Key Market Outlook(s) and Pick(s)

On Monday, I joined David Lin on his show “The David Lin Report” to discuss the market’s resilience amid tariff concerns, broader outlook for the second half, international equities, and natural gas as an AI-driven play. Thanks to David for having me on. My conversations with David tend to go viral and get a lot of attention. This one’s no different! Watch here to see why:

On Wednesday, I joined Sarah Al-Khaldi on Channel NewsAsia to discuss markets, outlook, and forced buyers. Thanks to Sarah and Audrey Tay for having me on:

On Monday, I joined Andrea Heng and Hairianto Diman on Channel NewsAsia (Singapore Radio) to discuss Warren Buffett, the greatest investor of all time! Thanks to Andrea and Hairianto for having me on:

Cooper Standard Update

Each week we try to cover 1-2 companies we have discussed in previous podcast|videocast(s) and/or own for clients (including personally).

10 Key Points

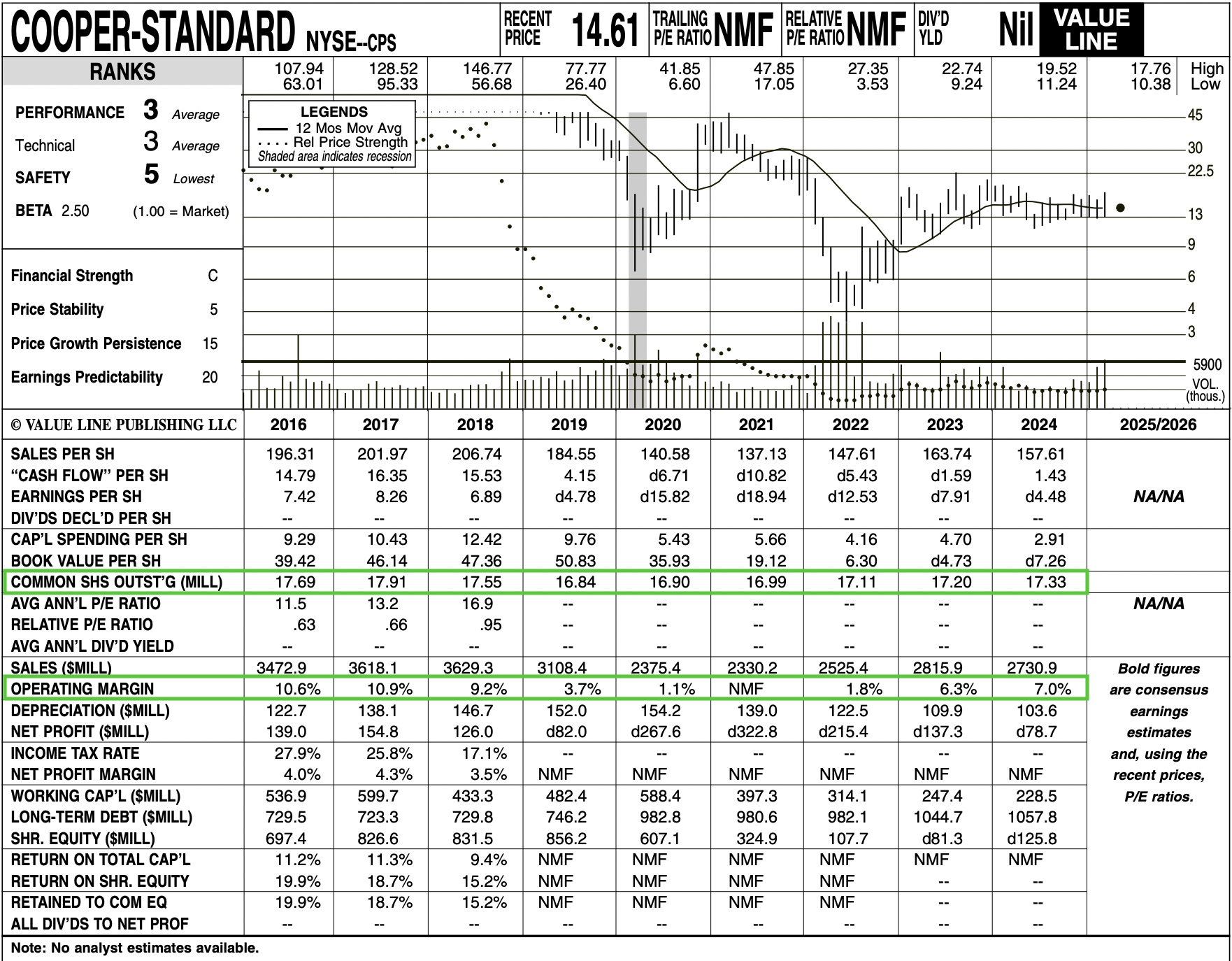

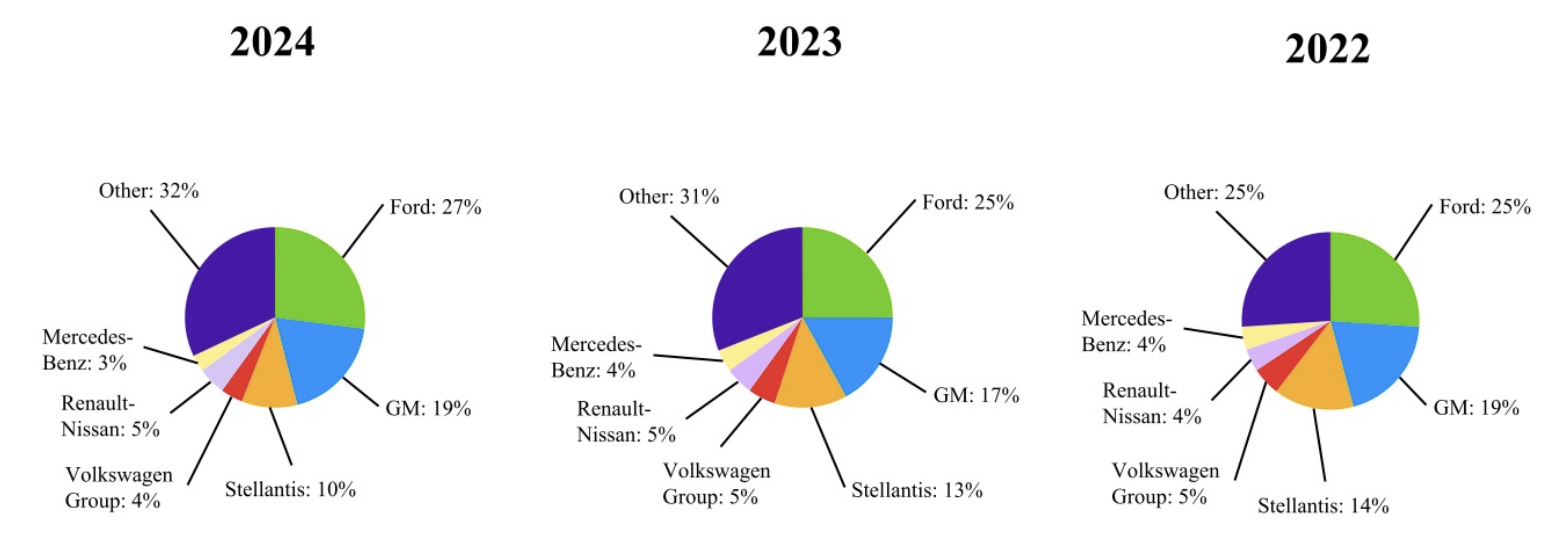

1) CPS was named a GM Supplier of the Year for the eighth consecutive year, but more importantly, received a Toyota Excellent Achievement Award for helping reduce costs during the quarter. This is a very big deal. Although CPS has long been a supplier to Toyota, the OEM has traditionally been included in the “Other” category of the business mix, which accounts for 32% of revenue and includes numerous automakers. See chart below. For comparison, Mercedes-Benz is broken out separately and represents just 3% of sales, leading us to believe Toyota likely contributes a very low single-digit percentage at most. Gaining this recognition is a strong indication of opportunities to win new, profitable business going forward, especially as Toyota considers expanding U.S. production in response to tariffs

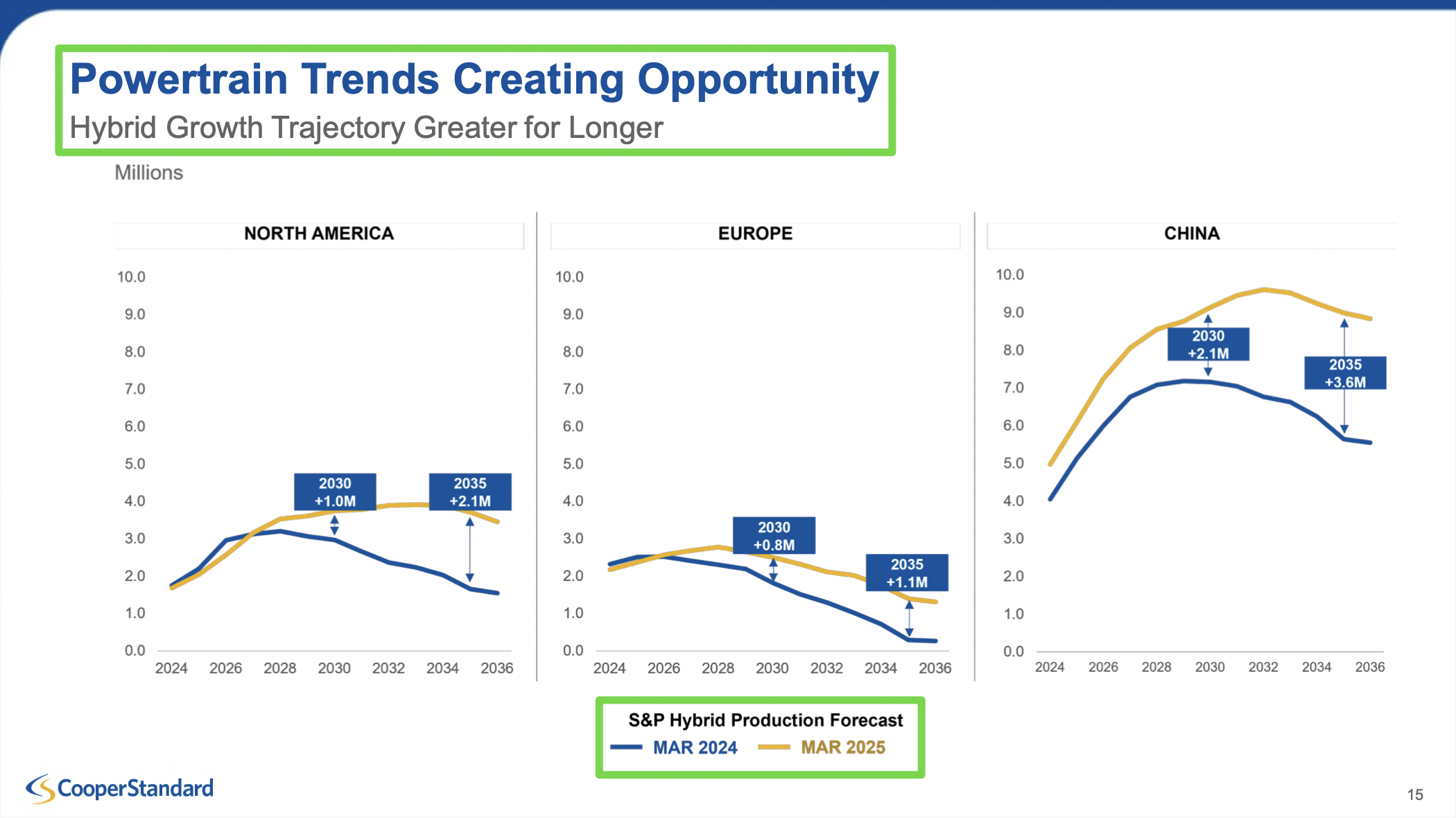

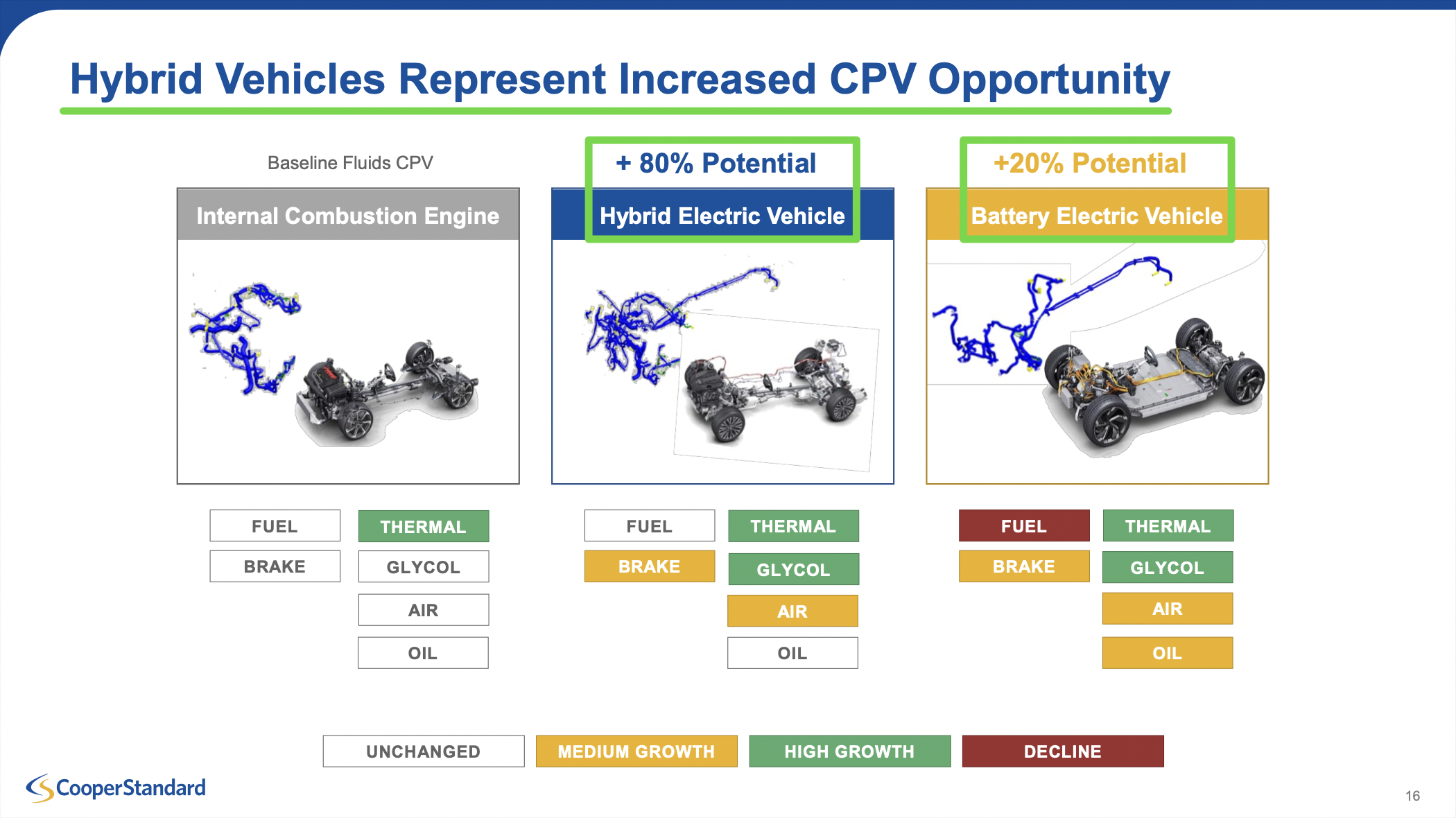

2) Increased hybrid adoption continues to represent a major opportunity for Cooper Standard, with +80% higher content per vehicle. Production forecasts have been raised across all major regions. In North America, annual hybrid production is expected to increase by 1 million units by 2030 and 2.1 million by 2035. Europe is projected to add 800,000 units by 2030 and 1.1 million by 2035. In China, hybrid output is estimated to grow by 2.1 million units by 2030 and 3.6 million by 2035. Altogether, this represents nearly 4 million additional hybrid units in 2030 and almost 7 million by 2035.

