Skip to content

S&P Global Mobility projects US sales volumes to reach 16.2 million units in 2025 (athensceo )

Cox Automotive is forecasting new light vehicle sales to continue to improve modestly in 2025, reaching 16.3 million by year’s end. (coxauto )

Improved Operating Income and Positive Cash Flow Highlight Cooper Standard’s Fourth Quarter and Full Year 2024 Results (cooper standard )

Intel Stock Is Climbing Like It Did Back in the ‘80s. Here’s What’s Driving Shares. (barrons )

Alibaba Stock Surges on Apple Collaboration Reported. Why China Tech Is Back in Style. (barrons )

Skeptics Circle European Stocks After $1 Trillion 2025 Rally (bloomberg )

Auto Executives Try to Sway Trump on Tariffs, EV Subsidies (wsj )

Renewed interest in China AI may offset US tariff concerns (bloomberg )

Mortgage rates dip to lowest level of 2025, lifting hopes for spring home-buying season (marketwatch )

Jack Ma Spotted Visiting Hema Store in Changsha, after Showing up at Alibaba HQ in Hangzhou (aastocks )

Could see joint ventures between Intel and TSMC, says Patrick Moorhead (cnbc )

Intel’s stock is on a run not seen in more than two decades (marketwatch )

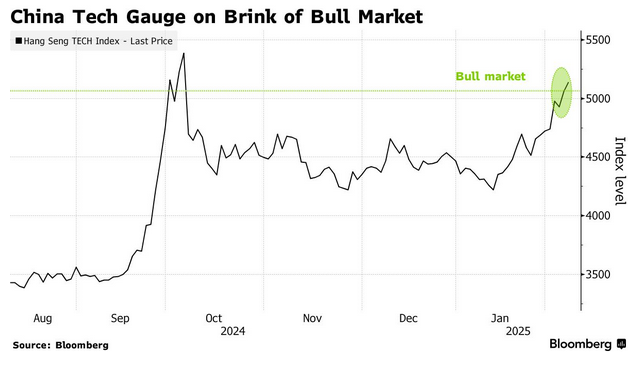

China Tech Stocks Head for Highest Level Since Reopening Rally (bloomberg )

JPMorgan Chase Begins Layoffs, With More Planned, After Record Profits (barrons )

IAC Stock Rises. Barry Diller Is Returning to the Top With a Vision. (barrons )

Inflation Hits 3% for the First Time in 7 Months (barrons )

Israel Sees Opening for Strikes on Iranian Nuclear Sites, U.S. Intelligence Finds (wsj )

The Trump Tracker: What the President Has Done So Far (wsj )

China Land Sales Show Property Market Stabilizing, Report Says (bloomberg )

Boeing to Cut Fewer Moon Rocket Jobs After ‘Daily’ NASA Talks (bloomberg )

QXO Seeks to Replace Beacon Roofing Board After Bid Snubbed (bloomberg )

US Tariffs Will Weaken Dollar If Nations Strike Back, Bank of America Says (bloomberg )

Apple’s AI partnership with Alibaba excites Chinese iOS developers ahead of conference (scmp )

With DeepSeek, China moves to take on Nvidia’s CUDA ecosystem (scmp )

Wall Street, UBS see upside for Chinese AI stocks with rally at less than halfway mark (scmp )

SoftBank swings to a loss ahead of big AI infrastructure bet on Stargate Project (scmp )

Alibaba Becomes China’s New AI Darling With $87 Billion Rally (bloomberg )

Alibaba pairs with Apple to develop AI features for China iPhones: source The US tech giant wants Alibaba’s Qwen AI model to make up for loss of Apple Intelligence on its iPhones in China (scmp )

Alibaba’s Qwen powers top 10 open-source models as China AI know-how goes beyond DeepSeek (scmp )

Billionaire investor David Tepper boosts China bet to 37% of his firm’s portfolio (scmp )

Jack Ma visits second-hand marketplace Xianyu as Alibaba’s AI grabs attention (scmp )

Is Intel now a Trump stock? Its shares surge after upbeat comments by J.D. Vance. (marketwatch )

The Magnificent 7 Are So Last Year. Cash Cows Are the New Kings. (wsj )

Powell Tells Congress Fed Still in No Rush to Lower Rates (bloomberg )

China’s Xi Is Building Economic Fortress Against U.S. Pressure (wsj )

China’s New Game Plan for Dealing With Trump Tariffs (bloomberg )

