Skip to content

Wells Fargo (WFC) PT Raised to $35 at Raymond James (StreetInsider )

10 things to know about Emerging Markets for 2021 (outlook): (CNBC Indonesia “Closing Bell” )

As Dow hits new record, ‘one of the most important tailwinds for equities’ is in place (MarketWatch )

This Was the Busiest Year for IPOs Since the Dot-Com Bubble (Barron’s )

The Falling Dollar Is Good News for Bank Stocks (Barron’s )

The Happy Place. The Energy Report 12/29/2020 (Phil Flynn )

3M Had a Solid 2020, but the Stock Doesn’t Show It (Barron’s )

Alibaba’s Woes Deepen. Why the Stock Is Starting to Look Oversold. (Barron’s )

5 Airline Stocks That Could Cruise Even Higher (Barron’s )

After recent price spike, the energy to produce bitcoin could power a country of more than 200 million people (MarketWatch )

Hedge Funds Are Still Buying Stocks. What That Means for the Market. (Barron’s )

Battle over $2,000 COVID-19 aid checks shifts to U.S. Senate (Reuters )

Global banks generate record $125bn fee haul in 2020 (Financial Times )

KeyBanc Upgrades Continental Resources (CLR) to Overweight on Improved Leverage, FCF Generation in 2021 (StreetInsider )

Commodities Breaking Out, Suggesting Bull Market Is Ahead (ZeroHedge )

Return to Almost Normal May Be Closer Than You Think (Wall Street Journal )

Boeing 737 MAX set to resume flights for American Airlines (New York Post )

U.S. 20-City Home Price Index Posts Biggest Gain Since 2014 (Bloomberg )

Warren Buffett said an 89-year-old carpet seller would ‘run rings around’ Fortune 500 CEOs. Here’s the remarkable story of Mrs B. (Business Insider )

Fundstrat’s Tom Lee says another epic rally in stocks hit hardest by COVID-19 could be coming soon (Business Insider )

Marathon Petroleum (MPC), Suncor (SU), and Exxon (XOM) are Oversold, Goldman Sachs Recommends a ‘Buy’ (StreetInsider )

Why 5 Dividend-Paying Dow Jones Industrials Are Great 2021 Stocks to Buy (24/7 Wall Street )

Trump signs COVID-19 relief bill with $600 stimulus checks (New York Post )

AstraZeneca’s Pascal Soriot says researchers believe shot will be effective against new variant of the virus (FoxBusiness )

Wonder Woman 1984 hauls in $16.7M with highest box office opening during COVID (New York Post )

IBM Stock Flatlined in 2020, Even With a New CEO and Spinoff Plans (Barron’s )

AstraZeneca jumps 6% after CEO says its COVID-19 vaccine will reach efficacy of 95% (Business Insider )

Goldman couldn’t be more bullish about the power of the new $900 billion stimulus bill (Yahoo! Finance )

These Are the 12 Most Overvalued Stocks in America Right Now (Barron’s )

Coke Is One of Barron’s Top Stock Picks for the New Year. Here’s Why. (Barron’s )

Which States Saw The Biggest Population Inflows And Outflows In 2020 (ZeroHedge )

Investors Double Down on Stocks, Pushing Margin Debt to Record (Wall Street Journal )

UK Could Approve AstraZeneca (AZN) COVID-19 Vaccine as Early as Tuesday (Street Insider )

The Richest Town in Every State (24/7 Wall Street )

Wells Fargo’s top predictions for 2021 include a warning for Tesla investors (CNBC )