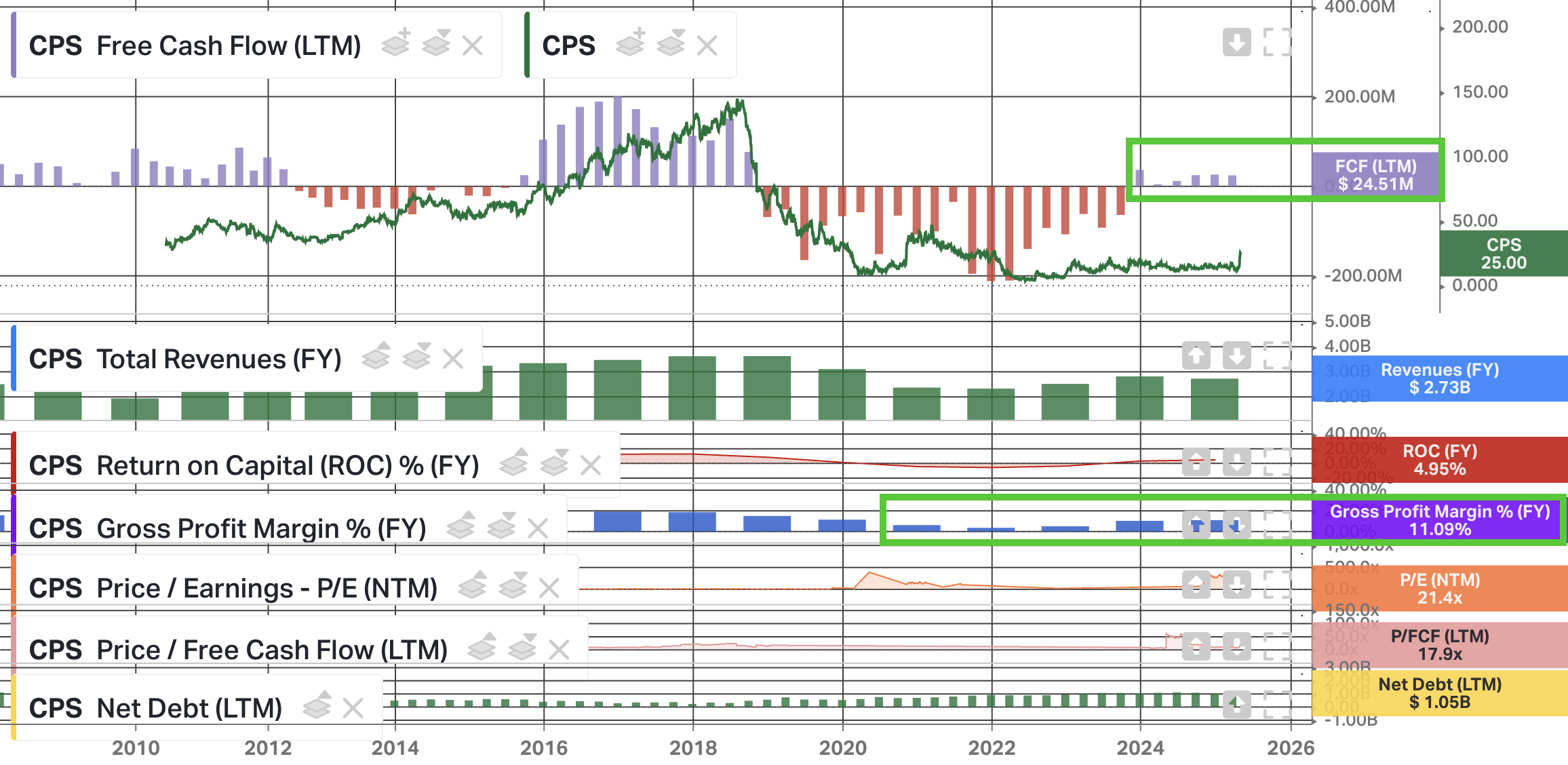

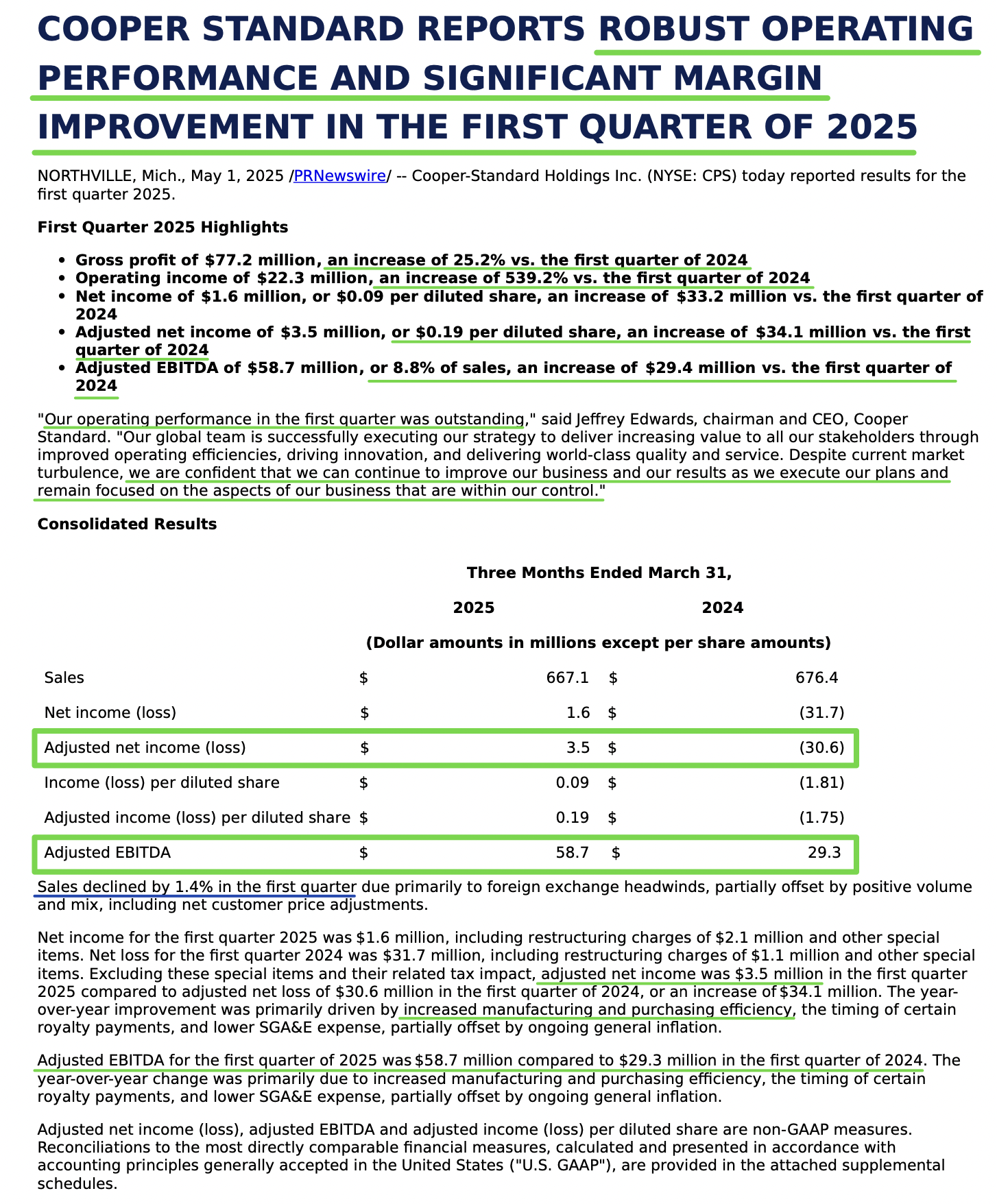

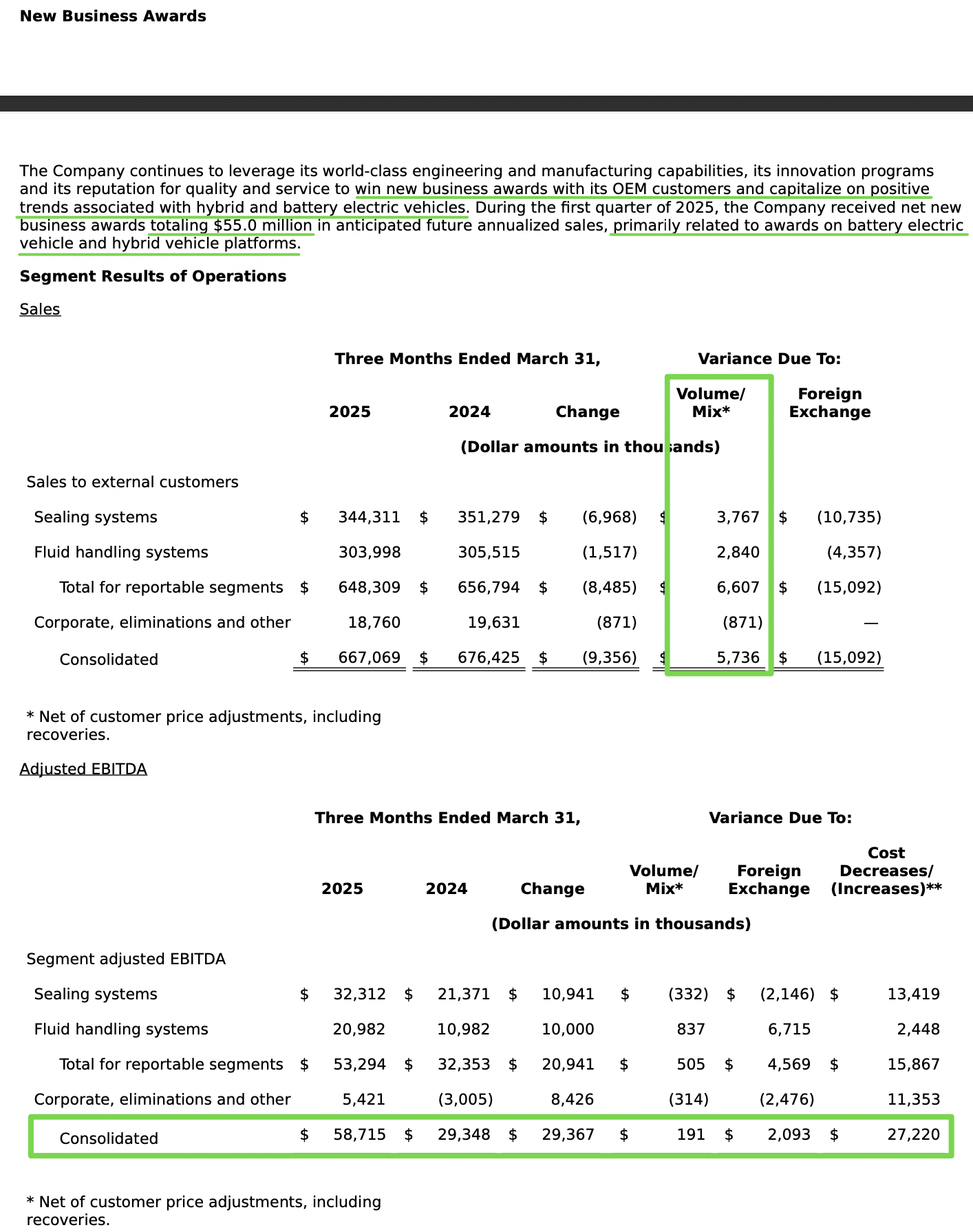

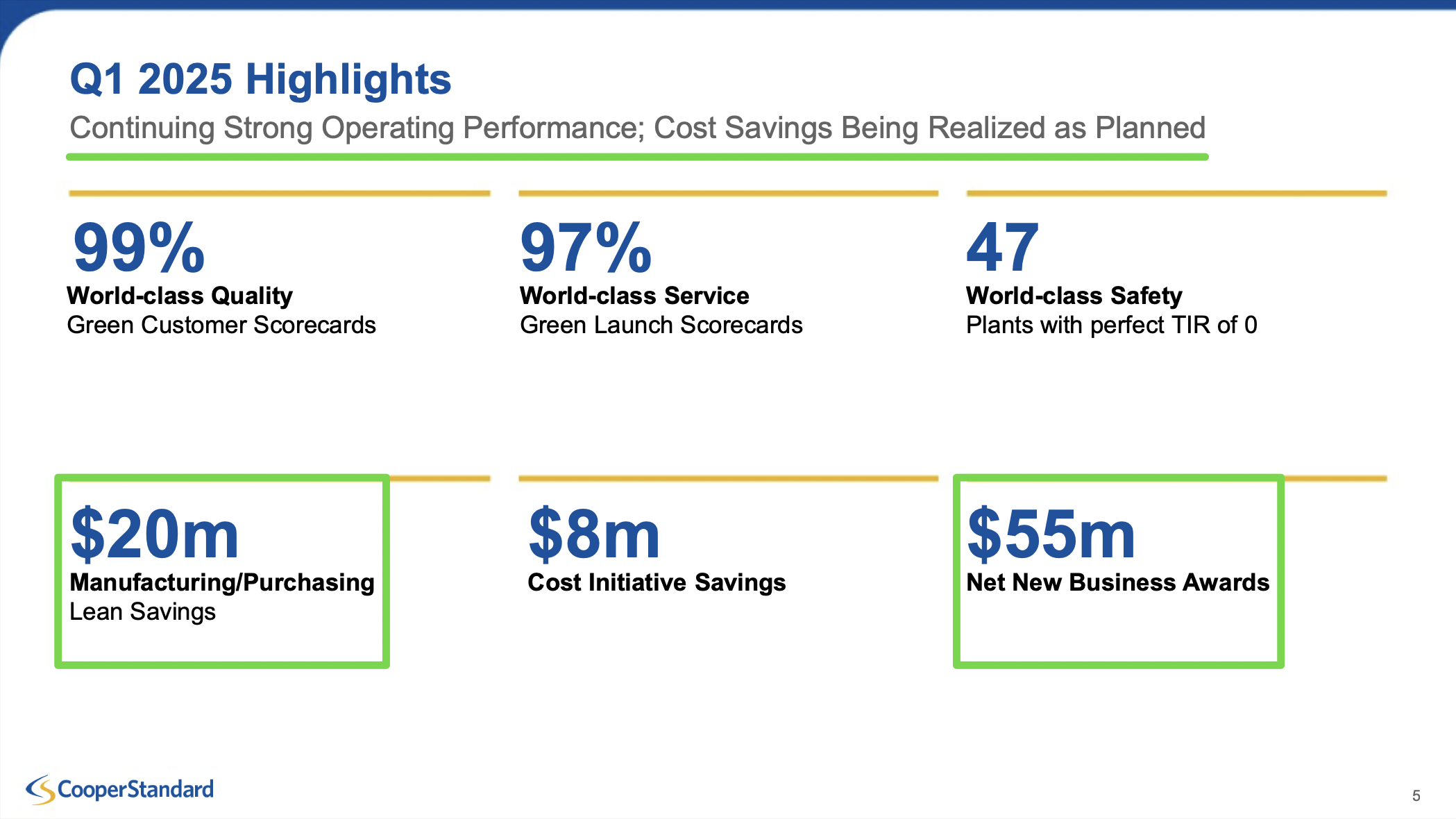

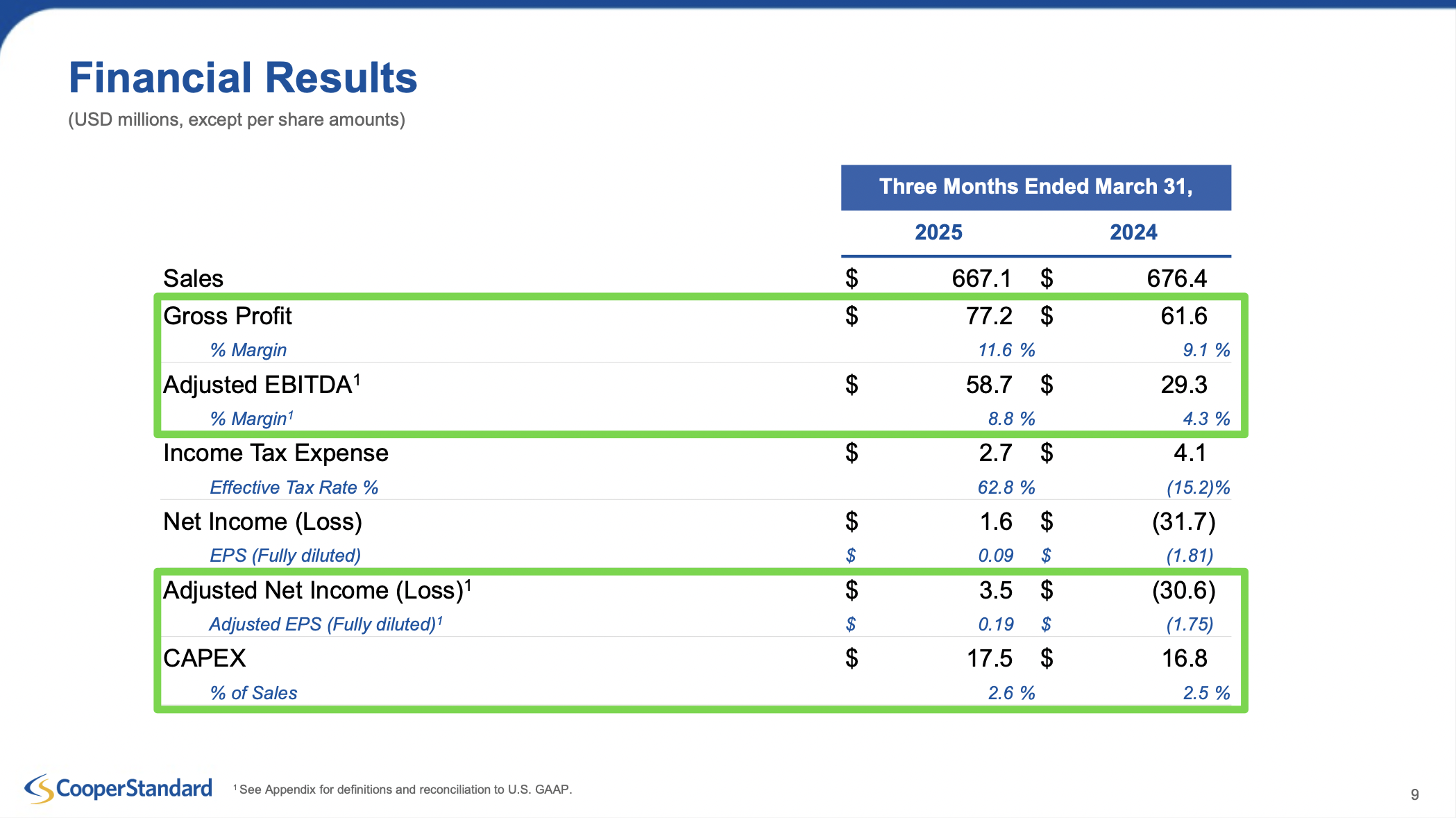

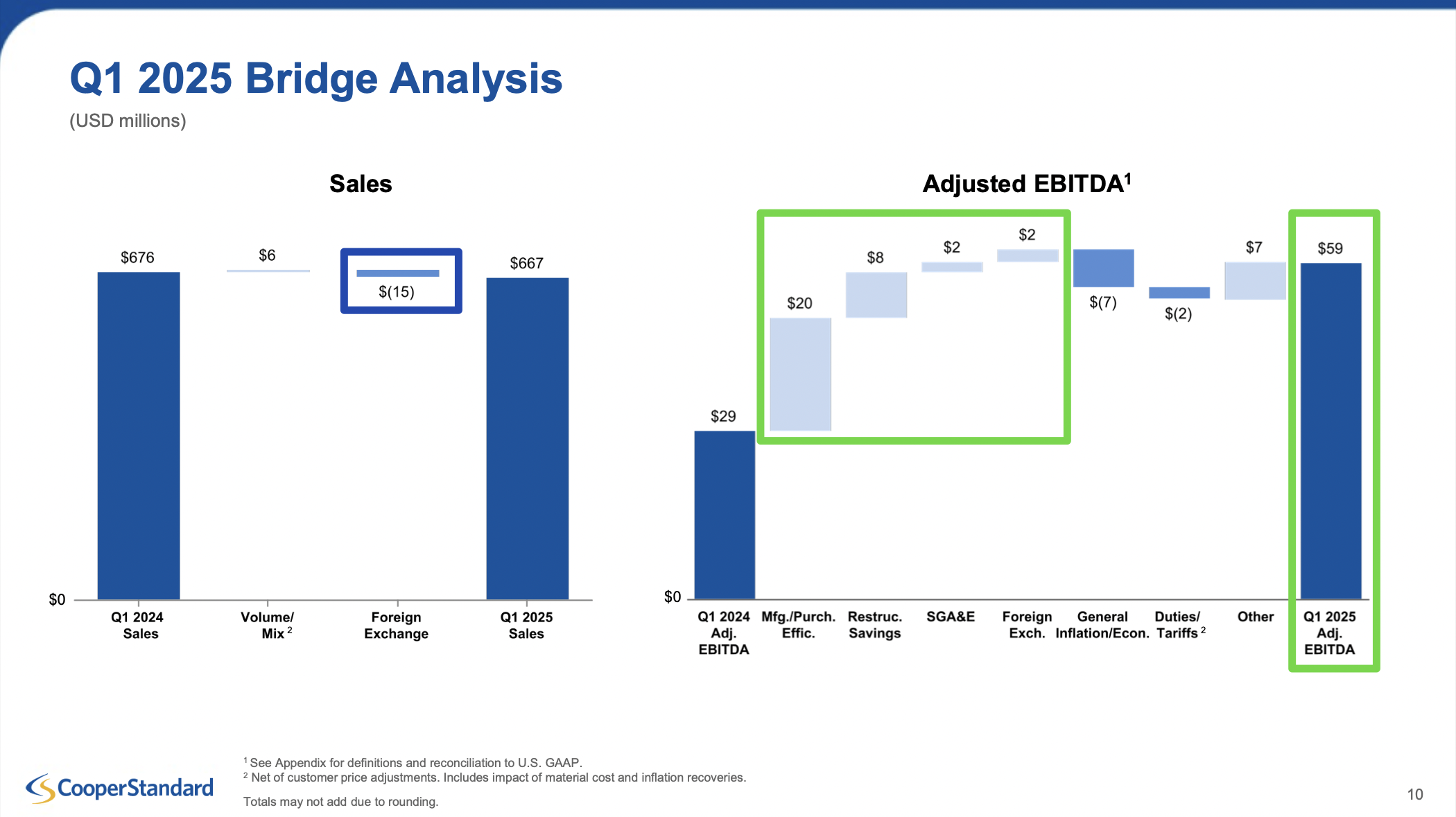

3) Adjusted EBITDA margins reached 8.8% in Q1, more than doubling from 4.3% a year ago. Management remains confident in achieving a return to double-digit adjusted EBITDA margins and double-digit returns on invested capital by the end of 2025.

