Skip to content

- ‘Lilo & Stitch,’ ‘Mission: Impossible’ Fuel Memorial Day Record (bloomberg)

- Cricket gives Disney-Ambani unit in India almost as many users as Netflix (ft)

- Goldman Sachs Expects Stronger Yuan to Boost Chinese Stocks (bloomberg)

- Alibaba chairman Joe Tsai says company on a ‘good path’ after years of setbacks (scmp)

- Wealthy investors see ‘time to buy’ Hong Kong stocks amid trade war: Standard Chartered (scmp)

- Chinese tech giants reveal how they’re dealing with U.S. chip curbs to stay in the AI race (cnbc)

- Alibaba’s Amap offers ride-hailing function catering to foreign visitors in China (scmp)

- American Homes Are Shrinking. Why Are They Still So Unaffordable? (wsj)

- Housing market shift: 80 major markets that are seeing falling home prices (fastcompany)

- Memorial Day weekend will see a surge in road trips with record-breaking travel expected (fastcompany)

- Trump Pushes Back Deadline on EU Tariffs to July 9 (wsj)

- Warren Buffett will retire as a CEO—but still plans to go into the office: ‘I’m not going to sit at home and watch soap operas’ (cnbc)

- Investors Pile Into ETFs at Record Pace Despite Market Turmoil (wsj)

- These 10 Charts Keep Us From Getting Bearish (zerohedge)

- Soaring bond yields threaten trouble (economist)

- US Wins First World Hockey Title Since 1933 With Victory Over Switzerland (bloomberg)

- Alex Palou Conquers the Indianapolis 500 and Finally Wins on an Oval (roadandtrack)

- Honda CEO Is All About Hybrids Now That EV Adoption Is ‘Pushed Back 5-6 Years’ (thedrive)

- Cox Automotive Q2 2025 Dealer Sentiment Index Reveals Market Momentum Amid Tariff Concerns (coxauto)

- More Homes Are for Sale. Who Is Listing in a Slow Market. (barrons)

- Zillow: Housing market to see first annual U.S. home price drop since 2011 (fastcompany)

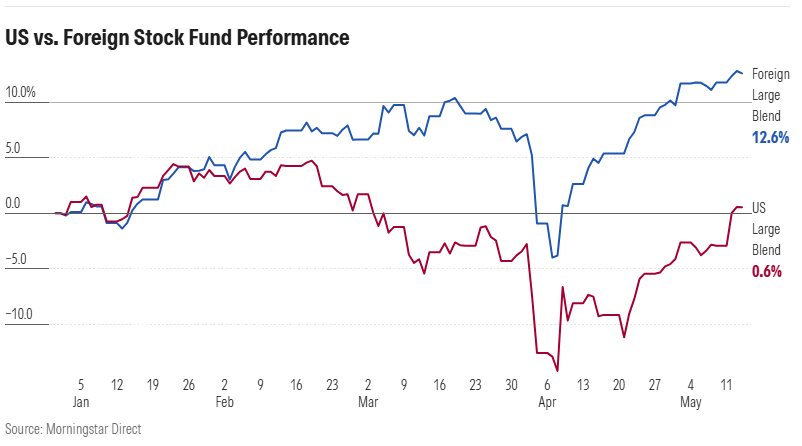

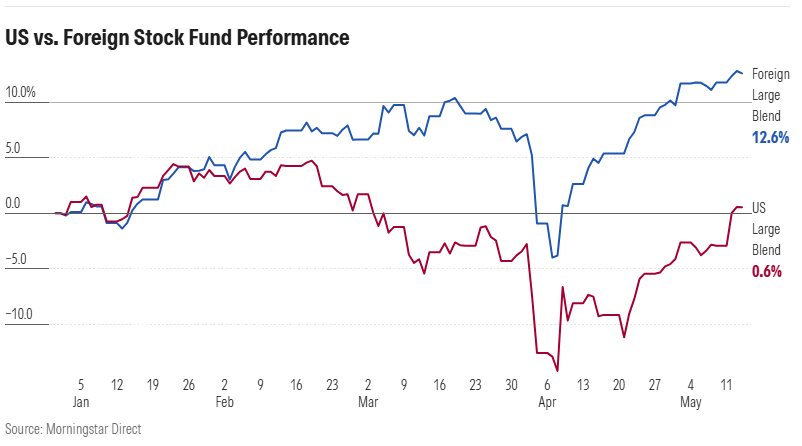

- Investors Are Getting a Taste of a Stock Market Without Big Tech Leadership (inc)

