Skip to content

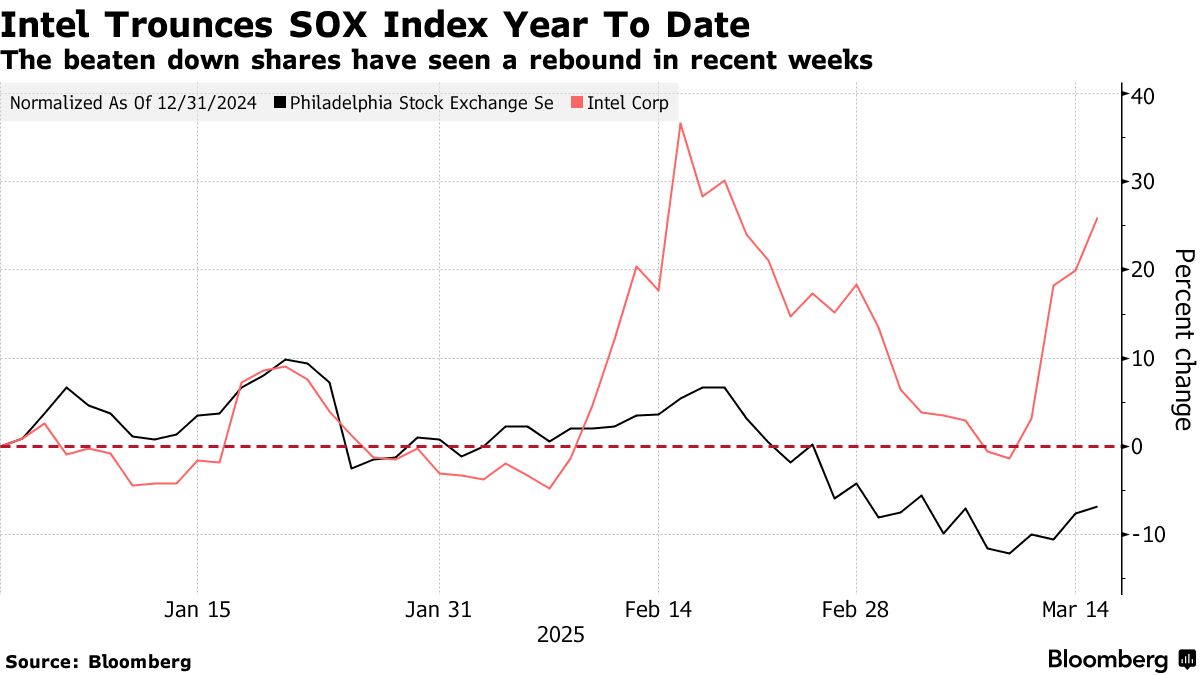

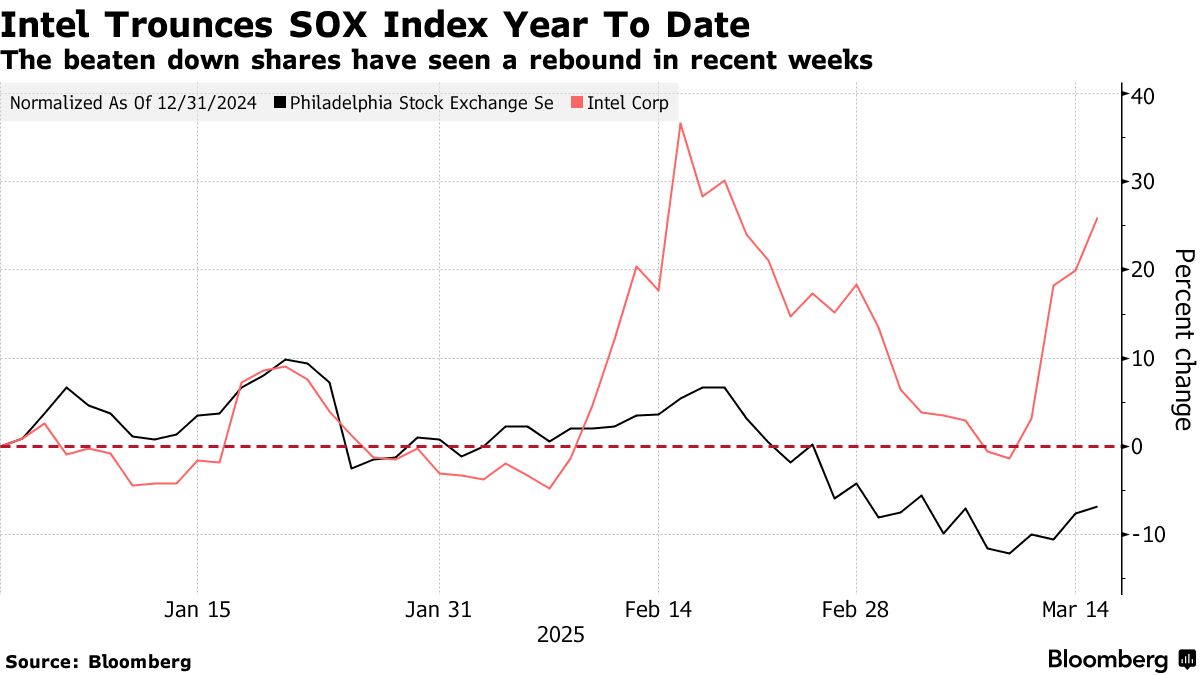

- Intel CEO Lip Bu Tan Completes $25 Million Stock Buy (barrons)

- Former Intel CEO Pat Gelsinger Makes a Few More Long-Shot Bets (wsj)

- TSMC’s $100bn pledge to Trump will not revive US chipmaking, says ex-Intel chief (ft)

- Alibaba Shows Off New AI Model After Warning U.S. Big Tech. It Looks Made for Apple. (barrons)

- Xiaomi Stock and the Rest of China’s ‘Terrific 10’ Are the Tech Bet for 2025 (barrons)

- China Raises Record $200 Billion From Bonds in Stimulus Signal (bloomberg)

- Chinese consumer companies signal spending is picking up again (cnbc)

