Skip to content

Why Wells Fargo Is a ‘Must-Own Stock’ (Barron’s )

Prescription-Drug Price Cuts Set to Be Left Out of White House Proposal (Wall Street Journal )

Still Getting Your Head Around Digital Currency? So Are Central Bankers. (New York Times )

U.S. Population Over Last Decade Grew at Slowest Rate Since 1930s (New York Times )

5 visuals explain the shifting House seats and how the changes could affect the 2022 midterm elections (USA Today )

Fed Will String Traders Along on Its Taper Timeline (Bloomberg )

BP beats first-quarter estimates, says it plans to resume share buybacks (CNBC )

OPEC+ to meet Tuesday amid concern about rising virus cases (CNBC )

If Fed Chair Jerome Powell sounds ‘too optimistic’ this week, he’ll rattle Wall Street, Morgan Stanley warns (CNBC )

6 Mid-Cap Stocks That Are Cheap—and Have Potential (Barron’s )

Saying Au Revoir to the Most Successful Policy in Federal Reserve History (Wall Street Journal )

Supermarkets Say Goodbye to Pantry Loading, Hello to Inflation (Wall Street Journal )

Biden’s first big speech to Congress is on Wednesday. Here’s what to expect. (MarketWatch )

The No. 1 emerging property market in America is NOT in Texas or Florida — you may never even have heard of it (MarketWatch )

Citi has updated its bear-market checklist. Here’s where we are now. (MarketWatch )

U.S. Durable-Goods Orders Rebound Following Dip (Wall Street Journal )

What Wall Street Is Telling Us About the U.S. Economic Outlook (Wall Street Journal )

Tesla and 12 Other Stocks Poised for Earnings Fireworks This Week (Barron’s )

Oil-Field Services—Lots to Like Beneath the Surface (Wall Street Journal )

Top Strategist Says Get Defensive for the Next 6 Months: 4 Safe Stocks to Buy (24/7 Wall Street )

Insurance Costs Threaten Florida Real-Estate Boom (Wall Street Journal )

West Looks Past Covid-19 and Sees Economic Resurgence (Wall Street Journal )

Fed to Taper Bond Buying in Fourth Quarter, Economists Say (Bloomberg )

Sanofi Agrees to Help Make Doses of Moderna’s Covid Vaccine (Bloomberg )

The Fed’s Next Test Is Breaking the Ice Over Policy Shift (Wall Street Journal )

SPAC Insiders Can Make Millions Even When the Company They Take Public Struggles (Wall Street Journal )

A capital-gains rate of 43.4% would reduce federal revenue. (Wall Street Journal )

10-year Treasury yields will break out of slump within weeks: Wells Fargo (CNBC )

Legendary investor Bill Miller lost 90% of his fortune in the late 2000s. Bitcoin and Amazon stock have made him a billionaire. (Business Insider )

Biden shocked markets this week with a proposal to nearly double the capital gains tax. Here’s what the move could mean for high-flying tech stocks, according to 5 experts. (Business Insider )

Wall Street edges higher on Tesla boost ahead of big tech earnings (Reuters )

No Surprises in President Biden’s Reported Capital Gains Proposal, a 28% Rate Looks Most Likely – Goldman Sachs (Street Insider )

As Good As It Gets: Goldman Is Last Big Bank To Turn Bearish, Sees Market Dropping In Coming Months (ZeroHedge )

The Transcript 04.19.21: So. Much. Liquidity. (theweeklytranscript )

How a Wave of Electric Trucks Could Create Millions of ‘Accidental Environmentalists’ (Wall Street Journal )

5 Sizzling Technology Stocks to Buy Now Trading Under $10 (247wallst )

Next Bump in Post-Election Year Rally Could Be in May (Almanac Trader )

5 Innovative New Helicopters That Are Coming to the Skies (Robb Report )

How to Stream All the Major Oscar Nominees This Year (townandcountrymag )

First Look at the Insanely Speedy Ferrari 812 Superfast Limited Edition (Men’s Journal )

Ari Emanuel Takes on the World (The New Yorker )

Elon Musk Will Host ‘Saturday Night Live’ on May 8. Yes, You Read That Right (The Drive )

How TikTok Chooses Which Songs Go Viral (Bloomberg )

The Origin Of The Oscars (NPR )

What We’re Watching In The NHL’s Playoff Races (fivethirtyeight )

Perrigo Stock Has Been Broken for a Long Time. It’s Time for a Turnaround. (Barron’s )

