Skip to content

- Leisure and Hospitality Wages Are Soaring. It’s the Economy Returning to Normal. (Barron’s)

- This Former Merck Company Could Have Big Potential (Barron’s)

- Amazon’s Jeff Bezos Is Going to Space (Barron’s)

- Google fined $268M in French antitrust case, will change ad practices (New York Post)

- The 5 Highest-Paying S&P 500 Dividend Stocks All Yield 5% or More (247wallst)

- Investors cash in on dividend stocks as recovery gathers pace (Financial Times)

- Carnival stock gains after confirming restart of cruises from U.S. port in less than a month (MarketWatch)

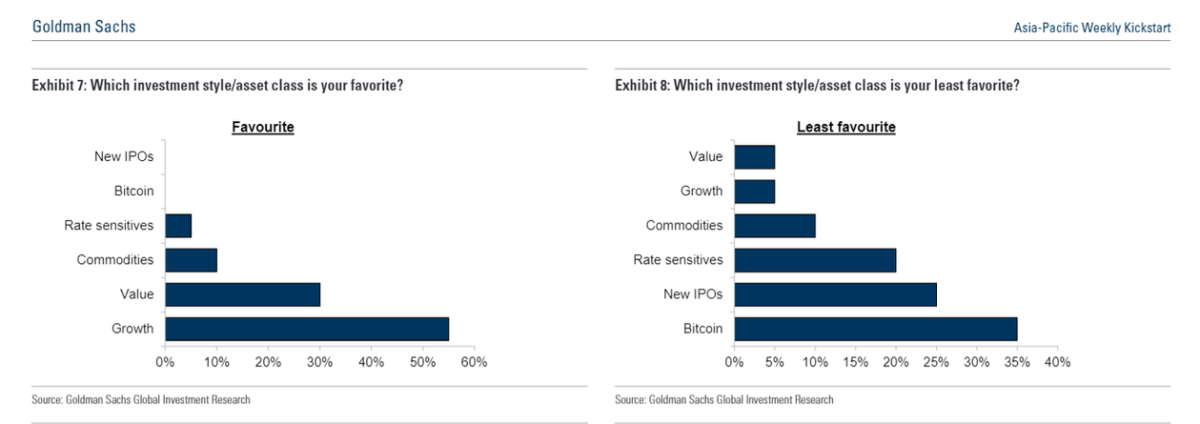

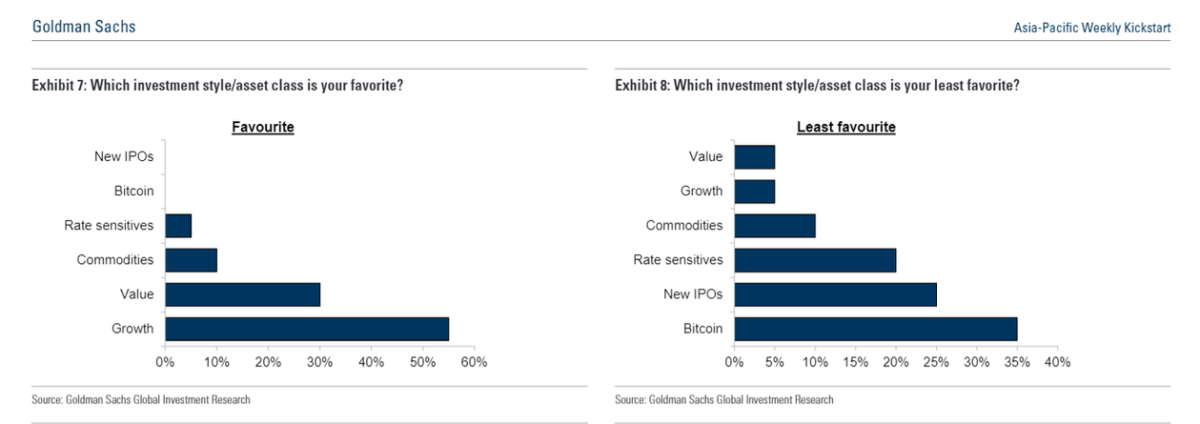

- Goldman chart reveals what hedge fund investment chiefs really think about bitcoin (MarketWatch)

- $70.00 Again. The Energy Report 06/07/2021 (Phil Flynn)

