Be in the know. 16 key reads for Thursday…

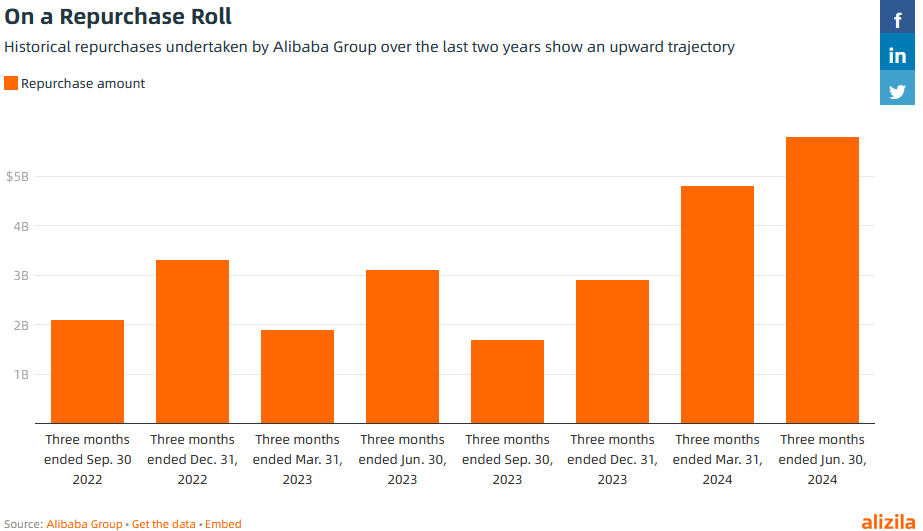

- Alibaba, Tencent Cast Wide Net for AI Upstarts (wsj)

- Fed policymakers see job market key to rate-cut decision (reuters)

- July home sales break a four-month losing streak as supply rises nearly 20% over last year (cnbc)

- Disney puts Morgan Stanley’s James Gorman in charge of finding Bob Iger’s successor (nypost)

- S. Added 818,000 Fewer Jobs Than Reported Earlier (nytimes)

- Fed Minutes Show a Cut ‘Likely’ to Come in September (nytimes)

- Summer spending boom showcases China’s service consumption potential (cn)

- The Fed is taking on risk they don’t have to take, says Wharton’s Jeremy Siegel (cnbc)

- The key to a soft landing is the Fed getting off data dependence, says Fundstrat’s Tom Lee (cnbc)

- com: No. of Overseas Payment Buyers Mount 30%+ YoY in 1H (aastocks)

- China names healthcare, education, tech as likely venues for more foreign investment (scmp)

- Major retail stores are cutting prices to entice customers as inflation soars (foxbusiness)

- Why China Is Battling Its Own Government Bond Market (barrons)

- Advance Auto Stock Skids. Earnings Miss Overshadows $1.5 Billion Sale of Worldpac. (barrons)

- Discount-Hungry Shoppers Propel Sales Gains for Target, T.J. Maxx (wsj)

- McDonald’s to Invest $1.30 Billion in U.K., Ireland Over Next 4 Years (wsj)

Babalicious Stock Market (and Sentiment Results)…

On Thursday, I joined Suart Varney on Fox Business to discuss Stock Market, Election, Seasonality, GXO Logistics, Paypal and more. Thanks to Christian Dagger, Preston Mizell and Stuart for having me on: Continue reading “Babalicious Stock Market (and Sentiment Results)…”

Where is money flowing today?