- Alibaba launches new open-source AI model for ‘cost-effective AI agents’ (cnbc)

- Vice Premier Promotes Internet Companies (chinalastnight)

- US Economy Grew 2.4% Last Quarter, Faster Than Previous Estimate (bloomberg)

- Bank of America mortgage applications jumped 80% in Q1, executive says (reuters)

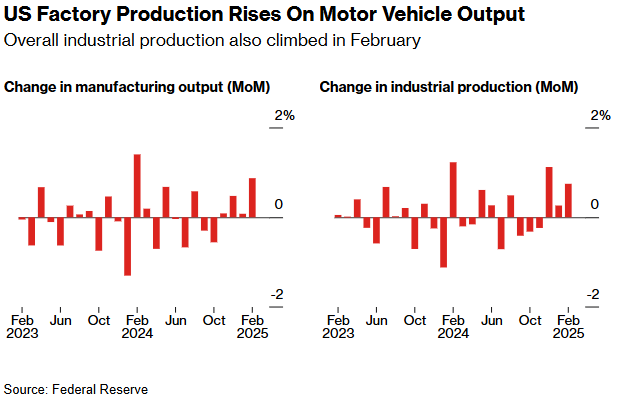

- Trump announces 25% auto tariffs. What it means for your next car purchase (usatoday)

- Asian, European Auto Stocks Fall After Trump Pledge to Impose 25% Tariffs on Imported Vehicles (wsj)

- Don’t Blame Trump for All of the Stock Market’s Problems (wsj)

- Bankers Were Dreaming of M&A Riches Under Trump. It Hasn’t Worked Out, Yet (bloomberg)