- BP Expects Strength in Global Oil Demand to Last, CEO Says (Bloomberg)

- Big First 5 Months Gains Consolidate Over Worst Months (Almanac Trader)

- The great private jet shortage? (Financial Times)

- Here’s Why the Fed Isn’t Frightened by the Jobs Report (Wall Street Journal)

- 2021 Porsche 718 Cayman GTS 4.0: Targeting The Driving Enthusiast (Forbes)

- 10 Best Stocks that will Benefit from Biden’s $6 Trillion Plan (Insider Monkey)

- Verizon CEO Hans Vestberg on why he tracks every hour of his day and the power of the ‘boss contract’ (Fortune)

- The big-pharma firm that saw the future (The Economist)

- The Czinger 3-D-Printed, 1250 HP Hypercar Has a Top Speed of 281 MPH (Robb Report)

- 5 Standout Yachts From This Year’s Venice Boat Show (Robb Report)

- Autonomous vehicle startup Aurora in final talks to merge with Reid Hoffman’s newest SPAC (Tech Crunch)

- Not every SPAC is pure garbage (Tech Crunch)

- Here’s Why You Have Zero Chance Of Winning At 3-Card Monte (digg)

- ‘Wedding Crashers’ Sequel To Begin Production in August With Original Cast (Maxim)

- Guy Fieri Praised After Leaving $5,000 Tip at Miami Restaurant For Entire Staff (Maxim)

- Xpeng says its self-driving tech outperforms Tesla’s (technode)

- What’s driving the surge in food prices and what are the knock-on effects? (MoneyWeek)

- Only 39% of Americans would switch to an EV — here’s why (TNW)

- China Has Triggered a Bitcoin Mining Exodus (Wired)

- The 23 greatest classic films on HBO Max (Mashable)

- How JetBlue Founder David Neeleman Launched a New Airline During a Pandemic (Inc.)

- Guy Fieri’s Bacon-Wrapped Danger Dogs Are a Ticket to Flavortown (Bloomberg)

- Manchin warns Dems about going it alone on Biden’s spending plan (Fox Business)

- Investors Need to Watch the Labor Shortage. Here’s Why. (Barron’s)

- Tiger Cubs: How Julian Robertson built a hedge fund dynasty (Financial Times)

- Lumber Prices Slump As Historic Boom Hits A Wall (ZeroHedge)

- The Best Investment of All: The People You Love the Most (New York Times)

- Fund Managers Are Ignoring Meme Stocks. That’s a Good Thing. (Barron’s)

- Brinker Stock Looks Set to Soar on Chili’s Comeback (Barron’s)

- Hedge fund stars shy away from the limelight (Financial Times)

- Banks Need Loan Growth to Keep Rallying. These Stocks Already Have It. (Barron’s)

- Why Boeing Could Fly High Again (Barron’s)

- Charlie Munger’s Book Recommendation List (CMQ)

- Driving the undriveable Ferrari (Financial Times)

- Payne: When I was a kid, getting a job was like winning the lottery (Fox Business)

- 4 Undervalued Stocks With Momentum (Morningstar)

- Dividends Are the Next Oil Catalyst. Here Are the Stocks that Could Benefit. (Barron’s)

- Natural-Gas Prices Stir Heading Into Summer (Barron’s)

- Peter Lynch on Common Investor Mistakes (Novel Investor)

- One stunning chart shows just how much faster the US labor market is recovering now compared to the financial crisis (Business Insider)

- A Wave of Global Spending Is Great News for Humanity (and Investors) (Barron’s)

- The Stock Market’s Long Run of Nothing Continued Last Week. What to Know. (Barron’s)

- Solar Power’s Land Grab Hits a Snag: Environmentalists (Wall Street Journal)

- Facebook’s Marketplace Faces Antitrust Probes in EU, U.K. (Wall Street Journal)

- iPhone? AirPods? MacBook? You Live in Apple’s World. Here’s What You Are Missing. (Wall Street Journal)

- Why Does Anyone Care About a Superyacht? (Wall Street Journal)

- Bill Gates, Warren Buffett building nuclear reactor in coal-rich Wyoming (New York Post)

- G-7 Strikes Historic Deal to Revamp Global Tax on Tech Firms (Bloomberg)

- How Ronald Read managed to accumulate a dividend portfolio worth $8 million (DGI)

- Emerging-Market Stocks in Pole Position to Gain as World Reopens (Bloomberg)

