Skip to content

China must not panic over deflation and reinflate a bubble (scmp )

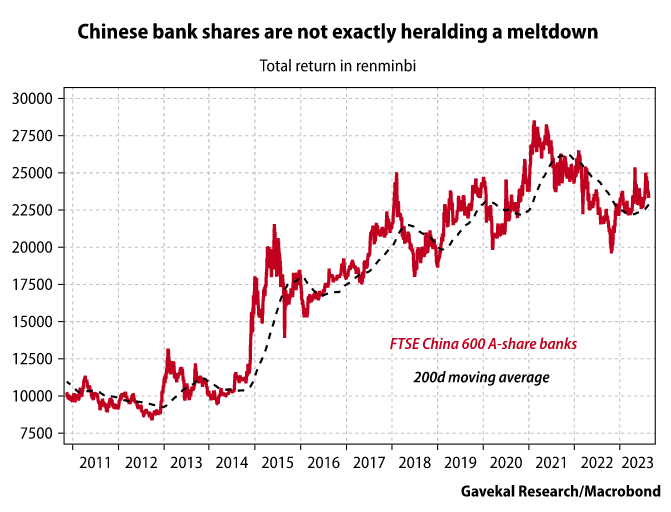

Making Sense Of The China Meltdown Story (gavekal )

From one of our loyal VideoCast viewers: Cooper-Standard Holdings: An Impressive Turnaround Story That’s Just Getting Started (seekingalpha )

For the full year, Advance now sees sales coming in at about $11.3 billion, up a little from prior guidance of $11.25 billion. (barrons )

Bank of America Trading Desks Gain Ground With More Capital, Headcount (bloomberg )

Goldman Sachs cancels ‘Summer Fridays,’ wants employees in office 5 days a week (marketwatch )

Column: A US-China detente to avoid ‘fiscally assured destruction?’ (reuters )

Kelcy Warren purchases nearly $40 million in Energy Transfer shares (finance.yahoo )

Betting Against U.S. Debt Has Cost Ackman This Year (institutionalinvestor )

China’s Services Sector Emerges as Bright Spot (bloomberg )

Sudden Rally in China Stocks Has Traders Scratching Their Heads (bloomberg )

U.S. Commerce secretary set to visit China as high-level talks continue (cnbc )

PayPal’s stock could be near its ultimate bottom, analyst says (marketwatch )

BABA Reportedly Establishes T-head Company in Beijing to Expand Integrated Circuit Sales (aastocks )

Baidu Smashes Estimates (barrons )

China Was Meant to Be the Travel Sector’s Next Tailwind. Why It Still Can Be. (barrons )

It Will Be Earnings—Not Bond Yields—That Finishes 2023’s Rally (barrons )

The Worker Bidding War Is Over. Companies Are Cutting Pay for New Hires. (wsj )

The Arm IPO Will Test Investors’ AI Conviction (wsj )

China’s Firmer Stance on Yuan Sparks Relief in Emerging Markets (bloomberg )

Satya Nadella Says AI Is a Tidal Wave as Big as the Internet (bloomberg )

How to View China’s Cautious Stimulus (bloomberg )

China Ramps Up Fight With Yuan Bears (bloomberg )

Stocks are still much better than bonds for generating long-term wealth, Wharton professor Jeremy Siegel says (businessinsider )

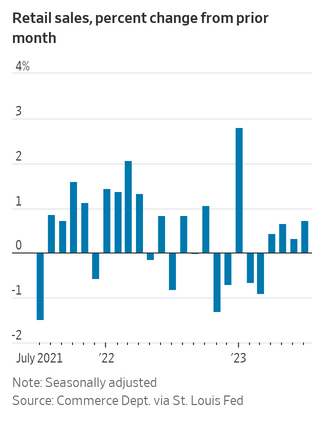

There are 2 big catalysts that could spark a stock market rally this week, according to Fundstrat (businessinsider )

Mark Zuckerberg’s new ‘in-person time policy’ will crack down on Meta’s remote work rebels (finance.yahoo )

Nvidia may be the AI stock for now, but here are the picks for later, says Goldman Sachs (marketwatch )

Hawaiian Electric says it’s not planning a restructuring after Maui wildfires, but seeking advice to ‘endure’ as a strong utility (marketwatch )

analysis | China’s underwhelming rate cuts aimed to ‘protect bank profit margins’ (scmp )

Oppenheimer’s John Stoltzfus on why he’s keeping his 4,900 price target for the S&P 500 (cnbc )

The Fed’s Jackson Hole Meeting Is Powell’s Big Moment (barrons )

Analysis: Why PayPal’s stablecoin is likely to succeed where Facebook’s Libra failed (reuters )

