Skip to content

Showtime’s ‘Billions’ Is Back With More Financial Schemes Than Ever (Wall Street Journal )

This CEO’s Formula For Building Success Is So Simple (Investor’s Business Daily )

Stocks Pause After Strong Rally (Barron’s )

Health Care Was Biggest Drag on GDP (Barron’s )

Cash-hungry firms are turning to convertible bonds (fnLondon )

Justin Amash Discloses Purchases of Disney Stock (Barron’s )

You’d Be Surprised Who Can Beat Buffett and Icahn (Barron’s )

China’s nonmanufacturing PMI hits 3-month high (MarketWatch )

Two Mortgage REITs Are Benefiting From Fed-Backed Market (Barron’s )

Elon Musk slams ‘fascist’ coronavirus lockdowns in Tesla earnings call (New York Post )

Kraft Heinz Sticks With Its Dividend. Earnings Were Strong. (Barron’s )

35 Stocks to Buy if the Economy Recovers in a V-Shape (Barron’s )

U.S. Explores Emergency-Use Approval for Gilead Drug After Study Found It Helped Recovery From Covid-19 (Wall Street Journal )

Fed’s Powell Says More Spending Will Be Needed From Congress (Wall Street Journal )

Steven Mnuchin Says U.S. Aims to Get Back Its Money From Fed Programs (Wall Street Journal )

The Bad News Won’t Stop, but Markets Keep Rising (New York Times )

Fed Suggests Tough Road Ahead as It Pledges to Help Insulate Economy (New York Times )

Gilead CEO Says Over 50,000 Remdesivir Courses Ready to Ship (Bloomberg )

Warren Buffett to Break Silence at Virtual Woodstock for Capitalists (Bloomberg )

Coronavirus pushed Twitter to a record 24% growth in daily users last quarter (Business Insider )

‘Trolls World Tour’ Breaks Digital Records and Charts a New Path for Hollywood (Wall Street Journal )

Simon Property to Reopen 49 Malls (Wall Street Journal )

Boeing’s stock surges after wider-than-expected loss and revenue miss, but free cash flow beat (MarketWatch )

‘Will You Help Save My Brother?’: The Scramble to Find Covid-19 Plasma Donors (New York Times )

China’s Factories Are Back. Its Consumers Aren’t. (New York Times )

Rhode Island Pushes Aggressive Testing, a Move That Could Ease Reopening (New York Times )

Icahn’s ‘Beautiful Trade’ Pays Off Early With Malls Forced Shut (Bloomberg )

Elon Musk Joins the Lockdown Rebels (Bloomberg )

Saudi Prince’s Year of Prestige Is Unraveling in Front of Him (Bloomberg )

Weekly mortgage applications to buy a home make a strong recovery (CNBC )

Pfizer coronavirus vaccine could be ready for emergency use by this fall (New York Post )

Starbucks expects to reopen 90 percent of its stores by June (New York Post )

Oil price jumps 15% after reports that a key measure of storage demand was 2 million barrels lower than expected. (Business Insider )

Arthritis drug may help fight severe coronavirus cases, study finds (New York Post )

Much of U.S. economy still plugging along despite coronavirus pain (Reuters )

Home-buying interest spikes to highest level in weeks, showing signs of recovery (Fox Business )

Stock futures jump after positive data on Gilead coronavirus treatment (CNBC )

U.S. Economy Shrinks at 4.8% Pace due to Coronavirus (GDP) (Bloomberg )

Gilead Remdesivir Trial for Covid-19 Has Met Primary Endpoint (Bloomberg )

IHOP parent Dine Brands shares jump after earnings beat (MarketWatch )

Pfizer Earnings, Sales Top; Dow Jones Drug Giant Rises (Investor’s Business Daily )

Chevron Stock Could Have a Record Month (Barron’s )

Investors to Get a Peek at Buffett’s Potential Successor (Barron’s )

The Fed Made It Easier for Municipalities to Borrow (Barron’s )

Caterpillar’s Earnings Missed Expectations. The Stock Is Rising Anyway. (Barron’s )

Best Movies You Can Stream at Home This Week (24/7 Wall Street )

Pfizer said sales of Eliquis, hospital products rose in Q1 on COVID-19 demand (MarketWatch )

No Junk Debt Is Too Risky: How Fed’s Action Changed Everything (Bloomberg )

Tesla asks employees to return to work before coronavirus lockdown ends (New York Post )

Warren Buffett to answer questions online at Berkshire Hathaway’s annual meeting Saturday (USA Today )

Texas Is Open, California’s Closed and States Go Their Own Way (Bloomberg )