- Hedge Funds Finally Bought Stocks As Market Flip-Flopped (zerohedge)

- BEYOND Expo 2025: Alibaba Cloud founder Jack Wang wants to take AI to space (technode)

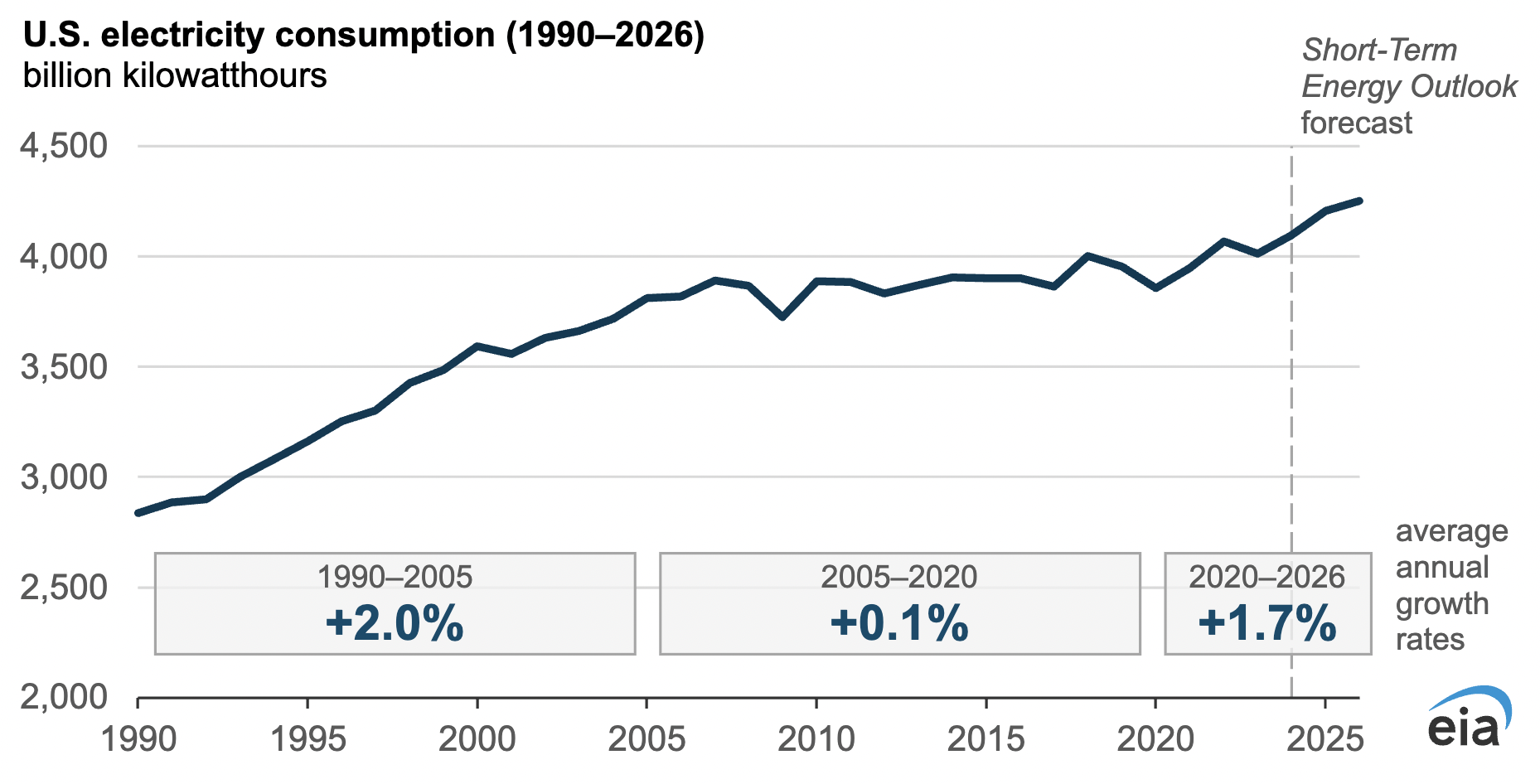

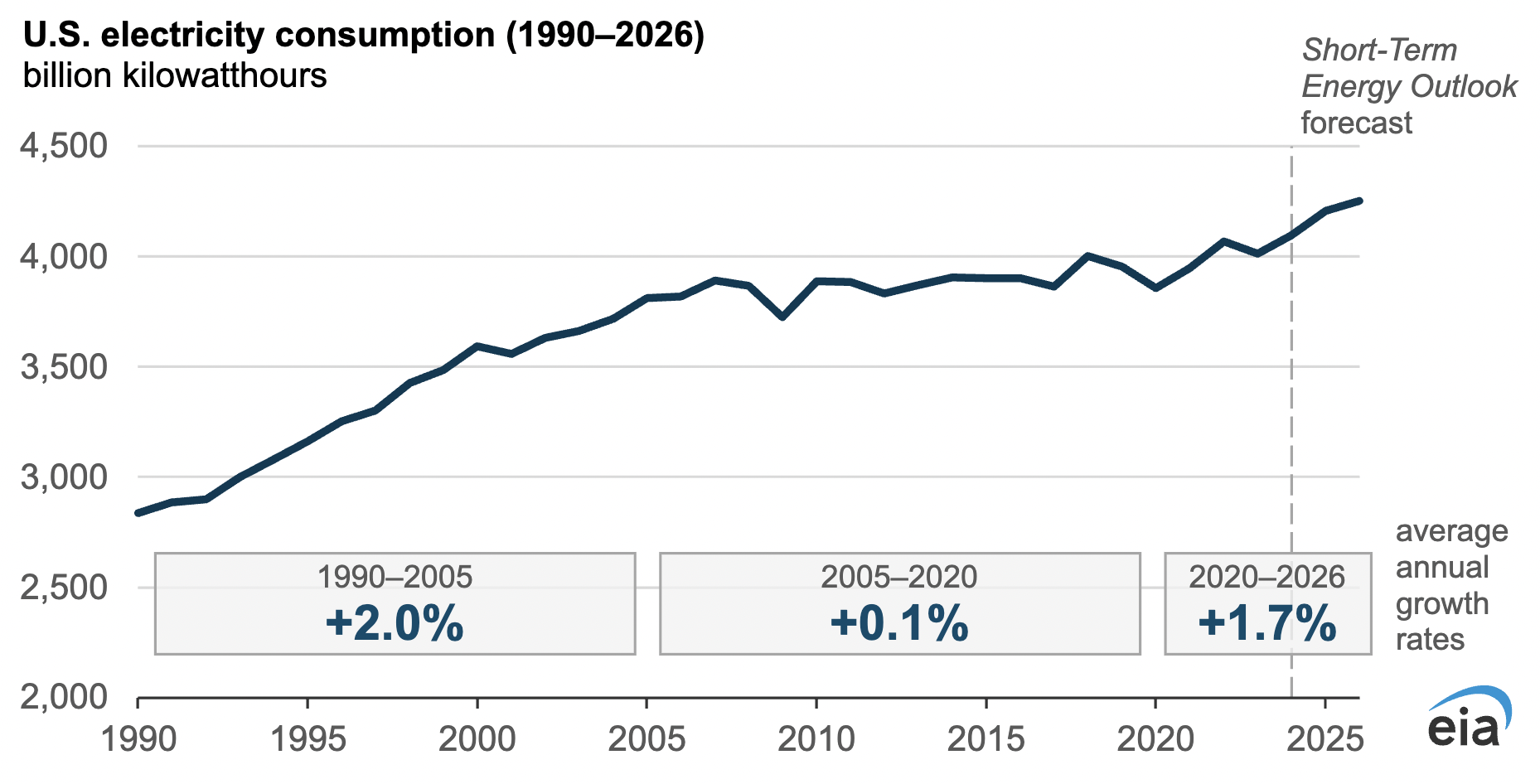

- AI Is Eating Data Center Power Demand—and It’s Only Getting Worse (wired)

