- NextEra Is the Country’s Biggest Electric Utility—and a Leader in Renewables (Barron’s)

- Inner Game with Steven Cohen (Stray Reflections)

- Feds accelerating crypto world crackdown (Fox Business)

- OPEC+ Expected to Boost Oil Production Next Week (Barron’s)

- The Banks Passed Stress Tests. Now They Get to Announce Payouts. (Barron’s)

- Pfizer Developed a Vaccine in Less Than a Year. There’s More to Come. (Barron’s)

- Larry Culp Is Building a Leaner, Meaner, More Profitable GE (Barron’s)

- Jamie Dimon on JPMorgan Chase: ‘There Isn’t a Single Area Where We Can’t Grow.’ (Barron’s)

- Larry Fink Made BlackRock a Powerhouse. Why He’s Bullish on China. (Barron’s)

- Progressive’s CEO Has Grown the Auto Insurer. Warren Buffett Approves. (Barron’s)

- Brian Moynihan Has Run Bank of America Conservatively. Shareholders Have Prospered.(Barron’s)

- Lightning return to Stanley Cup Final with Game 7 win vs. Islanders (USA Today)

- Two Energy Stocks See Large Insider Share Buys (Barron’s)

- 3 Reasons Nike Stock Is Soaring After Earnings (Barron’s)

- Our Top CEOs: Meet 30 Leaders Who Turned Crisis Into Opportunity (Barron’s)

- General Dynamics CEO Phebe Novakovic Believes in Patriotism and Resilience (Wall Street Journal)

- Haters Everywhere in Stock Market After S&P 500’s Big First Half (Bloomberg)

- Consumer Spending Is Primed to Fuel Summer Growth (Wall Street Journal)

- 2021 Tesla Model S Plaid: Feel the Force—0-60 in 2 Seconds (Wall Street Journal)

- Why Wall Street loves Joe Manchin right now (CNN)

Category: What I’m Reading Today

Be in the know. 40 key reads for Friday…

- Ant Is Addressing Regulators’ Demands. What Proposed Changes Could Mean for China’s Big Tech Valuations. (Barron’s)

- This Biotech Is Editing Genes Inside the Body. What It Means for the Stock. (Barron’s)

- Nearly 3.4M workers remain on jobless benefits despite drop in weekly claims (New York Post )

- Nike Earnings Beat Expectations. Why Its Stock Is Jumping. (Barron’s)

- Banks Pass the Fed’s Stress Tests. It’s Buyback Time. (Barron’s)

- Citigroup: From Laggard to Leader? (Barron’s)

- Biden Says an Infrastructure Deal Has Been Reached. Here’s What It Means for Stocks. (Barron’s)

- Will Fed tapering concerns derail the rising stock market? ‘Investors should look past it,’ says one strategist. (MarketWatch)

- 5 Things We Learned From This Week’s Big SPAC Conference (Barron’s)

- Merrill Lynch’s Raj Bhatia: ‘One Face-to-Face Meeting Is Worth More Than 100 Emails’ (Barron’s)

- Your NFT Sold for $69 Million—Now What? Beeple Turns to a New Project, and Old Masters. (Wall Street Journal)

- Didi Sets Valuation Target of $62 Billion to $67 Billion in IPO (Wall Street Journal)

- The Economic Recovery Is Here. It’s Unlike Anything You’ve Seen. (Wall Street Journal)

- 4,368 Episodes Later, Conan O’Brien’s Late-Night Run Ends (Wall Street Journal)

- Fed’s Williams Says More Progress Needed Before Rate-Hike Shift (Wall Street Journal)

- Eli Lilly to Seek FDA Approval for Alzheimer’s Drug (Wall Street Journal)

- ‘F9: The Fast Saga’ Review: Furiouser and Curiouser (Wall Street Journal)

- FedEx to Ramp Up Spending to Ease Delivery Delays (Wall Street Journal)

- Hospital Stocks’ Rally Points to Post-Covid Growth (Wall Street Journal)

- Fed Gives Big Banks Clean Bill of Health in Latest Stress Test (Wall Street Journal)

- Bond Anomalies Have Been Around Since Napoleon (Bloomberg)

- Wall Street Binges on Volatility Hedges as Stocks Hit Records (Bloomberg)

- Apple’s Car Obsession Is All About Taking Eyes Off the Road (Bloomberg)

