Skip to content

We’re Not Floating to Hell on an Oil Barrel (Bloomberg )

Driving Data Tells the Story of Sheltering in Place (Barron’s )

Record jump in Australian retail sales (MarketWatch )

Texas Instruments Beats Earnings Expectations, Uses Financial Crisis to Set Guidance (Barron’s )

Senate Passes Bill for More Small-Business Stimulus (Wall Street Journal )

Escape from New York City (Wall Street Journal )

Mortgage Firms Get a Reprieve on Paying Investors (New York Times )

McDonald’s to give free ‘Thank You Meals’ for first responders, health care workers starting Wednesday (USA Today )

Infect Everyone: How Herd Immunity Could Work for Poor Countries (Bloomberg )

Lotus Is Gearing Up to Make a Car You Can Drive Every Day (Bloomberg )

Larry Kudlow says oil should rebound as the economy starts to reopen (CNBC )

Trump to US Navy: ‘Destroy’ Iranian gunboats that ‘harass our ships’ (Fox Business )

AIMCo’s $3 Billion Volatility Trading Blunder (Institutional Investor )

Expedia nearing deal to sell stake to Silver Lake and Apollo: WSJ (Street Insider )

Kimberly-Clark shares rise after COVID-19 stockpiling drives earnings beat (MarketWatch )

How a Mailman Still Carries On During Coronavirus (Wall Street Journal )

Gucci’s Chinese Revenue up in April After Bruising First Quarter (Wall Street Journal )

Peter Thiel’s Palantir Saw Coronavirus Coming. Now It Braces for the Impact. (Wall Street Journal )

Oil price plunge below zero sends ‘oil tourists’ on wild ride (Reuters )

Risk Parity Is Supposed to Be All Weather. That’s Not Happening. (Institutional Investor )

No One: Absolutely No One: I Wonder What Phil Falcone Is Up To? (Institutional Investor )

Georgia and South Carolina Will Begin To Reopen (Barron’s )

Why Oil Turned Negative (Barron’s )

Schumer says he believes Senate will pass small business relief bill Tuesday (CNBC )

The Fed Is Buying $41 Billion of Assets Daily and It’s Not Alone (Bloomberg )

Ferrari rolls out coronavirus testing to get staff ready for work. (Business Insider )

Opinion: This is the one leading economic indicator stock investors should follow (MarketWatch )

Less Than Zero: What Oil’s Crazy Day Means (Wall Street Journal )

Online Gambling Is Booming Amid the Lockdown (Barron’s )

RBC Capital Upgrades Abbvie (ABBV) to Outperform, Added to Offensive Positioning List (Street Insider )

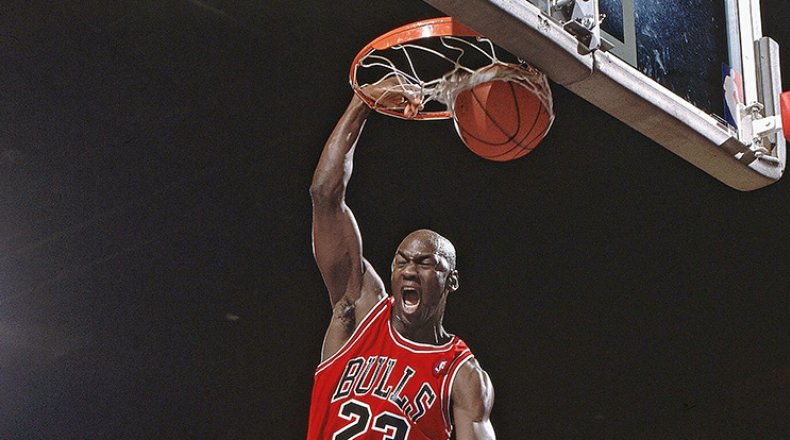

Twitter goes insane for ‘Last Dance’ premiere (USA Today )

A $1.2 Trillion Fund Says Skip Earnings Season, Buy U.S. Stocks (Bloomberg )

Mnuchin, Democrats Close on Virus Aid Deal Nearing $500 Billion (Bloomberg )

12 Stocks That Can Rocket Higher — but Aren’t For the Faint of Heart (Barron’s )

Marc Andreessen asks why we don’t build things anymore – here are some possible answers (CNBC )

Cuomo says New York will roll out antibody testing in ‘aggressive way’ this week (CNBC )

