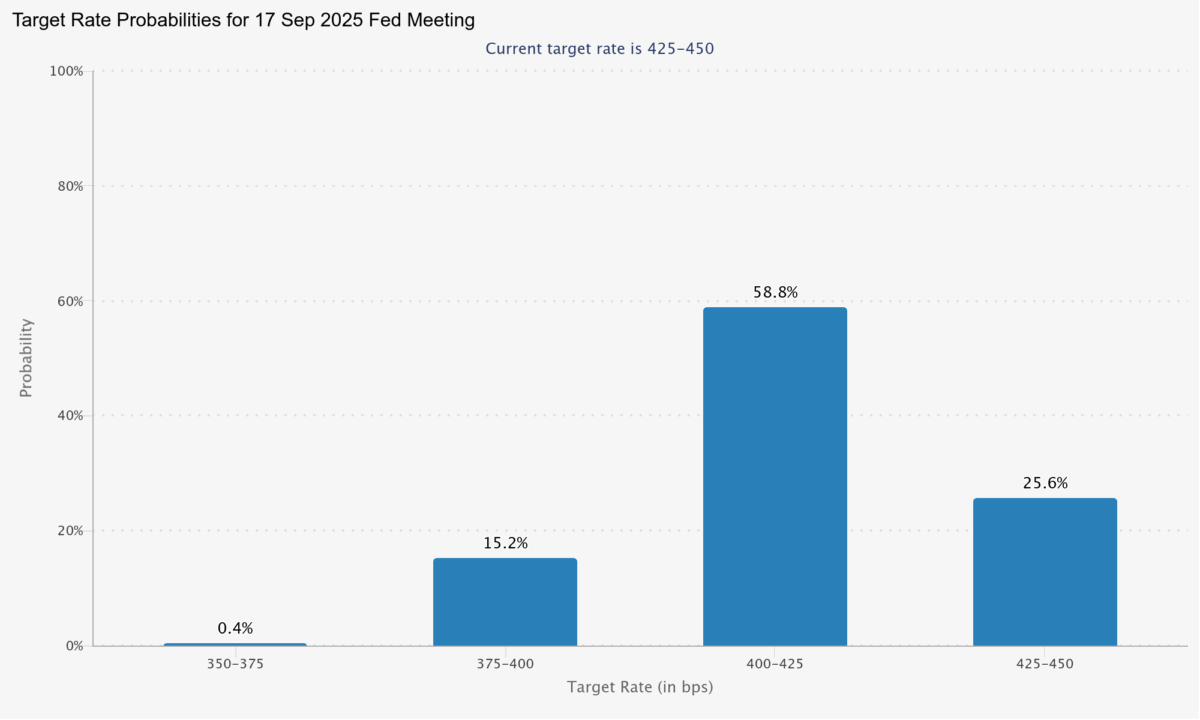

- The Fed Is Behind the Curve on Cutting Interest Rates (wsj)

- Bets Emerge That End to Powell’s Term Means More Fed Rate Cuts (bloomberg)

- The Senate just advanced a bill to regulate stablecoins—what the GENIUS Act could mean for crypto and other investors (cnbc)

- Consumer sentiment improves for first time in six months (marketwatch)

- The Best Consumer Cyclical Stocks to Buy (morningstar)

- 2025 Apparel Industry Trends: What Advisors Need to Know (morningstar)

- US, Vietnam Move Closer to Trade Framework as Deadline Nears (bloomberg)

- Israel-Iran Conflict Is Just a Setback on the S&P 500’s Path to 7000 (barrons)

- Boeing Delivers First Jet to China in Tariff War Reprieve (bloomberg)

- Hedge Funds Are Positioned For A Risk-Off Environment (zerohedge)

- Traders Resume Fully Pricing In Two Fed Rate Cuts This Year (bloomberg)

- Rate-Cut Optimism Buoys Wall Street (wsj)

- The Case for Rate Cuts Is Growing (wsj)