- U.S. Stocks Will Lag for Some Time. Here’s the Good News. (barrons)

- Hedge Funds Scoop Up Cyclical Stocks as Tariff Fears Swirl (bloomberg)

- Economic Growth Now Depends on Electricity, Not Oil (wsj)

- An Unusually Active Hurricane Season Is in Store for the Atlantic (bloomberg)

- Boeing Stock Could Gain From the Navy’s New Fighter Jet. How to Value the Decision. (barrons)

- Boeing-Lockheed’s Vulcan Approved for US Defense Launches (bloomberg)

- Why Brad Jacobs Is Spending $11 Billion on a Roofing Supply Business (bloomberg)

- Nvidia Stock Slumps. Everything Goes Wrong Everywhere, All at Once. (barrons)

- AI stocks weak on word Microsoft drops data center leases in U.S. and Europe (streetinsider)

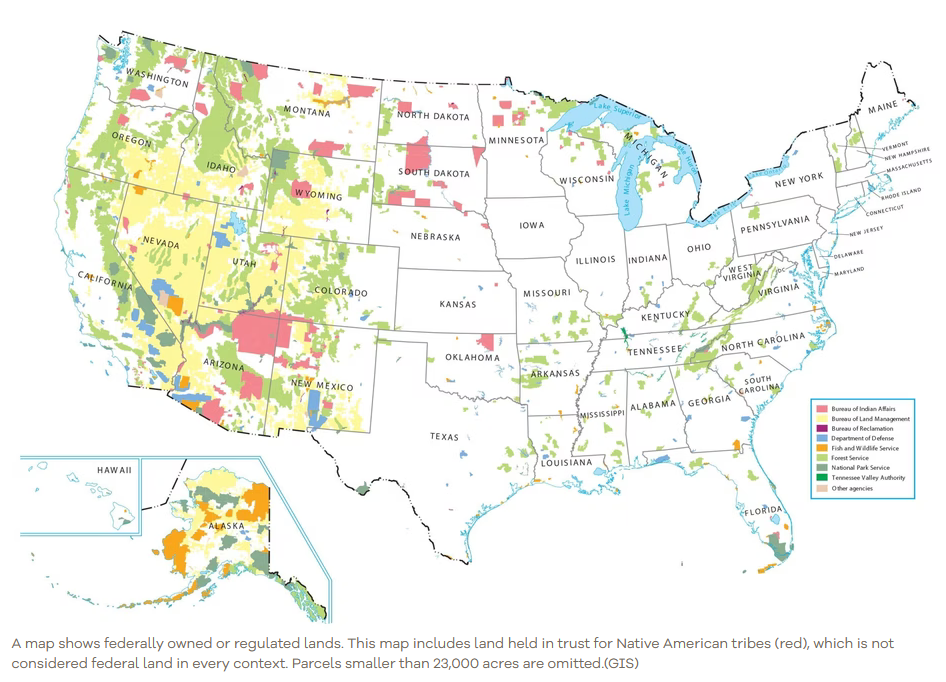

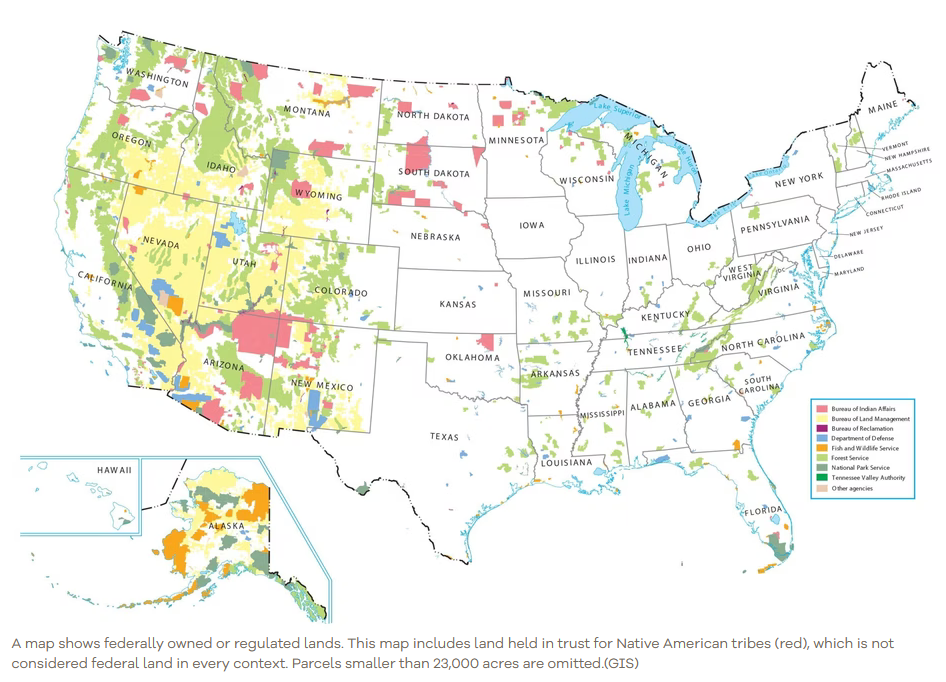

- Federal Land Can Be Home Sweet Home (wsj)

- A Solution to the Housing Shortage (cityjournal)