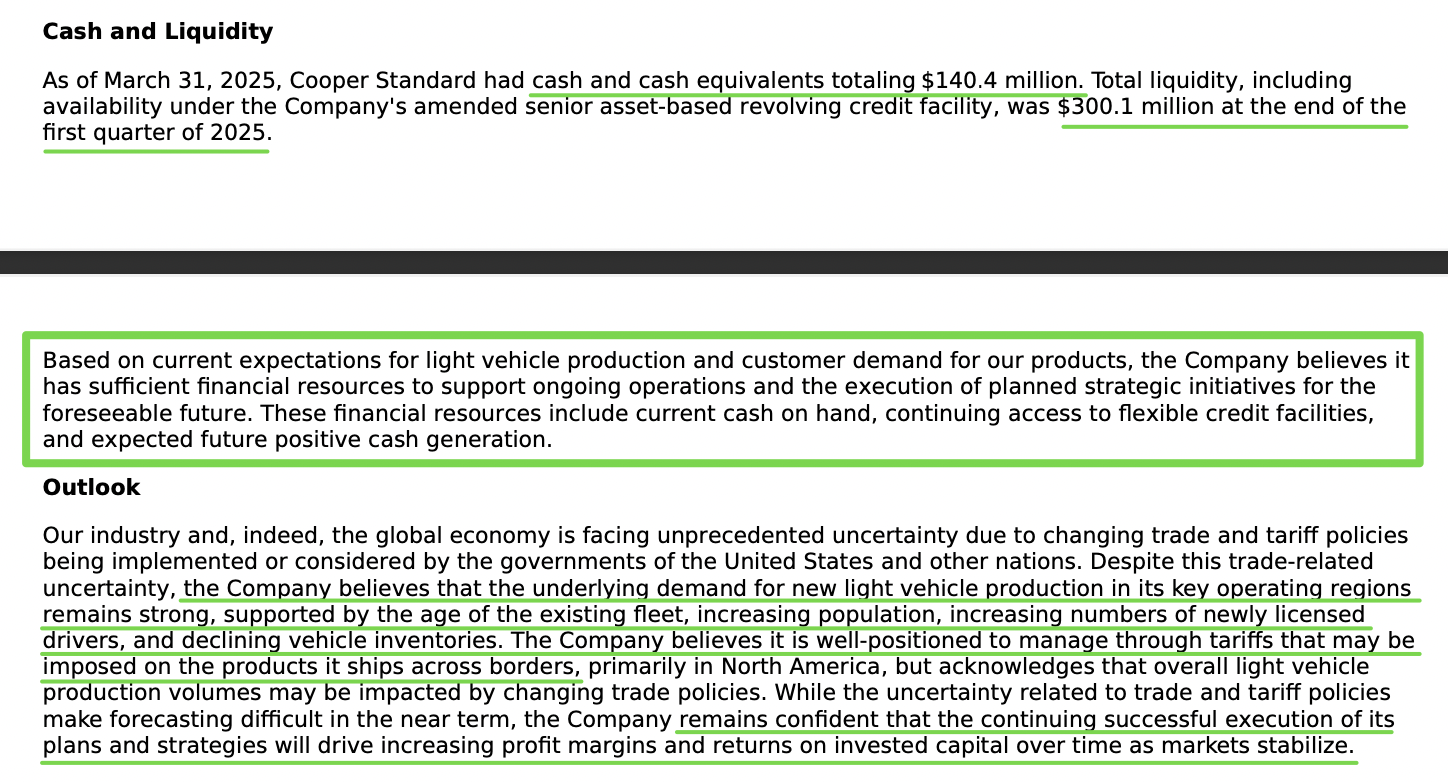

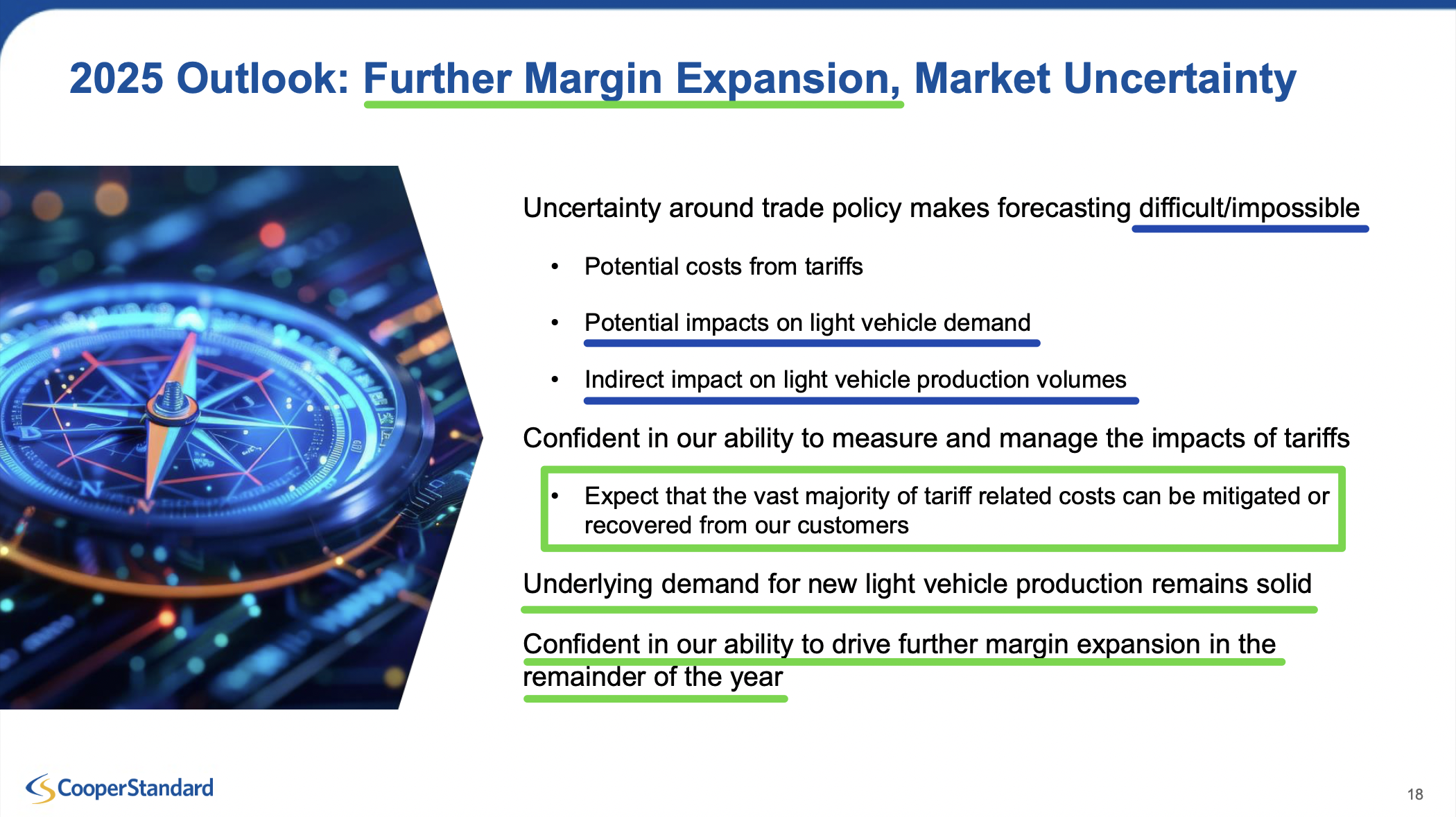

4) Management expects to mitigate or recover the vast majority of direct tariff impacts and does not view tariffs as a significant cost headwind going forward. The vast majority of parts fall under the free trade umbrella, making tariffs much less of a threat for CPS compared to other tier-one suppliers. For the small amount that was paid (~$2M), management expects to be reimbursed by the OEMs.

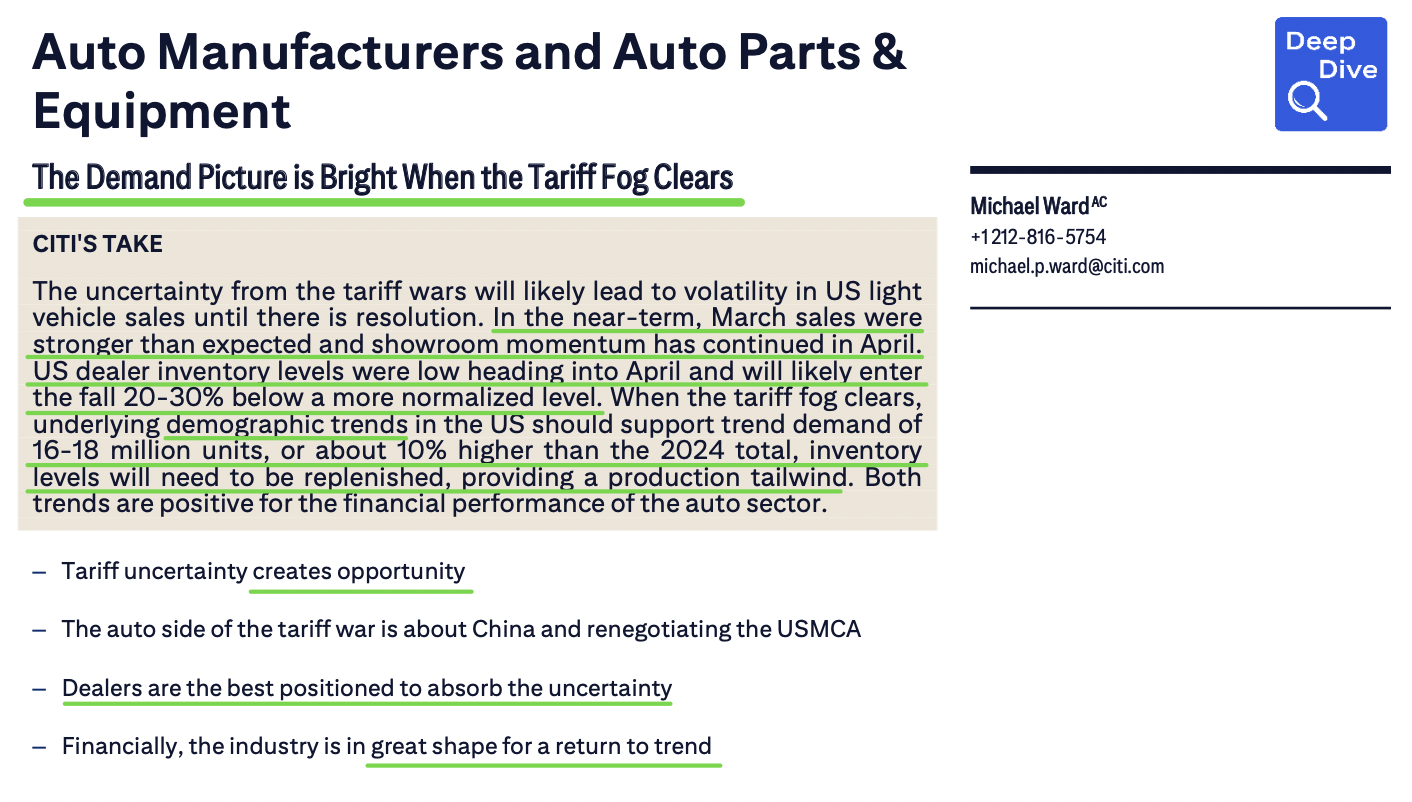

5) So far, management has seen no significant changes in Q2 compared to original volume expectations, with mix coming in more favorable due to higher truck/SUV production. Production schedules remain intact, and with many OEMs offering favorable incentive plans like employee pricing, domestic inventories which were already ~30% below historical averages continue to be depleted. Inventories will have to be replenished, suggesting strong second-half production outlook.

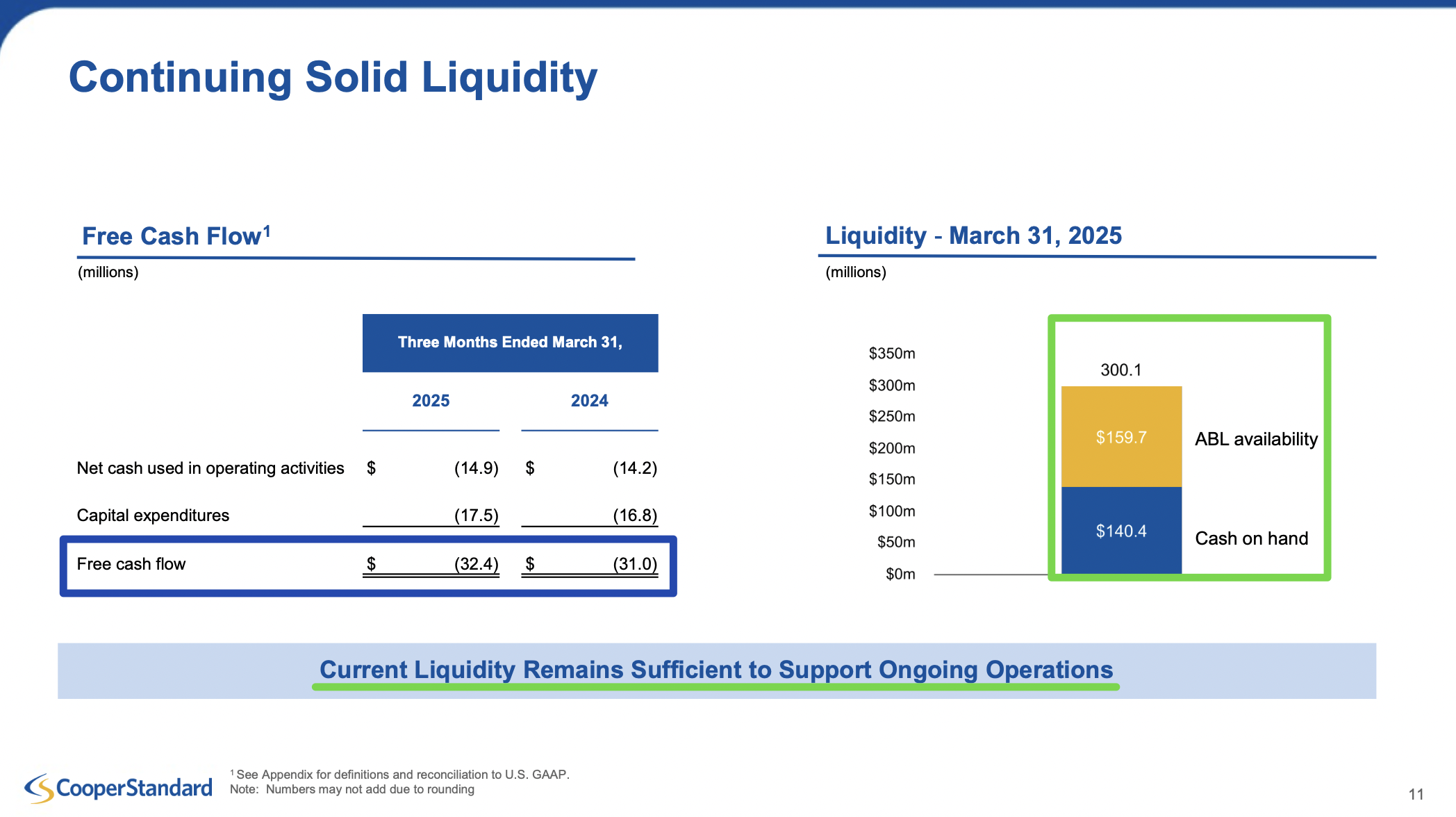

6) Free cash flow was a net outflow of approximately $32 million, in line with last year. However, Q1 has historically always been a working capital outflow from a seasonality perspective. Cash and cash equivalents totaled approximately $140 million, bringing total liquidity to $300 million.

7) The eCoFlow Switch Pump recently won the Automotive News PACE Pilot Award, a key industry benchmark for emerging technologies. Management expects that as production of this technology ramps up and becomes fully commercialized, it will drive further profitable growth and EXPAND the +80% CPV opportunity in hybrids even higher.

8) CPS continues to target a net leverage ratio of less than 2x by the end of 2027, which would be less than half of the current 4.6x. This target assumes normalized volume levels and, most importantly, does not factor in a global refi.

9) CPS was awarded $55 million in net new business during the quarter, heavily weighted towards more complex and higher CPV hybrid and battery electric vehicles.

10) Capex as a percentage of sales during the quarter was 2.6%, still well below the historical average of 4 to 5%, as management focuses on maximizing ROIC and maintaining capital discipline.