- How Trump made a 30% tariff feel like a relief (npr)

- America’s 100 Greatest Golf Courses (golfdigest)

- Bessent Sees Easing Capital Rule on Treasuries This Summer (bloomberg)

- U.S. Treasuries Might Be Wildly Undervalued. Here’s an Example. (barrons)

- New home sales unexpectedly surge despite high mortgage rates as builders lower prices (nypost)

- First-Time Home Buyers Downsize Amid Tight Supply, High Interest Rates (wsj)

- Healthcare Stocks Are So Bad, They’re Good. What to Buy Now. (barrons)

- Boeing’s stock has been surging. Here’s why it has become a FOMO play. (marketwatch)

- Boeing in Tentative Agreement to Pay $1.1 Billion to Avoid Trial for 737 MAX Crashes (wsj)

- Bessent Sees ‘Several Large’ Trade Deals in Next Few Weeks (bloomberg)

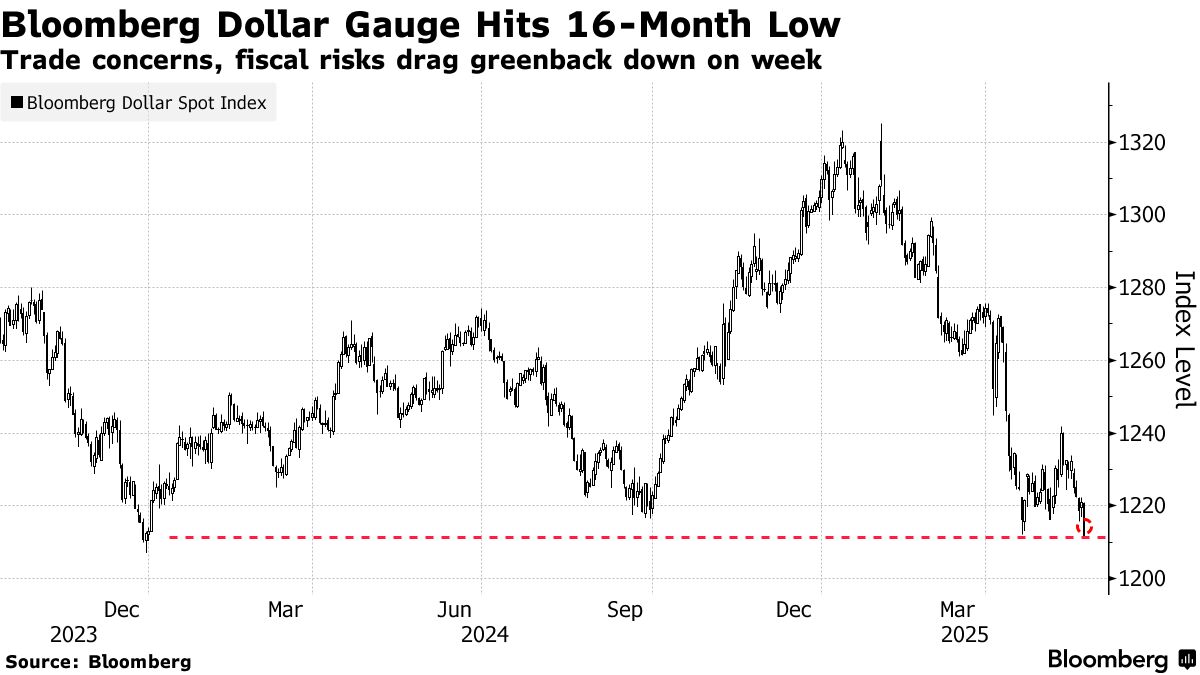

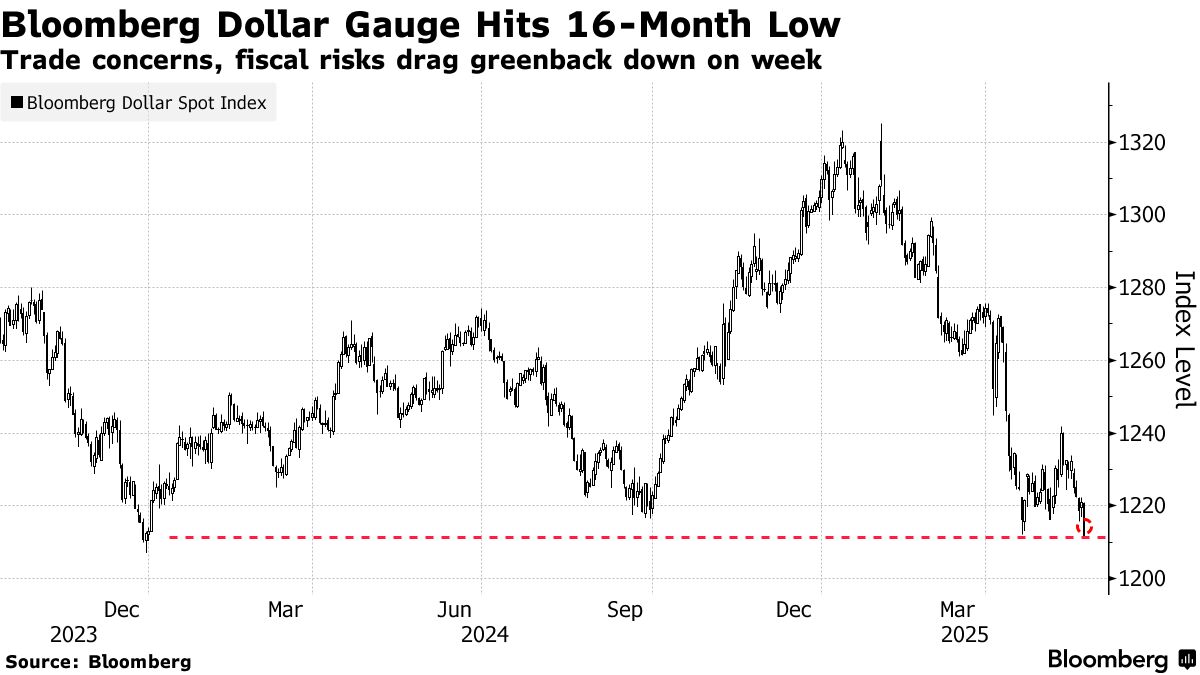

- Dollar Falls to Lowest Since 2023 as Investors Eye Trade Risks (bloomberg)

- Alibaba Chair Says Asian Firms Can Look For Growth Outside of US (bloomberg)

- The stock picker’s market is back: Chart of the Week (yahoo)

- The Best Basic Materials Stocks to Buy (morningstar)

- ‘Lilo & Stitch’ Thwarts ‘Mission’ While Shattering Box Office Records (forbes)

- GOP Bill Benefits Fossil Fuels, and Compensates for Adverse Impact (barrons)

- Ed Yardeni Says It’s Not as Bad as You Think (bloomberg)

- U.S. and China Hold First Call Since Geneva. Why It’s a Good Sign for Trade Talks. (barrons)

- Alibaba CEO doubles down on ‘unified global cloud network’ as Chinese firms expand abroad (scmp)

- Emerging market equity funds lure investors fleeing overvalued U.S. assets (reuters)

- How the US plans to break China’s stranglehold on lithium (ft)

- US Tariff Countdown Has Nations Racing to Turn Talks Into Deals (bloomberg)

- U.K. Retail Sales Rise for Fourth-Straight Month, Boosted by Warm Weather (wsj)

- Japan inflation climbs at fastest rate in more than 2 years (ft)

- It’s Time to Worry About Japan and the Yen Carry Trade Again (barrons)

