- 9 Beaten-Down Stocks That Look Promising (Barron’s)

- Wall Street set to rise after strong jobs data; eyes on services sector survey (Reuters)

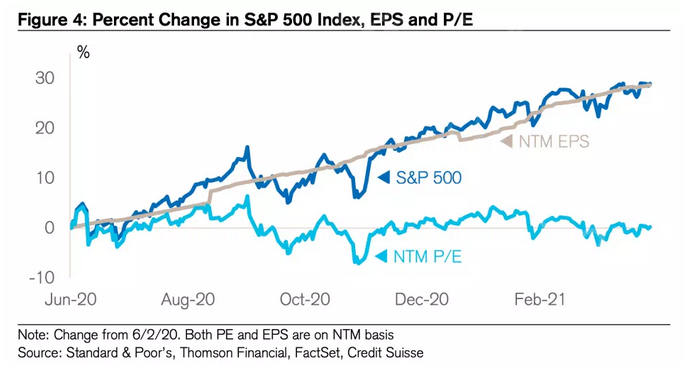

- This simple chart nails why stocks are up: Morning Brief (Yahoo! Finance)

- Goldman Sachs Says Buy Energy After Pullback: 3 Dividend-Paying Stocks to Buy Now (24/7WallSt)

- US companies are expected to see their strongest profit growth in nearly 20 years after downward revisions were ‘too aggressive’ (Business Insider)

- Betrayal. The Energy Report 04/05/2021 (Phil Flynn)

- Consumer Staples Have Been Left Out of the Stock Rally. It Might Be Time to Buy. (Barron’s)

- IPOs Post Their Best Record Since 1995. What Comes Next. (Barron’s)

- Uneven Gains in Job Market Give Investors a Goldilocks Moment. Can It Last? (Barron’s)

- J&J Will Manufacture Its Own Vaccine at Emergent Facility Where Doses Were Ruined (Barron’s)

- The Stock Market’s First Quarter Was Strong. What Comes Next. (Barron’s)

- Individual Investors Retreat from Markets After Show-Stopping Start to 2021 (Wall Street Journal)

- If You Sell a House These Days, the Buyer Might Be a Pension Fund (Wall Street Journal)

- The Post-Pandemic Office Is Already Here—in Australia (Wall Street Journal)

- How Big Is Amazon, Really? (New York Times)

- GameStop to Offer Up to $1 Billion in Shares; Stock Declines (Bloomberg)

- Tesla China Demand Fuels ‘Home Run’ Quarter for Deliveries (Bloomberg)

- Do-Nothing SPACs Sag, Offering Investors a $1.1 Billion Return (Bloomberg)

- Investors should buy real assets – from wine to art – as inflation reaches a ‘secular turning point,’ Bank of America says (Business Insider)

- Las Vegas shows reopen: Here’s what will be different for audiences and performers (USA Today)

- Here’s the $4.5 trillion ‘firepower’ that will drive stocks higher in April, says strategist Thomas Lee (MarketWatch)

- US Airports Busiest In More Than Year On Good Friday (ZeroHedge)

- Biden says his $2.3-trillion infrastructure plan will create 19 million jobs — most would not require a college degree (MarketWatch)

- ‘Godzilla vs. Kong’ has best box-office debut since pandemic started (MarketWatch)

- Norwegian Cruise stock surges after plan submitted to CDC to resume U.S. cruises in July (MarketWatch)

- Opinion: How to make money from stocks — while you sleep (MarketWatch)

- Palm Beach County Mansions Scooped Up in Hot Pandemic Market (Bloomberg)

- CVS to now offer COVID-19 antibody tests for $38 (MarketWatch)

- Britian to Launch Large-Scale Effort to Find Pill for Early Onset Mild-to-Moderate COVID-19: Will they Include Repurposed Generics in the Investigation? (TrialSiteNews)

- Alibaba May Be Seeing Tough Times But, Alongside Tencent, Remains ‘The Benchmark’ For Chinese Tech Stocks: Analyst (Benzinga)

Category: What I’m Reading Today

Be in the know. 10 key reads for Easter Sunday…

- Waffle House Chairman Joe Rogers Jr. Debuts As A Billionaire As Restaurant Industry Digs Out From Wreckage (Forbes)

- Billionaire Bill Foley Is SPAC Market’s Overlooked Star (Wall Street Journal)

- How Troubled Trader Bill Hwang Quietly Amassed $10 Billion (Forbes)

