Skip to content

Moderna’s Covid-19 Vaccine Works, Early Data Show (Barron’s )

Could the Fed act early? Yes, says this strategist who maps out the central bank’s possible next move (MarketWatch )

‘Keep the faith, trust the recovery’ — Morgan Stanley raises its S&P 500 target but says it won’t be a smooth ride (MarketWatch )

China economy picked up steam in October (MarketWatch )

Dustin Johnson Wins the Masters (Wall Street Journal )

Bond Investors Win Big Betting on U.S. Consumer (Wall Street Journal )

Big Gains From Small Stocks Power Russell 2000 Surge (Wall Street Journal )

Moderna COVID-19 vaccine nearly 95 percent effective in trial, firm says (New York Post )

Costco selling $17,500 subscription to Wheels Up private jet service (USA Today )

Norwegian Cruise Line (NCLH) Said Launch of Oceania Cruises 2022 Europe & North America Voyages Resulted in Record-Setting Day (StreetInsider )

Jamie Dimon should be top choice for Joe Biden’s Treasury secretary (New York Post )

Week before Thanksgiving DJIA Up 19 of 27, But… (Almanac Trader )

Tech groups’ services could face bans if they breach rules, EU industry chief says (Reuters )

10 Best Dividend Stocks To Buy According To Billionaire Ken Fisher (Insider Monkey )

The scientific link between Pfizer’s and Moderna’s COVID vaccines (Fortune )

Ferrari’s New 1,000 HP SF90 Spider Is Its Most Powerful Production Car Yet (Robb Report )

Cars Take Over MoMA and the Detroit Institute of Arts to Explore the 20th Century’s Most Iconic Machines (Robb Report )

Behind the Scenes of the New Brad Pitt–Narrated Frank Lloyd Wright Documentary (architecturaldigest )

America’s Driving Habits as of September 2020 (advisorperspectives )

ECRI Weekly Leading Index Update (advisorperspectives )

Watch BMW’s Electrified Wingsuit Hit 186 MPH on Soaring First Flight (maxim )

2020 Chevrolet Corvette Z51 Track Review: Awesome, But What’s Next Might Be Stunning (thedrive )

Watch This F-22 Raptor Fly Insane Maneuvers in Spectacular 4K (popularmechanics )

INCOME & WEALTH IN AMERICA: Who Owns Equities? (yardeni )

Last Week’s Notable Insider Buys: Kraft, IBM, Vertex And More (Benzinga )

A long winter for value investing could be ending. (Barron’s )

Intel Can Shine Again (Barron’s )

Moore’s Law Is Ending. Here’s What That Means for Investors and the Economy. (Barron’s )

Yellen Under Consideration by Biden Team for Treasury Chief (Bloomberg )

The Transcript 11.09.20 (quotes from this week’s earnings calls) (theweeklytranscript )

Vaccine Bursts Bubble of Concern Over Dot-Com Level Valuations (Bloomberg )

Value Investor Insight (OakMark )

Pfizer Vaccine Brings Vision of Relief Even as Pandemic Rages On (Bloomberg )

Learning From Cornelius Vanderbilt (IMC )

Brothers Build $22 Billion Fortune on Hope for Covid-19 Vaccine (Bloomberg )

How Allbirds Became Silicon Valley’s Favorite Sneaker (Wall Streeet Journal )

Warren Buffett and Charlie Munger on Investing in Tobacco Stocks (dividendgrowthinvestor )

Hedge funds hit after abrupt market pivot on vaccine (Financial Times )

Horses for Courses (Verdad )

Traditional Investments Can Weather Inflation (Morningstar )

Stock market investors start to look beyond coronavirus (Financial Times )

Learning Through Play (Farnam Street )

Value Stocks May Have Done a Lot Better Than You Think (Wall Street Journal )

Why Berkshire Hathaway Continues to Own Struggling Businesses (gurufocus )

Warren Buffett likely bought back $2.4 billion of Berkshire Hathaway stock in October, boosting repurchases to a record $18 billion this year (Business Insider )