- Iran Misses Deadline to Renew Nuclear Monitoring Pact With IAEA (Bloomberg)

- Virgin Galactic jumps 12% after getting the green light from the FAA to fly passengers to space (CNBC)

- Cramer’s lightning round: ‘I want to buy the stock of Verizon’ (CNBC)

- Elon Musk says he will debate Jack Dorsey about bitcoin, after criticizing the token’s energy use (Business Insider)

- These 30 stocks are the best dividend income growers among the S&P 500 (MarketWatch)

- U.S. consumer spending takes a breather in May (Reuters)

- Roche’s arthritis drug gets authorized as COVID-19 treatment for the severely ill (MarketWatch)

- Netflix upgraded to Outperform from Neutral at Credit Suisse (TheFly)

- Natgas Futures Hit 29-Month High Amid Heat Wave (ZeroHedge)

- All 23 US Banks Easily Pass Fed’s Stress Test, Setting Stage For Billions In Buybacks (ZeroHedge)

- Paris Air Show Reveals Increasing Demand for Boeing (BA) MAX and China Recert Likely in 3Q – Morgan Stanley (StreetInsider)

- Eli Lilly (LLY) Surges After Getting Breakthrough Therapy Designation From FDA, Analyst Raises PT and Sees Approval Chance at 90%, Biogen (BIIB) Plunges (Street Insider)

- Hershey Foods’ (HSY) Jet Spotted in Buffett’s Backyard – Analyst (StreetInsider)

- Jefferies Says Jump On the Weakness in Three Top Gaming Stocks and Buy Now (24/7 Wall Street)

- Here’s why Boeing’s stock will soar (Yahoo! Finance)

- Hedge funds rethink tactics after $12bn hit from meme stock army (FinancialTimes)

Be in the know. 30 key reads for Thursday…

- Jack Ma’s Ant in Talks to Share Data Trove With State Firms (Wall Street Journal)

- Lilly’s (LLY) donanemab receives U.S. FDA’s Breakthrough Therapy designation for treatment of Alzheimer’s disease (Street Insider)

- General Electric (GE) Approaching a Free Cash Flow Inflection Driven By Aviation – UBS (Street Insider)

- Vertex Pharma (VRTX) Approves $1.5B Buyback Program (Street Insider)

- SEC’s planned new ‘woke’ rules creating cost concerns for business leaders (FoxBusiness)

- Rates Are Still Low. Here Are 8 Large-Cap Stocks That Offer Income. (Barron’s)

- The Fed’s Stress Test Results Are Coming. All Eyes Are on Bank Stocks. (Barron’s)

- Berkshire Hathaway Appears to Have Bought Back $6 Billion of Stock in Quarter (Barron’s)

- India Warns About Delta Plus Covid-19 Variant (Barron’s)

- Economies Need Central Bank Digital Currencies More Than Bitcoin, Says Global Banking Watchdog (Barron’s)

- ViacomCBS, Roku Stock Jump on Report of Comcast M&A Speculation (Barron’s)

- Canadian Stocks Look Cheap, BofA Says. Why They Could Be Cyclical Superstars. (Barron’s)

- Prime Day Is Over. These 12 Stocks Are Still Good Deals. (Barron’s)

- The clearest evidence that Wall Street has no clue where Treasury yields are headed (MarketWatch)

- 5 BofA Securities US 1 List Stocks to Buy Now That Also Pay Very Dependable Dividends (24/7wallst)

- Biden and Senators Close In on Bipartisan Infrastructure Deal (New York Times)

- Emergency Landing for China’s Flying Pig Prices (Wall Street Journal)

- S. economy grew 6.4% in year’s first quarter, Commerce Department reiterates (MarketWatch)

- Jobless claims slip, but remain at elevated pandemic levels (Fox Business)

- Durable goods jump as transportation rebounds (Fox Business)

- OPEC+ Weighs Cautious Supply Hike as Oil Market Begs for Barrels (Bloomberg)

- How Home Builders Are Contributing to Housing Frenzy (Wall Street Journal)

- Big Win for Property Rights (Wall Street Journal)

- Xpeng (XPEV) Leaps After Receiving a Green Light From Regulators to Raise Up To $2 Billion in Hong Kong IPO (Street Insider)

- com (AMZN) Prime Day Sales Increase 7% Generating New Record – Morgan Stanley (Street Insider)