11 Undervalued Climate-Friendly Stocks (Morningstar )

Amazon CEO Jeff Bezos championed invention, failure, and customer obsession in his 24 shareholder letters. Here are the 25 best quotes. (Business Insider )

This Bull Market Is Far From Over, Pros Say. Where They’re Investing Now. (Barron’s )

SPAC IPOs Fall Out of Favor After Hot Streak (Barron’s )

Berkshire Hathaway 2021 Annual Meeting (valuewalk )

Take Heart, Investors. A Higher Capital-Gains Tax Wouldn’t Be as Scary as It Sounds. (Barron’s )

Wells Fargo’s Rehabilitation (netinterest )

U.S. Ends Pause on Johnson & Johnson’s Covid Vaccine. What to Know. (Barron’s )

Packaged Foods Boomed During the Pandemic. Why Their Stocks Still Have Room to Run. (Barron’s )

Early Days in the Value Recovery (pzena )

10 Places Where Home Buyers Pay the Most Above Asking Price (Barron’s )

Why Covid Surges in India Won’t Derail Global Recovery (Barron’s )

Johnson & Johnson and 6 Other Companies Raised Their Dividends This Week. What to Know. (Barron’s )

The Stock Market Got Spooked by What It Already Knew. Here’s Next Week’s Surprise. (Barron’s )

Capital gains tax hike? Why the stock market bounced back so fast (MarketWatch )

SPAC Surge Pumps Up Junk-Bond Market (Wall Street Journal )

Will 2021 Be the Year for Value Stocks? (Kiplinger )

Inflated Fears (investoramnesia )

When a Rising Tide Lifts All Boats (compoundadvisors )

Wells Fargo Has Used Its Lockdown Time Well (Wells Fargo )

The U.S. economy is still improving: Morning Brief (Yahoo! Finance )

Investors in uproar over Biden’s proposed capital gains tax rise (Financial Times )

Fat Valuations and Tech Stocks Seen as at Risk in Biden Tax Plan (Bloomberg )

Oil’s Hired Hands Declare Overseas Recovery With Robust 2022 (Bloomberg )

Wall Street’s Trillion-Dollar ESG Club Comes With Huge Tax Perks (Bloomberg )

Oil Frackers Best Be Boring on Earnings Calls (Bloomberg )

Congress likely to cap Joe Biden’s capital gains tax hike at around 28%, Goldman Sachs says (Business Insider )

With Few New Clotting Cases, Johnson & Johnson Pause Could Be Lifted Soon (New York Times )

Get ready for $178 billion of selling ahead of the capital-gains tax hike. These are the stocks most at risk. (MarketWatch )

Biden has pledged to tax the rich — but precisely how will he do that? Experts consider his options (MarketWatch )

Opinion: With SPACs down as much as 90%, there are finally some good buys (MarketWatch )

New home sales soar to highest level since 2006 (MarketWatch )

HBO Max Gains Traction in a Crowded Field (New York Times )

With Few New Clotting Cases, Johnson & Johnson Pause Could Be Lifted Soon (New York Times )

India Hits Global Record for Daily New Covid-19 Cases (Wall Street Journal )

Here’s What CEOs Are Saying About Inflation This Earnings Season (Barron’s )

Famed Investor Bill Miller Is Roaring Back With Amazon, Bitcoin, and GM (Barron’s )

China, India Complicate Biden’s Climate Ambitions (Wall Street Journal )

Southwest, American Say Leisure Travel Rebounding as Summer Season Approaches (Wall Street Journal )

ECB Keeps Rates Steady and Asset-Buying Program Unchanged (Barron’s )

Audio Could Perk Up Facebook’s Eyes and Ears (Wall Street Journal )

Netflix Will Need Some Post-Summer Blockbusters (Wall Street Journal )

Dealers Are Selling Cars So Fast They Don’t Need to Borrow (Wall Street Journal )

Johnson & Johnson Shows Health Economy Is Nearing Full Strength (Wall Street Journal )

4 Electric-Vehicle Charging Stocks at Fire-Sale Prices (Barron’s )

US to propose emissions cut of at least 50% by end of decade (Financial Times )

Koch Industries invests in supplier touted as alternative to Huawei (Financial Times )

For Japan’s Top CEOs, It’s Change or Die (institutionalinvestor )

Nikola (NKLA) , Travelcenters Of America (TA) Confirm Pact To Deploy Hydrogen Fueling Infrastructure (streetinsider )

Tractor Supply shares jump after ‘record performance’ drives guidance increase (MarketWatch )

