Skip to content

5 Food Stocks to Buy in 2021 (Barron’s )

Why Clover Health Chose a SPAC to Go Public (Barron’s )

Squeeze play? How the ‘most shorted’ stocks are crushing the market in the new year (MarketWatch )

Behind a Secret Deal Between Google and Facebook (New York Times )

Opinion: Here are the biggest stock market winners and losers in Biden’s massive stimulus plan (MarketWatch )

China Is Only Major Economy to Report 2020 Growth (Wall Street Journal )

Dollar Shorts Mount Before Yellen Outlines Market-Based Policy (Bloomberg )

Barron’s Picks And Pans: Exxon Mobil, GameStop, Intel, 3M, Toll Brothers And More (Yahoo! Finance )

Here’s How Americans Are Spending Their Stimulus Payments (Benzinga )

How to bring Brooks Brothers back from the brink (Financial Times )

Bill Gates is now the largest farmland owner in America (MarketWatch )

US small-cap stocks have raced ahead of their bigger peers in 2021. Experts say a number of factors could send them higher. (Business Insider )

What 1919 Teaches Us About Pent-Up Demand (NPR Planet Money )

Seasonal Soft Patch Ahead Starting Next Week (Almanac Trader )

Airline Investors Look for Bluer Skies Later This Year (Barron’s )

A new activist takes on Exxon to reverse the oil giant’s underperformance (CNBC )

Tanger Factory Outlet Centers Brings Back Its Dividend (Barron’s )

Concierge Medicine Has Boomed During Covid. Here’s How to Tell if It’s Right for You. (Barron’s )

Parler’s de-platforming shows extreme power of cloud providers like Amazon (CNBC )

Carnival’s Wave Season Should Lift Its Shares (Wall Street Journal )

Behind the Wheel of the 2021 Mustang Mach-E— Ford’s First Fully-Electric Mustang (Maxim )

After Rocky Start, Opportunity Zones Could Boom In 2021 (Forbes )

A THREE-MONTH LOOK AT SECTOR LEADERSHIP SHOWS MORE OPTIMISM — RISING COMMODITY PRICES AND RISING BOND YIELDS HAVE ALSO PLAYED A ROLE (stockcharts )

ECRI Weekly Leading Index Update (advisorperspectives )

After Stock Surge, Investors Ask Companies What’s Ahead (Wall Street Journal )

CRISPR and the Splice to Survive (New Yorker )

Biden Names Top Geneticist Eric Lander as Science Adviser (scientificamerican )

Cowen’s Co-President on Why SPACs Are Having a Moment (Podcast) (Bloomberg )

Lotus and Renault Are Teaming Up to Build an All-Electric Alpine Sports Car (roadandtrack )

Bank Stocks Could Be Set to Boom Under the Biden Administration (Barron’s )

US banks release billions from reserves foreseeing lower Covid losses (Financial Times )

A ‘Very Young’ Bull Market in Stocks Is Still Minting Believers (Bloomberg )

America’s Big Banks Girded for a Wave of Bad Loans. They’re Still Waiting. (Wall Street Journal )

Why Energy Could Have a Tesla-Like 2021 (Barron’s )

The Dow Dropped Exxon Mobil in August. But as Oil Prices Rise, So Does Its Stock. (Barron’s )

Blankfein Called It, Now the Whole World Is Watching Commodities (Bloomberg )

Defense Challenges Awaiting Biden: From Kim Jong Un to Budgeting (Bloomberg )

Charlie Munger: What Makes a Great Investor (Novel Investor )

We Are What We Remember (Farnam Street )

Wells Fargo records rare profit beat as credit costs fall (New York Post )

Welcome to the Roaring ’20s, but Maybe Not for Stocks (Barron’s )

JPMorgan posts strong final quarter of 2020, sounds optimistic for 2021 (New York Post )

Xi Jinping asks ex-Starbucks CEO for help with US-China relations (New York Post )

Howard Marks: Something of Value (oaktreecapital )

Which Parts of Biden’s Stimulus Can Get Enacted Fast? (Bloomberg )

U.S. Officials Plead for More Use of Languishing Antibody Drugs (Bloomberg )

GM Working on Expanding Corvette Line With Crossover SUV (Bloomberg )