Visa and Mastercard Are Under Attack. They Will Do Just Fine. (barrons )

Parents shift to Venmo, PayPal, Zelle to pay teens (foxbusiness )

Will August stock-market stumble turn into a rout? Here’s what to watch, says Fundstrat’s Tom Lee. (marketwatch )

Rates in China Cut Again, but by Less Than Expected (wsj )

Kraft Heinz Sees a $25 Billion Opportunity—in Schools (wsj )

Macau Reclaims Crown From Vegas as World’s Top Gambling Hub (wsj )

After 10 Years of My Ride, Our Writer Reveals What He Drives. Hint: It’s Not a Porsche. (wsj )

China Urges More Loans, Debt Risk Reduction as Woes Compound (bloomberg )

China’s financial regulators urge support for resolving local debt risks (cnbc )

Pessimism about China’s property market overblown, says veteran economist (scmp )

Shanghai vows 2-hour project approvals to woo foreign investments (scmp )

Why a default isn’t the worst possible news for Country Garden (scmp )

Bilibili Reports Q2, Officials Signal More Stimulus, Week in Review (chinalastnight )

An Auto-Parts Retailer Crashed—It Can Be Fixed (wsj )

China unveils measures to revive stock market (reuters )

China Urges More Loans, Debt Risk Reduction as Woes Compound (bloomberg )

Lamborghini, Ferrari, Rolls-Royce: The Best Debuts at Monterey Car Week (bloomberg )

How to Get Rich and Famous From a Stock Market Crash (wsj )

This New 263-Foot Superyacht Has a Grecian-Inspired Beach Club That Belongs in a 5-Star Hotel (robbreport )

Aston Martin Goes Topless With DB12 Volante Convertible (maxim )

Alibaba Cloud launches AI video creation tool Live Portrait (technode )

China’s internet regulator talks with foreign firms to address concerns over new data law (technode )

Is the U.S. Economy Really Growing by 5.8%? Not So Fast (barrons )

China set to cut lending rates as economic recovery drags (ft )

China Local Governments to Sell $206 Billion of Financing Debt (bloomberg )

GLP-1 Drugs Are Coming, and They Could Change Everything (bloomberg )

Is there a ‘life hack’ to break 80 for the first time? 2 top teachers have an idea (golf )

TIPS vs Gold: which is the better inflation hedge? (scottgrannis )

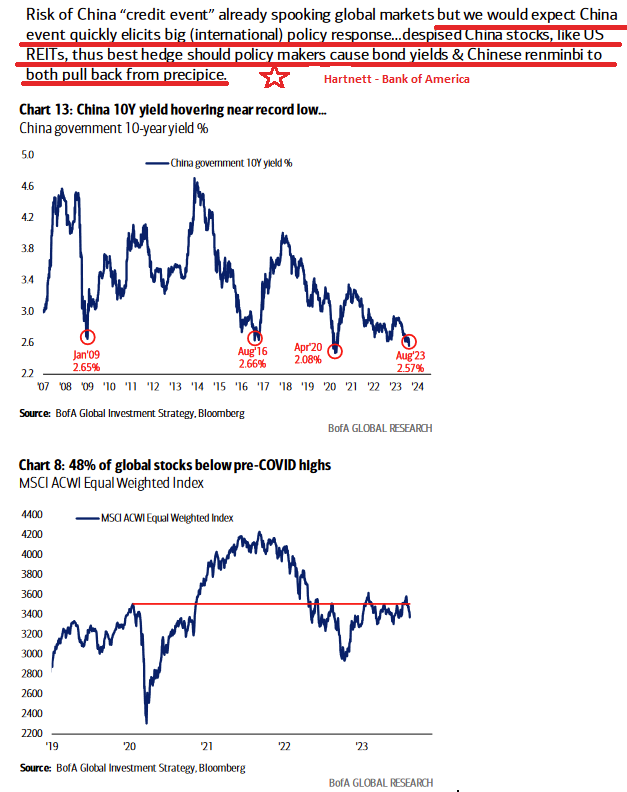

How serious is China’s economic slowdown? (piie )

China Isn’t Japan in the 1990s. How Its Economic Meltdown Is Different. (barrons )

Generac Is a Growth Stock at a Value Price. Buy It Before the Storms Start. (barrons )

Alibaba Unit to Hire 2,000 Graduates as Big Tech Crackdown Eases (bloomberg )

Alibaba, Tencent renew hiring as Big Tech gears up for growth (scmp )

CSRC vows to boost ‘vitality, efficiency and appeal’ of stock market (scmp )

We are close to bottoming from recent market decline, says Fundstrat’s Mark Newton (cnbc )