- Trump Moves Forward With Plans To Use Federal Land To Build Affordable Housing (realtor)

- HUD Secretary Scott Turner and DOI Secretary Doug Burgum Announce Joint Task Force To Use Federal Lands for Affordable Housing (hud.gov)

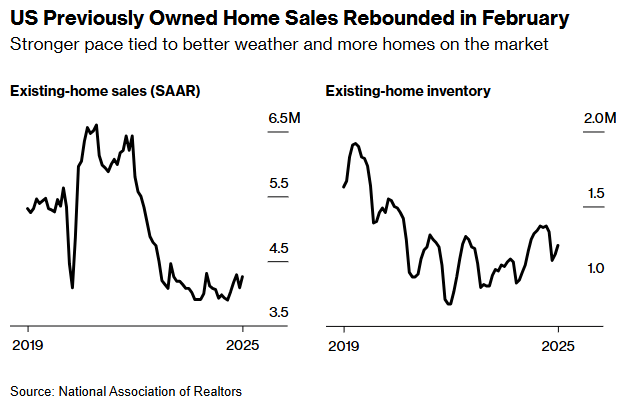

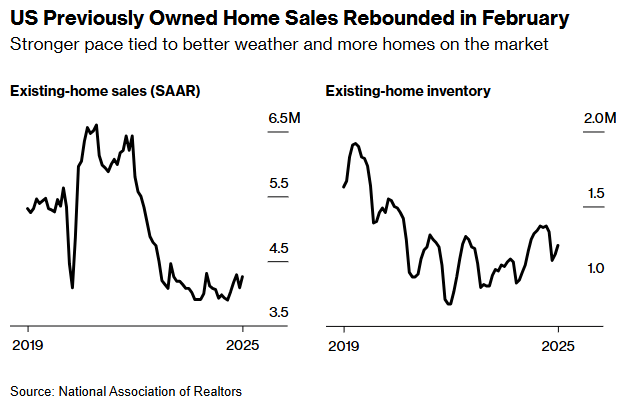

- Weekly mortgage demand from homebuyers is strongest in nearly two months (cnbc)

- Home buyers could see more deals on new homes as builders worry about a pullback (marketwatch)

- US New-Home Sales Rise Slightly Following Weather-Related Plunge (bloomberg)

- China Stocks Getting Back Into Investors’ Good Books (wsj)

- ‘China is back’ with stock appetite at post-2021 high, Morgan Stanley raises targets (scmp)

- China seen leading in chipmaking investment again in 2025, SEMI group says (reuters)

- China Floods the World With AI Models After DeepSeek Success (bloomberg)