Connor Bedard is 15 years old — and already touted as hockey’s next superstar (New York Post )

Wall Street Starts to See Weakness Emerge in Bitcoin Charts (Bloomberg )

How Left-for-Dead Hertz Bonds Returned 1,000% (Bloomberg )

Michelin Picks Best Restaurants in Washington Despite Pandemic Closures (Bloomberg )

US weekly jobless claims unexpectedly drop to new pandemic-era low of 547,000 (Business Insider )

SPACs could drive $900 billion of dealmaking over the next 2 years despite the boom slowing, Goldman says (Business Insider )

Pfizer declares 39c per share cash dividend, says dividend won’t be cut (TheFly )

The Job Market Is Tighter Than You Think (Wall Street Journal )

Dow Earnings Smashed Expectations. Investors Should Take Note. (Barron’s )

Goldman Sachs says S&P 500 returns may tumble as U.S. economic growth peaks. Buy these stocks. (MarketWatch )

Opinion: Warren Buffett could teach traders in dogecoin, GameStop and other hot trends a few things about ‘Mr. Market’ (MarketWatch )

Demand may exceed supply as CEO of one of the world’s biggest hotel groups sees ‘surge’ in bookings (MarketWatch )

Get ready for the ‘reflation and reopening trade’ to kick into high gear, says JPMorgan’s top quant (MarketWatch )

The FAANG Stocks Could Fall, if History Is Any Guide (Barron’s )

Tech Stocks Waver After Netflix Results (Barron’s )

Legendary investor Bill Miller says the window is closing on the SPAC market, but singles out 2 names that remain attractive (Business Insider )

For AT&T’s Earnings, HBO Max Is the Only Thing to Watch (Barron’s )

The Fed won’t taper until 2023 at the earliest, says former White House economist. Here’s why. (MarketWatch )

Central Banks Are Trying to Muscle Aside Bitcoin (Barron’s )

This chart shows the deluge of corporate spending on technology since 1980 (MarketWatch )

Why Growth Stocks’ Rebound Doesn’t Mean Value’s Comeback Is Over (Barron’s )

Coca-Cola CEO says company will raise prices to offset higher commodity costs (CNBC )

Prices for household staples like diapers, tampons poised to surge (New York Post )

Johnson & Johnson (JNJ) COVID-19 Vaccine Roll-out to Resume in Europe Following EMA Review (streetinsider )

Weekly mortgage demand jumps 8.6% after interest rates fall to a two-month low (CNBC )

U.S. inflation could hit 3% or 4% by the middle of 2022, veteran strategist warns (CNBC )

Stock-market sentiment shifts after investor euphoria pushed U.S. equities to record highs (MarketWatch )

Bitcoin’s momentum will see an ugly end as regulation kicks in and countries are no longer about to ignore its huge carbon footprint, an investment adviser says (Business Insider )

Vertex to study experimental gene-editing therapy as treatment for sickle cell, beta-thalassemia (MarketWatch )

Fisker could jump another 116% due to rising reservations and an EV boom, BofA says (Business Insider )

These Are the Stocks to Play Europe’s Red-Hot Property Market, Says JPMorgan (Barron’s )

Blackstone Bets on India’s Rising E-Commerce With Warehouse Deal (Wall Street Journal )

Shell, Exxon Look to Profit From Capturing Customers’ Carbon Emissions (Wall Street Journal )

Central Banks Are Trying to Muscle Aside Bitcoin (Barron’s )

Procter & Gamble earnings beat as consumers hang on to pandemic cleaning habits; price hikes ahead (CNBC )

Company earnings are rebounding, but anything short of perfect could be trouble. (New York Times )

You’ve Come a Long Way. The Energy Report 04/20/2021 (Phil Flynn )

The Rage of Carson Block (institutional investor )

Natural gas producer EQT backs Biden’s methane crackdown (Financial Times )

Johnson & Johnson Just Reported Earnings. This Number Is Critical. (Barron’s )

10 Stocks That Could Get Hit by Higher Taxes (Barron’s )

Why the Reflation Trade Remains a Good Bet (Barron’s )

These 6 Commercial REITs Are Too Cheap, Morgan Stanley Says (Barron’s )

Lockheed Produced a Strong Quarter. (Barron’s )

P&G Flags Price Increases as Earnings Beat Forecasts (Barron’s )

These 20 Affordable European Companies May See Earnings Surge (Barron’s )

Stock Shorts Collapse as No Hedge Fund Wants ‘Head Ripped Off’ (Bloomberg )

More Stocks Are Participating in Rally, an Encouraging Sign for Bull Market (Wall Street Journal )