- Easing US Capital Rules Will Cut Treasury Yields, Eurizon’s Jen Says (bloomberg)

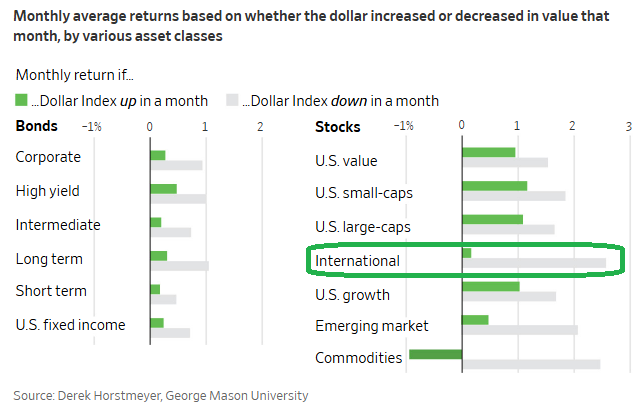

- Dollar’s Slump Is Worst Since 1980s. Don’t Expect a Quick Rebound. (barrons)

- Morgan Stanley says the new ’bull case’ for stocks is emerging (streetinsider)

- UBS identifies stock winners amid structural growth tailwinds (streetinsider)

- Trend-Followers Stumble Into One of Their Worst Years (institutionalinvestor)

- Mortgage rates under 7% as housing leans into buyer’s market (yahoo)

- Data Centers Pose Threat to Electric Grids, US Regulator Says (bloomberg)

- Your Electric Bill Is Rising Faster Than Inflation. Here’s Why. (wsj)

- Alibaba Movie Unit’s Pivot, Rebrand Bring $2 Billion Value Gain (bloomberg)

- Global EV sales rise in May as China hits 2025 peak -Rho Motion (reuters)

- Walmart, Aflac and 8 Other Dividend Aristocrats That Also Wear Buyback Crowns (barrons)

- The Best Healthcare Stocks to Buy (morningstar)

- The Only Remedy for Intel’s Woes May Be a Breakup (wsj)

- US Equity Funds Hit by Biggest Outflows in 11 Weeks, BofA Says (bloomberg)

- Beverage giants target ‘fourth category’ of alcoholic drinks to bring in younger generation (foxbusiness)

- This bull market is alive and well, says Carson Group’s Ryan Detrick (youtube)

- Estee Lauder Launches in the Amazon.ca Premium Beauty Store (investing)

- How PayPal is using Venmo, Honey transactions to win over marketers to its ads business (digiday)

- How stablecoins are entering the financial mainstream (ft)

- PayPal seeks to launch USD stablecoin on Stellar (yahoo)

- Bessent Says $2 Trillion Reasonable for Dollar Stablecoin Market (bloomberg)

- Ant International and Ant Digital to seek stablecoin licences in Hong Kong (scmp)

- Alibaba’s Joe Tsai says open-sourcing its AI models will boost firm’s cloud business (scmp)

- China Trade Deal ‘Done,’ Other Countries May Get More Time (barrons)

- China Puts Six-Month Limit on Its Ease of Rare-Earth Export Licenses (wsj)

- Bessent floats extending tariff pause for countries in ‘good faith’ trade talks (cnbc)

