Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Where is money flowing today?

Be in the know. 25 key reads for Friday…

- What Small-Cap Stocks Need to Finally Join the Market Rally (barrons)

- Where Will Intel Stock Be in 3 Years? (fool)

- U.S. and China hold first informal nuclear talks in five years (reuters)

- As Nvidia Soars, History Advises Caution. (barrons)

- FedEx Stock Has Delivered Disappointment. Next Week’s Earnings Could Change That. (barrons)

- Gilead’s Twice-Yearly Shot Prevents HIV. Where the Stock Is Headed. (barrons)

- 2025 McLaren Artura Spider: An Unobnoxious Supercar (wsj)

- Nvidia’s Success Is the Stock Market’s Problem (wsj)

- New Home Construction Slows as Mortgage Rates Remain High (nytimes)

- Elon Musk Wants You to Have More Babies (bloomberg)

- US business activity inches up in June; price pressures abating (reuters)

- Chart Master: Is a REIT revival incoming? (cnbc)

- Bugatti Unveils V-16 Hybrid Supercar ‘Tourbillon’ (bloomberg)

- US Services Activity Expands by Most in More Than Two Years (bloomberg)

- Boeing-Spirit Aero Deal Nears Close as Airbus Talks Advance (bloomberg)

- Odd Lots: John Arnold on Why It’s Hard To Build Things (bloomberg)

- How YouTube Became Must Watch TV (bloomberg)

- Nike Stock Can Just Do It. It’s Time to Buy. (barrons)

- VF Stock Keeps Sliding. CEO Bracken Darrell Just Bought $1 Million of Shares. (barrons)

- Chances of ‘no landing’ grows by the day: Bank of America (streetinsider)

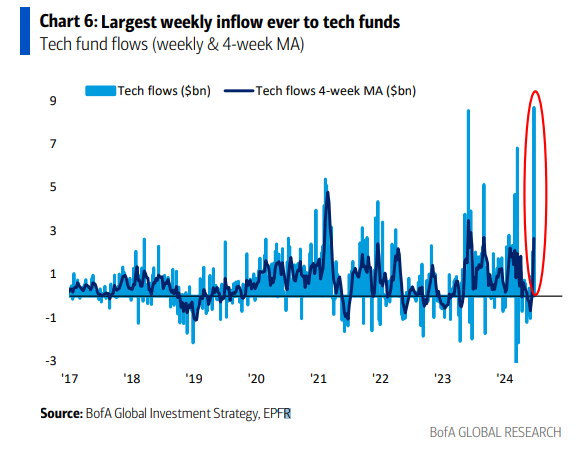

- Wells Fargo tells its clients to reduce exposure to ‘overvalued’ tech stocks (streetinsider)

- Amazon stock target lifted at Baird on revised margin outlook (streetinsider)

- China talks up support for IPOs. Investors are watching the speed of approval (cnbc)

- Leading economic index falls again, but it’s not signaling recession (marketwatch)

- Hertz upsizes junk-bond offering to $1 billion as it pushes ahead with fleet refresh (marketwatch)

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know 18 key reads for Thursday…

- JPMorgan Analyst Known for Bearish Call Touts China Tech Stocks (bloomberg)

- ‘Sellers Are Entering the Market’ With S&P Faltering Beyond Tech (bloomberg)

- Swiss National Bank presses ahead as rate cutting front-runner (reuters)

- Opinion: Why AMD, Intel, Qualcomm and other PC giants need Apple’s AI effort to succeed (marketwatch)

- This indicator suggests unloved small-cap stocks may be poised for a turnaround (marketwatch)

- Nvidia’s Ascent to Most Valuable Company Has Echoes of Dot-Com Boom (wsj)

- Inside Citigroup’s Most Mysterious Business (wsj)

- Tiger Woods’ son Charlie 15, to play in first USGA event after winning qualifier (nypost)

- Treasuries Are a Whisker Away From Erasing This Year’s Loss (bloomberg)

- US Initial Jobless Claims Lingered Near 10-Month High Last Week (bloomberg)

- Fed’s Kaskhari sees some signs of ‘some softening’ in the economy (marketwatch)

- Xi’s Mystery PBOC Plans Surface With Biggest Shift in Years (bloomberg)

- EU imposes sanctions on Russian LNG (ft)

- This Undervalued Stock Could Join Nvidia in the $3 Trillion Club (fool)

- Is This Amazon’s Next $100 Billion Opportunity? (fool)

- America’s ‘cardboard-box recession’ is finally over, BofA says (businessinsider)

- 2 states where home prices are falling because there are too many houses and not enough buyers (businessinsider)

- US Housing Starts & Building Permits Plunge To COVID Lockdown Lows (zerohedge)

The Next Pain Trade – Stock Market (and Sentiment Results)…

Above: Nvidia CEO Jensen Huang giving his signature to a fan.

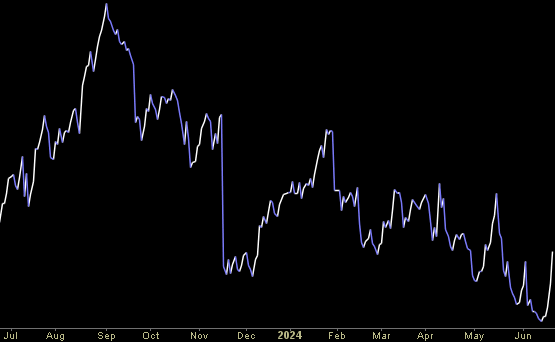

Nvidia

Nvidia has been all the rage – and justifiably so. Since NVDA reported its Q1 2023 earnings report and disclosed the huge demand for its AI chips, the stock has gone straight up. Now it’s worth $3.3T. Revenues up 4x, margin expansion, everything anyone could ever wish for. Continue reading “The Next Pain Trade – Stock Market (and Sentiment Results)…”