Skip to content

The Bull Market in US Stocks Is Just Starting, Evercore Says (bloomberg )

Opinion: How Trump’s election could push this ‘Roaring 2020s’ stock market into the 2030s (marketwatch )

Opinion: ‘The market isn’t overbought yet, so enjoy the party.’ How to trade the post-election melt-up. (marketwatch )

The Fed is draining liquidity from markets for longer than expected. Here’s why it’s making Wall Street nervous. (marketwatch )

Moderna Earnings Beat Estimates. But Its Future Still Looks Uncertain. (barrons )

Trump Comeback Means Reckoning for China as It Draws Up Stimulus (bloomberg )

China urges U.S. cooperation as Trump trade threat looms (cnbc )

Trump likely to uphold CHIPS Act despite his campaign rhetoric, policy experts say (cnbc )

China October exports record highest jump in 19 months, imports decline more than expected (cnbc )

Chinese Stocks Bounce Back as Stimulus Hopes Offset Trump Risks (bloomberg )

Trump’s return is not all bad news for Chinese stock investors: analysts (scmp )

China’s Preferred Candidate Wins As Mainland Investors Buy The Hong Kong Dip in Size (chinalastnight )

PBOC Pledges to Maintain Supportive Monetary Policy at Meeting with Foreign Financial Institutions (aastocks )

Trump’s 60% Tariffs on CN Goods to Cut CN Econ Growth by 2 ppts: Report (aastocks )

What will M&A look like under a Trump administration (cnbc )

How Donald Trump Won—by Being Donald Trump (wsj )

New Starbucks CEO Scouted Cafes Before Taking Over: What He’s Tackling First (wsj )

Wayfair Ups Promotions Without Taking a Big Financial Hit. Here’s How They Do It. (wsj )

Is This Undefeated Team the Best Story in College Sports? (wsj )

Xi congratulates Trump on his election as U.S. president (cn )

Trump Defeats Harris, Marking Historic Comeback. Former president is first in over a century to reclaim the White House after losing it (wsj )

Fed Readies a Rate Cut and Faces These Four Questions (wsj )

Beijing puts no price cap on land sale, signalling property-market shift (scmp )

Services PMI Beats As Premier Li Signals Economic Policy Support (chinalastnight )

China’s central bank affirms supportive monetary policy stance at closely watched meeting (cnbc )

Nuclear Energy’s AI Boom Blew a Fuse—Here’s What Could Happen Next (wsj )

AI Startup Perplexity to Triple Valuation to $9 Billion in New Funding Round (wsj )

China’s New Stock Accounts Hit Nine-Year High as Market Booms (bloomberg )

The next U.S. president could face a tax battle in 2025 — here’s what it means for investors (cnbc )

Elon Musk says his super PAC won’t go away after the 2024 election (businessinsider )

Boeing Strike Ends, Work Set To Resume (investors )

Fox Corp. shares soar as record ad boom ahead of elections helps revenue beat estimates (nypost )

Housing market hits highest inventory since 2019 as sellers flood the market (nypost )

What the Prediction Markets Think. Odds of winning implied by trades on different platforms (bloomberg )

Alibaba’s Black Friday alternative hits US with AliExpress Singles’ Day sales (scmp )

YUM China’s Results Are “Finger Lickin’ Good”, NPC Kicks Off (chinalastnight )

A split Congress is probably the favorite for the markets, says Wharton’s Jeremy Siegel (cnbc )

Advance Auto Parts Closes on Sale of Worldpac to Carlyle. Advance Auto Parts said the transaction strengthens its balance sheet and liquidity with $1.5 billion of cash proceeds. (aftermarketnews )

The SALT Deduction Fight Is Coming Back—Whoever Wins the Election (wsj )

The ‘Trump Trade’ Isn’t What You Think (wsj )

China gears up for a big week as markets await U.S. elections and stimulus details (cnbc )

China’s Singles Day shopping festival is more than halfway over. Here’s how consumers are spending (cnbc )

Striking Boeing machinists vote on union-backed contract proposal, this time with a warning (cnbc )

The incumbent party has historically won if stocks rally into an election. Here’s why this time could be different. (businessinsider )

Alibaba brings Singles’ Day to US with AliExpress, offering alternative to Black Friday (scmp )

China’s Singles Day shopping festival is more than halfway over. Here’s how consumers are spending (cnbc )

China Reviews Plan to Refinance Local Governments’ Hidden Debt (bloomberg )

Talen Stock Tumbles on Amazon Nuclear Power Deal Setback. Constellation, Vistra Down, Too. (barrons )

Market expert bullish on China’s Alibaba (foxbusiness )

The burrito king in coffee land: Starbucks CEO Brian Niccol’s most important job is fixing the bad vibes (fortune )

Nvidia’s stock performance has been ‘staggering.’ But recent buyers of the stock are taking a far greater risk than they realize (fortune )

ChatGPT releases a search engine, an opening salvo in a brewing war with Google for dominance of the AI-powered internet (fortune )