Warren Buffett will soon tell us what he really thinks about stocks, investing and the coronavirus pandemic (MarketWatch )

3M’s Earnings Were Strong. Health Care, Masks Boosted Sales. (MarketWatch )

Fed has simple goal this week — project confidence in face of the unknown (MarketWatch )

PepsiCo adjusted earnings rise as consumers stock up, but company yanks outlook (CNBC )

Confused by the tax implications of the CARES Act? Here’s a breakdown. CNBC )

Allbirds debuts its first running shoe. To succeed, it must face rivals like Nike—and a pandemic (CNBC )

One group of small-cap stocks could outperform, Oppenheimer says (CNBC )

Raymond James Has 5 Stocks to Buy Now If We Have a Snapback V Recovery (24/7 Wall Street )

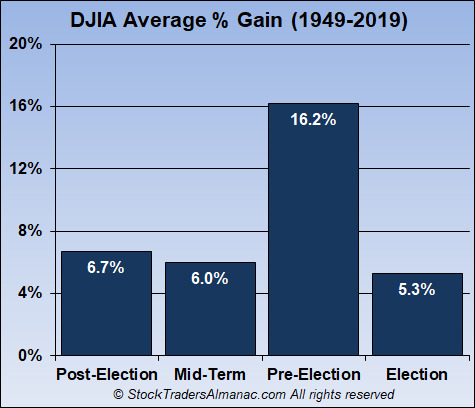

This is Still an Election Year (Almanac Trader )

The most important chart to support an economic re-opening (Yahoo! Finance )

Secret group of billionaires, scientists work to find modern A-bomb for virus (Fox Business )

The Value Investor Who Sold Lysol Stock — And Bought Oil (Institutional Investor )

How Kim’s sister could be next in line to rule North Korea (Financial Times )

Warren Buffett offers his 2 best pieces of advice for aspiring young investors (Yahoo! Finance )

Opinion: Investors have $5.1 trillion hiding out in the shares of five companies, which will be tested this week (MarketWatch )

Coronavirus Relief Often Pays Workers More Than Work (Wall Street Journal )

‘Trolls World Tour’ Breaks Digital Records and Charts a New Path for Hollywood (Wall Street Journal )

Consensus Is Emerging That Children Are Less Vulnerable to Coronavirus (Wall Street Journal )

Japan’s Coronavirus Cases Fall Sharply Without Compulsory Measures (Wall Street Journal )

Global Stocks Climb on Central Bank and Reopening Hopes (Barron’s )

British stocks join global rally as Johnson returns to work (MarketWatch )

U.S. Debates How Quickly It Can Reopen (Wall Street Journal )

DraftKings shares surge as company goes public despite sports shutdown (New York Post )

Coronavirus: Steven Mnuchin says economy will rebound over the summer (USA Today )

Cuomo Announces Phased Plan to Reopen New York; Deaths Drop (Bloomberg )

Private Equity Firms Fight for Lifeline Deals in Buffett-Goldman Redux (Bloomberg )

Goldman Says Narrow Breadth in S&P 500 a Bad Sign for Stocks (Bloomberg )

‘One of the most ridiculous deals that I’ve ever seen’: Carl Icahn blasted Occidental Petroleum’s $10 billion financing from Warren Buffett again (Business Insider )

Wall Street Quants Are Turning Their Skills to the Virus Fight (Bloomberg )

Berkshire Investors Will Get to Quiz Buffett, Abel at Annual Meeting Bloomberg )

Despite Market Carnage, Arena Sees Opportunity in Airlines, Oil, and Gas (Institutional Invvestor )

How Jamie Dimon went from getting fired to becoming a banking leader (Fox Business )

How Fed Intervention Saved Carnival (Wall Street Journal )

‘The Soul of an Entrepreneur’ Review: Doing It for Themselves (Wall Street Journal )

The Doctor Will Zoom You Now (Wall Street Journal )

Investors Eye Fed Emergency Lending Program That Brought Rich Returns in 2009 (Wall Street Journal )

Barron’s Picks And Pans: Albertsons, Carnival, Harley-Davidson And More (Yahoo! Finance )

Some States Ease Lockdowns (Wall Street Journal )

Pandemic Triggers a Wave of Distress (Wall Street Journal )

The Next Round of Bailouts Will Name Names (New York Times )

For charitable givers, CARES Act offers big tax breaks (InvestmertNews )

Big Biotechs Make a Big Statement (StockCharts )

Time to Consider Herd Immunity For New York City And The Rest Of The Country (Insider Monkey )

ECRI Weekly Leading Index Update: WLIg Inches Up (Advisor Perspectives )

