Skip to content

Lichtenstein Nude Leads Christie’s $421 Million Live-Stream Auction (Bloomberg )

Wall Street Forges a New Relationship to Data in Coronavirus Age (Bloomberg )

What to expect as banks report earnings: more loan pain but plenty of fee income (MarketWatch )

Hedge Fund Tips Podcast/VideoCast: Cyclicals, The Election and Buffett (ZeroHedge )

Gilead Says New Analysis Suggests Remdesivir Reduces Covid-19 Deaths (Barron’s )

37 Stocks to Buy for the Second Half of 2020, According to Barron’s Roundtable Experts (Barron’s )

How Barron’s Roundtable Panelists’ 2020 Stock Picks Have Performed So Far This Year (Barron’s )

The Tanger Outlets CEO Thinks Online Shopping Is Overrated. Now He’s Betting on It. (Wall Street Journal )

How to Visit the National Parks Safely in the Summer of Covid-19 (Wall Street Journal )

German Biotech Sees Its Coronavirus Vaccine Ready for Approval by December (Wall Street Journal )

Jair Bolsonaro: The rightwing leader may emerge politically stronger from the pandemic (Financial Times )

Disney World to Reopen as Coronavirus Cases Surge in Florida (Bloomberg )

Goodbye, extra $600: Unemployment benefits won’t exceed former wages in next stimulus bill, Treasury’s Mnuchin says (MarketWatch )

Here’s what Trump’s back-to-work bonus could look like (Fox Business )

Hedge Funds Would Get to Keep Lots of Trades Secret in SEC Plan (Bloomberg )

The latest Corvette is great, but wait until you see what comes next (CNN Business )

Warren Buffett bets big with $10 billion Dominion Energy deal—What it means (CNBC )

Emerging Markets Rally as Economies Reopen in the Second Quarter (Advisor Perspectives )

A contrarian take on recovery prospects (Andreessen Horowitz )

Bill Miller: The Economy, What The Pandemic Has & Has Not Changed (YouTube )

Wells Fargo upgraded to Outperform from Neutral at Baird. (TheFly )Gilead says remdesivir coronavirus treatment reduces risk of death (CNBC )

Maryland man may be first person successfully vaccinated against COVID-19 (New York Post )

Trump says he’ll wear a mask on trip to Walter Reed medical center (New York Post )

Lumber Prices Rise Sharply Despite Covid-19 (Barron’s )

2 Bank Stocks Worth a Look Heading Into Earnings (Barron’s )

Wells Fargo Stock Has Potential, Because ‘a Broken Bank Can Be Fixed’ (Barron’s )

Mnuchin wants ‘another round’ of stimulus checks passed this month (New York Post )

68% Have Antibodies in This Clinic. Can Neighborhood Beat a Next Wave? (New York Times )

Wear a Mask — That’s How We Stop Covid-19 Together (Barron’s )

Walgreens to Cut 4,000 Jobs in U.K. Boots Stores (Wall Street Journal )

Oil Went Below $0. Some Think It Will Rebound to $150 One Day. (Wall Street Journal )

German Biotech Sees Covid-19 Vaccine Ready for Approval by December (Wall Street Journal )

Cruise Ships Still Have Their Fans, Even After Coronavirus (Wall Street Journal )

GM reveals price, features of 2021 Corvette Stingray, including two new colors (USA Today )

These ‘epicenter’ stocks could surge higher, says analyst who called March bottom (Yahoo! Finance )

Natural Gas Is Rebounding. 3 Stocks to Play the Move. (Barron’s )

Fed balance sheet below $7 trillion, repo drops to zero for first time since September (Street Insider )

Wells Fargo preparing to cut thousands of jobs: Bloomberg Law (Street Insider )

Mortgage bailout sees biggest one-week decline, but more borrowers are extending terms (CNBC )

Wells Fargo Has Potential, Because ‘a Broken Bank Can Be Fixed’ (Barron’s )

Gilead Is Testing an Inhaled Version of Its Covid-19 Drug (Barron’s )

Warren Buffett Gives Another $2.9 Billion to Charity (New York Times )

U.S. Initial Jobless Claims Fell Last Week by More Than Forecast (Bloomberg )

The coronavirus has given investors a ‘once-in-a-lifetime opportunity,’ says hedge-fund billionaire (MarketWatch )

Former Fox News Anchor Shepard Smith Joins CNBC to Host Evening Newscast (Wall Street Journal )

Costco (COST) June U.S. Comps Increase 11% (StreetInsider )

