Key Market Outlook(s) and Pick(s)

On Thursday, I joined Liz Claman on Fox Business “Claman Countdown” to discuss markets, the Fed, trade, PayPal, and Boeing. Thanks to Liz, Brooke Haliscak, and Jake Mack for having me on:

On Wednesday, I joined Stuart Varney on Fox Business “Varney & Co” to discuss the Trump Put, Fed Put, Treasury Put, and earnings from Microsoft and Meta. Thanks to Stuart and Christian Dagger for having me on:

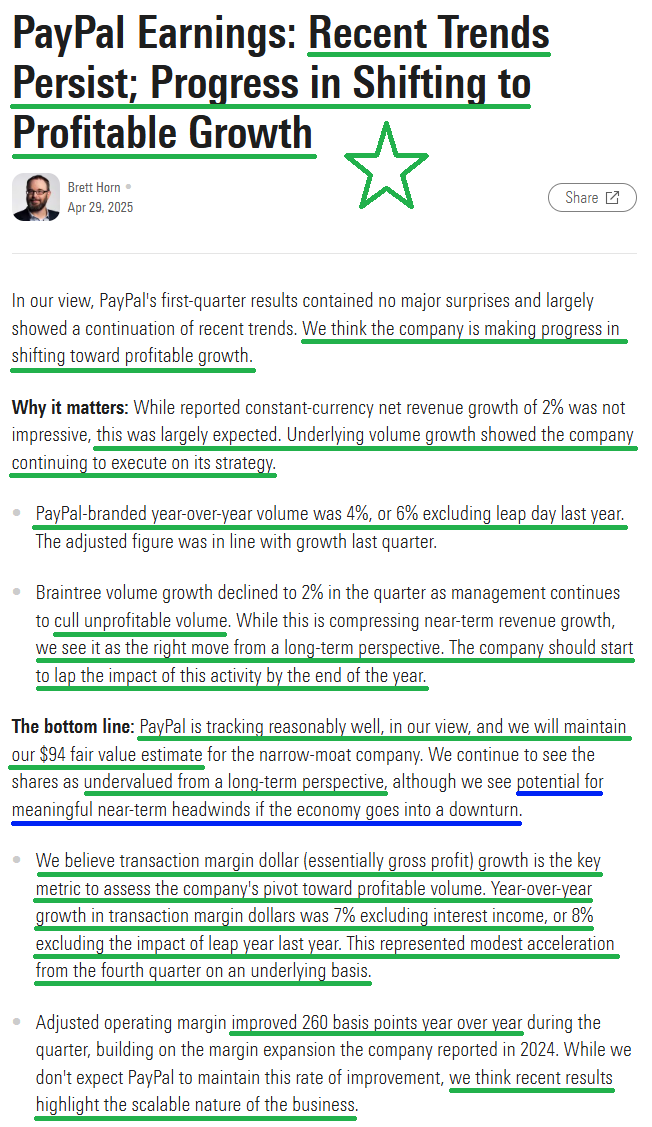

PayPal Update

Each week we try to cover 1-2 companies we have discussed in previous podcast|videocast(s) and/or own for clients (including personally).

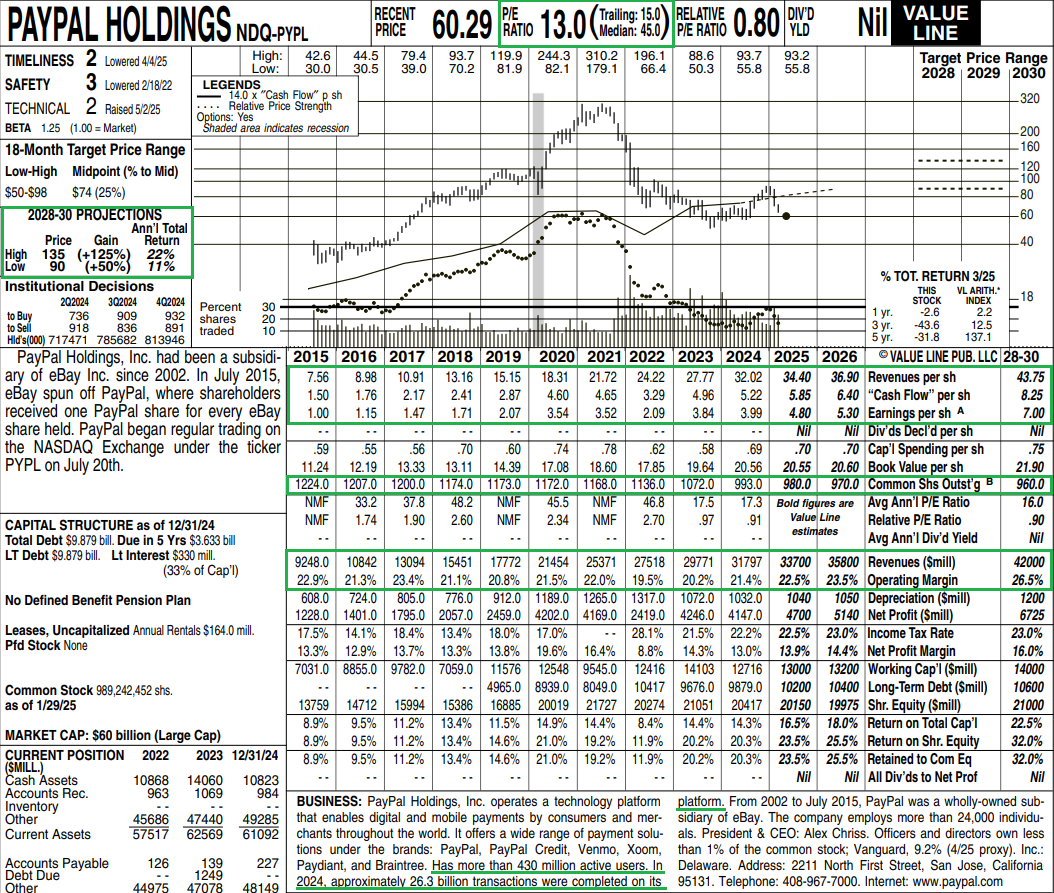

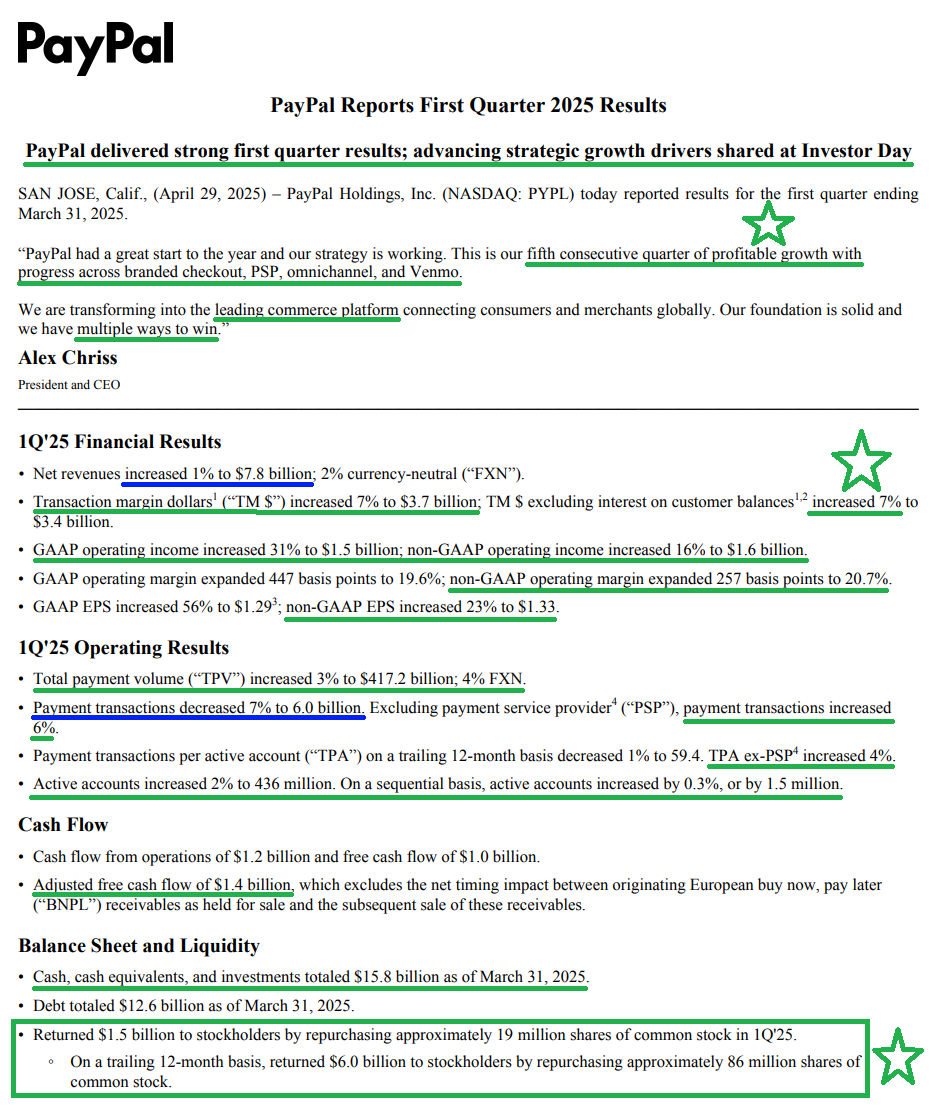

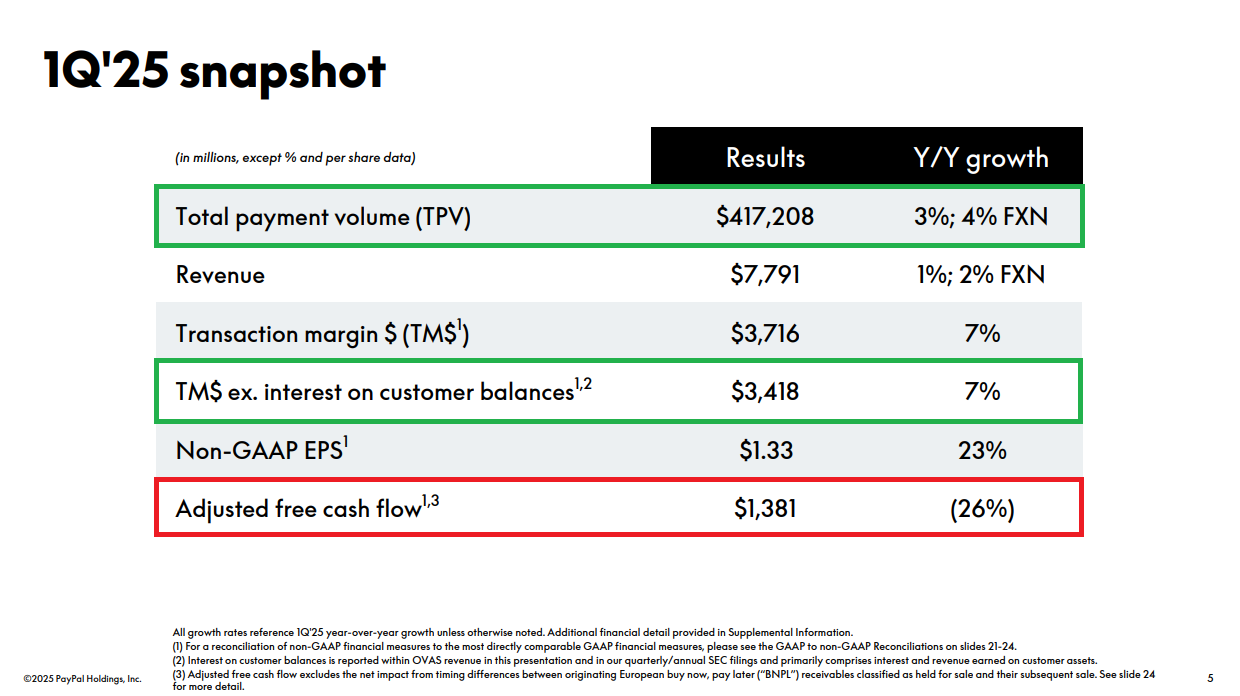

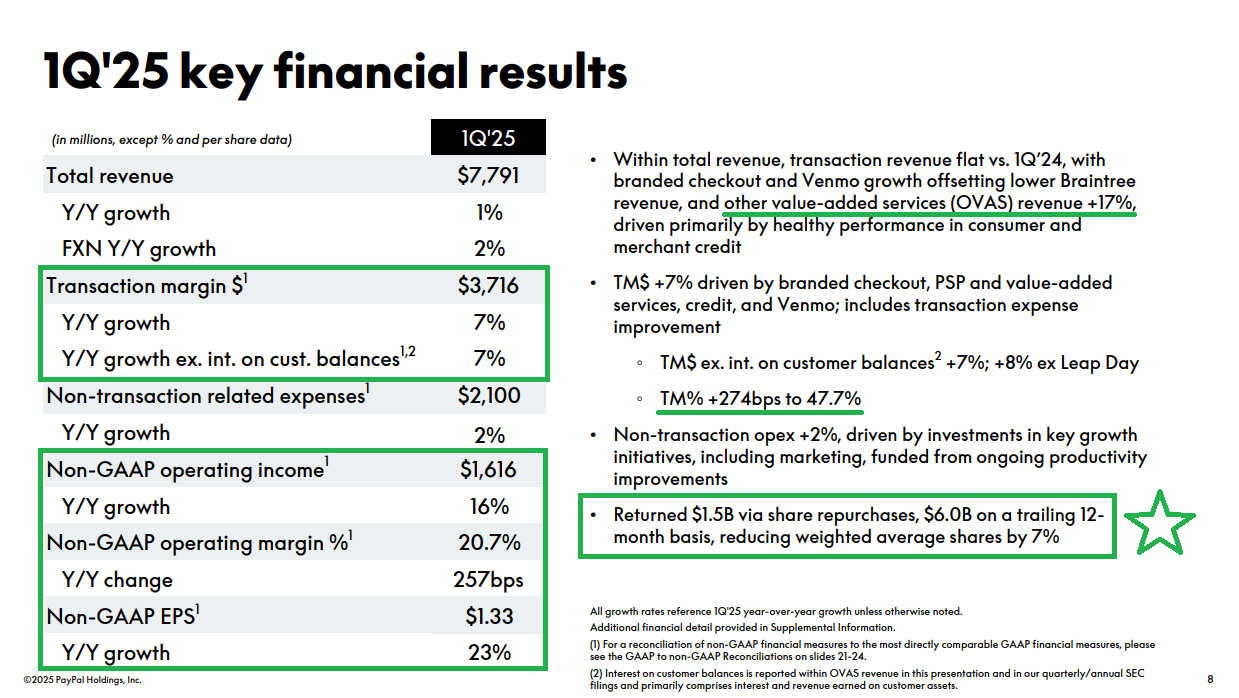

PayPal delivered yet another strong quarter earlier this week. Non-GAAP EPS of $1.33 came in well ahead of the $1.16 consensus, while revenue of $7.8B was a slight ~$40M miss.

