Skip to content

New coronavirus losing potency, top Italian doctor says (Reuters )

Why Protests Rarely Rattle Markets (Barron’s )

Coty shakes off Kylie Jenner problem, surges 20 percent after KKR buys stake (New York Post )

American Exporters Sell Soy to China Despite Rising Tensions (Bloomberg )

Pound Advances on Glimmer of Optimism Around Latest Brexit Talks (Bloomberg )

Investment banks are torn on which way the market is heading. Citi warns stocks are ‘way ahead of reality,’ but JPMorgan says they can climb higher. (Business Insider )

The pandemic leads to a running boom in America: Morning Brief (Yahoo! Finance )

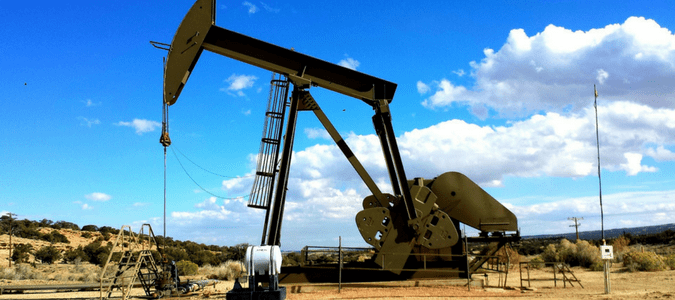

Oil prices rise ahead of OPEC+ meeting on output cuts (Reuters )

EasyJet to restart flights to 75% of route network by August (BBC )

Oil Prices Mixed As OPEC Tries To Get Ahead Of New Flash Point (Investor’s Business Daily )

Citi Option Trader Bets Nearly $1M On Long-Term Upside (Benzinga )

The Buy-Side Trader Is Getting Outsourced in Coronavirus Crisis (Bloomberg )

One in Four U.S. Covid-19 Deaths Are in Nursing Homes, Data Shows (Wall Street Journal )

The Lancet’s Politicized Science on Antimalarial Drugs (Wall Street Journal )

Buy Lilly, AbbVie and Merck, J.P. Morgan Says (Barron’s )

Las Vegas Casinos Reopen This Week. The Stocks May Reap Different Fortunes. (Barron’s )

Norwegian Cruise Stock Has Tumbled. The Company Has a New Top Investor. (Barron’s )

Here Are Six Dividend Stocks With Solid Payout Prospects—and a Built-In Exit Strategy (Barron’s )

Morgan Stanley Thinks a V-Shaped Recovery Is Possible (Barron’s )

Who Can Get a Loan Through the Paycheck Protection Program? (Barron’s )

Wall Street and Fed fly blind as coronavirus upends annual stress tests (Reuters )

Chinese manufacturing output surged the most in 9 years in May, signaling a coronavirus recovery. (Business Insider )

OPEC+ to Discuss Short Extension of Oil Output Cuts (Bloomberg )

Russians claim to have an effective treatment for the coronavirus, which hospitals will start using this month (CNBC )

Coronavirus May Be a Blood Vessel Disease, Which Explains Everything (Medium )

Tesla CEO Elon Musk Makes History With SpaceX (Barron’s )

Not All Cyclicals Are Created Equal. These 7 Are Resilient. (Barron’s )

Dollar Slides as Investors Regain Confidence in Global Economy (Wall Street Journal )

Tenants Largely Stay Current on Rent, for Now (New York Times )

Record Ratings and Record Chaos on Cable News (New York Times )

Wuhan’s Mass Testing May Have Eradicated the Coronavirus (Bloomberg )

The Unusual Ambitions of Chamath Palihapitiya (Institutional Investor )

Women-led hedge funds beat male rivals in coronavirus crisis (Financial Times )

Nio CEO Says Tesla An Ally In Increasing Sales, Remains Bullish On Chinese EV Market Growth (Benzinga )

Yale Epidemiologist: Hydroxychloroquine Should Be ‘Widely Available And Promoted Immediately’ As Standard Treatment (ZeroHedge )