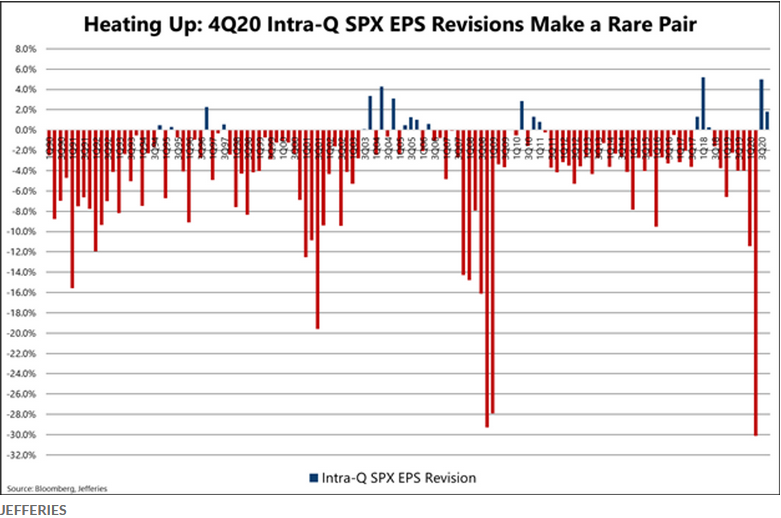

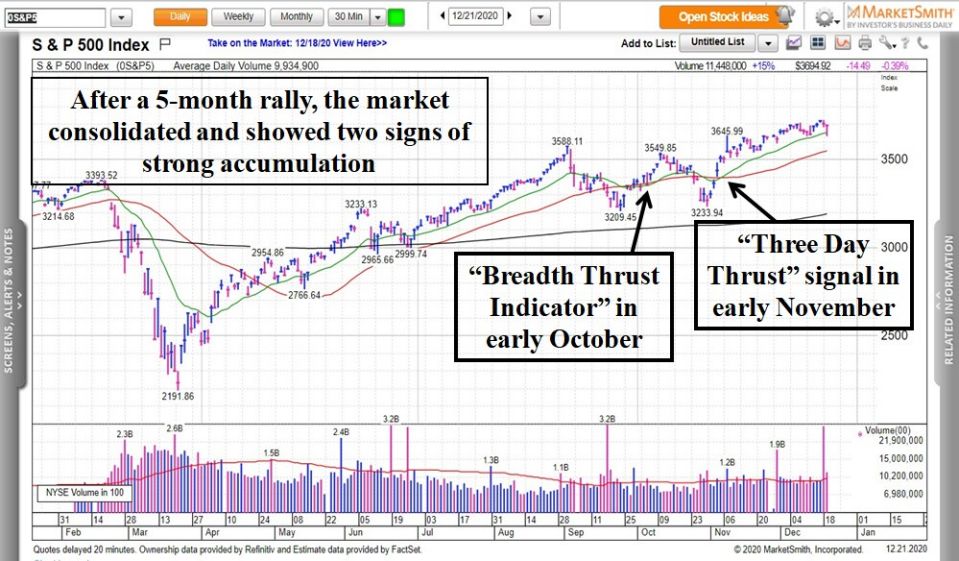

2021 markets preview: 2 rare events are a sign of what’s to come (Yahoo! Finance )

US holiday retail sales rise 3.0% – Mastercard report (Fox Business )

Warren Buffett swapped stock for cocoa in the 1950s. Here’s the story of the billionaire investor’s chocolate arbitrage (Business Insider )

Don’t Blame the Fed for Today’s Low Rates, Says Minneapolis Fed Chief (Barron’s )

Amgen’s Competition Heated Up in 2020. What’s Ahead for the Stock. (Barron’s )

UPDATE 2-China financial regulators urges Ant Group to set ‘rectification’ plan swiftly (Reuters )

Stimulus Bill’s Fate Remains in Limbo. The Stock Market Isn’t Reacting So Far. (Barron’s )

What could rattle markets in 2021, even as vaccines are rolling out (MarketWatch )

Berkshire Hathaway Is One of Barron’s Top Stock Picks for the New Year (Barron’s )

The U.S. real estate markets that are poised for a post-pandemic boom in 2021 (MarketWatch )

Another rush of IPOs on tap for 2021 after a year of impressive pandemic offerings (MarketWatch )