- Rosneft Warns of ‘Severe’ Oil Shortage Amid Hasty Energy Shift (Bloomberg)

- Bonds Aren’t Freaking Out About Inflation (Bloomberg)

- S.-China Trade Relationship Significantly Imbalanced, Tai Says (Bloomberg)

- Crypto investor Vignesh Sundaresan: ‘It’s the NFT that changed the world’ (Financial Times)

- Royal Caribbean sets 2021 cruises in Florida, Texas and Alaska (CNBC)

- Interactive Brokers founder says problem with AMC Entertainment memes: ‘People…will lose a very substantial amount of money’ (MarketWatch)

- Pete Najarian Sees Unusual Options Activity In Tapestry And IQIYI (Benzinga)

- Electric Car Batteries Are Turning This Country Into an Actual Hellscape (Futurism)

- Bill Ackman’s SPAC Is in Talks to Buy a Stake in Universal Music —But So Far It’s Not Music to Investors’ Ears (Institutional Investor)

- The Pied Piper of SPACs (New Yorker)

- Lots of Liquidity (Yardeni)

- FDA’s Call on Biogen’s Alzheimer’s Drug Is Coming Soon (Barron’s)

- Viva Las Vegas: Sin City Presses Its Luck in the Postpandemic Era (Barron’s)

- May’s Employment Report Is Another Disappointment (Barron’s)

- Buy Take-Two Interactive Because a Whole Lot of Videogames Are in the Works (Barron’s)

- Alibaba, Alphabet, and Amazon Stock Are Bargains, This Value Manager Says (Barron’s)

- How Pitchers Are Conquering Baseball’s Home Run Revolution (Wall Street Journal)

- Ant to Change How It Makes Loans With New Consumer-Finance Company (Wall Street Journal)

- Services Boom? You Ain’t Seen Nothing Yet (Wall Street Journal)

- Biden Narrows Infrastructure Request, but Hurdles Remain for Bipartisan Deal (New York Times)

- The Momentum Is With Active Fund Managers for Now (Bloomberg)

- Texas Rising: Hedge Funds, Big Tech Drive Lone Star Wealth Boom (Bloomberg)

- Palantir gets aggressive in SPAC investments, backing digital health, aviation and robot companies (CNBC)

- Billionaire hedge-fund manager Julian Robertson endorses high-flying US tech stocks — and says their valuations aren’t lofty (Business Insider)

- Apple’s Big Show May Not Be Enough (Wall Street Journal)

- Cloud Software’s Low-Hanging Fruit Is a Tempting Target (Wall Street Journal)

- Apple stock on track for longest weekly losing streak in more than 2 1/2 years (MarketWatch)

- Is the Fed ‘tightening cycle’ already happening? (MarketWatch)

- Italian Artist Sells Invisible Sculpture For $18,000 (ZeroHedge)

- Strong Inflows to Cash Continue, Largest Selling of Tech Stocks Since December 2018 – BofA’s Flow Show (Street Insider)

- Northrop Grumman (NOC) Upgraded to ‘Buy’ at Stifel on Compelling Valuation (Street Insider)

- Apple’s (AAPL) WWDC Unlikely to Blunt the Deceleration Narrative – Wolfe Research (Street Insider)

- Biden open to dropping corporation tax rise in infrastructure talks (Financial Times)

- UK approves Pfizer jab for younger adolescents (Financial Times)

- Tiger’s Julian Robertson bets big tech stocks will keep marching higher (Finaicial Times)

- Washington to bar US investors from 59 Chinese companies (Financial Times)

- What’s In Store For Biogen If Alzheimer’s Drug Gains FDA Approval? (Investor’s Business Daily)

- 2022 Defense Department Budget Bodes Well for 4 Top Stocks to Buy Now (247wallst)

- This Nobel Laureate In Physics Looks To The Next Huge Thing (Investor’s Business Daily)

- Alibaba, Alphabet, and Amazon Stock Are Bargains, This Value Manager Says (Barron’s)

- Discovery’s ‘K’ Shares Are One Way to Play the Merger With Warner Media (Barron’s)

- Business Travel Is Coming Back (Wall Street Journal)

- Traveling to Europe? Here’s What’s Open to U.S. Tourists (Wall Street Journal)

