Skip to content

- Disney Raises Profit Forecast on Strong Parks, Streaming (bloomberg)

- Disney reports surprise uptick in streaming subscribers, beats on top and bottom lines (cnbc)

- Alibaba’s Qwen3 topples DeepSeek’s R1 as world’s highest-ranked open-source AI model (scmp)

- Trump officials Bessent and Greer to meet with Chinese counterparts on trade, economic issues (cnbc)

- China injects ‘tactical’ monetary stimulus ahead of US trade meeting (reuters)

- China Cuts Key Rate, Reserve Ratio to Aid Economy Hit by Tariffs (bloomberg)

- Alibaba collaborates with social media platform RedNote in fresh domestic e-commerce push (scmp)

- US-China Tariff Pause Reasonable to Expect, Council Head Says (bloomberg)

- Post-Holiday Rebound Driven By Consumer Stocks (chinalastnight)

- Bessent Says Good Trade Offers Made, Sees Deal Soon as This Week (bloomberg)

- So Much For “Not A Safe Asset”: Yields Tumble After Stellar 10Y Treasury Auction Stops Through On Soaring Direct Demand (zerohedge)

- UK and US in Intensive Talks on Economic Deal to Reduce Tariffs (bloomberg)

- Rush to beat tariffs boosts US trade deficit to record high in March (reuters)

- The economy is resilient enough to handle this uncertainty, says Ed Yardeni (youtube)

- Europe Is a Safe Haven. 5 Stocks—and 3 ETFs—to Buy for Turbulent Markets. (barrons)

- EU Lays Out Plan to Cut Russian Energy Imports by 2027 (wsj)

- BMW chief predicts lower tariffs from July (ft)

- US companies plot $500bn share buyback spree (ft)

- What’s in Buffett’s Berkshire Empire? Cowboy Boots, Candy and Railroads (wsj)

- Baby boomers are buying more homes than millennials. Is that backwards? (usatoday)

- Traders Most Bullish Loonie Since 2009 as Carney, Trump Meet (bloomberg)

- Intel shareholders approve equity incentive plan, new CEO pay (reuters)

- PayPal to introduce contactless mobile wallet in Germany (yahoo)

- Temu, Shein See US Sales Drop in Week After Tariff Price Hikes (bloomberg)

- ‘Made in China’ airliner faces trade turbulence (ft)

- Trump’s Middle East Trip Has Qatar Lining Up Major Boeing Order (bloomberg)

- Alipay and WeChat Pay see booming inbound spending in China during Labour Day holiday (scmp)

- China Plans Wednesday Briefing on Market Stabilization Measures (bloomberg)

- Beijing’s ‘Made in China’ Plan Is Narrowing Tech Gap, Study Finds (wsj)

- China’s New AI Niche Could Upend Global Tech Investing. How to Get in on the Data Gold Rush. (barrons)

- Pres. Trump will reduce China tariffs to 60% in coming weeks, says Piper Sandler (youtube)

- Optimism Is Back for Biotech Stocks. This Time, It Could Last. (barrons)

- What Recession: Goldman Now Expects Q2 GDP To Surge To 2.4% (zerohedge)

- Hollywood Wanted Trump to Bring Movie-Making Back to the U.S.—but Not Like This (wsj)

- Bessent Pitches Skittish Investors to Bet on Trump’s Economic Plan (nytimes)

- India Offers Zero-for-Zero Tariffs on Auto Parts, Steel From US (bloomberg)

- We should not believe consumers who say they’ve got the blues (ft)

- Avoid Unforced Errors and Stay Humble: Warren Buffett’s Leadership Lessons (wsj)

- BofA’s Trading Chief Says Shift Out of US Is Still Marginal (bloomberg)

- 5 Stocks to Buy in May and Hold for the Long Term (morningstar)

- GXO secures $2.5 billion NHS logistics contract (investing)

- Generac Urges Homeowners to Prepare as 2025 Hurricane Season Forecasts Above-Average Storm Activity (investing)

- Nike Switches Up Leadership Team Amid Ongoing Turnaround (wsj)

- Hims & Hers Stock Stumbles After Earnings. The Long-Term Sales Outlook Looks Low. (barrons)

- You’re More Like Warren Buffett Than You Think (wsj)

- How Warren Buffett Changed the Way Investors Think of Investing (nytimes)

- What Warren Buffett Learned From His Biggest Hits—and Misses (wsj)

- CEOs Celebrate Buffett as He Calls a Close on 5,500,000% Run (bloomberg)

