Skip to content

- Global Stocks Rise as Governments and Central Banks Pour on Stimulus (Barron’s)

- In the Hunt for Cash, Here Are 5 Companies With Plenty of It (Barron’s)

- Gilead upgraded to Overweight from Neutral at Piper Sandler (TheFly)

- Search for Coronavirus Vaccine Becomes a Global Competition (New York Times)

- Will ‘Helicopter Money’ and the ‘Big Bazooka’ Help Rescue Europe? (New York Times)

- Experts recommend these stocks to buy during coronavirus outbreak (New York Post)

- Divided G20 faces pressure to lead global response to coronavirus (Reuters)

- Republicans work to cut withdrawal penalty from savings accounts (Fox Business)

- This big bank to offer mortgage relief (Fox Business)

- Ventilator manufacturer works to ease shortage (USA Today)

- Ray Dalio: Damage From Coronavirus Will Be ‘Much Greater’ Than Reported (Institutional Investor)

- J.P. Morgan strategist says markets are about to get calmer, if not better (MarketWatch)

- Market action a century ago suggests worst could be over for stocks (MarketWatch)

- Carl Icahn Shows New 14.86% Stake in Delek US Holdings (DK), Pushes for CVI (CVI) Merger (Street Insider)

- Fed buying more this week than biggest week during the financial crisis – CNBC’s Liesman (Street Insider)

- The Spanish Flu – Coo coo ca choo – Stock Market (and sentiment results)… (ZeroHedge)

- Another Exxon Mobil Executive Makes a $1 Million Stock Buy (Barron’s)

- Health Crisis Could Give Cigarette Makers a Break (Wall Street Journal)

- 5 Bottom-Fishing Blue-Chip Dividend Stocks (24/7 Wall Street)

- Mnuchin and Pelosi Are Most Pivotal Duo in Virus-Hit Capital (Bloomberg)

- ‘Dividend Cuts Are Inevitable.’ They Won’t Be Across the Board (Barron’s)

- In U.S. Markets, Capitulation Was the Word of the Day (Barron’s)

- The Coronavirus Crisis Is Showing Us How to Live Online (New York Times)

- Is Saudi Arabia To Blame For The Looming Economic Recession? (Yahoo! Finance)

- Trump Signs Coronavirus Relief Bill, ECB Injects $821B In Liquidity, Japan Considers Cash Payouts (Benzinga)

- Gilead Sciences’ (GILD) First COVID-19 Antiviral Data Validates Remdesivir – Wells Fargo (StreetInsider)

- The European Central Bank has launched a ‘bazooka’ $820 billion pandemic fund to aid markets. ‘There are no limits.’ (Business Insider)

- Buffett’s Cash Stash Makes Berkshire a Safe Port in the Storm (Barron’s)

- When to buy during an ugly stock market rout? These charts have the answers. (MarketWatch)

- Strong Restaurant Chains May Feast After Coronavirus Famine (Wall Street Journal)

- Regeneron’s CEO Says We Could Have a Covid-19 Treatment ‘Quickly’ (Barron’s)

- Market Plumbing Is Hit, But the Fed Can Probably Handle It (Wall Street Journal)

- Fed Unveils Emergency Lending Programs as Companies Struggle to Raise Cash (New York Times)

- Trump wants to start sending millions of Americans a check. Here’s how to use it wisely (CNBC)

- The Federal Reserve is adding another program to keep money flowing for big financial institutions (CNBC)

- Here’s one analyst’s take on the coronavirus drugs for today and the future (MarketWatch)

- As China’s coronavirus outbreak eases, a wary return to shops for consumers (Reuters)

- Hydroxychloroquine and Remdesivir Info (Nature.com)

- Article on Chloroquine Treatment for Coronavirus (COVID-19) (Presented by: James M. Todaro, MD)

- French researcher posts successful Covid-19 drug trial (connexionfrance)

