Skip to content

Sanofi and Glaxo Are Back With a Covid-19 Vaccine (Barron’s )

Shares of Realogy Look Cheap as Housing Booms (Barron’s )

New Oil Barons Strike It $329 Billion Richer On Powerful Rally (Investor’s )

Will Demographics Tank China’s Housing Market? (Wall Street Journal )

Inside Jeff Bezos’ Obsessions (New York Times )

AT&T signs deal to combine media business with Discovery (USA Today )

Elon Musk says bitcoin isn’t decentralized as he goes to war with crypto bulls (Business Insider )

The red-hot commodity market is being underappreciated in the long term by investors still obsessed with stocks, JPMorgan says (Business Insider )

Foxconn the carmaker? Disruption in the era of electric vehicles (Financial Times )

Swiss Central Bank Bought Li Auto, XPeng, Zoom, and This Marijuana Stock (Yahoo! Finance )

Central banks seek out riskier assets for reserves in yield drought (Financial Times )

Markets weigh prospect of new commodities supercycle (Financial Times )

U.S. screens 1.85 million people on Sunday at airports, highest since March 2020 (Street Insider )

Rackspace Technology (RXT) Sees Insider Buys from 3 C-Level Executives (Street Insider )

Companies Ponder Speeding Up Plans to Bring Workers Back to Offices (Wall Street Journal )

Soros buys stocks linked to Bill Hwang’s Archegos collapse – Bloomberg News (Reuters )

Hedge Fund Investor Letters Q1 2021 (Insider Monkey )

Daniel Kahneman on Behavioral Economics (Podcast) (Bloomberg )

US banks could cut 200,000 jobs over next decade, top analyst says (Financial Times )

Major Rare And Vintage Car Shows Making A Comeback This Spring And Summer (Forbes )

ECRI Weekly Leading Index Update (Advisor Perspectives )

GoodRx helps people afford drugs. But is it improving health care or profiting off a broken system? (Fortune )

How Bumble’s Whitney Wolfe Herd Became the Youngest Female Self-Made Billionaire (Robb Report )

2021 NHL Playoffs: The Storylines That Will Shape This Year’s Postseason (Men’s Journal )

Inside the Hotel du Cap, The South Of France’s Legendary Celebrity Getaway (Maxim )

Here’s What Could Stop Inflation in Its Tracks (Barron’s )

GE Stock Is Getting a Boost From Wall Street (Barron’s )

Lumber prices fall for a 5th straight day in a reprieve for surging commodity prices (Business Insider )

Inflation Is Here and Hotter Than It Looks. Why It’s Time to Worry. (Barron’s )

Shares of Realogy, an Unlikely Hero of the Realty Revolution, Look Cheap (Barron’s )

Income Investors, Meet GARY: It Brings Growth and Reasonable Yield (Barron’s )

Disney CEO: CDC mask rule will spur ‘immediate’ jump in theme park attendance (New York Post )

Value Investing Still Beats Growth Investing, Historically (Alpha Architect )

Lessons from the 2021 Berkshire Meeting (Novel Investor )

U.S. Shoppers Continued Stimulus-Fueled Spending in April (Wall Street Journal )

Marijuana Medical Research Growers Receive U.S. Approval (Wall Street Journal )

The Capitalist Culture That Built America (Wall Street Journal )

The summer of inflation: will central banks and investors hold their nerve? (Financial Times )

Israel’s Iron Dome keeps toll of rockets in check (Finacial Times )

US day trading frenzy eases as investors ‘move on to other things’ (Financial Times )

Solar panels are key to Biden’s energy plan. But the global supply chain may rely on forced labor from China (CNN )

When Inflation Is High, Hedge Fund Managers Thrive (Institutional Investor )

A Look Under the Hood For Inflation (DGI )

David Swensen: The Peter Lynch of Institutional Investing (Morningstar )

The Pygmalion Effect: Proving Them Right (Farnam Street )

Is the Stock Market’s Inflation Reset Over? (Barron’s )

The New York Mets’ Record-Breaking Folk Hero (Wall Street Journal )

Airbnb Sales Top Estimates as Some Travel Resumes (Barron’s )