- Goldman Sachs Sees S&P 500 Dividend Growth Much Higher Than Market is Pricing (Street Insider)

- Lumber continues to skid below $900 with the commodity in free-fall from May highs (Business Insider)

- Tencent takes quiet path through China’s tech turbulence (Financial Times)

- Russian supply curbs exacerbate squeeze on European gas market (Financial Times)

- Carnival expects second-quarter losses of $2 billion, teases additional cruise restarts (MarketWatch)

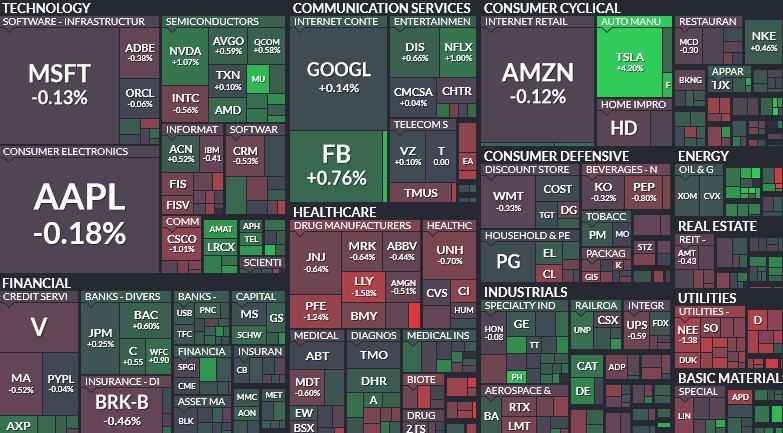

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Wednesday…

- Earnings Bonanza Could Dwarf Fed Worries (Wall Street Journal)

- That Was a Lot of Sound and Fury for a 0.0% Return (Bloomberg)

- ‘F9’ Is Under Pressure to Be the Flick That Revives Moviegoing (Bloomberg)

- Wells Fargo: Here’s The Best Asset To Own When Inflation Strikes (Investor’s Business Daily)

- Don’t Call the Value Rally Dead Just Yet (Barron’s)

- The Nasdaq Hit a Record. The Rally May Just Be Starting. (Barron’s)

- European stocks ease, but PMI shows business activity surging (MarketWatch)

- XPeng stock jumps as Chinese Tesla rival reportedly gets approval for Hong Kong IPO (MarketWatch)

- Citigroup Has Been a Laggard. This Fund Manager Thinks It’s Ready to Be a Leader (Barron’s)

- S. Existing-Home Prices Hit Record High in May (Wall Street Journal)

- Fed’s Powell Plays Down Inflation Threat (Wall Street Journal)

- Why There Is No ‘Taper Tantrum’ This Time Around (Wall Street Journal)

- Nonbank Lenders Are Dominating the Mortgage Market (Wall Street Journal)

- Bostic: Fed should avoid ‘prematurely’ declaring win in jobs battle (Reuters)

- Value Investors Don’t Need to Avoid Growth Companies. In Fact, Doing So Can Hurt Returns. (Institutional Investor)

- Stunning Confessions of a Short Seller (Institutional Investor)

- BofA Securities Out with Top Small and MidCap Stock Picks For 2nd Half (24/7 Wall Street)

- The SPAC Man Method: Inside the Billionaire Rush for Riches (Bloomberg)

- Americans Are On the Cusp of Another Borrowing Binge (Bloomberg)

- Millionaire Investors Have ‘No Choice’ But to Take On More Risk (Bloomberg)

Be in the know. 28 key reads for Tuesday…

- Splunk to receive $1B investment from Silverlake (TheFly)

- The recovery in air flight bookings has stalled — and business travel is to blame (New York Post)

- Splunk Shares Soar on $1 Billion Investment From Silver Lake (Bloomberg)

- Fed Pivot Seen as More Detour Than Dead-End for Reflation Trades (Bloomberg)

- This Big Tech Stock Is Always on Sale (Wall Street Journal)

- Google Executives See Cracks in Their Company’s Success (New York Times)

- White House Officials Head to Hill for Infrastructure Talks (Bloomberg)

- Economy Is Showing Sustained Progress, Powell Says (Wall Street Journal)

- Powell Holds Firm to Fed’s Inflation Stance in House Covid-19 Update (Barron’s)