John Cena Is Just Getting Started (Men’s Journal )

Jerry Seinfeld Spoofs James Bond in Netflix Trailer for ’23 Hours To Kill’ (Maxim )

Bugatti Divo Will Be Delivered This Year (TheDrive )

Chris Whalen on PPP Loans (Podcast) (Bloomberg )

Pennsylvania’s Comeback from Coronavirus Shutdowns Could Determine the Outcome of the 2020 Presidential Race (Manhattan Institute )

When Is It Safe To Ease Social Distancing? Here’s What One Model Says For Each State (NPR )

How The Fed Fights Coronavirus (NPR Planet Money )

Explore the Fascinating History of Soul Food (Mental Floss )

Why Exercise Is So Good For You (Scientific American )

How The Crisis Pushed The Fed Into New Territory (Podcast) (Bloomberg )

Trump: Apple CEO sees coronavirus V-shaped economic recovery (Fox Business )

Sweden keeping open during coronavirus protects its economy (Fox Business )

Apple and Google’s new contact tracing tool is almost ready. Just don’t call it a contact tracing tool. (recode )

Phased Opening for NYSE Floor Talked (Traders Magazine )

The New Koenigsegg Gemera: The World’s First, Four-Seater Mega-GT (JustLuxe )

This respected market-timing model just flashed a bullish four-year outlook for stocks (MarketWatch )

Kanye West Vaults From Broke to Billions With Yeezy in Demand ()

It’s the Physical Market That’s Broken, Not the Futures (Futures )

As States Reopen, Hold Your Breath (Investors Business Daily )

Stocks Could Gain 15% in the Next Year, Experts Say (Barron’s )

Yes, Stocks Have Rallied. Just Don’t Get Complacent. (Barron’s )

Covid Is Changing How We Eat. These Food Stocks Are Benefiting the Most. (Barron’s )

Is That Jerry Jones on a…Yacht? Riding the Seas of the NFL’s ‘Virtual’ Draft. (Wall Street Journal )

4 ‘Oily Industrial’ Stocks to Buy After Oil’s Collapse (Barron’s )

The Shock of Subzero Oil Will Shake the U.S. Energy Industry. 4 Stocks Worth a Look. (Barron’s )

The Oil Market Has Gotten Weird. Here’s How Investors Can Make Sense of It. (Barron’s )

Mnuchin Says Federal Government Might Take Stakes in Energy Companies (Barron’s )

Trump pulls punches and clings to his China trade deal as backlash against Beijing grows (CNBC )

Some Oil Producers Have Secret Weapon in Hedging (Wall Street Journal )

Gilead Poised to Upend Market With Its First Covid-19 Study Data (Bloomberg )

Mortgage bailout balloons by half a million more loans in one week (CNBC )

Saudis Begin Curbing Oil Output Ahead of OPEC+ Start Date (Bloomberg )

Famed ‘Big Short’ investor Steve Eisman explains why he’s betting big on major US banks (Business Insider )

“Without Them, I Don’t Know What We’d Do†(Vanity Fair )

Why stocks rebound before the economy (USA Today )

‘Capitalism as we know it will likely be changed forever’ and 9 other lasting implications of coronavirus, according to billionaire Leon Cooperman (MarketWatch )

In the Coronavirus Era, the Force Is Still With Jack Dorsey (Vanity Fair )

Why We Focus on Trivial Things: The Bikeshed Effect (Farnam Street )

Apple Aims to Sell Macs With Its Own Chips Starting in 2021 (Bloomberg )

Which Kind of Investor Could You Aspire to Be: Graham, Fisher, Lynch, Greenblatt, or Marks? (Focused Compounding )

Bill Miller 1Q 2020 Market Letter (Miller Value )

Facebook Announces Video Calls for Up to 50 People – Zoom Shares Tank (TheStreet )

Autocrats see opportunity in disaster (The Economist )

Will Coronavirus Wreck The Classic Car Market? (ZeroHedge )

Change in Electricity Consumption (The Reformed Broker )

U.S. Stock Futures Climb on More Coronavirus Aid (Barron’s )

Chesapeake Adopts Poison Pill After Shares Drop on Oil Rout (Yahoo! Finance )

How Tanker Companies Like Teekay Are Profiting From the Oil Glut (Barron’s )

This Famous Poker Player Can Help Investors Play a Tough Hand (Barron’s )

Mustang Cobra Jet destroys quarter mile at 170 mph, all electric (USA Today )

Don’t Try to Prepare for the Next Black Swan. You Can’t. (Wall Street Journal )