Warren Buffett blasted Bitcoin as a worthless delusion and ‘rat poison squared.’ Here are his 16 best quotes about crypto. (BusinessInsider )

Bank stocks are market favorites in 2021: Investment strategist (Fox Business )

Biden called his $1.9 trillion relief plan the ‘first step.’ Here’s his idea for Part Two (MarketWatch )

How Joe Biden’s stimulus plan shook up global financial markets (Financial Times )

Kim Jong Un Offers a Rare Sneak Peek at North Korea’s Weapons Program (Wall Street Journal )

Boeing’s Other Big Problem: Fixing Its Space Program (Wall Street Journal )

Have Large-Growth Stocks Peaked? (Morningstar )

LNG rally heralds more volatile gas prices to come (Financial Times )

Bridgerton and the art of power dressing (Financial Times )

Political Conflict & Markets (investoramnesia )

Biden to Face a China Intent on Leading the World in Technology (Bloomberg )

JPMorgan Lending Ratio Falls as Bank Is Flooded With Deposits (Bloomberg )

Investors should avoid bonds: Wharton’s Jeremy Siegel (CNBC )

The Periodic Table of Commodity Returns (2021 Edition) (visualcapitalist )

Biden Proposes Bigger Federal Role in Vaccinations (Wall Street Journal )

FAA Approves Fully Automated Commercial Drone Flights (Wall Street Journal )

China’s Xi Looks to Take Advantage of a Strong Economic Hand (Wall Street Journal )

Welcome to the Roaring ’20s, but Maybe Not for Stocks (Barron’s )

3M Stock Is Unloved and Underpriced. Here’s Why It Could Shoot Up Higher. (Barron’s )

Citigroup Beats Profit Expectations for Fourth Quarter (Wall Street Journal )

Why Toll Brothers Is a Play on the ‘Single-Family Supercycle’ (Barron’s )

Biden’s ‘rescue America’ plan is big. How its trillions could help both Wall Street and Main Street (MarketWatch )

JPMorgan’s Wall Street Strength Draws a Record Quarterly Profit (Bloomberg )

Here Are the Major Parts of $1.9 Trillion Biden Relief Plan (Bloomberg )

Banks Boycott! The Energy Report 01/15/2021 (Phil Flynn )

Buy any ‘sell-the-news reactions’ in the banks after earnings, market analyst says (CNBC )

6 Bank Stocks That Could Stand Out as the Sector Soars (Barron’s )

Brazil’s Stocks Are in the Bargain Basement. Investors Should Start Shopping. (Barron’s )

Value stocks are about to come out of their coma, says index fund powerhouse Vanguard (MarketWatch )

Boeing Has a 787 Problem. But Investors Needn’t Worry. (Barron’s )

With Rare Speed, Gene Editing Emerges as Biotech’s New Cutting Edge (Barron’s )

Apache, Devon Energy, and EOG Are a Few of the Oil and Gas Industry’s ‘Democrat Darlings’ (Barron’s )

Higher Dividend Tax Looks Possible for Top Earners Under Biden Administration (Barron’s )

Delta Looks Toward Recovery After Dark Pandemic Winter (Wall Street Journal )

Investors Find Value in Low-Rated Loans (Wall Street Journal )

Why Finding Workers Is Getting Harder for U.S. Homebuilders (Bloomberg )

U.S. producer prices increase moderately in December (Reuters )

Wells Fargo profit beats Wall Street estimates as credit costs fall (Reuters )

An S.U.V.? Ferrari Sees the Writing on the Road (New York Times )

Why Wells Fargo Can Grow Faster Than Other Banks (Barron’s )

JPMorgan, Wells Fargo & Citigroup may kick off a banner earnings season (Fox Business )

Wall Street Fumes Over Last-Minute Rule From Bank Watchdog (Bloomberg )

What to Expect From Bank Earnings Reports (Barron’s )

TikTok until the Stock Market “Ghosts” us… (ZeroHedge )

BlackRock Stock Gains as Earnings Top Forecasts. It Wasn’t Just ETFs. (Barron’s )

The Political Pendulum Swings, but the Economy Does Its Own Thing (Barron’s )

