Oil Players put out Carbon/ESG Plans to attract Institutional Investors back into the fold (Important Point Covered in this Week’s VideoCast):

- Occidental Petroleum Claims Green Push ‘Does More Than Tesla’ (hartenergy)

- ExxonMobil is doing its part to address the dual challenge of ensuring the world has the energy it needs while also minimizing climate-change risks (ExxonMobil)

- We’re charged up: Canada’s Electric Highway (Suncor)

- BP sets ambition for net zero by 2050, fundamentally changing organisation to deliver (BP)

- Shell unveils plans to become net-zero carbon company by 2050 (The Guardian)

SUNDAY READS:

- February Almanac: Worst S&P 500 Month of Post-Election Years (Almanac Trader)

- The U.N. Says America Is Already Cutting So Much Carbon It Doesn’t Need The Paris Climate Accord (Forbes)

- 12 Best Utility Stocks To Buy Now (insidermonkey)

- Opinion: Electric Cars’ Looming Recycling Problem (undark)

- How Mat Ishbia Cashed In On The Biggest SPAC Ever: From Benchwarmer To $13 Billion (Forbes)

- The EV Bubble spreadsheet: update uno (Financial Times)

- For Oil Servicers, Adversity Spells Opportunity (Wall Street Journal)

- Auto Investors Are Doing the Charleston (Wall Street Journal)

- Here’s What’s In The Two New Covid Relief Executive Orders Biden Just Signed (Forbes)

- 3 Reasons The Major Bank Stocks Should See Better Returns (Forbes)

- The NHL’s Highest-Paid Players 2021 (Forbes)

- U.S. factory activity near 14-year high; home sales rise in December (Reuters)

- ECRI Weekly Leading Index Update: WLI Highest Since Jan 2020 (advisorperspectives)

- Here are Larry King’s 10 most memorable interviews (New York Post)

- 5 Must-See Blockbuster Movies Coming Out in 2021 (Men’s Journal)

- this meme-generator puts bernie sanders anywhere on google street view (designboom)

- UFC 257: Where does Conor McGregor go from here? (espn)

- 10 free online classes from Harvard to learn something new (Mashable)

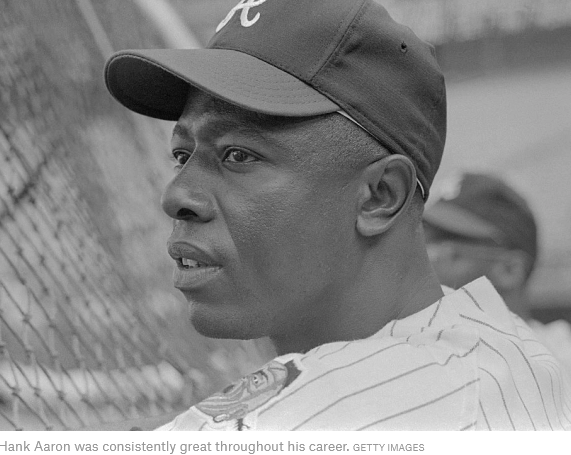

- Nobody — And We Mean Nobody — Was Consistently Great Like Hank Aaron (538)

- 9 Heavy-hitting Facts About the Greatest, Muhammad Ali (howstuffworks)

- The Glorious Fish and Chips at Dame (New Yorker)

- Why the Cost of Shipping Goods From China Is Soaring (Podcast) (Bloomberg)

- Sotheby’s is Selling the Ultimate Renaissance Painting (Town & Country)

- Inside Ford’s Plans to Become an EV Leader (Road and Track)

- Bullish Stock Bets Explode as Major Indexes Repeatedly Set Records (Wall Street Journal)