Why Kamala and Trump are turning to podcasts to woo uncertain voters (nypost )

Cool, cool, cooling jobs (npr )

Abundant reserves enabled a soft landing (scottgrannis )

🔴 【LIVE BLOG】Alibaba’s 2024 11.11 Global Shopping Festival 🔥:Brands Surge, 88VIP Drives Growth 📈(Continuous Updating)(alizila )

Warren Buffett is sitting on over $325 billion cash as Berkshire Hathaway keeps selling Apple stock (apnews )

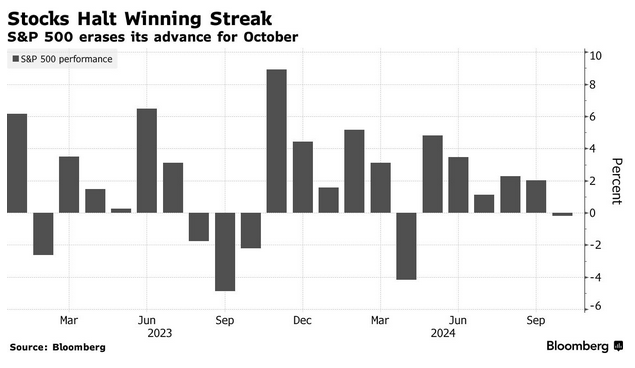

Tech Earnings Fail to Fire Up Traders With Sky-High Expectations (bloomberg )

Fed and Peers Will Go Ahead With Rate Cuts After This Week’s US Election (bloomberg )

Harnett: This Is The Most Contrarian Post-Election Trade (zerohedge )

Alibaba cuts ‘dozens of employees’ at metaverse unit as sector’s hype cools down (scmp )

China may have big opportunity to change household & consumer sentiment: Longview’s Dewardric McNeal (cnbc )

China Eases Curbs to Woo Global Investors Ahead of US Elections (bloomberg )

Berkshire Sold 25% of Its Apple Stock in the Third Quarter (barrons )

Berkshire Sold Bank of America Stock Again. Here’s Why. (barrons )

Wells Fargo, Capital One, and Other Value Picks From a Berkshire Board Member (barrons )

Intel Stock Needs an Nvidia-Like Run to Save the CEO’s Stock Awards (barrons )

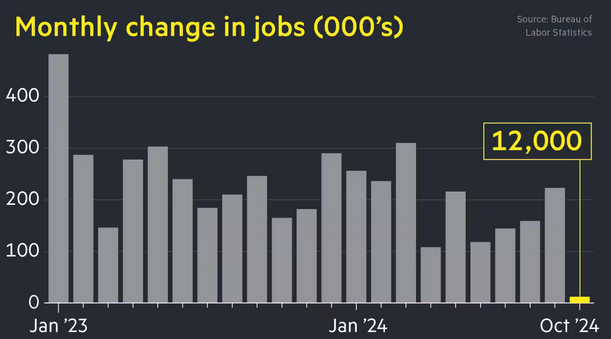

US adds just 12,000 jobs as storms and strikes hit labour market (ft )

Betting Markets Tend to Get Elections Right—With Some Notable Exceptions (wsj )

Ski Bums Love It. So Do Billionaires and History Buffs. How This Aspen Hotel Kept Its Gilded Age Appeal. (wsj )

Paralyzed people may soon be able to walk thanks to NYC innovation — and that’s only the beginning (nypost )

Wall Street frets over Big Tech’s $200bn AI spending splurge (ft )

Boeing Reaches New Deal With Union in Hopes of Ending Strike (nytimes )

Fed seen agreeing to quarter-point rate cut, while disputes flare about the road ahead (marketwatch )

This closely watched stock-market indicator hit a 2½-year high. What it says will happen next. (marketwatch )

AI Today and Tomorrow (bridgewater )

Mopar Unleashes All-Electric Plymouth GTX Muscle Car (maxim )

How John Hennessey Builds Some Of The World’s Fastest Supercars (maxim )

Cooper Standard Reports Third Quarter Results; Continuing Lean Initiatives Delivering Cost Savings as Planned (cooperstandard )

Intel CEO’s turnaround mirrors some moves by Steve Jobs. (marketwatch )

Boeing Dismantles DEI Team as Pressure Builds on New CEO (bloomberg )

U.S. Added Only 12,000 Jobs in October. Blame Strikes, Storms. (barrons )

Walmart Is on a Winning Streak. How the Walton Family Keeps the World’s Biggest Retailer on Track. (barrons )

Boeing Stock Rises After Offer to Pay $119,000 a Year. Vote Due Next Week as Strike Rolls On. (barrons )

Wayfair Stock Leaps on Earnings Beat. CEO Is Focused on ‘Healthy Profitability.’ (barrons )

Intel Says Sales Outlook Is Improving (wsj )

The Fed’s Preferred Inflation Gauge Cooled Overall in September (nytimes )

Boeing Gains After Union Endorses Sweetened Offer to End Strike (bloomberg )