A Booster Shot for Your Portfolio (barrons )

AI Is the Real Deal—if You Understand It. Our 5 Roundtable Pros Are Here to Help. (barrons )

How Kroger Became the Biggest Sushi Seller in America (wsj )

China moves to shore up investor confidence in the economy (ft )

What Wall Street needs to know about UAW talks, a potential strike and what it could all cost (cnbc )

Will August stock-market stumble turn into a rout? Here’s what to watch, says Fundstrat’s Tom Lee. (marketwatch )

Italian Scientists Research Whether Eating Pizza Carries Health Benefits (futurism )

The 10 Best Dividend Stocks (morningstar )

China Needs to Engineer a Beautiful Deleveraging (Ray Dalio )

Amazon’s Pharmacy Deal Shows It Is More Than Tech (barrons )

What CVS Faces After Being Dropped by Insurer (barrons )

Opinion: Bears are knocking at the door but bulls still hold the key to this stock market (marketwatch )

U.S. Mortgage Rates Jump to Highest Level Since 2002 (nytimes )

Trump Says He’s ‘Not A Fan’ of Powell (bloomberg )

Despite China’s economic troubles, Cramer says its market won’t collapse (cnbc )

Would You Spend $60 Million on a Ferrari? (wsj )

China Evergrande files Chapter 15 bankruptcy in New York (scmp )

Wage growth won’t mean a new inflationary spiral, says Wharton Professor Jeremy Siegel (cnbc )

Alibaba, JD.com Stocks Rebound. China Sets Out Plan to Hit Growth Targets. (barrons )

China’s premier says country will work to achieve growth targets (cnbc )

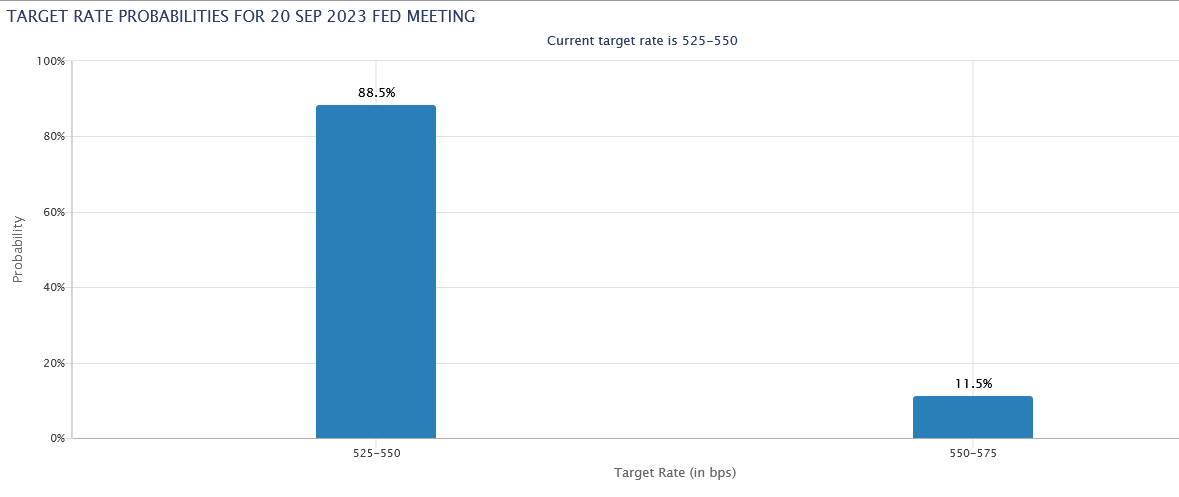

Some Fed Officials Are Turning Cautious about Raising Rates Too High (wsj )

It’s a matter of ‘when not if’ Apple buys ESPN, says Wedbush’s Dan Ives (cnbc )

Fed signals more scepticism over need for further rate rises (ft )

I’m not that worried about a strike by the UAW, it’s not a reason to sell, says Jim Cramer (cnbc )

PayPal Stock Can’t Catch a Break. A Big Investor Cut Its Stake. (barrons )

Google-Parent Alphabet Wants to Rein In Costs. The Unit Housing Waymo Is in Its Sights. (barrons )

K. Inflation Slows, but Still a Worry (wsj )

A Big Health Insurer Is Ripping Up the Playbook on Drug Pricing (wsj )

Walmart raises full-year forecast as grocery, online growth fuel higher sales (cnbc )

Pharma stocks are typically shunned by Wall St. when people feel confident about economy: Jim Cramer (cnbc )

China’s state banks seen selling dollars for yuan in London and New York hours (reuters )

Ant Group’s Alipay widens support for Visa, Mastercard, other major credit cards (scmp )