Trump to use Defense Production Act to increase swab production amid coronavirus testing shortage (CNBC )

Novartis, US drug regulator agree to malaria drug trial against Covid-19 (CNBC )

Traders are using giant supertankers to store 160 million barrels of oil as the coronavirus torpedoes demand (Business Insider )

‘Warren Buffett created the template’: Mark Cuban said US officials should copy the investor’s past bailout deals (Business Insider )

Here’s why the U.S. stock market rally has legs, strategist says (MarketWatch )

Muzzled Activists Are Mixed Blessing for Companies (Wall Street Journal )

Computers Were Going to Upend Home Buying. They Didn’t See the Coronavirus Coming. (Wall Street Journal )

Inside Italy’s trials to find effective antibody tests for Covid-19 (CNN )

Buy Stocks at Crisis ‘Epicenter’ as Lows Are In, Top Bull Says (Bloomberg )

Barron’s Picks And Pans: Dropbox, Ford, Johnson & Johnson, Teladoc And More Yahoo! Finance )

Annie Duke – Decision Making in a Crisis (Capital Allocators Podcast )

EXCLUSIVE: Michael Milken lobbying Amazon to distribute free coronavirus tests (Fox Business )

Inside $370B relief deal Mnuchin, Dems are very close to finalizing (Fox Business )

DuPont Earnings Beat Estimates. That Could Help the Stock. (Barron’s )

Governments Face Pressure to Ease Coronavirus Lockdowns (Wall Street Journal )

Oil Plunges by Record to Below $11 With Storage Rapidly Filling (Bloomberg )

Why Deflation Is Poison for Virus-Plagued Economies (Wall Street Journal )

Typical April Trading: Strength from Start to Finish (Almanac Trader )

ECRI Weekly Leading Index Update: WLIg At Lowest Levels (Advisor Perspectives )

Starting to Think About Opening Day (FuturesMag )

5 Stock Picks from the Hedge Fund Manager Who Saw The Pandemic Coming (Insider Monkey )

Doug Parker CEO Of American Airlines: US Treasury Has Been “Fair” Regarding Aid (ValueWalk )

NY Fed Pres John Williams on coronavirus “We saw signs of concern and we acted promptly and decisively” (ValueWalk )

Mark Cuban Calls for NBA Restart with No Fans, Says Owners Will Support (Breitbart )

China now has more leading COVID-19 vaccine candidates than any other country (Fortune )

