Skip to content

China Weighs Removing Major Homebuying Curbs to Boost Demand (bloomberg )

How Luxury Stocks Lost Their Shine. These Are the Ones That Will Get It Back. (barrons )

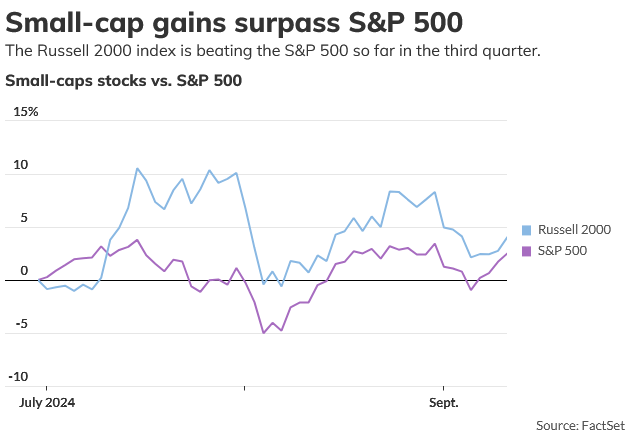

Small-Caps Are Outperforming. They Could Be the Stock Market’s Best Bet. (barrons )

Chinese Officials are also mulling measures to shore up stock market (bloomberg )

This Money Manager Likes Durable Businesses. 4 Industrial Stocks He’s Got His Eye On. (barrons )

Yen Weakens as Ueda Indicates BOJ Isn’t in Hurry to Hike Rates (bloomberg )

The Fed’s New R-Word Is ‘Recalibrate.’ Why Investors Love It. (barrons )

Analysts warned about the fallout from a surging yen. But then this happened. (marketwatch )

FedEx’s earnings miss may be more of a speed bump than a brick wall, analyst says (marketwatch )

This is what the Fed’s interest-rate cut means for distressed companies (marketwatch )

Hang Seng Index posts biggest weekly gain in 5 months (scmp )

Alibaba CEO eyes greater AI research and development, open sources 100 new LLMs (scmp )

Hong Kong cuts base rate by 50 basis points to reboot economy (scmp )

PayPal Stock Rises On Amazon Prime Checkout Partnership (investors )

PayPal, Amazon Team Up in ‘First Step’ of Branded Checkout Collaboration (barrons )

Central Bank Cuts Interest Rates in Half-Point Move (barrons )

Fed Officials See Cooler Inflation Ahead This Year (barrons )

Mortgage Rates Won’t Fall That Much. Don’t Be Too Disappointed. (barrons )

Fed’s Powell Isn’t Dovish or Hawkish. He’s Bullish. (barrons )

Small-cap stocks’ bullish ‘Fed day’ performance reflects investors’ confidence in the economy (marketwatch )

Bond market gets a Fed wake-up call after pricing in a recession (marketwatch )

Homeowners scramble to refinance with mortgage rates now at 2-year lows (marketwatch )

Here’s when falling interest rates will hit your mortgage, car loan, credit-card bills and savings accounts (marketwatch )

Starbucks should make this dramatic move to help its stock, BofA says (marketwatch )

Fed starts rate-cutting cycle with a bang — but wants it to be the only one (marketwatch )

Boeing Stock Is Steady Amid a Strike and Furloughs. Help Has Arrived. (barrons )

Big Rate Cut Forces Fed to Contend With New Obstacles (wsj )

The Fed Has Significantly Improved the Odds of a Soft Landing (wsj )

Fed Opts for Outsize Cut as Powell Seeks to Ensure Soft Landing (bloomberg )

Boeing starts furloughing tens of thousands of employees amid machinist strike (cnbc )

The Fed Isn’t First to Cut Rates, but It Is the Signal Other Central Banks Want (wsj )

Chinese chip stocks jump after claims of equipment breakthrough (finance.yahoo )

Apple iPhone 16 Pro Max review: Long battery life and great cameras. Apple Intelligence isn’t ready (cnbc )

Boeing Stock Is Steady as the Strike Continues. Help Has Arrived. (barrons )

3 ways the Fed interest-rate cut could jump-start buying and selling homes again (marketwatch )

Fed interest-rate cut boosts home builders confidence (marketwatch )

New-home construction posts biggest increase in 6 months (marketwatch )

A Fed interest-rate cut could make small-cap stocks a good investment now (marketwatch )