Characteristics of High-Quality Compounders (vintagevalueinvesting )

Paul Tudor Jones: The Mental Obstacles of Investing (NovelInvestor )

These are the 14 value stocks that top-performing investment newsletters like the most (MarketWatch )

Here are 20 stocks that may benefit as investors rotate money into cyclical sectors (MarketWatch )

Want to become a better investor? Here are 5 lessons from Warren Buffett. (USA Today )

Why Value Stocks’ Gains Might Be Real This Time (Barron’s )

Stocks in these 11 industries are set to rocket higher once a COVID-19 vaccine is approved, UBS says (Business Insider )

Disney’s Stream Is Floating an Awfully Big Ship (Wall Street Journal )

Apple doc ‘Becoming You’ shows what happens when parents don’t coddle kids (New York Post )

Why healthcare stocks are the best value sector to buy right now, according to a Goldman Sachs stock chief (Business insider )

Markets Are Already Pricing a Successful Moderna Vaccine Shot (Bloomberg )

DoorDash makes U.S. IPO filing public, reveals rapid revenue growth (Reuters )

Palantir boosts its full-year revenue outlook (Fox Business )

Betting Odds, Picks For 2020 Masters Tournament: DeChambeau, Johnson And Tiger (Benzinga )

We’ll Be Home For Christmas. The Energy Report 11/13/2020 (Phil Flynn )

15 Stocks That Held Up Amid This Week’s Wild Swings (Barron’s )

Quant Shock That ‘Never Could Happen’ Hits Wall Street Models (Bloomberg )

‘Help is coming — and it’s coming soon’: Dr. Fauci outlines when COVID-19 vaccine will be available to all Americans (MarketWatch )

It’s Time to Get ‘Aggressive’ on Bank Stocks. Here’s Why. (Barron’s )

Pfizer’s Vaccine Is a Pick-Me-Up for Value Stocks (Wall Street Journal )

Scanwell Aims to Offer Instant At-Home Covid Antibody Test (Wall Street Journal )

Oil Forecasters’ Gloom Eclipsed by Vaccine Hope (Wall Street Journal )

Overall Consumer Prices Were Unchanged in October (Barron’s )

Companies with more women in management have outperformed their more male-led peers, according to Goldman Sachs (Business Insider )

6 Bank Stocks That Could Be Winners in 2021 (Barron’s )

The Louis Armstrong, “What a Wonderful World” Stock Market (and Sentiment Results)… (ZeroHedge )

AC/DC’s Wild Ride on the ‘Highway to Hell’ (Wall Street Journal )

Alibaba Sets ‘Singles Day’ Sales Record (Wall Street Journal )

Hollywood gets back to work as film permits rise 24 percent (New York Post )

U.S. Initial Jobless Claims Decline by the Most in Five Weeks (Bloomberg )

Moderna Poised to Take Vaccine Spotlight With Data Due (Bloomberg )

Oil CEOs believe a demand recovery is coming, but volatility is here to stay (CNBC )

‘Help is coming — and it’s coming soon’: Dr. Fauci outlines when COVID-19 vaccination will be available to all Americans (MarketWatch )

Energy Assault. The Energy Report 11/12/2020 (Phil Flynn )

Google releases predictions of popular holiday gifts (USA Today )

The stock market’s fear gauge is approaching a key technical level that could signal further upside for equities, Fundstrat’s Tom Lee says (Business Insider )

Nissan Is an Unlikely Pandemic Winner (Wall Street Journal )

Landowners in America: These people own the most land in the U.S. (USA Today )

Bridgewater’s Dalio Sees Governments Banning Bitcoin Should It Become ‘Material’ (Yahoo! Finance )

Rob Arnott Sees Value Recovery Taking Root After Worst Meltdown Since 1931 (Institutional Investor )

Consumer Sentiment Edges Higher – BofA Securities (Street Insider )

American Airlines restarts China flights, bringing U.S. weekly total to 10 (Fox Business )