Barron’s Picks And Pans: Cheniere Energy, Delta Air Lines, Extended Stay And More (Benzinga )

Goldman Sachs bets against the dollar as economies reopen (CNBC )

7 Cyclical Stocks That Can Ride Out the Coronavirus Slump (Barron’s )

Europeans Want to Travel Again. What That Means for Booking Stock. (Barron’s )

Remote Work Could Spark Housing Boom in Suburbs, Smaller Cities (Wall Street Journal )

SpaceX Speeding Astronauts to Space Station in Landmark Trip (Bloomberg )

An Encouraging EIA Report (Futures Mag )

Howard Marks: Get Used to Uncertainty (Institutional Investor )

Powell says Fed ‘strongly committed’ to helping US economy (Financial Times )

Under Pressure (The Reformed Broker )

Latest memo from Howard Marks: Uncertainty II (OakTree )

Lockdowns vs. the Vulnerable (Wall Street Journal )

When Safety Proves Dangerous (Farnam Street )

Top Value Managers Share Stock Ideas (Validea )

Typical June Trading: Early Gains Tend to Fade After Mid-Month (Almanac Trader )

Gordon Murray Says the Hotly Anticipated T.50 Will Be the Lightest Supercar Ever Made (Robb Report )

ECRI Weekly Leading Index Update (Advisor Perspectives )

2021 Dodge Challenger ACR Is Being Benchmarked Against the Viper: Report (The Drive )

The Beige Book And The Pig Farmer (NPR Planet Money )

“We are about to see the best economic data we’ve seen in the history of this country,” says a top former economic adviser to Obama. (POLITICO )

How sugar can temporarily sabotage your immune system (CNET )

Ryan Gosling’s ‘Wolfman’ Gears Up at Universal as Director Decision Nears (EXCLUSIVE) (Variety )

A Giant Pension Bought Citigroup and CVS Stock. Here’s What It’s Selling. (Barron’s )

Watch Musk, Leno Test Drive the Tesla Cybertruck (Popular Mechanics )

Netflix comedy ‘Space Force’ shows real military branch’s struggle to be taken seriously (NBC News )

How Fed Could Goose Economy via Yield-Curve Control (Bloomberg )

JPMorgan provides 5 charts that suggest the stock market still has ‘plenty of room’ to rise from current levels (Business Insider )

Ride the Travel Rebound With 7 Less Risky Stocks (Barron’s )

Saudis transfer $40bn to back wealth fund’s spending spree (Financial Times )

Disney World gets green light to reopen July 11 (CNBC )

‘Return-to-work’ bonuses of $450 a week, second stimulus checks: What’s being discussed in DC (CNBC )

Trump’s China Response Leaves Room to De-Escalate Tensions (Bloomberg )

The Really Big Stock Bull Case Says Fed Stimulus Doesn’t Go Away (Bloomberg )

Texas Is Showing the World How to Reopen Cautiously (Bloomberg )

Defense Stocks Lockheed, Northrop, L3Harris Just Below Buy Points In Coronavirus Market Rally (Investor’s Business Daily )

How to Assess U.S. Threat to Delist Chinese Stocks (Barron’s )

The Market’s Rally Could Linger for a Few Weeks. That Doesn’t Mean We’re in the Clear. (Barron’s )

Casinos and Theme Parks Are Reopening This Summer. It Could Be Good News for Airlines. (Barron’s )

3 Airline Stocks That Can Benefit From a Pickup in Domestic Travel (Barron’s )

Americans Are Getting Back on the Road. 3 Stocks to Buy. (Barron’s )

Why the Stock Market Shrugged Off Escalating U.S.-China Tension This Week (Barron’s )

U.S. oil futures up 88% in May, biggest monthly rise on record (MarketWatch )

Plan to Save World’s Crops Lives in Norwegian Bunker (Wall Street Journal )

William Lyon Built Homes in California and Survived Busts (Wall Street Journal )

The Best James Bond Book for Summer—Especially This Summer (Wall Street Journal )

Remote Work Could Spark Housing Boom in Suburbs, Smaller Cities (Wall Street Journal )