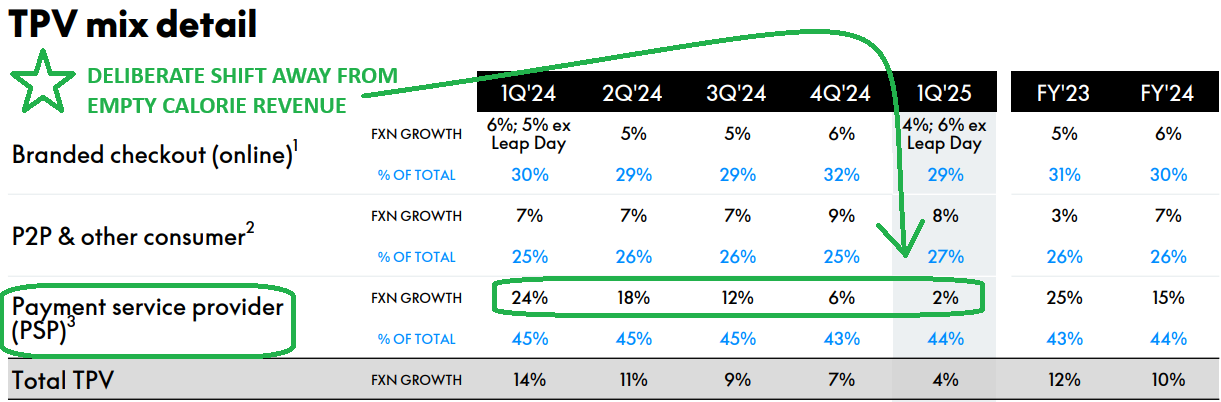

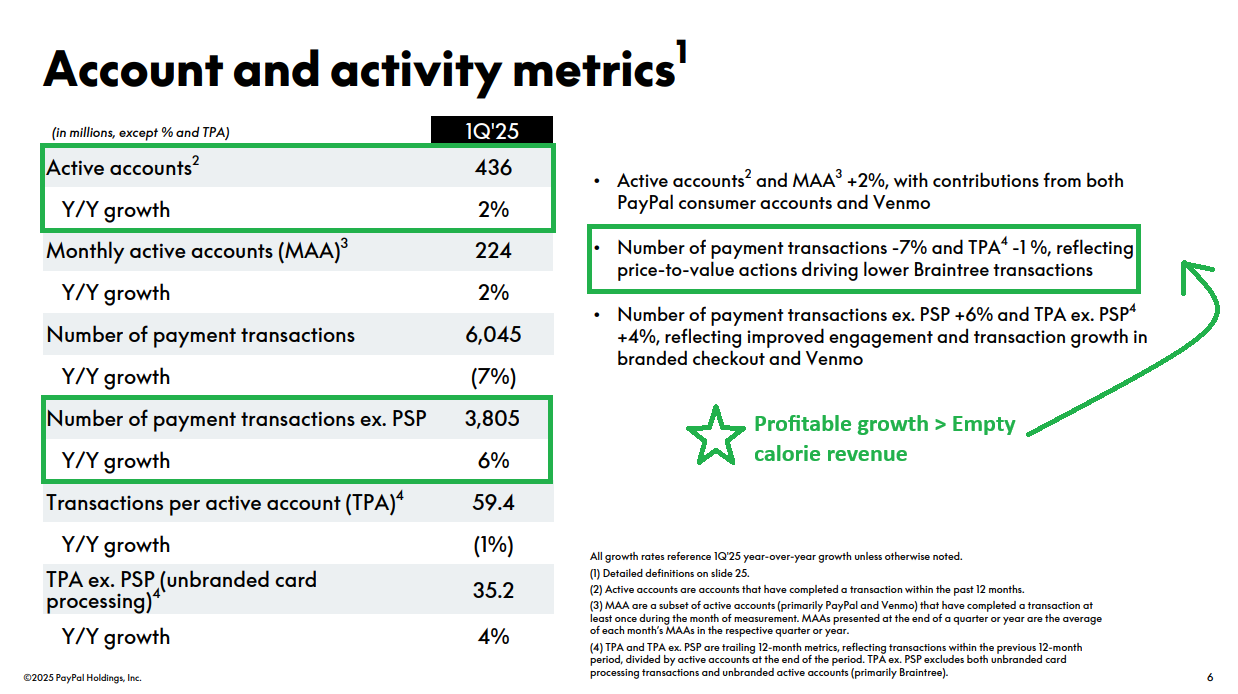

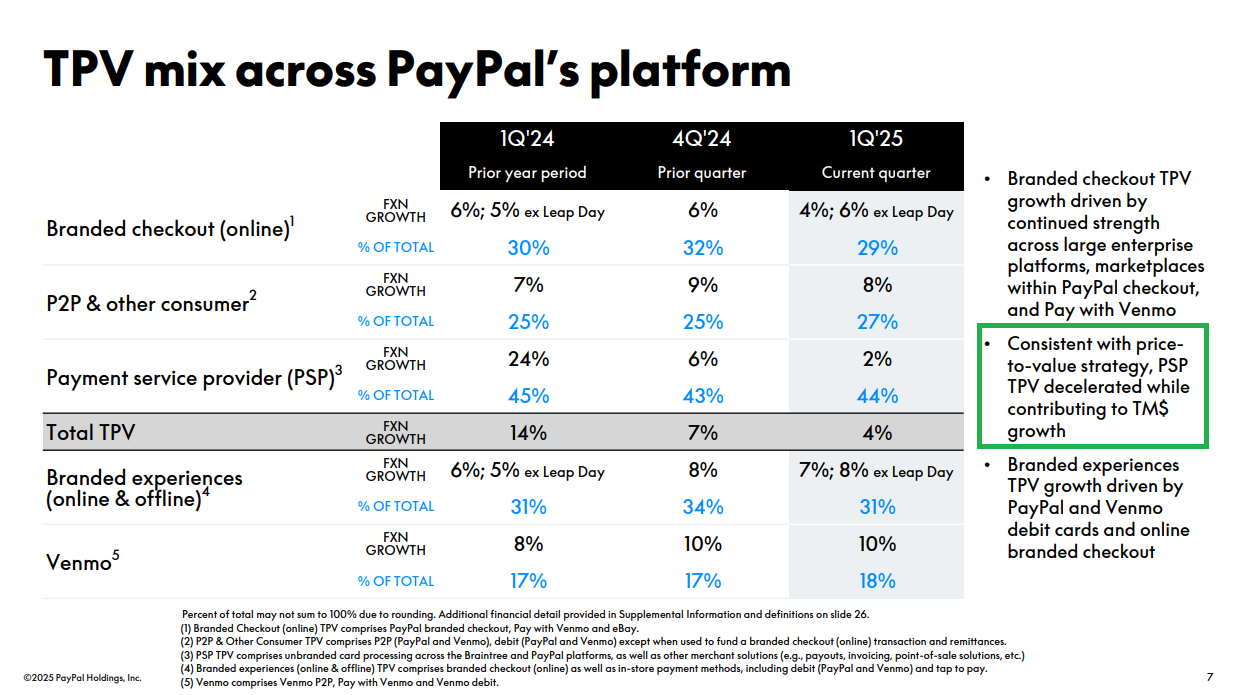

Again, for those calling out the “slowing growth,” this is a DELIBERATE SHIFT IN STRATEGY. Since stepping in, Alex Chriss has made it a clear priority to move away from “growth at all costs” and cut the EMPTY CALORIE revenues that were popular under prior leadership. The focus now is on PayPal’s most important metric — Transaction Margin.

Shifting away from unprofitable volume is expected to create a 5-6% headwind to top-line revenue this year. Most of that impact will be lapped in the back half of the year, and things should start to reaccelerate from there. You can see this shift reflected in PSP (Braintree) growth, which has slowed from 24% in Q1 2024 to just 2% this quarter.

If your holding period stretches beyond the next quarter or two, this is a welcome change. Not to mention, transaction margins are now sitting at a TWO-YEAR HIGH…

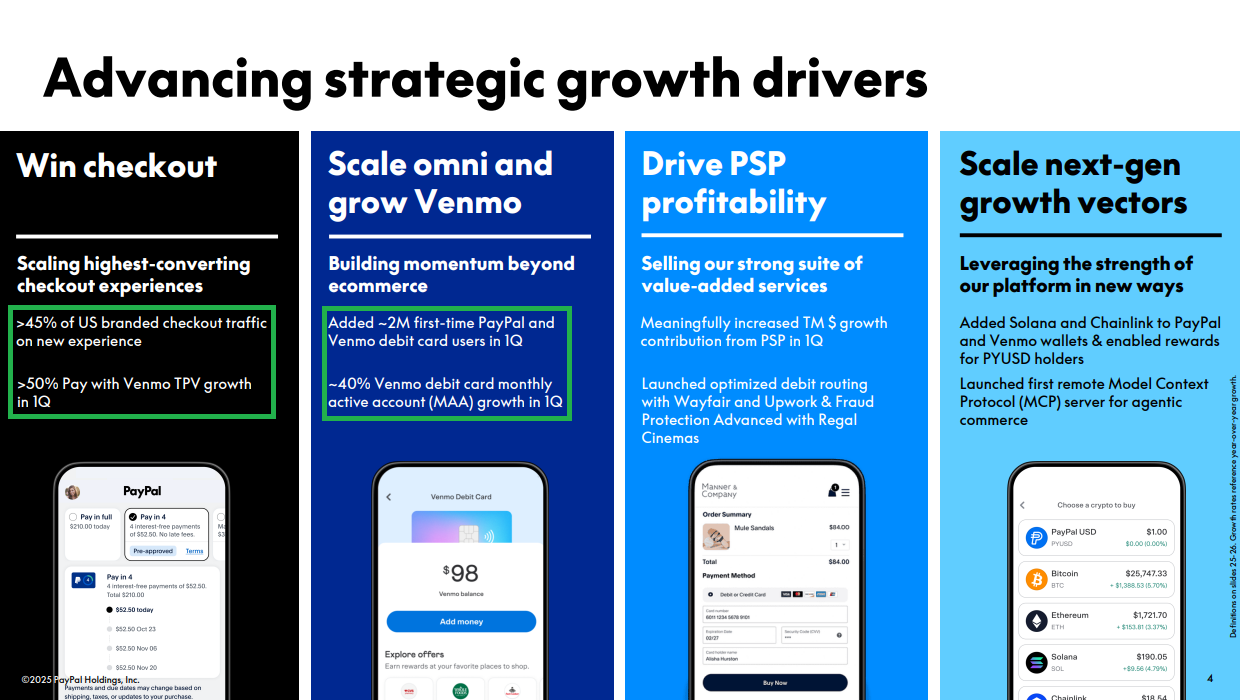

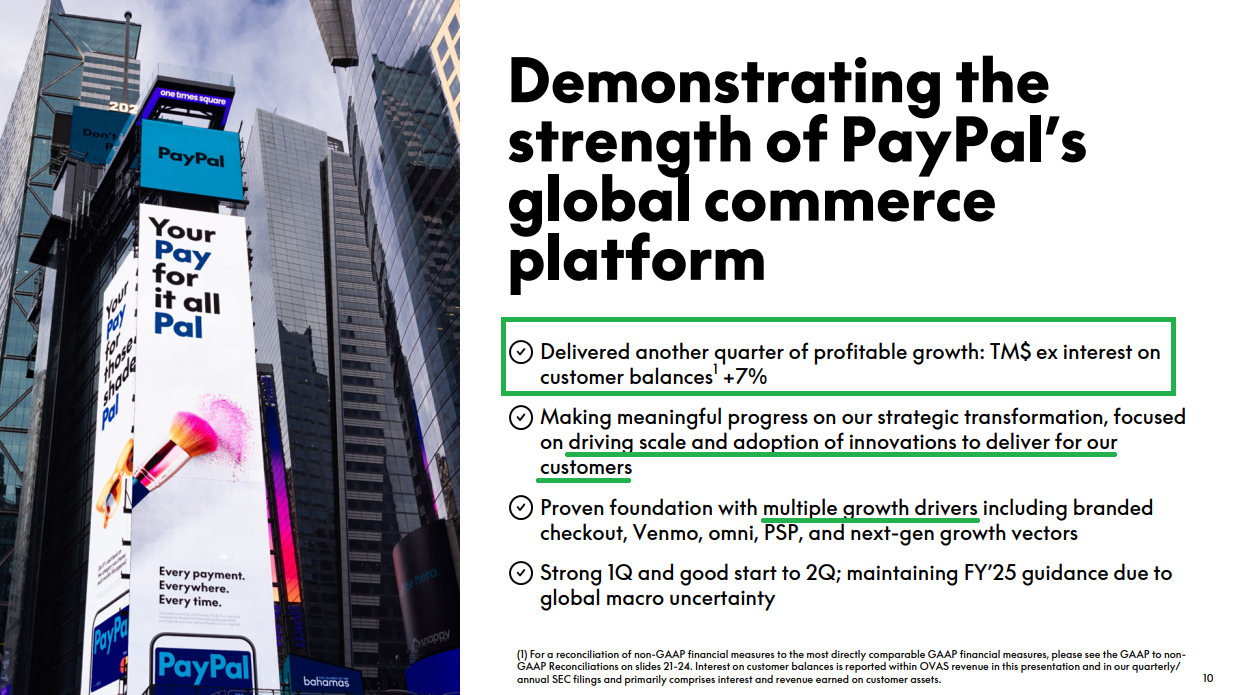

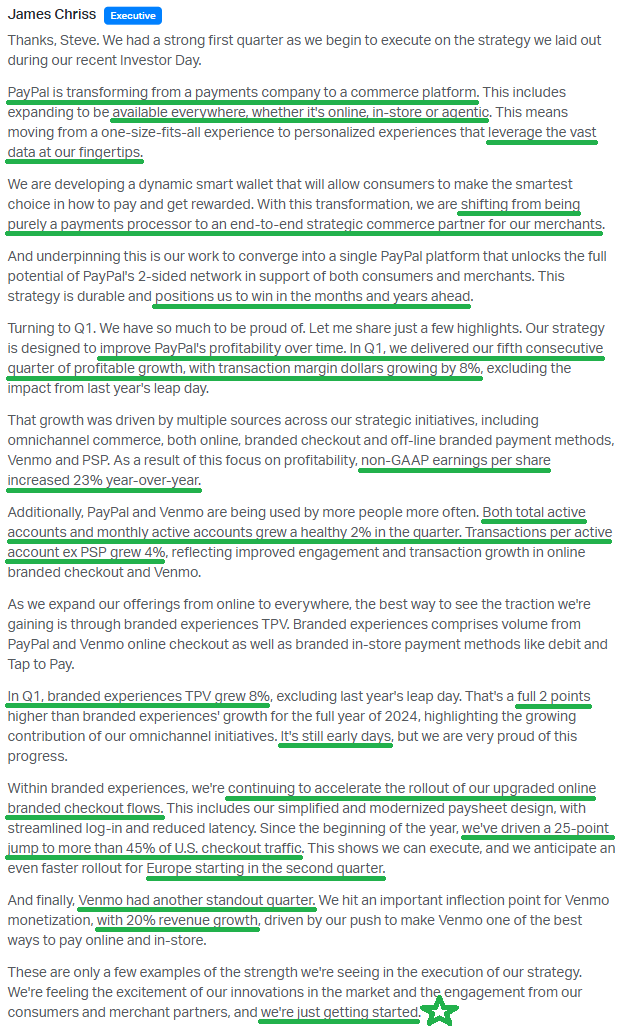

If we had to sum up this quarter in one line, it’d be “just getting started.” In fact, Alex Chriss and co. used that phrase, along with “early days,” a total of five times during the earnings call. And that makes sense. 2024 was always seen as a transition year, while 2025 is all about scaling product adoption and ramping up new initiatives. This quarter, that was on full display.

Whether it’s leaning into Buy Now, Pay Later, launching the Ads business, scaling Fastlane, rolling out the PayPal Everywhere campaign, or finally monetizing Venmo, the flywheel is clearly starting to spin. In Alex Chriss’ own words, PayPal is transforming from just a payments company into a COMMERCE PLATFORM right in front of our eyes.