- China Will Ramp Up Stimulus If Growth Falters, PBOC Adviser Says (bloomberg)

- Alibaba Teams Up With BMW to Develop AI for Cars in China (bloomberg)

- Alibaba, Ant partner with home province Zhejiang to support China’s AI drive (scmp)

- U.S. Adds Export Restrictions to More Chinese Tech Firms Over Security Concerns (nytimes)

- Nvidia Stock Stutters. Fears China Could Tighten AI Chip Controls Intensify. (barrons)

- Nvidia’s China sales face threat from Beijing’s environmental curbs (ft)

- Three Energy Charts Suggest China’s Demand Recovery Underway (zerohedge)

- Are There Now Real Alternatives To The US Equity Market? (zerohedge)

- Dollar Suffers Its Worst Month Since 2023 as Bullish Bets Recede (bloomberg)

- U.S. Faces Uphill Task to Refill Natural Gas Storage for Next Winter (wsj)

- Shell Wants to Be a Natural Gas Behemoth. Oil’s Growth Is Ending. (barrons)

- Boeing production of Patriot component hits record (reuters)

- Bring on the F-47 Fighter Jet (wsj)

- Exclusive: Advance Auto Parts completes mass closures, plans to open over 100 new stores (usatoday)

- 10 Cheap Wide-Moat Stocks for 2025 (morningstar)

- Dollar Tree Loss Widens, Confirms Sale of Family Dollar Business (wsj)

- Mobileye Stock Gains. Why a New Deal Has Shares Soaring. (barrons)

- Boeing Goes for Two Defense Wins in a Row With Navy Jet Fighter (barrons)

- Alibaba Stock Gains. Its AI Chips Could Be Gaining Traction in China. (barrons)

- Boeing Gets Lifeline in Pentagon Deal to Build Most Expensive Jet Fighter Ever (wsj)

- China Adviser Urges Boosting Consumption to 70% of GDP by 2035 (bloomberg)

- Alibaba says to restart hiring, sees signs of start of AI bubble in the US (reuters)

- Crown Castle Fires CEO After Selling Business Segments (wsj)

- Retailers Bulk Up Inventories to Blunt Tariff Impact (wsj)

- What Covid’s One-Hit Wonders Should Have Taught Us (wsj)

- Home Prices Likely Kept Climbing in January. Why a Slowdown Is Coming. (barrons)

- Housing Hopes! Goldman Sees Incremental Confidence From Prospective Buyers (zerohedge)

- Rising Temperatures Drive Surge in Energy Demand, IEA Says (wsj)

- German Business Confidence Climbs After Lawmakers Unlock Spending Increase (wsj)

- Tariffs Might Be Lighter Than Expected. It’s a Relief for Markets. (barrons)

- China explores services subsidy to boost weak domestic demand (ft)

- Chinese AI start-ups overhaul business models after DeepSeek’s success (ft)

- American CEOs Visit Beijing, Investors Ask: 5 BYDs or 1 Tesla? (chinalastnight)

- China’s commerce minister meets with Boeing Global president (reuters)

- Smithfield Foods expects growth in sales, profit on strong packaged meats demand (reuters)

- Jack Ma-Backed Ant Touts AI Breakthrough Using Chinese Chips (bloomberg)

- Trump Ally Visits Beijing to Pave Way for Xi Summit (wsj)

- China’s open-source embrace upends conventional wisdom around artificial intelligence (cnbc)

- Beijing pledges greater market access as top global CEOs gather at the China Development Forum (cnbc)

- Global Investors Tout Improving China Sentiment at Milken (bloomberg)

- Chinese Stocks Show Signs of Rotation From Small-Caps to Large (bloomberg)

- And the Winner Is….China! (zerohedge)

- BYD sales surge 29% on strong Chinese demand for hybrid cars (ft)

- Emerging-Market Assets Rebound on Signs of Targeted Tariffs (bloomberg)

