Skip to content

JD.com’s Successful Ecommerce Sale Bodes Well for China (Barron’s )

How to Play Biotech’s Next Big Runup (Barron’s )

SPAC in the Middle of a Boom for New Stocks (Barron’s )

Fuel Prices Will Rebound in Different Stages (Barron’s )

Goldman Sachs Stock Is Poised to Shine Again (Barron’s )

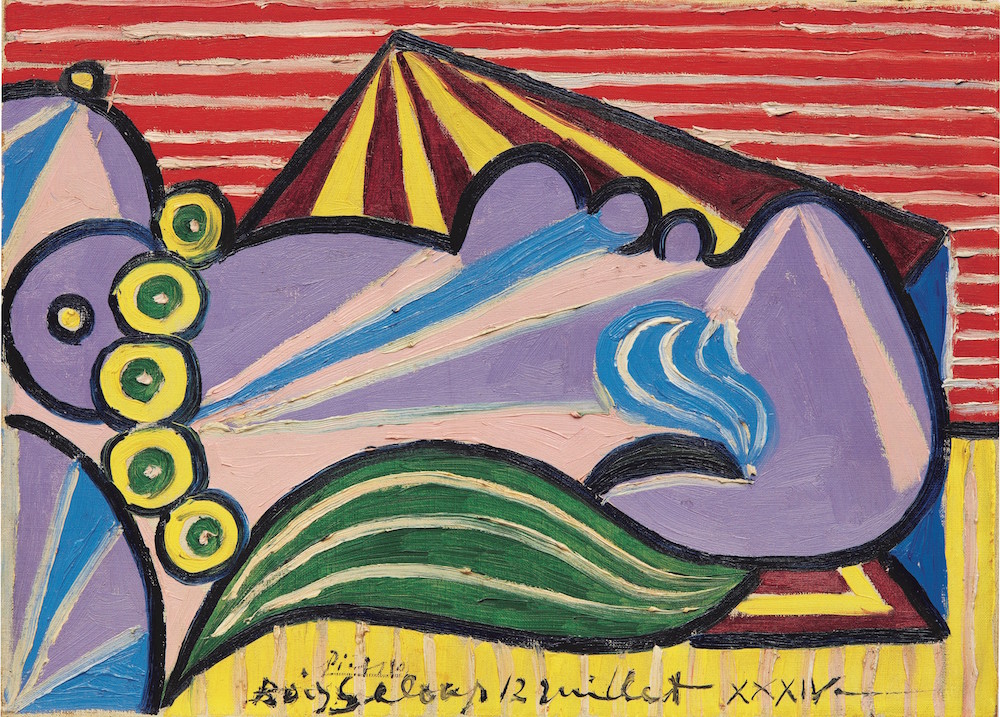

Picasso’s ‘Head of a Sleeping Woman’ Available for the First Time in Decades (Barron’s )

Oil Prices Rise Above $40 on Demand Hopes (Wall Street Journal )

May’s U.S. Jobs Rebound Was Widespread (Wall Street Journal )

Covid-19 and the case against caution (Financial Times )

John Paul DeJoria — From Homelessness to Building Paul Mitchell and Patrón Tequila (#441) (Tim Ferriss )

The Anatomy of a Rally – Oaktree Capital (Howard Marks )

Small Value Stocks: Peril and Opportunity (Morningstar )

Seth Klarman on Relative Value and Relative Performance (gurufocus )

Walter Schloss: His rules that beat the market (Monevator )

Ben Graham: The Other Advantage of Diversification (Novel Investor )

Small-Cap Valuations: Historic Opportunity or Overvalued? (WisdomTree )

Jeremy Siegel on the Stock Market and Covid-19 (Podcast) (Bloomberg )

SBA Opens Up New Grants And Loans For Small Businesses And Independent Contractors: The EIDL Program (Forbes )

This Is Not Your Grandma’s Fried Chicken—It’s Better (The Daily Beast )

These Michelada Ribs Are The Perfect Summer BBQ Recipe (Maxim )

China to Accelerate U.S. Farm Purchases After Hawaii Talks (Bloomberg )

What the Rush to Cash Means for the Stock Market (Barron’s )

Anthony Bourdain’s Trick for Great Steak Tartare Isn’t About the Meat (Bloomberg )

This fund manager whose biggest short was Wirecard says he is the most bullish toward stocks since 2009 (MarketWatch )

Oil prices climb, head for roughly 10% weekly gain on optimism over global demand (MarketWatch )

Biogen Can Bounce Back from Multiple-Sclerosis Blow (Wall Street Journal )

This Cheap Hedge Could Save Investors Some Grief (Bloomberg )

Rollerblading for Grown-Ups Is Back, and It’s Not Just Like Riding a Bike (Wall Street Journal )