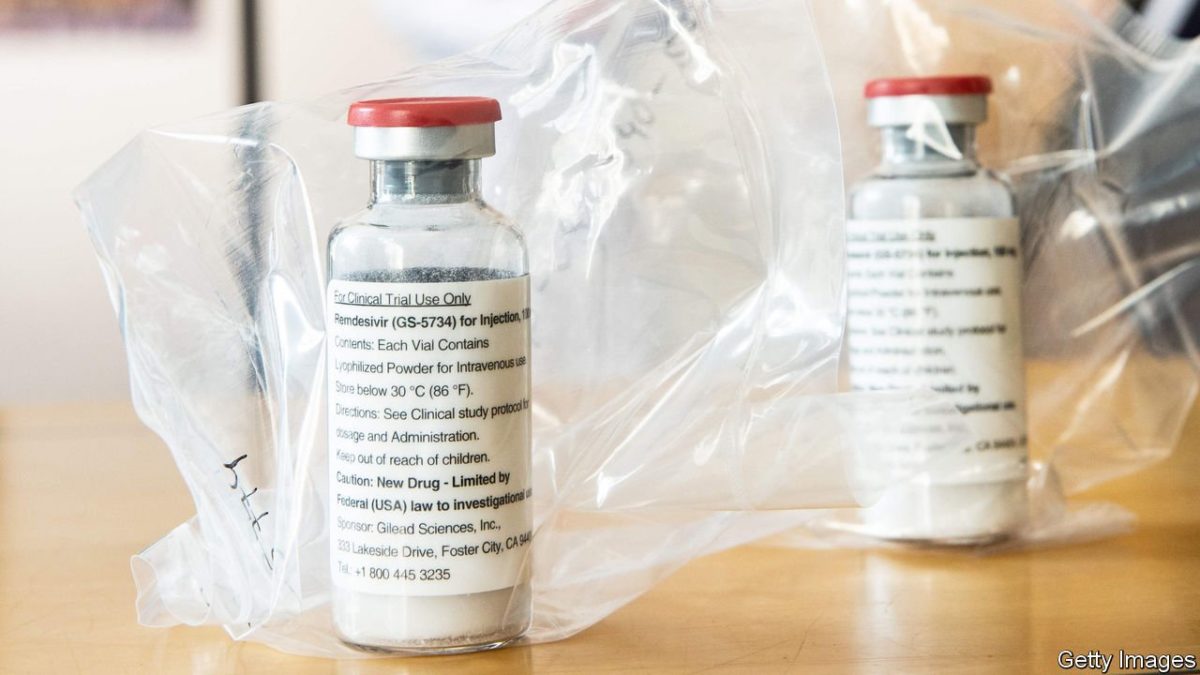

Is remdesivir the drug that can kill the coronavirus? (The Economist )

16 Fascinating Facts About the Iconic Ferrari F40 (Robb Report )

Real Estate Investors Are Set to Benefit from the Stimulus Bill (Architectural Digest )

Hedge Fund and Insider Trading News: John Griffin, Jim Simons, Seth Klarman, Daniel Kamensky, Engaged Capital, JPMorgan Chase & Co. (JPM), Columbia Sportswear Company (COLM), and More (Insider Monkey )

Severe truck driver shortage amid growing demand (OAN )

Here’s What It Really Costs To Own Or Charter A Private Jet (TheDrive )

Tom Hardy Goes Gangster In ‘Capone’ Trailer (Maxim )

The US won’t run out of food during the coronavirus pandemic (Vox )

Pennsylvania Is Place to Watch for Whether Post-Shutdown Recovery Works (Manhattan Institute )

Episode 992: The Mask Mover (NPR Planet Money )

Why Michael Jordan Was The Best (FiveThirtyEight )

Boeing to restart operations at Philadelphia area plants next week (Fox Business )

Chinese doctors using plasma therapy on coronavirus, WHO says ‘very valid’ approach (Reuters )

A Feast for The Senses in Marrakech (justluxe )

Drive-In Movie Theaters Thrive Despite Lack of New Titles: “People Just Want to Get Out” (Hollywood Reporter )

Here’s How America Needs to ‘Reopen’ to Avoid Deeper Woes (Barron’s )

Where Activist Investors Are Turning Their Focus to Now (Barron’s )

Seoul’s Full Cafes, Apple Store Lines Show Mass Testing Success (Bloomberg )

Bank Earnings Were Terrible. It’s Time to Buy the Banks. (Barron’s )

Energy Hedge Fund That Shorted Oil Sees Chance for $100 a Barrel (Bloomberg )

Charlie Munger: ‘The Phone Is Not Ringing Off the Hook’ (Wall Street Journal )

Opinion: Vitamin D and Coronavirus Disparities (Wall Street Journal )

Opening Up America Again (CDC/White House PDF Plan )

Here’s why sauerkraut and kimchi sales have surged during the coronavirus (New York Post )

Coronavirus Ushered in Medicine’s Digital Revolution (Barron’s )

Big Pharma Sees Its Strengths Surface ()

Reasons to Gobble Up Kraft Heinz’s Battered Shares (Barron’s )

3 Former United Technologies Stocks That Are Ready to Fly (Barron’s )

Union Pacific Sees Biggest Insider Stock Buy in Years (Barron’s )

Trump Announces $19 Billion Relief Program for Farmers (Wall Street Journal )

Here Are the Companies Getting Federal Funds for Covid Relief (Bloomberg )

‘MacGyvering’: A Modern ‘Can-Do’ Approach To Bad Situations (Wall Street Journal )

Wells Fargo, J.C. Penney, Amazon.com: Stocks That Defined the Week (Wall Street Journal )

Procter & Gamble Posts Biggest U.S. Sales Gain in Decades (Wall Street Journal )

Leaked Research: This Drug May Be Saving COVID Patients’ Lives (Futurism )

Coronavirus latest: Hong Kong shows no need for total lockdown, says study (Financial Times )

The Day of Reckoning for Private Equity (Institutional Investor )

Warren Buffett’s financial crisis bailouts inspired the US government’s ‘big 4’ airline rescue deals (Business Insider )

Pro golf plans to be the first major sport to return during the coronavirus pandemic (CNBC )

Macy’s reportedly looking to use real estate to come up with cash during coronavirus pandemic (CNBC )

Fed Says It Will Disclose Borrower Information in Crisis Lending (Bloomberg )