- Elon Musk’s Starlink Could Get Boost From German Subsidies (Wall Street Journal)

- No Grave Dancing for Sam Zell Now. He’s Paying Up for Hot Properties. (Wall Street Journal)

- The Fed announces plans to sell off its corporate bond holdings. (New York Times)

- AMC files to sell 11 million shares (CNBC)

- Jack Ma’s Ant Group gets China’s approval to operate consumer finance firm (CNBC)

- US weekly jobless claims tumble to new pandemic-era low of 385,000 (Business Insider)

- Fed’s Beige Book sees pickup in U.S. economic growth (MarketWatch)

- United Plans to Buy 15 Supersonic Planes (Wall Street Journal)

- Carbon Price Boom Attracts Investors to Emissions-Trading Market (Wall Street Journal)

- Tracking Covid-19 Vaccine Distribution (Wall Street Journal)

- World Food Prices at 10-Year Highs in May, Says United Nations Food Agency, Biggest Monthly Jump Since 2010 (Street Insider)

- Tellurian signs 10-year LNG agreement with Vitol for 3 MTPA (Reuters)

- Spac promoter Palihapitiya seeks $800m to target biotech companies (Financial Times)

- U.S. Stocks Are Near Record Highs. Why It’s Time to Buy in Europe. (Barron’s)

- Futures Point to Flat Open as Investors Monitor Inflation (Cheddar)

- HP Enterprise Earnings Top Estimates, Sees First-Ever Double-Digit Sales Growth (Barron’s)

- Oil’s Sunset Years Could Be Profitable for Some (Wall Street Journal)

- U.S. labor market worse than it appears, Fed paper suggests (Reuters)

- Cathie Wood Buys Another $1.6M In Netflix And Trims Stake In Chipmaker NXP By $14.8M (Benzinga)

- Attention Biotech Investors: Mark Your Calendar For June PDUFA Dates (Benzinga)

- Why central bankers no longer agree how to handle inflation (Financial Times)

- Fed’s Bullard: US jobs market is tighter than it looks (Financial Times)

- Unhedged: Will value stocks save the day? (Financial Times)

- OPEC Plus agrees to add production as oil prices climb. (New York Times)

- Why China’s Most-Hated Internet Company Decided to Play Nice (New York Times)

- Energy Stocks Are on Fire and These 5 Pay Lavish and Reliable Dividends (247wallst)

- Costco is bringing back sample stations this week (CNBC)

- Opinion: Tech stocks are out of favor — 5 reasons to buy alongside the contrarians (MarketWatch)

- Tweedy Browne Comments on Alibaba (gurufocus)

- Hedge Funds Boost Short Bets, Escalating Retail-Trader Showdown (Bloomberg)

- Oil Price Rises to Two-Year High as OPEC and Allies See Higher Demand (Wall Street Journal)

- Brazil’s Economy Bounces Back to Pre-Pandemic Levels While Covid-19 Still Rages (Wall Street Journal)

- The Southwest Is America’s New Factory Hub. ‘Cranes Everywhere.’ (Wall Street Journal)

- Krispy Kreme’s Sales Rise Ahead of Its Planned IPO (Bloomberg)

- 5 Stocks to Buy Now That May Be Huge 2021 Summertime Winners (247wallst)

- Reopen! The Energy Report 06/01/2021 (Phil Flynn)

- MLB, players’ union facing all-star lawsuit for pulling game out of Atlanta (Fox Business)

- The New York Office Market Is Coming Back. Here’s the Stock to Bet On. (Barron’s)

- Al Gore’s Firm Doubled Down on Alibaba (Barron’s)

- EQT CEO Says Natural Gas Is Key to Cleaner Energy (Barron’s)

- China Three-Child Policy Aims to Rejuvenate Aging Population (Wall Street Journal)

- Jobs Report Could Be Pivotal for Federal Reserve (Wall Street Journal)

- Small Businesses Have Surged in Black Communities. Was It the Stimulus? (New York Times)

- Employees Are Quitting Instead of Giving Up Working From Home (Bloomberg)

- Oil Highest Since 2018 With Iran Deal Elusive and OPEC Talks Due (Bloomberg)

- Investing legend Bill Gross says the Fed risks sinking the dollar if it persists with its ultra-easy policies (Business Insider)

- Dolly Parton Still Swears by Cheap Makeup (Wall Street Journal)