- Warren Buffett to Remain Berkshire Hathaway Chairman (wsj)

- Disney’s Marvel Takes Top Spot at Weekend Box Office (barrons)

- Trump Calls for 100% Tariff on Movies Made Overseas (wsj)

- Trump Suggests Some Trade Deals May Come as Soon as This Week (bloomberg)

- Trump Won’t Fire Powell, But He Wants a Rate Cut (barrons)

- Hartnett: Market Now Expecting Trump Pivot To “Lower Tariffs, Lower Rates, Lower Taxes” (zerohedge)

- Trump Says He’s Willing to Lower China Tariffs at Some Point (bloomberg)

- Malaysia Seeks to Bring US-Imposed Tariffs Down to Zero in Talks (bloomberg)

- Strategists optimistic on China even as US-China trade war climbdown looks far off (reuters)

- Goldman: Upside massively under-priced (zerohedge)

- “Better Than Cash”: PayPal Announces Plans to Revolutionize In-Store Payments in Germany (paypal)

- Warren Buffett Plans to Step Down as Berkshire CEO at Year-End (wsj)

- Why There Will Never Be Another Warren Buffett (wsj)

- Read the WSJ’s Early Coverage of Warren Buffett (wsj)

- Warren Buffett, on Stage at Berkshire Meeting, Defends Global Trade (wsj)

- Who Is Greg Abel, the Man Preparing to Take Over for Warren Buffett? (wsj)

- Warren Buffett has created a $348bn question for his successor (economist)

- U.S. auto sales up 10.0% in April on rush demand, inventory decline and price hikes concerns going forward (marklines)

- Ford CEO does the math on Trump’s auto tariffs (npr)

- GM to increase production in existing U.S. plants, hold pricing steady (marklines)

- April Auto Sales: How Tariffs Shaped the Market (coxauto)

- eBay and Etsy are relatively confident despite tariff pressures (techcrunch)

- China’s Ant Group plans to list overseas unit in Hong Kong, report says (reuters)

- Can Starbucks be turned around? (economist)

- Big tech has a big Trump problem (economist)

- The trouble with MAGA’s manufacturing dream (economist)

- 69 housing markets where higher inventory is tipping scales to buyers (fastcompany)

- The 4 bucket-list trips that any cultured golfer needs to take (golfdigest)

- The Ferrari 296 just got a lot more Speciale (classicdriver)

- Nike, Adidas, Puma, Steve Madden, Caleres + Dozens More Companies Urge Trump to Exempt Shoes From Tariffs in FDRA Letter (footwearnews)

- Vans Owner VF Corp. Confirms 400 More Layoffs Across the Company (footwearnews)

- Berkshire Stock Could Drop 99% and Still Top S&P 500 Over Buffett’s 60-Year Reign (barrons)

- Berkshire shareholders head to Buffett’s 60th annual meeting, economy top of mind (reuters)

- Trump’s Auto Tariff Relief Shields USMCA Auto Parts From 25% Tax (bloomberg)

- Commercial aircraft demand boosts US factory orders in March (reuters)

- U.S. natural gas inventories in underground storage ended winter at a three-year low (eia.gov)

- US adds surprisingly strong 177K jobs in April as labor market holds up in face of tariffs (nypost)

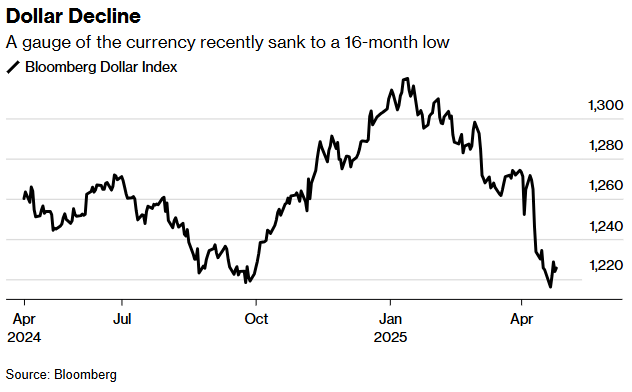

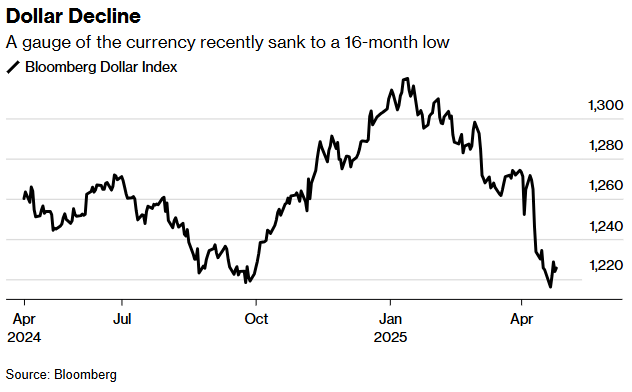

- Speculators Turn Most Bearish on the Dollar Since September (bloomberg)