- Opendoor CFO Says Company Can Succeed in a Housing Market Downturn (Barron’s)

- Rates Are Still Low. These 8 Large-Cap Stocks Offer Income (Barron’s)

- Covid-19 Showed mRNA Vaccines Work. Translate Bio, Sanofi, Test One for Flu. (Barron’s)

- Energy Stocks Have Potential New Appeal: Dividends (Barron’s)

- Royal Dutch Shell’s cash-generation potential is highlighted by JPMorgan (MarketWatch)

- After a Years-Long Slump, New York Townhouse Sales Picked up in the Pandemic (Barron’s)

- YouTube Shorts Is Taking on TikTok and Minting a New Constellation of Concise Video Stars (Bloomberg)

- Hedge Funds Held on to Pandemic Losers, and Now It’s Paying Off (Bloomberg)

- A Record Buyout Is Just the Start as Wealthy Flee U.S. Tax Hike (Bloomberg)

- EU opens antitrust probe into Google’s advertising unit (CNBC)

- Hedge fund that bet against GameStop shuts down (Financial Times)

- Shipping stocks have notched triple-digit gains in 2021 as transport rates skyrocket (Business Insider)

- Fed’s Williams says slowing down bond purchases ‘quite a ways off’ (MarketWatch)

- Netflix (NFLX) Confirms Partnership with Steven Spielberg’s Amblin (StreetInsider)

- Splunk (SPLK) Announces $1 Billion Investment from Silver Lake, Announces $1B Buyback (StreetInsider)

- Mad Money Host Jim Cramer Says He’s Sold Most of His Bitcoin Following China Crackdown (Yahoo! Finance)

- Bridgewater’s Prince rejects return of 1970s ‘Great Inflation’ (Financial Times)

- Bond spreads collapse as investors rush into corporate debt (Financial Times)

- Gilead’s Veklury® (Remdesivir) Associated With a Reduction in Mortality Rate in Hospitalized Patients With COVID-19 Across Three Analyses of Large Retrospective Real-World Data Sets (TrialSiteNews)

Be in the know. 17 key reads for Monday…

- Bank Stocks Got Beaten Up by the Fed. How the Fed Can Help Them Bounce Back. (MarketWatch)

- ‘Nice underpinning to the market’: Buybacks may prop stock market rattled after Fed meeting (MarketWatch)

- Consolidation May Be Coming to a Screen Near You (Wall Street Journal)

- This Home Builder Stock Is a Buy. Here’s Why. (MarketWatch)

- Gilead says real-world data shows COVID-19 drug Veklury can reduce the risk of death (MarketWatch)

- Nuclear Talks on Hold. The Energy Report 06/21/2021 (Phil Flynn)

- 3 Of Jefferies Top Value Stocks To Buy Are Mega-Cap Tech and Defense Giants (24/7 Wall Street)

- Inflation hasn’t dented earnings forecasts: Morning Brief (Yahoo! Finance)

- The natural-gas glut has evaporated, driving prices higher (Fox Business)

- Germany’s Armin Laschet warns against cold war with China (Financial Times)

- Michael Burry Issues Grim Warning On Cryptocurrency, Stonks: Losses Will ‘Approach The Size Of Countries’ (Benzinga)

- EU tech policy is not anti-American, says Vestager (Financial Times)

- Olympic venues to cap number of spectators at 10,000 (Financial Times)

- Bitcoin drops as China intensifies crypto mining crackdown (CNBC)

- China has administered more than 1 billion doses of its Covid-19 vaccines (CNBC)

- Cruise Operators Win Relief as Florida Judge Rules Against CDC’s Sailing Order (Barron’s)

- Lidar Technology Will Enable a Self-Driving Future. What to Know About 6 Stocks. (Barron’s)

Be in the know. 12 key reads for Sunday…

- Robert Cialdini on the Psychology of Influence (Podcast) (Bloomberg)

- Down Triple Witching Weeks Trigger More Weakness Week After (Almanac Trader)

- Amazon Prime Day 2021 Is Three Days Away—Here’s Everything To Know (Forbes)

- 23andMe’s Anne Wojcicki Becomes Newest Self-Made Billionaire After SPAC Deal With Richard Branson (Forbes)