China Shadow Bank Crisis Sparks Protest by Angry Investors (yahoo )

Global Yields March to 15-Year Highs as Rate-Hike Worries Build (bloomberg )

China Police Visit Shadow Bank Investors at Home to Quash Unrest (bloomberg )

Why is China not rushing to fix its ailing economy? (reuters )

China Pledges Domestic Consumption Expansion to Boost Growth (bloomberg )

China Asks Some Funds to Avoid Net Equity Sales as Markets Sink (bloomberg )

com’s Sales Beat Estimates Despite Chinese Economy Weakness (bloomberg )

China Digs Deeper Into Toolbag in Grapple With Investor Gloom (bloomberg )

China Will Have to Put More Fiscal Policy to Work: Leong (bloomberg )

China Is Buying the Most Iranian Oil in a Decade, Kpler Says (bloomberg )

Why China’s Reopening Isn’t Providing Enough Youth Employment (bloomberg )

OMNI PGA Frisco Resort, a new star in golf travel (golfdigest )

TENCENT (00700.HK) Expects Domestic Games Revenue to Resume YoY Growth in 3Q23 (aastocks )

Inflation is on a glide path towards sub-2% by the middle of next year, says Fundstrat’s Tom Lee (cnbc )

Surprise Rate Cut Confirms Economic Support Measures (chinalastnight )

Furious Investors Protest Outside China’s Insolvent Shadow Banking Giant After It Misses Payments, Warns “Liquidity Has Suddenly Dried Up” (zerohedge )

Shoppers Boost Retail Sales for Fourth Straight Month (wsj )

Biden’s China Investment Rules Go Far Enough (bloomberg )

Tepper increased his stake in Alibaba Group Holding Ltd, buying 4,375,000 shares for a total holding of 4,475,000 shares. (yahoo )

Loeb’s investment company increased its Alibaba Group Holding Ltd. BABA, position by 122% to 2.95 million shares that were worth $245.9 million as of the end of the period. (marketwatch )

Chinese stock funds attracted $4.4 billion in 8 days, fueling speculation of a state-run buying-spree (businessinsider )

Wall Street Is Ready to Scoop Up Commercial Real Estate on the Cheap (wsj )

PBOC Adviser Says China Urgently Needs to Boost Consumption (bloomberg )

China Central Bank Unexpectedly Cuts Rates (bloomberg )

China Cuts Rate by Most Since 2020 as Economic Woes Deepen (bloomberg )

China Mulls Stamp Duty Cut to Revive Slumping Stock Market (bloomberg )

China Halts Youth Jobs Data, Stoking Transparency Concerns (bloomberg )

The Fed’s Interest-Rate Debate Is Shifting (bloomberg )

‘Magnificent 7’ Stock Meltdown Costs Investors $632 Billion (investors )

Home Depot Tops Earnings Estimates, Launches $15 Billion Stock Buyback (barrons )

Jim Cramer says new Trump indictment, not weak China economic data, is reason for depressed sentiment (marketwatch )

Intel and Synopsys Expand Partnership to Help Foundry Customers Build Chips Faster (barrons )

Chriss is currently executive vice president and general manager of Intuit’s small business and self-employed group, which generates more than half of the TurboTax parent’s revenue (PYPL). (wsj )

Kraft Heinz Names Carlos Abrams-Rivera as Next CEO (wsj )

Fitch warns it may be forced to downgrade dozens of banks, including JPMorgan Chase (cnbc )

China on course to become the world’s No.1 car exporter by end of year (cnbc )

New PayPal CEO Alex Chriss ‘is a good fit,’ analyst says (yahoo )

Yeti and Newell both might be buys, says Jim Cramer (cnbc )

PayPal Picks Intuit Executive as CEO. He Needs to Stop a Stock Slump. The Stock Market Is Falling. (barrons )

China Looks to Attract Foreign Investment as Its Economy Struggles (finance.yahoo )

PayPal Names Intuit’s Alex Chriss CEO, Replacing Schulman (bloomberg )

Why It’s Time to Get Happy. (barrons )

Legendary investor Seth Klarman just got back into Amazon and bought three other stocks (marketwatch )

A smooth ‘last mile’ to 2% inflation may not be a stretch for Fed (reuters )

BNP Paribas Is Still ‘Overweight’ China, Hong Kong Stocks (bloomberg )

China Ending Crackdown Brings Optimism in Tech Earnings (bloomberg )

The UAW vs. The Big Three: Why the union’s wish list isn’t ‘going to happen’ (finance.yahoo )

Morningstar: These 10 dividend stocks have increased their payouts every year for the past 5 years and look cheap right now (businessinsider )