Skip to content

10 reasons why the value-stock resurgence has further to run, according to BofA (Business Insider )

10 Solid Dividend-Paying Stocks on Sale (Morningstar )

Tech Stocks Are Mired in Unfamiliar Territory as Market Laggards (Bloomberg )

Li Lu: Value Investing in China, Full Transcript (latticeworkinvesting )

Activist Investors Are Rattling Cages Again (Barron’s )

Last winter saw larger-than-average U.S. natural gas withdrawals from storage (EIA )

Home Building Picked Up in March. What It Could Mean for Skyrocketing Prices. (Barron’s )

3 Big Banks Had Huge Bond Sales This Week. What It Means for Markets. (Barron’s )

Mark Rothko’s ‘Untitled’ From 1970 Could Fetch US$40 Million at Christie’s (Barron’s )

What It Would Take for the S&P 500 to Hit 4500 by Year End (Barron’s )

How People Get Rich Now (paulgraham )

4 Electric-Vehicle Charging Stocks at Fire-Sale Prices (Barron’s )

Mexican Stocks Look Ready to Rally. Here’s Why. (Barron’s )

Jane Fraser’s Debut as Citi’s CEO Hits All the Right Notes (Barron’s )

The Stock Market Climbed Because Tumbling Bond Yields Don’t Mean What They Used To (Barron’s )

Here’s how the ‘pause’ on J&J’s COVID-19 shot may or may not affect the company’s earnings (MarketWatch )

Bill Miller 1Q 2021 Market Letter (millervalue )

No Causal Link Found So Far Between J&J’s Covid-19 Vaccine and Blood-Clot Cases, Company Researchers Say (Wall Street Journal )

Oakmark’s Bill Nygren on his expectations for the economic recovery (CNBC )

The Bull Case for a $100 Million New Jersey Deli (Wall Street Journal )

The Most Important Number of the Week Is 9.8% (Bloomberg )

Boom Times Are Coming, If Only You Can Wait (Bloomberg )

Hedge Funds Are Ready to Get Out of New York and Move to Florida (Bloomberg )

SpaceX wins $2.9bn Nasa contract to land Americans on the moon (Financial Times )

The labor market is the strongest it’s been since the pandemic started — and setting up a huge boost to America’s most crucial economic engine (Business Insider )

3 reasons the stock market is poised for a near-term correction, according to LPL (Business Insider )

Pipeline pressure and Elliott’s stake have GSK in a spin (Financial Times )

Netscape 2.0: Coinbase stock debut rekindles memories of web breakthrough (Financial Times )

U.S. housing starts increase more than expected in March (Reuters )

4 reasons why the bull market in stocks is alive and well with more upside ahead, according to LPL (Business Insider )

Bitcoin falls as Turkey bans cryptocurrency payments (MarketWatch )

Completing the Process. The Energy Report 04/16/2021 (Phil Flynn )

This Is the Richest American of All Time (247wallst )

Morgan Stanley tops earnings estimates on better-than-expected trading, investment banking results (CNBC )

David Einhorn calls out Elon Musk and Chamath Palihapitiya, defends GameStop champion Roaring Kitty, and blasts market regulators in a new letter. Here are the 11 best quotes. (Business Insider )

Jeff Bezos posts his final letter to shareholders as Amazon CEO. Read the key takeaways and full note. (Business Insider )

Chinese Economy Grew More Than 18% in First Quarter (Wall Street Journal )

Morgan Stanley tops earnings estimates on better-than-expected trading, investment banking results (CNBC )

Family Offices Targeting 800% Returns With SPAC Economics (Bloomberg )

Pfizer CEO Says a Covid Booster Shot Will Likely Be Needed (Barron’s )

Citigroup Reports Higher Earnings, Plans to Trim Consumer Businesses in Asia (Wall Street Journal )

Delta Reports Another Quarterly Loss, but Says Travel Demand Is Rising (Wall Street Journal )

Shell to Let Shareholders Vote on Shift to Cleaner Energy (Wall Street Journal )

This Recovery Is Special, Whatever Bond Yields Say (Bloomberg )

China’s Economy Is Booming. Shoppers Are Skittish Anyway. (New York Times )

Bank of America Profit Doubles After It Releases Reserves for Bad Loans (Wall Street Journal )

Businesses are struggling to hire workers — and say Uncle Sam is to blame (New York Post )

Bank of America Gains on Earnings Beat. What to Know. (Barron’s )

Wall Street Banks Do More With Less (Wall Street Journal )

With Earnings Soaring, Wall Street Banks See Economic Boom Ahead (New York Times )

Spending at US retailers rockets 9.8% higher as stimulus supercharges reopening (Business Insider )

Citi posted record profit in the 1st quarter as SPAC activity led a surge in underwriting fees and stock trading exploded (Business Insider )