How Exactly Do You Catch Covid-19? There Is a Growing Consensus (Wall Street Journal )

Waiting to buy that hot new 2020 mid-engine Corvette? Keep waiting. (USA Today )

Oil Prices Rise Amid Supply Cuts (Wall Street Journal )

Twitch’s Streaming Boom Is Jolting the Music Industry (Bloomberg )

Second-half economic recovery ‘has begun’: Kevin Hassett (Fox Business )

Mortgage rates drop to another record low — here’s why Americans may not want to wait too much longer before locking rates in (MarketWatch )

Investors Edge Back Into Emerging Markets (Wall Street Journal )

Beijing Virus Outbreak Contained, Top China Expert Say (Bloomberg )

We will dress up again (Financial Times )

TikTok’s U.S. Revenues Expected to Hit $500 Million This Year (The Information )

Initial Jobless Claims 1.5M vs 1.29M Expected (Street Insider )

BoE Buying by $125 Billion to Counter Virus Crisis (Bloomberg )

Wall Street giants including the CEOs of Goldman and Blackstone are pouring money into the campaign to defeat AOC in a June primary. (Business Insider )

China Pledges Faster Credit Growth as Economy Faces Virus Return (Bloomberg )

BP raises nearly $12 billion in first hybrid bonds issue (Reuters )

Initial jobless claims continue to trend lower (Yahoo! Finance )

Banks rush to borrow record €1.3tn at negative rates from ECB (Financial Times )

Boaz Weinstein Is Making Bank. He’s Not Happy That You Know About It. (Institutional Investor )

How Strict Are Airlines About Face Masks in Flight? (Wall Street Journal )

Opinion: Insiders in these 2 market sectors are spending the most money to buy more of their company’s stock (MarketWatch )

Banks’ trading bonanza just keeps going — markets units to see 20% revenue surge (fn london )

Debt investors let borrowers go back to the future (Financial Times )

Jim Cramer: A Zweig Wave Is One That’s Definitively Worth Surfing (TheStreet )

U.K. approves use of life-saving coronavirus drug dexamethasone in ‘biggest breakthrough yet’ (MarketWatch )

The Worst Is Over. Where to Find Promising Stocks. (Barron’s )

U.S. home construction rebounds 4.3% in May (CNBC )

‘The dollar is going to fall very, very sharply,’ warns prominent Yale economist (MarketWatch )

Moderna Is Racing Toward a Covid-19 Vaccine, but the Field Is Getting Crowded (Barron’s )

Keep an eye on these infrastructure stocks, with possible $1 trillion Trump plan on deck: Traders (CNBC )

Mortgage applications to buy a home surge to the highest in 11 years as rates hit a survey low (Business Insider )

A Maserati Straight Out of a Vintage-Car Lover’s Dreams (Wall Street Journal )

Investors Are Sitting on the Biggest Pile of Cash Ever (Wall Street Journal )

If Inflation Is Coming, the Market Isn’t Ready (Wall Street Journal )

Oil Demand Is Headed for Record Rebound in 2021 (Wall Street Journal )

Retail Sales Surge as Shoppers Emerge From Lockdown (Barron’s )

Steroid dexamethasone reduces deaths among patients with severe COVID-19: trial shows (Street Insider )

10-year Treasury yield climbs above 0.75% on recovery in U.S. retail sales and report of $1 trillion infrastructure spending plan (MarketWatch )

European stocks rally on central bank action and U.S. data (MarketWatch )

A portfolio of stocks being bought by mom-and-pop investors is trouncing Wall Street pros — here’s what they’re buying (MarketWatch )

Oil prices rally as IEA report points to record appetite for crude next year (MarketWatch )

‘The dollar is going to fall very, very sharply,’ warns prominent Yale economist (MarketWatch )

U.K. and EU Want a Quick Brexit. They Just Disagree on Everything Else. (Barron’s )

Bluebird and Crispr Show Promise for Sickle-Cell Cures (Barron’s )

10 REITs With Strong Rent Collection and Lower Debt (Barron’s )

Dividend Stocks Set to Benefit From the Search for Yield (Barron’s )

Retail Traders Are Beating Hedge Funds (Barron’s )

Fed Will Amass Corporate Bond Portfolio Using Index Approach Wall Street Journal )

Airlines Are Losing Money. They Will Still Buy a Lot of Planes (Wall Street Journal )

iRobot Cleans Up (Wall Street Journal )

Apple price target raised to $400 from $310 at Cit (TheFly )

BofA boosts Disney target to $146, sees ‘compelling’ entry point (TheFly )

Lennar Corp. (LEN) Tops Q2 EPS by 51c, Offers Guidance (Street Insider )

Major US airlines may ban passengers who don’t wear face masks (New York Post )

Hedge fund coach claims ‘Billions’ trolling her by dressing character in favorite outfit (New York Post )