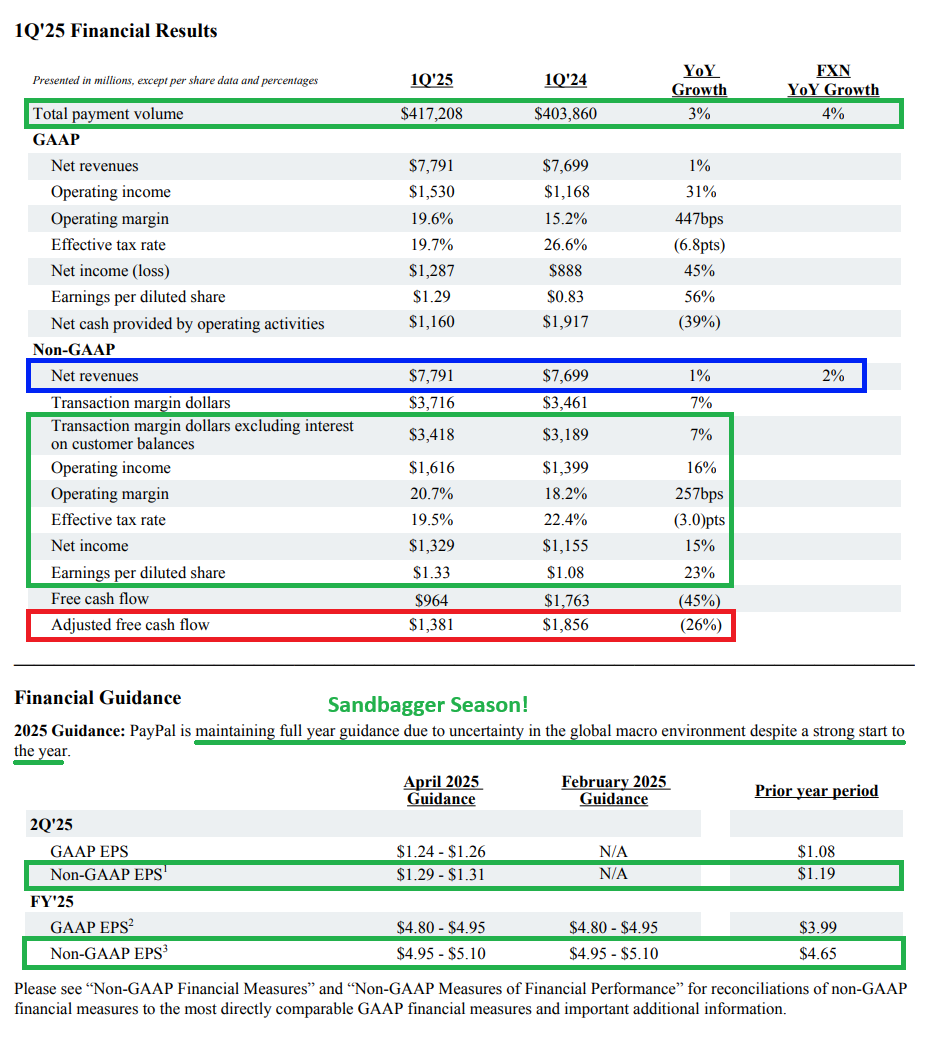

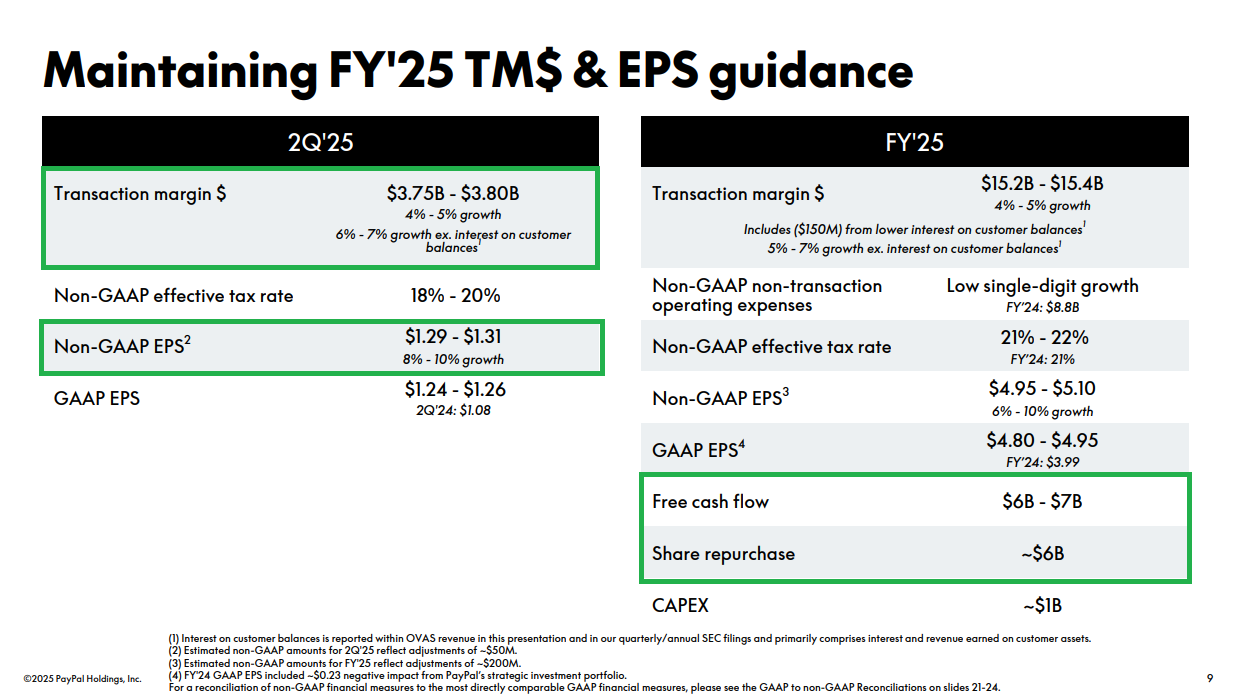

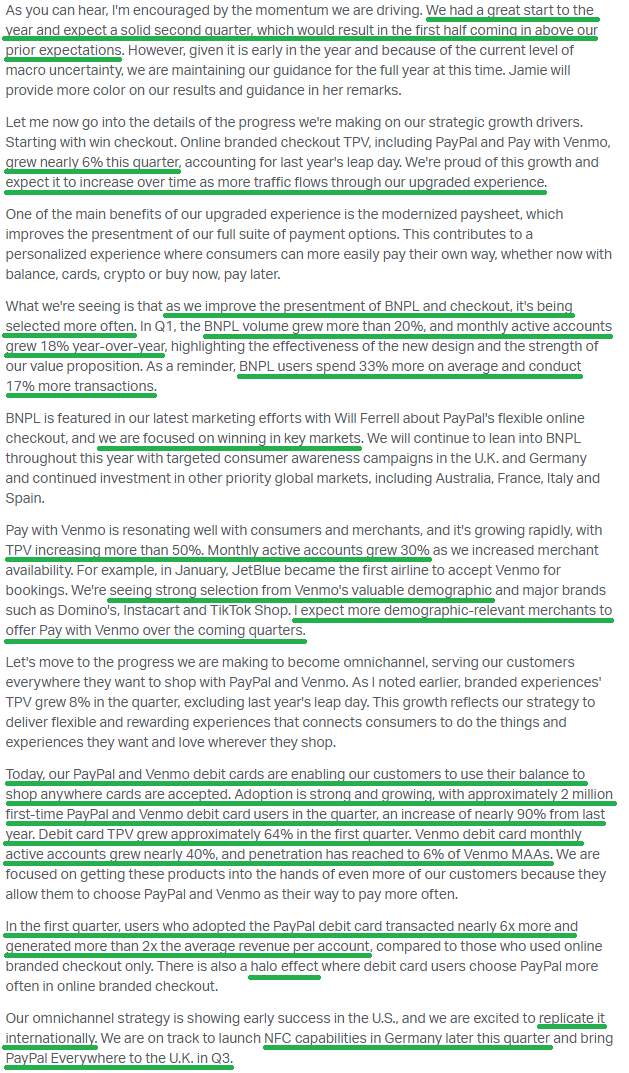

Now, there’s one thing that stood out to us. Guidance.

Despite crushing EPS expectations this quarter and issuing very strong Q2 guidance, PayPal chose, in typical sandbagger fashion, to leave full-year 2025 guidance unchanged.

We understand the need to stay cautious given the macro uncertainty. But let’s be clear: this is Sandbagger City.

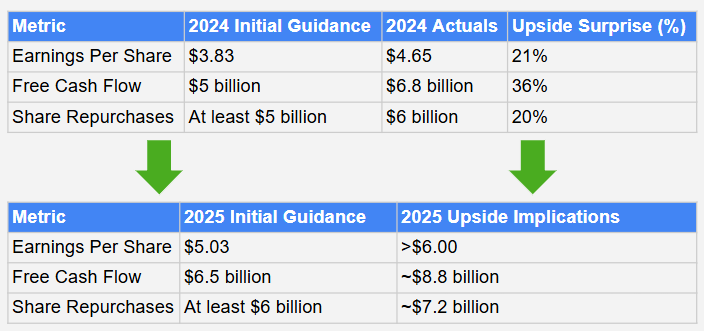

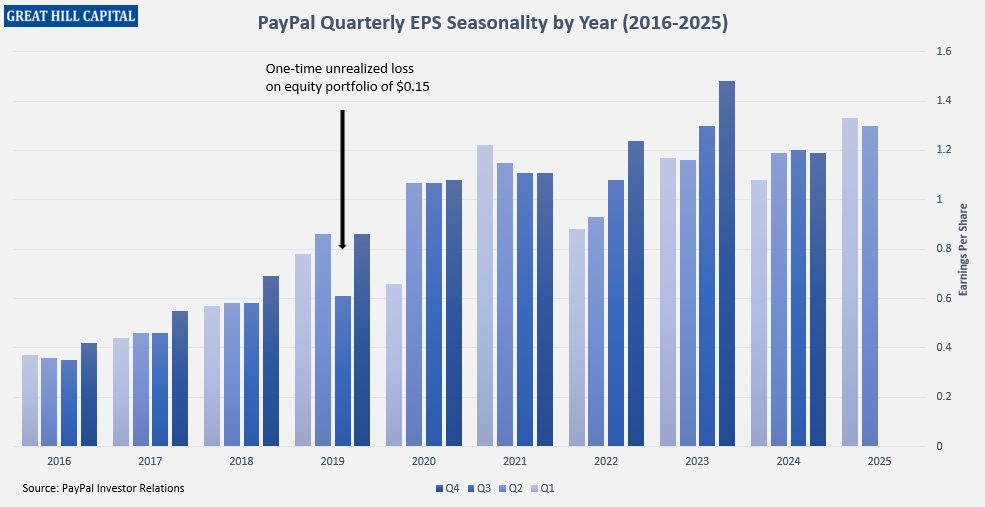

In our last article on PayPal, we highlighted how 2024 results came in well above initial guidance. We also laid out the potential upside if PayPal delivers similar “surprises” in 2025. The chart below speaks for itself.

Here’s another way to look at management’s current guidance that makes the sandbagging hard to ignore. It’s no surprise that PayPal has historically been back-half weighted. Q3 gets a lift from back-to-school shopping, and Q4 benefits from the holiday shopping season. With Q2 EPS guided to $1.30, this implies 1H EPS would total $2.63. Keep in mind, management’s full-year midpoint is $5.03. This suggests just $2.40 in EPS for the ENTIRE SECOND HALF.

That doesn’t seem to add up.

Looking at the quarterly EPS chart above, you can see just how rare this would be if it actually played out.

In 7 of the last 9 years, 2H EPS was higher than 1H, often by DOUBLE-DIGIT PERCENTAGES. In 6 of those 9 years, Q1 was the LOWEST QUARTER. Not to mention, Q4 HAS NEVER BEEN THE LOWEST QUARTER. For current guidance to hold, PayPal’s entire seasonal pattern would need to be flipped on its head.

We’d assign the odds of this happening as slim to none.

Meanwhile, PayPal continues to roll out new growth drivers. NFC launches in Germany in Q2. “PayPal Everywhere” is expanding to the UK in Q3. Fastlane and the Ads business continue to scale. AND NONE OF THIS IS REFLECTED IN GUIDANCE.

Ladies and gentlemen, this is sandbagging at its finest. As the saying goes, history doesn’t repeat, but it often rhymes. Don’t be shocked if we see similar upside “surprises,” just like we did in 2024…

Here’s a detailed breakdown of everything you need to know following PayPal’s first quarter:

Key Points

1) PayPal saw their fifth consecutive quarter of PROFTIABLE GROWTH, with transaction margin expanding over 270 basis points year-over-year to 47.7%, a two-year high. Declining transaction margin was always part of the bear case on PayPal. Alex Chriss and the team have flipped this on its head.