- Dollar Could Drop Another 10%, Says Morgan Stanley’s Wilson (youtube)

- Bond Market Sees Trump Tax Bill as Big, and Not Beautiful (barrons)

- House budget bill effectively halts US clean energy boom (reuters)

- Hybrids still in the mix despite boom in fully electric cars (ft)

- Gas prices hit 4-year low ahead of Memorial Day weekend (nypost)

- Buyers are gaining the upper hand in a shifting housing market. ‘Everybody wants a deal.’ (marketwatch)

- Housing affordability is showing marginal improvement in some parts of U.S., says ICE’s Andy Walden (youtube)

- Home Price Declines Could Be on the Horizon. Don’t Expect Them to Crater. (barrons)

- Boeing back in ‘dynamic’ production mode, engine supplier Safran says (reuters)

- Advance Auto Parts Stock Soars 55%. Guidance Is Holding Up in the Face of Tariffs. (barrons)

- Consumer Stocks Have Taken It on the Chin. Buy These 8. (barrons)

- 10 Stocks with the Largest Fair Value Estimate Increases During Q1 Earnings (morningstar)

- UBS raises S&P year end target, eyes more gains in 2026 (reuters)

- Advance Auto Parts Maintains 2025 Outlook (wsj)

- Canada Goose Sales Unexpectedly Rise as Luxury Spending Holds Up (wsj)

- Canada Goose Avoids Tariff Woes With Made-in-Canada Supply Chain (bloomberg)

- Boeing’s Internal Safety Plan: Make Problems Easier to Report (wsj)

- Boeing increases 737 production pace as quality, safety culture improves (reuters)

- A Turnaround Stock to Buy Before It Rebounds Further (morningstar)

- A Building Boom on Federal Land? It Just Might Work. (bloomberg)

- The Best Financial-Services Stocks to Buy (morningstar)

- Resilient European Earnings Support the Bull Case for Stocks (bloomberg)

- U.K. Consumer Sentiment Lifts From Post-Trump-Tariff Lows, BRC Says (wsj)

- Why it Isn’t Time to Panic About the 20-Year Treasury Auction Yet (barrons)

- Hedge funds are shorting stocks again, boosting leverage to new record (marketwatch)

- Hedge Fund Trend Monitor: Q1 Short Interest Soars To 6 Year High (zerohedge)

- House Narrowly Passes Trump Tax-and-Spending Bill, Sends Legislation to Senate (barrons)

- Emerging markets said to see the next bull run as the ‘sell U.S.’ narrative gains ground (cnbc)

- Vietnam Cites Progress in US Trade Talks, Will Continue in June (bloomberg)

- Alibaba.com sees more US buyers after tariff pause (techinasia)

- Ultra Rich Wanted More China Exposure Before Trade War, UBS Says (bloomberg)

- Nvidia’s Jensen Huang thinks U.S. chip curbs failed — and he’s not alone (cnbc)

- Toyota Goes All-Hybrid With Its Best-Selling US Vehicle (bloomberg)

- Toyota Mulls Making Tiny Trucks for US Market as Demand Booms (bloomberg)

- Toll Maintains Home Sales Forecast as Luxury Demand Holds Up (bloomberg)

- Lowe’s sticks by full-year forecast as sales from home professionals boost business (cnbc)

- Dimon slams mortgage regulations for pushing rates higher, hurting lower-income homebuyers (foxbusiness)

- Great News DIYers: Home Depot CFO Reveals No Tariff Price Hikes (zerohedge)

- Home Sellers Are Dropping Prices But Buyers Aren’t Budging. What Could Change That. (barrons)

- QXO targets $50 billion in annual revenue, plans to double Beacon EBITDA (investing)

- Why Disney’s ‘Lilo & Stitch’ Is Set to Beat ‘Mission: Impossible’ at the Box Office (wsj)

- Streamers Are Finally Making Money. For Consumers, It’s Getting Messier. (wsj)

- Boeing Nears Key 737 Factory Milestone as CEO Steadies Factories (bloomberg)