Be in the know. 10 key reads for Wednesday…

- Bottom-Fishers Snap Up Office Buildings at Huge Discounts (barrons)

- Wall Street Strategists Bet on Record Highs for European Stocks (bloomberg)

- Fed Minutes to Shed Light on Rate-Cut Debate (barrons)

- Retailers have pulled back on raising prices. More are now lowering them (marketwatch)

- Opinion: Chinese e-commerce giants want your business — and U.S. retailers are losing it (marketwatch)

- ‘The first cut is the deepest’ may hold true for Fed interest-rate cuts, too (marketwatch)

- Ford to overhaul EV strategy with more and cheaper options in its latest push for profit (marketwatch)

- Investors Brace for a Jobs Wipeout (nytimes)

- The Story of Walmart & JD.com (chinalastnight)

- If Fed starts cutting, money on the sidelines could funnel into small caps, says Fundstrat’s Tom Lee (cnbc)

Where is money flowing today?

Be in the know. 15 key reads for Tuesday…

- Small cars are selling faster than SUVs and trucks. Here’s what’s driving more buyers to settle for less. (marketwatch)

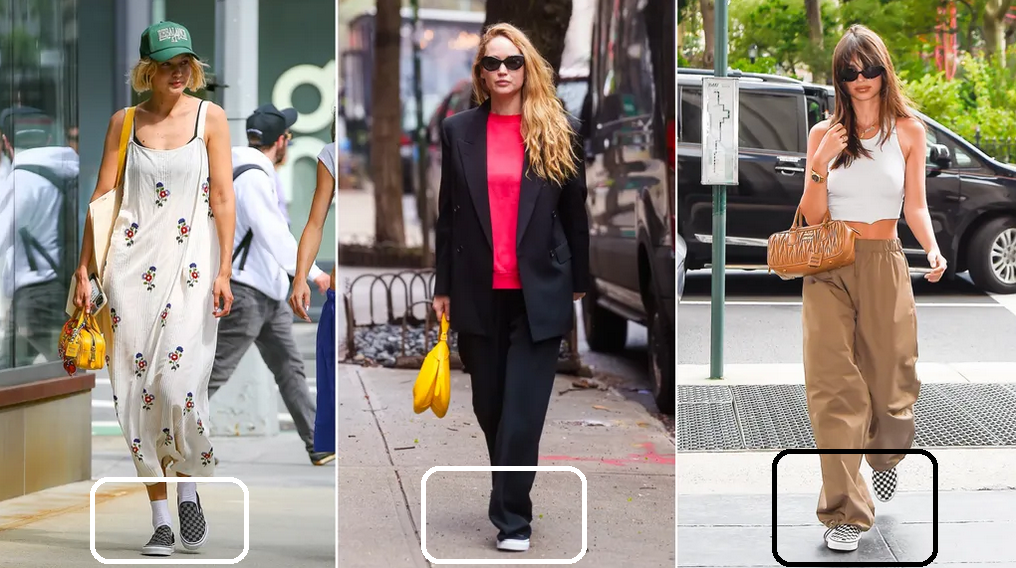

- Jennifer Lawrence and Gigi Hadid Are Kick-Starting a Vans Sneaker Trend (marieclaire)

- Copy Gigi Hadid’s Rock ‘n’ Roll Style With the Exact Vans She Wears (usmagazine)

- Are Slip-On Vans The Sambas Of Summer 2024? (elle)

- We’re Calling It: Checkered Vans Are the 2024 It Shoe (fashionmagazine)

- Why the upcoming payroll revisions could tilt Powell’s Jackson Hole message on Friday (marketwatch)

- Chinese Regulator Asks Banks to Survey Impact of Stronger Yuan (bloomberg)

- Fed’s Jackson Hole meeting: A plan to cut interest rates gradually is emerging (marketwatch)

- Defensive stocks have outperformed lately — but it’s no reason to panic (marketwatch)

- Mega-cap tech stocks still make up core of hedge funds’ top positions, analysis shows (marketwatch)

- Citi Says Hedge Funds Are Using Dollars for New Carry Trades (bloomberg)

- China Says ‘Please Stop Buying Our Bonds’ (wsj)

- Chinese Banks Hold Lending Rates After PBOC Signals Caution (bloomberg)

- China May Let Local Governments Sell Bonds to Buy Homes (bloomberg)

- Dollar hits year’s low as traders prepare for rate cuts (ft)