- Mark Cuban predicts DAOs will transform companies. Warren Buffett’s Berkshire Hathaway embraced the core ideas behind the latest crypto trend decades ago. (Business Insider)

- Brazil manufacturing PMI rebounds in May to three-month high -IHS Markit (Reuters)

- AMC Raises $230.5M Through Private Placement To Hedge Fund Mudrick: What Investors Need To Know (Benzinga)

- Nio Vs. XPeng: How Chinese EV Duo’s May Deliveries Stack Up (Benzinga)

- SPAC Pullback Pressures Creators to Find Quality Mergers (Wall Street Journal)

- How to Know When Inflation Is Here to Stay (Wall Street Journal)

- Reopening Bets Pay Off Big for Stock Pickers (Wall Street Journal)

- China Factory Activity Nudges Down On Slower Demand, Services Strong (Barron’s)

- Al Gore’s Firm Doubled Down on Alibaba. It Sold Airbnb and One Chip Stock. (Barron’s)

- This Just-Approved Amgen Drug Is the First to Hit a Hard Target in Cancer (Barron’s)

- Why once-hot hedge-fund stock picks are now the ‘pain trade’ of 2021 (MarketWatch)

- China Moves to Three-Child Policy to Boost Falling Birthrate (Bloomberg)

- OECD raises growth forecasts on vaccine rollouts, U.S. stimulus (Reuters)

- Putin Is Betting Coal Still Has a Future (Yahoo! Finance)

- US regulators signal bigger role in crypto market (Financial Times)

- European stocks set to seal fourth consecutive month of gains (Financial Times)

- From Junk Bond King To SPAC Whale: How Michael Milken Became A Big Investor In The SPAC Boom (Forbes)

- Unpacking President Biden’s Big Budget (NPR Planet Money)

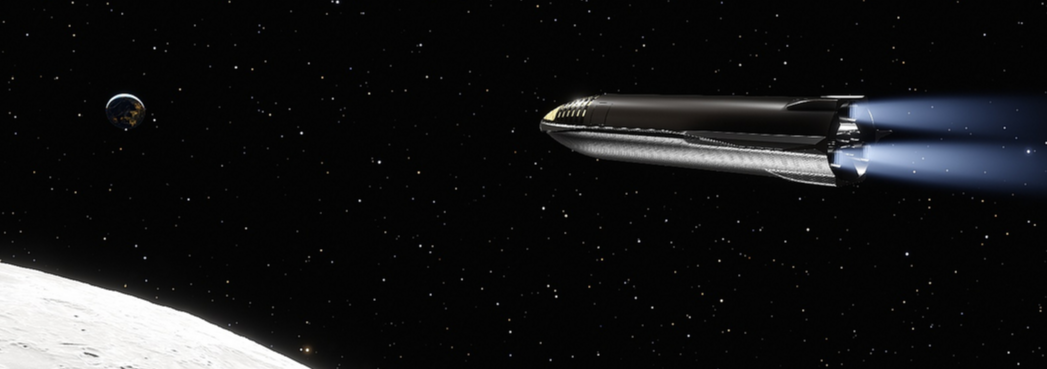

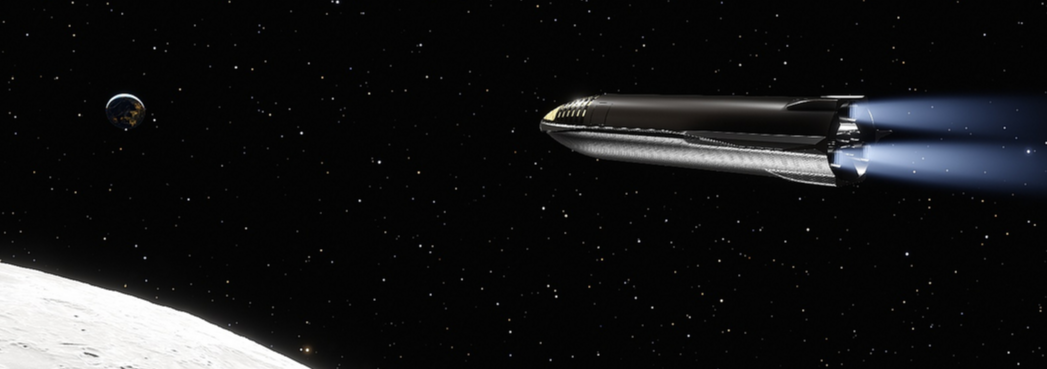

- The Profound Potential of Elon Musk’s New Rocket (Nautilus)

