Skip to content

Why the Drivers of Lower Inflation Matter (wsj )

Commercial property markets aren’t closed (ft )

1st 8 or 9 Days of August Weaker Pre-Election Years (Almanac Trader )

Katie Ledecky passes Michael Phelps for most individual golds at world championships (npr )

Zillow is so sure that U.S. home prices have bottomed that it just issued bullish calls for these 48 housing markets (fortune )

The 50 Greatest Luxury Hotels on Earth (robbreport )

Test-Driving The 207-MPH Flying Spur Speed On The Ultimate Bentley Road Trip (maxim )

Watch This $4 Million McLaren Solus Race Car Win The Goodwood Festival Of Speed Shootout (maxim )

The Aston Martin Valour Is An Awesomely Old-School V12 Muscle Car (maxim )

2023 Lotus Emira Review: Playtime Is Over (thedrive )

Ant Group plans restructuring ahead of Hong Kong IPO (technode )

Alibaba logistics unit Cainiao offers domestic express services, directly competing with rivals (technode )

The Disney Magic Will Return. It’s Time to Buy the Stock. (barrons )

China Moves to Bolster Consumer Industries, Grow Fledging Bourse (bloomberg )

Billionaire Mark Mobius says he’s so bullish on emerging markets that all his money is outside the US (businessinsider )

Investing in Liberty Stock Is Tricky. Do It Anyway. (barrons )

‘It’s a great, great time for bulls’: Soft-landing views solidify in U.S. stock market (marketwatch )

Investing in Liberty Stock Is Tricky. Do It Anyway. (barrons )

For the Stock Market, Earnings Are Everything—and More Than Enough (barrons )

Eli Lilly, Pfizer, and Others Are Working on Weight-Loss Pills. What to Know. (barrons )

Small-Cap Stocks Have Struggled. Here Are 6 Whose Time Has Come. (barrons )

The U.S. Economy Is Sticking the Soft Landing (wsj )

Biogen Deal for Reata Signals a Turn to Rare Diseases (bloomberg )

China’s Central Bank Chief Is Task Master Xi Couldn’t Let Retire (bloomberg )

Hedge Funds Turn More Bullish Across Energy as Prices Rally (bloomberg )

Traders Are Risking It All on Bets That Market Boom Will Last (bloomberg )

Intel stock rallies after earnings show AI data-center beat, strong PC sales (marketwatch )

The Fed’s favorite inflation measure cooled down even further in June (cnn )

8 Book Recommendations By Joel Greenblatt (acquirersmultiple )

The Pritzkers: Buffett’s Blueprint (substack )

Billionaire Ken Fisher on how to invest in AI, intelligently (theglobeandmail )

Ford Earnings: Remarkable Strength As Pro Segment Profits Explode (morningstar )

Intel jumps 7% as it returns to profitability after two quarters of losses (cnbc )

China Bulls Look for Redemption as Beijing Shows Policy Resolve (bloomberg )

Biogen agrees to acquire Reata Pharmaceuticals for $7.3 billion in cash (marketwatch )

China’s housing ministry is getting ‘bolder’ about real estate support (cnbc )

The Disney Magic Will Return. It’s Time to Buy the Stock. (barrons )

Drugmakers Want to Crush Medicare’s Pricing Power. They’ll Probably Succeed. (barrons )

Fed Goes From Stocks’ Boogeyman to Markets’ Pal (barrons )

Key US Inflation, Wage Measures Cool in Boost for Soft Landing (bloomberg )

US Consumer Sentiment Rises to Highest Since 2021 as Prices Ease (bloomberg )

Bank of Japan Surprise Foreshadows End to Key Anchor for Global Bond Yields (bloomberg )

Hedge funds rush to buy China stocks on economy stimulus prospects – Goldman (reuters )

China Asks Banks to Bankroll Tech in Latest Private Sector Boost (bloomberg )

GDP grew at a 2.4% pace in the second quarter, topping expectations despite recession calls (cnbc )

The Most Interesting Economic News This Week Won’t Come From the Fed (barrons )

The S&P 500 Hasn’t Had Many Ugly Days This Year. That’s a Pretty Good Sign. (barrons )

Federal Reserve Raises Interest Rates to 22-Year High (wsj )