Green infrastructure could be the next bubble as the world shifts to alternative energy, Schwab says (Business Insider )

Buy bank stocks after Citi, Goldman Sachs, BoA and JPMorgan earnings wowed, says this research group (MarketWatch )

Hedge fund Elliott builds up multibillion-pound stake in GSK (Financial Times )

PepsiCo expects growth to accelerate as hospitality recovers (Financial Times )

State Jobless Claims in U.S. Fall to Lowest Since March 2020 (Bloomberg )

American Airlines Plans Expanded Summer Flying Schedule (Wall Street Journal )

Oil Demand Is Recovering Despite Vaccination Hiccups, IEA Says (Wall Street Journal )

J&J Vaccine Pause Could Boost Pfizer, Moderna Stock (Barron’s )

Oil Stocks Have Gotten Crushed. They Could Be Poised for a Comeback. (Barron’s )

Wells Fargo Earnings Jump as Economy Bounces Back (Wall Street Journal )

JPMorgan Beat Profit Estimates, Driven by a Release of Credit Reserves (Barron’s )

Here Are 10 Italian Stocks to Play the Reflation Trade (Barron’s )

Moderna Previews Its Pipeline of Vaccines. The Stock Is Rising. (Barron’s )

Exxon Mobil stock gains after Raymond James analyst backs off long-time bearish stance (MarketWatch )

American Air Bets on Travel Resurgence With New Summer Schedule (Bloomberg )

Goldman Sachs Says Buy These 4 Energy Stocks for Possible Summer Rally (247wallst )

Banks, After Bracing for Disaster, Are Now Ready for a Boom (Wall Street Journal )

JPMorgan Chief Strategist Says Markets May Be at Long-Term Turning Point (Bloomberg )

Citigroup’s Path Forward Is as Important to Wall Street as the Numbers (Barron’s )

Big banks can maintain revenue boom for years with $400bn transaction banking push (fnlondon )

The Used Car Bubble: How Sky-High Pricing Is Good for Stocks (Barron’s )

Signs of Spring. The Energy Report 04/13/2021 (Phil Flynn )

Majority of CEOs say Biden tax hikes will harm business, slow wage growth: poll (New York Post )

U.S. Consumer Prices Increased in March by Most Since 2012 (Bloomberg )

‘Fear of Missing Out’ Will Drive Workers Back Into the Office (Bloomberg )

Don’t ‘overinterpret’ decision to pause J&J vaccine, Dr. Scott Gottlieb says (CNBC )

Consumer prices rise more than expected, pushed by 9.1% jump in gasoline (CNBC )

Oil Majors Face Tough Choices Even With Higher Prices (Wall Street Journal )

Banks Might Get Partial Immunity to Tax Increases (Wall Street Journal )

Hedge Fund Managers Are Feeling Confident (institutionalinvestor )

Here’s where investors see a market bubble — and it isn’t stocks, says Bank of America (MarketWatch )

These stocks are cheap when you factor in how much their sales are expected to rise (MarketWatch )

Fed’s Bullard says inflation risks won’t be clear until later this year (MarketWatch )

US STOCKS-S&P 500 set for muted open on strong inflation (Reuters )

‘Don’t fight the Fed,’ Goldman says. These stocks can benefit from higher inflation. (MarketWatch )

Red-Hot Banks Report Earnings This Week: 4 Stocks to Buy Before They Do (247wallst )

BABA Stock Jumps After Record Alibaba Fine (Investor’s Business Daily )

Powell Says It Will Be ‘a While’ Before Fed Lifts Rates (MarketWatch )

Regeneron’s Covid-19 Antibody Protects Household Contacts From Infection (Barron’s )

GE Gets a New Top Target Price From Wall Street (Barron’s )

Fed Chair Jerome Powell says economy ‘to start growing much more quickly’ (New York Post )

With Economy Poised for Best Growth Since 1983, Inflation Lurks (Wal Street Journal )

Sizzling Stock Market Sets High Bar for Earnings Season (Wall Street Journal )

Defaults Fall Again, Aiding Rally in Low-Rated Debt (Wall Street Journal )

Simple Math Is About to Cause a U.S. Inflation Problem (Bloomberg )

Nobel Economist Warns Against Wealth Tax to Pay for Pandemic (Bloomberg )

Watch the highlights from CNBC’s Pro Talk with Oakmark’s Bill Nygren (Banks & Energy) (CNBC )

33 Undervalued Stocks for the Second Quarter (Morningstar )

San Francisco Fed’s Mary Daly Says the Economy Will Rebound Sharply by the Fall (Barron’s )

Wall Street comes to grips with a Fed that will do what it says (MarketWatch )

Stock-Market Investing Is Picking Up. Baby Boomers Might Be Behind It. (Barron’s )