- The NYSE, a symbol of America, is fighting to keep its trading floor open amid coronavirus pandemic (MarketWatch)

- FedEx stock spikes as sales grow amid coronavirus outbreak, but earnings guidance is pulled (MarketWatch)

- Warren Buffett on negative rates and ‘the most important question in the world’ (Yahoo! Finance)

- Markets Want Congress to Help Private Sector, Morgan Stanley Head Says (Institutional Investor)

- Japanese flu drug ‘clearly effective’ in treating coronavirus, says China (The Guardian)

- Fed QE Starts With A Bang — $80 Billion In Two Days (Investor’s Business Daily)

- ‘We came back to the office in shifts.’ Hong Kong takes first, cautious steps to return to a New Normal, this expat says (MarketWatch)

- GE Stock Has Gotten Hammered by Coronavirus and Debt Worries. Here’s What Could Turn the Tide. (Barron’s)

- Wells Fargo CEO Charles Scharf Bought ~$5M of Stock (Barron’s)

- Opinion: Who’s buying stocks? Executives at TripAdvisor, Newell Brands and other companies are buying at low prices (MarketWatch)

- A rare win for Gen X? Boomers gave us latchkey childhoods that prepped us for coronavirus quarantine (MarketWatch)

- How much stimulus would rescue economy from outbreak? (USA Today)

- Coronavirus Could Very Well Slow by the Summer (Bloomberg)

- Wall Street Pros Panic Over Coronavirus While Mom and Pop Buy (Bloomberg)

- Fed’s Kashkari says ‘we are using our tools aggressively,’ but he doesn’t see negative rates coming (CNBC)

- 18 Stocks to Buy Amid the Coronavirus Carnage, According to Barron’s Roundtable Experts (Barron’s)

- 8 Big Banks Are Halting Buybacks to Brace for More Virus Fallout (Barron’s)

- Fed Cuts Rates to Zero as Financial-Crisis Tools Return (Barron’s)

- Buffett’s Massive Cash Stash Makes Berkshire a Safe Port in the Storm (Barron’s)

- How Coronavirus Remade American Life in One Weekend (Wall Street Journal)

- The Fed and Friends: What Central Banks Did in Past 24 Hours (Bloomberg)

- Regeneron, Sanofi to evaluate Kevzara in patients hospitalized with severe COVID-19 (MarketWatch)

- Coronavirus vaccine clinical trial begins (Fox Business)

- Peter Navarro: Faced with coronavirus pandemic, Congress should pass Trump’s $800 billion payroll tax cut (Fox Business)

- Barron’s Picks And Pans: Roundtable Picks, Airline And Oil Stocks, And More (Benzinga)

- Carl Icahn Says Some Stocks Are Being ‘Given Away’ (Benzinga)

- Can Risk Parity Funds Hang in There? (Institutional Investor)

- Thinking About Airline Stocks? This Is How Air Travel Is Recovering in China. (Barron’s)

- Secretary of the Treasury – Steven T Mnuchin – discusses federal coronavirus response (ValueWalk)

- Italians are singing songs from their windows to boost morale during coronavirus lockdown (CNBC)

- National Emergency Declaration for COVID-19 Helps Oil & Gas, To Fill Strategic Petroleum Reserve (24/7 Wall Street)

- MiB: Cristiano Amon, President of Qualcomm on 5G (Bloomberg)

- Friday 13th, DJIA Attempting to Recover & End Losing Friday Streak (Almanac Trader)

- Coronavirus Drug Update: The Latest Info On Pharmaceutical Treatments And Vaccines ()

- The Big Bet of 10-year Breakevens at 0.94% (E-piphany)

- Why Soap Is Such An Effective Killer Of The Coronavirus (digg)

- McLaren Elva ‘M1A Theme’ Honors Retro Grand Prix Winner (Maxim)

- 7 Energy Stocks to Buy on the Dip (U.S. News & World Report)

- ECRI Weekly Leading Index Update (AdvisorPerspectives)