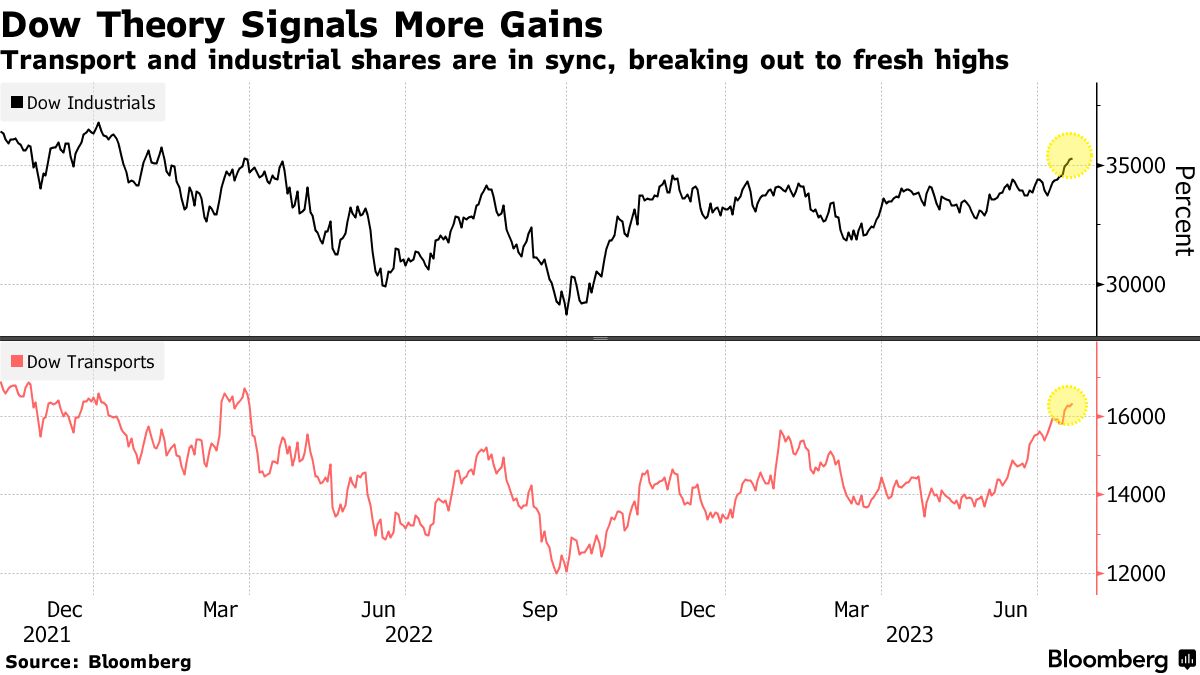

Dow Notches Longest Winning Streak Since 1987 (wsj )

Biotech Stocks Join AI-Fueled Rally (wsj )

PacWest, Banc of California Merge to Get Smaller. Others May Follow. (wsj )

Investors Can Read the Fed’s Poker Face (wsj )

What Fed Hikes? Much of Americans’ Debt Is Still Riding Ultralow Rates (wsj )

Inside the world’s hardest place to get a reservation with a 4-year waitlist (nypost )

How Regional Banks Got Healthy Again (nytimes )

A Beach Club Dinner and Jamie Dimon’s Touch: How PacWest Was Rescued (bloomberg )

Rolls-Royce Takes the Fast Lane Out of Pity City (bloomberg )

Meta stock gains after earnings, guidance from Facebook parent top expectations (yahoo )

Ant IPO Gets Back To Where It All Began (chinalastnight )

Big Tech earnings are sending the bears into hibernation mode, says Dan Ives (cnbc )

Alibaba Cloud to Support Meta AI Model for Chinese Users. Why It’s a Big Deal. (barrons )

CN State Media Says Stimulus Measures for Capital Mkts Anticipated to Be Launched Intensively (aastocks )

“Something Very Strange Has Happened”: Albert Edwards Stunned By “The Maddest Macro Chart I Have Seen In Many Years” (zerohedge )

Chinese stocks set to bounce back as strong earnings revive confidence: analysts (scmp )

Alibaba Cloud Releases All-in-one HTAP Database Solution (aastocks )

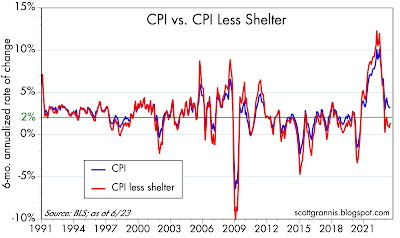

Inflation is heading to zero, according to the one factor Jerome Powell absolutely will not discuss (marketwatch )

Microsoft, Google Are Key Earnings Movers After S&P 500 Hits New High; Fed Rate Hike Due (ibd )

Google Earnings Beat Views Amid Rising AI Investments To Drive Ad, Cloud Growth (ibd )

Fed Set to Raise Rates to 22-Year High and Decide If It’s Done Hiking (bloomberg )

AT&T’s Results Eclipse Lead Problems (barrons )

Global Economy Shows Signs of Resilience Despite Lingering Threats (nytimes )

Fed Set to Hike as Hawks and Doves Diverge (bloomberg )

How Jack Ma’s Ant Group Is Inching Toward IPO Reboot (bloomberg )