Walmart Forays Into Health Insurance In A Bid To Expand Health Care Offerings (Benzinga )

Fed withdraws from repo market after 10 months (Financial Times )

The AC/DC “Back in Black” Stock Market (and Sentiment Results)…(ZeroHedge )

Walgreens stock rises on plans to open 700 primary care practices (MarketWatch )

Banks Could Get $24 Billion in Fees From PPP Loans (Wall Street Journal )

Can Biotechs Make it to the Finish in the Covid-19 Vaccine Race? (Barron’s )

Disney Stock Is Undervalued by Nearly 30%, Analyst Says (Barron’s )

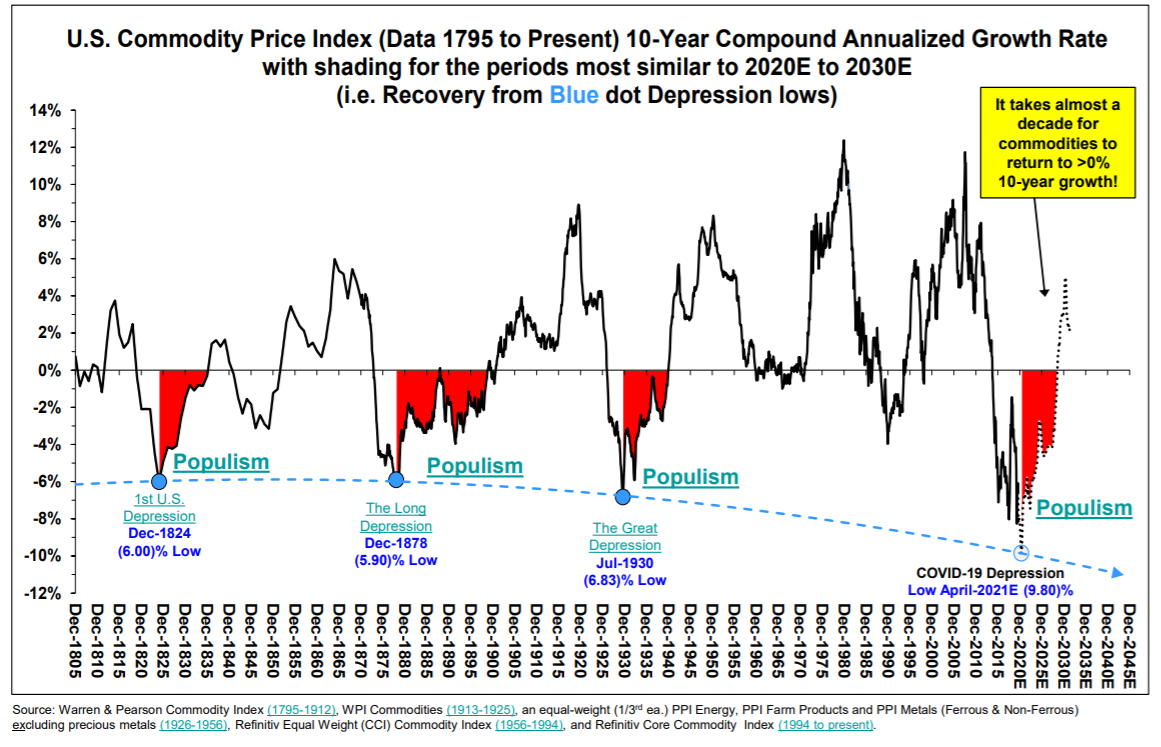

This fascinating chart shows the link between commodity prices and populism (MarketWatch )

Here’s how much money banks earned for distributing PPP funds (New York Post )

Walmart launching a subscription service for less than $100 a year (USA Today )

Chubb’s Pandemic Estimate Could Buffer Insurers (Wall Street Journal )

Homebuyer mortgage demand spikes 33% as rates set another record low (CNBC )

What Wall Street Pros Will Look for This Earnings Season (Bloomberg )

Taylor Morrison shares soar premarket after home builder says June was its best ever sales month (MarketWatch )

Morgan Stanley Sees Multiple COVID-19 Vaccine Makers with Pivotal Data Before Year End, Supporting ‘V’ Shaped Recovery (StreetInsider )

Biogen (BIIB) Completes Submission of BLA to FDA for Aducanumab as Treatment for Alzheimer’s Disease (StreetInsider )

Big economies face surging debt, have time to put house in order, Barclays says (Reuters )