- Warren Buffett: ‘I won’t be selling airline stocks’ (Yahoo! Finance)

- Why Did the Wright Brothers Succeed When Others Failed? (Scientific American)

- House passes aid bill after Trump declares virus emergency (Fox Business)

- Trump emerges as oil’s white knight after worst week since 2008 (Fox Business)

- These Common Household Products Can Destroy the Novel Coronavirus (Consumer Reports)

- Shopping for Stocks? Think Like a Lender. (Barron’s)

- Crown Prince’s Oil War Looms Over First Aramco Results Since IPO (Yahoo! Finance)

- Will The Fed’s $1.5 Trillion Emergency Stimulus Actually Help? (Benzinga)

- Where does the stock market go from here after the worst drop since 1987? Here’s what the analyst who called the 2018 rout says (MarketWatch)

- Trump to buy oil for strategic reserve to aid energy industry: ‘We’re going to fill it’ (CNBC)

- Gilead Pops After Coronavirus Drug Helps Cruise Ship Patients In Japan Investor’s Business Daily)

- Europe Pledges Billions in Economic Aid in Rare Sign of Unity (New York Times)

- Dow surges nearly 2,000 points after Trump declares coronavirus national emergency (New York Post)

- Trump Says He Supports Pelosi Virus Bill, Urges GOP to Vote Yes (Bloomberg)

- Trump Waives Student-Loan Interest, Stockpiles Oil in Virus Plan (Bloomberg)

- Esports Leagues Are Only Game in Town After NBA and NHL Go Dark (Bloomberg)

- Stocks Retrace 90% of Thursday’s Sell-Off With Trump Address Hitting Mark (Bloomberg)

- Cash-Rich Billionaire Hargreaves Jumps Back Into Market (Bloomberg)

- Trump called on Walmart, CVS, Target, and Walgreens to help slow the spread of the coronavirus as he declares a national emergency (Business Insider)

- Stocks Surge After Trump Promises Speedier Testing (New York Times)

- How Billie Eilish Rode Teenage Weirdness to Stardom (New York Times)

- Deadly viruses are no match for plain, old soap — here’s the science behind it (MarketWatch)

- 18 Stocks to Buy Amid the Coronavirus Carnage, According to Barron’s Roundtable Experts (Barron’s)

- China’s coronavirus epicenter reports just five cases (Reuters)

- Here’s everything you need to know about 5G (CNN)

- Google, Walmart join U.S. effort to speed up coronavirus testing (Reuters)

- 7 Stocks That Could Ride Out the Turmoil in Energy Markets (Barron’s)

- The World Is One Big Carry Trade (Institutional Investor)