- Pfizer CEO Albert Bourla Helped Save The World. Can He Save His Company’s Stock? (Forbes)

- Tilman Fertitta says he’s been surprised by strength of his restaurants and casinos in March by Kevin Stankiewicz (CNBC)

- ECRI Weekly Leading Index Update (advisorperspectives)

- The Maserati Levante GTS: Behind The Wheel of a Racy Italian SUV (Maxim)

- What Information Do You Need in Order to Change? (Farnam Street)

- The Transcript 03.29.20: Higher Confidence (theweeklytranscript)

- Individual Investors Retreat from Markets After Show-Stopping Start to 2021 (Wall Street Journal)

Be in the know. 15 key reads for Saturday…

- Consumer Staples Have Been Left Out of the Stock Rally. It Might Be Time to Buy. (Barron’s)

- Don’t Raise Taxes for Infrastructure Push. The U.S. Should Be Like a Business and Borrow. (Barron’s)

- After 10 Years of Underperformance, Commodities Are Set to Boom. Here’s How to Play the Rally. (Barron’s)

- This Torrid Market Still Has Plenty of Room to Run (Barron’s)

- Two REIT Stocks See Large Insider Buys (Barron’s)

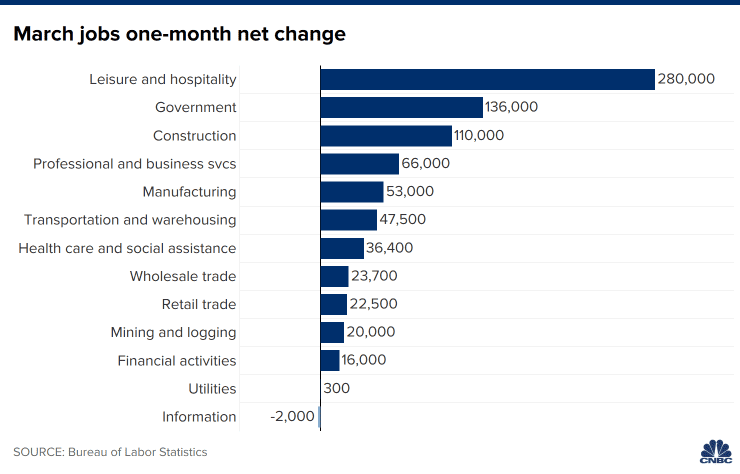

- U.S. Added 916,000 Jobs in March as Hiring Accelerated (Wall Street Journal)

- This 1950s Spanish Resort—Beloved by Audrey Hepburn—Is Still Going Strong (Wall Street Journal)

- Vaccine Trickle Becomes Torrent as U.S. Eligibility Rules Widen (Bloomberg)

- Bill Gates says companies have gone from staying private too long to going public too soon and that he’s avoiding ‘low quality’ SPACs (Business Insider)

- 2 consecutive days of gains points to a stronger than usual April for the stock market, Fundstrat’s Tom Lee says (Business Insider)

- Hotels reaching highest occupancy levels since the pandemic, Wyndham CEO says (CNBC)

- 76 all-cash offers on one home. The housing madness shows no signs of slowing (CNN Business)

- How Close Is The UK To Herd Immunity? (ZeroHedge)

- 10 Undervalued Wide-Moat Stocks (Morningstar)

- A History of Boats, Canals & Finance (investoramnesia)

Be in the know. 15 key reads for Friday…

- OPEC and Its Allies Agree to Gradual Increases in Oil Production (New York Times)

- Job Growth in U.S. Topped 900,000 in March as Hiring Broadened (Bloomberg)

- God and Man Collide in Bill Hwang’s Dueling Lives on Wall Street (Bloomberg)

- Why Biden’s Infrastructure Plan Is a Green Jobs Plan (Bloomberg)

- U.S. Small-Business Job Openings Rise to Record in March (Bloomberg)

- New Supercycle Makes Energy Billionaires Richer Globally (Bloomberg)

- The Bull Market Roulette Wheel Just Keeps Landing on Winners (Bloomberg)

- Saudis keep control of the oil market despite a production increase. (New York Times)

- Asia Goes Big on Hydrogen. What It Means for EVs. (Barron’s)

- Rehypothecated Leverage: How Archegos Built A $100 Billion Portfolio Out Of Thin Air… And Then Blew Up (ZeroHedge)

- Goldman Sachs Sees “Significant Downside Risk” to Apple (AAPL) Services Growth (Street Insider)