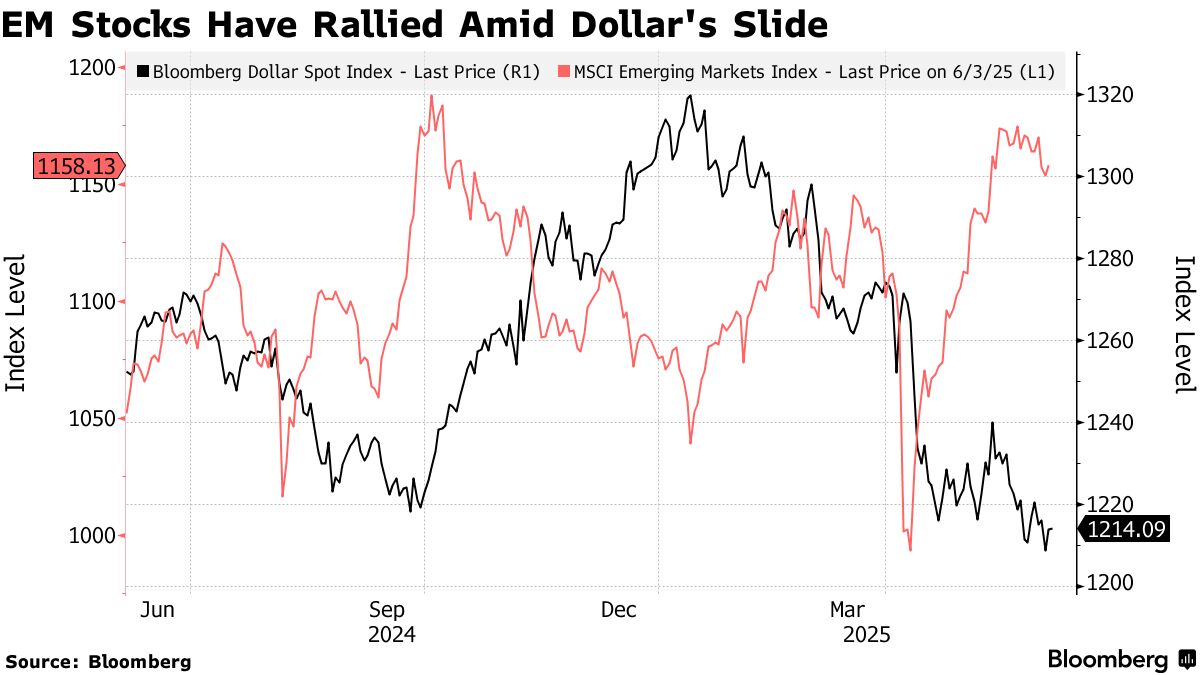

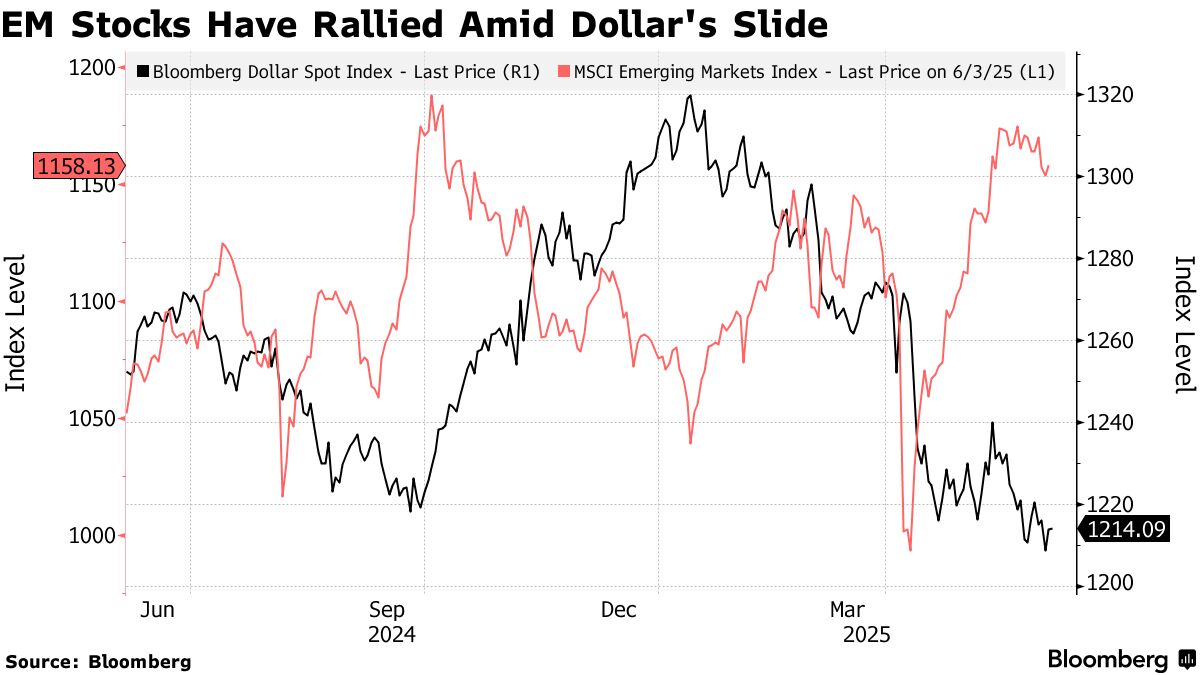

- Investors pull out of US stocks and into Europe and emerging markets (reuters)

- The World Is Embracing the Dollar, Not Abandoning It: BofA (barrons)

- Rush into safe haven assets pushes euro to highest since late 2021 (streetinsider)

- Everything Soars Higher As Rate-Cut Odds Jump After CPI ‘Miss’ (zerohedge)

- 10-Year Treasury Auction Was Strong Again in Positive Sign for U.S. Assets (barrons)

- Scott Bessent’s Bretton Woods Moment Is Here (barrons)

- Trump’s Fed Chair Pick Could Come Soon. Who the Contenders Are. (barrons)

- Disney and Universal Sue A.I. Firm for Copyright Infringement (nytimes)

- There Aren’t Enough Cables to Meet Growing Electricity Demand (bloomberg)

- Boeing Stock Declines Sharply After Plane Crashes in India (barrons)

- Not sure if Air India crash is a Boeing or GE problem per se, says Mike Boyd (youtube)

- QXO stock initiated with outperform rating by Baird on growth outlook (investing)

- Oppenheimer starts QXO at Outperform on strategic acquisition, growth outlook (investing)

- US Core Inflation Rises Less Than Forecast for Fourth Month (bloomberg)

- U.S. and China Agree to Get Geneva Pact Back on Track (wsj)

- Trump says China will supply rare earths in ‘done’ deal (cnbc)

- Analysts react to US-China trade agreement (reuters)

- JPMorgan lifts yuan forecast on easing tariff risks, de-dollarisation trend (reuters)

- Chinese automakers pledge faster supplier payments as price wars intensify (ft)