Herd Immunity May Be Closer Than You Think (Wall Street Journal )

10 stock picks from Jefferies for investors who want to be ‘trendy’ as the economy recovers (MarketWatch )

Dividend Stocks With Solid Payout Prospects (Barrons )

Here’s one ‘remarkable’ difference between COVID-19 and the 1918 Spanish flu (MarketWatch )

Novavax shares soar 38% premarket on news of $1.6 billion in funding for COVID-19 vaccine candidate (MarketWatch )

Regeneron’s stock gains on $450 million manufacturing deal with U.S. for experimental COVID-19 treatment (MarketWatch )

Gilead Will Make a Profit on Remdesivir This Year, Says Analyst (Barron’s )

Behind Oil’s Rise Is a Historic Drop in U.S. Crude Output (Wall Street Journal )

Elon Musk’s red satin Tesla ‘short shorts’ sell out in minutes (New York Post )

The Next Energy Battle: Renewables vs. Natural Gas (New York Times )

Economists call for more direct cash payments tied to the health of the economy (Reuters )

Disney+ Sees Massive Surge In Downloads During ‘Hamilton’ Weekend (Benzinga )

Revisiting Coronavirus Vaccine Timelines: Moderna Denies Delay, Pfizer Advances Project Lightspeed And More (Benzinga )

Peter Thiel’s Palantir Confidentially Files To Go Public (Benzinga )

Warren Buffett’s Bet Is a Midstream Buying Signal (Wall Street Journal )

Samsung says its second quarter profits likely rose 23% (CNBC )

Warren Buffett’s Berkshire buys Dominion Energy natural gas assets in $10 billion deal (CNBC )

Coronavirus Researchers Compete to Enroll Subjects for Vaccine Tests (Wall Street Journal )

2021 Ford GT: 660-horsepower super car will come in new customizable colors (USA Today )

At Etsy, Come for the Face Masks, Stay for the Growth Potential (Wall Street Journal )

SPACs Are Booming. These 21 May Be About to Announce Deals. (Barron’s )

Need access to Wi-Fi? There are more options than ever (USA Today )

Regional hot dog styles you need to try (USA Today )

Shanghai soars nearly 6%, leading gains in Asia as ‘bull sentiment’ drives markets (CNBC )

Regeneron begins coronavirus antibody cocktail late-stage trial (CNBC )

Nio’s stock rockets toward a near 2-year high after upbeat report on June sales (MarketWatch )

Fed’s Next Policy Move Looks Tied to Long-Run View on Inflation (Bloomberg )

The Staying Inside Guide: Raise a Glass to Art History (Wall Street Journal )

JPMorgan Says Global Liquidity Surge to Boost Stocks and Bonds (Bloomberg )

Ford Revives Bronco Brand to Lure Off-Road Enthusiasts From Jeep (Bloomberg )

Becton Dickinson Wins FDA Approval of 15-Minute, Hand-Held Covid Test (Bloomberg )

President of Dominican Republic’s Largest Private Health Group Discusses the Success of Ivermectin as a Treatment for Early Stage COVID-19 (Trial Site News )

More studies on Ivermectin: (Trial Site News )

Current clinical trials on Ivermectin (clinicaltrials.gov )

The FDA-approved drug ivermectin inhibits the replication of SARS-CoV-2 in vitro (Science Direct )

Ivermectin Petition (Change.org ) More details/Video (Get Tested )

How Ford is making sure its F150 remains the most popular truck ever (The Next Web )

COVID-19 vaccine: ICMR urges institutes chosen for Bharat Biotech’s COVAXIN to complete recruitment for human trials by 7 July (Firstpost )

Inflation, Deflation (NPR Planet Money )

The secret economics of a VIP party (The Economist )

Kanye West tweets he’s ‘running for president of the United States’ (Fox News )

Which country will develop coronavirus vaccine first? (Fox Business )

20 Patriotic Movies and Series to Stream on July 4th Weekend (PC Mag )

Indulging in Singapore’s Big Deal, The Marina Bay Sands (Just Luxe )

‘Hamilton’: Film Review (Hollywood Reporter )

Saudi Arabia Is Bullying OPEC Members Into Compliance (OilPrice )

Americans Are Snacking More. Utz Explains How the Company Is Catering to Those Appetites. (Barron’s )

Elon Musk To Bring Tesla Cybertruck On Cross-Country Drive (Benzinga )

Stanford doctor: Coronavirus fatality rate for people under 45 ‘almost 0%’ (Washington Examiner )