Boeing and 10 Other Companies That Don’t Have to Worry About Biden Raising Taxes (Barron’s )

What’s up with WhatsApp? Everything you need to know about the shift to Signal (fnLondon )

5 Stocks That Could Pop After Earnings — and 5 That Are Ready to Drop (Barron’s )

New Data Boosts Confidence In J&J Vaccine (Barron’s )

Goldman Sachs says the S&P 500 will rise 14% in 2021. Here’s the road map (MarketWatch )

It Could Be a Big Year for Bank Mergers. Here Are Names to Watch. (Barron’s )

Spike in Gas Prices Drove Up Consumer Prices Last Month (Barron’s )

Stocks Are Less Driven by Macro Forces. Keep Stock Picking. (Barron’s )

Fed survey finds economy slowing in some areas of country (Fox Business )

OPEC Monthly Report Signals Demand Optimism, On Track To Drain Oil Inventories (ZeroHedge )

Biden to unveil plan to pump $1.5 trillion into pandemic-hit economy (Reuters )

Option Trader Bets $4M On Citigroup Stock Ahead Of Q4 Earnings (Benzinga )

Investors Bet U.K. Stocks Can Banish Brexit Blues (Wall Street Journal )

Manhattan Bargain-Hunters Drive a 94% Jump in Apartment Leases (Bloomberg )

CEO of world’s largest money manager sees stocks rallying in 2021 but not as much as last year (CNBC )

Delta halves cash burn in fourth quarter, narrows losses to cap worst year ever (CNBC )

How to stay in stocks if the record market has you fearing bubble (CNBC )

All theories of what generates higher inflation are pointing in the same direction – up: Fed’s Bullard (MarketWatch )

Exxon Mobil stock rises again after J.P. Morgan analyst turns bullish for the first time in 7 years (MarketWatch )

Oil Rally Will Continue as Producers Curb Supplies (Barron’s )

5 Stocks to Play the Next Surge in Natural Gas (Barron’s )

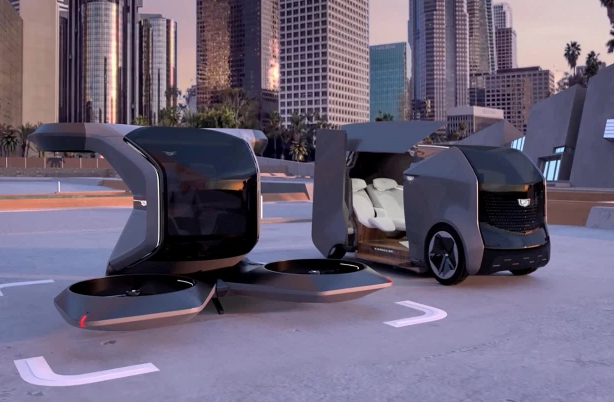

GM Teased Flying Cars at CES. Its Ambitions Are Even Bigger. (Barron’s )

LNG Cargo Prices Rising Faster Than Bitcoin (Yahoo! Finance )

Regeneron Inks Deal to Sell Covid-19 Treatment to U.S., Even as Usage Lags (Barron’s )

Barron’s Daily: The Apple Car Chatter Is Back—and It’s Helping Everyone Except Apple (Barron’s )

Bristol Myers Looks to Drug Pipeline to Turbocharge Growth (Barron’s )

Bank of America Stock Could Pop on Earnings. How to Play the Results. (Barron’s )

What Eli Lilly’s Good News About Its Alzheimer’s Drug Means for Biogen (Barron’s )

GM unveils self-driving Cadillac that can fly (New York Post )

Atop the Powerful Budget Committee at Last, Bernie Sanders Wants to Go Big (New York Times )

Bitcoin Will Break Wall Street’s Heart (Wall Street Journal )

Walgreens to launch credit cards with Synchrony Financial and Mastercard (MarketWatch )

Lagarde Blasts Bitcoin’s Role in Facilitating Money Laundering (Bloomberg )

Occidental to Strip Carbon From the Air and Use It to Pump Crude (Bloomberg )

6 Energy Stocks Trading Well Below 52-Week Highs (247wallst )

Schumer pledges quick delivery of $2,000 stimulus checks: ‘We will get that done’ (Fox Business )