Chinese consumption edged up slightly during a major holiday this week from its pre-pandemic level (bloomberg )

Chinese Stocks Edge Up as Mainland Markets Reopen After Break (bloomberg )

Fed’s ‘Reverse Repo’ Balance Fell to Lowest Level in Over 3 Years. Why It Matters. (barrons )

Dollar Stores Expand Aggressively Even as Sales Shrink (wsj )

Intel stock jumps on plan to turn foundry business into subsidiary and allow for outside funding (cnbc )

Intel to Make Custom AI Chip for Amazon (bloomberg )

Big names like David Tepper and ‘Big Short’ investor Michael Burry are quietly upping their bets on the Chinese economy (cnbc )

Fed to cut rates by a quarter point with a soft landing expected, according to CNBC Fed Survey (cnbc )

China seeks a homegrown alternative to Nvidia — these are some of the companies to watch (cnbc )

Markets Hinge on Powell Emulating Greenspan’s Soft Landing (bloomberg )

A Fed interest-rate cut could make small-cap stocks a good investment now (marketwatch )

Intel, Aiming to Reverse Slump, Unveils New Contracts and Cost Cuts (nytimes )

Opinion: Why Intel’s latest move for its foundry business is so significant (marketwatch )

U.S. Officials Jet to Beijing Amid Flood of Cheap Chinese Exports (wsj )

Amazon Tells Workers to Return to Office Five Days a Week (wsj )

Boeing, union negotiators to meet as striking workers dig in (reuters )

This is the only Fed that eased while inflation surged all the way to its peak, says Jim Paulsen (cnbc )

Intel’s Turnaround Is Working. Buy the Dip. (barrons )

Intel made 3 big announcements since solvency concerns: Thomas Hayes (foxbusiness )

Life in the Fast Lane for PayPal? New Partnerships Could Boost the Stock. (barrons )

Markets should trade well into FOMC meeting, and for a few weeks after, says Fundstrat’s Tom Lee (cnbc )

Yen Strengthens Beyond 140 Per Dollar for First Time Since 2023 (bloomberg )

The Fed Should Go Big Now. I Think It Will. (bloomberg )

The 10 Best Hotels in North America, According to the Michelin Guide (bloomberg )

The Fed Meeting Isn’t the Only Rate Decision to Watch. Why Japan Could Matter More. (barrons )

Disney Deal With DirecTV Ends Blackout of ESPN, ABC (barrons )

13 times this has occurred, the S&P 500 has rallied 18% on average over the next 12 months (marketwatch )

Boeing labor issue likely to be a final milestone before news turns more constructive: Citi (streetinsider )

$2.1 Billion Net Flows To Alibaba In First Week of Connect, Week in Review (chinalastnight )

It’s Time to Start Wearing Vans Again (gq )

Vans’ Classic Skate Shoes Look Dapper as Preppy Brogues (highsnobiety )

Biden Targets Temu With Import Rule. Impact Could Go Beyond PDD Stock. (investors )

Schlumberger Stock Was Once as Hot as Nvidia. Why It’s a Buy. (barrons )

The Man Who Made Nike Uncool (bloomberg )

Peter Lynch on Big Winners and Patience (dgi )

Price is what you pay, value is what you get (dgi )

6-foot-8 Christo Lamprecht’s unique and fascinating golf swing, explained (golfdigest )

Intel Solidifies $3.5 Billion Deal to Make Chips for Military (bloomberg )

Economists widely expect PBOC to ease monetary policy in the coming weeks, including by reducing the amount of cash lenders must keep in reserve. The central bank could also lower the interest rate on policy loans to reduce banks’ funding cost. (bloomberg )

EV Leases Go as Low as $20 a Month to Help Dealers Clear Their Lots (bloomberg )

Boeing Craft’s Smooth Return Spotlights NASA’s Safety Calculus (blommberg )

China’s First Retirement Age Hike Since 1978 Triggers Discontent (bloomberg )

Why It’s Not Too Late to Swap Tech for Tech Beneficiaries, From Utilities to REITs (barrons )

Rates Could Fall Below 3% In This Cycle, Says This Economist (barrons )

Lululemon CEO Bought Up the Slumping Stock (barrons )

Boeing’s bonds are being snapped up as stock slides on strike worries (marketwatch )