- Big oil is under pressure to cut production – what does that mean for investors? (moneyweek)

- 2022 Maserati MC20: The Italian Supercar Reinvented the Smart Way (Road and Track)

- The Biggest Surprises (And Disappointments) From Round 1 Of The Stanley Cup Playoffs (fivethirtyeight)

- Carson Block on the Short-Selling Market (Podcast) (Bloomberg)

- 5 Sizzling Energy Stocks Trading Under $10 With Oil Closing in on $70 a Barrel (24/7wallst)

- Days After Memorial Day Improving (Almanac Trader)

- China, U.S. can find common ground on tariff exclusions, Chinese think tank says (Reuters)

- 10 Best Cheap Stocks to Buy According to Billionaire Mario Gabelli (Insider Monkey)

- The 1750 HP SSC Tuatara, the World’s Fastest Car, Just Got Even More Powerful (Robb Report)

- Watch: Elon Musk’s Other Company Tests Its Tesla Tunnel System in Las Vegas With Real Passengers (Robb Report)

- Rolls-Royce’s Newest Car Features Its Own Cocktail Tables for Alfresco Dining (architecturaldigest)

- Alibaba is making its cloud OS compatible with multiple chip architectures (Tech Crunch)

- Tesla Roadster Will Hit 60 MPH in Just 1.1 Seconds, Says Elon Musk (Maxim)

- The 212-MPH McLaren 720S Supercar Gets Racy Special Edition (Maxim)

- Flamboyant 1968 Lamborghini Miura P400 S Expected to Fetch $1.1 Million at Auction (TheDrive)

- Marques Brownlee Gives His First Impressions Of The Ford F150 Lightning Electric Truck, And It Was Better Than He Thought (digg)

- JD revenue grows 39%, Ali-backed new retail eyes IPO: Retailheads (Tech Node)

- Thrill-seeking traders send ‘meme stocks’ soaring as crypto tumbles (Financial Times)

- The rise of crypto laundries: how criminals cash out of bitcoin (Financial Times)

- White House Budget Shows Focus on Wealth Redistribution, Not Growth (Bloomberg)

- This Just-Approved Amgen Drug Is the First to Hit a Hard Target in Cancer (Barron’s)

- Housing Supply Shortage Hits Pending Home Sales in April (Barron’s)

- GM Restarts Several Assembly Plants as Global Chip Shortage Begins to Ease (Barron’s)

- Watch CNBC’s full interview with Liberty Media’s John Malone on WarnerMedia-Discovery deal (CNBC)

- Big Oil Had a Bad Week. Why That’s Good News for Investors. (Barron’s)

- Natural Gas Prices Are Rising. Here Is the Stock to Play It. (Barron’s)

- Apple Stock Could Drop 30% If iPhones Sales Slow, Analyst Says (Barron’s)

- Biogen’s Alzheimer’s Drug Faces Its Moment of Truth. Biotech Investors Are Watching. (Barron’s)

- From Graham to Buffett and Beyond (Columbia)

- This Might Be the Most Bizarre Baseball Highlight in Years (Wall Street Journal)

- U.S. Corporate Bond Spreads Hit 14-Year Low as Economy Resurges (Bloomberg)

- Market sentiment readings suggest investors are fearful even as the S&P 500 nears record high (Business Insider)

- Costco is seeing inflation abound, impacting a slew of consumer products (CNBC)

- Millions of Americans in 24 states are set to lose unemployment benefits (CNBC)

- Here’s the firepower the Pentagon is asking for in its $715 billion budget (CNBC)

- President Biden is banking on a $3.6 trillion tax hike on wealthy Americans and big corporations. (New York Times)

- Carnival gets OK from CDC on port plans to restart cruising (USA Today)

- Why NASA Scientists Are So Excited by New Hints of Organic Compounds on Mars (Futurism)

- Scientists Say This Is the Maximum Human Lifespan (Futurism)

- Better Thinking & Incentives: Lessons From Shakespeare (Farnam Street)

- Americans Will Hit the Road With Highest Fuel Price Since 2014 (Bloomberg)

- Sam Zell’s success in business in seven rules (mrzepczynski)