- China Taps $1.5 Trillion Fund To Offer Cheap Mortgages, Boost Housing Demand (zerohedge)

- Boeing books 303 new orders, hits 737 MAX production target in blockbuster May (reuters)

- Data Centers Prompt US to Boost Power-Usage Forecast by 92% (bloomberg)

- Mortgage demand rises to the highest level in over a month, after holiday adjustment (cnbc)

- Roofr and QXO Partner to Bring Real-Time Pricing and Digital Material Ordering to Roofing Contractors (yahoo)

- Disney’s Iger Plans to Hold On to Traditional Television Networks (bloomberg)

- CEO Bob Iger on Disney gaining full control of Hulu: We are ‘very pleased’ with this (youtube)

- BofA institutional clients dump stocks at historic rate, retail keeps buying (streetinsider)

- For Fund Contrarians, ‘Ex’ Can Mark the Spot (morningstar)

- Bessent Emerging as a Contender to Succeed Fed’s Powell (bloomberg)

- GM Plans $4 Billion Investment to Boost U.S. Manufacturing (wsj)

- Why Goldman Sachs says high-flying tech stocks may be headed for a tough stretch (marketwatch)

- Disney Takes Full Control of Hulu for Billions Less Than Comcast Wanted (nytimes)

- Disney gets a price target increase from Loop Capital as media giant gains full control of Hulu (cnbc)

- US says trade talks with China ‘going well’ as sides reconvene (ft)

- CPI Shows Consumption Green Shoots, US-China Officials Meet In London (chinalastnight)

- Huawei chips are one generation behind US but firm finding workarounds, CEO says (reuters)

- Equity Analysts Are Over Liberation Day Tariffs (bloomberg)