- First-time buyers fuel Manhattan housing market revival (Fox Business)

- Oil producer Pioneer to snap up rival DoublePoint for $6.4bn (Financial Times)

- Hotels are reaching the highest occupancy levels since the pandemic, Wyndham CEO says (CNBC)

- Here’s where the jobs are — in one chart (CNBC)

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Thursday…

- Top Analyst Says Software Stocks Are Expensive Now: 5 High-Value Conviction Buys (24/7 Wall Street)

- Spac boom fuels strongest start for global M&A since 1980 (Financial Times)

- Long-term US government bonds endure worst quarterly fall since 1980 (Financial Times)

- Archegos debacle reveals hidden risk of lucrative swaps (Financial Times)

- 5 Weirdest Corporate April’s Fool Pranks Of All Time: Voltswagen, Tesla Model W And More (Benzinga)

- The Wrong Guy. The Energy Report 04/01/2021 (Phil Flynn)

- Biden’s Push for Electric Cars: $174 Billion, 10 Years and a Bit of Luck (New York Times)

- 3 Underperforming IPO Stocks Worth a Second Look (Barron’s)

- It’s a Great Time to Own Financial Stocks. Here’s Why. (Barron’s)

- Optimistic Forecasts on Economy Might Still Be Too Dismal (Wall Street Journal)

- Biden’s $2.3 Trillion Infrastructure Plan Takes Broad Aim (Wall Street Journal)

- What’s in Biden’s $2 Trillion Corporate Tax Plan (Wall Street Journal)

- Shoppers Start to See Effect of Higher Commodity Costs (Wall Street Journal)

- How Japanese Investors Accelerated the Treasury Selloff (Wall Street Journal)

- Walgreens Reports Stronger Profit as Covid-19 Vaccine Rollout Ramps Up (Wall Street Journal)

- Pfizer says COVID-19 vaccine lasts 6 months, protects against variants (New York Post)

- Goldman Sachs Sees “Significant Downside Risk” to Apple (AAPL) Services Growth (Street Insider)

- US home prices are rising at their fastest in 15 years – and Goldman says they’ll surge another 7% this year (Business Insider)

- S&P 500 clears 4,000 milestone as data show U.S. factories booming (MarketWatch)

- Japan and South Korea reported unexpectedly strong economic data, as Asian stocks rise (MarketWatch)

Be in the know. 15 key reads for Wednesday…

- What’s in Biden’s $2.25 Trillion Infrastructure and Tax Proposal (Bloomberg)

- Pfizer’s Vaccine Is 100% Effective in Adolescents, Company Says (Barron’s)

- H&R Block Wants to Do More Than Your Taxes. Why Its Stock Is a Buy. (Barron’s)

- Tesla Could Be One of the Big Winners in Biden’s $2 Trillion Infrastructure Plan (Barron’s)

- OPEC cuts, vaccines to sustain oil’s recovery: Reuters poll (Reuters)

- Biden to unveil $2tn infrastructure plan and big corporate tax rise (Financial Times)

- Boeing Gets More 737 MAX Orders From Alaska Airlines Over December Commitment (Benzinga)

- Wall Street is pricing in $4 trillion of infrastructure spending. Here are the stocks that could benefit, according to Bank of America. (MarketWatch)

- These are the stocks for playing Biden’s infrastructure push, analysts say (MarketWatch)

- Biden kicks off effort to reshape U.S. economy with infrastructure package (Reuters)

- Energy Mixer. The Energy Report 03/31/2021 (Phil Flynn)

- U.S. Companies Add Most Jobs Since September, ADP Data Show (Bloomberg)

- Kimberly-Clark (KMB) Announces Price Increases for North American Consumer Products Business (Street Insider)

- U.S. Home Prices Rise at Fastest Pace in 15 Years (Wall Street Journal)

- What Is a Total Return Swap and How Did Archegos Capital Use It? (Wall Street Journal)

Be in the know. 20 key reads for Tuesday…

- Institutional investors have been net sellers of stocks since December but that’s actually a bullish signal for equities, according to Fundstrat (Business Insider)

- Here are the complex bets at the heart of ‘unprecedented’ Archegos-linked $30 billion margin call (MarketWatch)