Companies Reset Plans Following Post-Brexit Deal (Wall Street Journal )

Screen Stars Turn to Podcasts (Wall Street Journal )

Why the U.S. Economy Will Take Off in 2021 (Wall Street Journal )

Investors Rethink Role of Bonds, Tech and ESG After Chaotic Year (Bloomberg )

In Bullet Points: The Key Terms of the Brexit Deal (Bloomberg )

McLaren’s Newest Supercar Is a 1-of-15, 824 HP Monster That’s Only Available in the US (Robb Report )

Santa Claus Rally Started Today! First Leg of January Indicator Trifecta (Almanac Trader )

Explained: Why RNA vaccines for Covid-19 raced to the front of the pack (MIT )

Why the Century-Old Family Business Behind Dum-Dums Lollipops Is Thriving in 2020 (Inc. )

Try These 6 Travel and Leisure Stocks to Play a Vaccine-Driven Rebound in Demand (Barrons )

5 Airline Stocks That Could Cruise Even Higher (Barron’s )

Do Headlines Move Markets? Researchers Say Yes, but Stocks Aren’t Buying the Story. (Barron’s )

Chevron Weathered This Year Better Than Most. Its Future Depends on These Factors. (Barron’s )

Stock-market pros are having a tough time imagining an S&P 500 slump in 2021 (MarketWatch )

U.S. Housing Market Faces a Land Shortage (Wall Street Journal )

What to watch on Christmas: 10 movies and TV shows to stream in 2020 (New York Post )

Britain and E.U. Reach Landmark Deal on Brexit (New York Times )

Pelosi Sets New Vote as GOP Foils Move on Trump’s $2,000 Checks (Bloomberg )

Warren Buffett recommended these 4 books to learn about investing (CNBC )

Pound Rallies as Brexit Deal Nears (Barron’s )

2 charts show China’s shortfall in buying U.S. goods under the ‘phase one’ trade deal (CNBC )

The Sheryl Crow, “Merry Christmas Baby” Stock Market (and Sentiment Results)… (Hedge Fund Tips )

Beijing Sends Alibaba an Unwelcome Christmas Present (Wall Street Journal )

New Yorkers have spoken — this is NYC’s best outdoor dining spot (New York Post )

The Year in Tech, Explained in Charts and Numbers (Bloomberg )

Live virtual tours let travelers see the world from home this Christmas (CNBC )

Warren Buffett ‘walked in like Santa Claus’ to a friend’s dinner party, carrying huge teddy bears for her children (Business Insider )

Warren Buffett bought Microsoft stock after meeting Bill Gates and made a $37 billion acquisition thanks to a chance encounter. Here are his 10 best quotes from an interview in a new book. (Business Insider )

Warren Buffett trolled Bill Gates by telling him to spend $370 million on an engagement ring (Business Insider )

There’s good chance a ‘Santa Claus rally’ will drive the stock market higher into year-end, LPL says (Business Insider )

‘Santa Claus’ rally starts today. Why few 7-session stretches are better for the stock market. (MarketWatch )

Trump Administration’s Shift in Tone Shakes Cryptocurrency Industry (Barron’s )

2-year/10-year Treasury yield curve hits steepest since 2017 (MarketWatch )

General Dynamics (GD) awarded $4.6 billion U.S. Army contract for latest configuration of Abrams Main Battle Tanks (Street Insider )

U.S. to ship around 4.7 million vaccine doses next week -U.S. Army General (Street Insider )

5 Highest-Yielding Dividend Aristocrat Stocks to Buy Now for 2021 (Business Insider )

How The Santa Claus Rally Could Predict January And 2021 Returns (Benzinga )

Three Reasons 2021 Could Be (a Lot) Better Than You Think (Wall Street Journal )

5G Auction Shatters Record as Bidding Tops $69 Billion (Wall Street Journal )

France Lifts U.K. Blockade as Leaders Reach Deal on Covid-19 Testing at Border (Barron’s )