Buy Raytheon, Spirit Because of Pfizer’s Vaccine News, Analyst Says. Here’s How Far Those Stocks Can Run. (Barron’s )

Wells Fargo says banks are the best economy comeback trade, tells clients to get ‘aggressive’ (CNBC )

Goldman Sachs has just boosted its S&P 500 target. Here’s why (MarketWatch )

Why Vince Vaughn Tried to Avoid Sequels Until Wedding Crashers 2 (MovieWeb )

12 Beaten-Up Stocks That Won’t Blow You Up (Barron’s )

What’s in Store for Stocks, Stimulus, Trade, and Other Issues During a Biden Presidency (Barron’s )

The Small-Cap Rally is Just Getting Started (Barron’s )

FDA Authorizes Eli Lilly’s Covid Antibody Drug (Barron’s )

Oil Prices Continue Their Rally. And Market Watchers Think There’s Room to Run. (Barron’s )

The Stock Market Gained 10% Over Just 6 Days. Here’s What History Says Happens Next. (Barron’s )

Pfizer’s News Ignited the Markets. How to Invest for a Post-Vaccine World. (Barron’s )

Oil Prices Continue Their Rally. And Market Watchers Think There’s Room to Run. (Barron’s )

Bank Stocks Still Have Room to Run Even With Challenges, Analyst Says (Barron’s )

Lyft’s Revenues Top Estimates. It Still Expects a Profit in ‘21. (Barron’s )

The Future Is Now for Industrials, as Renewable Power, Connectivity and Automation Converge (Barron’s )

Alibaba Shatters Singles Day Sales Record At $56B — With Another 24 Hours To Go (Benzinga )

Rocket Companies Revenue Up 163% In Record Q3 (Benzinga )

Ackman places new bet against corporate credit (Financial Times )

“It’s The Roaring ’20s Again”: Goldman Now Expects The S&P To Hit 4,600 In 2022 (ZeroHedge )

U.S. Job Openings Are Rising Closer to Prepandemic Levels (Wall Street Journal )

Lael Brainard’s Steady Rise Could Culminate in Treasury Secretary Post (New York Times )

Why a Trump Loss May Be No Match for Rupert Murdoch’s Realpolitik (New York Times )

The Covid-Winter Backyard: Fire Pits, Pizza Ovens and Patio Heaters (Wall Street Journal )

Cyclical Stocks Power Dow Industrials Higher (Wall Street Journal )

China Targets Alibaba, Other Homegrown Tech Giants With Antimonopoly Rules (Wall Street Journal )

Theater Chains Are Loving This Summer Preview (Wall Street Journal )

Parler, MeWe, Gab gain momentum (USA Today )

The Global Rich Are Rushing to Buy U.K. Country Estates (Bloomberg )

CEO sells stock worth $5.6 mln on same day as Pfizer’s COVID-19 vaccine update (Reuters )

Billionaire investor Ray Dalio believes Ant’s IPO suspension was reasonable — and says not investing in China is ‘very risky’ (Business Insider )

‘The greatest hole-in-one in history’ just happened at the Masters, and it has to be seen to be believed (MarketWatch )

US banks in line for windfall after Covid-19 vaccine progress (Financial Times )

Berkshire Appears to Have Sold $4 Billion of Apple Stock in Third Quarter (Barron’s )

Pfizer’s Vaccine News Sends Stock Market’s Biggest 2020 Losers Soaring (Barron’s )

Eli Lilly Covid Antibody Drug Gets Emergency FDA Clearance (Bloomberg )

EU hits Amazon with antitrust charges for distorting competition in online retail markets (CNBC )

Homebuilder DR Horton posts 81% sales spike (Fox Business )

Vaccine Has Wall Street Ready to Suit Back Up (Wall Street Journal )

Bank Stocks Break Out on Upbeat Covid-19 Vaccine Data (Barron’s )

CureVac’s stock is up 8% as it shares additional Phase 1 data about its COVID-19 vaccine candidate (MarketWatch )

Ulta Beauty shop-in-shops coming to 100 Target stores in 2021 (MarketWatch )