- 10 Best Dividend Stocks to Buy According to Billionaire David Tepper (Insider Monkey)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Fed Reverse Repos Surge to Record of $756 Billion After Rate Tweak Wall Street Journal)

- Beverly Hills Tour d’Elegance Hits the Road This Weekend with a $100M+ Convoy (TheDrive)

- AirTags and Find My are ushering in a whole new Apple era (TNW)

- Meet Dr. Jennifer Doudna: she’s leading the biotech revolution (Big Think)

- Listen to the One-Off Bugatti Bolide’s Wild Straight-Piped 1850-HP W-16 Engine (roadandtrack)

- Why Ram Parameswaran Says the World’s Biggest Tech Stocks Are Ridiculously Cheap Right Now (Bloomberg)

Be in the know. 20 key reads for Saturday…

- Tesla Isn’t the Only Self-Driving Car Company. The Stocks to Buy—and Ones to Avoid. (Barron’s)

- S. Faces a Housing Shortage. This Builder Can Help Fill the Gap—and Its Stock Is a Buy. (Barron’s)

- Markets to the Fed: Your Hawkish Turn Isn’t Fooling Anyone (Barron’s)

- Disney Stock Looks Set to Get a Boost From a Quicker Reopening (Barron’s)

- The Reopening Could Send Six Flags Stock Vertical (Barron’s)

- Energy Stocks Have Potential New Appeal: Dividends (Barron’s)

- Why Moderna, Illumina, or Meituan Could Be the Next Tesla Stock (Barron’s)

- Rate-Hike Worries Send Dow to Worst Week Since October (Wall Street Journal)

- At Olympic Swim Trials, the Battle Is in the Warm-Up Pool (Wall Street Journal)

- CVS and Walgreens Were Reeling From Pandemic, but Fortunes Have Changed (Wall Street Journal)

- Boeing’s largest 737 Max model jets off on maiden flight (New York Post)

- Fed Shocks Stocks With Blow to Dreams of Value Investor Nirvana (Bloomberg)

- The Fed’s latest policy decision will prop up stocks through 2021 but it may be a misstep for the central bank, Mohamed El-Erian says (Business Insider)

- Fed’s Kashkari opposed to rate hikes at least through 2023 (CNBC)

- 16 short-squeeze targets in the stock market, including Canoo, Tootsie Roll and a prison operator (MarketWatch)

- Empty Oil Tanks at Key Storage Hub Show Speedy Demand Rebound (Bloomberg)

- The Long-Term Forecast for U.S. Stock Returns (Morningstar)

- Billionaire investor David Tepper says ‘the stock market is still fine’ after Fed announcements (CNBC)

- Seizing The Middle: Chess Strategy in Business (Farnam Street)

- “The stock market is not created for Value Investors” – Li Lu (YouTube)

Be in the know. 15 key reads for Friday…

- Global Stocks Struggle As Fed Fallout Continues, With Techs Set to Stay in Favor (Barron’s)

- David Tepper Hates Social Media, but Still Loves FAANG Stocks (institutionalinvestor)

- The Oil Resurgence Is Real. These Are the Stocks to Buy. (Barron’s)

- Americans Can Fly to Europe Again. That’s Great News for Airline Stocks. (Barron’s)

- Biogen Stock Can Go ‘Decisively Higher’ on Sales of Alzheimer’s Drug (Barron’s)

- Why These 24 Controversial S&P 500 Stocks Could Be Worth Buying (Barron’s)

- Jobless Claims Rose Last Week, Pausing Downward Trend (Wall Street Journal)

- Bipartisan $1 Trillion Infrastructure Package Gains Steam (Wall Street Journal)

- U.S. to Invest More Than $3 Billion in Covid-19 Antiviral Development (Wall Street Journal)

- TikTok Owner ByteDance’s Annual Revenue Jumps to $34.3 Billion (Wall Street Journal)

- The Economic Gauges Are Going Nuts. Jerome Powell Is Taking a Longer View. (New York Times)

- Yield on 30-Year Treasuries Tumbles as Curve Continues to Flatten (Bloomberg)

- Old World Order Is Back in Stocks as Reopening Trade Takes Lumps (Bloomberg)

- Fed Statement Very Bullish for Tech Stocks, Focus on Cloud and Cyber Stocks – Wedbush (Street Insider)

- Amazon’s Jeff Bezos backing nuclear fusion plant in the UK (Fox Business)