DoorDash Stock Rallies as Earnings Top Expectations (Barron’s )

Fully Vaccinated People Can Stop Wearing Face Masks and End Physical Distancing in Most Settings, CDC Says (Wall Street Journal )

Fisker (FSR) Announces Framework Agreement with Foxconn (Street Insider )

McDonald’s to boost wages by 10 percent amid worker shortage (New York Post )

U.S. Retail Sales Stall After Latest Wave of Stimulus Spending (Bloomberg )

Opinion: These big bank stocks may be a great three-year play on the economy and inflation (MarketWatch )

Israel steps up battle against communal violence and Gaza rocket attacks (Financial Times )

XPeng’s Earnings Have a Lot to Like. That’s Good News for Weary EV Investors. (Barron’s )

Tesla Stops Accepting Bitcoin for Environmental Reasons (Barron’s )

SoftBank Boosts Size of Vision Fund 2 to $30 Billion (Barron’s )

The Stock Market Selloff Has Hit Everything. Why It’s Not Time to Panic. (Barron’s )

Alibaba posts loss due to anti-monopoly fine but beats revenue expectations (MarketWatch )

As World Runs Short of Workers, a Boost for Wages—and Inflation (Wall Street Journal )

CDC Recommends Pfizer-BioNTech Covid-19 Vaccine for 12- to 15-Year-Olds (Wall Street Journal )

US Producer Prices Surge Most On Record (ZeroHedge )

Why Is New TV So Much Like Cable? (New York Times )

Carnival Cruise Line aims for July restart from Florida and Texas, cancels other sailings through July (USA Today )

Fed Lists Six Reasons in Arguing Inflation Surge Will Pass (Bloomberg )

Billionaire investor Bill Ackman hopes to close his mega SPAC deal within weeks — and called his target an ‘iconic’ business (Business Insider )

The current stock market sell-off is rotational rather than toppy, and a bullish backdrop supports a summer rally, according to Bank of America (Business Insider )

How mRNA became a vaccine game-changer (Financial Times )

Pentagon delays report on Chinese companies with military ties (Financial Times )

US Core Consumer Prices Explode Higher At Fastest Pace Since 1981 (ZeroHedge )

US casinos raked in $11B in first quarter to match best-ever ‘win’ (New York Post )

There’s a Lot Riding On Disney+ When Disney Reports on Thursday (Barron’s )

What Rising Inflation Means for the Stock Market (Barron’s )

What is the Jones Act? And why might waiving it help ease gas ‘supply crunch’? (MarketWatch )

IEA sees oil demand recovery outpacing growth in supply (Reuters )

Toyota profit nearly doubles, beats expectations (FoxBusiness )

Return of SALT deduction spicing up debate on Capitol Hill (Fox Business )

Occidental Petroleum Climbing Out of Its Anadarko Hole (Wall Street Journal )

Mortgage Lenders Need to Pump Up the Volume (Wall Street Journal )

These ‘panic events’ could soon spell relief for stock markets, says top strategist Thomas Lee (MarketWatch )

Weekly mortgage refinance demand jumped on brief drop in rates (CNBC )

Billionaire investor Stanley Druckenmiller blasted the Fed, touted bitcoin over ethereum, and issued a dire warning about the dollar in a recent interview. Here are the 10 best quotes. (Business Insider )

MGM Resorts’ Las Vegas Strip gaming floors can return to 100% occupancy, no social distancing (MarketWatch )

Americans Up and Moved During the Pandemic. Here’s Where They Went. (Wall Street Journal )

Not-So-Clean Energy Transition (Wall Street Journal )

US military ship fires 30 warning shots at Iranian boats (New York Post )

What BioNTech’s Earnings Mean for the Drug Makers (Barron’s )

Netflix and 17 More Stocks Investors Are Selling That Wall Street Loves (Barron’s )

Tech Stocks Are Getting Hammered. Here’s the Logic Behind the Rout (Barron’s )

China’s Factory Gate Prices Jump As Commodities Rally (Barron’s )

10 Beaten-Down Stocks That Could See a Rebound (Barron’s )

Tech Megacaps Face Higher Rates, Tax Hikes, Regulation, Says Goldman (Barron’s )