Citi Research Note

Earnings Call Highlights

Stanley Black & Decker Update

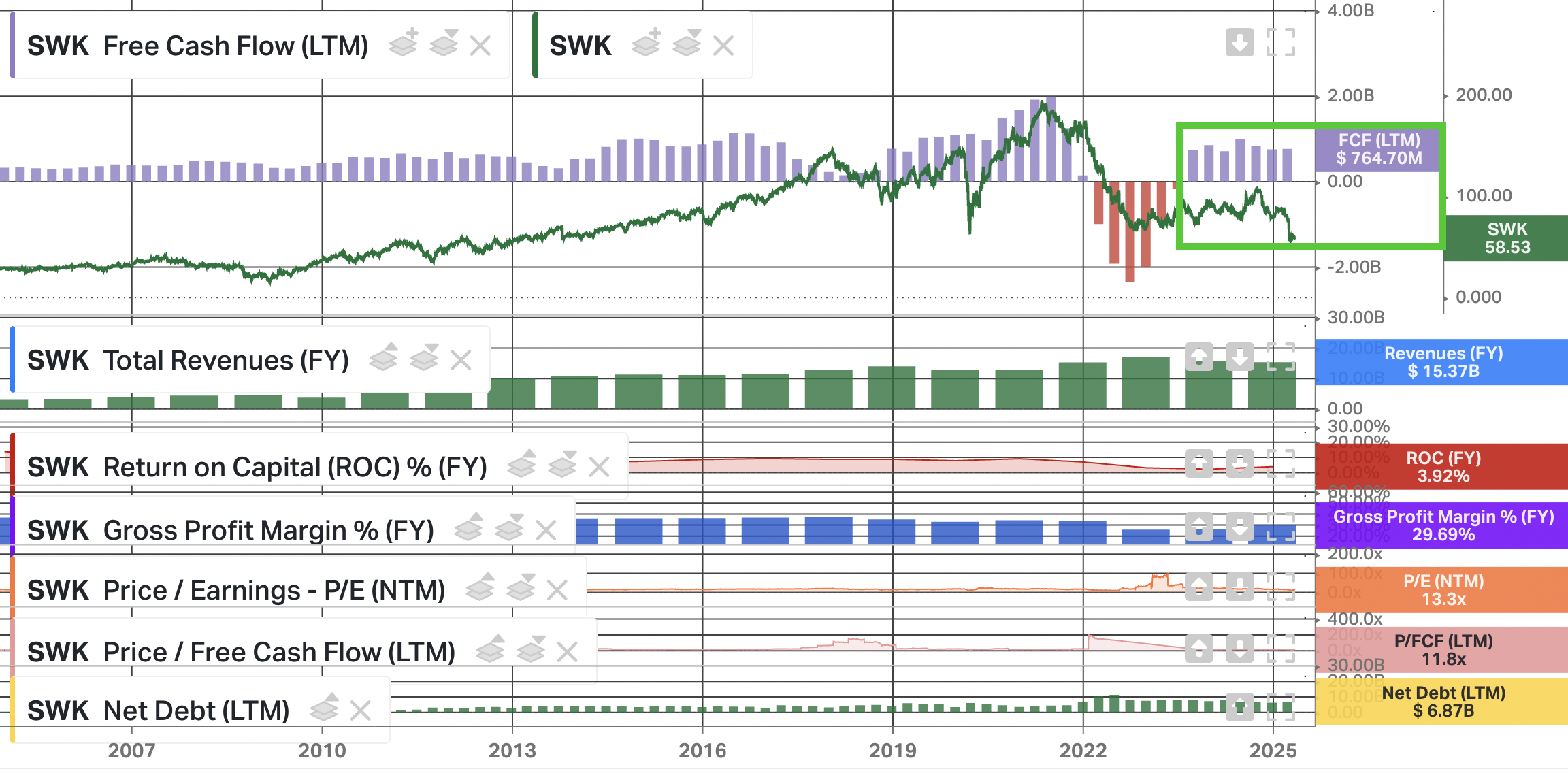

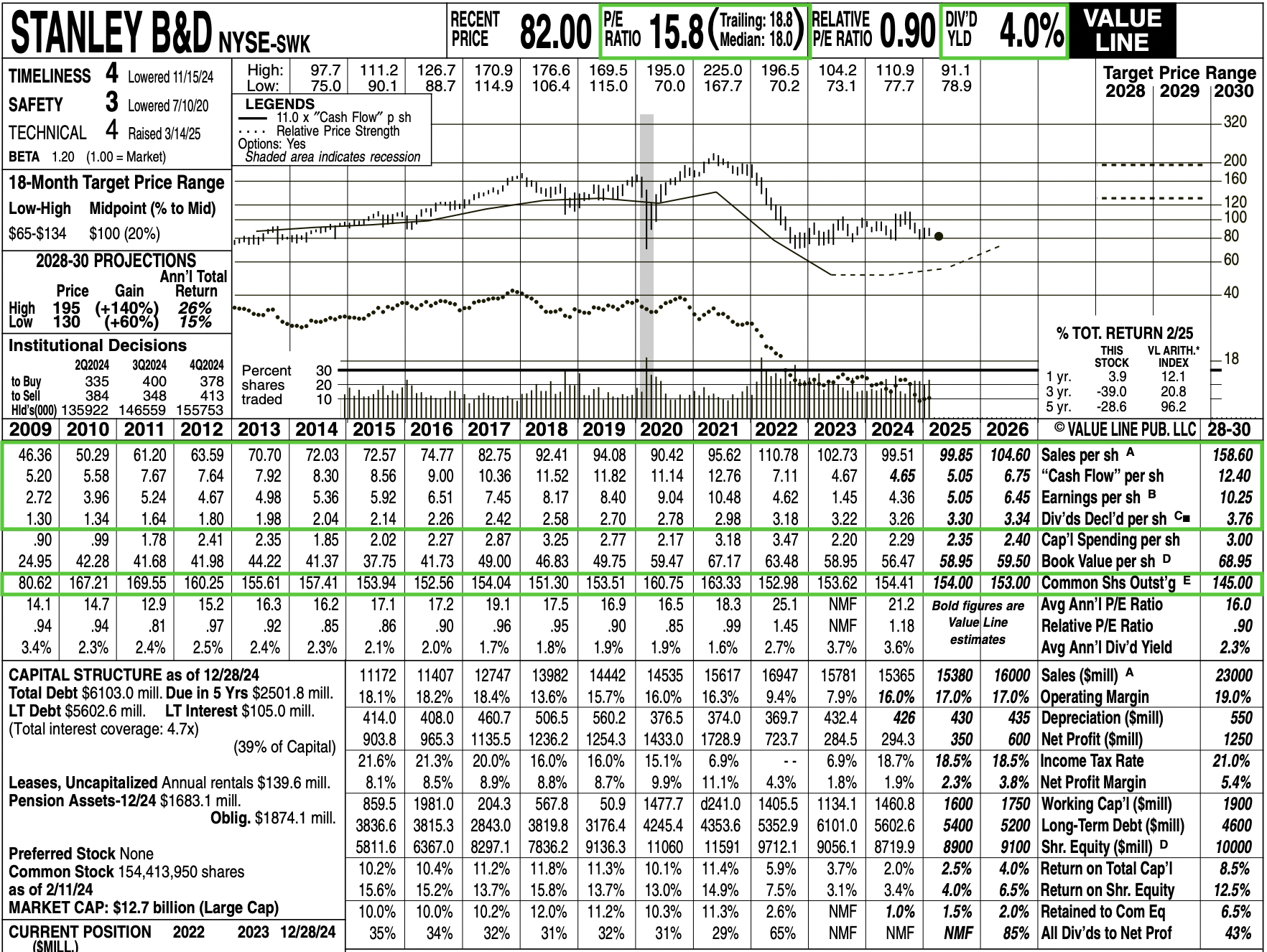

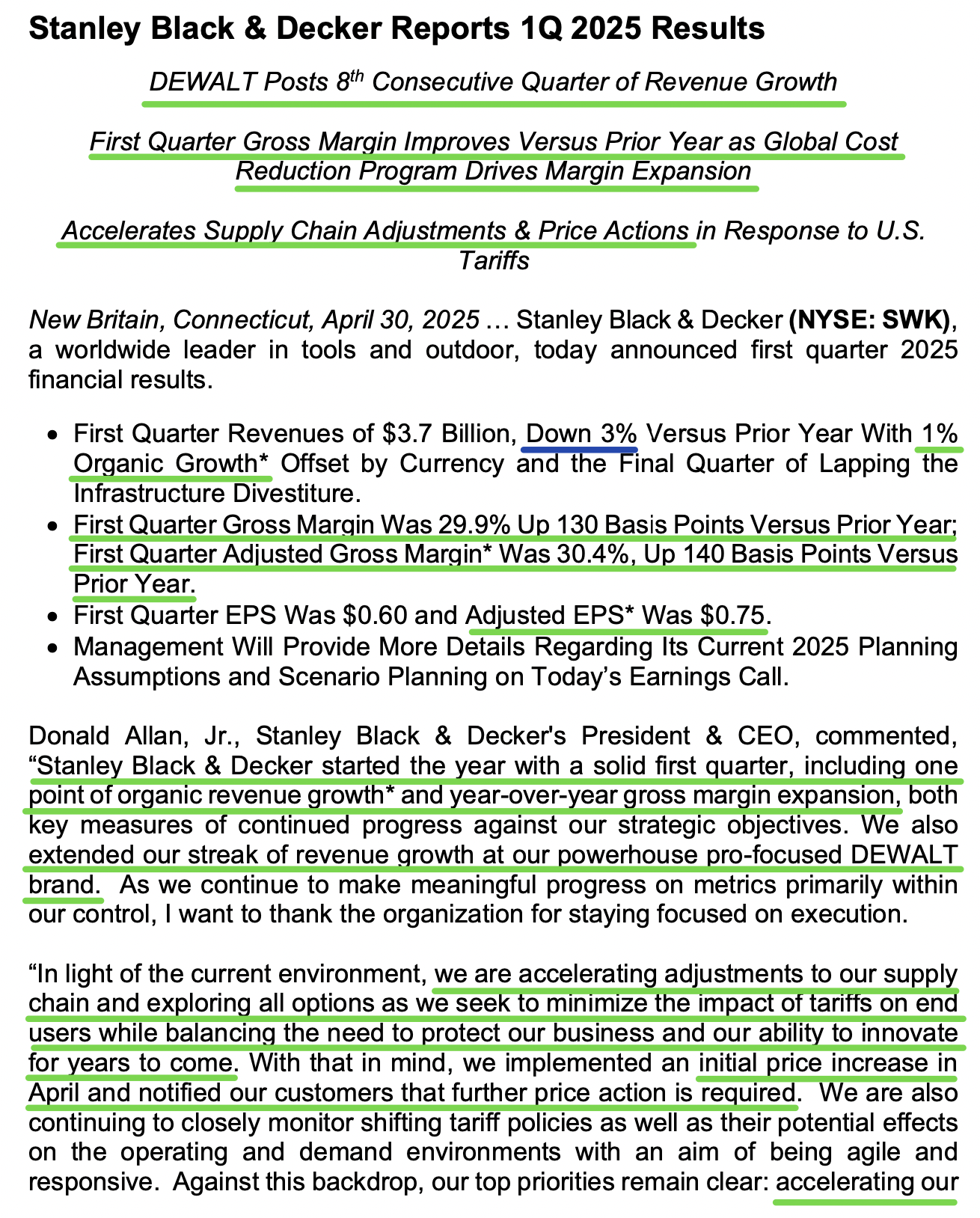

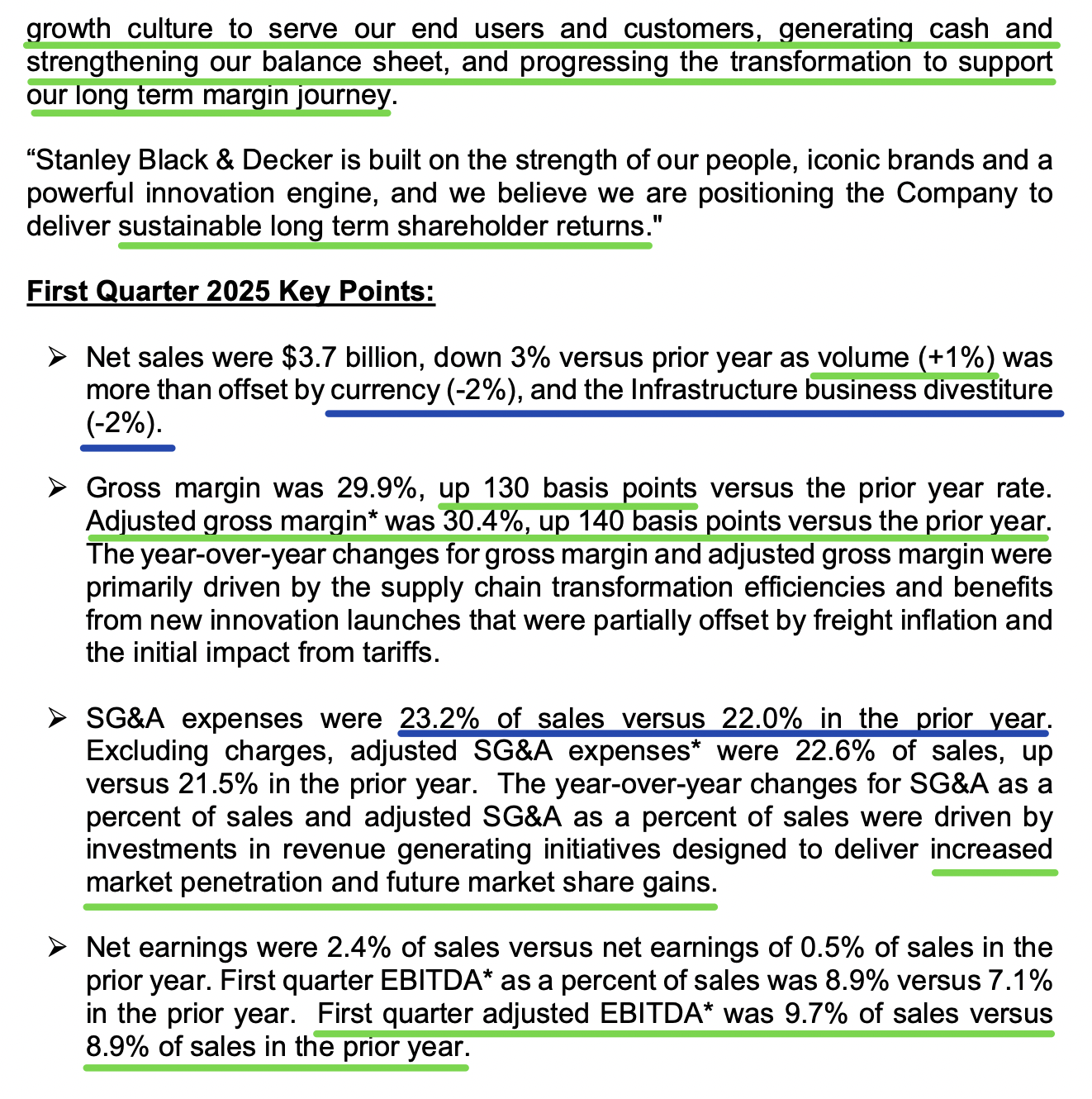

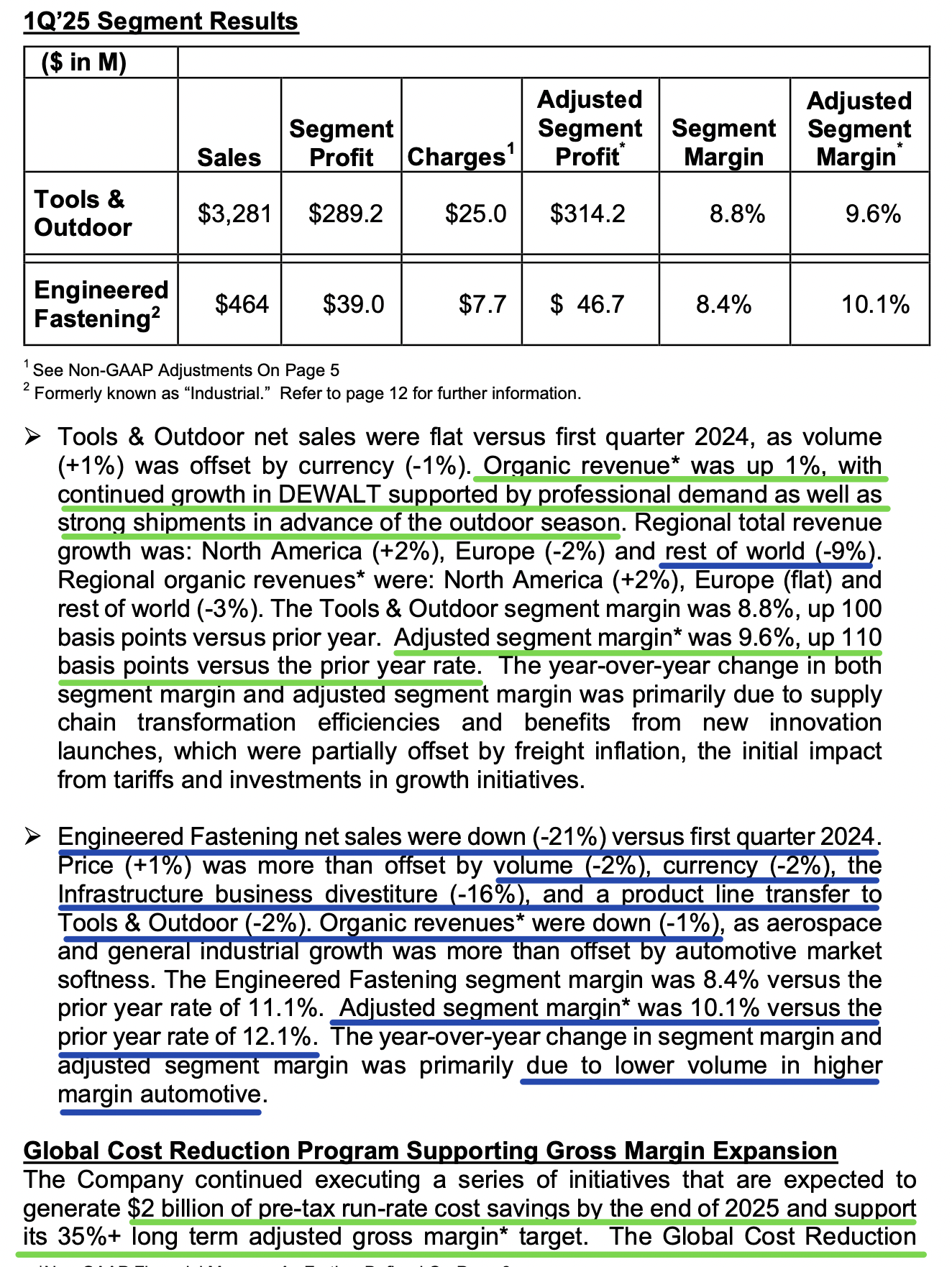

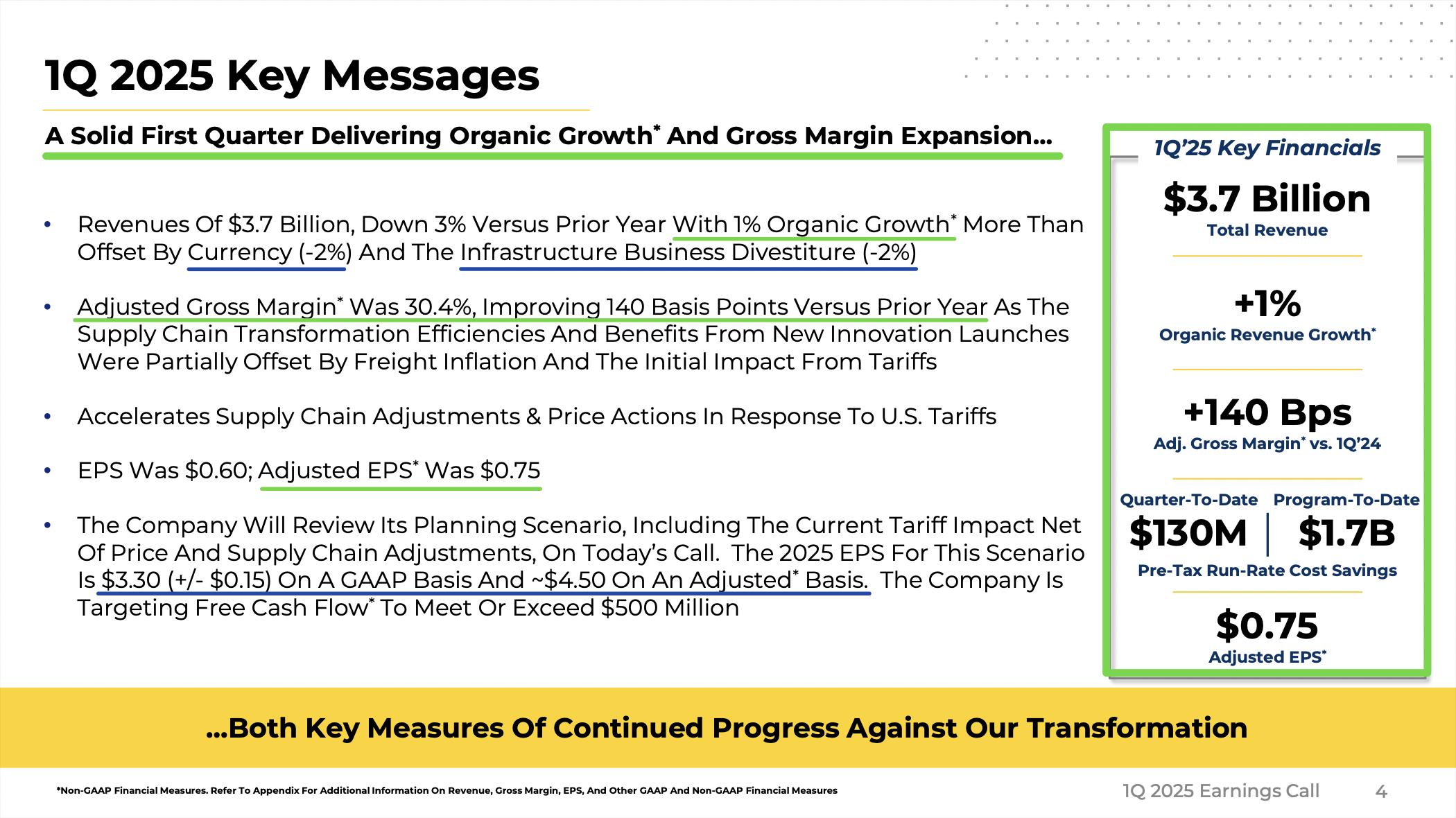

Stanley Black & Decker reported a strong Q1 last week, beating expectations on both the top and bottom line. Revenue came in at $3.74 billion, ahead by about $25 million. Non GAAP EPS came in at $0.75, well above the $0.66 analysts were expecting.