- Boeing Stock Price Targets Are Rising. Where Shares Can Go Now. (barrons)

- Goldman Says Hedge Funds Cut Magnificent Seven, Bought China Stocks (bloomberg)

- Alibaba lands US$250 million convertible bonds deal, AI pact with selfie app giant Meitu (scmp)

- Alibaba and DeepSeek’s home province launches AI spending spree to become innovation hub (scmp)

- Nvidia’s Chief Says U.S. Chip Controls on China Have Backfired (nytimes)

- The AI Diffusion Rule is Over. What That Means for Trump and China. (barrons)

- Morgan Stanley turns bullish on most US assets, except dollar (streetinsider)

- For Goldman’s Trading Desk, Only Three Things Matter: CTAs, Buyback And Retail Buying (zerohedge)

- Options Traders Are Boosting Bearish Dollar Views to Record (bloomberg)

- Travel to U.S. Rebounds After Slump. It’s a Boost for These Stocks. (barrons)

- Never Bet Against Corporate America (zerohedge)

- VF Falls After Vans Owner Rushes Products to US to Beat Tariffs (bloomberg)

- VF earnings beat by $0.01, revenue topped estimates (investing)

- Canada Goose shares surge over 6% as Q4 results top estimates (investing)

- Canada Goose Profit Up But Withholds Guidance, Cites Tariff Uncertainty (wsj)

- China cuts benchmark lending rates for the first time in 7 months in Beijing’s growth push (cnbc)

- Alibaba, JD, and Other China Stocks Rise. What’s Giving Them a Boost. (barrons)

- China Banks Cut Deposit Rates to Aid Margins, Drive Spending (bloomberg)

- Understanding the US Housing Market in 2025: Mortgage Rates, Affordability, and Growth Trends (morningstar)

- Home Depot Maintains Guidance as US Spending Holds Up (bloomberg)

- A Third Of Russell 3000 Energy Companies Trade Below Book Value (zerohedge)

- Natural Gas Power Plants are Energy’s Biggest Buyout Targets (barrons)

- JPMorgan and Citi See European Stocks Blowing Past the US (bloomberg)

- Citi Sees Weaker Dollar After G-7 Meeting as US Softens Tariffs (bloomberg)

- Dollar set for more weakness as ‘Brand USA’ falls further out of favor (reuters)

- Tax Cuts Are Coming. Moody’s Warning on Debt Won’t Make a Difference. (barrons)

- Fundstrat’s Tom Lee: There’s not much signal in Moody’s U.S. downgrade (youtube)

- 5 Stocks to Buy to Profit From Trump’s Trade Deals (morningstar)

- Exclusive: Intel explores sale of networking and edge unit, sources say (reuters)

- Goldman: Biopharma Valuation Discount Hits Extreme Lows; Key Near-Term Catalysts In Focus (zerohedge)

- Bernstein raises Boeing stock price target to $249, maintains Outperform (investing)

- Retail Traders Go on Record Dip Buying Spree, Calming a Jumpy Stock Market (bloomberg)

- UnitedHealth Built a Giant. Now Its Model Is Faltering. (wsj)

- Nike Will Be the Winner If Dick’s Can Revive Foot Locker (bloomberg)

- Wall Street Banks Bet on Emerging Markets After Wasted Years (bloomberg)

- Despite US Rebound, International Stock Funds Continue to Lead (morningstar)

- Alibaba cements AI leadership as cloud unit reports fastest growth since 2022 (scmp)

- Exclusive | ‘Still a good time to buy’: Goldman urges value investors to make ‘precise’ stock picks (scmp)

- Ant Group Global Unit Brings in $3 Billion Ahead of Spinoff (bloomberg)

- Breaking down the US and Chinese markets’ recoveries (ft)

- Morgan Stanley’s Wilson Says Buy US Stock Dips After Moody’s Cut (bloomberg)

- Goldman Prime: OWICs Galore, Hedge Funds Stopped-In During Biggest Squeeze Since Dec 2021 (zerohedge)

- M&A Target Stocks Surge in Bet on Wall Street Dealmaking Rebound (bloomberg)