- Dollar Weakness Becomes Profit Boon for US Multinationals (bloomberg)

- UK PMI Hits Six-Month High in Early Sign of Economic Turnaround (bloomberg)

- Euro-Zone Private Sector Picks Up as Germany Fuels Recovery (bloomberg)

- It’s been 25 years since European stocks beat U.S. rivals this way. Deutsche Bank still prefers ‘MEGA’ to ‘MAGA.’ (marketwatch)

- EU Trade Chief Sefcovic to Meet Greer, Lutnick in US Tuesday (bloomberg)

- Americans Are Choosing Smaller Vehicles (kbb)

- Disney’s ‘Snow White’ Tops Weekend Box Office, Despite Controversies (barrons)

- Americans Are Rushing to Get Off the Grid (bloomberg)

- US planning to exclude sector-specific tariffs on April 2, Bloomberg News, WSJ report (reuters)

- Exclusive: Airbus, Boeing eye fast output as plastics loom for future jets (reuters)

- Acting FAA Administrator on hiring air traffic controllers, airspace congestion and Boeing progress (youtube)

- BofA Securities resumes Generac stock with Buy, $182 target (investing)

- Google’s $32 billion Wiz deal may signal a turning point for slow IPO, M&A markets (cnbc)

- Shell CEO Seen Honing In on LNG at Strategy Day in New York (bloomberg)

- Beneath investors’ feet, the ground is shifting (economist)

- Why everyone is harping on about Guinness (economist)

- Carmakers rush to ship vehicles to US ahead of new round of April tariffs (ft)

- New-Vehicle Average Transaction Price Decreases Year Over Year and Incentives Increase (coxauto)

- Record 1.3 Million Electric Vehicles Sold (coxauto)

- Intel has great risk and great opportunity, strategist says (yahoo)

- Will Trump’s tariffs turbocharge foreign investment in America? (economist)

- U.S. tower stock valuations refreshed at MoffettNathanson (yahoo)

- Boeing’s double dose of good news: Fighter jets and cash (foxbusiness)

- Disney CEO Defends Park Pricing, Unveils New Tech and Plans 7 More Cruise Ships (yahoo)

- What might save China’s economy (npr)

- Just More Bull Market Stuff (allstarcharts)

- What Are AI Agents? Here’s How They Can Help You Get Stuff Done (inc)

- As Ovechkin nears the NHL goals record, the hockey world leans in to savor the moment (npr)

- Bugatti Just Made the New Tourbillon Hypercar Even Better (robbreport)

- 5 collector cars to put into your garage this week (classicdriver)

- Boeing Wins Next-Generation Jet Fighter Contract (wsj)

- Can Healthcare Stocks Keep Outperforming the Market? (morningstar)

- Wall Street Investors With Diversified Bets Are Winning at Last (bloomberg)

- South-east Asian markets roiled as investors turn to China (ft)

- US Trade Chief Greer Set for China Counterpart Call Next Week (bloomberg)

- Home sales see a bump in February thanks to higher-income buyers (marketwatch)

- Booze faces big tobacco moment (ft)

- Stocks & Rate-Cut-Hopes Rebound As Tariff ‘Flexibility’ Trumps FedSpeak (zerohedge)

- Traders Bet on Weaker US Dollar for First Time Since Trump’s Win (bloomberg)

- Carnival Says All Signs Point to Robust Cruise Demand Continuing (bloomberg)

- The North Face’s Latest High-Fashion Collab is Already Nearly Sold Out (shopeatsurf)

- Majority of AI Researchers Say Tech Industry Is Pouring Billions Into a Dead End (futurism)

- Housing Can Be Trump’s Legacy. Just Follow Lincoln’s Example. (barrons)

- Nike Stock Sinks. Its ‘Win Now’ Strategy Is Turning Into ‘Win Later.’ (barrons)

- Tesla Stock Sees 9th Straight Weekly Drop. Wall Street Is Worried. (barrons)