Chesapeake Adopts Poison Pill After Shares Drop on Oil Rout (Yahoo! Finance )

Oil world zeroes in on Cushing, Oklahoma (Financial Times )

Hedge Funds’ Favorite Stocks Were Hit Hardest in the Coronavirus Crash (Institutional Investor )

Oxford scientists reveal coronavirus vaccine timeline as human trial begins (MarketWatch )

The Kanye West, “Drive Slow†Stock Market (and Sentiment Results)… (ZeroHedge )

Target says same-store sales rose more than 7% so far in first quarter as digital sales double (CNBC )

Stocks Still Make Sense for The Long Term (Barron’s )

The Next Coronavirus Package Might Not Pass Until June (Barron’s )

Restaurant Chains Received Many of the Biggest Paycheck Protection Loans (Barron’s )

Texas Instruments Bets Big on Shelf Life (Wall Street Journal )

Private Equity to Get Squeezed Out of Another Stimulus Program (Bloomberg )

Kuwait Cutting Oil Output Ahead of Schedule, Minister Says (Bloomberg )

Germophobes Shunning Public Transit Give Carmakers a Bit of Hope (Bloomberg )

Harvard Professor Reaps 17,000% Return on Early Moderna Bet (Bloomberg )

Hot Pharma Stock Rallies After Strong Earnings (Investor’s Business Daily )

What to Watch: The Return of Michael Jordan, the End of ‘Homeland’ (Wall Street Journal )

565 Americans Have Lost Their Job For Every Confirmed COVID-19 Death In The US (ZeroHedge )

Las Vegas Sands predicts speedy recovery in Asia on pent-up gambling demand (StreetInsider )

RBC Capital Handicaps Gilead Sciences (GILD) Upcoming Remdesivir Data (StreetInsider )

5 Buy-Rated Oil Stocks Trading Under $10 With Massive Upside Potential (24/7 Wall Street )

Steve Forbes: How Trump can help our oil industry now and skip Pelosi’s stall tactics (Fox Business )

The Curious Case of Dmitry Balyasny (Institutional Investor )

The Chinese Trick That Could Save Oil (Yahoo! Finance )

Oil jumps 25%, extending Wednesday’s rally as traders bet on US production cuts (CNBC )

We’re Not Floating to Hell on an Oil Barrel (Bloomberg )

Driving Data Tells the Story of Sheltering in Place (Barron’s )

Record jump in Australian retail sales (MarketWatch )

Texas Instruments Beats Earnings Expectations, Uses Financial Crisis to Set Guidance (Barron’s )

Senate Passes Bill for More Small-Business Stimulus (Wall Street Journal )

Escape from New York City (Wall Street Journal )

Mortgage Firms Get a Reprieve on Paying Investors (New York Times )

McDonald’s to give free ‘Thank You Meals’ for first responders, health care workers starting Wednesday (USA Today )

Infect Everyone: How Herd Immunity Could Work for Poor Countries (Bloomberg )

Lotus Is Gearing Up to Make a Car You Can Drive Every Day (Bloomberg )

Larry Kudlow says oil should rebound as the economy starts to reopen (CNBC )

Trump to US Navy: ‘Destroy’ Iranian gunboats that ‘harass our ships’ (Fox Business )

AIMCo’s $3 Billion Volatility Trading Blunder (Institutional Investor )

Expedia nearing deal to sell stake to Silver Lake and Apollo: WSJ (Street Insider )

Kimberly-Clark shares rise after COVID-19 stockpiling drives earnings beat (MarketWatch )

How a Mailman Still Carries On During Coronavirus (Wall Street Journal )

Gucci’s Chinese Revenue up in April After Bruising First Quarter (Wall Street Journal )

Peter Thiel’s Palantir Saw Coronavirus Coming. Now It Braces for the Impact. (Wall Street Journal )

Oil price plunge below zero sends ‘oil tourists’ on wild ride (Reuters )

Risk Parity Is Supposed to Be All Weather. That’s Not Happening. (Institutional Investor )

No One: Absolutely No One: I Wonder What Phil Falcone Is Up To? (Institutional Investor )

Georgia and South Carolina Will Begin To Reopen (Barron’s )

Why Oil Turned Negative (Barron’s )

Schumer says he believes Senate will pass small business relief bill Tuesday (CNBC )

The Fed Is Buying $41 Billion of Assets Daily and It’s Not Alone (Bloomberg )

Ferrari rolls out coronavirus testing to get staff ready for work. (Business Insider )

Opinion: This is the one leading economic indicator stock investors should follow (MarketWatch )

Less Than Zero: What Oil’s Crazy Day Means (Wall Street Journal )