- Big Tech Goes From Stock Market’s Safest Bet to Biggest Question (bloomberg)

- What are the key similarities and differences between 2025 and 2000 (streetinsider)

- Bessent Dismisses Moody’s Downgrade as ‘Lagging’ Indicator (barrons)

- Why the U.S. consumer may be more resilient than many think (marketwatch)

- Intel debuts AI GPUs for workstation system as it works to gain ground on Nvidia, AMD (yahoo)

- Johnnie Walker Maker Diageo Expects Tariff Hit, But Sticks With Guidance (wsj)

- Diageo plans $500 million in cost savings by 2028, lowers tariff impact view (reuters)

- House Republicans Advance Trump’s “Big, Beautiful Bill” After Weekend Of Negotiations (zerohedge)

- Will Anyone Take the Factory Jobs Trump Wants to Bring Back to America? (wsj)

- Spain Boosts Costlier Gas Power to Secure Grid After Blackout (bloomberg)

- Clean Energy Is Under Attack Even Where It’s Booming (wsj)

- First LNG ship bunkering hub in US Gulf Coast secures permits to start work (reuters)

- Hartnett: How To Trade The “Next Big Bull Market” (zerohedge)

- The U.S. Doesn’t Have a Perfect Credit Rating Anymore. Investors Shouldn’t Worry Yet. (barrons)

- Does Moody’s US downgrade matter? (ft)

- M2 charts look good (scottgrannis)

- The Trump Administration’s New ‘Big Star’ Could Make All the Difference for Markets (barrons)

- Housing market shift explained—and where it’s happening the fastest (fastcompany)

- Housing market standoff: Gen Z wants in, but boomers are staying put (fastcompany)

- Why aren’t Americans filling the manufacturing jobs we already have? (npr)

- Is the market up or down? Republicans and Democrats disagree (economist)

- America has given China a strangely good tariff deal (economist)

- AliViews: Eddie Wu on Alibaba’s Q4 Earnings (alizila)

- The invisible tech revolution poised to make in-chat AI shopping real (yahoo)

- Disney parks boss Josh D’Amaro touts Mouse House bona fides as succession chatter rages (yahoo)

- Consumers Face Challenges as New-Vehicle Inventory Drops 7.4% in April Amid Tariff Uncertainty (coxauto)

- Scottie Scheffler took control of PGA Championship with 4 superhuman swings (golf)

- After more than a decade of little change, U.S. electricity consumption is rising again (eia)

- Data Centers’ Hunger for Energy Could Raise All Electric Bills (nytimes)

- 13 Energy Stocks to Buy Even as Oil Prices Fall, According to Roundtable Pros (barrons)

- Builder Stocks Shrug Off Bad Construction Data. Mortgage Rates Matter More. (barrons)

- U.S. Housing Starts Ticked Up in April (wsj)

- Hedge Fund Insider Sees Dollar Rout as Biggest Players Eye Exit (bloomberg)

- What a Weaker US Dollar Means for the Economy (bloomberg)

- Businesses Made a Big Tax-Cut Request. Republicans Said Yes—and Then Some. (wsj)

- Value investing is poised to rise from the dead (reuters)

- There’s a big disconnect between US economic vibes and what the data actually says (marketsinsider)

- Elite CEOs Don’t Need Earnings Guidance (wsj)

- Why Small Cap Stocks Are Ready For A Rebound (forbes)

- Push To Exempt Treasuries From Liquidity Ratio Is Boon For Bond Rally (zerohedge)

- Here’s What Hedge Funds Bought And Sold In Q1: 13F Summary (zerohedge)

- Trump Says He’s Willing to Travel to China for Xi Meeting (bloomberg)

- Alibaba Earnings: Results In Line, With Cloud Business to Drive Growth (morningstar)

- Vietnam steps up talks with US to reduce hefty tariff (reuters)

- U.S. Credit Gets Downgraded by Moody’s, the Last Triple-A Rating (barrons)

- U.S. Won’t Prosecute Boeing Over 737 MAX Crashes, WSJ Reports (barrons)