- Even Marvel Knows Its Movies and Shows Need to Be Better (wsj)

- Beijing Weighs Fentanyl Offer to U.S. to Start Trade Talks (wsj)

- Europe’s first grid crisis may not be its last (ft)

- Visa, Mastercard, PayPal Fuel Agentic AI Commerce Boom (pymnts)

- Temu and Shein Will Feel ‘De Minimis’ Pain. So Will These U.S. Companies. (barrons)

- These 3 Oil Refiners Can Buck the Energy Downturn (barrons)

- Warren Buffett proves, once again, why he’s the best (marketwatch)

- Warren Buffett, Mum So Far on the Trade War, Steps Up to the Mic (wsj)

- 10 Burning Questions for Warren Buffett at the Annual Berkshire Meeting (barrons)

- Cooper Standard Reports Robust Operating Performance and Significant Margin Improvement in the First Quarter of 2025 (investing)

- Ford’s April sales, led by pickups, surged 16% ahead of tariffs (usatoday)

- Inside Ford’s Kentucky Truck Plant, It’s About as American as Can Be (barrons)

- General Motors to deploy ‘Covid playbook’ to offset $5bn tariff hit (ft)

- Chinese EV makers sell more plugin-hybrids in the EU to avoid tariffs, research firm says (reuters)

- China Signals Readiness to Respond to U.S. Trade Overtures (wsj)

- China Says Its ‘Door Is Wide Open’ for Trade Talks. What It Means for the Market. (barrons)

- China Quietly Exempts About a Quarter of US Imports from Tariffs (bloomberg)

- Hong Kong’s Growth Unexpectedly Picks Up on Tourism, Export Boom (bloomberg)

- Alibaba launches Taobao fast-delivery service ahead of time to challenge JD.com, Meituan (scmp)

- Emerging-Market Stocks Roar Back a Month After Tariff Shock (bloomberg)

- EU Could Offer to Buy $56 Billion of U.S. Products to End Trade War, Top Negotiator Says (wsj)

- Venmo gaining ground in payments as Cash App struggles (cnbc)

- Etsy is leveraging AI to boost personalization (yahoo)

- Baxter tops quarterly estimates on strong demand for medical devices (reuters)

- Trump Plans Record $1.01 Trillion National Security Budget (bloomberg)

- Amazon Shares Drop on Tariff Concerns Despite Strong Quarter (wsj)

- Why the dollar doom is overdone (ft)

- Investing Pros Haven’t Been This Worried About the Stock Market in at Least 28 Years, Our Exclusive Poll Finds (barrons)

- Chinese Stocks Look Like an Opportunity Amid Trump’s Tariff Chaos (barrons)

- China signals opening for trade talks with US (ft)

- US Has Reached Out to China to Initiate Tariff Talks, CCTV Says (bloomberg)

- Alibaba’s Qwen3 AI model family helps narrow tech gap between China and US: analysts (scmp)

- Goldman’s First-Take On Alibaba’s Hybrid Qwen3 Model (zerohedge)

- Chinese Automakers Report Robust Sales Growth in April (wsj)

- How the New Trump Tariffs on Car Parts Will Work (wsj)

- A Small, Affordable Pickup Truck? It’s Finally Here (wsj)

- Ford to Delay Price Increases to See How Rivals React to Tariffs (bloomberg)

- Home Builders Are Piling on Discounts as They Struggle to Entice Buyers (wsj)

- America’s housing crisis: Realtor.com CEO says there is way to solve it (foxbusiness)

- US Pending Sales of Existing Homes Increase by Most Since 2023 (bloomberg)

- US Treasury chief urges Fed to cut rates (reuters)

- U.S. Treasury Won’t Boost Bond Sizes for Refunding, Signals Changes to Buybacks (barrons)

- Small-Cap Stocks Have Suffered. It’s Time to Be Cautiously Optimistic. (barrons)

- EU to Present Trade Proposals to US Negotiators Next Week (bloomberg)