Getting Women Back into the Workforce Is a Priority of the Fed. Here’s Why. (Barron’s )

Value Stocks Are Ready to Win Again, if the Fed Behaves (Barron’s )

Musk’s Las Vegas Tunnel Is Like a Tesla Amusement Park Ride (Bloomberg )

Nancy Reagan and the Power of Intimacy (Wall Street Journal )

Wall Street investors look warily at gathering tax ‘storm’ (Financial Times )

Why ‘Peak Oil’ Won’t Mean the End of Drilling (Bloomberg )

The broader stock market is not in a bubble, but these 5 sectors are, according to JPMorgan (Business Insider )

The economy is on the cusp of a major boom. Economists believe it could last (CNBC )

Billionaire investor Peter Thiel called out Apple and Google, warned about TikTok and bitcoin, and criticized China at a recent event. Here are the 17 best quotes. (Business Insider )

Earning season is about to get underway and that could be a positive catalyst for stocks (CNBC )

Finances not so grim for millions of Americans a year after COVID (USA Today )

Warren Buffett and Charlie Munger on Leverage (dividendgrowthinvestor )

Drugmakers and Managed-Care Firms Are Poised for Growth (Morningstar )

Q&A: Finding 100-Baggers (woodlockhousefamilycapital )

JPM Annual Letter Jamie Dimon (jpmorganchase )

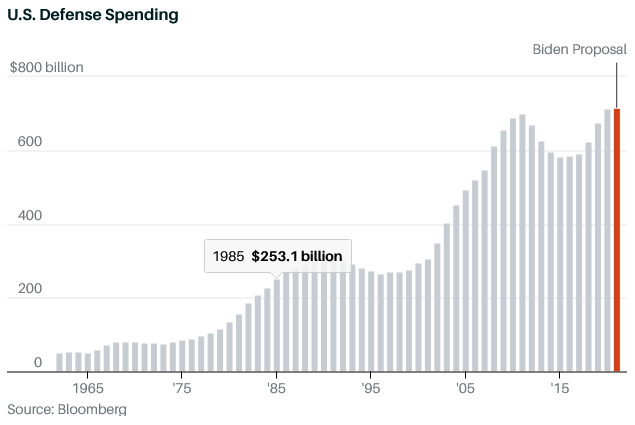

Investors Shouldn’t Sweat the Defense Budget. Here’s Why. (Barron’s )

Aerospace and Defense May Be the Best Offense for Q2: 5 Top Stocks to Buy Now (24/7wallst )

U.S. PPI up 1% in March, with factory-level inflation rate registering 4.2% on a year-over-year basis (MarketWatch )

Biotech Stocks Hit A Snag — Why Experts Say The Heyday Isn’t Over (IBD )

Why It Might Be Time to Buy Brazil Stocks (Barron’s )

Stocks Are Close to Bubble Territory Again—but Only by Some Measures (Barron’s )

Safe haven plays still popular amid rotation into cyclical stocks, March fund flows show (MarketWatch )

Stock-Market Investing Is Picking Up. Baby Boomers Might Be Behind It. (Barron’s )

First-Time Investors Now Make Up 15% of Retail Market (Institutional Investor )

How Equity Analysts Filled the Covid-19 ‘Information Void’ (Institutional Investor )

New York City’s Wealthy Will Pay Nation’s Highest Tax Rates. How Will That Affect a Rebound? (Wall Street Journal )

Dangerous Games. The Energy Report 04/09/2021 (Phil Flynn )

Home Prices Soar in Frenzied U.S. Market Drained of Supply (Bloomberg )

‘Enjoy this ride’ — Wharton’s Jeremy Siegel says stock market could go up 30% before boom ends (CNBC )

NIH recommends Lilly and Regeneron’s combination antibody treatments to people with mild and moderate COVID-19 (MarketWatch )

General Electric (GE) PT Raised to $17 at UBS on Turnaround (Street Insider )

2 wild economic charts we’ll be watching closely: Morning Brief (Yahoo! Finance )

Inflation might be the way out of the debt crisis (Financial Times )

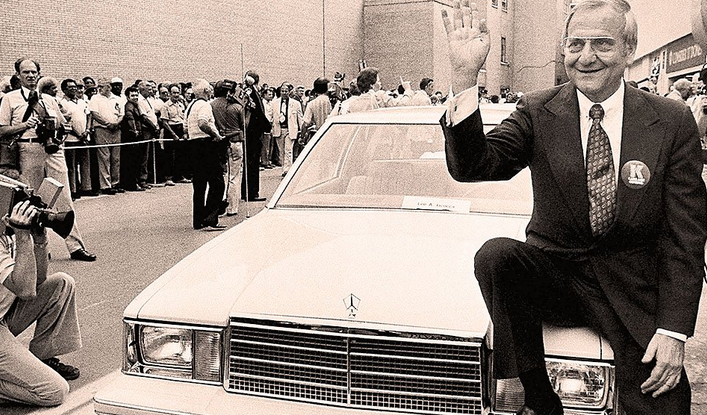

How Lee Iacocca Turned Getting Fired Into The Best Thing In The Long Run (Investor’s Business Daily )