- Home Sales Rose 4.2% in February, Beating Expectations (wsj)

- ASOS Expects In-Line Revenue, Earnings Ahead of Views (wsj)

- Japan’s Inflation Slows Less Than Expected, Backing BOJ Hikes (bloomberg)

- Disney’s Robotic Droids Are the Toast of Silicon Valley (wsj)

- Germany Set for Trillion-Euro Defense and Infrastructure Splurge (wsj)

- High-End Travel Bookings Are Up. It’s a Good Sign for the Economy. (barrons)

- BofA Says Tariff Risk Dismissed as Stocks Get ‘Monster’ Inflows (bloomberg)

- Jacobs’ QXO acquires Beacon in first step to build $50 billion revenue powerhouse (streetinsider)

- Malaysia Airlines Orders Up to 60 Boeing Jets to Revamp Fleet (bloomberg)

- Tech war: Chinese AI models led by DeepSeek catch up with US rivals at lower prices (scmp)

- Billions Flowed Into New Leveraged ETFs Last Year. Now They’re in Free Fall. (wsj)

- Hedge fund pessimism over Wall Street hits 5-year high, Goldman says (yahoo)

- Nike Forecast Steeper Fourth-Quarter Sales Drop in Early Days of Turnaround (wsj)

- FedEx Stock Drops. Trade Fears Take a Bite Out Of Business Activity. (barrons)

- Building-Products Distributor QXO Clinches Deal for Beacon Roofing (wsj)

- China is tackling weak consumption with child care subsidies (cnbc)

- Boeing Sees Cash Flow Improve as Jet Factories Stabilize (bloomberg)

- Exclusive: Air India in talks for dozens of new widebody jets from Airbus, Boeing, sources say (reuters)

- BofA: Boeing’s March deliveries set for end of quarter surge (streetinsider)

- Fed Projections See an Economy Dramatically Reset by Trump’s Election (wsj)

- The Fed Pencils in 2 Rate Cuts. Anything Could Happen. (barrons)

- A Housing Expert Sizes Up the Outlook for Home Sales, Mortgage Rates, and Tariff Impacts (barrons)

- Is this the start of a period of European exceptionalism in markets? (ft)

- Hold the Obituary: Europe Comes to Life as U.S. Stumbles (wsj)

- US natural gas prices up on record flows to LNG export plants, cooler weather forecasts (reuters)

- Disney and Universal Prepare for a Theme Park Brawl. What’s at Stake in Orlando. (barrons)

- Temu-Owner PDD’s Revenue Misses Estimates as Expansions Slow (bloomberg)

- Nike’s Earnings Are Here. Expect News About Its Turnaround. (barrons)

- Signs of an Office Market Bottom: ‘The Worst Is Probably Over’ (nytimes)

- The Dream Team With a ‘Miracle’ Coach: Can Anyone Stop This Hockey Powerhouse? (wsj)

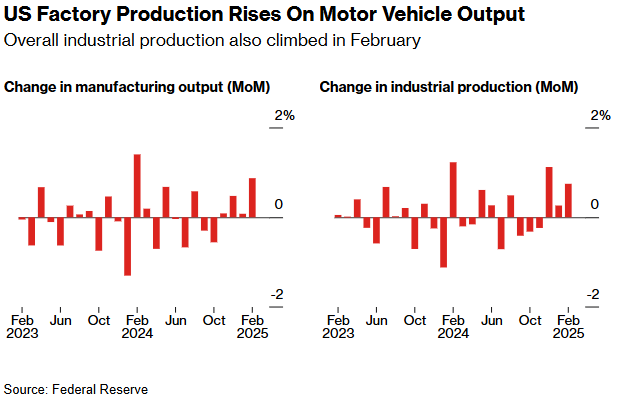

- US Factory Production Rises by Most in a Year on Auto Output (bloomberg)

- Investors Are Ditching U.S. Stocks. When That Could Be a Buy Signal. (barrons)