- Millions of people in Europe lost power for hours on Monday, and no one knows why (marketwatch)

- Biggest Dollar Slump Since 2022 Hints at More Losses Ahead (bloomberg)

- U.S. Economy Shrank in First Quarter as Imports Surged Ahead of Tariffs (wsj)

- E-Commerce Sellers Brace for End of De Minimis (wsj)

- The 10 Best Companies to Invest in Now (morningstar)

- Estée Lauder Forecasts Return to Sales Growth in 2026 (bloomberg)

- Albemarle maintains 2025 outlook due to lithium tariff exemptions (reuters)

- Baxter shares rise as Q1 earnings top estimates, guidance raised (investing)

- Crown Castle Reports First Quarter 2025 Results and Maintains Outlook for Full Year 2025 (investing)

- Comstock Resources beats Q1 estimates, stock rises 3.5% (investing)

- Trump Softens Blow of Automotive Tariffs (wsj)

- For Ford, Tesla, the Worst Auto Tariff Case Is Off the Table (barrons)

- Trump eases auto tariffs burden as Lutnick touts first foreign trade deal (reuters)

- Stanley Black & Decker Raising Prices to Offset Tariff Costs (wsj)

- Generac tops Q1 forecasts, lowers bottom end of 2025 outlook (investing)

- Etsy tops quarterly revenue estimates on steady demand for apparel, gifts (reuters)

- Etsy shares pop on revenue beat as company says it’s ‘staying nimble’ to tariff uncertainty (cnbc)

- Intel Says Clients Preparing to Test New Production Process (bloomberg)

- Intel CEO Lip-Bu Tan charts foundry roadmap (streetinsider)

- PayPal Is Launching Programmatic Ads Powered By Shopping Data (adweek)

- Disney, Universal Films to Screen in China Despite Trade Dispute (bloomberg)

- Alibaba Rolls Out ‘Instant Commerce’ Feature as China Delivery Battle Heats Up (wsj)

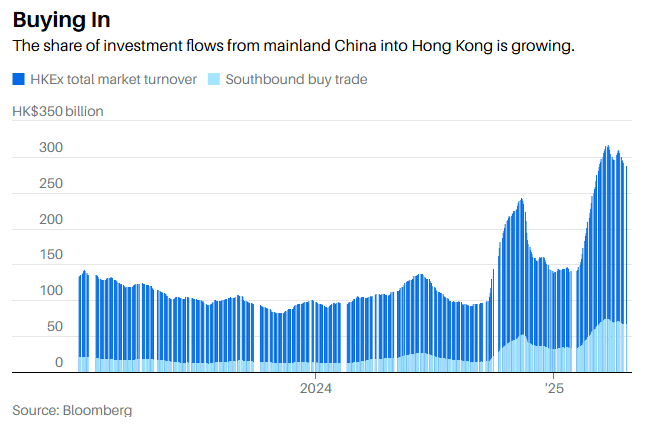

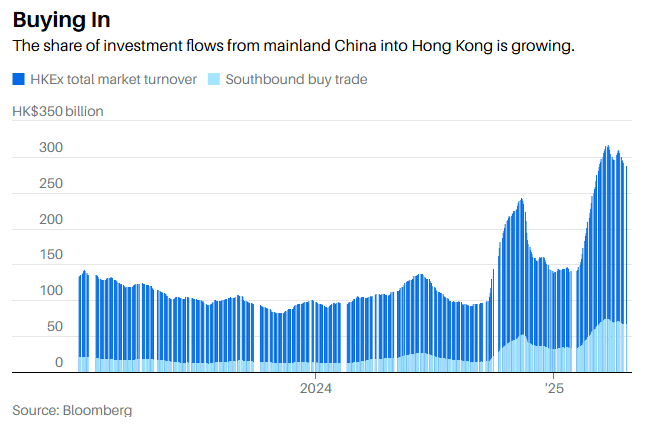

- Demand for Chinese stocks lifts Hong Kong exchange’s profits (ft)

- Alibaba gives Taobao on-demand delivery an upgrade in Meituan, JD.com competition (scmp)

- Huawei delivers advanced AI chip ‘cluster’ to Chinese clients cut off from Nvidia (ft)

- Chinese Set to Spend Record $1 Trillion in Local Travel Boom (bloomberg)

- A Weak Dollar Is A Blessing for Emerging Markets (zerohedge)

- Bessent Cites Digital Services Tax as Sticking Point in EU Talks (bloomberg)