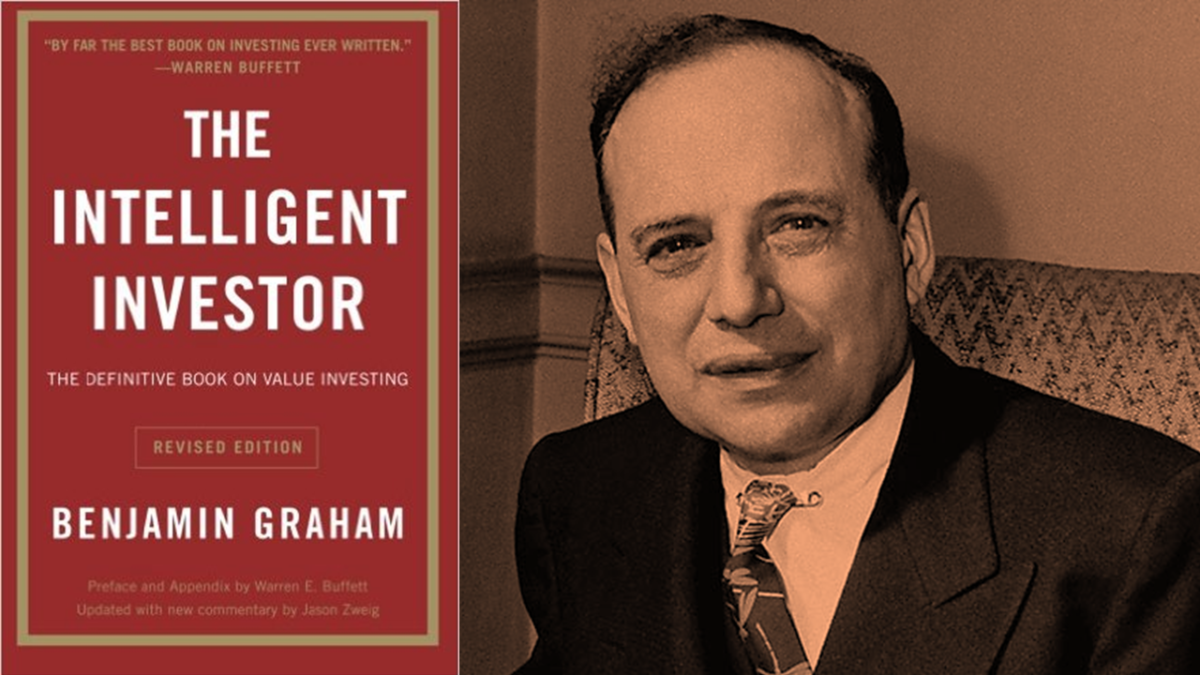

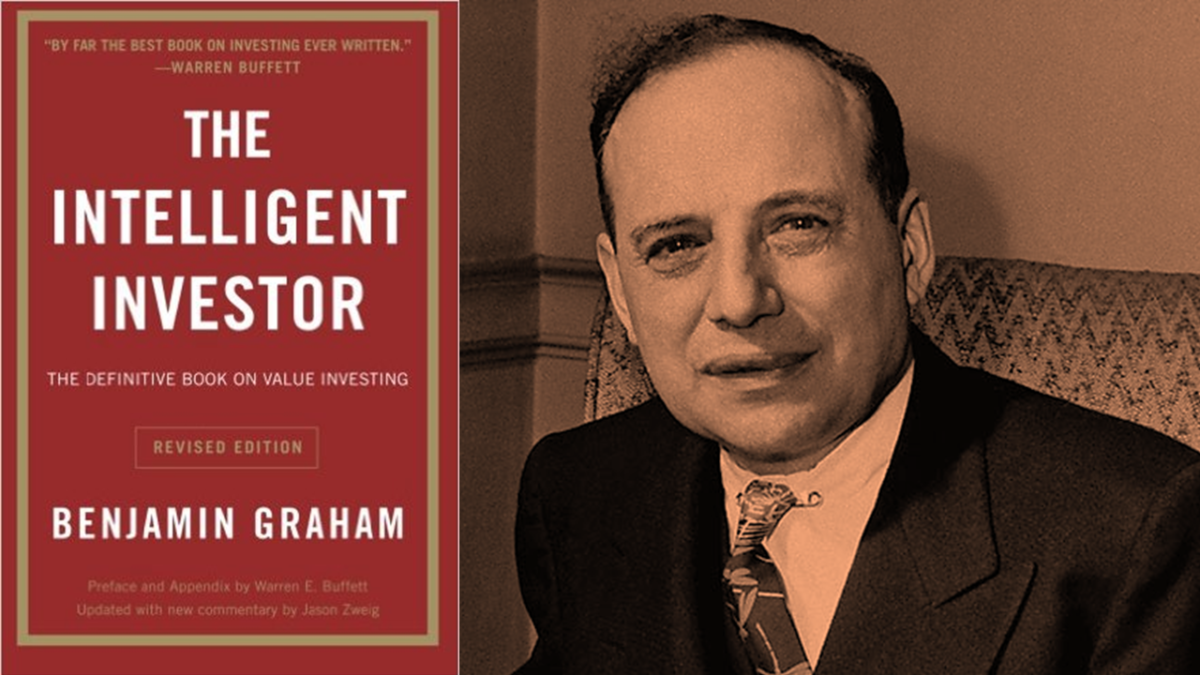

- Value investors: why are they so calm in a crisis? (Schroders)