Rolls-Royce Enters Fast Lane on Turnaround: The London Rush (bloomberg )

Boeing’s quarterly results top expectations as airplane deliveries pick up pace (cnbc )

Think there’s an AI bubble in the stock market? Think again. (businessinsider )

Month-End Politburo Meeting Happens Sooner Than Expected (chinalastnight )

I’m excited for what Alzheimer’s drugs will do for patients, says GE Healthcare CEO Peter Arduini (cnbc )

This is the start of a new tech bull market, says Dan Ives after Big Tech earnings (cnbc )

Chinese Investors Are in a Waiting Game: BNP Paribas (bloomberg )

3M Earnings Beat. The Stock Is Rising. (barrons )

3M raises full-year profit forecast (reuters )

‘We Were Wrong’: Morgan Stanley’s Wilson Offers Stocks Mea Culpa (bloomberg )

China hints at bringing in a stimulus package to support its faltering economy (businessinsider )

Cracks Inside the Fed Deepen at Crucial Moment in Inflation Fight (bloomberg )

China Names Pan Gongsheng as New Central Bank Governor to Revive Economy (bloomberg )

China’s New Central Banker Once Fixed a Crisis. He May Need to Again. (nytimes )

China’s Foreign Minister Replaced After Unexplained Absence (wsj )

S. Weighs Potential Deal With China on Fentanyl (wsj )

GM tops earnings estimates and raises guidance for the second time this year (marketwatch )

It’s Microsoft Earnings Day. Watch AI and the Cloud. (barrons )

Dividend Stocks Are a Victim of AI’s Success. It’s Time to Buy. (barrons )

Verizon Delivers Earnings Beat Despite Revenue Miss. The Stock Is Rising. (barrons )

Alphabet Kicks Off Big Tech Earnings on Tuesday (barrons )

GM delivered 691,978 vehicles in the U.S. in the second quarter, up from 582,401 delivered in the second quarter of 2022. (barrons )

Stocks of Chinese developers jump after Beijing signals support for property sector (marketwatch )

Stock-market ‘meltup’ will continue as long as there’s no sign of recession, says Steve Eisman of ‘Big Short’ fame (marketwatch )

Why the Fed Isn’t Ready to Declare Victory on Inflation (wsj )

Here Come the Family EVs (wsj )

No one is really embracing this rally as an upward new bull market, says Fundstrat’s Tom Lee (cnbc )

GM CFO Jacobson on Second-Quarter, Outlook, EV Demand (bloomberg )

President Xi Gets Involved in 2nd Half Economic Planning (chinalastnight )

Chinese Traders Hope Xi’s Lifeline Will Sustain Rally (bloomberg )

Xi Goes Into Overdrive to Talk Up the Economy: Balance of Power (bloomberg )

Warren Buffett Lifts Fossil Fuel Bets (bloomberg )

The Fed needs to stay put on rates (ft )

Hedge Funds Brawl Over Battered Commercial Real Estate (wsj )

Commercial Real Estate Sentiment vs. Reality (bloomberg )

China has announced a slew of measures to bolster its economy. Here’s what we know so far (cnbc )

President Xi Chairs CCP Politburo Meeting, Laying out 2H23 Econ Work (aastocks )

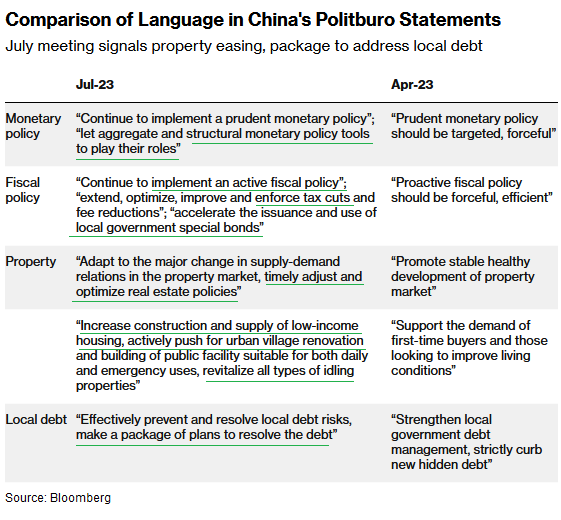

China Holds Off on Major Stimulus as It Signals Property Easing (bloomberg )

China’s Alibaba says will not join Ant Group share buyback (reuters )

Xi’s Housing Speculation Warning Left Out of Politburo Statement (bloomberg )

Earnings Are the Tech-Stock Rally’s Next Big Test (barrons )

The AI Bubble Isn’t Big Enough. Why There’s More Upside Ahead for Big Tech. (barrons )

Restaurants Are Packed Again. Earnings Will Show How Long They’ll Stay That Way. (barrons )

Elon Musk Says Twitter Will Change Its Logo to X (wsj )