- Tariff-Frontrunning Sends US Trade Deficit To New Record High In March (zerohedge)

- Hedge Funds Lose Market Conviction, Except for Shorting US Stocks (bloomberg)

- The Best Basic Materials Stocks to Buy (morningstar)

- US NatGas Deemed “Oversold” By Goldman Ahead Of Summer (zerohedge)

- Bank of America, Mattel, and 5 Other Stocks Have Priced in Recession. Buy Them. (barrons)

- Starbucks’ Sales Keep Falling, Amping Up Turnaround Stakes (bloomberg)

- US Economy Contracts for First Time Since 2022 on Imports Surge (bloomberg)

- US Firms Add 62,000 Jobs, Smallest Gain Since July in ADP Data (bloomberg)

- PayPal Reports Strong First-Quarter Earnings. Turnaround Strategy is Working, CEO Says. (barrons)

- PayPal Profit Gauge Tops Estimates in Sign of Turnaround Success (bloomberg)

- Venmo revenue grows 20%, with debit card payment volume soaring (cnbc)

- Alibaba launches new Qwen LLMs in China’s latest open-source AI breakthrough (cnbc)

- Alibaba Rolls Out Latest Flagship AI Model in Post-DeepSeek Race (bloomberg)

- China Offers Olive Branch to U.S. Firms After Boeing Delivery Halt (wsj)

- Bessent Says China Must Take Lead on Tariffs Talks, Hints at India Deal (barrons)

- The Best Chinese Stocks to Buy (morningstar)

- China’s E-Commerce Giants Are Putting Up a Fight (bloomberg)

- What’s the De Minimis Tariff Loophole Trump Is Closing? (bloomberg)

- Huawei Races To Replace Nvidia: New Ascend 910D AI Chip Will Begin Testing Next Month In China (zerohedge)

- Nvidia’s Chip Market Problems Aren’t Just in China (wsj)

- Trump to Soften Blow of Automotive Tariffs (wsj)

- Boeing Removed From Credit Watch by S&P in Turnaround Boost (bloomberg)

- India Plans to Highlight Boeing Order Pipeline in US Trade Talks (bloomberg)

- Why Restarting a Power Grid After Massive Collapse Is So Hard (bloomberg)

- Housing on Federal Lands Aims to Ease Affordability Crisis (nytimes)

- How to Invest Like Warren Buffett (morningstar)

- Dollar on track for biggest two-month fall in more than two decades (streetinsider)

- Has sentiment bottomed out? (ft)

- Buyback Blackout Period Ends: Record Stock Repurchases On Deck (zerohedge)

- Woodside Energy Approves $17.5 Billion Louisiana LNG Development (wsj)

- GM Beats Earnings Estimates, Delays Conference Call. It’s Waiting for Trump Tariff Changes. (barrons)

- Royal Caribbean raises annual profit forecast on strong cruise demand (reuters)

- American Tower beats quarterly revenue estimate on strong telecom infrastructure leasing demand (reuters)

- Starbucks Is Reinventing Itself. Earnings Will Show the Progress. (barrons)

- Unhedged and Burned, Stock Investors Brace for More Dollar Pain (bloomberg)

- The Dollar’s Weakness Creates an Opportunity for the Euro. Can It Last? (nytimes)

- Morgan Stanley’s Wilson Says Weak Dollar Will Buoy US Stocks (bloomberg)

- China moves to protect economy from trade war, vows to hit 5% growth target (scmp)

- China rolls out employment support and hints at more stimulus as U.S. tensions escalate (cnbc)

- Goldman says China funds to buy US$110 billion of Hong Kong-listed stocks (scmp)

- China’s Huawei Develops New AI Chip, Seeking to Match Nvidia (wsj)

- Goldman Sachs Offers Advice on Tariffs to Countries Scrambling to Please Trump (wsj)

- Philippines Aims to Lower US Tariff to Zero During Talks (bloomberg)

- Emerging-Market Stocks Extend Rally Amid Earnings Optimism (bloomberg)

- Riyadh Air willing to buy Boeing planes from cancelled Chinese orders, CEO says (reuters)

- Bernstein raises Boeing stock rating, price target to $218 (investing)

- Boeing Stock Is Rising for Two Reasons (barrons)

- Inflation Fear Is Making Some People Spend More—and Others Less (wsj)

- Home prices starting to crack: Here’s why (youtube)

- The 7-year car loan is here. Do you really want to be paying off your car in 2032? (usatoday)