Here’s a detailed breakdown of everything you need to know following the first quarter:

Key Points

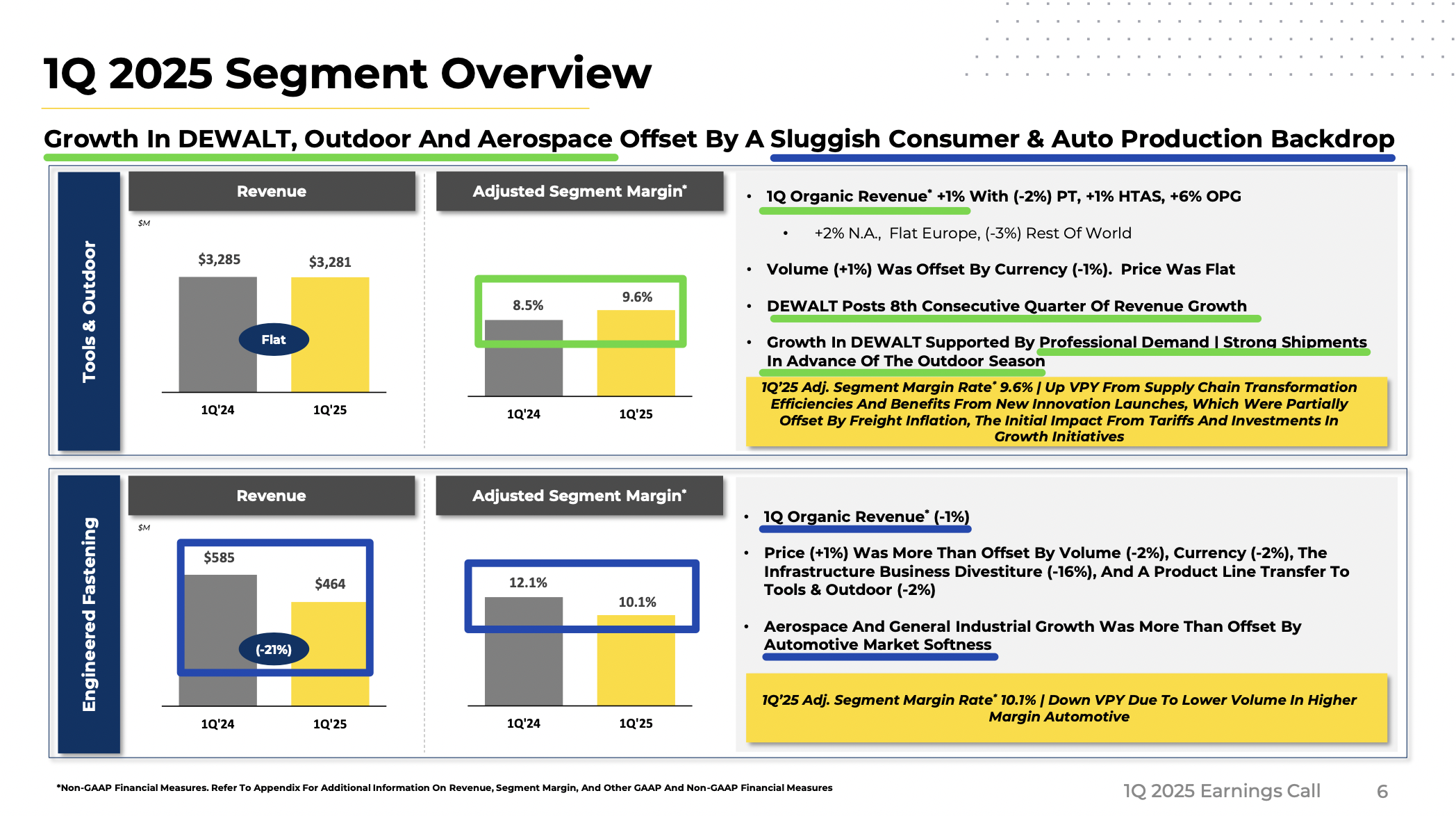

- DEWALT posted its eighth consecutive quarter of revenue growth, coming in at a mid-single-digit clip, driven by strong professional demand and shipments ahead of the outdoor season. Overall, total Q1 organic revenue growth came in at 1%.

- Adjusted gross margins for Q1 came in at 30.4%, up 140 basis points year over year. Management remains on track and confident in achieving its long-term goal of returning to 35% or higher adjusted gross margins.