Why is the U.S. stock market ignoring a brewing crisis in Hong Kong? (MarketWatch )

Uneven Stock Recovery Divides Real-Estate Industry (Wall Street Journal )

Elon Musk: “We Want to Be a Leader in Apocalypse Technology” (Futurism )

Secretary Madeleine Albright — Optimism, the Future of the US, and 450-Pound Leg Presses (#437) (Tim Ferriss )

Here’s what the Fed will do next, according to a Goldman Sachs economist (MarketWatch )

BAE Systems Stock Should Be on Investors’ Radar. Here’s Why. (Barron’s )

The Market May Have Gotten Ahead of Itself. But Cyclicals Still Look Cheap. (Barron’s )

Sales Challenges Prove that Luxury Carmakers Aren’t Covid-Immune (Barron’s )

Tesla’s Elon Musk just scored this massive payday (Fox Business )

The Dirty Secret of Asset Management: It’s Doing…Okay? (Institutional Investor )

How investors learnt to love the rally in stocks (Financial Times )

Alan Jackson is the latest country star to play outdoor drive-in concerts (USA Today )

Scientists Question Study Linking Malaria Drugs to Covid Risks (Bloomberg )

Americans Have Stopped Thinking the Economy Is Getting Worse (Bloomberg )

Sweden’s Economy Grew Last Quarter, Adding to Covid-19 Debate (Bloomberg )

Mnuchin’s $29 Billion Loan Fund Untapped as Airlines Eye Rebound (Bloomberg )

Boeing Restarts 737 Max Production As Massive Job Cuts Detailed (Investor’s Business Daily )

The Dua Lipa “Did a full 180” Stock Market (and Sentiment Results)… (ZeroHedge )

Vacation rentals around the world have jumped 127% since early April in a sign that people are slowly starting to travel again (Business Insider )

Why Ackman Sold His Berkshire Hathaway Stake (Barron’s )

Regal Owner Cineworld to Reopen Cinemas in July. That’s Not The Only Reason The Stock Is Soaring. (Barron’s )

Battered Delta Stock Could Take Off. Here’s How to Play It. (Barron’s )

Papa John’s second record sales month sends stocks soaring (New York Post )

Apple Lands Martin Scorsese Movie Starring Leonardo DiCaprio and Robert DeNiro (Wall Street Journal )

Facebook’s Mark Zuckerberg on Twitter fact-checking Trump: Companies shouldn’t serve as ‘arbiter of truth’ (USA Today )

Roche Partners With Gilead in Covid Trial of Drug Combination (Bloomberg )

Jamie Dimon Captures the Stock Market Moment (Bloomberg )

With M&A Dead, Wall Street Bankers Keep Busy With Stock Sales (Bloomberg )

Jobless claims rise over 2 million again but data offer glimmer of hope (MarketWatch )

Bank of America CEO Brian Moynihan says U.S. economy starting to ‘come out of the hole’ (CNBC )

Dollar General (DG) Tops Q1 EPS by 86c, Same-Store Sales Increased 21.7% (Street Insider )

Toll Brothers (TOL) Tops Q2 EPS by 11c (Street Insider )

4 Dow Stocks to Buy Now That Have Lagged the Huge Rally (24/7 Wall Street )

Ex-White House adviser Gary Cohn: Congress must act to help US recovery (Fox Business )

Zuckerberg and Dorsey clash as Trump order looms (Financial Times )

Hedge Funds Said One Thing. Their Portfolios Show Another. (Institutional Investor )

33 Stocks That Will See Strong Earnings Growth This Quarter (Barron’s )

European stocks climb as investors eye bigger-than-expected EU stimulus plan (MarketWatch )

Burger King debuts giant crowns to encourage social distancing (New York Post )

Why Dollar Tree and Family Dollar Stock Are Buys Right Now (Barron’s )

Fed should lift caps to buy as much corporate bond ETFs as it wants, says BofA (MarketWatch )