Hennessey’s New Roadster Is The ‘World’s Most Powerful Manual’ Hypercar (maxim )

Small-cap stocks beating S&P 500 this quarter as investors expect Fed rate cuts (marketwatch )

Top Economist Backs Off Recession Call. Why He Made the ‘Very Difficult Decision.’ (barrons )

Temu and Shein face U.S. crackdown as Biden administration cites abuse of trade loophole (marketwatch )

Alibaba, Tencent, & Meituan Are Buying Their Stock. Are You? (chinalastnight )

Boeing Workers Vote to Strike, Halt Jet Production (barrons )

‘Real’ Interest Rates Point to Bigger Fed Cut (barrons )

Investor sentiment dived in September. Here’s why it’s a good sign for stock bulls. (marketwatch )

Mortgage rates are falling ahead of the Fed’s planned rate cut. How borrowers can capitalize. (marketwatch )

ECB Cuts Interest Rates for Second Time in Three Months (wsj )

Tech giants and investors are shoveling cash into artificial intelligence amid questions about whether it will pay off (wsj )

Traders See 40% Chance of a Half-Point Fed Cut by Next Week (bloomberg )

The Return of the Gas-Guzzling, Huge-Engine Supercar (bloomberg )

China Internal Passport Revamp Could Fuel New China Growth (bloomberg )

Alibaba to benefit more from cross-border link, trading history of Tencent, Meituan shows (scmp )

China to Cut Rates on $5 Trillion Mortgages as Soon as September (bloomberg )

ECB Cuts Interest Rate. It’s Finally on the Same Page as the Fed. (barrons )

PPI Inflation Data Was Tame in August. (barrons )

Jobless claims inch up to 230,000, but still no sign of rising layoffs (marketwatch )

Xi Urges Efforts to Hit Annual Growth Target Amid Rising Doubt (bloomberg )

PGA Tour Meets With Saudi Fund in Hopes of Getting Closer to Deal (nytimes )

“Gelsinger insists the time to reap the rewards is finally arriving. He says Intel’s foundry business has “engagements” with a number of customers for $15 billion, spread out over multiple years.” (bloomberg )

Ajit Jain, Buffett’s insurance leader for nearly 40 years, dumps more than half of Berkshire stake (cnbc )

Chinese chip making shows progress with new EUV patent from domestic lithography champion (scmp )

5B Southbound Trading Net Inflow to BABA-W (aastocks )

Consumer Staples Stocks Are Looking Pricey. It’s Time to Sell. (barrons )

CPI data tees up Fed to begin gradually cutting rates next week (wsj )

Shelter Inflation Makes 50 Basis Point Cut a Heavier Lift (wsj )

Goldman Sachs Strategists Say Stocks Unlikely to Sink Into Bear Market (bloomberg )

One of the world’s largest consulting firms will spy on employee locations as it forces workers back into the office (nypost )

Google and Apple Face Billions in Penalties After Losing E.U. Appeals (nypost )

Berkshire Hathaway Big Bet on Occidental Petroleum May Be Going Bad (barrons )

Lithium Mining Stocks Are Soaring. Supply Is the Reason. (barrons )

Alibaba Is Battling with Temu Parent PDD. Founder Jack Ma Says That’s a Good Thing. (barrons )

Inflation unexpectedly cools to slowest rate in more than three years (foxbusiness )

Alibaba Shares Rise on Hopes for Higher Demand From Mainland Investors (wsj )

Sunbelt Manufacturing Boom Lures Property Investors (wsj )

Fed Backpedals on Plan to Increase Big Bank Capital (wsj )

Topgolf Sent Callaway Into the Rough (wsj )

Lululemon Is Seeing a Slowdown in Its Women’s Business. Has It Reached Its Ceiling? (wsj )

Here Are the Key Takeaways From the US CPI Report for August (bloomberg )

Alibaba logistics arm Cainiao launches next-day delivery in Europe, builds new hubs (scmp )

Alibaba founder Jack Ma urges business empire to remain steadfast, ‘believe in the future’ (scmp )

“Mainland investors bought $400 million of stock today via Southbound Stock Connect versus yesterday’s $1.086 billion. It is worth noting Alibaba bought the equivalent of 719,500 US-listed ADRs yesterday, which means the buyback accounted for 4.7% of yesterday’s ADR volume (15.327 million ADRs shares traded).” (chinalastnight )