Berkshire Hathaway’s Mystery Investor Could Soon Be Revealed (Barron’s )

Roblox Stock Is Surging on After Earnings. Its CEO Sees a ‘Massive’ Opportunity. (Barron’s )

Virgin Galactic Stock Is Getting Crushed After Releasing Earnings. Here’s Why. (Barron’s )

Biden Defends Unemployment Benefits, Provided Workers Accept Job Offers (New York Times )

Commodities boom sends bulk shipping costs to decade highs (Financial Times )

Palantir’s Sales Top Estimates in the Quarter. Why the Company Sees at Least 30% Growth Through 2025. (Barron’s )

Richard Branson’s Virgin Galactic flights face potential delays (Fox Business )

Five Best Chinese Stocks To Buy And Watch Now (Investor’s Business Daily )

Social-Media Stocks Under Pressure as Citi Cuts Ratings on Facebook and Alphabet (Barron’s )

FDA permits use of the Pfizer-BioNTech Covid vaccine in kids ages 12 to 15 (CNBC )

Stanley Druckenmiller says the Fed is endangering the dollar’s global reserve status (CNBC )

Job Openings in U.S. Surge to a Record High 8.12 Million (Bloomberg )

Elliott Management Has Stake in Duke Energy (Wall Street Journal )

Billionaire investor Dan Loeb praised SPACs, revealed his winning bets, and predicted a surge in risky debt in his latest investor letter (Business Insider )

Yellen’s Views on the Deficit and Rates Have Been Consistent—Even if Wrong (Barron’s )

Australian business conditions hit record high (MarketWatch )

Higher Prices Leave Consumers Feeling the Pinch (Wall Street Journal )

Sotheby’s, Christie’s Expect to Sell $1 Billion in Art at Spring Auctions (Wall Street Journal )

Economists Disagree Over How Much Covid-19 ‘Herd Immunity’ Needed for Recovery (Wall Street Journal )

As Scrutiny of Cryptocurrency Grows, the Industry Turns to K Street (New York Times )

Hacked Pipeline May Stay Shut for Days, Raising Concerns About Fuel Supply (New York Times )

VIX Higher Than Actual Volatility Is Good News for Stock Bulls (Bloomberg )

Alibaba’s Ant Group will let more users test China’s digital yuan (CNBC )

This is the ‘greatest threat’ to Big Tech’s S&P 500 dominance, Goldman says (MarketWatch )

BioNTech shares soar 8% in premarket as COVID-19 vaccines help revenues smash estimates (MarketWatch )

Retail Participation In Stock Trading Has Collapsed (ZeroHedge )

COLONIAL PIPELINE POP. The Energy Report 05/10/2021 (Phil Flynn )

Will inflation thwart the US economic recovery? (Financial Times )

Here Is Every Michelin-Starred New York Restaurant for 2021 (Robb Report )

Guy Fieri Talks Chevys and Cheeseburgers With R&T Crew (roadandtrack )

Jeff Bezos Is Building a Superyacht So Big It Needs a ‘Support Yacht’ With a Helipad (Maxim )

2021 Ferrari Roma: First Drive Review (Maxim )

Inside L.A.’s Lowrider Car Clubs (smithsonian )

Reposition in May – Seasonality Works (Almanac Trader )

Elon Musk a bigger autograph draw on ‘SNL’ than BTS or Justin Bieber (New York Post )

First Look at the New Summer-Ready One & Only Portonovi Resort in Montenegro (Robb Report )

Efficiency is the Enemy (Farnam Street )

Lewis Hamilton Now Has 100 Formula 1 Poles (roadandtrack )