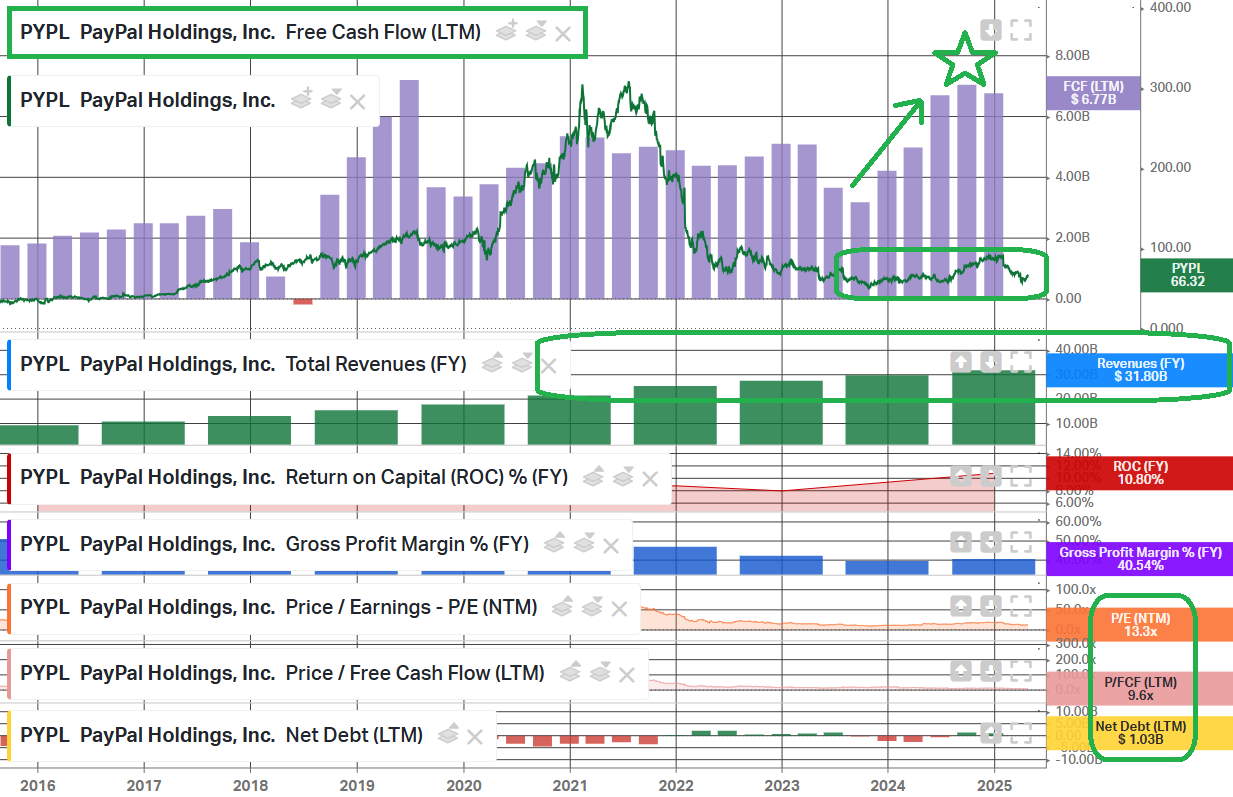

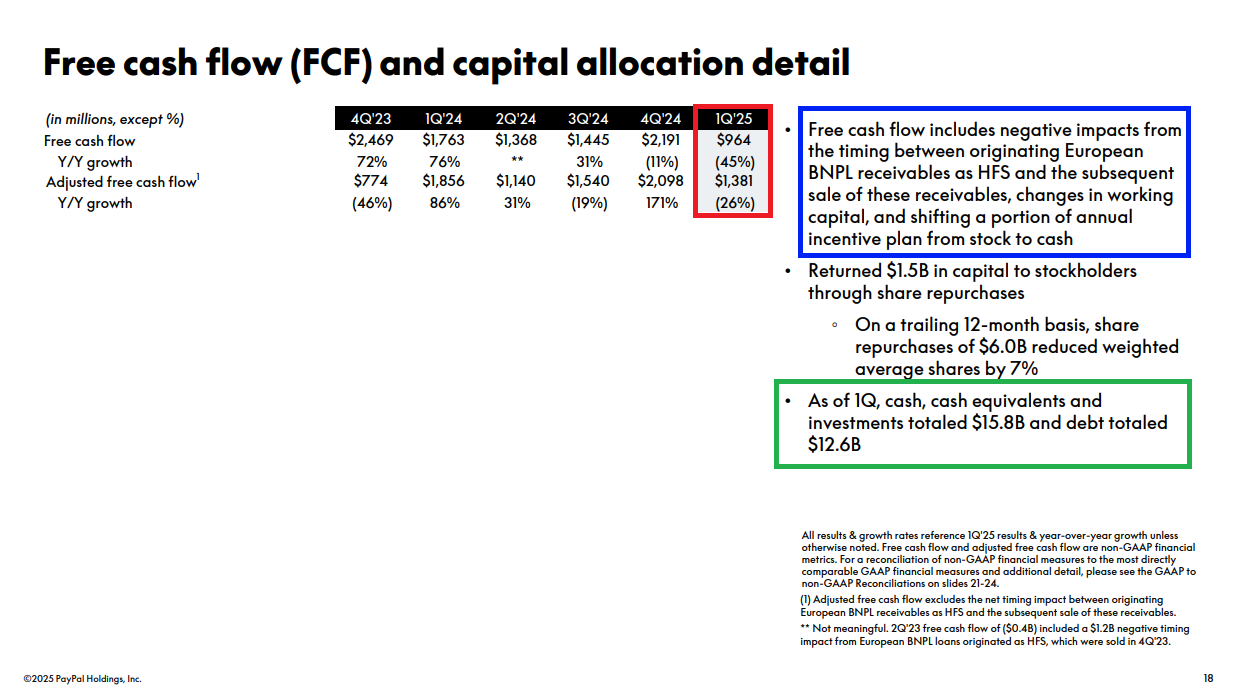

2) Adjusted free cash flow came in a bit light at $1.4 billion, down from $1.86 billion in the prior year. While PayPal’s free cash flow has always been a bit lumpy, a big driver of this was the shift away from stock-based compensation, which they used to give out like candy, to cash as part of the annual incentive plan. This is a WELCOME CHANGE. Most importantly, management maintained the annual guidance range of $6-$7 billion in free cash flow.

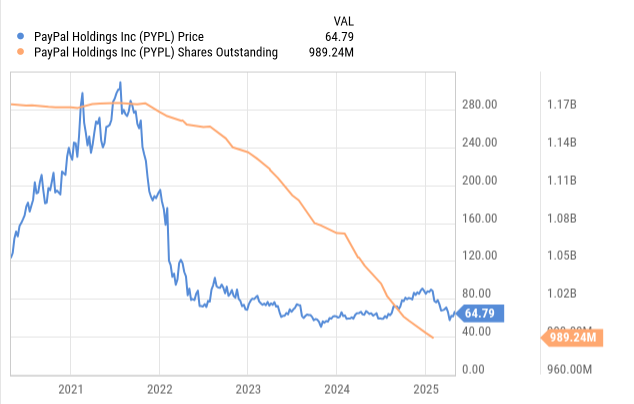

3) Share repurchases during Q1 totaled $1.5 billion, or 19 million shares purchased at an average price of around $79. On a trailing twelve-month basis, management has repurchased $6 billion worth of shares, reducing the share count by ~7%. Management maintained annual guidance of $6 billion in repurchases for the full year, which at today’s market cap, implies nearly a 10% reduction in the share count this year alone. Most importantly, these repurchases are happening at trough valuation prices, the opposite of what we typically see from most US companies. See chart below.

With $15.8 billion in cash and cash equivalents and just $12.6 billion in debt on the balance sheet, along with what we believe is the opportunity to buy $1 bills for 50 cents, repurchases should be ramped up at these levels.

4) Venmo is a verb and continues to grow like a weed, with revenues growing at their highest rate in years, up 20% YoY and showing sequential double digit growth. Most importantly, management is finally MONETIZING Venmo. Pay with Venmo total payment volume is up more than 50%, and monthly active accounts are up over 30%. The Venmo debit card is also gaining momentum, with TPV up nearly 64% in Q1 and debit card penetration climbing to 6%, up from 4% a year ago. Again, users who adopt the debit card transact nearly 6x more and generate over 2x the average revenue per account.

5) Buy Now, Pay Later continues to be a standout, with volume growth of more than 20% and MAA up 18% year over year. It’s a highly attractive segment that PayPal plans to lean into, with BNPL users spending up to 33% more on average and making 17% more transactions.

6) Last year, PYPL brought in Mark Grether to build out the Ads business. He was the architect behind Uber’s ad platform back in 2022, which scaled to a $1B annual run rate with over half a million advertisers in just over a year. Until this week, PayPal’s Ads were only live within the app and limited to the US. Now, management announced the international launch in the UK and, most importantly, Offsite Ads. PYPL is finally leveraging its two-sided network and transaction data to onboard advertisers and grow its ads business across new channels, including websites, apps, and TV. We think as the business scales, this has the potential to be one of PayPal’s next gold mine opportunities.

7) Active accounts increased 2% to 436 million, reaching a new ALL-TIME HIGH.

8) The PayPal Everywhere campaign, featuring Will Ferrell, launched in September of last year. Since then, PayPal debit card has added 4 million new active accounts. Total payment volume from the debit card is up over 100%, with strong economics both online and offline.