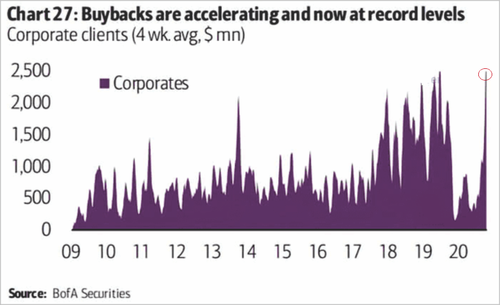

- This past week, share buybacks hit a new record. (zerohedge)

- Real Estate Investors Desperate to Spend $250 Billion Hoard (Bloomberg)

- Splunk Fell Behind in the Cloud Era. Now It’s Catching Up and the Stock Could Soar. (Barron’s)

- The Fed May Allow Bank Dividend Hikes. How to Play It. (Barron’s)

- Investors See Poor Large-Cap Stock Gains This Year. Here’s Where There’s Opportunity. (Barron’s)

- Boeing Stock Is Jumping, With 3 Pieces of Good News (Barron’s)

- Billions in Secret Derivatives at Center of Archegos Blowup (Bloomberg)

- Here’s why Wall Street and investors aren’t giddy enough, says top strategist (MarketWatch)

- China, Long a Source of Deflation, Starts Raising Prices for the World (Wall Street Journal)

- SPACs Are the Stock Market’s Hottest Trend. Here’s How They Work. (Wall Street Journal)

- Treasury Yields Rise With Biden Spending in Focus: Markets Wrap (Bloomberg)

- How the U.S. Is Vaccinating Its Way Out of the Pandemic (Bloomberg)

- Value Quants Take Wall Street by Storm With Best Run Since 2000 (Bloomberg)

- Big Oil’s Secret World of Trading (Bloomberg)

- Bank and cyclical stocks should be bought on the dip, Jim Cramer says (CNBC)

- Oil drops as Suez opens, focus turns to OPEC+ output cuts (Street Insider)

- Oil Choppy Ahead of OPEC Plus. The Energy Report 03/30/2021 (Phil Flynn)

- ‘Biggest Risk’ Facing Apple, Tesla, Other Nasdaq Stocks? US-China ‘Cold Tech War,’ Says Analyst (Benzinga)

Be in the know. 15 key reads for Monday…

- Global Banks Tally Up Potential Costs Linked to U.S. Client (Barron’s)

- US companies sound inflation alarm (Financial Times)

- 25 Undervalued European Stocks Set to Beat Post-Pandemic Earnings (Barron’s)

- Bluebird Shares Jump as FDA Approves Cancer Therapy (Barron’s)

- A Windfall Is Coming for Banks. Here’s How They Should Use It. (Barron’s)

- The Parable of the Suez Canal (Barron’s)

- New Trade Representative Says U.S. Isn’t Ready to Lift China Tariffs (Wall Street Journal)

- Bond Bulls Charge Ahead, Challenging Consensus on Rising Yields Wall Street Journal)

- The Two Tiger Cubs at the Center of Friday’s $35 Billion Meltdown (institutionalinvestor)

- Gen X emerging from pandemic with firmer grip on America’s wallet (Reuters)

- Boeing Nabs Southwest Airlines Order for 100 737 Max Jets, 155 Added Options (24/7 Wall Street)

- Contentious Union Vote at Amazon Heads to a Count (New York Times)

- Billions in Secretive Derivatives at Center of Hedge Fund Blowup (Bloomberg)

- CFDs – The Dirty Little Secret Behind The Collapse Of Archegos (ZeroHedge)

- ‘What the hell’s an NFT?’ — ‘SNL’ explains in an amazing rap parody (MarketWatch)

Be in the know. 11 key reads for Sunday…

- Episode 21-13 The Birth of CRISPR (Tech Nation)

- Mean Reversion After Biggest 1-Year Spike Since 1949? (Almanac Trader)

- Democrats confident they can pass $3tn infrastructure bill (Financial Times)

- The Economy Doesn’t Need The Fed’s Easy Monetary Policy To Keep Booming, BofA Says (Forbes)

- Are we heading for a post-pandemic ‘Roaring 2020s,’ with parties and excess? (Washington Post)

- Amazon could get its first unionised workforce in America (The Economist)

- Electric Air Taxis Must Be Just as Safe as Commercial Planes, VTOL Exec Says (robbreport)

- Watch this $1.2M supercar EV drift on ice like a ballerina (thenextweb)

- F1 live stream: how to watch every 2021 Grand Prix online from anywhere (techradar)

- Boats And Bull Markets: Indicators Of The Week (NPR Planet Money)

- Succession Season 3: Everything We Know So Far (Town & Country)