- Why one Wall Street analyst sees a major opportunity in unloved small-cap stocks (marketwatch)

- Evercore ISI’s Julian Emanuel says now is the time to buy small-caps (youtube)

- Europe Is Pricier This Summer. Its Stocks Aren’t. (barrons)

- Wary Wall Street Positioning Leaves Room for S&P 500 to Rally (bloomberg)

- Melting Up Without Euphoria: The Pain Trade Rolls On (zerohedge)

- America’s Small Businesses Hopeful of Boost From Trump’s Spending Bill (wsj)

- Boeing Stock Rises. Its Turnaround Was Boosted By An Unexpected Source. (barrons)

- Diageo Weighs Options for Stake in Indian Cricket Team (bloomberg)

- Selfbook collaborates with PayPal to streamline hotel bookings (yahoo)

- Stablecoins Bring Crypto to the Mainstream. What Could Go Wrong? (bloomberg)

- GXO Logistics Introduces Enhanced GXO Direct Solution in the U.S. (investing)

- How Kelly Ortberg is piloting Boeing from crisis to cash (ft)

- Boeing plane lands back in China for delivery as tariff war eases (reuters)

- Chinese Stocks in Hong Kong Enter Bull Market Before US Talks (bloomberg)

- China and U.S. trade officials to hold talks in London (cnbc)

- China extends an olive branch to Western auto giants over rare earth shortage (cnbc)

- Global investors are underinvested in China, though many express interest: Morgan Stanley (scmp)

- China’s May lending seen tripling on monetary measures, trade truce: Reuters poll (reuters)

- Home sellers face harsh new reality as listings hit record $698B value (foxbusiness)

- An Inside Look At Disney’s Affordable Housing Development In Florida (yahoo)

- ‘Lilo & Stitch’ fends off ‘Ballerina’ to top box office for third straight week (marketwatch)

- European small-caps outshine US rivals as investors bet on growth revival (ft)

- Will America’s Unbalanced Trade Doom the Dollar? (wsj)

- Morgan Stanley, Goldman See Resilient Economy Supporting Stocks (bloomberg)

- Morgan Stanley: The Dollar Has Decoupled From Treasury Yields – This Is The Best Way To Trade It (zerohedge)

- Citigroup drops July rate cut bets for US, trims forecast to 75 bps (streetinsider)

- 10 states with the biggest housing market inventory shift (fastcompany)

- Some Would-Be Home Sellers Are Stepping Back As Market Tilts Toward Buyers (redfin)

- Odd Lots: Jersey City’s Mayor on How the City Built So Much Housing (bloomberg)

- Trump thinks Americans consume too much. He has a point (economist)

- Can bringing back manufacturing help the heartland catch up with ‘superstar’ cities? (npr)

- How managing energy demand got glamorous (economist)

- Americans’ Electric Bills Are Headed Higher With the Temperatures (wsj)

- 3 surprising market winners in 2025 (ap)

- Why Disney and Universal are investing billions into their theme parks (cnbc)

- Inflation pressures were tamed a few years ago (scottgrannis)

- Goldman: Funds Have Missed The Rally And Are Facing A Critical Question: Chase… Or Wait For The Pullback (zerohedge)

- China is waking up from its property nightmare (economist)

- Trump and Washington Are Making Tons of Noise. Why the Stock Market Will Be Just Fine. (barrons)

- Electric Truck Battery Demand Increased More Than 70% Last Year, Future Is Uncertain (thedrive)

- Aston Martin Channels Sunny Florida Vibes With ‘Palm Beach Edition’ DB12 Volante (maxim)

- 6 steps to crush the ball off the tee like Bryson DeChambeau (golf)