Real Estate Prices & Transaction Volume Rebound In October, Week in Review (chinalastnight )

Intel books big charges for restructuring, but here’s why its stock is surging (marketwatch )

China’s Economy Shows Flashes of Stimulus Taking Hold (bloomberg )

China Home Sales Slump Eases as Stimulus Boosts Buyer Morale (bloomberg )

AliExpress Invites U.S. Retailers to Sell on the Platform (aliexpress )

Alibaba Stock Has Soared. It’s Still Cheap Enough to Buy. (barrons )

BABA-W’s AliExpess Sees Some Merchants’ Stocking Growth 8x+ (aastocks )

Meta Stock Falls Further After Facebook Parent’s Earnings Beat. Spending Is an Issue. (barrons )

Intel Reports Earnings Today. Analysts Are Worried About the Outlook. (barrons )

PCE Inflation Slips to 2.1% Annual Rise, Moves Closer to the Fed’s Target (barrons )

Boeing Stock Won’t Budge Despite All the Bad News. This Is Why. (barrons )

Estée Lauder Stock Is Dropping on Disappointing Guidance and Cut Dividend (barrons )

23 Stocks That Pay a Huge Dividend. Why They Should Be a Better Bet Than Treasuries. (barrons )

Temu’s debut in Vietnam faces scrutiny after Indonesian ban (scmp )

Boeing’s New 6% Convertible Preferred Stock Scores With Investors (barrons )

Microsoft Shares Slip as Forecast Sparks Concern About AI and Cloud Revenue (wsj )

Starbucks Is Bringing Back the Condiment Bar (wsj )

US Jobless Claims Fall to Five-Month Low as Storm Impact Fades (bloomberg )

American Airlines Busts Travelers Who Cut the Boarding Line (wsj )

China Central Bank Adds $70 Billion With New Liquidity Tool (bloomberg )

Boeing strike will dent last jobs report before election (cnbc )

How Hermès is bucking the global luxury slowdown (cnbc )

Why the bond market may have it entirely backwards on Trump and Harris (marketwatch )

Disney to Pay More Than $500 Million to Air the Grammys (wsj )

Can We Prevent Cancer With a Shot? (wsj )

Science Is Finding Ways to Regenerate Your Heart (wsj )

Eurozone inflation rises to 2% in October (ft )

Big Tech’s AI splurge worries investors about returns ahead of Amazon results (reuters )

PayPal’s Real Friends Will Have to Be Patient (wsj )

Boeing, Union Hold ‘Productive’ Talks in Attempt to End Strike (bloomberg )

Super Micro Stock in Free Fall After Accountant Resigns (barrons )

New retail car sales increased 2% in the latest week of data, and they are now up 10% over last year. (cox )

U.S. Economic Growth Extended Solid Streak in Third Quarter (wsj )

Eli Lilly Stock Plummets After Earnings Miss (barrons )

China Beige Book Sees Economy Perking Up. (barrons )

What the Election Means for Tesla and Other Car Stocks (barrons )

US Hiring in ADP Data Rises to Fastest Pace in More Than a Year (bloomberg )

Mortgage demand stalls as interest rates surge higher ahead of election (cnbc )

VF Stock Surges After Q2 Sales Beat, Profit Swing (footwearnews )

For fiscal 2024, PayPal now expects adjusted earnings per share to grow in the high teens, compared with an earlier forecast of low to mid-teens growth. (barrons )

China Weighs $1.4 Trillion Fiscal Stimulus Package, Reuters Says (bloomberg )

It Has Your Money—and Your Pants Size. Here’s What PayPal Is Doing With Them. (wsj )

Alphabet’s Search and Spending Is All Wall Street Cares About. (barrons )

3 Titans Spent Tens of Billions on AI. Will They Regret It? (barrons )

Pfizer Rises After Earnings Beat, Guidance Hike (barrons )

Boeing Moves to Raise $19 Billion in Equity (wsj )

Bosses Are Calling Workers Back to the Office. That’s Good News for Landlords. (wsj )

At Boeing and Starbucks, Different Problems but Similar CEO Messages (wsj )

Estée Lauder Succession Drama to End With Insider Pick (wsj )

The 25 Best Pizza Places in New York Right Now (nytimes )

Milei’s Revamp Offers CEOs a Glimmer of Optimism About Argentina (bloomberg )

China Investors Scour Protest Data for Clues to Next Stimulus Moves (bloomberg )

CEOs Are Saying This Is as Bad as It Gets for Their Earnings (bloomberg )

What’s Different Between 2016 Trump Trade and Now (bloomberg )

Fed goes quiet ahead of its Nov. 7 meeting, with quarter-point cut seen as likely (marketwatch )

Ministry Of Finance Hints At NPC Fiscal Policy, Reiterates 2024 GDP Goal (chinalastnight )

JPMorgan CEO Jamie Dimon says ‘it’s time to fight back’ on regulation (reuters )

Job openings fall to lowest level since January 2021 (yahoo )