“Next week administration officials plan to promote a new study they say shows promising results on therapeutics, the officials said. They wouldn’t describe the study in any further detail because, they said, its disclosure would be ‘market-moving’” (NBC News )

Ivermectin: a systematic review from antiviral effects to COVID-19 complementary regimen (Nature )

Second Stimulus Checks Could Be Sent As Early As August (Forbes )

Value Investing: Even Deeper History (Two Centuries )

3 Scenarios for Playing the Coronavirus Economy in the Second Half (Barron’s )

Covid-19 Is a Stress Test for China’s Economy. Why It Keeps Passing. (Barron’s )

3 Regional Casino Stocks to Buy, Despite Covid-19 Concerns (Barron’s )

Multi-strategy hedge funds post double-digit gains (Financial Times )

Handicapping the market from here — what history tells us about the odds the comeback continues (CNBC )

FedEx standout quarter in ‘tough conditions’ boost stock to best gain since 1986 (MarketWatch )

The Dodge Durango Hellcat is a family SUV that can go 180 mph (CNN )

Hugh Jackman on Best Decisions, Daily Routines, The 85% Rule, Favorite Exercises, Mind Training, and Much More (#444) (Tim Ferriss )

JP Morgan Guide To The Markets Q3 2020 (JP Morgan )

Jeremy Siegel On The Markets (CNBC )

Don’t Miss the Rise of the “Value” Phoenix (Advisor Perspectives )

Baltic index posts 7th straight weekly gain on higher demand (Reuters )

Mean Reversion: Lessons from Liverpool’s 2020 Title Win (Research Affiliates )

Next Stimulus Bill May Include Stimulus Checks & Back To Work Bonuses (Forbes )

Millions are giving up the extra $600 per week in unemployment benefits to go back to work, data shows (Fortune )

This New Flying Car Could Finally Deliver on the Promise of ‘The Jetsons’ (Robb Report )

Master Butcher Pat LaFrieda’s Tips For Better Burgers (Maxim )

2021 Dodge Challenger SRT Super Stock: Drag Radials and 807 HP on Pump Gas (The Drive )

Growth’s Edge Over Value May Finally Be Nearing Its End (Barron’s )

Chinese PMI hits highest level in a decade in latest sign that the world’s 2nd largest economy is surging back (Business Insider )

Apache (APA) Explores Potential Bid for U.K.’s Premier Oil – Source (Street Insider )

Andy Puzder: Signs of a ‘V’-shaped recovery — a welcome bounce back in economy (Fox News )

Chinese shares hit 5-year high on growing optimism over economy (Financial Times )

Cramer’s week ahead: Big business is bouncing back, and bouncing back with a vengeance (CNBC )

Driving Older Cars: Light on Tech, Heavy on Fun (New York Times )

Texas Makes Face Masks Compulsory in Reversal by Governor (Bloomberg )

A Lazy Escape to Portugal Is What We All Could Use Right Now (Bloomberg )

Why Investors Should Fear a ‘Summertime Melt-Up’ (Barron’s )

U.S. Unemployment Rate Declined to 11.1% in June (Wall Street Journal )

Economy adds record-breaking 4.8M jobs in June as unemployment rate falls (Fox Business )

Trump says he supports ‘larger’ payments to Americans than Democrats in next coronavirus relief bill (CNBC )

Tesla’s Deliveries Were Incredible. The Stock Is Flying. (Barron’s )

Boeing Played Down Key Change to MAX Jet, Report Says. Why Investors Don’t Care. (Barron’s )

European Stocks Have Long Lagged Behind the U.S. That Might Change. (Barron’s )

House Passes Extension of Paycheck Protection Program (Wall Street Journal )

Coronavirus Vaccine Candidate From Pfizer, BioNTech Produces Positive Results in Early Study (Wall Street Journal )

FedEx Delivers Through the Crisis (Wall Street Journal )

Baltic index rises on firmer vessel rates (Reuters )

House approves $1.5T plan to fix crumbling infrastructure (Fox Business )

You’re Doing It Wrong: A Tail-Risk Hedger Calls Out His Industry (Institutional Investor )

Nio June Deliveries Jump 179%, Q2 Sales Exceed Guidance (Benzinga )

3 reasons why Bank of America says to be bullish on US stocks, including economic surprise index hitting record high (Business Insider )

BANK OF AMERICA: Wall Street bullishness gauge spikes most in 2 years, signaling a 11% gain for S&P 500 within a year (Business Insider )