Earnings Call Highlights

Morningstar Analyst Note

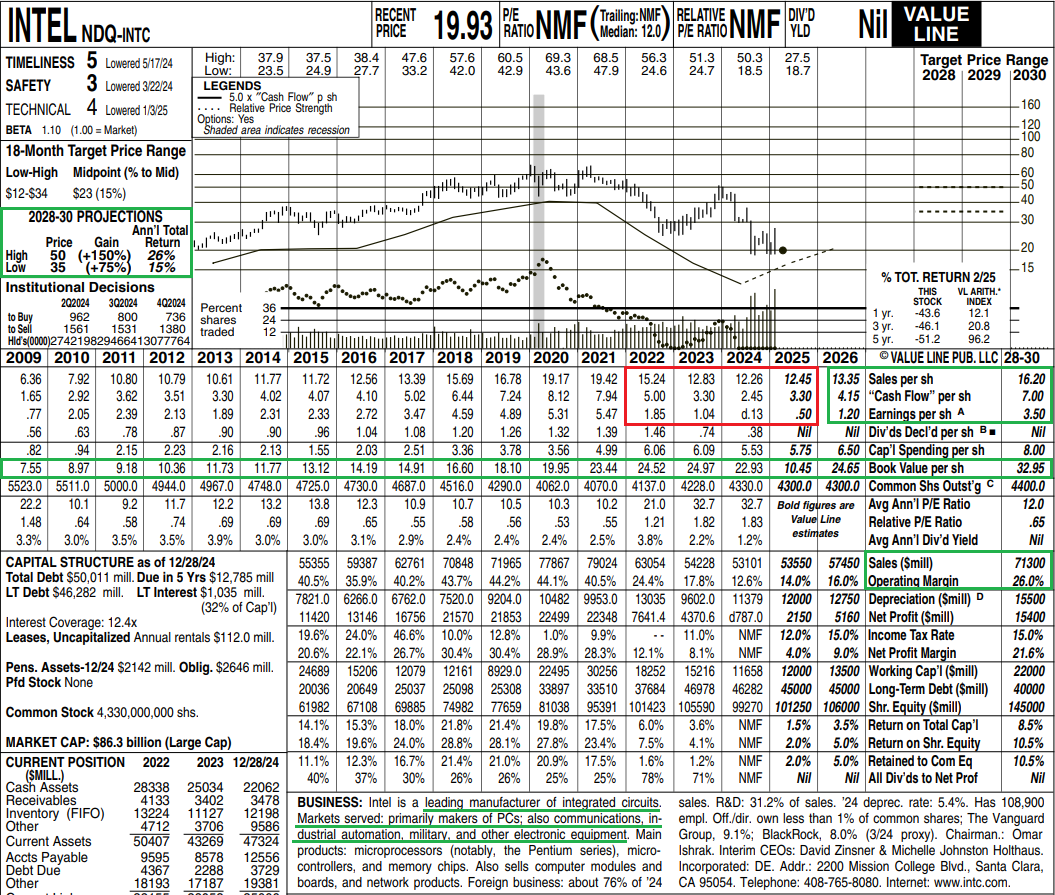

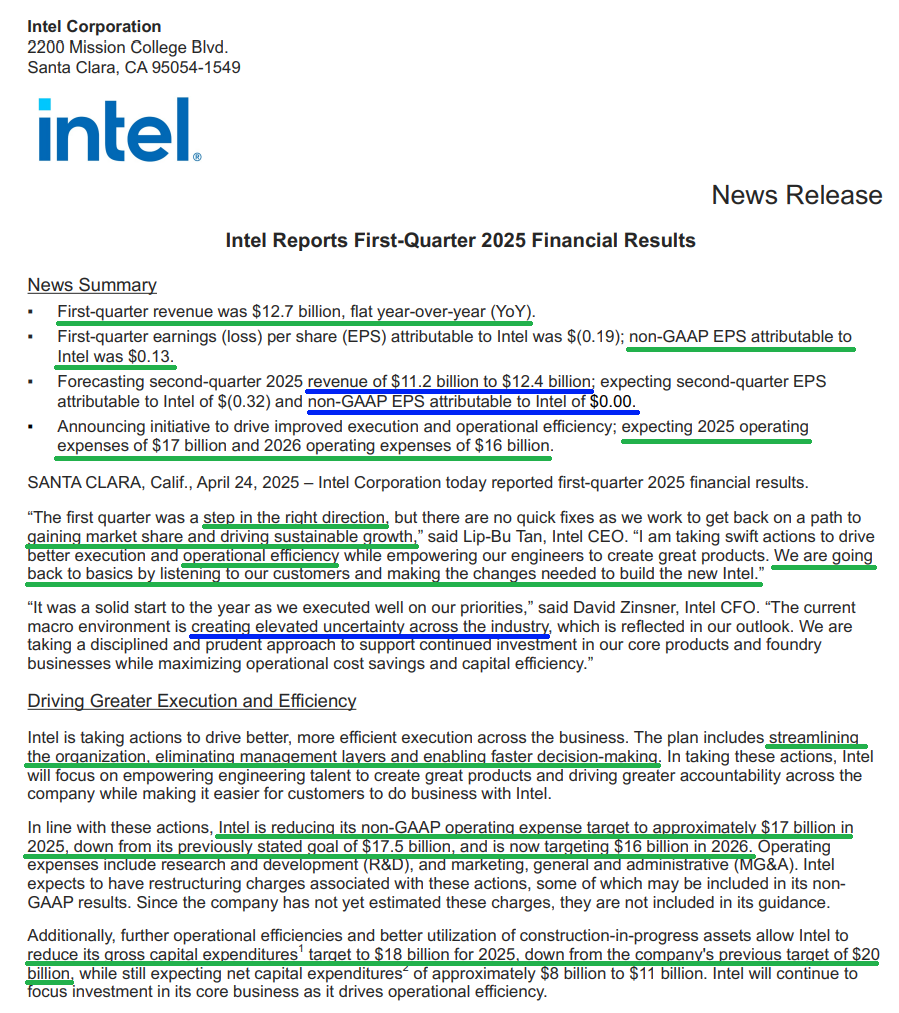

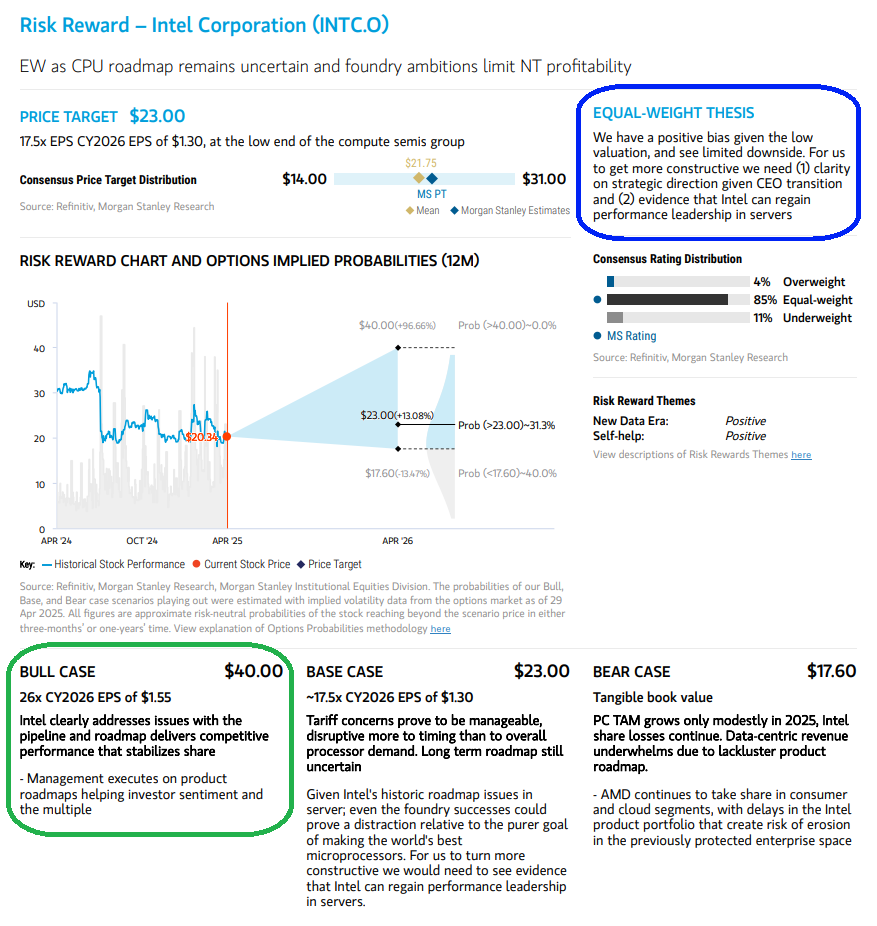

Intel Update

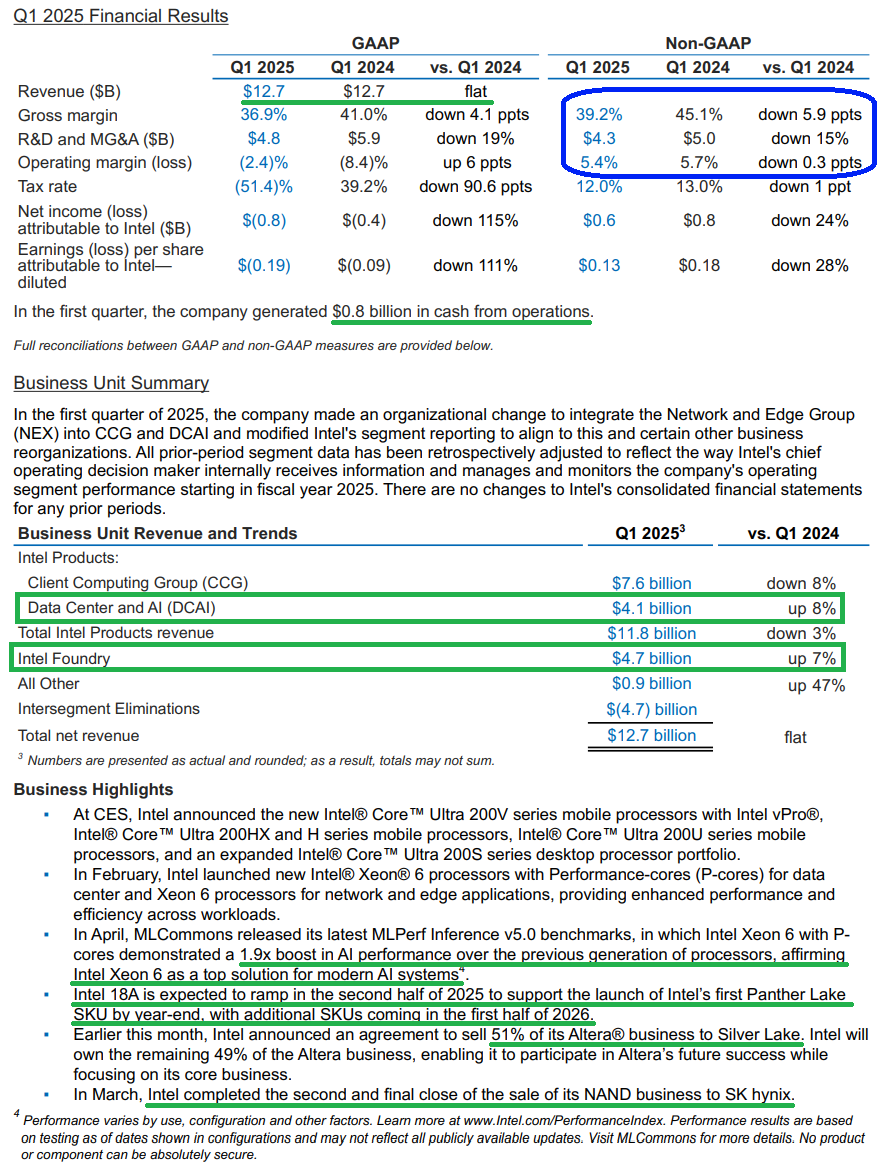

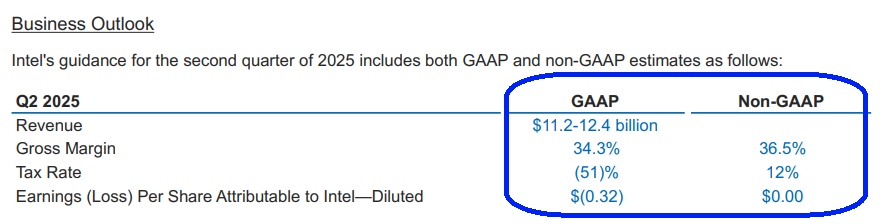

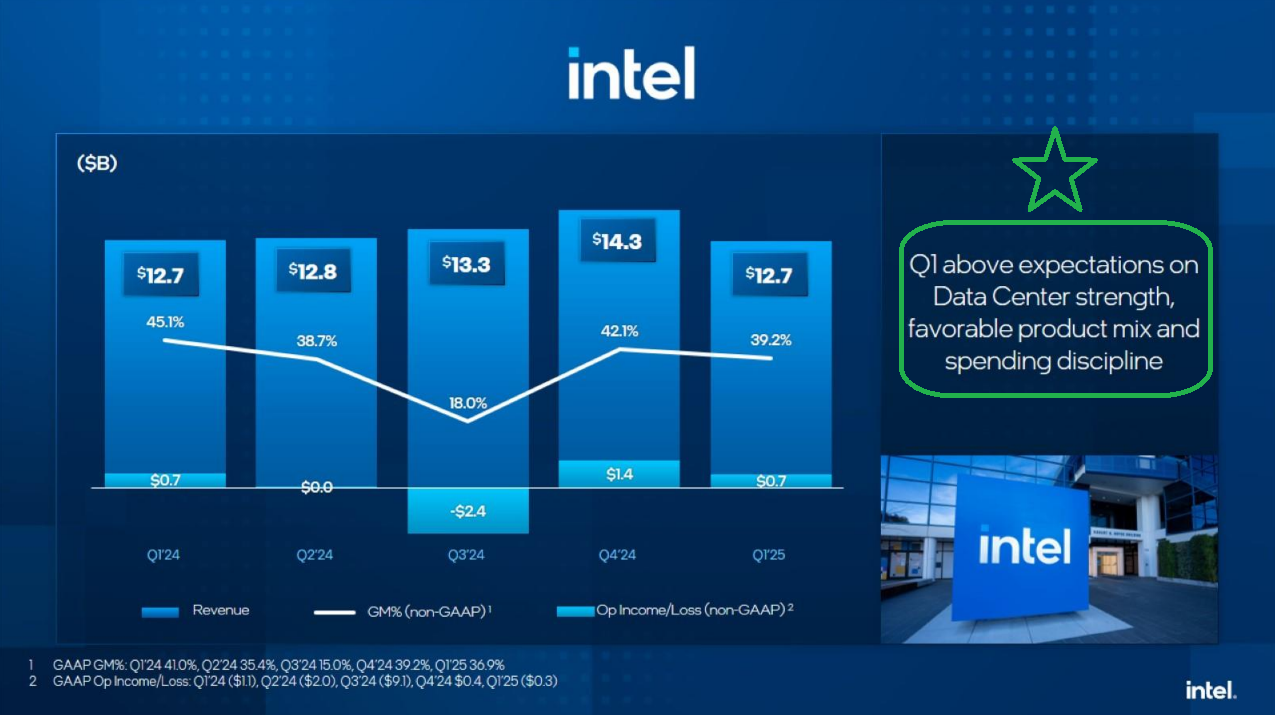

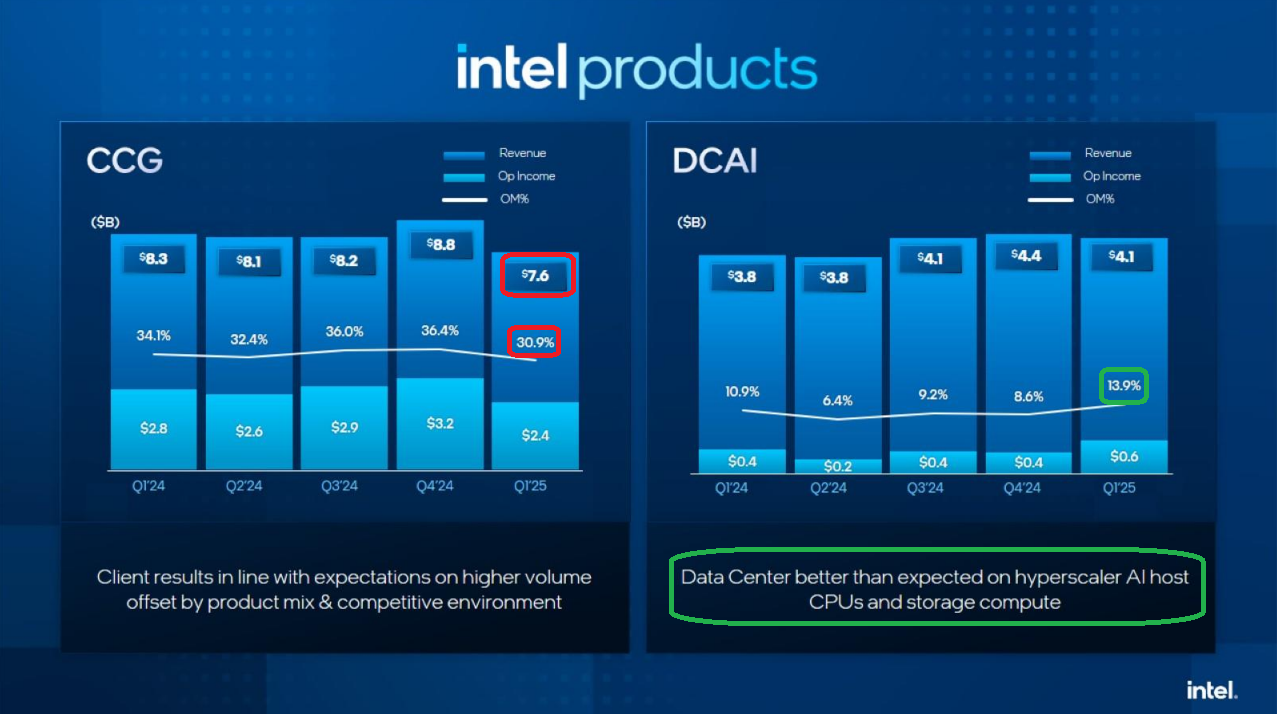

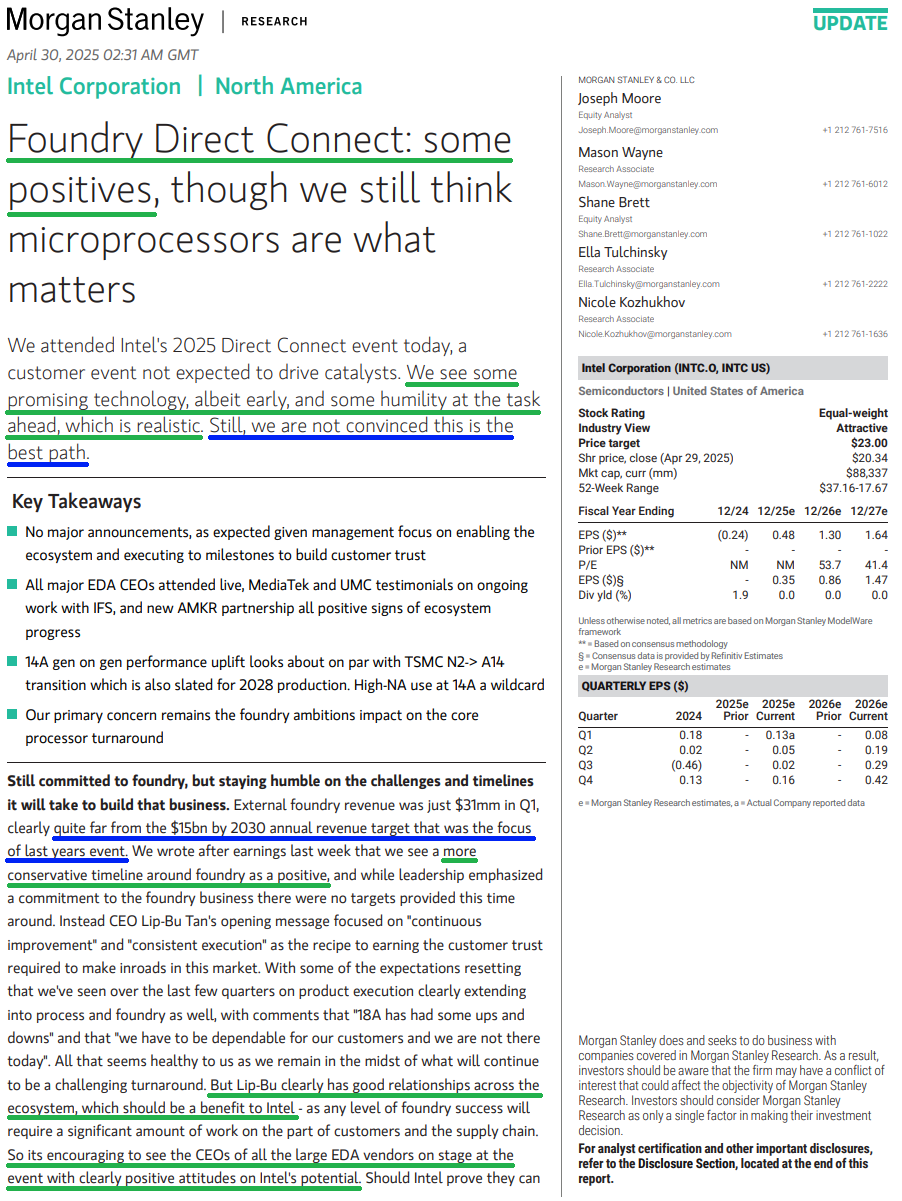

Intel reported a strong Q1 last week, beating expectations on both the top and bottom line. Revenue came in at $12.67 billion, ahead by about $350 million. Non GAAP EPS came in at $0.13, well above the break even that analysts were expecting.

Here’s a detailed breakdown of everything you need to know following Intel’s first quarter:

10 Key Points

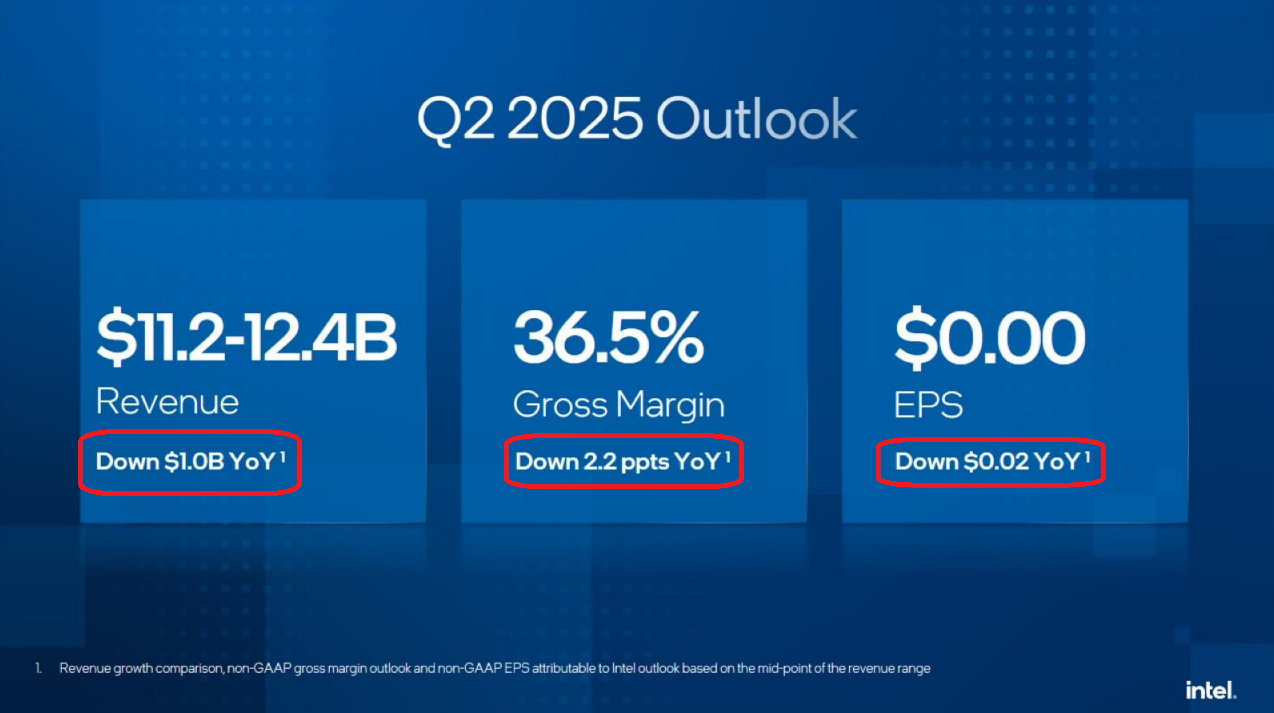

1) Q1 revenue came in at $12.7 billion, beating January guidance by $0.5 billion. Gross margins hit 39.2%, 320 basis points above guidance. EPS came in at $0.13, beating break-even expectations.

2) Intel lowered its 2025 operating expense forecast to $17 billion (from $17.5 billion), and 2026 is now projected at $16 billion.

3) Gross capex for 2025 has been reduced to $18 billion, down from the prior target of $20 billion.