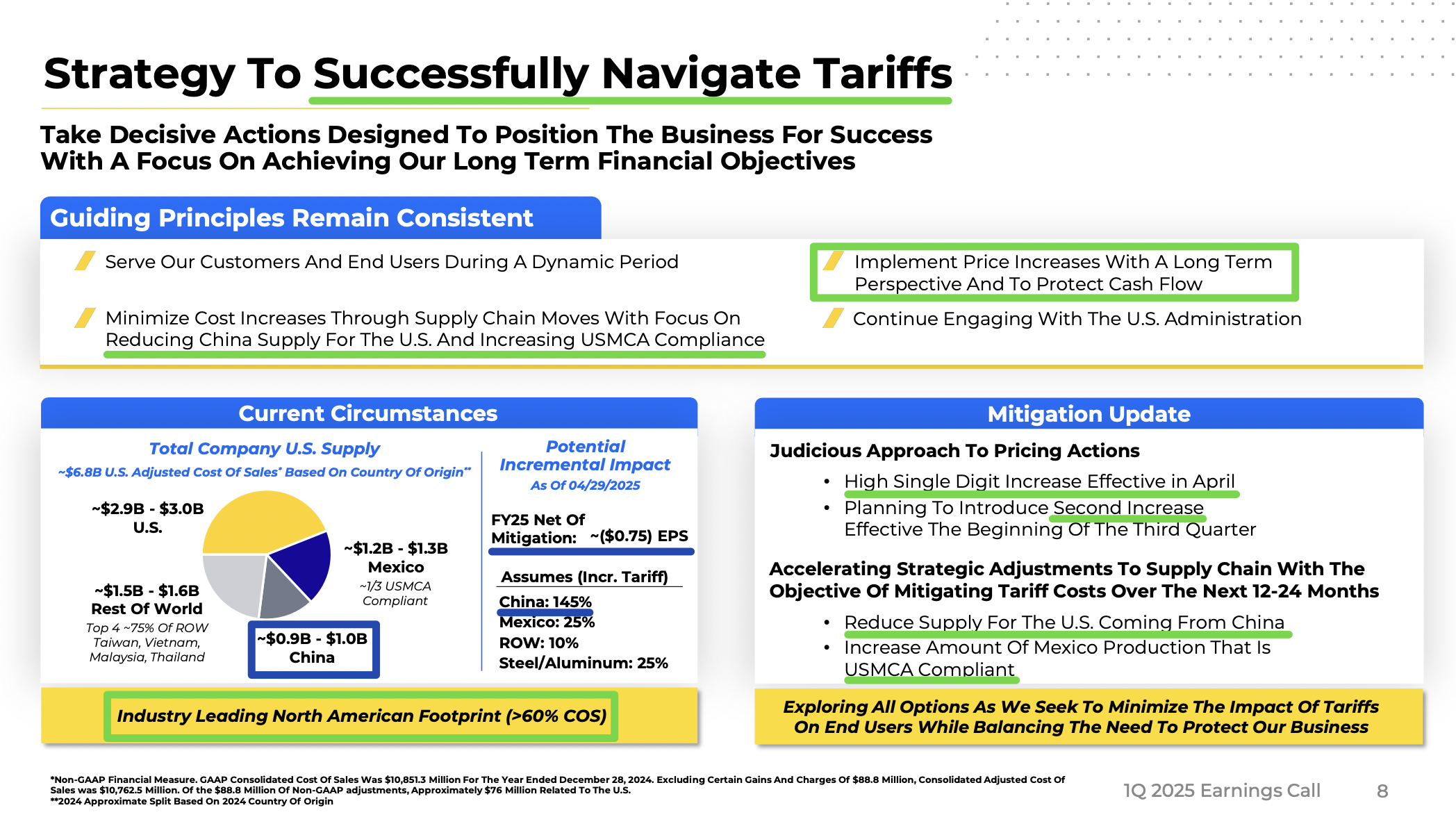

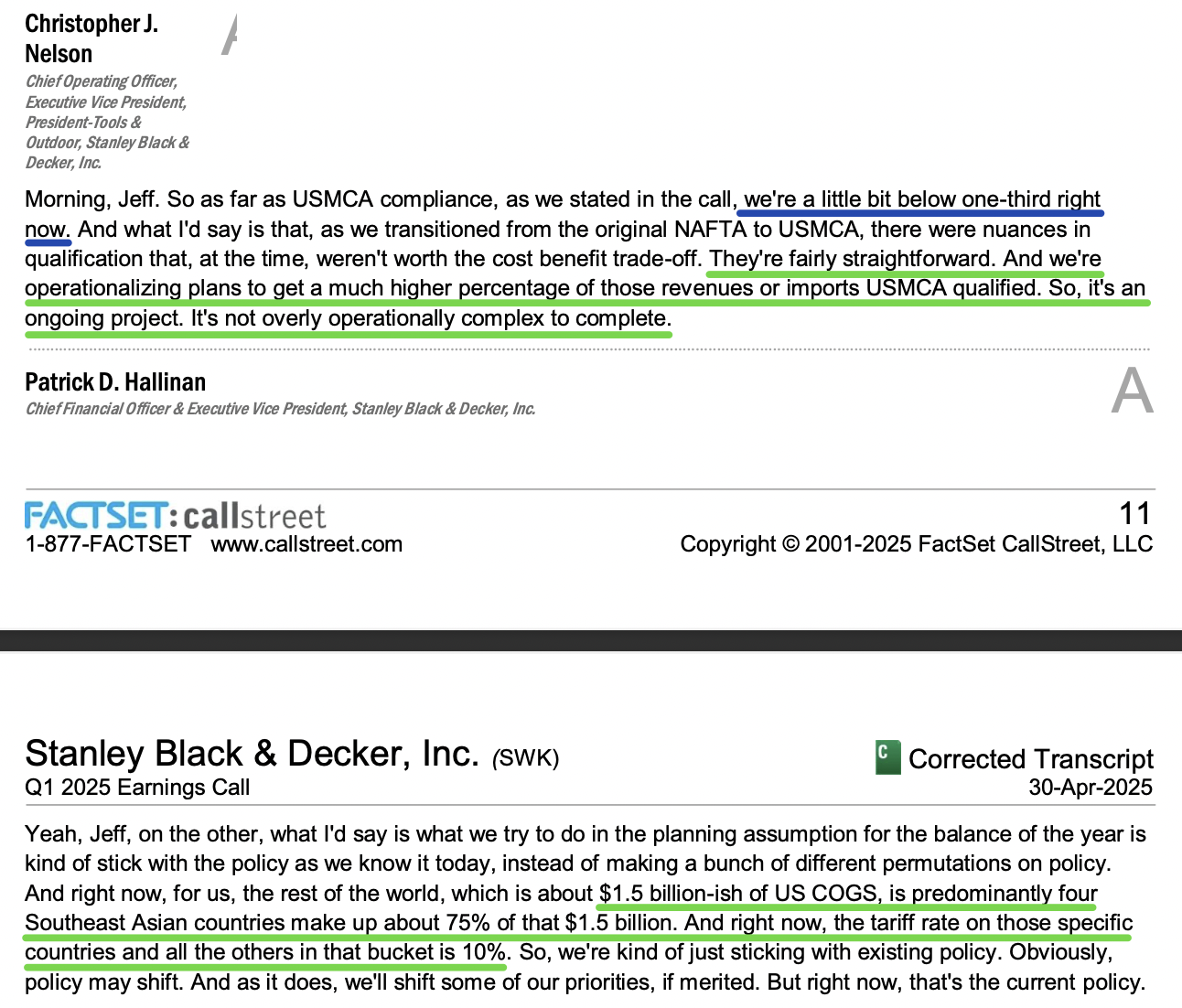

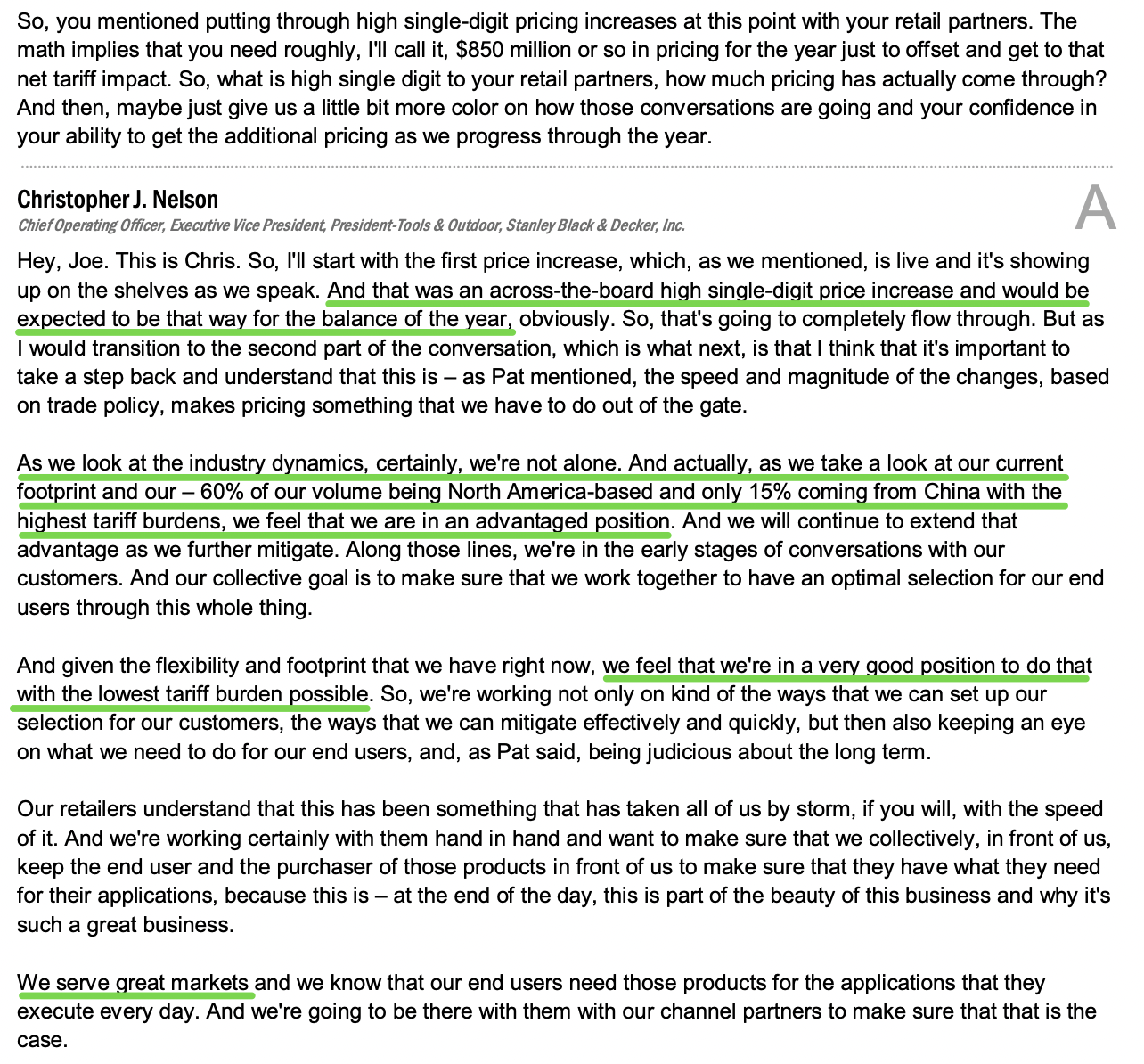

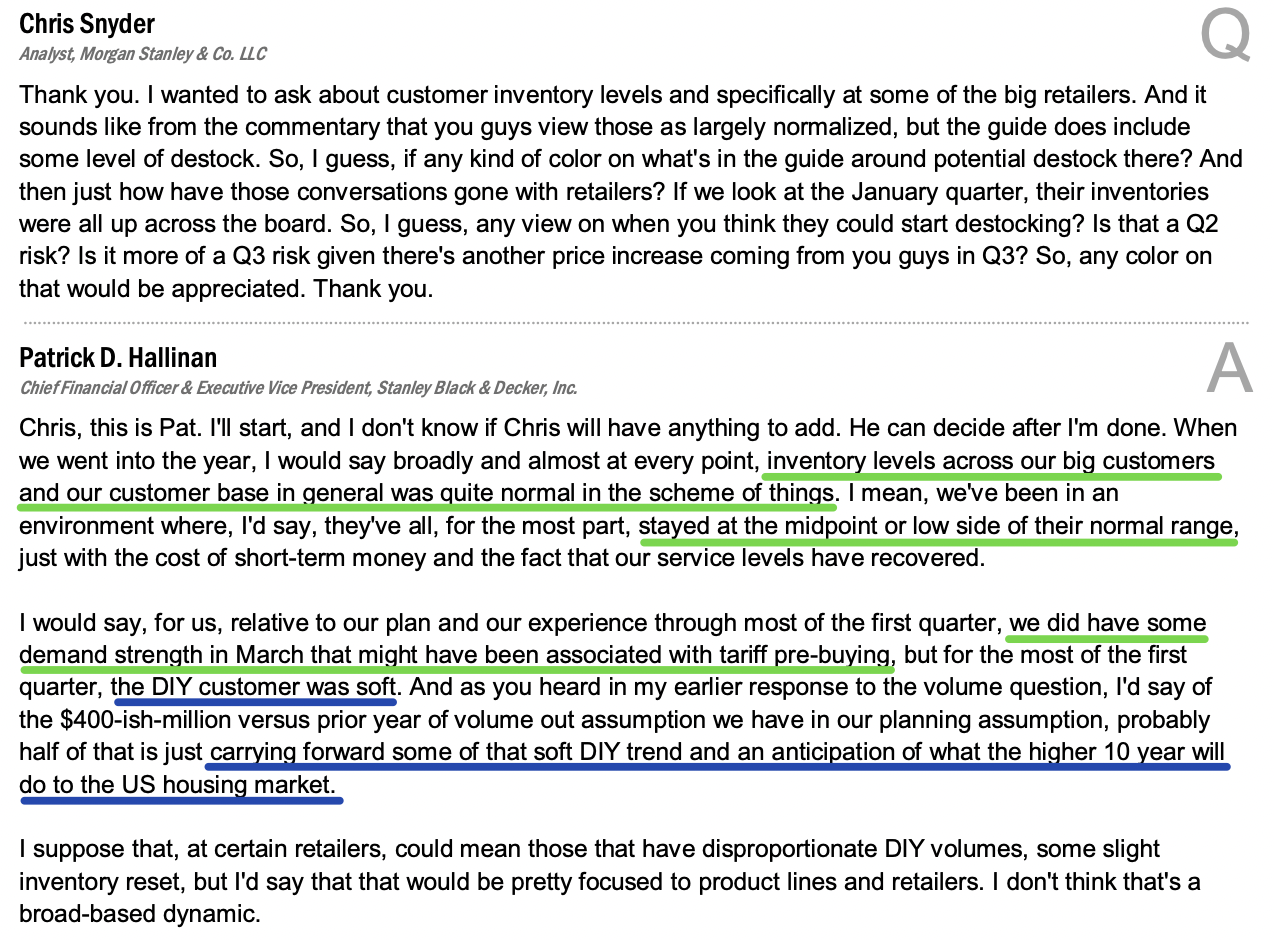

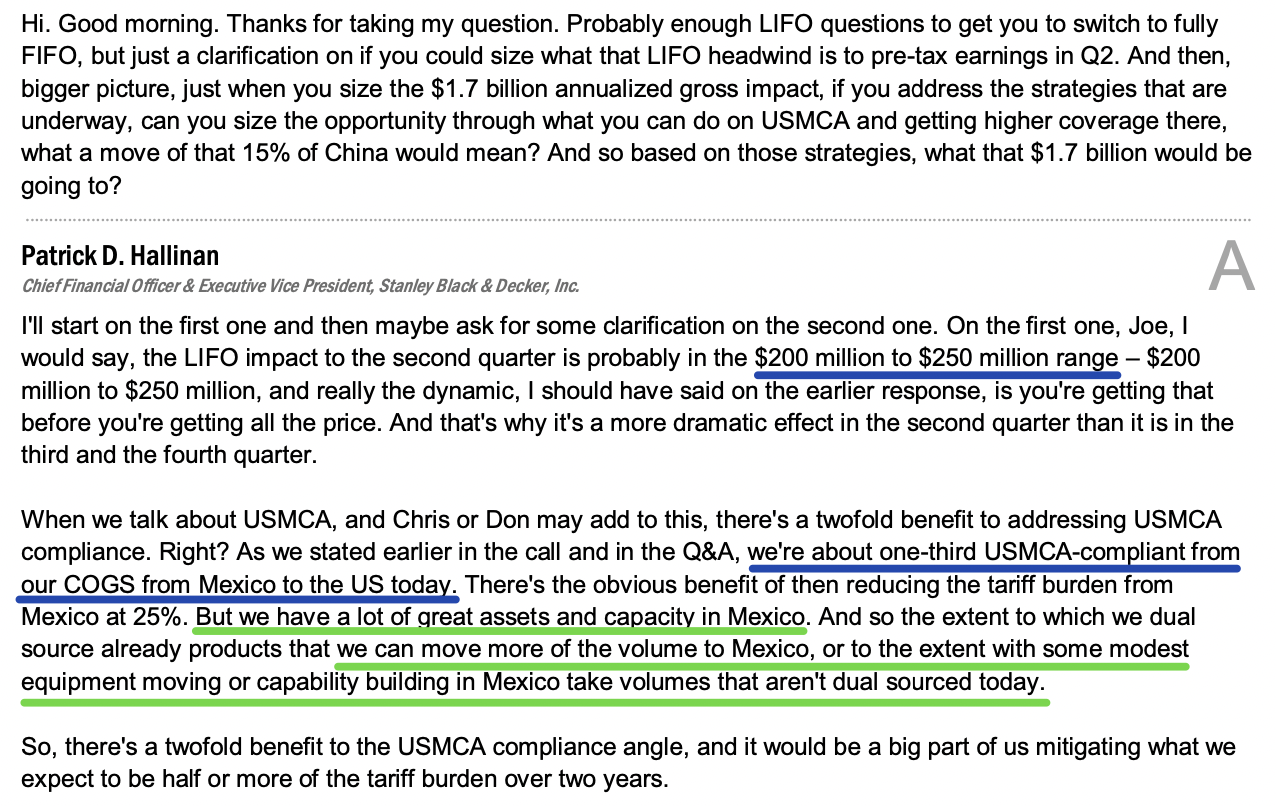

- Management is accelerating supply chain adjustments and actively exploring options to minimize the impact of tariffs by leveraging production in Mexico and reducing reliance on China, which currently accounts for 15% of the U.S. supply chain. These changes are expected to take place over the next 12 to 24 months. SWK has the most flexible supply chain in the industry and a leading North American manufacturing footprint, with roughly 60% of U.S. cost of sales produced domestically. This provides a massive competitive advantage. Management is also focused on increasing the share of Mexico production that qualifies as USMCA compliant, which currently stands just below one-third.

- An initial mid-single-digit price increase in U.S. Tools and Outdoor was implemented in April to offset tariffs. This increase is expected to remain in place for the remainder of the year, with plans for a second substantial price increase at the beginning of Q3.

- The $2 billion cost savings program is still expected to be completed by the end of 2025, with $130 million generated during Q1, bringing the total pre-tax run rate cost savings to $1.7 billion since inception.

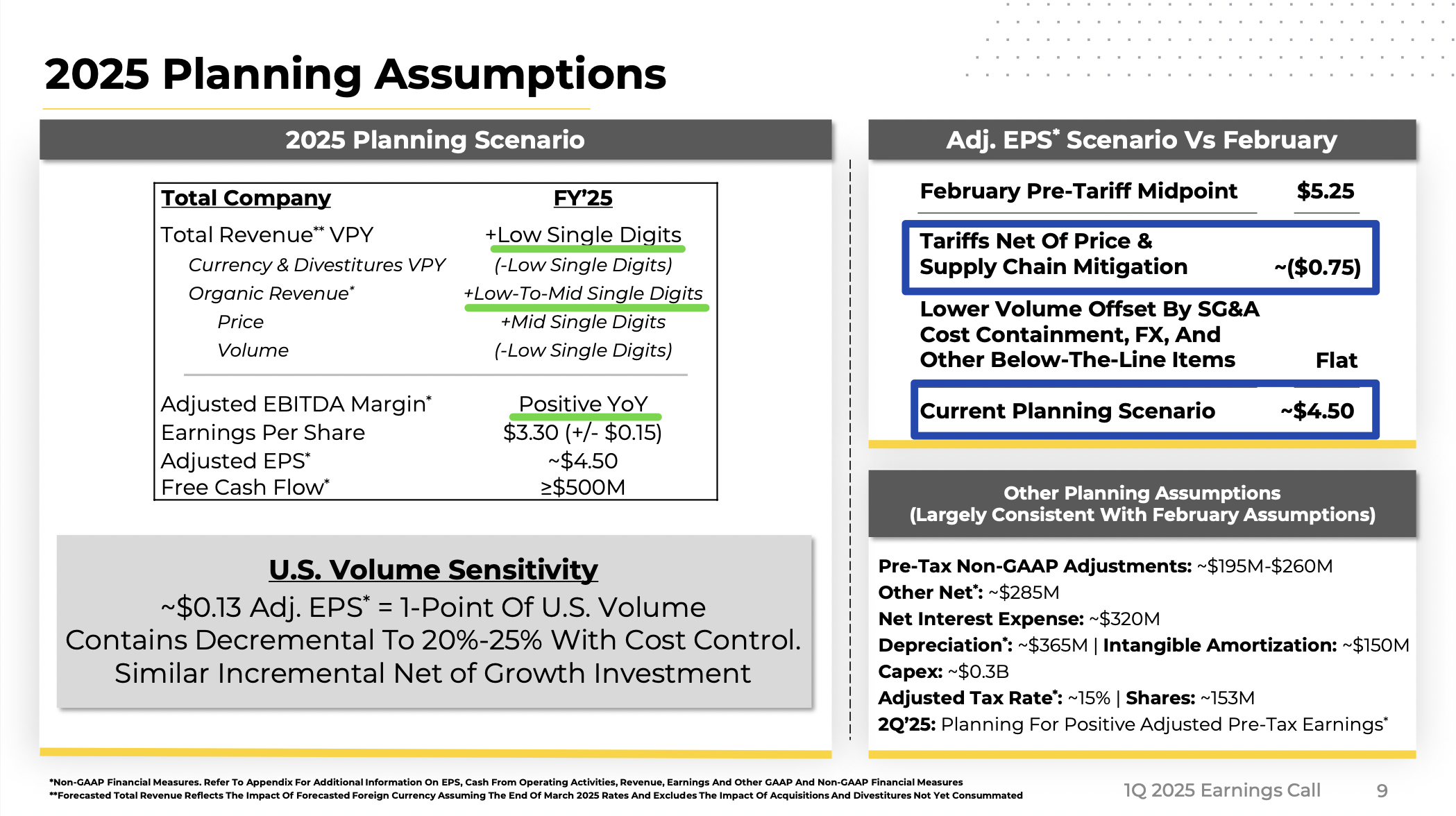

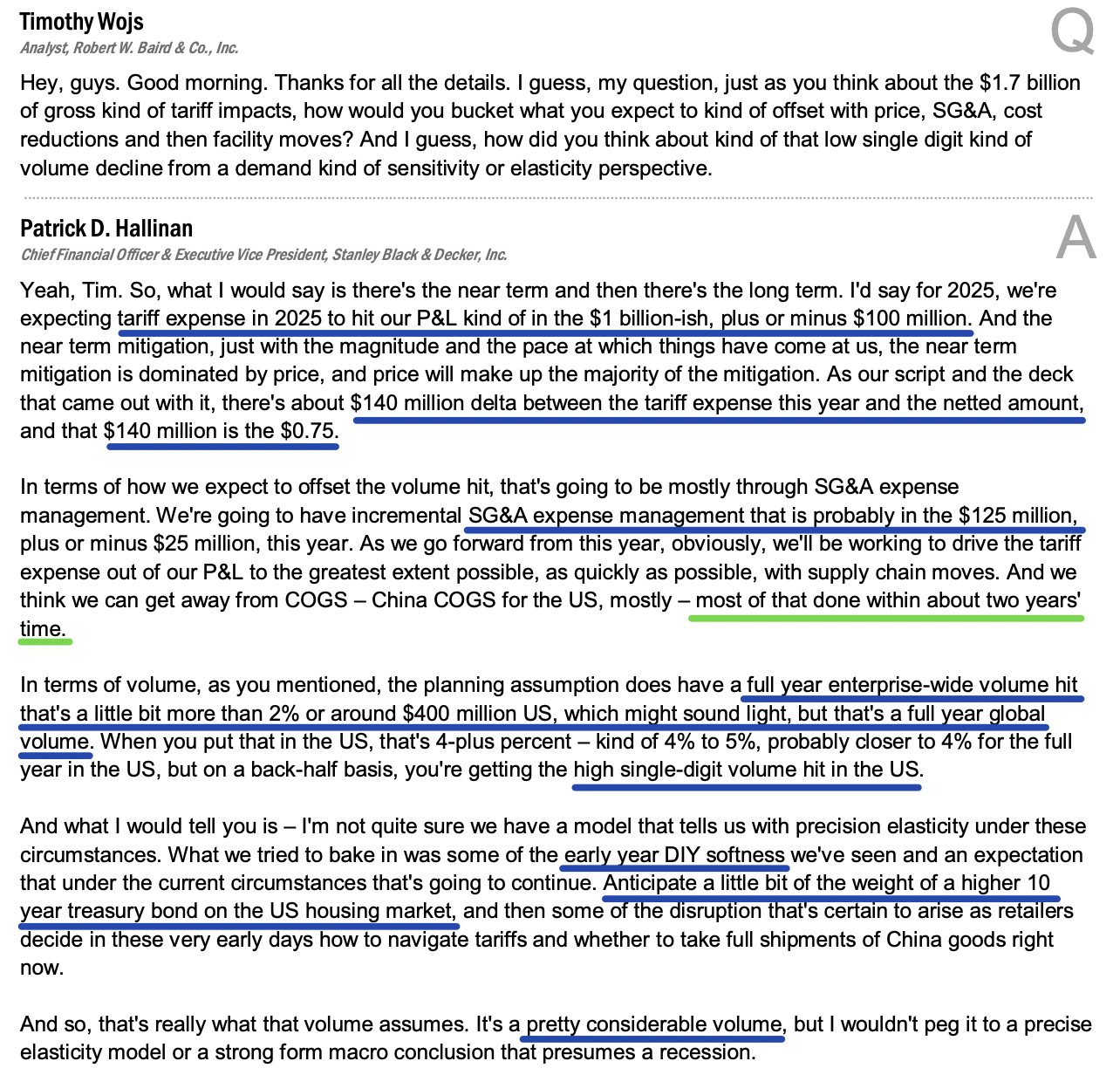

- Total tariff impacts, net of price and supply chain adjustments for the full year, are expected to be ($0.75), assuming 145% China tariffs remain in place, along with 25% tariffs on Mexico, 25% on steel/aluminum, and 10% on the rest of the world. This brings full-year adjusted EPS guidance to approximately $4.50. SWK is still targeting to meet or exceed $500 million in free cash flow for 2025.

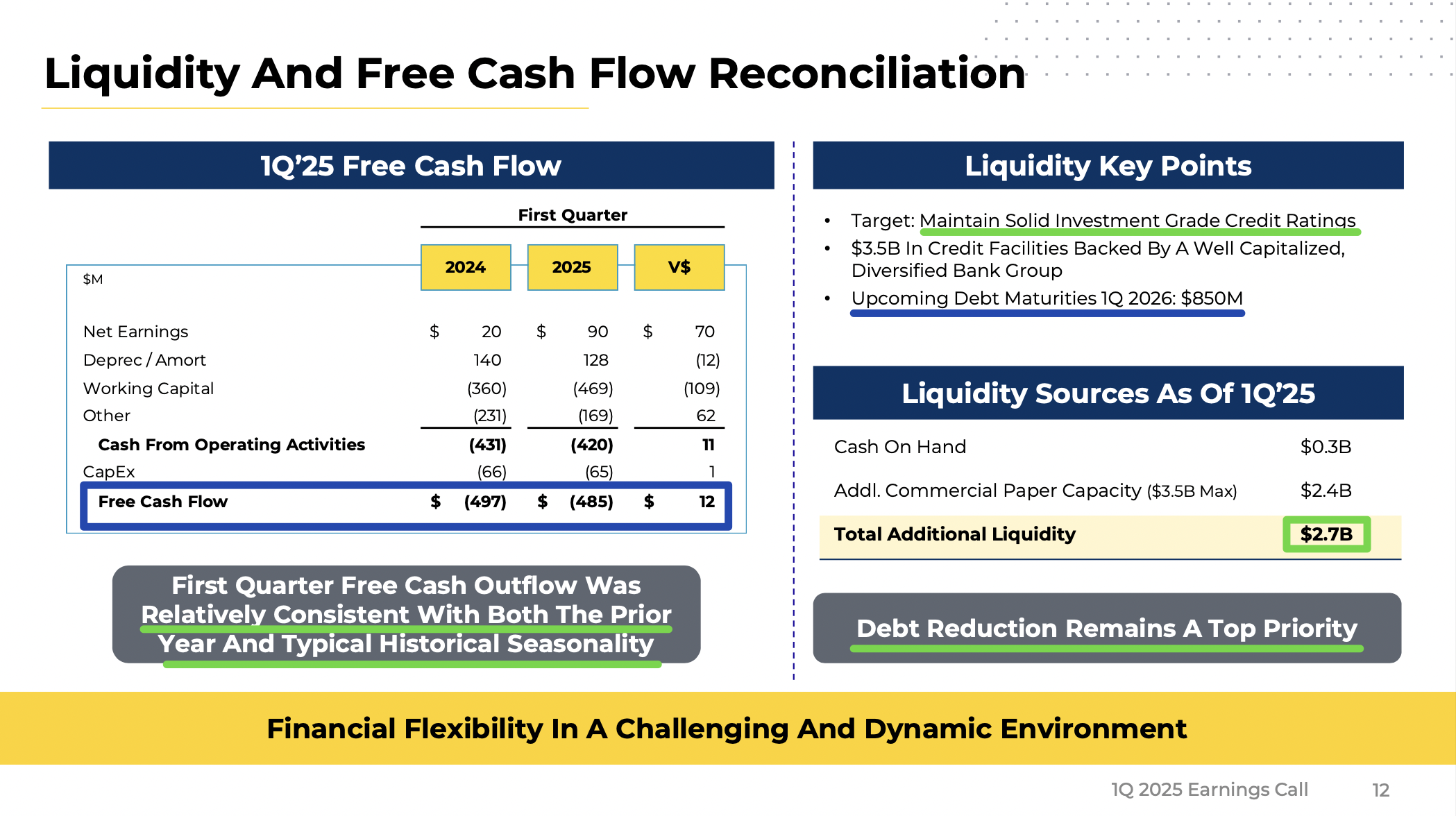

- Q1 free cash flow was an outflow of ($485 million), which is consistent with both the prior year and historical seasonality in terms of working capital. Considering the targeted inventory investments to front-run tariffs, free cash flow actually came in much better than expected.