These Are the Drugs and Vaccines That Might End the Coronavirus Pandemic (Bloomberg )

Google seeks to launch a debit card with banks (USA Today )

Standing on the Shoulders of Giants: The Key to Innovation (Farnam Street )

A Primer On Reading Annual Reports (docdroid )

Have Small Value Stocks Become a Bargain? (Morningstar )

Gilead increases enrollment target for remdesivir trial in COVID-19 patients (Reuters )

“Maybe He Doesn’t Want to Be the Hero”: In the COVID-19 Crisis, Warren Buffett is Lying Low (Vanity Fair )

Virus Vaccine May Be Ready for Mass Production By Autumn, Oxford Professor Says (Bloomberg )

Gilead Gains on Report Claiming Coronavirus Drug Working (Bloomberg )

Covid Report: Gilead Pops On Promising Sneak Peek For Coronavirus Drug (Investor’s Business Daily )

The Fear Gauge Is Sending False Signals (Barron’s )

Why Emerging Market Currencies Are Cheap (Barron’s )

Treasury yields follow stocks higher on hopes for coronavirus drug MarketWatch )

AMC Entertainment’s stock rockets after liquidity update, private debt offering (MarketWatch )

Schlumberger swings to large loss, misses revenue and cuts dividend by 75%; stock surges (MarketWatch )

Trump administration working to ease drilling industry cash crunch (Reuters )

Johnson & Johnson execs offer upbeat view of second-half recovery from COVID-19 pandemic (MarketWatch )

Fed’s Bostic says watching closely for signs of ‘unbearable’ stress among mortgage servicers (MarketWatch )

Boeing to Restart Jetliner Production (Wall Street Journal )

Mnuchin Under Growing Pressure to Help Struggling Mortgage Companies (Wall Street Journal )

Screening Rooms That Bring Hollywood Home (Wall Street Journal )

Car-rental firm Hertz seeks coronavirus bailout (New York Post )

Fed Gives Banks a Break to Keep Markets Calm (New York Times )

Disney, McDonald’s share secret recipes to cook in quarantine (USA Today )

Where to Look in China’s Data Dump for Any Signs of a Rebound (Bloomberg )

Jeff Bezos Wants to Test All Amazon Employees for Covid-19 (Bloomberg )

The Fed Loves Main Street as Much as Wall Street This Time (Bloomberg )

Some Companies Are Looking Cheap. That Could Drive a Wave of M&A. (Barron’s )

J&J, P&G, Buck the Trend by Raising Dividends (Barron’s )

Fear Is Down, but We’re Not Out of the Woods Yet (Barron’s )

Record Amount of Risky Debt Is Coming Due (Barron’s )

Buy Stocks Now, Investing Legend Burton Malkiel Says (Barron’s )

Jobless claims total 5.245 million as 22 million positions have been lost in a month due to coronavirus (CNBC )

Larry Fink: Coronavirus low last month may have been the market bottom (CNBC )

‘The shopping list is being readied’: Saudi Arabia and Abu Dhabi are scouting for cheap investments after the coronavirus sell-off (Business Insider )

Gilead (GILD) Said to Hold Talks to Buy Stake in Arcus Biosciences (RCUS) – Bloomberg (Street Insider )

Working From Home Permanently Could Rise 100% and These Stocks May Benefit (24/7 Wall Street )

Options markets send cautiously bullish signal on U.S. stock rally (Reuters )

U.S. opposes general allocation of Special Drawing Rights to IMF members (Reuters )

States paying extra $600 unemployment aid (Fox Business )

Mainstream Investors Might Get Access to Alts, But They Won’t Get Alpha (Institutional Investor )

Hedgie with a ‘higher purpose’ to run world’s biggest sovereign fund (Financial Times )

Dalio Says Investors ‘Crazy’ to Hold Government Bonds Now (Dalio Says Investors ‘Crazy’ to Hold Government Bonds Now (Yahoo! Finance )

Warren Buffett will ‘let everybody know’ once he invests the bulk of Berkshire Hathaway’s $128 billion cash pile, Bill Ackman says. (Business Insider )

Billionaire bond king Jeff Gundlach sent a bizarre tweet predicting the end of the ‘You blow dry my hair and I’ll blow dry your hair’ economy. (Business Insider )

Coronavirus Closures Froze Swaths of U.S. Economy in March (Wall Street Journal )