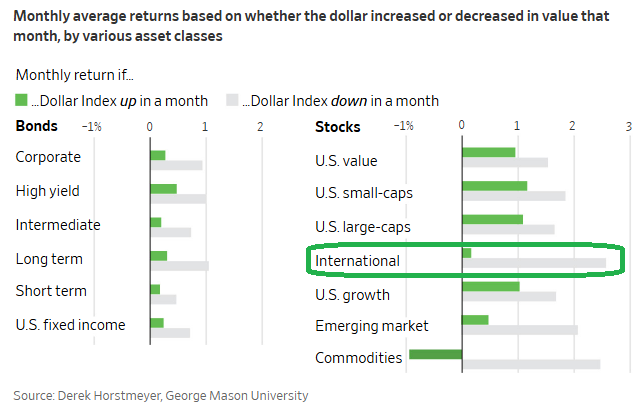

- What Stocks Do Best When the Dollar Weakens or Strengthens (wsj)

- Small-Cap Stocks Are Underloved. Why Their Time May Be Coming. (barrons)

- Healthcare Stocks Got Left Behind in the Market Rally. Are They a Buy? (morningstar)

- China eases stranglehold on rare minerals in welcome news for GM, Ford: report (nypost)

- Donald Trump says US-China trade talks to be held in London on June 9 (ft)

- Boeing Set to Restart Jet Handovers to China Amid Trade Spat (bloomberg)

- Forget Planes in Paris. GE Aero, Boeing Investors Should Focus On This. (barrons)

- Trump’s New Steel Tariffs Look Vulnerable to a Courtroom Challenge (wsj)

- Pandemic-era homebuyers are now selling into a completely different market (yahoo)

- Bank of America predicts major housing market changes are coming soon (thestreet)

- 7 Trillion Reasons Why Traders Remain “Begrudgingly Bullish”; Goldman (zerohedge)

- What Recession Fears? Stocks Are Up Again (wsj)

- Vietnam Inks Deals to Buy $3 Billion US Products Before Talks (bloomberg)

- Forbes Iconoclast Summit 2025: How The World’s Best Investors Are Navigating Trump’s Economy (forbes)

- The North Face’s Caroline Brown on Reaching Casual Consumers, Innovation, and Tariffs (shopeatsurf)

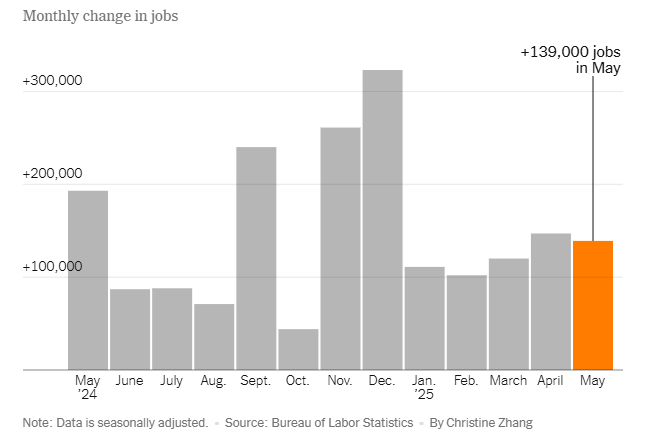

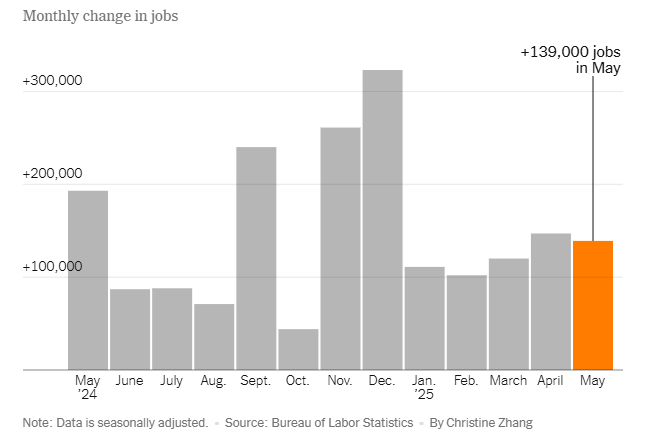

- U.S. payrolls increased 139,000 in May, more than expected; unemployment at 4.2% (cnbc)