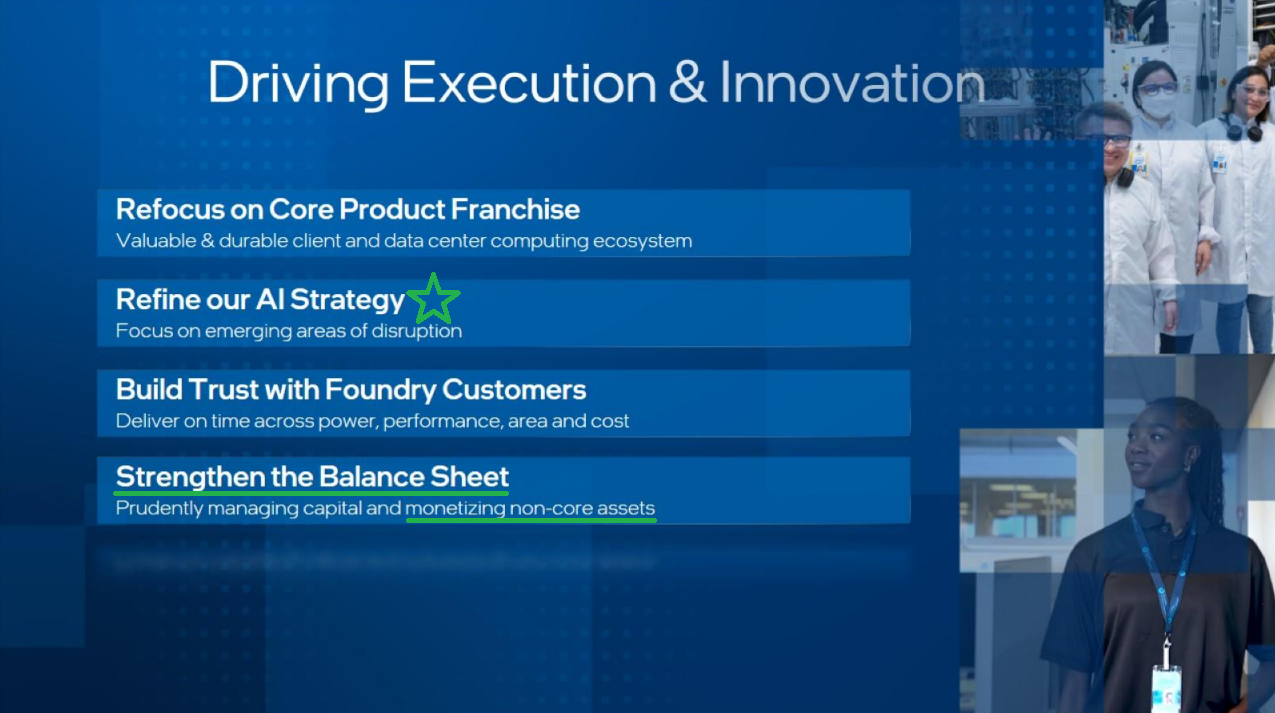

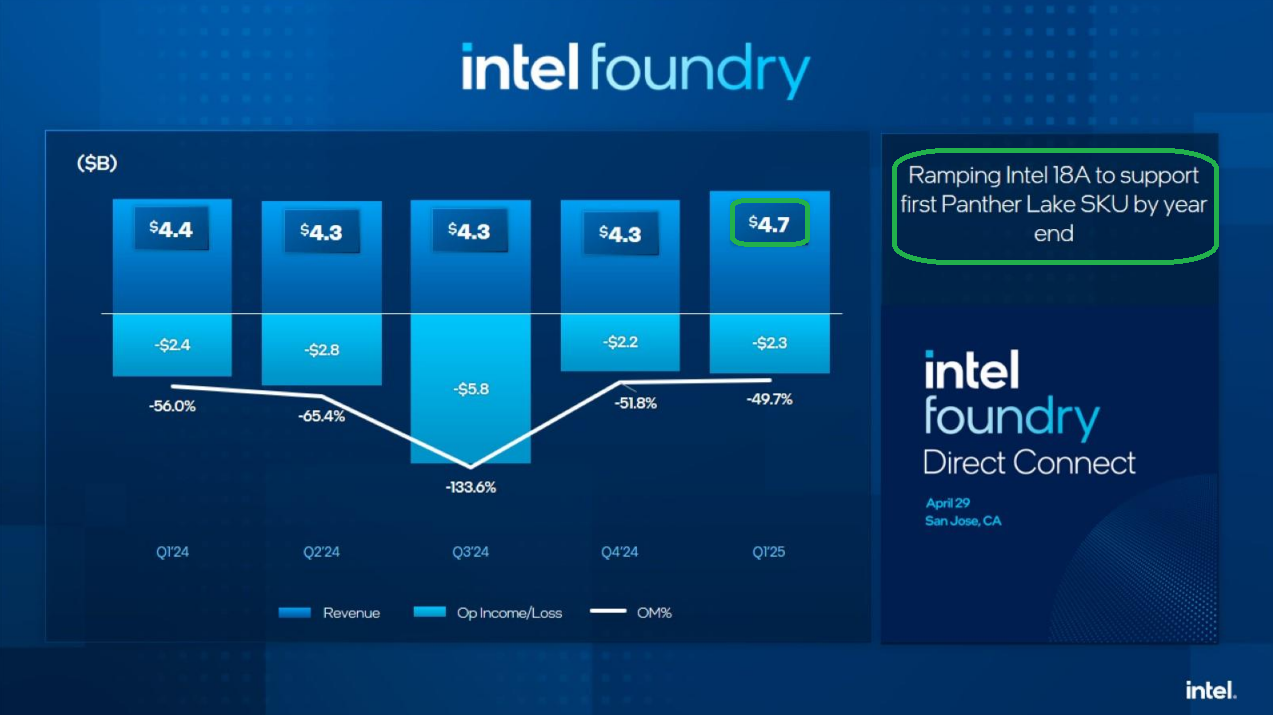

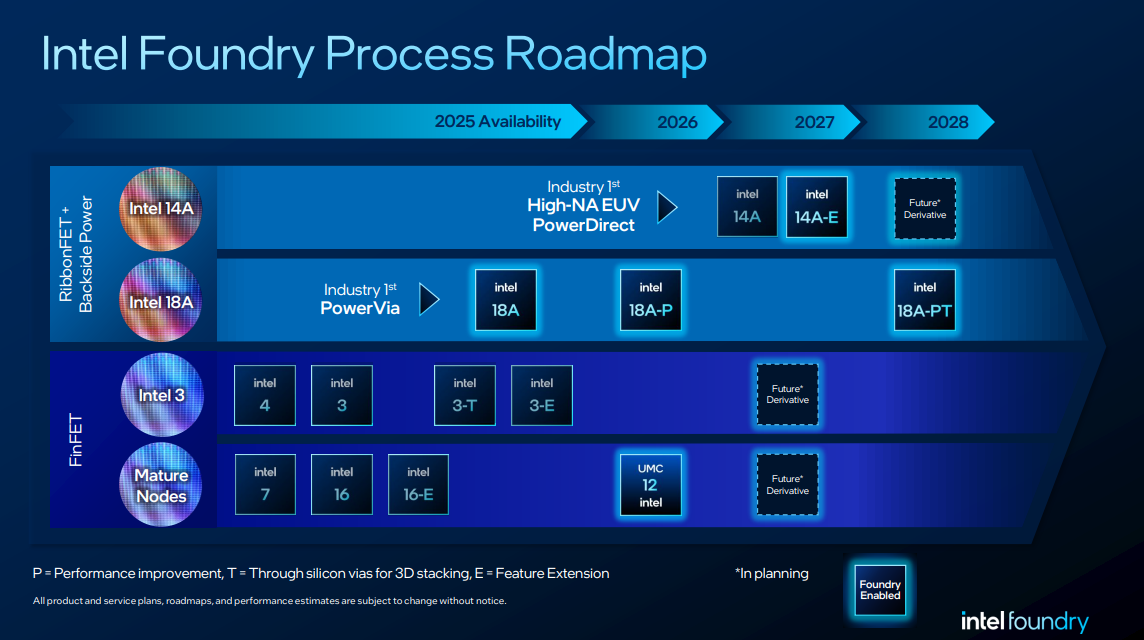

4) Intel 18A has entered risk production and remains on track for volume manufacturing in the second half of 2025. Successfully ramping up 18A is still the linchpin of Intel’s Foundry bull case and its ability to compete with TSMC going forward.

5) The 18A ramp will also support Panther Lake, with the first SKU expected by year-end and more in 1H 2026. As Panther Lake’s volumes scale, management expects a gross margin tailwind, primarily due to Panther Lake’s stronger margin profile compared to Lunar Lake.

6) Foundry revenue rose to $4.7 billion, up 8% sequentially. The segment posted a $2.3 billion operating loss, in line with expectations and slightly better than the $2.4 billion loss a year ago.

7) Deleveraging the balance sheet remains a top priority for 2025. Intel is in the process of monetizing non-core assets, including a 51% stake in Altera to Silver Lake (expected to close later this year), which values the business at $9 billion and brings in $4.4 billion. Intel also finalized the sale of its NAND business in March, bringing in $1.9 billion.

8) Data Center and AI (DCAI) revenue came in ahead of expectations at $4.1 billion, up 8% year over year. Management also highlighted some recovery in telecom and remains upbeat about the rest of the year, with strength largely driven by hyperscalers.

9) While no exact figures were shared, Lip-Bu Tan promised a flatter leadership structure and leaner organization, with rumors of a ~20% workforce cut. The goal is to slash bureaucracy and rebuild Intel to an engineering-driven culture.

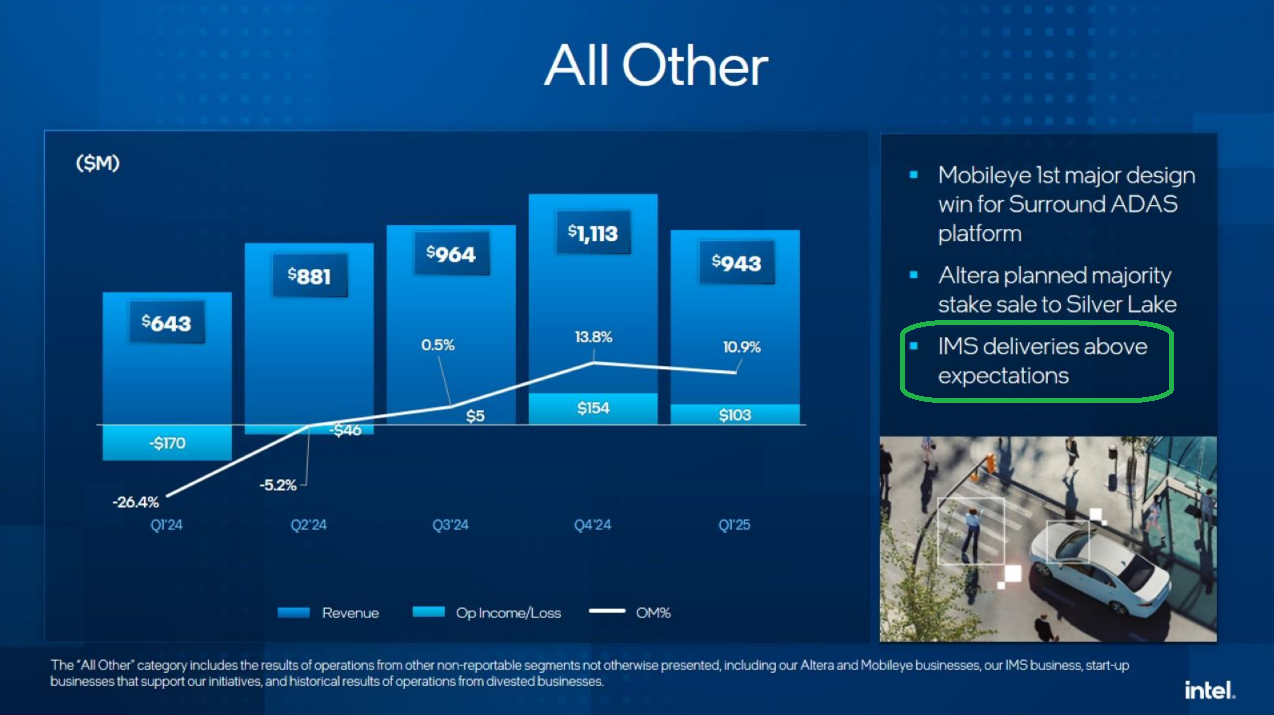

10) Intel’s “Other” segment, which includes stakes in Mobileye and Altera, saw revenue jump 43% year over year, posting an operating profit of $103 million compared to a $170 million loss last year.

Earnings Call Highlights

Foundry Direct Connect Overview

Since we first took our position in Intel, our thesis has been simple: the legacy PC and server processor business alone was worth $45 to $50+ per share. Any upside from AI chips or the Foundry business was whipped cream on top. People seem to forget. Despite Intel’s missteps (which there have been plenty), they still hold leading share in both the PC and server markets.

We also said that after Pat Gelsinger spent four years pouring over $95 billion into Foundry and laying the groundwork, he essentially got fired at the 5-yard line. Now, new CEO Lip-Bu Tan has stepped in to punch it into the end zone (and likely get all of the credit).

But if there’s one person who can pull this off, it’s undoubtedly Lip-Bu Tan. The chart of Cadence Design before and after he took the reins says all you need to know. He took over after the stock collapsed 86%. Over the next 14 years, CDNS became a 68-BAGGER.

Now his next turnaround is Intel. Not only has he said he wants to “pull off a comeback that will be studied in business schools for generations,” but he also put his money where his mouth is, writing a $25 million check out of his own pocket within 30 days of taking the job.

Earlier this week, Lip-Bu Tan took the stage at Intel’s Foundry Direct Connect event, laying out the roadmap and doubling down on the vision for Intel to become a chip foundry duopoly with TSMC, the much-awaited partner that Western governments have been patiently waiting for.