U.S. approves NYSE listing plan to cut out Wall Street middlemen (Reuters )

Monday reversal signals ‘lot more gas’ left in U.S. stock market for 2020, says Lee (MarketWatch )

BioNTech CEO Optimistic Vaccine Can Work Against New Virus Strain (Barron’s )

This Fund Is Bullish on Emerging Markets for a ‘Laundry List’ of Reasons (Barron’s )

Investors Think Republicans Will Win Georgia’s Senate Seats. What That Means for Stocks. (Barron’s )

Pfizer to Supply U.S. With 100 Million More Vaccine Doses (Bloomberg )

New York Luxury Real Estate Could Be a Bargain in 2021 (Bloomberg )

Brian Sullivan: 5 predictions for 2021 (CNBC )

BC surveyed 75 big-money investors and found that these are the 3 biggest stock-market trends to watch in 2021 (Business Insider )

Warren Buffett’s favorite business is a little chocolate maker with an 8000% return. Here are 5 reasons why he loves See’s Candies. (Business Insider )

Jobless claims fall to 3-week low of 803,000 (MarketWatch )

It’s Beginning. The Energy Report 12/23/2020 (Phil Flynn )

Private equity dealmaking defies pandemic to hit post-crisis high (Financial Times )

Billionaire Gabelli eyeing investments in sports betting, infrastructure (Fox Business )

Durable Goods Orders Surge Back Into The Green For The Year (ZeroHedge )

Hiring Frenzy for Pharmacists as Covid-19 Vaccines Roll Out (Wall Street Journal )

Publishers Feel Validated by States’ Google Antitrust Lawsuit (Wall Street Journal )

Airlines to Bring Back Thousands of Workers After Passage of Covid-19 Aid Bill (Wall Street Journal )

Goldman Unit Makes New Push Into Real Estate With Stake in Sale-Leaseback Firm (Wall Street Journal )

Dividends and Buybacks Look Poised for a 2021 Rebound (Barron’s )

BioNTech believes its vaccine with Pfizer works on new strain (CNBC )

BioNTech says it can produce new vaccine for Covid variant in 6 weeks (Financial Times )

Travel stocks recover from hit after countries ban flights from UK (Yahoo! Finance U.K. )

Meet the Preliminary Dogs of the Dow for 2021 (24/7 Wall Street )

Financial stocks a ‘safe’ recovery play: Expert (Fox Business )

U.S. Congress passes nearly $900 billion COVID-19 aid bill, awaits Trump approval (Reuters )

Apple shares rise on report of 2024 car rollout plan (Reuters )

Banks Need Spenders to Be Stimulated (Wall Street Journal )

Wells Fargo set to be freed from AML consent order (American Banker )

Banks Can Buy Back Stocks Again. Wall Street Is Cheering. (Barron’s )

Bank Stocks Are Going to Be Higher Next Year, Expert Says (Barron’s )

Better Returns With Less Risk? Goldman Has a Basket of Stocks for That. (Barron’s )

COVID-19 stimulus bill will let businesses seek second PPP loan (New York Post )

Sex-crazed ‘roaring ‘20s’ awaits post-pandemic: Yale prof (New York Post )

U.S. Economy Gets a Bridge to the Spring (Wall Street Journal )

Brussels urges EU states to reopen their borders with the UK (Financial Times )

Sneak Peek At Guy Fieri’s ‘Restaurant Hustle’ Documentary (Benzinga )

Alaska Air boosts Boeing 737 orders and options to 120, to ‘largely’ replace Airbus fleet (MarketWatch )

Goldman Sachs, once reserved for the rich, is close to offering wealth management for the masses (CNBC )

Larry Culp Locks Up $47 Million Payday by Winning Over GE’s Doubters (Bloomberg )

Beer, Restaurants and Nascar Win Tax Breaks in Virus-Relief Bill (Bloomberg )