Mortgage refinancing jumps 20% to begin the year (Fox Business )

Billionaire investor Howard Marks discussed Tesla’s valuation, growth vs value investing, and the Fed juicing markets in a recent interview. Here are the 8 best quotes. (Business Insider )

Oil prices rise to near 1-year highs as vaccines, stimulus and Saudi Arabian production cuts lift the energy outlook (Business Insider )

The bull market will continue in 2021 with stock holdings still well below dangerous Global Financial Crisis levels, JPMorgan says (Business Insider )

Covid-19 Rapid-Test Sites Planned for New York Office Buildings (Wall Street Journal )

New GM Electric-Truck Business Targets Delivery Market (Wall Street Journal )

Big Real-Estate Firms Turn Buyers of Their Own Shares (Wall Street Journal )

Wells Fargo’s stock surges toward 10-month high after UBS analyst upgrades to ‘top pick’ (MarketWatch )

Underinvestment Risk Rising. The Energy Report 01/12/2021 (Phil Flynn )

Bank of America Stock Could Pop on Earnings. How to Play the Results. (Barron’s )

What to Expect From Banks’ Earnings (Barron’s )

Why Bill Miller Likes Teva, Gannett, and Bitcoin (Barron’s )

Elon Musk’s Internet Venture Gets the Green Light in Another Major Market (Barron’s )

Intel Unveils New Chips. What Investors Need to Know. (Barron’s )

U.S. Daily Covid Vaccinations Rise by Record 1.25 Million (Bloomberg )

‘You’re A Fool’ Who Will ‘Lose Everything’ If You Take On Debt To Invest In Crypto, Mark Cuban Says (Benzinga )

Cramer: With Trump Out Of Picture, Twitter Could Struggle To Draw New Users (Benzinga )

Gilead CEO: We Expect Remdesivir To Work On New COVID-19 Strains (Benzinga )

Howard Marks’s Latest Warning (Institutional Investor )

Jabs equal jobs? Fed sees possible economic boom if vaccine gets on track (Reuters )

Playing chicken: Iran sets up challenge for Biden with nuclear ramp-up (CNBC )

How this 34-year-old chess champion became India’s youngest new billionaire (CNBC )

First, the Good News on Biden’s Stimulus (Wall Street Journal )

Buying airline stocks now takes ‘leap of faith,’ analyst says (MarketWatch )

Banks are back — almost half of 15 large U.S. banks are expected to increase quarterly profit (MarketWatch )

Bank of America stock rallies after analyst says it’s time to buy (MarketWatch )

2-year/10-year Treasury yield curve steepest since mid-2017 (MarketWatch )

Gilead raises 2020 profit forecast on remdesivir strength (CNBC )

Exxon Mobil upgraded to Overweight from Equal Weight at Morgan Stanley (TheFly )

Biden’s Big Decision on Tech Taxes (Wall Street Journal )

Covid-19 Vaccine Rollout Goes Smoothly in Connecticut (Wall Street Journal )

Stock market exuberance is here to stay, Credit Suisse says. Here’s why investors can be positive (MarketWatch )

JPMorgan Chase, Wells Fargo, Delta, TSMC, and Other Stocks to Watch This Week (Barron’s )

‘Prepare to lose all your money’ — regulator’s blunt warning on bitcoin and other cryptocurrencies (MarketWatch )

Earnings Season Is About to Begin. What to Expect. (Barron’s )

Nearly $170 billion wiped off cryptocurrency market in 24 hours as bitcoin pulls back (CNBC )

Twitter Shares Under Pressure After Ban on Trump’s Account (Barron’s )

Wall Street analysts are cautiously optimistic on J&J’s ‘one-dose’ Covid vaccine (CNBC )

Goldman, JPMorgan, Citi Suspend Political Donations (Bloomberg )

Trump’s social media bans are raising new questions on tech regulation (CNBC )

Pickup trucks dominate America’s 10 best-selling vehicles of 2020 (CNBC )

Gene-Therapy Firm Bluebird Bio Is Spinning Off Its Cancer Programs (Bloomberg )

Moderna to develop vaccine candidates for seasonal flu, HIV (MarketWatch )