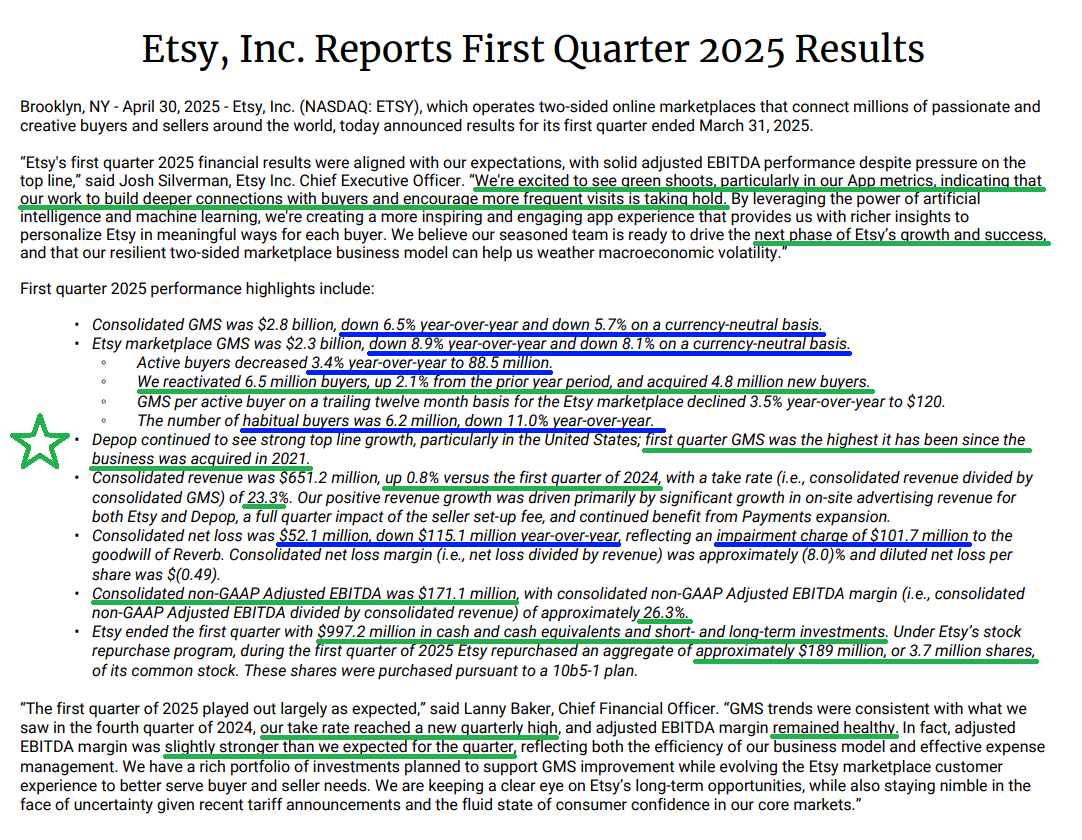

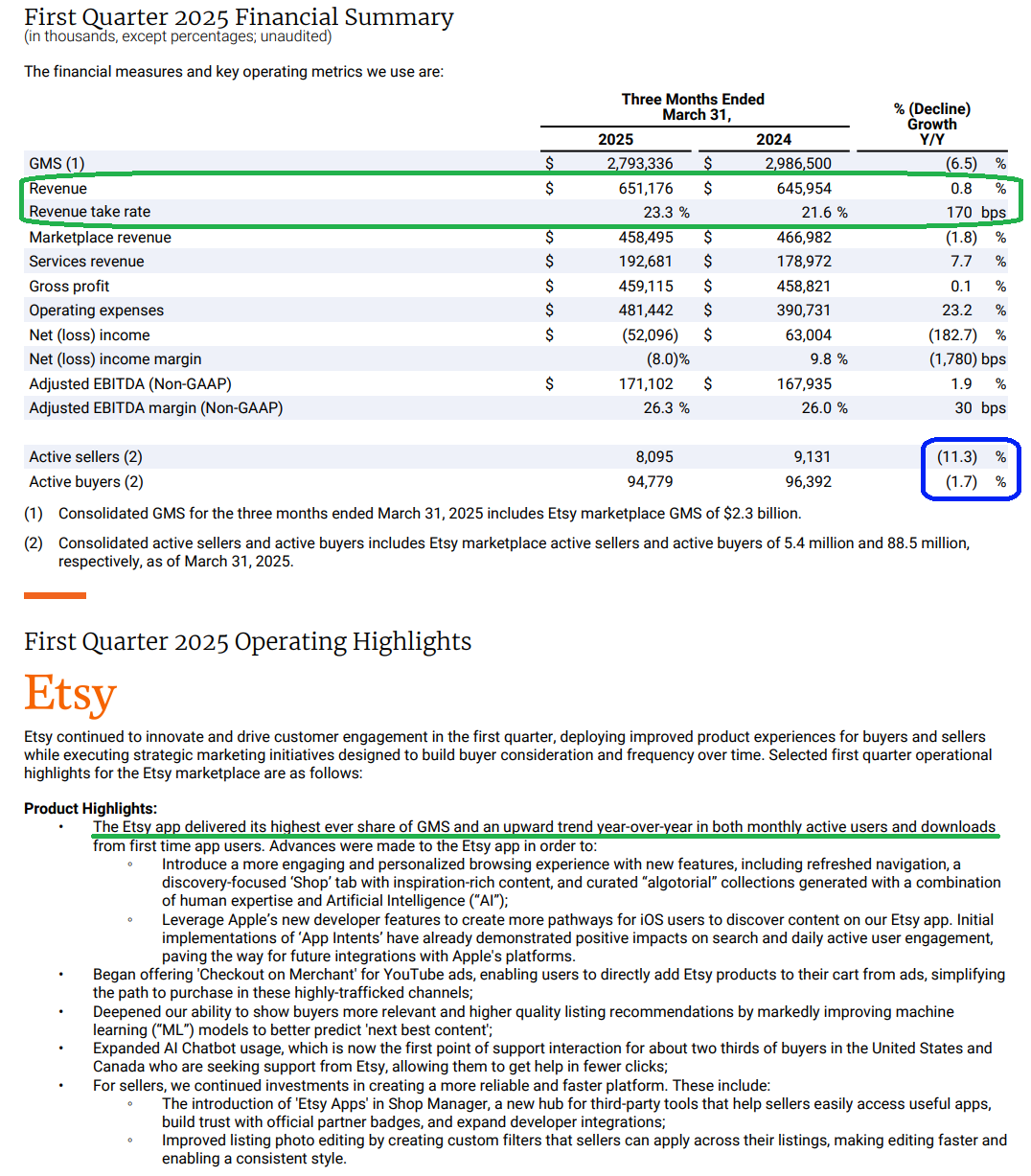

Etsy Quick Update

Key Points

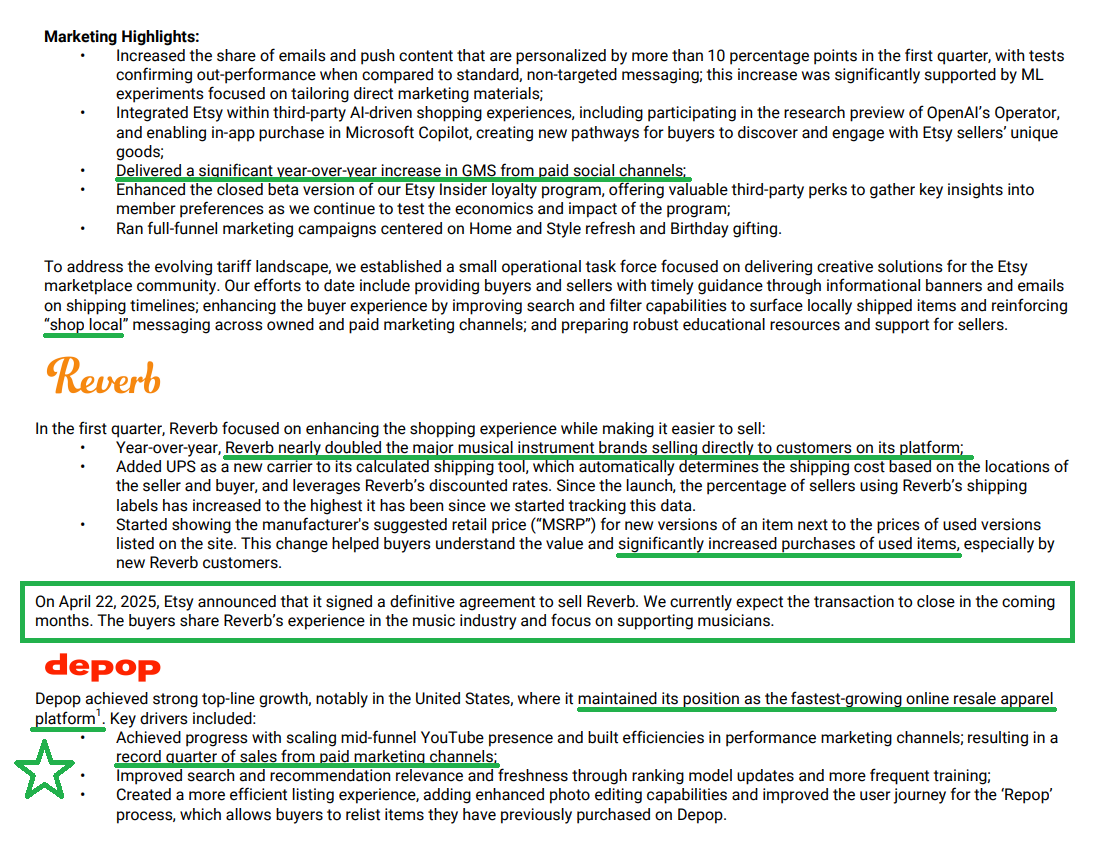

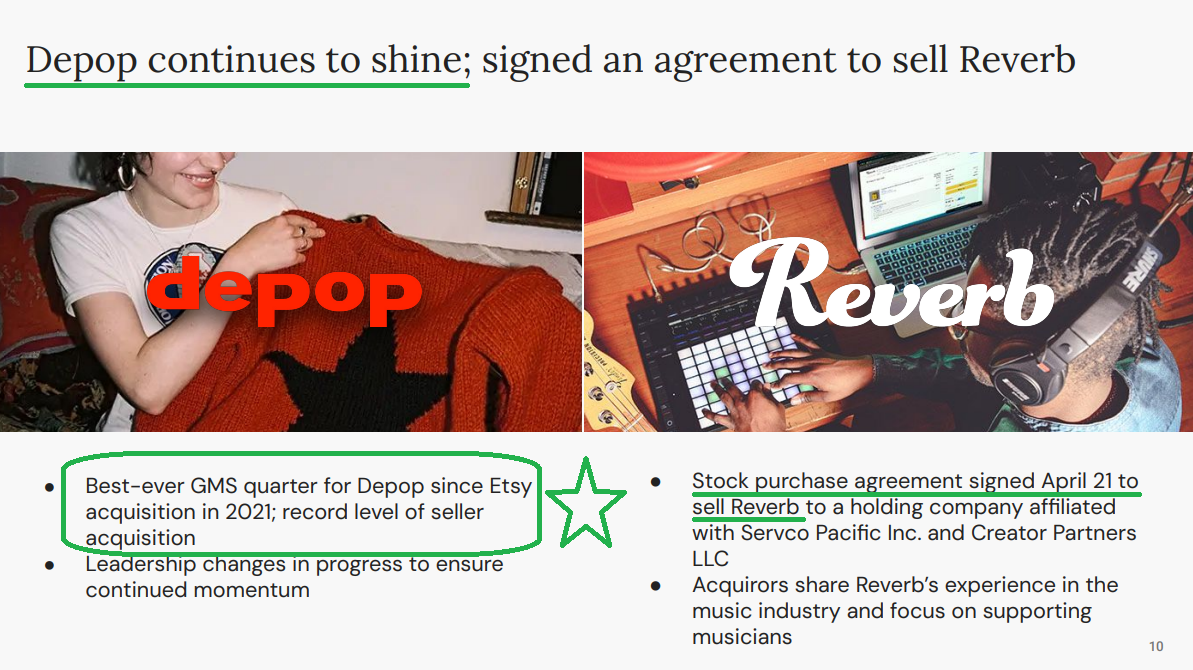

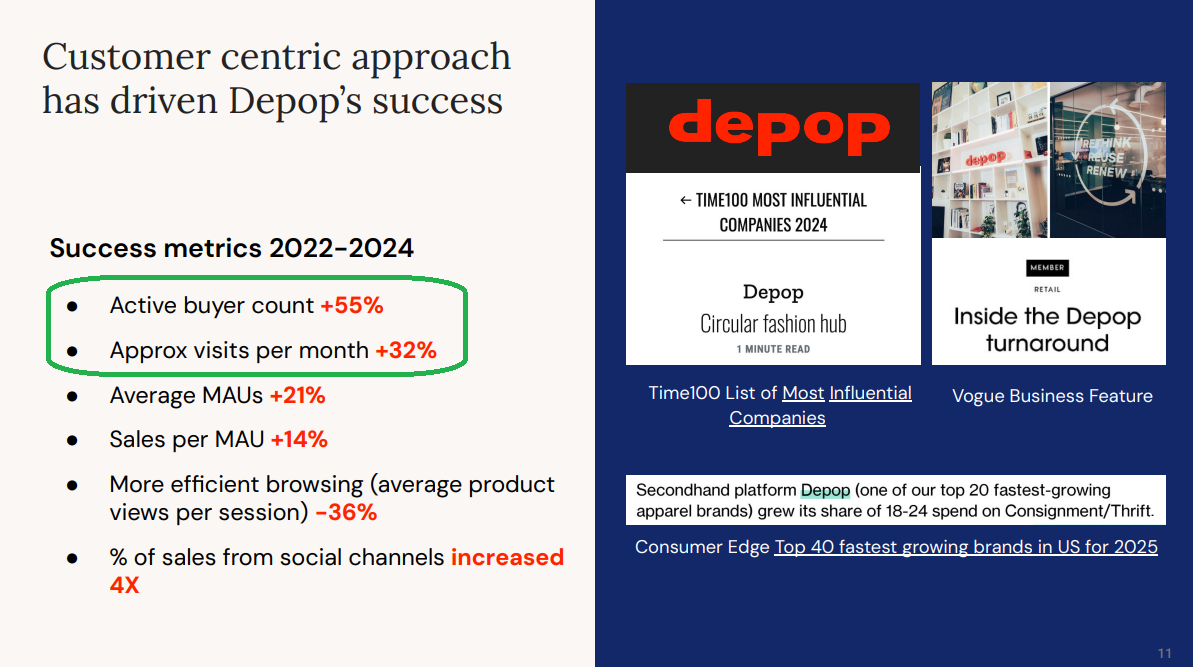

1) Depop saw another quarter of strong top-line growth, with first-quarter GMS hitting its highest level since the business was acquired in 2021. Depop remains the fastest-growing online resale apparel platform in the US, with active buyers up 55% and monthly visits up 32%.