Billionaire Reubens Bet Big on Manhattan’s Battered Real Estate (Bloomberg )

Billionaire investor Sam Zell questions Tesla and Bitcoin, predicts workers will return to offices, and warns the US dollar could be replaced as the world’s reserve currency in a new interview. (Business Insider )

Diamondback Buys West Texas Shale Driller QEP Resources (Wall Street Journal )

What’s in the $900 billion U.S. COVID-19 aid package? (Reuters )

Bank Stocks Are Going To Be Higher Next Year, Expert Says (Barron’s )

Lockheed Buys Aerojet Rocketdyne (Barron’s )

Experts expect vaccines to protect against the UK’s fast-spreading Covid strain (CNBC )

Are COVID-19 vaccines effective against new coronavirus strain? Here’s what we know (cnbctv18 )

Why You Shouldn’t Freak Out About the New Strain of Coronavirus (healthline )

What is the new Covid strain – and will vaccines work against it? (The Guardian )

Mutant Meltdown. The Energy Report 12/21/2020 (Phil Flynn )

A new COVID-19 strain is sending stocks plunging, but here’s why investors shouldn’t panic, says this analyst (MarketWatch )

Philip Morris’ Next CEO Says Investors Are Underestimating the Company’s Smoke-Free Future (Barron’s )

How a weaker dollar could help fuel a commodities boom in 2021 (MarketWatch )

The Fed Says Banks Can Buy Back Stock Again. (Barron’s )

The Antitrust Case Against Big Tech, Shaped by Tech Industry Exiles (New York Times )

Congress Reaches Final Agreement on Pandemic Relief (Wall Street Journal )

Alacazoom! Magic Acts Disappear from Theaters, Reappear Online (Wall Street Journal )

Affluent Families Ditch Public Schools (Bloomberg )

Regeneron (REGN) Reports Publication of Initial Clinical Data from Ongoing Ph. 1/2/3 Trial of Antibody Cocktail Casirivimab & Imdevimab in Non-Hospitalized Patients with COVID-19 (Street Insider )

Walgreens Boots Alliance (WBA) Initiates Administration of Pfizer’s (PFE) COVID-19 Vaccine in Long-Term Care Facilities (Street Insider )

Diamondback Energy to Buy QEP and Guidon for Combined $3 Billion (Yahoo! Finance )

China rethinks the Jack Ma model (Financial Times )

Real Santa Claus Rally (Almanac Trader )

What’s Wrong with Wind and Solar? (Manhattan Institute )

The Year in Deals Can Be Summed Up in 4 Letters (New York Times )

California Reports Record COVID Cases And Deaths… Despite Strictest Lockdown (ZeroHedge )

Boom conditions for US homebuilders defy the pandemic (Financial Times )

Congress poised to vote on COVID aid package after Fed compromise (Reuters )

ECRI Weekly Leading Index Update (advisorperspectives )

Billion-Dollar Dynasties: These Are The Richest Families In America (Forbes )

Senate Leaders Clear Last Hurdle on Covid-19 Package (Wall Street Journal )

‘Coming 2 America’: First Look At Eddie Murphy’s Sequel to Comedy Classic (Maxim )

Guy Fieri’s Epic ‘Trash Can Nachos’ Are Now Available For Delivery Across U.S. (Maxim )

This Classic Aston Martin Drophead Coupe Could Be Yours (Maxim )

Epidemologist explains why COVID-19 mutations shouldn’t scare you (thenextweb )

Tiger Woods Proudly Looks on as Son Charlie, 11, Drains Impressive Shot at PNC Championship: ‘Atta Boy’ (People )

Without Frank’s RedHot There’d Be No Buffalo Wings (howstuffworks )

41 Festive Facts About Christmas Vacation (Mental Floss )

The 10 Best Movies to Watch on Netflix This Holiday Season (Mental Floss )

Everything You Need to Know About Indian Creek Island, Miami’s Most Exclusive Enclave (townandcountry )