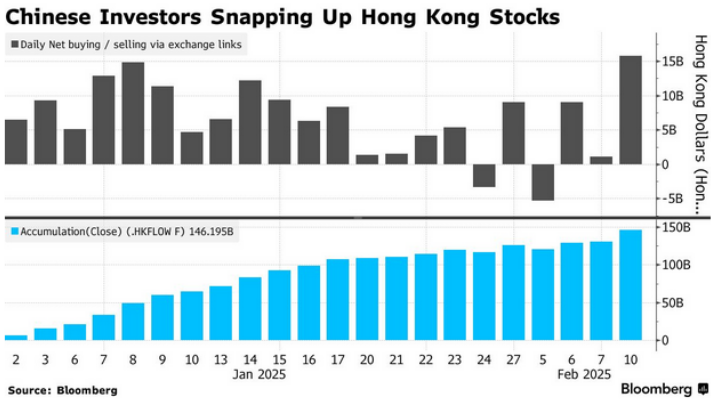

Chinese stock bulls add to record buying spree in Hong Kong as DeepSeek fuels rally (scmp )

Disney cuts diversity category from executive pay scheme (ft )

David Tepper’s ‘Everything’ China Trade Has a New Plot (bloomberg )

Chinese Investors Drive Hong Kong Rally With $19 Billion Inflow (bloomberg )

AI for the price of a sandwich: Alibaba’s Qwen enables US breakthroughs(scmp )

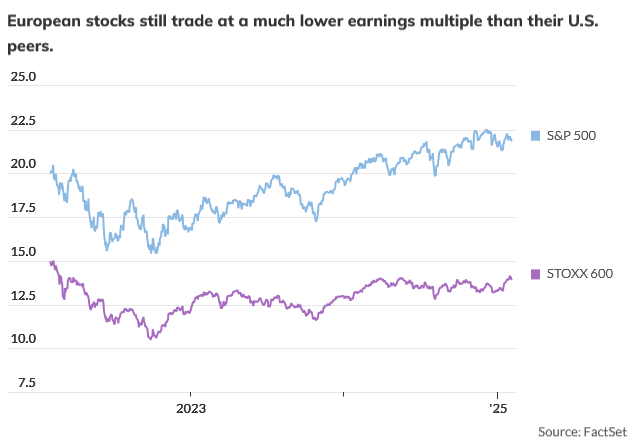

Europe’s Unloved Stocks Are Suddenly on Top of the World (wsj )

European gas prices hit two-year high as cold weather boosts demand (ft )

Japan’s borrowing costs soar to 14-year high (ft )

Good news for thrifty car buyers: Automakers bring back the base trim (marketwatch )

Tepper Lifts China Bet, Undaunted as Stimulus-Fueled Rally Fades (bloomberg )

Appaloosa added to stakes in Alibaba (marketwatch )

Alibaba’s DeepSeek Integration Fuels Rally (chinalastnight )

The ‘Magnificent Seven’ companies just did something they haven’t in two years. Goldman says it’s time to make a shift. “This marks the first quarter with no positive sales surprises for the [‘Magnificent Seven’] since 2022,” Kostin and his team told clients in a recent note. (marketwatch )

These cheap stock markets could make you more money than the usual picks (marketwatch )

A Sore Spot in L.A.’s Housing Crisis: Foreign-Owned Homes Sitting Empty (wsj )

Billionaire Investor Tepper’s Firm Loves China. Alibaba Is Its Biggest Bet. (barrons )

Value Stocks Are Outearning Forecasts. (barrons )

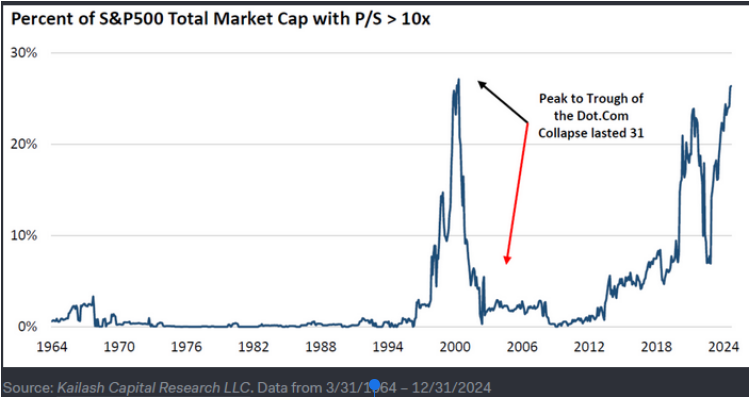

3 Reasons It’s Time to Sell Some Magnificent 7 Stock (barrons )

The New Wave of AI Is Here (wsj )

Elliott Builds $2.5 Billion-Plus Stake in Phillips 66 (bloomberg )

Alibaba offers more DeepSeek AI models, denies investment rumours (scmp )

Iron Dome coming, positive for these stocks – TD Cowen (streetinsider )

Analysts expect China property recovery in 2025 after seeing January improvement (scmp )