6 Stocks That Let You Sleep at Night (Morningstar )

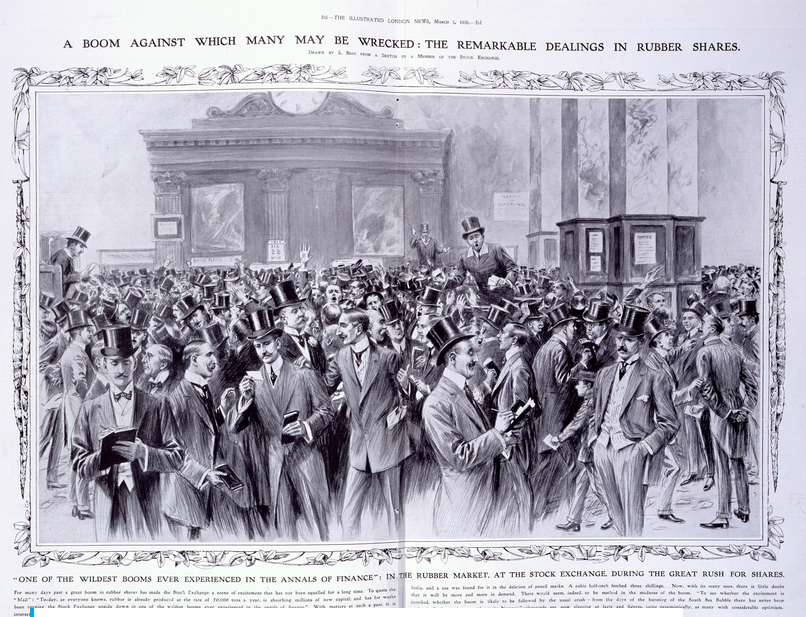

A History of Commodity Booms & Busts (investoramnesia )

Tussle Over Covid Vaccine Patents Looks Overblown (Barron’s )

Swap Into Nokia Shares From Ericsson. The Momentum May Be Changing. (Barron’s )

‘Wrath of Man’ Heist Film Is Set to Top Weekend Box Office (Bloomberg )

Imagining the Next 100 Years in Business, Science, and Investing (Barron’s )

U.S.’s Biggest Gasoline Pipeline Halted After Cyber-Attack (Bloomberg )

Consumers getting socked with higher prices — and it could last months or years (New York Post )

On Barron’s 100th Anniversary, We Look Ahead as Well as Behind (Barron’s )

The stock market will face a ‘day of reckoning’ this year when an inevitable inflation spike forces the Fed’s hand, says Wharton professor Jeremy Siegel (Business Insider )

How the Green Economy Will Be a Gold Mine for Copper (Barron’s )

Graham & Doddsville Newsletter Spring 2021 (Columbia University )

6 Agricultural Stocks Poised to Ride Food Prices Higher (Barron’s )

Movie-Theater Stocks Leap Despite Quarterly Losses (Barron’s )

Clarence W. Barron, Father of Financial Journalism, Was Full of Contradictions (Barron’s )

Time to Get Dressed for the Reopening. These Stocks Will Benefit. (Barron’s )

How Barron’s Writer Abe Briloff Exposed Companies’ Shady Accounting (Barron’s )

Unemployment Benefits Become Target Amid Hiring Difficulty (Wall Street Journal )

U.S. Covid-19 Metrics Signal Hopeful Turn (Wall Street Journal )

The Next Decade in European Value (verdadcap )

Pfizer Lifts Covid-19 Vaccine Production Targets for 2021, 2022 (Wall Street Journal )

2021 Virtual Value Investing Conference | Keynote Speaker: Howard Marks (YouTube )

What We Learned From 100 Years of the Trader Column (Barron’s )

April’s Weak Jobs Report Says We’re Overstimulated (Barron’s )

Some of Barron’s Biggest Hits—and Misses—Over the Past Century (Barron’s )

‘I love this setup’ — star stock-picker Cathie Wood keeps cool over ARK Innovation ETF’s dismal May start (MarketWatch )

Billionaire Leon Cooperman Says Bond Market Is in a Bubble (Bloomberg )

Chinese Consumers Are Opening Their Wallets Again (Wall Street Journal )

For Better Burgers, Try a Backyard Flat-Top Griddle (Wall Street Journal )

EU’s Michel says US vaccine patent waiver will not solve supply problem (Financial Times )

End the $300 federal unemployment bonus, business group says (USA Today )

Energy production in the United States fell by more than 5% in 2020 (EIA )

Peter Lynch’s advice to Bill Miller (alphaideas )