Earnings Call Highlights

Generac Update

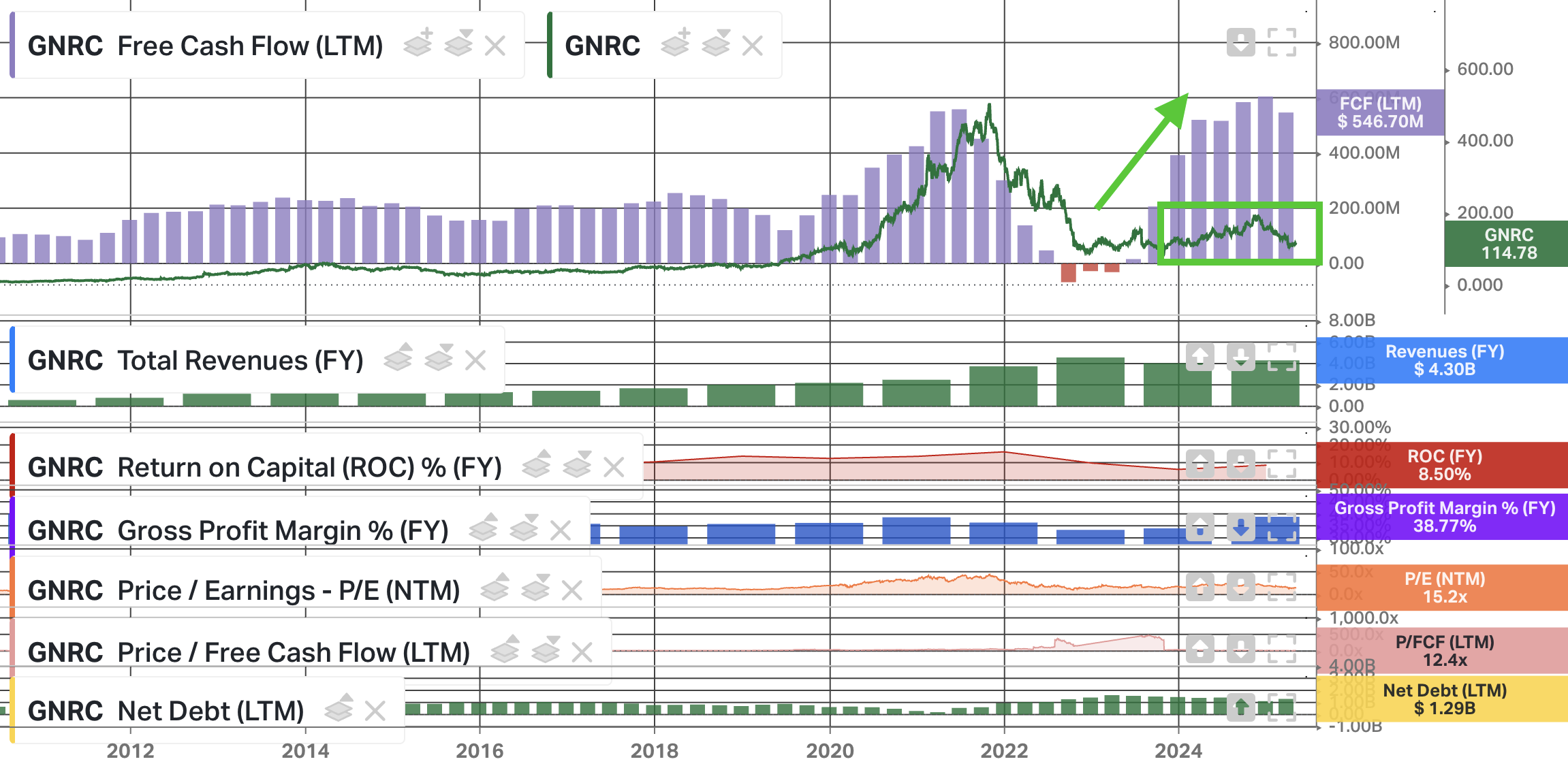

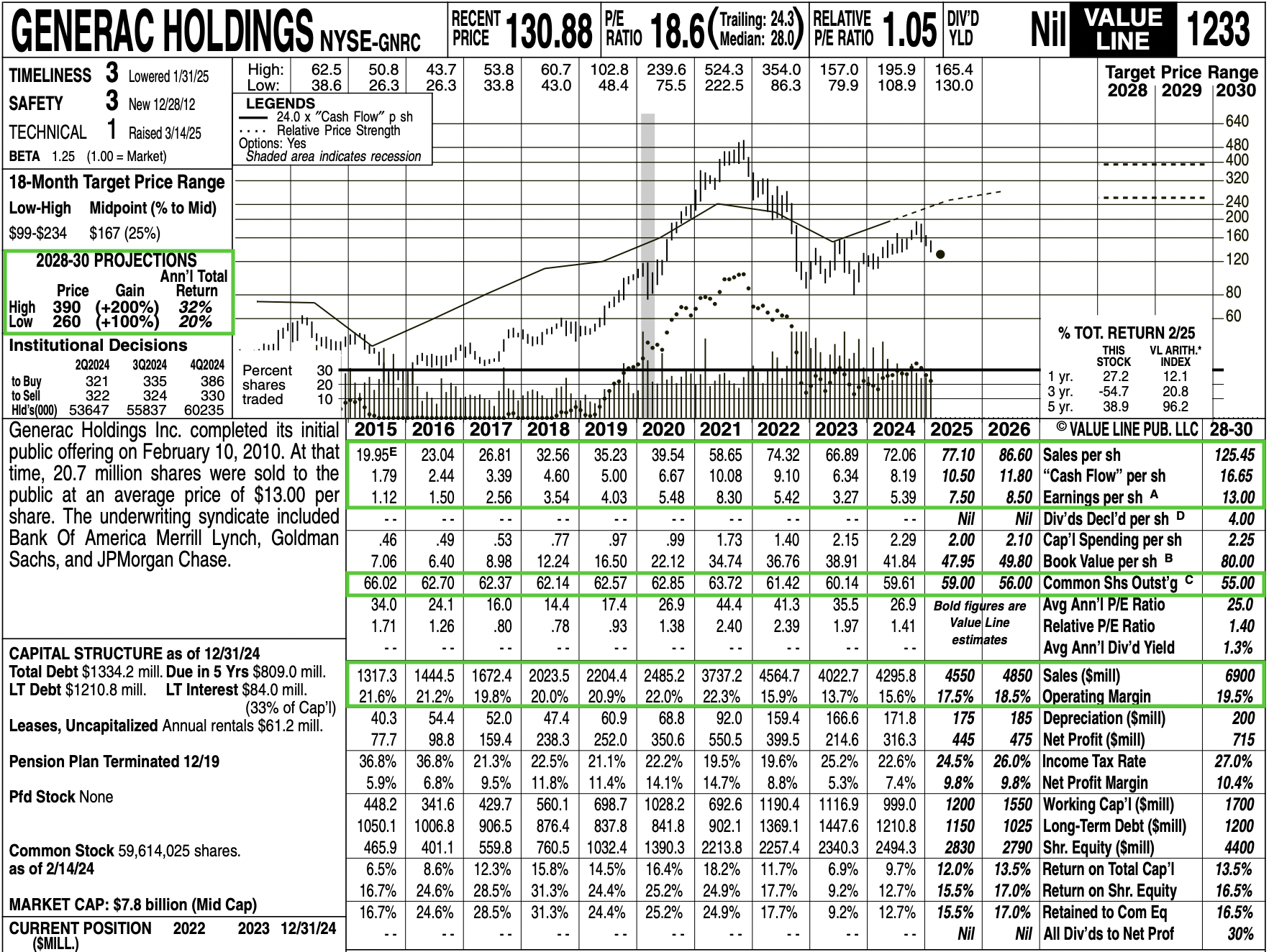

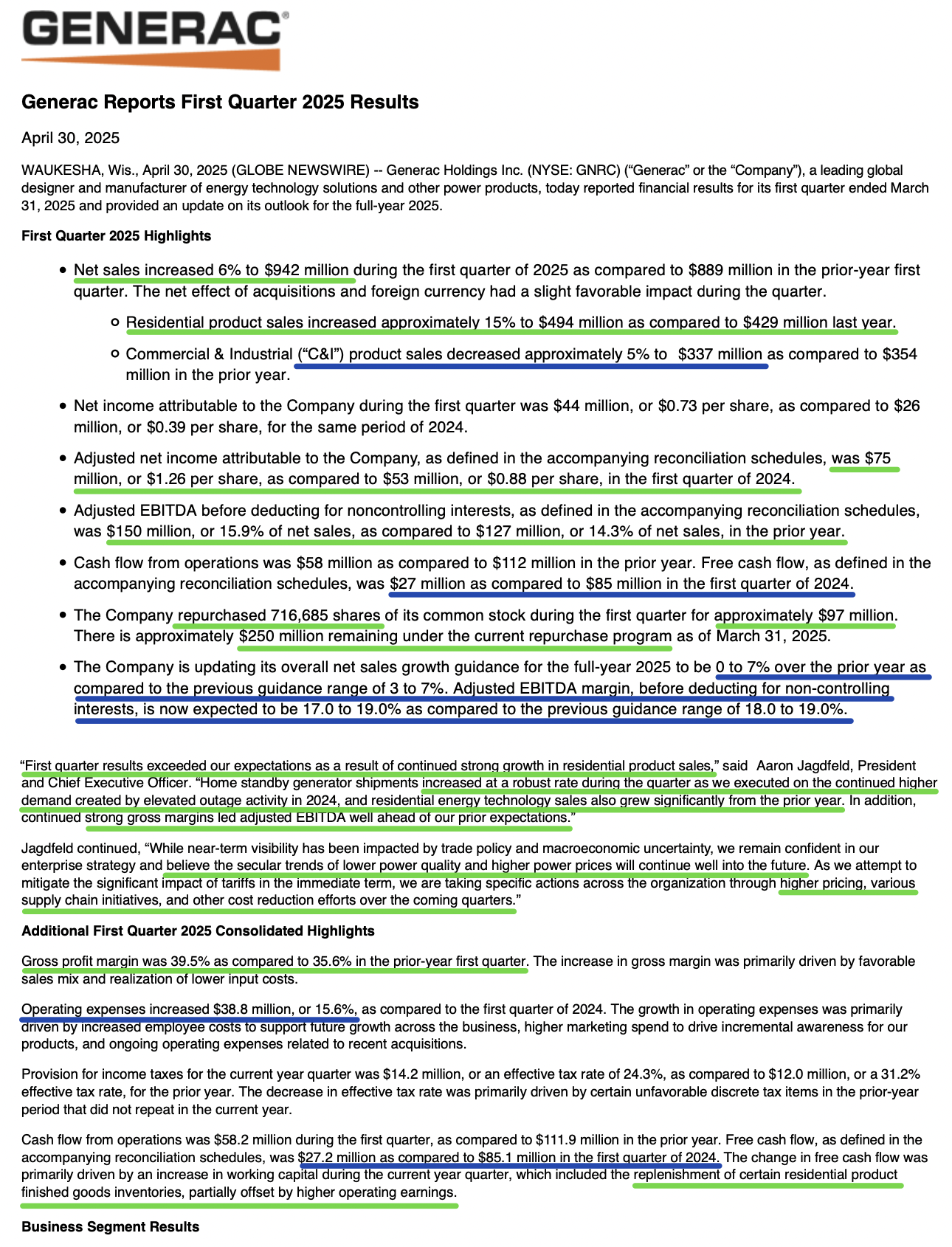

Generac reported a strong Q1 last week, beating expectations on both the top and bottom line. Revenue came in at $942 million, ahead by about $23 million. Non GAAP EPS came in at $1.26, crushing analyst consensus estimates by $0.29.

Here’s a detailed breakdown of everything you need to know following the first quarter:

10 Key Points

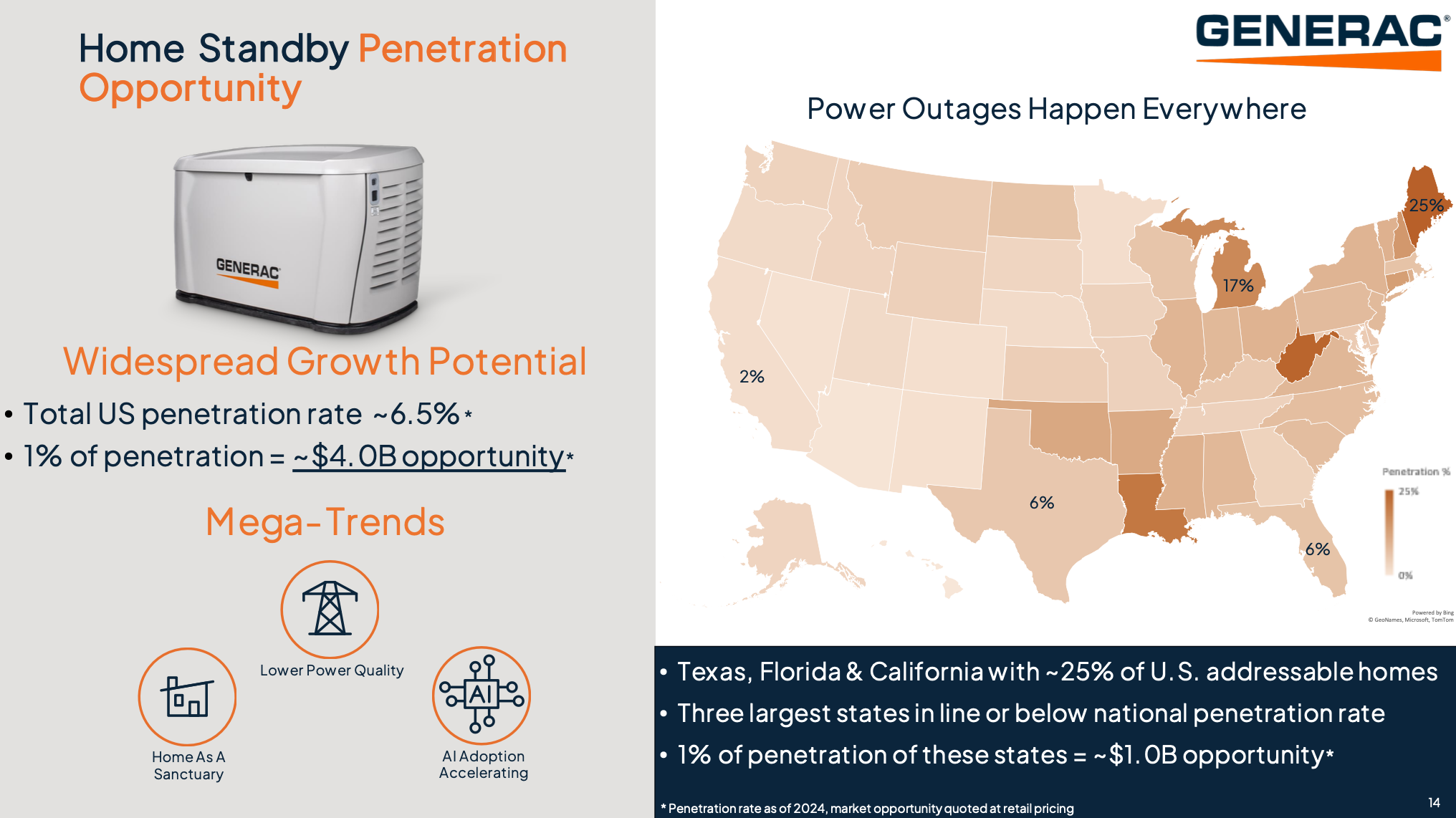

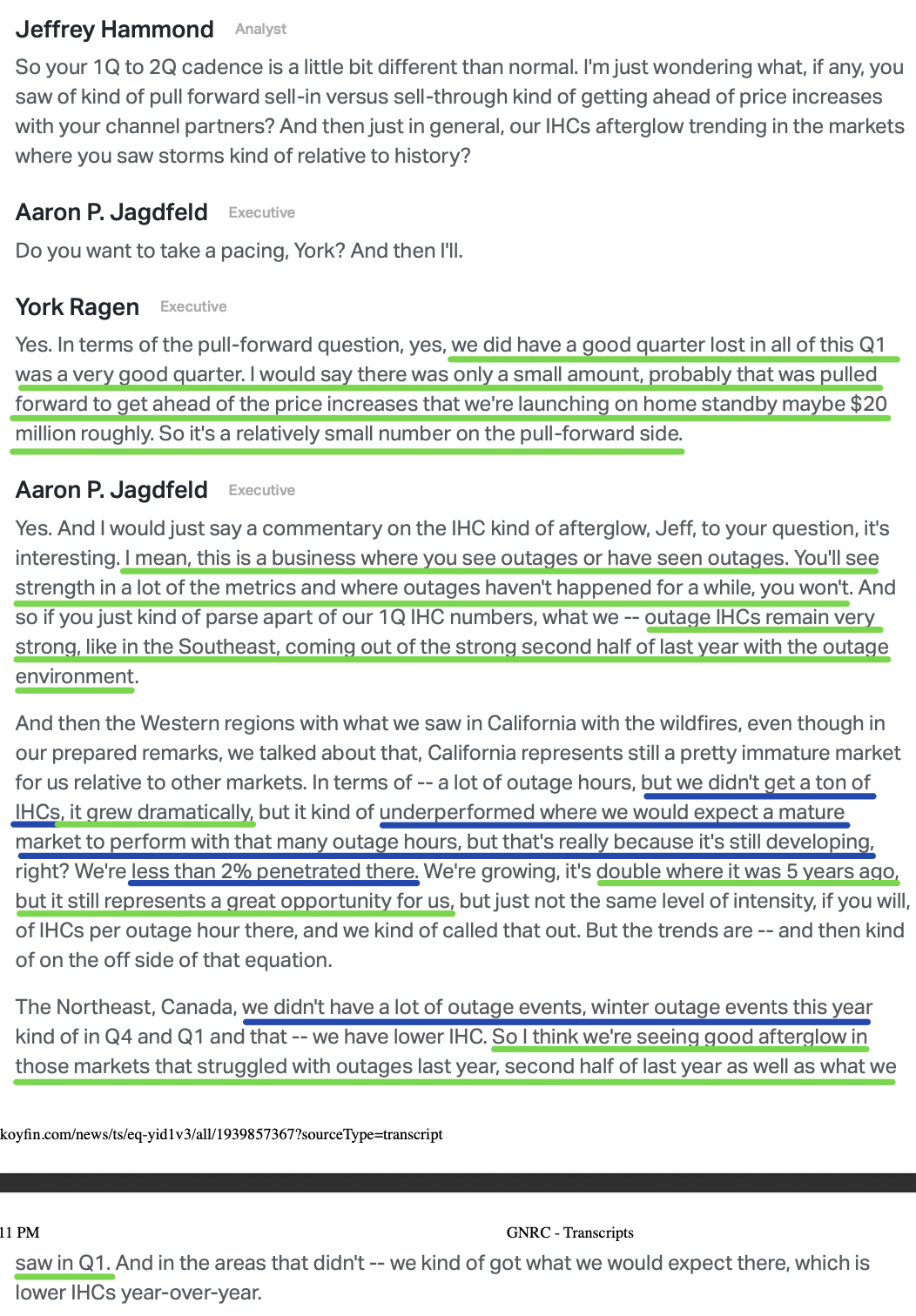

1) Home standby generators are expected to continue growing in 2025, driven by an increase in activations in the first half and higher pricing beginning in the second half. Most importantly, the category is expected to maintain the new, higher baseline of demand that was achieved following the record-high outage activity in 2024. Keep in mind, total U.S. home standby penetration rates remain at approximately 6.5%, with each 1% of penetration representing a $4 billion opportunity.

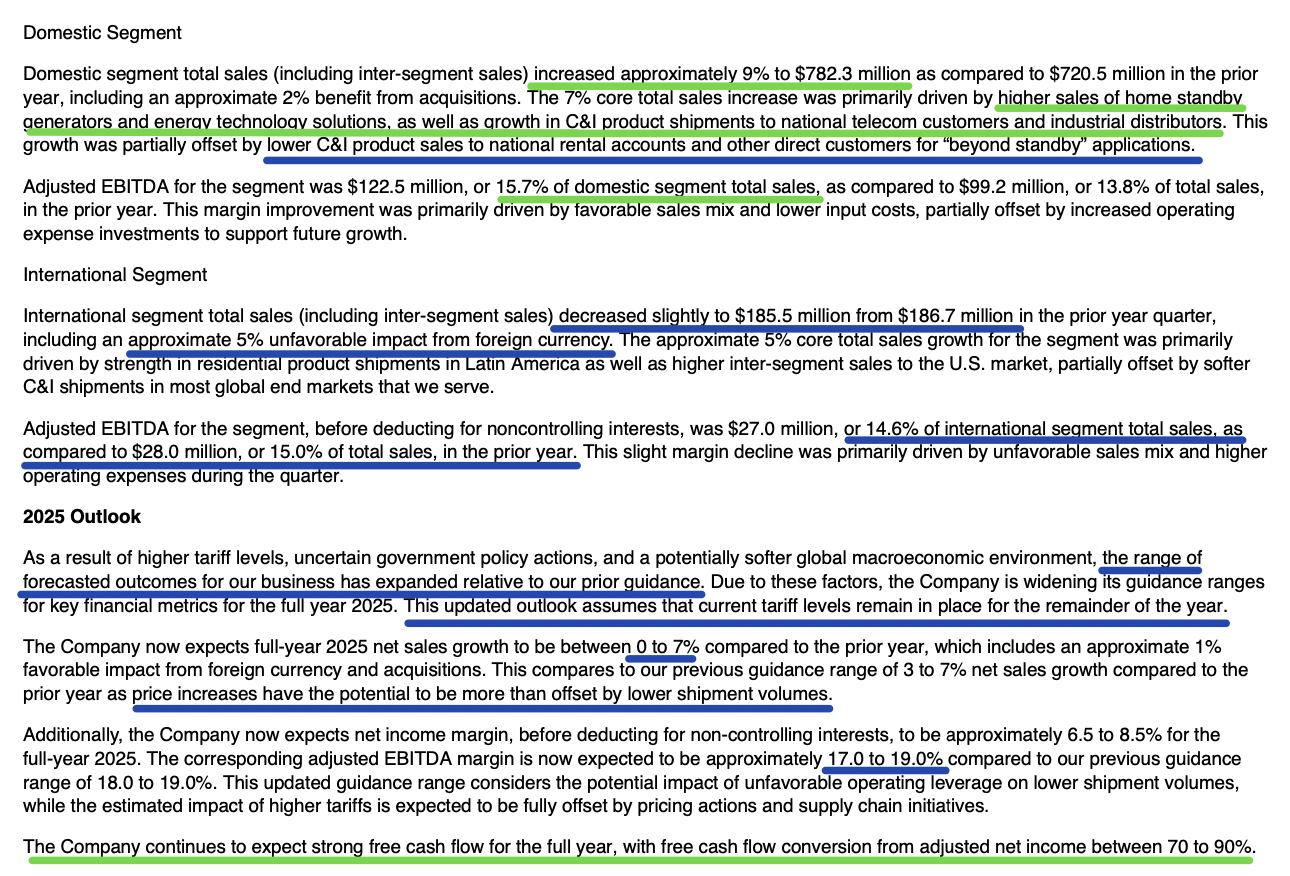

2) C&I business sales decreased 5% year-over-year, with strong growth in domestic telecom and industrial distributor customers offset by softness in domestic rental beyond standby and international end markets. Telecom grew at a significant rate year-over-year and is expected to return to growth for the full year. Industrial distributors also saw growth this quarter, supported by reduced lead times, improved win rates, and increased quoting activity. Management is expanding the C&I product line to target hyperscalers and data center demand, with new megawatt diesel generators on track for quoting and shipments later this year. Early indicators, both domestically and internationally, are very strong.