Trump to Sign Executive Order on Policing (Wall Street Journal )

Fannie, Freddie Tap Wall Street Banks to Advise on Recapitalization (Wall Street Journal )

The coronavirus pandemic can’t stop Americans from buying pickups USA Today )

BofA Survey Finds 78% of Investors See Market as ‘Overvalued’ (Bloomberg )

Supply Chains of 2020 Needing Repair Now Are the Banks of 2008 (Bloomberg )

Oil Rises Above $40 on U.S. Stimulus and Tighter Supplies (Bloomberg )

Light, Fast, and Powerful, the Porsche 718 Also Runs Under $100,000 (Bloomberg )

Ford unveils 2021 Mustang Mach 1 as new global ‘pinnacle’ of pony car lineup CNBC )

10 tech stocks left behind by the market’s furious rally (MarketWatch )

Investors Approaching Retirement Face Painful Decisions (Wall Street Journal )

Bank of Japan pledges $1tn in coronavirus loans (Financial Times )

More Market Makers To Be Allowed Back On The NYSE Floor Wednesday (Benzinga )

Tesla Says Model S Long Range Plus Finally Received 402 Miles Rating From EPA, Confirms $5,000 Price Cut (Benzinga )

How Tiger Funds Navigated the Market Volatility (Institutional Investor )

Fed’s Powell set to reiterate long U.S. economic recovery, call for more fiscal support (Reuters )

How the Pandemic Has Changed What Home Buyers Want. (Barron’s )

Goldman Says Mom-and-Pop’s Stock Picks Are Trouncing Wall Street (Bloomberg )

Why Investors Shouldn’t Worry About Last Week’s Fall (Barron’s )

Lilly Is Testing Its Arthritis Drug as a Coronavirus Treatment (Barron’s )

Americans Are Driving Again. What That Means for Auto Stocks. (Barron’s )

Get Ready for the ‘Mother of All Bidding-War Seasons’ (Barron’s )

Hedge fund Elliott Management shifts to elephant hunting as fund size balloons (CNBC )

Warren Buffett says this is ‘by far the best book on investing ever written’ (CNBC )

A portfolio of stocks being bought by mom-and-pop investors is trouncing Wall Street pros — here’s what they’re buying (MarketWatch )

China’s factory output perks up but consumers stay cautious (Reuters )

Big money may soon be chasing the ‘Robinhood’ investor (Yahoo! Finance )

Retail investors top Wall Street pros as stock market recovers from coronavirus selloff (Fox Business )

Barron’s Picks And Pans: Chevron, Goldman Sachs, Progressive And More (Benzinga )

AstraZeneca Strikes Deal With Four EU Countries Over 400M Coronavirus Vaccine Doses (Benzinga )

Source image: Unsplash.com

ByteDance Explores Partnership With Singapore’s Lee Business Family For Digital Banking License: Report (Benzinga )

Morgan Stanley Economists Double Down on V-Shape Global Recovery (Bloomberg )

Singapore to Ease Virus Curbs, Resume Most Activities Friday (Bloomberg )

China a Bright Spot for U.S. in Gloomy Global Trade Picture (Wall Street Journal )

Signs of a V-Shaped Early-Stage Economic Recovery Emerge (Wall Street Journal )

Kudlow Urges Replacing Unemployment-Benefit Boost With Return-to-Work ‘Bonus’ (Wall Street Journal )

‘Billions’ Recap, Season 5, Episode 7: Axe Capital on Drugs, a Scandal and a Firing (Wall Street Journal )

JPMorgan’s Kolanovic Drops Caution on Stocks, Says Buy the Dip (Bloomberg )

Second Wave Fears Won’t Crush Oil Demand (Futures Mag )

2 Energy Stocks to Buy in June 2020 (Insider Monkey )

ECRI Weekly Leading Index Update (Advisor Perspectives )

Here’s Proof That the 2021 Ford Bronco Has a Seven-Speed Manual and Crawler Gear (The Drive )

The Cost Of Contact Tracing (NPR )

A Guy Named Craig May Soon Have Control Over a Large Swath of Utah (New Yorker )

Two Investors Search The Globe For An Investment Edge (Podcast) (Bloomberg )

Joe Rogan Got Ripped Off by Spotify? (Marker )

Why the Worst Is Over for Mortgage-Backed Securities, Maybe (Chief Invesment Officer )

Fresh OPEC+ cuts point to crude and condensate supply deficits through 2021 (Oil & Gas Journal )