IPO Market Awakens From Long Slumber (wsj )

Why Businesses Can’t Stop Asking for Tips (wsj )

Big Pharma Bets Big on China (wsj )

Beijing Offers Love, but Chinese Entrepreneurs Aren’t Buying It (nytimes )

Fed, ECB Weigh End-Game After Next Rate Hikes to Curb Inflation (bloomberg )

A ‘momentous week’ ahead as the Fed, ECB and Bank of Japan near pivot point (cnbc )

China to resume 15-day visa-free entry for citizens of Singapore and Brunei (cnbc )

Podcast: Why We May Be About to See the Shortest Housing Cycle Ever (bloomberg )

China Politburo Shifts Stance on Property, Keeps Fiscal Language (bloomberg )

China to Review Official Appointments, Removals Tuesday (bloomberg )

China’s Options to Retaliate in Trade Fight With US Are Limited (bloomberg )

Altice USA Said to Be Considering a Sale of Cheddar News (nytimes )

China’s Politburo Aims To Stabilize Property Market By Intensifying “Counter-Cyclical Adjustments” (zerohedge )

AT&T, Verizon Investors Have More Than Lead Cables to Worry About (wsj )

China Addresses Investor Concerns in Global Fund Meeting (bloomberg )

The Fed and the Dollar (bloomberg )

I repeat: the Fed is done (scottgrannis )

Is the Dollar Still King? (cfr )

Trucks, transfers and trolls (npr )

Explained: How to tell if artificial intelligence is working the way we want it to (mit )

Are Semiconductors (SMH) Setting Up For A Historic Breakout? (seeitmarket )

Here Are the Actual Mechanics Behind Powering AI (bloomberg )

Brian Harman’s ‘waggle’ is going viral. Here’s why the Open leader does it (golf )

One moment from Jon Rahm proved he isn’t like the rest of us (golf )

The secrets of a superbomber: Understanding 6-foot-8 Christo Lamprecht’s golf swing (gollfdigest )

Fed Readies Another Rate Hike in Pivotal Week for Central Banks (bloomberg )

Amazon Is Asking Some Employees to Relocate, Return to ‘Main Hub’ Offices (wsj )

America’s Bet on Wind Power Is Running Into a Big Problem (barrons )

Alibaba Group Chairman Daniel Zhang’s 2023 Letter to Shareholders (alizila )

Alibaba Top Executive Regains Partnership (bloomberg )

Alibaba Annual Report (alibaba )

The Bear Market Has Nearly Been Erased, Fewer Than 20 Months After It Began (bloomberg )

Tony Bennett, Jazzy Crooner of the American Songbook, Is Dead at 96 (nytimes )

Federal Reserve officially launches new FedNow instant-payments service (cnbc )

Big Regional Banks Reported Stable Deposits. For Investors, That Counts as Great News. (wsj )

The 10 Best Dividend Stocks (morningstar )

Seth Klarman – Timeless Value Investing (EP.328) (youtube )

Investor Mario Gabelli ’67 Shares Insights on the Shifting Landscape of Value Investing: From Graham to Buffett and Beyond (columbia )

Wharton Professor Jeremy Siegel: Here’s why the Fed should stop raising rates (cnbc )

First Drive: Lotus’s 905 HP All-Electric SUV Has the Power to Challenge Lamborghini and Ferrari (robbreport )

Are AT&T and Verizon’s Dividends Safe? Here’s the Math. (barrons )

Even this longtime bull is worried about cracks in the tech-stock rally. Here’s how Tom Lee expects the market to shake out. (marketwatch )

AutoNation Beats Profit Estimates on Demand for New Cars (barrons )

China’s $100 Billion Tutoring Ban Backfires, Spawning Black Market (bloomberg )

Comerica stock up 5% after earnings beat target on increased loan activity (marketwatch )

Housing’s Recession Already Happened (wsj )

These Energy Companies Don’t Need Sky-High Oil and Gas Prices (wsj )

Sergey Brin Is Back in the Trenches at Google (wsj )

Threads User Engagement Continues to Decline (wsj )

Road Trip Like James Bond in Aston Martin’s DB12 (barrons )

Xi Jinping Praises Henry Kissinger in Beijing, in Veiled Message to Biden Administration (wsj )

Buffett’s Florida Bet Bodes Well for Troubled Insurance Market (bloomberg )

China Vows Urban Redevelopment Support to Boost Construction (bloomberg )

Starwood chairman, known as a bargain-hunting investor during downturns, sees opportunities in bank failures, commercial-property slump. (bloomberg )

McIlroy pleased with level-par start (theopen )

President Xi commented China is ready to “…explore with the United States the right way for the two countries to get along and take their relations steadily forward, which will be good for both sides and deliver benefits to the world.” (chinalastnight )