Teach Your Children to Preserve Family Wealth, Not Squander It (barrons )

Trump Wants ‘Reciprocal Tariffs’ on Any Country. What That Means. (barrons )

6 Steps to Raising Money-Savvy Children (barrons )

The bond market just sent a message about Trump’s second term. Stock investors should listen. (marktwatch )

Trump administration orders Consumer Financial Protection Bureau to stop work (marketwatch )

DeepSeek Sent Silicon Valley Reeling. In China, It’s a Different Story. (barrons )

The Magnificent 7 Stocks Are the New Staples. Is It Time to Worry? (barrons )

Hiring Slows but Remains Solid, With Economy Adding 143,000 Jobs (wsj )

Elliott Takes Stake in Struggling Oil Giant BP (wsj )

The most successful people all have this mindset, Hollywood producer says: ‘The room is better because I’m in it’ (cnbc )

‘Private Banker’ TV Drama Explores the Secret World of Japan’s Ultra-Rich (bloomberg )

China Consumer Inflation Picks Up as Holiday Boosts Spending (bloomberg )

Investors await new inflation data amid tariff concerns: What to know this week (finance.yahoo )

China imposes retaliatory tariffs on $14bn worth of US goods (ft )

Trump says he has spoken to Putin about ending the Ukraine war, NY Post reports (reuters )

Chinese companies detail use of AI amid DeepSeek frenzy (reuters )

Amazon and Alphabet CEOs Plan Big Stock Sales (barrons )

Alibaba Cloud’s Qwen2.5-Max Secures Top Rankings in Chatbot Arena (alizila )

The Cloud Just Became Kryptonite for the Mag 7 (barrons )

Diageo’s Non-Alcoholic Spirits Are up by 56%, Outperforming Its Alcoholic Brands (robbreport )

The Magnificent 7 Stocks Are the New Staples. Is It Time to Worry? (barrons )

Value Stocks Are Outearning Forecasts. (barrons )

Stock Market Falls On Trump Tariff, Inflation Fears (investors )

The Mood of the American Consumer Is Souring (wsj )

Power Stocks Had Been on an AI Tear. Then Came DeepSeek. (wsj )

US Consumer Borrowing Surges by $40.8 Billion, Most on Record (bloomberg )

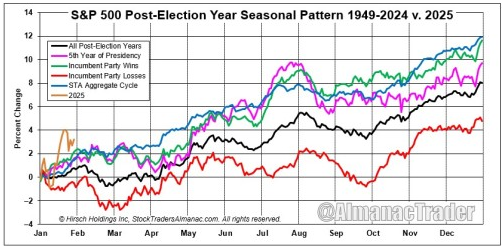

Bloomberg At the Money: Jeff Hirsch on Presidential Cycles (bloomberg )

Bullish 2025 Forecast on Track (Almanac Trader )

Historical Deja Vu: Will 30-Year Treasury Bond Yields Repeat 2007? (kimblechartingsolutions )

The Drug Industry Is Having Its Own DeepSeek Moment (wsj )

Dana White Pulls No Punches: A No-Holds-Barred Interview (forbes )

Gordon Murray Says It’s Easier to Win an F1 Championship Than Le Mans—Here’s Why (robbreport )

The Ferrari Testarossa Is an Icon of 1980s Style That’s Making a Comeback (robbreport )

This 1,184-HP F80 Is The Most Powerful Road-Going Ferrari Ever (maxim )

The 2025 V12 Vanquish Boasts Highest Top Speed Of Any Aston Martin Production Car (maxim )

Racing Genius Gordon Murray Says Winning F1 Title Is Easier Than Le Mans (thedrive )

Alibaba denies it has made $1 billion investment in DeepSeek (technode )

Trump’s tariff role model (npr )

ECB Chief Economist Philip Lane on How to Get Europe Growing Again (bloomberg )

Ferrari F80 vs. McLaren W1: The Brief (roadandtrack )

Tiger Woods announces he will play in the Genesis Invitational at Torrey Pines next week (gd )

Amazon and Alphabet CEOs Plan Big Stock Sales (barrons )

The Magnificent 7 Stocks Are the New Staples. Is It Time to Worry? (barrons )

Value Stocks Are Outearning Forecasts. (barrons )

Stock Market Falls On Trump Tariff, Inflation Fears (investors )

The Mood of the American Consumer Is Souring (wsj )

Power Stocks Had Been on an AI Tear. Then Came DeepSeek. (wsj )

US Consumer Borrowing Surges by $40.8 Billion, Most on Record (bloomberg )

Chinese Tech Stocks Near Technical Bull Market (bloomberg )

European Stocks Hit Record as Upbeat Earnings Temper Trade Fears (bloomberg )