3) Guidance ranges have been widened to 0% to 7% revenue growth, down from the prior 3% to 7%. Adjusted EBITDA margin guidance has been revised to 17% to 19%, down from the previous 18% to 19%. The updated guidance assumes that current tariff levels remain in place for the remainder of the year (China 145%, steel/aluminum 25%, and the rest of the world at 10%), including the assumption that reciprocal tariffs continue beyond the 90-day pause. The lowered guidance also assumes interest rates remain elevated for the full year and does not account for the benefit of a major power outage event or new share repurchases. Ladies and gentlemen, this is sandbagging in plain sight.

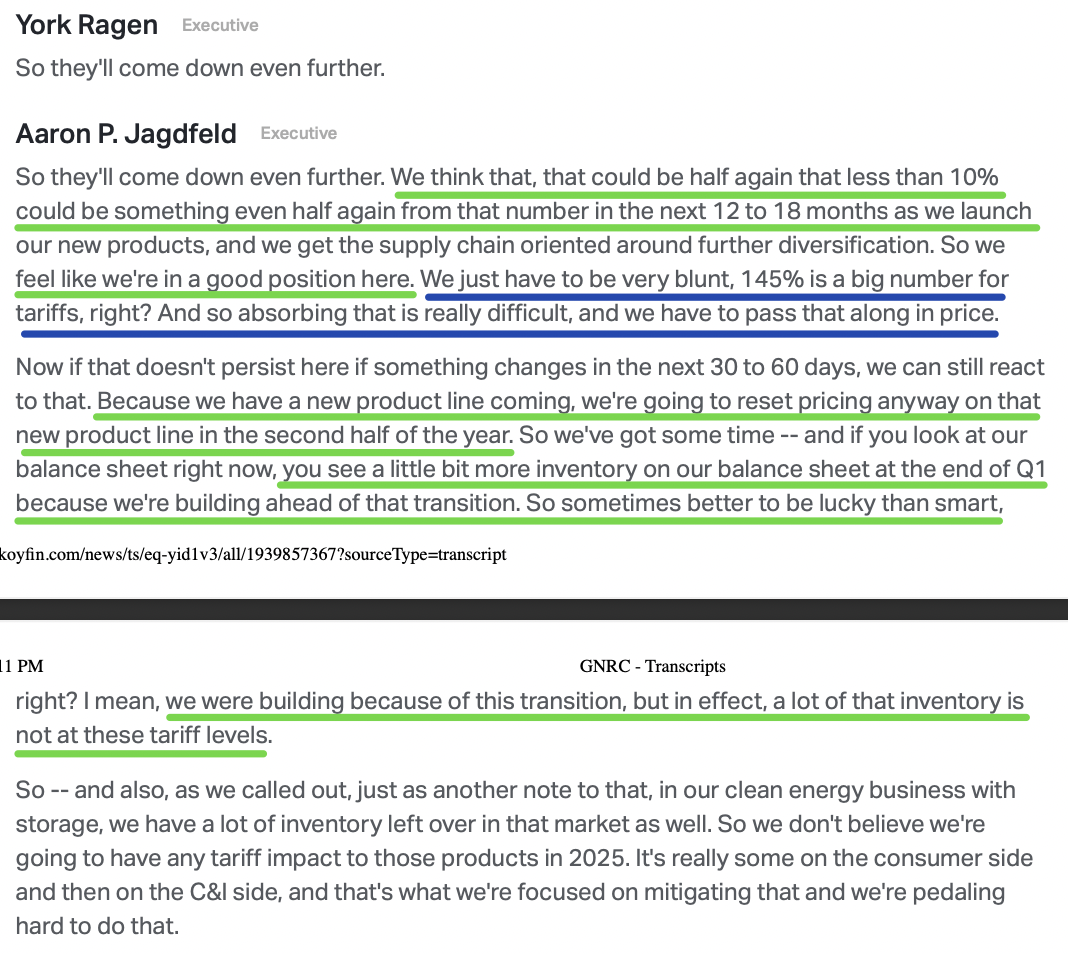

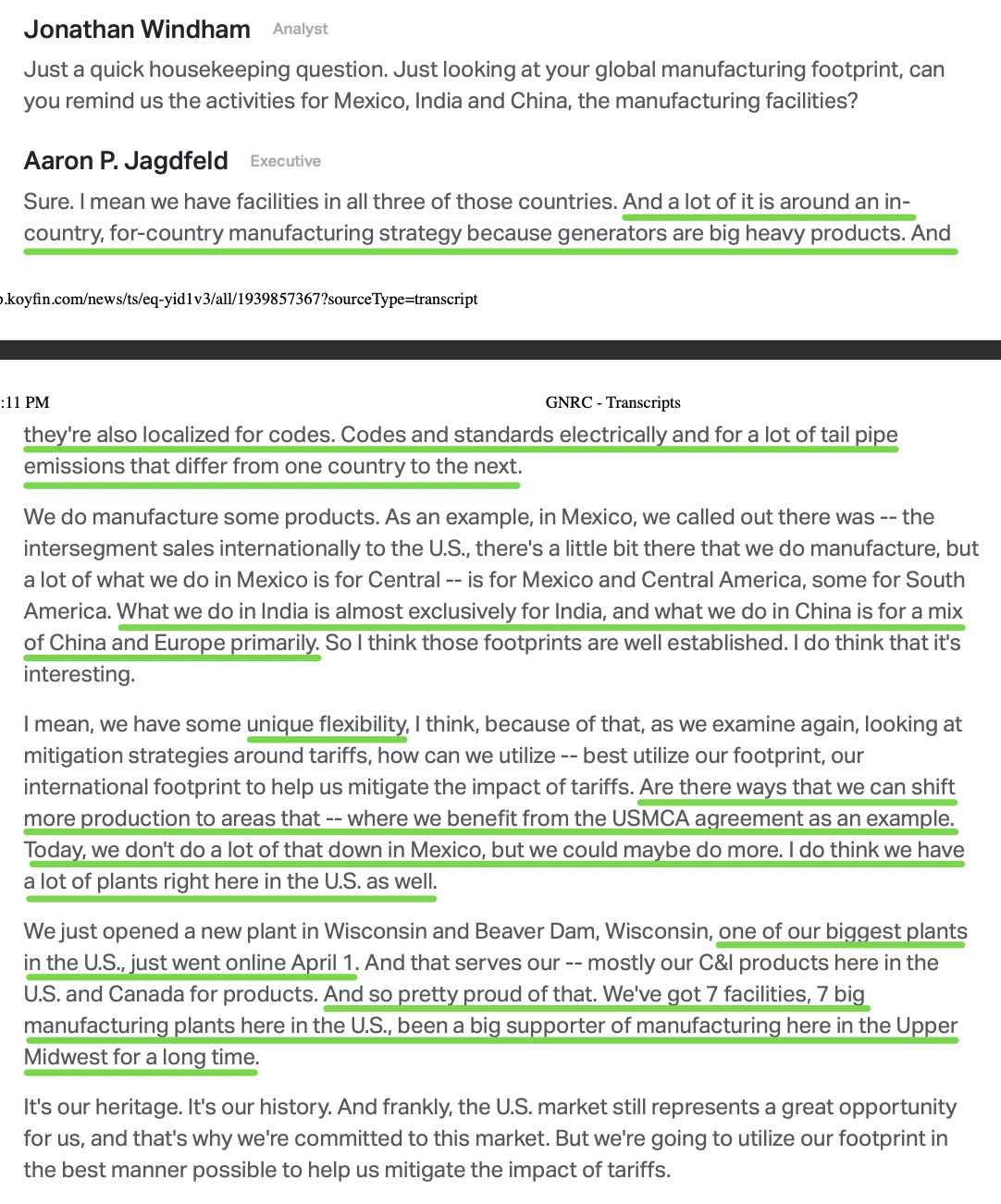

4) 70% to 80% of Generac’s cost of goods sold (COGS) are in materials, with 50% of materials sourced from the U.S. or North America. Exposure to China specifically is less than 10% annually, which has been halved from where it was just five years ago. Management expects to reduce this further to around 5% over the next 12 to 18 months. A significant portion of materials is sourced from Europe, and most manufacturing is done locally for each respective market, with 7 large manufacturing plants in the U.S. alone.

5) Total product costs are expected to increase in the second half by approximately $125 million, prior to any mitigation efforts. Management expects that price actions will fully offset the cost of tariffs in dollar terms.

6) Free cash flow for the quarter was $27.2 million, compared to $85.1 million in the first quarter of 2024. However, this decrease was primarily due to the replenishment of certain residential product finished goods inventories, all at pre-tariff prices. Management is still targeting strong free cash flow for the full year, with 70% to 90% free cash flow conversion from adjusted net income.

7) Gross profit margins came in at 39.5%, an increase of over 400 basis points year-over-year, marking the highest first-quarter gross margin level since 2021.

8) Management repurchased 716,685 shares during the quarter for a total of $97 million, with $250 million remaining under the current share repurchase program.

9) Ecobee continues to drive strong top-line sales and gross margin improvement, with connected homes increasing approximately 17% year-over-year. Ecobee is expected to reach profitability for the full year, with residential energy technology sales remaining unchanged at $300 to $400 million and minimal impact from tariffs.

10) The next-generation home standby lineup is on track for a second-half 2025 launch, marking the most comprehensive platform update for the product category in more than a decade. It is expected to lower the total cost of ownership through improved fuel efficiency and reduced installation and maintenance costs.

Earnings Call Highlights

Disney Quick Update

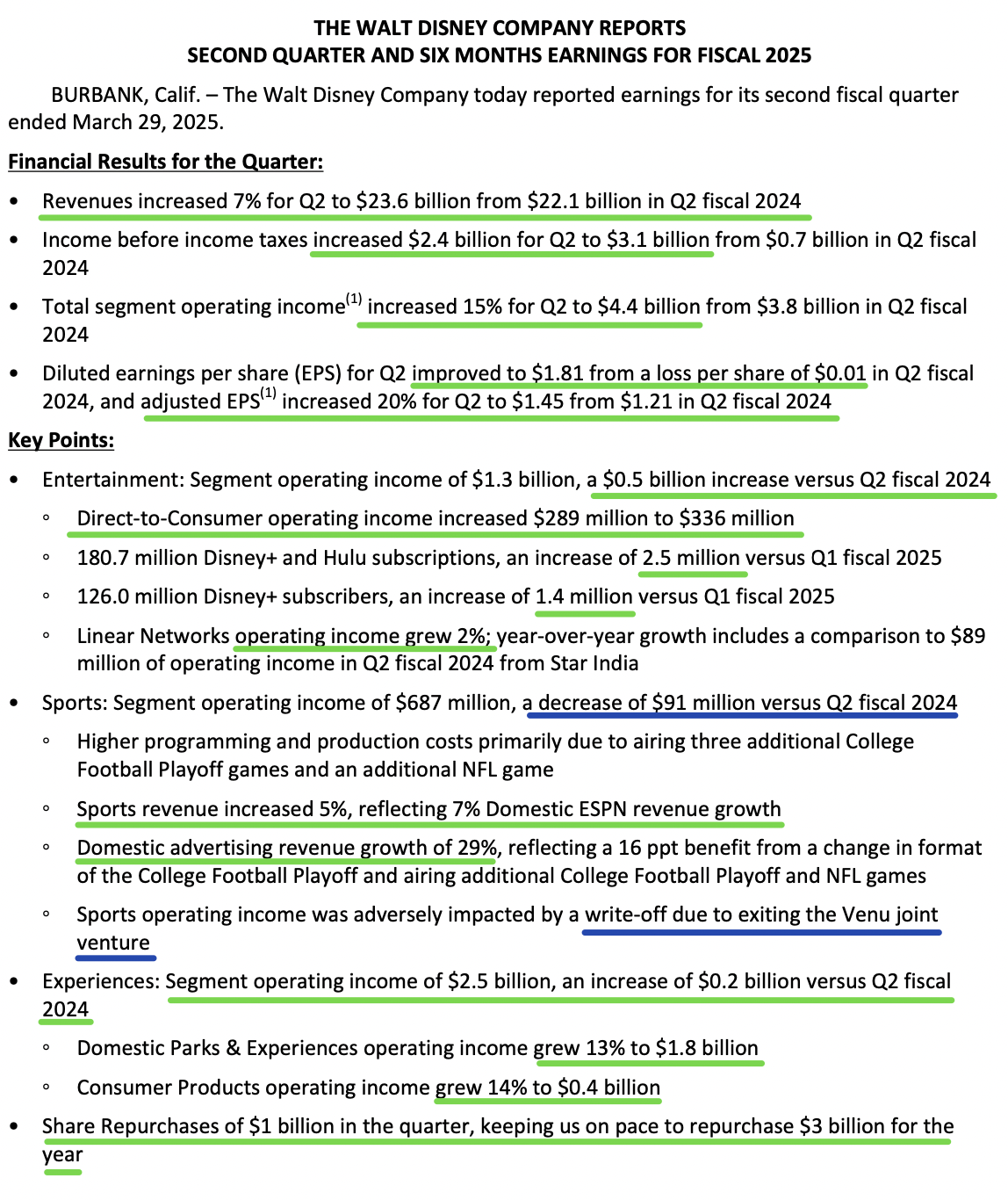

Disney reported a lights-out quarter yesterday, beating expectations on both the top and bottom line. Revenue came in at $23.62 billion, ahead by about $495 million. Non GAAP EPS came in at $1.45, well ahead of $1.21 analyst consensus. To top it off, management raised full-year guidance, bringing EPS projections up from $5.30 to $5.75. For those worried about the state of the consumer, you can now take a breath.

More on Disney next week…

General Market

The CNN “Fear and Greed Index” ticked up from 39 last week to 57 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

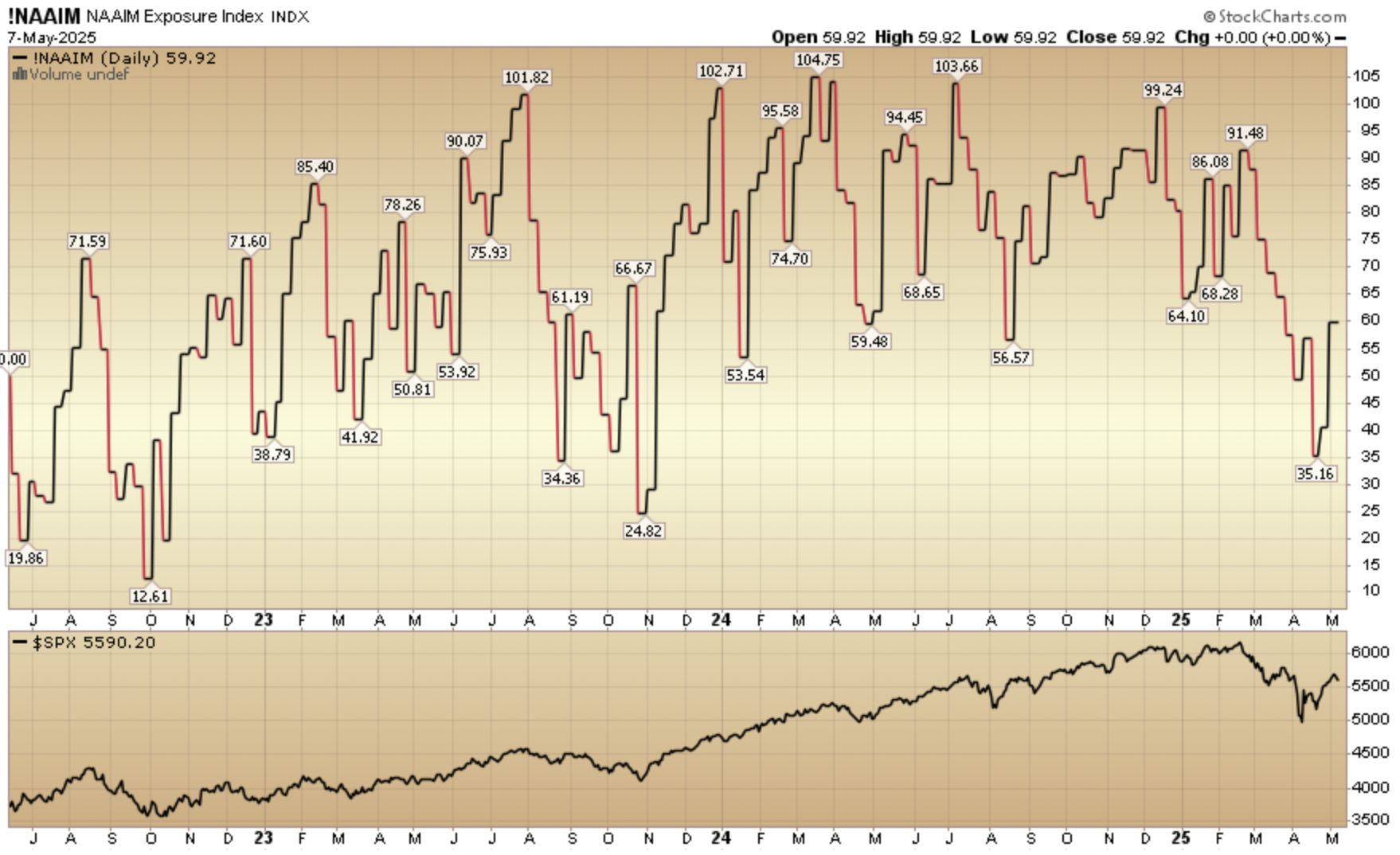

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 59.92% this week from 40.67% equity exposure last week.

Our podcast|videocast will be out sometime on Thursday or Friday. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, Not Advice. See Terms

Not a solicitation.