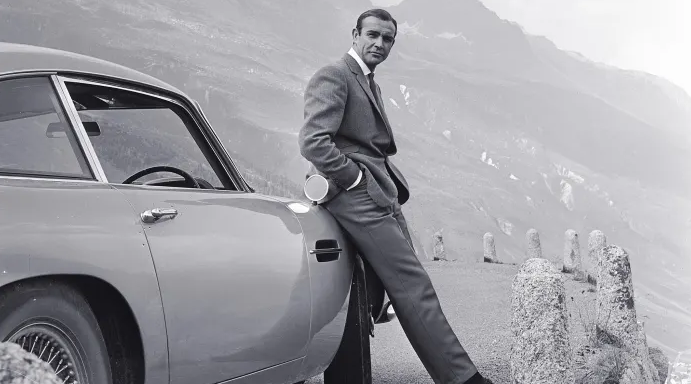

Bond Moves Up (Variety )

Lasry: Hertz Debt Is an Opportunity (Barron’s )

Hedge Fund Tips – Who Was Really the Dumb Money? (Zero Hedge )

The Fed Is Optimistic—If Congress Does More Now (Barron’s )

Get Ready for ‘Mother of All Bidding-War Seasons,’ Says Real Estate CEO (Barron’s )

Why Regional Theme Parks Could Be the Place to Be This Summer (Barron’s )

Here’s how the stock market tends to trade after brutal selloffs like Thursday’s (MarketWatch )

Bank of America Stock Stands to Gain on Stress Test and Earnings (Barron’s )

10,000 Steps a Day Is a Myth. The Number to Stay Healthy Is Far Lower. (Wall Street Journal )

Before Catching Coronavirus, Some People’s Immune Systems Are Already Primed to Fight It (Wall Street Journal )

American Express Gets Nod to Start Operating Card Network in China (Wall Street Journal )

Steven Mnuchin Says White House Considering Second Round of Stimulus Payments (Wall Street Journal )

Twitter Restores Zero Hedge Account After Admitting Error (Bloomberg )

‘Economists make fortune-tellers look good’: This investment manager thinks the US is on course for a V-shaped recovery as markets ‘have already priced in’ a 2nd wave of coronavirus (Business Insider )

Global stocks could soar 47% from current levels as recent sell-off rejuvenates the bull market, JPMorgan says (Business Insider )

US consumer sentiment jumps the most since 2016 on renewed hiring efforts (Business Insider )

Cliff Asness, AQR Founder and Libertarian Firebrand, Tells Staff That ‘Black Lives Matter’ (Institutional Investor )

Donald Trump’s New Secret Weapon: Boats (Vanity Fair )

5 Signs This Might Be a New Bull Market (A Wealth of Common Sense )

Jeremy Siegel declares end to the 40-year bull market in bonds (CNBC )

CNBC’s full interview with Ron Baron (CNBC )

5 Stocks to Rotate to Now as Stock Market Melt-Up Rally Hits a Massive Wall (24/7 Wall Street )

A Tesla Fan Talks Down Nikola’s Highflying Stock (Barron’s )

NASA Needs to Find Ice on the Moon. This Rover Will Lead the Search. (New York Times )

Bankrupt Hertz wants to sell up to $1 billion in stock (MarketWatch )

More turning to RVs, motor homes to escape COVID-19 — and get away from it all (USA Today )

Defense contractor L3Harris CEO: Tech will ‘drive the future’ of warfare (CNBC )

Palantir Technologies close to stock market debut (Fox Business )

Is now the right time to buy a holiday home abroad? (Financial Times )

Stolen Banksy artwork honoring Bataclan victims found in Italy (USA Today )

Why TikTok’s Addison Rae Is More Than Just a “Pouty Face” (Wall Street Journal )

Bank of America Stock Stands to Gain on Stress Test and Earnings (Barron’s )

Fed Officials Project No Rate Increases Through 2022 (Wall Street Journal )

Bank of America’s top equity strategist is looking for these signals to get more bullish on stocks (MarketWatch )

Davey the Day Trader Deconstructed (Wall Street Journal )

Exclusive: Pershing Square’s Ackman eyes $1 billion-plus ‘blank-check’ company – sources (Reuters )

Suburban housing is a seller’s market now: Real estate agent (Fox Business )

Regeneron (REGN) announced initiation of first clinical trial of REGN-COV2, dual antibody cocktail for prevention and treatment of COVID-19 (Street Insider )

This Exclusive Dataset Shows Why Investor Optimism Is Surging (Institutional Investor )

Moderna Will Start Testing Vaccine on 30,000 People in July (Barron’s )

Jay Powell delivers dovish message to financial markets (Financial Times )

Mnuchin Backs More Aid to Hard-Hit Small Businesses (Wall Street Journal )

$130 Billion in Small-Business Aid Still Hasn’t Been Used (New York Times )

Pessimistic Pros Missed the Big Rally, and So Did Many Americans (Bloomberg )

Johnson & Johnson To Start Coronavirus Vaccine Human Trials Ahead Of Schedule In July (Benzinga )

Here are the biggest stock-market bets among institutional and retail investors, ranked MarketWatch )