- HIV drugs are being used as part of coronavirus treatment (New York Post)

- Here’s What Could Help Calm Markets, According to Wall Street’s Best Minds (Barron’s)

- U.S. Stock Futures and European Equities Surge as Markets Try to Stabilize After Historic Meltdown (Barron’s)

- It’s Time for Warren Buffett to Get Greedy. Here’s What He Might Be Looking to Buy. (Barron’s)

- ‘This Is All Coming to a Head’: Investors React to Market Chaos (Bloomberg)

- Mohamed El-Erian: The stock market looks ‘less scary’ (CNBC)

- Fed to Inject $1.5 Trillion in Bid to Prevent ‘Unusual Disruptions’ in Markets (Wall Street Journal)

- New Coronavirus Test 10 Times Faster Is FDA Approved (Bloomberg)

- Germany Pledges Unlimited Cash as EU Set to Green Light Spending (Bloomberg)

- Oracle earnings show best revenue growth in nearly two years (MarketWatch)

- 11. Trump’s $800 billion payroll tax cut plan would dwarf Obama’s stimulus package from the height of the financial crisis (Business Insider)

- What Warren Buffett thinks of his Occidental investment after shares crashed with oil prices (Yahoo! Finance)

- Time to Buy, Says GMO (Institutional Investor)

- Carl Icahn Boosts Occidental Stake to Almost 10% as Shares Plummet (Wall Street Journal)

- Can Gilead’s Virus Test Results Cure Broader Stock Market Woes? (Investor’s Business Daily)

- Let’s Talk About Coronavirus Bailouts, Before We Need Them (New York Times)

- Stocks Plunge With Virus Response Missing Mark (Bloomberg)

- 21 Stocks To Buy In a Virus Economy (Barron’s)

- Markets Are in Turmoil. Buy These Stocks, Jefferies Says (Barron’s)

- The losers — and even bigger losers — of an oil price war between Saudi Arabia and Russia (CNBC)

- Here’s how Invesco’s top strategist says long-term investors should navigate this market panic (MarketWatch)

- Buffett and Occidental: We’ve Seen This Movie Before (Wall Street Journal)

- Oil Price Shock on Top of Coronavirus Compounding Sovereign Credit Risks (24/7 Wall Street)

- ECB approves fresh stimulus for reeling economy but keeps rates steady (Reuters)

- Private Equity Firms Won’t Waste Another Crisis (Institutional Investor)

- What Warren Buffett thinks of his Occidental investment after shares crashed with oil prices (Yahoo! Finance)

- What Benjamin Graham Would Tell You to Do Now: Look in the Mirror (Wall Street Journal)

- China’s Stocks Have Recouped Most CoronavirusStocks to Buy Amid the Selloff (Barron’s)

- U.S. Consumers Just Got a $725 Billion Windfall. Here’s How. (Barron’s)

- Coronavirus Is Bad — and Good — for Biotech Stocks (Barron’s)

- How China Slowed Coronavirus: Lockdowns, Surveillance, Enforcers (Wall Street Journal)

- Inside Saudi Arabia’s Decision to Launch an Oil-Price War (Wall Street Journal)

- Here’s why people are panic buying and stockpiling toilet paper (CNBC)

- The Bank of England cut rates by 0.5% in an emergency coronavirus response, mirroring the Fed. Business Insider)

- China’s Stocks Have Recouped Most Coronavirus Losses. Key Points to Watch for the U.S. (Barron’s)

- Goldman Sachs analyzed bear markets back to 1835, and here’s the bad news — and the good — about the current slump (MarketWatch)