S&P 500, Dow set to ease from record levels; Coca-Cola rises on results (Reuters )

Nearly half of Americans are too nervous to invest in stocks right now, new survey shows (Business Insider )

John Hempton on What It’s Like To Short Right Now (Podcast) (Bloomberg )

Why did the Fed print so much money? Thomas Hayes on valuations, and best stock sectors (KITCO )

Feel the Earth. The Energy Report 04/19/2021 (Phil Flynn )

Here’s a technical analyst’s explanation of the short squeeze driving bonds (MarketWatch )

Consumer Staples Stocks Had a Rough Year. We Found 3 Potential Winners. (Barron’s )

Economic Growth Is Set to Surge. Hiring Might Not Keep Up. (Wall Street Journal )

BP Wants to Stop Burning Off Gas in America’s Top Oil Field (Wall Street Journal )

The New York Power Lunch Is Back, With New Rules (Wall Street Journal )

Employers are chasing candidates amid worker shortages (USA Today )

Tesla Runs on Faith, Exxon Runs on Discipline. Only One Is Right (Bloomberg )

Fauci expects J&J COVID-19 vaccines to be back in use by Friday (MarketWatch )

Coca-Cola beats on earnings, says demand in March hit pre-Covid levels (CNBC )

Stocks are booming higher, but traders are having a harder time making money (CNBC )

Investors should be ‘aggressively buying’ if stock market has pullback: Investment strategist (Fox Business )

Citigroup to ramp up Chinese investment banking plan – source (streetinsider )

Biogen (BIIB) Has Best Risk/Reward Over Next Couple of Years – Jefferies (streetinsider )

CVS to offer three over-the-counter COVID-19 tests for use at home (Yahoo! Finance )

America Is Short of Home Builders as Well as Homes (Wall Street Journal )

Robert Arnott on Global Asset Management (Podcast) (Bloomberg )

Sell in May??? Post-Election-Year “Worst Months” Mixed (Almanac Trader )

How Pfizer Became the Status Vax (Slate )

Billionaire Reveals His ‘Secret’ To Beating China At Manufacturing (Forbes )

How spooks are turning to superforecasting in the Cosmic Bazaar (The Economist )

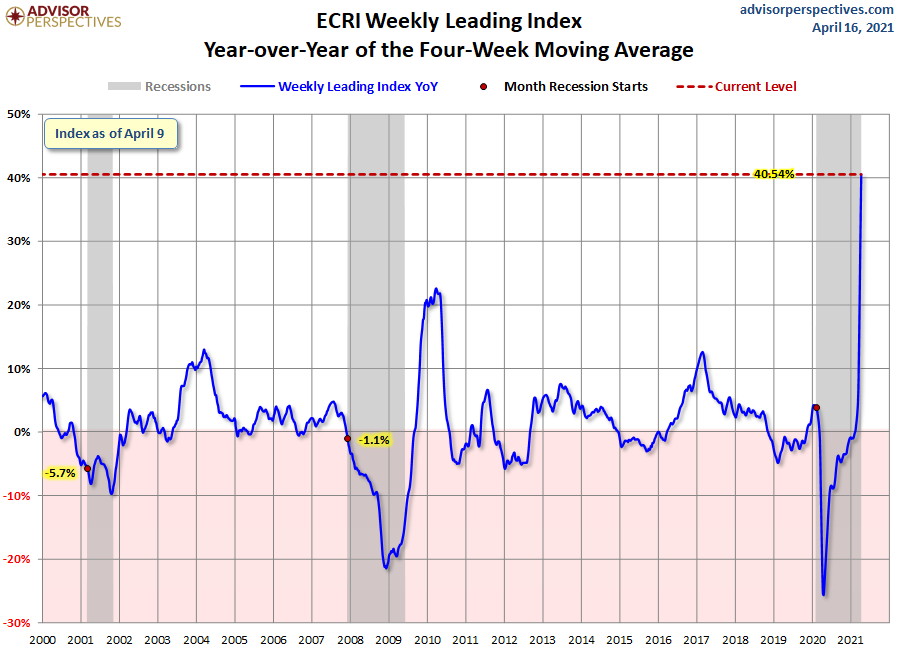

ECRI Weekly Leading Index Update (advisorperspectives )

The Transcript 04.12.21: Reopening euphoria (The Weekly Transcript )

Formula 1 Is Heading to Miami (Road and Track )

Historic Oil Glut Amassed During the Pandemic Has Almost Gone (Bloomberg )