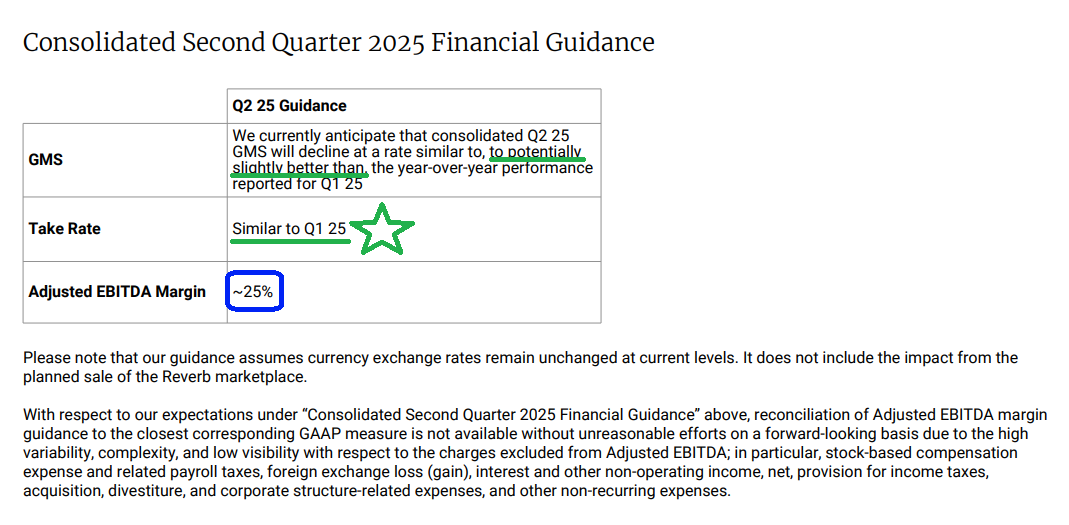

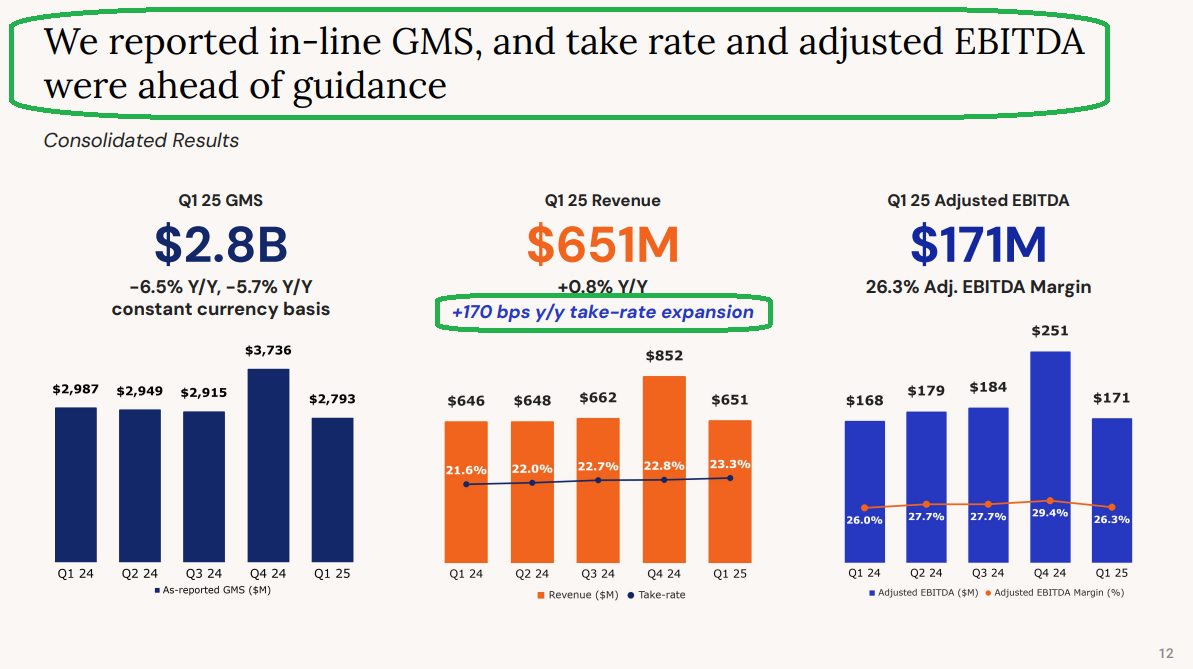

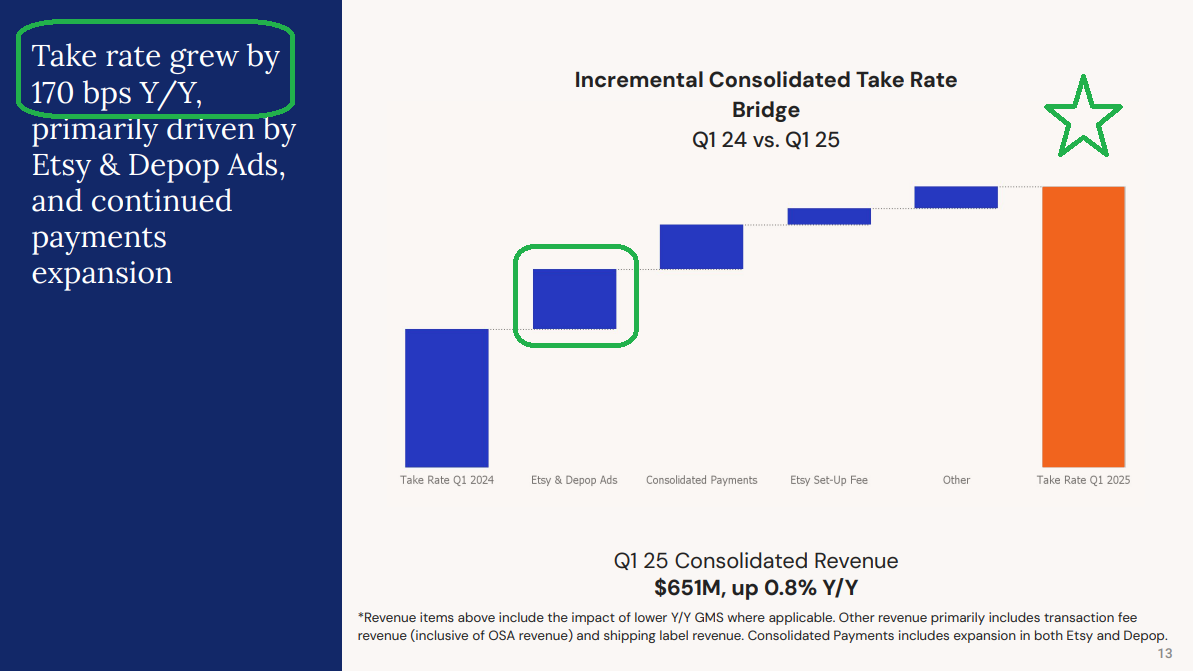

2) Take rate reached a new quarterly high, up 170 basis points YoY to 23.3%, with similar results guided for Q2. This was driven primarily by Etsy and Depop Ads, contributing to consolidated revenue of $651 million for the quarter, up 0.8% despite a 6.5% decline in GMS.

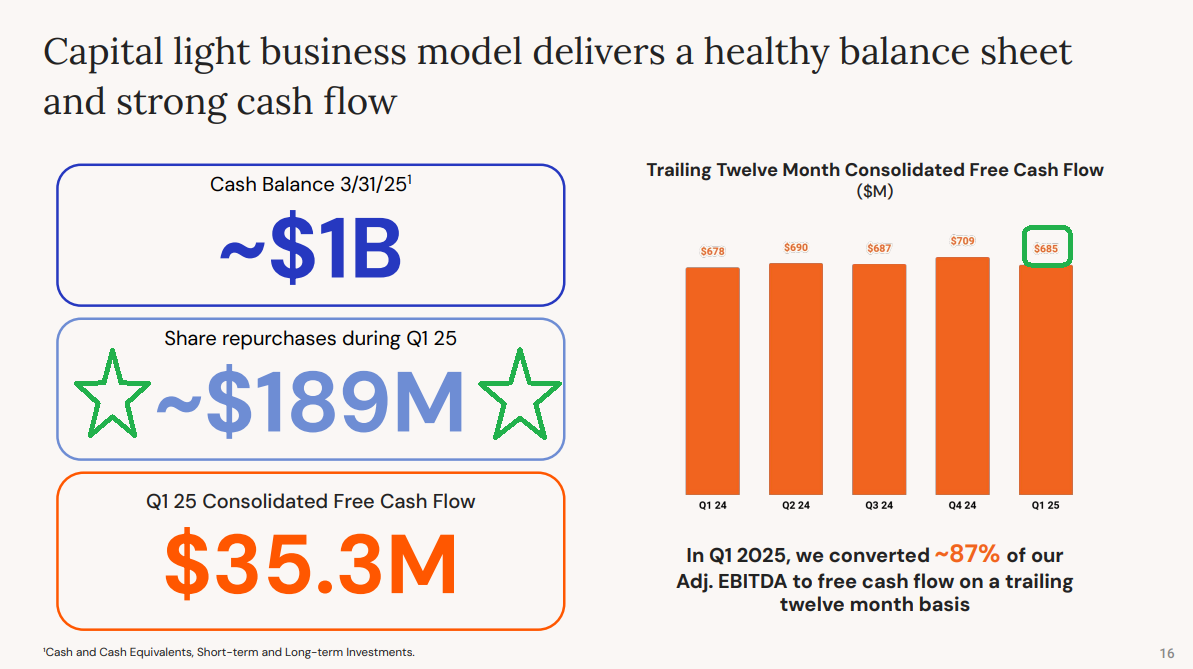

3) Management repurchased $189 million worth of shares, reducing the share count by 3.7 million at an average price of $51. Cash balance at quarter-end was $1 billion, with TTM free cash flow of $685 million.

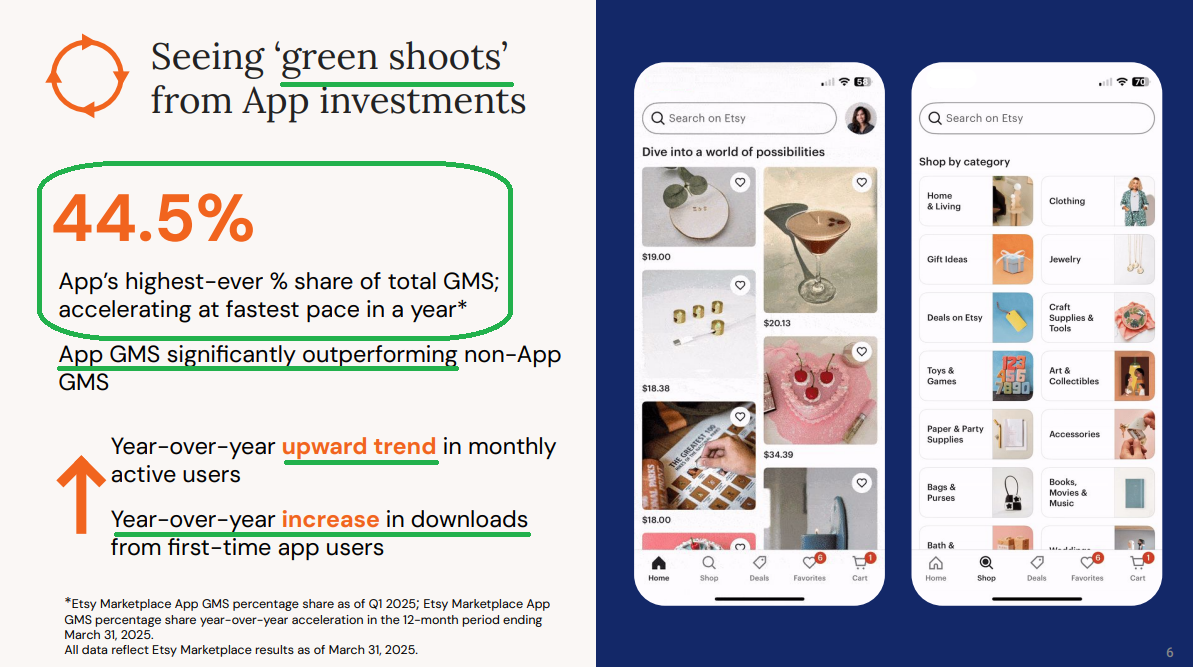

4) The Etsy app continues to show green shoots, capturing 44.5% of total GMS—its highest share ever—and growing at the fastest pace in over a year. Both monthly active users and first-time app users continue to trend higher YoY.

5) Etsy signed a stock purchase agreement this month to sell Reverb, which is expected to close in the coming months and led to a $101.7 million impairment charge.

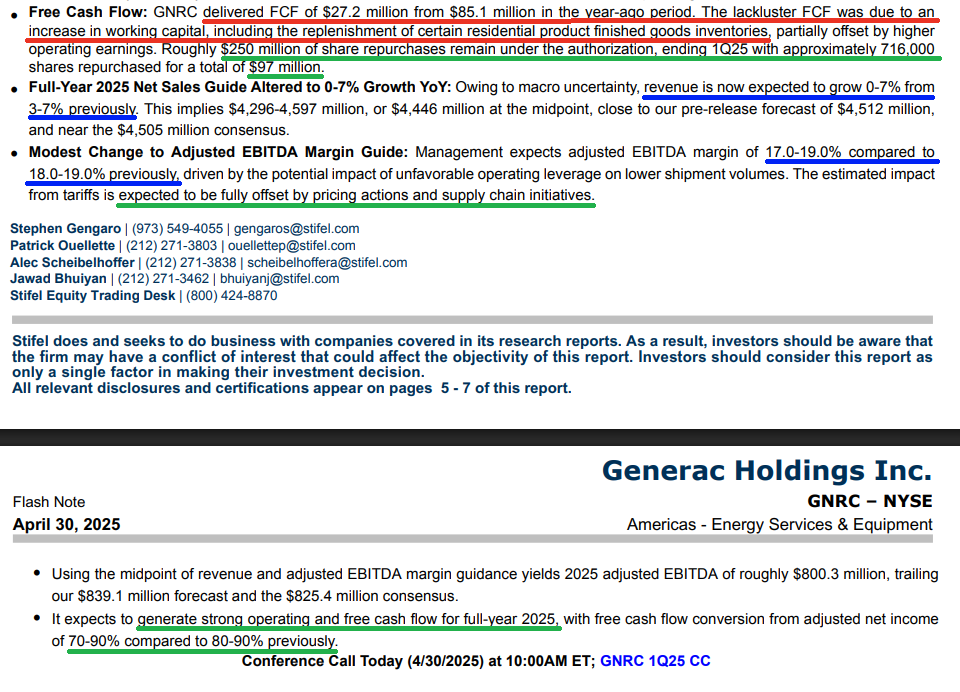

Generac Quick Update

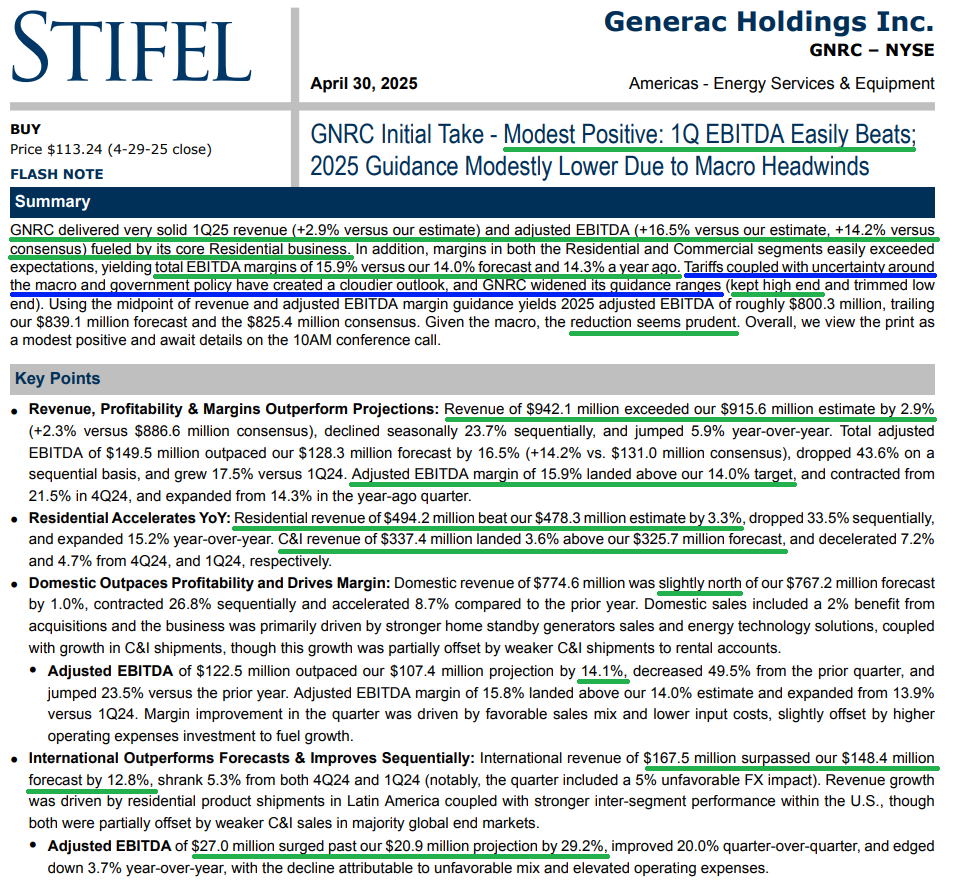

Generac posted another strong quarter, with revenue of $942 million beating estimates by $23 million and non-GAAP EPS of $1.26 crushing expectations by $0.29. More to come next week—stay tuned.

General Market

The CNN “Fear and Greed Index” ticked up from 30 last week to 39 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

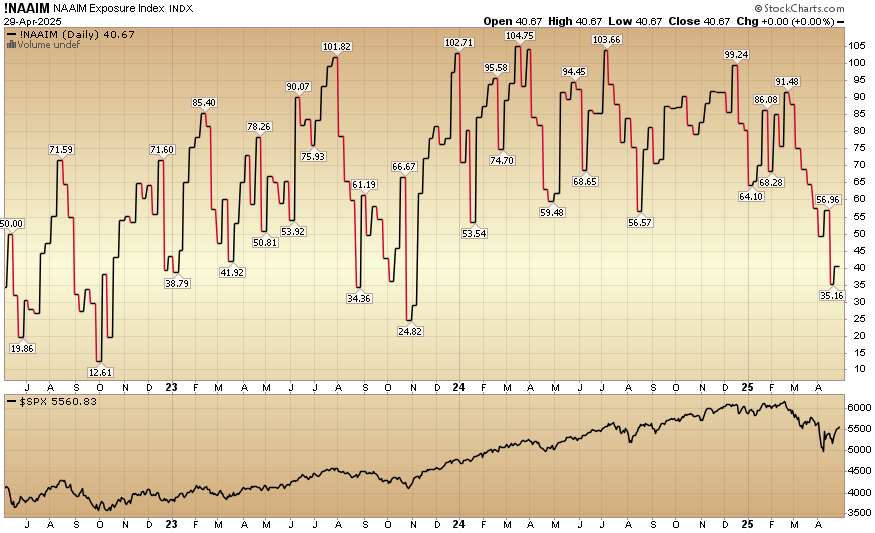

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 40.67% this week from 35.16% equity exposure last week.

Our podcast|videocast will be out sometime on Thursday or Friday. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, Not Advice. See Terms

Not a solicitation.