13 Deeply Discounted Dividend Stocks to Play in a Recovery (Barron’s )

15 Cheap Stocks Growing Fast Enough to Avoid Value Trap (Barron’s )

Europe Is Subsidizing Millions of Paychecks. Companies Want to Keep It That Way, for Now. (Wall Street Journal )

Distressed Real Estate Market Beckons Opportunistic Buyers (New York Times )

KFC tests a new chicken sandwich (USA Today )

Mortgage demand from homebuyers shows strong and unexpectedly quick recovery (CNBC )

Jay Leno: What it’s like to drive the Tesla Cybertruck—from ‘instant acceleration’ to how the interior feels (CNBC )

A top Trump economic adviser says the White House is considering offering ‘back to work’ cash bonuses for unemployed Americans ) (Business Insider )

Cuomo to press Trump on reviving U.S. economy with roads, bridges in White House meeting (Reuters )

Ross to Bartiromo: Trump mulling ‘menu’ of action against China over Hong Kong (Fox Business )

Top-rated companies raise $1tn to fill ‘war chests’ (Financial Times )

Boeing and Airbus Study How Coronavirus Behaves During Air Travel Wall Street Journal )

This is the time for active managers to shine, Goldman notes. How — and what — are they doing? (MarketWatch )

Airline stocks soared as much as 16% Tuesday — here are Wall Street’s favorites (MarketWatch )

Gilead Sciences Stock Is Moving Back Into Favor (MarketWatch )

Wall Street’s 6 Favorite Defense Stocks for Memorial Day (Barron’s )

Small caps outperform after recessions, so ‘you have history on your side,’ money manager says (CNBC )

Global Stocks Rally on Recovery Hopes and Vaccine News (Barron’s )

Mike Tyson nears boxing return as another $20 million opportunity emerges (New Yoork Post )

Classic Car Auctions Upended by Coronavirus (New York Times )

Oil Gains on Optimism Market May Balance in Coming Weeks (Bloomberg )

Six Flags’ stock surges after plan to reopen first theme park on June 5 (MarketWatch )

What Hedge Funds Own – and What It Says About the Market (Barron’s )

Stanley Ho, ‘King of Gambling’ Who Built Macau, Dies at 98 (Bloomberg )

Square’s Co-Founder: A Recession Is a Great Time to Start a Company (Wall Street Journal )

James Bond’s Car Comes to Life With Oil-Slick Sprayer, but No Ejector Seat (New York Times )

NYSE’s Floor to Reopen With Masks, Waivers and Handshake Ban Wall Street Journal )

Cyclical Stocks Are Staging Comeback (Wall Street Journal )

The Secret to Searing a Bistro-Quality Steak (Wall Street Journal )

As Passengers Disappeared, Airlines Filled Planes With Cargo (New York Times )

Global Oil Demand Has Yet to Peak, Energy Watchdog Predicts (Bloomberg )

Germany’s Ifo Index rises above forecasts in May (MarketWatch )

Covid-19 Patients Not Infectious After 11 Days: Singapore Study (Bloomberg )

China warns audit plans will drive companies from US exchanges (Financial Times )

‘Never waste a crisis’: inside Saudi Arabia’s shopping spree (Financial Times )

Election-Year June: Candidate Clarity Boosts Performance (Almanac Trader )

Disneyland to feature ‘modified’ experience for guests upon reopening amid pandemic (OAN )

Triumph Celebrates James Bond With Special Edition Scrambler 1200 (Maxim )

Southeastern: The Exceptional Opportunity in Small-Cap Value (Advisor Perspectives )

Stocks Are Up But The Economy’s Down (NPR Planet Money )

The Coronavirus Vaccine Is on Track to Be the Fastest Ever Developed (The New Yorker )

Gut Microbes May Be Key to Solving Food Allergies (Scientific American )

The Billionaire, an African Mine and a Spy Network (Bloomberg )

The Sprint to Raise a $1.75 Billion Credit Fund During a ‘Maelstrom’ (InstitutionalInvestor )

The top 9 shows on Netflix and other streaming services this week (BusinessInsider )