While the Pandemic Wrecked Some Businesses, Others Did Fine. Even Great. (New York Times )

Pfizer, Eli Lilly Breakthroughs Provide Hope for Ending Pandemic (Bloomberg )

Stanley Druckenmiller says he wouldn’t want to be short market, sees stock rotation continuing (CNBC )

12 Stocks Are Still Cheap After Huge Vaccine And Election Rally (Investor’s Business Daily )

Boeing (BA) Surges on Vaccine News and Likely 737 MAX Ungrounding (streetinsider )

Pfizer COVID-19 vaccine could be given by the end of the year, says Fauci (MarketWatch )

Why Vaccine News Is Such Good News for GE Stock (Barron’s )

Want to travel at 600 mph in a tube? It could happen (USA Today )

Here are the 2 big signals that stocks need to keep moving higher, says Credit Suisse’s top equity strategist (MarketWatch )

Small caps break to record high for first time since 2018 (CNBC )

Pfizer’s Covid Vaccine Prevents 90% of Infections in Study (Bloomberg )

Pfizer, BioNtech say Covid-19 vaccine is 90% effective (CNBC )

A 30-Year Look At Value Vs Growth (ETF.com )

Homebody in a Hoodie: Hedge Fund Founder Builds Quant Paradise (Bloomberg )

Berkshire Hathaway Is Increasingly Betting on Itself. That Should Cheer Shareholders. (Barron’s )

A ‘growth bomb’ is brewing in the US with consumers sitting on $2.5 trillion in savings — and it’s poised to give the economy a huge boost, one Wall Street chief strategist says (Business Insider )

Warren Buffett’s Berkshire Hathaway swings back into action, spending a net $4.8 billion on stocks and a record $9 billion on buybacks in the 3rd quarter (Business Insider )

Biden and transition team ready to move on cabinet picks (Financial Times )

Rebounding Corporate Profits Fortify Stock Market Rally (Wall Street Journal )

The Cure for Oil. The Energy Report 11/09/2020 (Phil Flynn )

Kamala Harris Makes History: What The First Female Vice President-Elect Means For Women (Forbes )

America’s Richest Self-Made Women (Forbes )

Ray Dalio on the Decline of Real Interest Rates (Podcast) (Bloomberg )

Here’s What A Biden Presidency Means for You. (Barron’s )

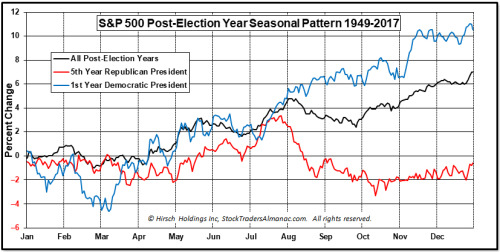

S&P 500 Post-Election Year Seasonal Pattern (Almanac Trader )

Winners and Losers During Trump’s Presidency (Bespoke )

ECRI Weekly Leading Index Update (Advisor Perspectives )

Behind the Wheel of The Completely Insane $2.4 Million Pagani Huayra Roadster (Maxim )

klein vision releases video of the maiden flight of its transforming AirCar (designboom )

Ferrari F40 vs. McLaren P1 Drag Race Shows What a Difference 25 Years Can Make (thedrive )

20 Things Most People Learn Too Late In Life (medium )

Michael Mauboussin On Valuing Intangible Assets (Podcast) (Bloomberg )