How a Simple Blood Test Could Reduce Cancer Deaths (Barron’s )

5 Things You Might Have Missed in the Fed’s Minutes (Barron’s )

Not All Dividend Aristocrats Are the Same. Here Are 5 With the Fastest-Growing Payouts. (Barron’s )

Job Openings Are Near Prepandemic Levels. Expect a Jolt of Hiring Post-Covid. (Barron’s )

Citigroup Reports Earnings Next Week. How to Get Out in Front. (Barron’s )

The Pandemic Took a Bite From Dividends in 2020. Now They’re Recovering. (Barron’s )

2 Home-Building Stocks That Could Be a Buy, Even If a Pullback Is Coming (Barron’s )

This Time Is Different. Infrastructure Spending Could Actually Boost Stocks. (Barron’s )

What Amazon’s Union Vote Means for Inflation (Barron’s )

FDA Grants Full Approval to Gilead Breast Cancer Drug (Barron’s )

Billionaire Peter Thiel warns bitcoin is a ‘Chinese financial weapon’ that needs tougher scrutiny (fnlondon )

The biggest ‘inflation scare’ in 40 years is coming — what stock-market investors need to know (MarketWatch )

The Dollar Bond Binge Will Come Home to Roost Even Without a Blow-Up (Wall Street Journal )

As Americans start traveling again, airlines revive pilot hiring plans (CNBC )

A large chunk of the retail investing crowd got their start during the pandemic, Schwab survey shows (CNBC )

Fed Minutes Show Expectations for Stronger Economic Recovery (Wall Street Journal )

Investors Big and Small Are Driving Stock Gains With Borrowed Money (Wall Street Journal )

What’s in Biden’s Tax Plan? (New York Times )

Amazon Is Helping to Resurrect the Labor Movement (Bloomberg )

America’s Population Growth Looks to Be the Slowest Since 1918 (Bloomberg )

JPMorgan’s Dimon Says ‘This Boom Could Easily Run Into 2023’ (Bloomberg )

Yellen Says Tax Plan Recoups $2 Trillion in Overseas Profits (Bloomberg )

Panasonic Bets on Tesla ‘Beer Can’ Battery to Unlock $25,000 EVs (Bloomberg )

3G Billionaires Snap Up Real Estate Bargains in Covid Hotbed (Bloomberg )

The World’s Most Powerful Convertible Is a Study in Versatility (Bloomberg )

US weekly jobless claims climb to 744,000 as unemployment remains persistently high Business Insider )

Retail investors recovered faster than expected from February’s losses and data suggest older Americans are leading the latest round of buying (Business Insider )

IHOP looks to reach goal of 10,000 new hires in coming months ahead of ‘restaurant renaissance’ (MarketWatch )

Enbridge Seeks to Get More Gas to Energy-Hungry U.S. Northeast (Bloomberg )

U.S. Is Primed for Spring Hiring Spree (Wall Street Journal )

Jamie Dimon says economic boom fueled by deficit spending, vaccines could ‘easily run into 2023’ (CNBC )

Goldman and Morgan Stanley Analysts Battle Over Apple (AAPL) Services Revenue as Shares Test 50D SMA (streetinsider )

Some Wall Street banks say rate-hike bets are overdone — so buy bonds (MarketWatch )

U.S. jobs progress still far short of Fed’s ‘substantial’ tripwire (Reuters )

Top Oil Stocks To Watch In U.S. Shale As New No. 1 Emerges In Permian Basin (Investor’s Business Daily )

The recession is over in all but name. Why a retreat for stocks might be fast approaching, according to Deutsche Bank. (MarketWatch )

Fed’s Mester lauds jobs report, but says loose policy is staying put (CNBC )

Investors are selling their stocks even as the S&P 500 cruises to all-time highs, according to BofA (Business Insider )

Amazon Is the Target of Small-Business Antitrust Campaign (Wall Street Journal )

BP Signals Recovery for Oil Industry in Wake of Pandemic (Wall Street Journal )

Real-Estate Losers in 2020, Like Hotel and Mall Owners, Starred in the First Quarter (Wall Street Journal )

Shell to Turn First Oil Production Profit Since Pandemic (Barron’s )

Odds Improve for Global Deal on Corporate Tax (Barron’s )

Buy Exxon and Other Big Oil Stocks Instead of Chevron, Goldman Says (Barron’s )