DeepSeek’s emergence is a ‘Sputnik moment’ not just for AI, but for China, which is ‘outcompeting the rest of the world’, bank says (scmp )

Trump’s focus on 10-year Treasury yield to cut borrowing costs raises curiosity — and problems (marketwatch )

One of the few surviving Gilded Age mansions designed by a revered NYC architect has listed for a massive discount (nypost )

Trump is ‘not bluffing’ on Gaza takeover, will do ‘what it takes,’ sources close to prez say (nypost )

C.A.A., Following Trump’s Order, Excludes Transgender Athletes From Women’s Sports (nytimes )

Bessent Projects Normalcy While ‘Completely Aligned’ With Musk (bloomberg )

Trump Will Seek to End Carried Interest, Expand SALT in Tax Bill (bloomberg )

Amazon plans to spend $100 billion this year to capture ‘once in a lifetime opportunity’ in AI (cnbc )

Amazon fourth-quarter cloud revenue falls just shy of Wall Street estimates (cnbc )

Japan’s household spending massively beats expectations, boosting case for further BOJ hikes (cnbc )

Amazon’s outlook underwhelms as tech giant forecasts ‘lumpy’ cloud growth in years ahead (marketwatch )

Tech Giants Double Down on Their Massive AI Spending (wsj )

Amazon Earnings: Shares Fall After Sales Outlook Is Weaker Than Expected (wsj )

Former UPenn Athletes Sue To Expunge Trans Swimmer Lia Thomas’ Records (zerohedge )

Trump administration to keep only 294 USAID staff out of over 10,000 globally, sources say (reuters )

BOJ’s fresh take on labour crunch opens door for more rate hikes (reuters )

XPO Stock Soars. Freight Demand Is Looking Up. (barrons )

Mortgage Rates in US Decrease for Third Week, Slipping to 6.89% (bloomberg )

Alibaba’s updated Qwen AI model overtakes DeepSeek’s V3 in chatbot ranking (scmp )

European stocks are beating the U.S. so far this year. Is American exceptionalism dead? (marketwatch )

What Do Trump’s First Weeks Tell Us About His China Strategy? (wsj )

Disney to Centralize Streaming Offerings Within Disney+ (wsj )

Options Traders Bet the Rally in Big Tech Stocks Has More Room to Run (wsj )

Starboard Launches Proxy Fight at Kenvue (wsj )

Honeywell to Break Up in Bid to Recreate Some GE Magic (wsj )

Trump Gets McKinley’s Tariffs Wrong (wsj )

In the deep end Former UPenn athletes sue to vacate Lia Thomas’ records as Trump signs order banning transgender athletes from women’s sports (nypost )

Trump lays out exactly how he plans for US to seize control of Gaza (nypost )

Disney Returns to Its Steamrolling Self (nytimes )

Bessent says Trump is focused on the 10-year yield, won’t push the Fed to cut (cnbc )

Opinion: DeepSeek could sink Big Tech’s AI growth plans (marketwatch )

Doubts about ‘Magnificent Seven’ AI spending plans are creeping in (marketwatch )

Trump has less leverage over China than during prior trade war – Wells Fargo (streetinsider )

Chinese tech stocks get DeepSeek bump, narrow valuation gap vs ‘Magnificent Seven’ (scmp )

Alibaba bolsters consumer AI team with expert Steven Hoi amid race for top tech talent (scmp )

Markets Shrug Off Tariffs, AI Optimism Fuels Rally (chinalastnight )

Trump’s de minimis cancellation is bad news for Temu, but worse for Shein (reuters )

Disney posts a big profit beat amid strength in sports and experiences (marketwatch )

Say Goodbye to Temu’s Cheap Thrills (bloomberg )

USPS suspends inbound packages from China, Hong Kong Posts (foxbusiness )

Opinion: AMD stops giving AI-chip revenue forecast. History says that’s not a great sign. (marketwatch )

Alphabet’s stock slides in the wake of a revenue miss and huge AI spending target (marketwatch )

Trump Tariffs Risk $29,000 Rise in US Home Building Costs (bloomberg )

Should Comcast split into three? This analyst says a breakup would mean big upside. (marketwatch )

Opinion: Trump has two strong options to defuse the U.S. debt time-bomb. He should use them. (marketwatch )

Trump says US will ‘take over’ and develop Gaza Strip (ft )

Spring Festival boosts travel, consumption as 8-day holiday nears end (cn )

Alphabet Slides After Cloud Sales Fall Short of Expectations (bloomberg )

AMD Tumbles After Giving Disappointing Outlook for AI Growth (bloomberg )

Are Markets Underestimating the Tariff Problem? (wsj )

Disney Earnings Are Up Next. Watch for This Number. (barrons )

Chipotle Revenue Falls Short (barrons )