BioNTech to target supply of up to 2 billion doses of COVID-19 vaccine in 2021 (MarketWatch )

Israel Plans to Vaccinate Everyone by March. Here’s How. (Wall Street Journal )

Ban on Chinese Stocks Roils Investors (Wall Street Journal )

Barron’s Picks And Pans: Dividend Aristocrats, Alibaba, GameStop, Walmart And More (Yahoo! Finance )

Bank Stocks Are Back in Vogue on Stimulus, Interest-Rate Outlook (Bloomberg )

OPEC crude output cuts should help U.S. shale profits in 2021 (Reuters )

How to Turn $3,000 Into $41 Million: Investing Lessons From a Century (Barron’s )

ECRI Weekly Leading Index Update (Advisor Perspectives )

TEN-YEAR TREASURY YIELD EXCEEDS 1% FOR FIRST TIME SINCE MARCH — THAT’S HELPING MAKE FINANCIALS THE DAY’S STRONGEST SECTOR — MATERIALS AND INDUSTRIALS HIT RECORDS (StockCharts )

Markets Update: 2021 Global Growth Outlook (GoldmanSachs )

Here’s Why Formula 1 Can’t Go Electric Yet, Explained with Simple Science (TheDrive )

Chess Grandmaster Hikaru Nakamura on Twitch Streaming and ‘The Queen’s Gambit’ (Bloomberg )

Transition 2021: What Will Biden’s Trade Policy Look Like? (CFR )

Why Breathing Through Your Nose Is Best (howstuffworks )

2021 Performance Car of the Year (Road and Track )

“Jootsing”: The Key to Creativity (Farnam Street )

JP Morgan Guide To The Markets Q1 2021 (JP Morgan )

Here Comes Joe Biden’s Washington. Consider These Stocks and Funds for Your Portfolio. (Barron’s )

The Risks Are Rising for Big Tech (Barron’s )

China will vie to become world financial centre, says Ray Dalio (Financial Times )

Dr. Jim Loehr on Mental Toughness, Energy Management, the Power of Journaling, and Olympic Gold Medals (#490) (Tim Ferriss )

The Great Wisdom of Sam Zell (Real Vision )

33 Undervalued Stocks for 2021 (Morningstar )

Energy Remains the Most Undervalued Sector (Morningstar )

Value and Growth Are Attached at the Hip (dividendgrowthinvestor )

Bill Miller 4Q 2020 Market Letter (Miller Value )

Is Value Investing Dead? Not So Fast, Says A Recent Study (Forbes )

Why Rookie CEOs Outperform (Harvard Business Review )

5 Investing Insights from Charlie Munger (2020) (behavioralvalueinvestor )

20VC: Bill Gurley and Howard Marks: What Happened In 2020? What Can We Expect Looking Forward to 2021? (thetwentyminutevc )

Rob Arnott On Why Value Investing Is Here to Stay (Rob Arnott )

The Best Time to Invest in Value (Validea )

Wall Street Is the Most Bullish on Commodities in a Decade (Bloomberg )

Stocks enter the manic, exuberant bull market stage, but that doesn’t mean it’s near ending (CNBC )

Warren Buffett’s Equity Bond Method Explained (vintagevalueinvesting )

Finding Value In The Stocks 2020 Left Behind (boyarvaluegroup )

Kamala Harris’ top economic advisor is another BlackRock exec (New York Post )

Bitcoin rally may be the ‘mother of all bubbles’ says BofA (CNN )

Warren Buffett’s Latest Challenger Will Fizzle Like the Rest (Wall Street Journal )

‘Big Short’ investor Michael Burry predicts Tesla stock will collapse like the housing bubble: ‘Enjoy it while it lasts’ (Business Insider )

Tom Brady Is 43. He’s Playing Like He’s 28. (Wall Street Journal )

Rental Home Construction Climbs as Purchase Prices Surge (Wall Street Journal )

Earnings Season Is About to Begin. Investors Are Already Looking Past it. (Barron’s )

Oldies but Goodies: Some Century-Old Stocks Still Deliver (Barron’s )

This Is What’s Driving Stocks to Records as the Nation Reels (Barron’s )

Tiny Satellites Will Connect Cows, Cars and Shipping Containers to the Internet (Wall Street Journal )