- China markets are set to outperform Wall Street as U.S. exceptionalism comes to a pause (cnbc)

- China Banks Cut Consumer Loan Rates to Record Low to Spur Demand (bloomberg)

- Confidence in German economy surges as parliament approves huge spending plan (marketwatch)

- Tencent AI Plans Seen as Key for Further China Tech Stock Gains (bloomberg)

- Retail investors ditch buy-the-dip mentality during the market correction (cnbc)

- Big Tech’s data center boom poses new risk to US grid operators (reuters)

- The ‘Energy Transition’ May Be Disappearing, but Renewable Energy Isn’t (barrons)

- Why China is suddenly flooding the market with powerful AI models (ft)

- China Electric Vehicles Roar (Silently) (chinalastnight)

- Dollar Is In The Crosshairs As Europe Jumps US Ship (zerohedge)

- Japan Airlines to buy 17 more Boeing 737-8s (reuters)

- Ram Owner Wants to Bring Cheaper Pickup Back to US (bloomberg)

- Dell CEO explains why he thinks the PC refresh cycle is starting (cnbc)

- The North Face Just Took an Era-Defining ’90s Jacket Off Ice (gq)

- Nike Returns to Sports While Investors Impatiently Await Reset (bloomberg)

- 10 Best Value Stocks to Buy for the Long Term (morningstar)

- March Dot Plot to Highlight Fed Officials’ Outlook (wsj)

- Nvidia Was Once a Hot Stock, Why It’s Now Leaving the Market Cold. (barrons)

- Intel’s new CEO is putting his money where his mouth is (marketwatch)

- Exclusive: Intel’s new CEO plots overhaul of manufacturing and AI operations (reuters)

- Intel’s New CEO Faces ‘Show Me’ Moment After $22 Billion Rally (bloomberg)

- Why is China spending billions to get people to open their wallets? (bbc)

- Alibaba and Other Chinese Stocks Are Crushing U.S. Shares. Here’s Why. (barrons)

- More China Consumers Feel Better Off, Deutsche Bank Survey Shows (bloomberg)

- China’s Onshore Markets See Record Inflows Despite Trade Angst (bloomberg)

- Hong Kong stocks hit 3-year high on hopes Trump-Xi talks could ease trade tensions (scmp)

- Alibaba’s ‘killer app’: Quark draws positive reviews in China as AI agent race heats up (scmp)

- The Action Plan For Boosting Consumption Includes Stock Market & Real Estate Support (chinalastnight)

- Donald Trump says China’s Xi Jinping to visit US in ‘not too distant future’ (ft)

- Cheap Chinese Cars Are Taking Over Roads From Brazil to South Africa (bloomberg)

- Warren Buffett said it’s best to ‘be greedy when others are fearful,’ Thomas Hayes says (foxbusiness)

- BofA Survey Shows Biggest-Ever Drop in US Stock Allocations (bloomberg)

- Corporate Insiders’ Buying Burst Gives Confidence to S&P Bulls (bloomberg)

- Bessent Sees No Reason for Recession, Economic Data ‘Healthy’ (bloomberg)

- How many rate cuts does the market expect this year? (foxbusiness)

- Cadillac expects one of every three vehicle sales to be EVs in 2025 (cnbc)

- More home builders cut prices to lure buyers put off by high costs (marketwatch)

- US Housing Starts Increase by More Than Forecast After Storms (bloomberg)

- Germany’s economic sentiment hits 2-year high, EU exports to US soar (yahoo)

- Euro hits five-month high before German vote on massive spending surge (streetinsider)

- Short Positioning Can Push Euro Yet Higher (zerohedge)

- What to Expect During Disney’s Annual Meeting (morningstar)

- Norwegian Cruise Stock Gets an Upgrade. Why Demand Fears Are Just ‘Noise.’ (barrons)

- Yeti Stock Surges on Deal with Activist (barrons)