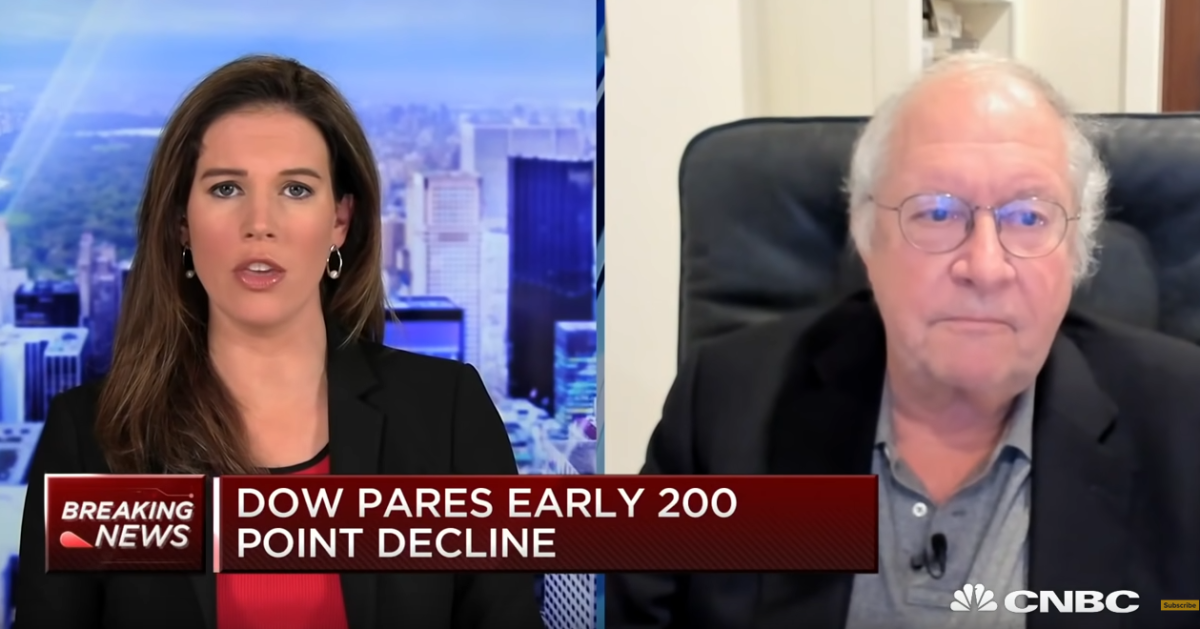

Bill Miller: There’s a lot to buy out there: Legendary investor Bill Miller (CNBC )

Why the election result is the ‘best of both worlds’ for stocks, according to JPMorgan’s quant guru (Business Insider )

Can Warren Buffett Forecast the Stock Market? (Morningstar )

If you had to own one company for a generation.. (dividendgrowthinvestor )

DuPont Is Materially Undervalued (Morningstar )

Common Probability Errors to Avoid (Farnam Street )

Traveling Back in Time: Historical Resources (investoramnesia )

GAMCO CEO Mario Gabelli on how he’s assessing the micro and macro landscape (CNBC )

Are Value Investors Just Missing Growth Stocks? (behavioralvalueinvestor )

Long Term + Value = Winning Potential (Miller Value )

Why Millennials Should Own Value Stocks (Oakmark )

Dot-Com Redux: Is This Tech “Bubble” Different? (CFA Institute )

Reminiscences of a Stock Operator by Edwin Lefèvre (novelinvestor )

Factored In? (humbledollar )

Berkshire Buybacks Hit Record $9 Billion in Third Quarter. Operating Earnings Miss Mark. (Barron’s )

No Stimulus? This Expansion Still Looks Self-Sustaining, Says One Economist (Barron’s )

Here’s a Timeshare Pitch That’s Worth a Listen: The Investment Case for Marriott Vacations (Barron’s )

Apollo Could Thrive With or Without CEO Leon Black. What’s at Stake for Investors. (Barron’s )

Opinion: How sharp investors use a CEO’s annual shareholder letter as a secret door to superior stocks (MarketWatch )

Opinion: This veteran stock investor is sticking to his strategy no matter who wins the 2020 presidential election (MarketWatch )

Matthew McConaughey and the Art of Livin’ (Vanity Fair )

The president for the next four years gets a surprisingly strong jobs market (CNBC )

The Last 4 Days Show Nice Momentum (quantifiableedges )

Intel’s Success Came With Making Its Own Chips. Until Now. (Wall Street Journal )

Dish Network Stems Pay-TV Defections (Wall Street Journal )