Weekly mortgage applications rise as rates drop to 30-year low, but it’s all refinances (CNBC )

Could It Be Value Stocks’ Time to Shine? One Long-Skeptical Strategist Thinks So. (Barron’s )

UnitedHealth beats quarterly profit on strength across its businesses (CNBC )

Larry Kudlow’s War Bonds Are Coming But in a Plain Vanilla Wrapper (Bloomberg )

China’s Data on Symptom-Free Cases Reveals Most Never Get Sick (Bloomberg )

Pound May Turn Into Unlikely Winner From Europe’s Virus Troubles (Bloomberg )

Tesla Wooed by $1 Billion Missouri Package for Cybertruck Plant (Bloomberg )

Smartphone Makers Ordering Parts Like There’s No Pandemic (Bloomberg )

Virus Sell-Off Turns Bonds Into ‘Fallen Angels.’ Here’s Why Downgrades Matter (Bloomberg )

Why A 50% Drop in U.S. GDP May Not Be So Bad (Barron’s )

Hedge Funds’ Top Holdings Are Beating the Market. They’re a Familiar Bunch. (Barron’s )

Trump says close to plan to reopen economy possibly, in part, before May 1 (Street Insider )

Saudi energy chief: Historic oil cuts more than double amount reported (Fox Business )

Trump: At least 29 states ‘ready’ to reopen (Fox Business )

Ray Dalio Said ‘Cash Is Trash.’ But Managers Are Hoarding It. (Institutional Investor )

ByteDance looks to hire 10,000 thanks to TikTok boom (Financial Times )

Saudi Arabia says price war was ‘unwelcome departure’ from oil policy (Financial Times )

GlaxoSmithKline, Sanofi Announce Coronavirus Vaccine Program (Barron’s )

Here’s How Much Of Delta Air Lines The Government Will Own After Rescue (Investor’s Business Daily )

3 reasons why Warren Buffett is so successful in bear markets (USA Today )

When the Coronavirus Outbreak Could Peak in Each U.S. State (Bloomberg )

Six Flags to offer up to $665 million of bonds to repay debt and fund operations (MarketWatch )

Ten U.S. states developing ‘reopening’ plans account for 38% of U.S. economy (Reuters )

Signs That New Virus Cases Have Peaked Push Stocks Higher (Barron’s )

IPhone Sales Surged in China (Barron’s )

States Move to Coordinate on Reopening Plans (Wall Street Journal )

Private Equity Firms Plead With Government to Help Salvage Oil and Gas Industry (Institutional Investor )

FDA approves coronavirus saliva test (Fox Business )

Trump Negotiating to Lease Oil Storage Space to Nine Companies (Bloomberg )

World Watches China’s Economy for Signs of Life After Lockdown (Bloomberg )

Exxon borrows $9.5 billion as investment-grade companies race to fill war chests ahead of earnings (MarketWatch )

Wells Fargo Earned 1 Penny in the First Quarter. Why the Stock Is Rising Anyway. (MarketWatch )

The Art of the Oil Deal (Wall Street Journal )

Gilead Sciences (GILD) Remdesivir Study Shows Two-Third of Severe COVID-19 Patients Improved (Street Insider )

Fed’s Clarida says central bank has tools to avoid deflation: BBG (Reuters )

Fauci: ‘Rolling re-entry’ possible in May (Fox Business )

Photo credit: Emily Elconin

Barron’s Picks And Pans: Berkshire Hathaway, Disney, SoftBank And More (Benzinga )

OPEC and its allies strike historic agreement to cut nearly 10 million barrels a day (MarketWatch )

Higher Natural Gas Prices Are On The Horizon (Yahoo! Finance )

OPEC+ deal saved ‘more than 2 million’ jobs in the US: Russian wealth fund (CNBC )

Historic OPEC+ cut is Trump’s ‘biggest and most complex’ deal ever: Dan Yergin (CNBC )

Goldman Sachs abandons its bearish near-term view on stocks, says the bottom is in (MarketWatch )

U.S. Stabilizes, CDC Says; 70 Vaccines in Progress: Virus Update (Bloomberg )

Alaska Bought Up Berkshire Hathaway, Walmart, and AMD Stock (Barron’s )

12 Stocks That Are Beating the Market During the Coronavirus Crisis—and Can Keep on Growing After (Barron’s )

Can Cruise Lines and Small Theme Parks Survive? (Barron’s )