- Is China Reversing Its ‘Uninvestable’ Image? (bloomberg)

- Alibaba unveils new open-source AI embedding models, a field it leads globally (scmp)

- Regulatory Support For AI & Tech Raises Growth Stocks, Trump & Xi Speak (chinalastnight)

- Trump Gets His Call With Xi. The Two Sides Agreed to Keep Talking. (barrons)

- Xi’s Message to Trump: Rein in the Hawks Trying to Derail the Truce (nytimes)

- US Power Grid “Getting Critically Tight” — Time To Consider Backup Power At Home (zerohedge)

- Surging electricity demand is just one reason natural gas looks so appealing to investors this summer and beyond (marketwatch)

- Boeing rebuilding trust as airline bosses see improved jet quality (reuters)

- Mortgage rates fall for the first time in 5 weeks, opening up a ‘window of opportunity’ for home buyers (marketwatch)

- Disney says its theme parks generate $67 billion in annual U.S. economic impact (cnbc)

- Wolfe Research initiates QXO stock with outperform rating and $44 target (investing)

- ‘Summer Euphoria’ – Goldman Flows Gurus Give “Greenlight” For Equity Bulls (zerohedge)

- Stop-In Season: The Real Pain Is Still to the Upside (zerohedge)

- US Treasury Calls on BOJ to Hike Rates to Correct Yen Weakness (bloomberg)

- BofA stays bearish on the U.S. dollar (streetinsider)

- Wall Street Is Too Pessimistic on the Dollar. That Could Be a Problem. (barrons)

- Stablecoins may be nasty, but for Americans they’re also cheap (ft)

- The case for a Fed rate cut (ft)

- Should Investors Bet on Intel’s Turnaround In 2025? (yahoo)

- Shop Slow, Spend More: The Retailers Hoping That Customers Linger (wsj)

- Norwegian and Other Cruise Stocks Stage a Recovery. Why There’s Smoother Sailing Ahead. (barrons)

- The economy is still growing despite the craziness every day: Hightower’s Stephanie Link (youtube)

- More Homes Are for Sale Since Before the Pandemic. What It Means for Buyers and Sellers. (barrons)

- Home Remodeling Bond Sales Surge as Americans Avoid Moving (bloomberg)

- ‘So Bad It’s Good’: Buying Window Opens for Battered Small Caps (bloomberg)

- Bond Yields & Dollar Plunge As ‘Bad’ Data Sparks Surge In Rate-Cut Hopes (zerohedge)

- Trump Loves Europe’s Rate Cuts. Why the Fed Should Take Cover. (barrons)

- BofA’s Hauner Expects More Emerging-Market Gains as Dollar Drops (bloomberg)

- Big investors shift away from US markets (ft)

- Confidence Game: Share Buybacks Are Soaring. CEO Optimism Isn’t. (barrons)

- As S&P 6,000 Looms, Speculators Are Ramping Up Their Bullish Bets (zerohedge)

- Hong Kong stocks rise for third day as China’s services PMI beats expectations (scmp)

- Shein and Temu see U.S. demand plunge on ‘de minimis’ trade loophole closure (cnbc)

- Apple and Alibaba’s AI rollout in China delayed by Donald Trump’s trade war (ft)

- US, Vietnam to hold new round of trade talks by end of next week, Hanoi says (reuters)

- Mizuho updates U.S. top picks: Adds CVS Health, PayPal and Oracle (streetinsider)

- Mastercard and PayPal collaborate to ease checkout (yahoo)

- Venmo Unleashes Next Phase of Commerce with the Venmo Debit Card and Venmo Checkout (yahoo)

- Jefferies raises Boeing stock price target to $250 on delivery growth (investing)

- Boeing Agrees to Pay $1.1 Billion to Avoid Prosecution for 737 MAX Crashes (wsj)

- Cooper Standard Wins 2024 Ford Supplier of the Year Award (yahoo)

- Meta Talks to Disney, A24 About Content for New VR Headset (wsj)