- China’s consumer prices rise for third month, signaling demand recovery (cnbc)

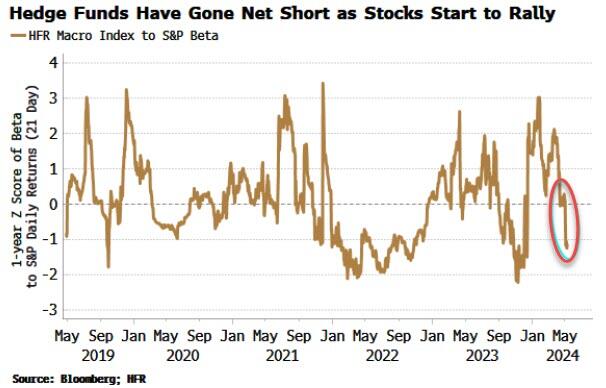

- Hedge Funds That Sold In May Might Now Push Stocks To New Highs (zerohedge)

- Stocks Rally Pushes On With Fed Speakers in Focus (bloomberg)

- The ‘Fed Put’ Is Back, and That’s Great News for the Stock Market (barrons)

- Why Warren Buffett Hates Bonds (barrons)

- A Struggling Pfizer Looks for Help From a Wall Streeter (barrons)

- He Rebuilt Morgan Stanley. Now He’s Buying Disney Stock. (barrons)

- Life on the Edge: A Guide to the Newest Frontier in Computing (barrons)

- Howard Schultz Is Back-Seat Driving Starbucks. That’s a Problem for His Successor. (wsj)

- Jim Simons, billionaire hedge fund manager, math whiz and philanthropist, dies at 86 (nypost)

- The history of the iconic Lamborghini logo and badge (com)

- Apple Nears Deal With OpenAI to Put ChatGPT on iPhone (bloomberg)

- Consumer sentiment tumbles (cnbc)

- China’s Country Garden repays onshore coupons within grace period (yahoo)

- Generative AI Productivity Gains Will Come (institutionalinvestor)

- China tech is seeking growth in the Middle East (ft)

- Disney’s streaming success could point to next chief (ft)

- Hong Kong Gains, Zeekr Lists In US, Week in Review (chinalastnight)

- Earnings will make new record highs over the next few quarters, says Ed Yardeni (cnbc)

- Pininfarina Is Now Selling Bruce Wayne-Inspired Electric Hypercars (maxim)

Tom Hayes – Yahoo! Finance Appearance – 5/10/2024

Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – May 10, 2024

Watch in HD directly on Yahoo! Finance

Tom Hayes – Quoted in Reuters article – 5/10/2024

Thanks to Herb Lash for including me in his article on Reuters today. You can find it here:

Click Here to View The Full Reuters Article

Where is money flowing today?

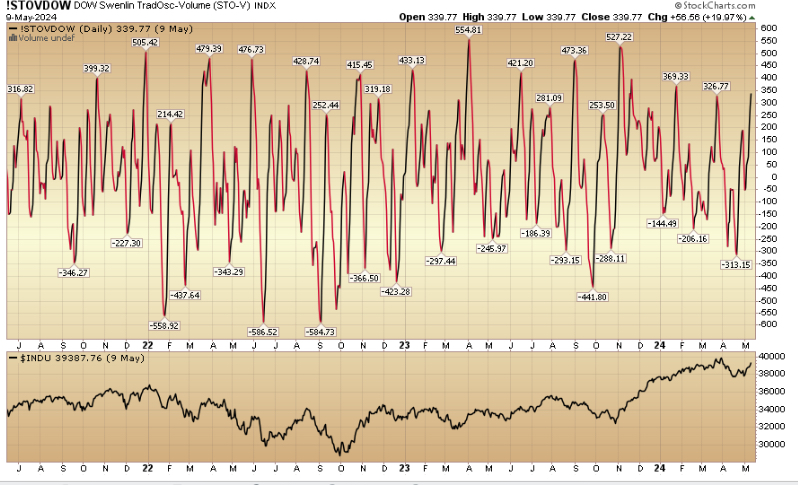

Indicator of the Day (video): DOW Swenlin Trading Oscillator VOLUME

Be in the know. 22 key reads for Friday…

- Alibaba says its AI models are used by 90,000 corporate clients in China (scmp)

- 3M Is Leaner and Ready to Grow. It’s Time to Buy the Stock. (barrons)

- China Property Stocks Surge as Home-Buying Easing Gains Momentum (bloomberg)

- PBOC May Trade Bonds to Shake Off Reliance on Banks, ANZ Says (bloomberg)

- Hong Kong Stocks Power to Nine-Month High on Dividends, Property (bloomberg)

- Public Companies Are Alive and Well (wsj)

- Profits Are Booming—and That’s Shielding the Economy (wsj)

- Buybacks Are Back: Corporate America Is on a Spending Spree (wsj)

- Stocks Rally Pushes On With Fed Speakers in Focus (bloomberg)

- The Dow Is a Terrible Index. But It Is Telling Us Something Important. (wsj)

- UK exits recession with fastest growth in nearly three years (reuters)

- Stocks Haven’t Had an Earnings Boost. Why It Will Come. (barrons)

- Small-Caps Are Stuck. How They Get Moving Again. (barrons)

- The surprising reason why utilities stocks have suddenly transformed into the hottest sector on Wall Street (marketwatch)

- Where does China’s production capacity come from? (peoplesdaily)

- Valuation levels for Chinese stocks are attractive, says Kinger Lau (cnbc)

- Fed’s Bostic says economy likely slowing, though rate-cut timing uncertain (reuters)

- Alibaba opens new global headquarters in China on annual family day (scmp)

- The US can do one big thing to weaken the dollar and put pressure on China (businessinsider)

- Why China’s tolerance for a cheaper currency may be temporary (reuters)

- Loonie Surges After Canada Job Gains Blow Past Expectations (yahoo)

- What should the BoJ do with its huge stock portfolio? (ft)

Where is money flowing today?

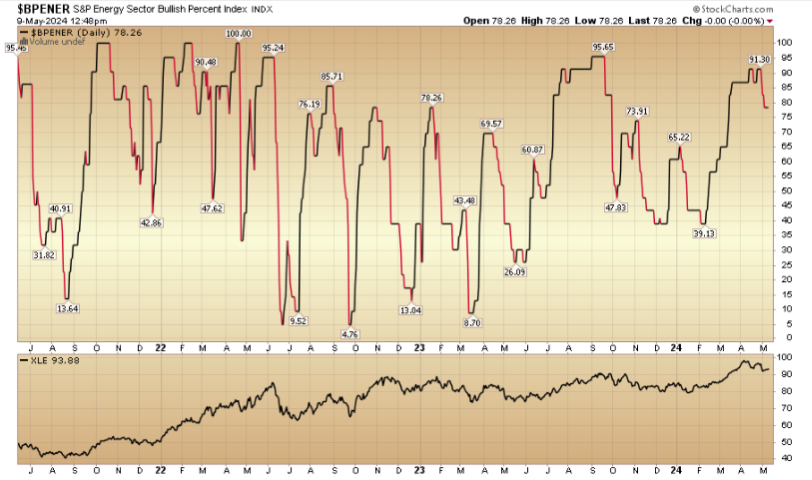

Indicator of the Day (video): Bullish Percent Energy

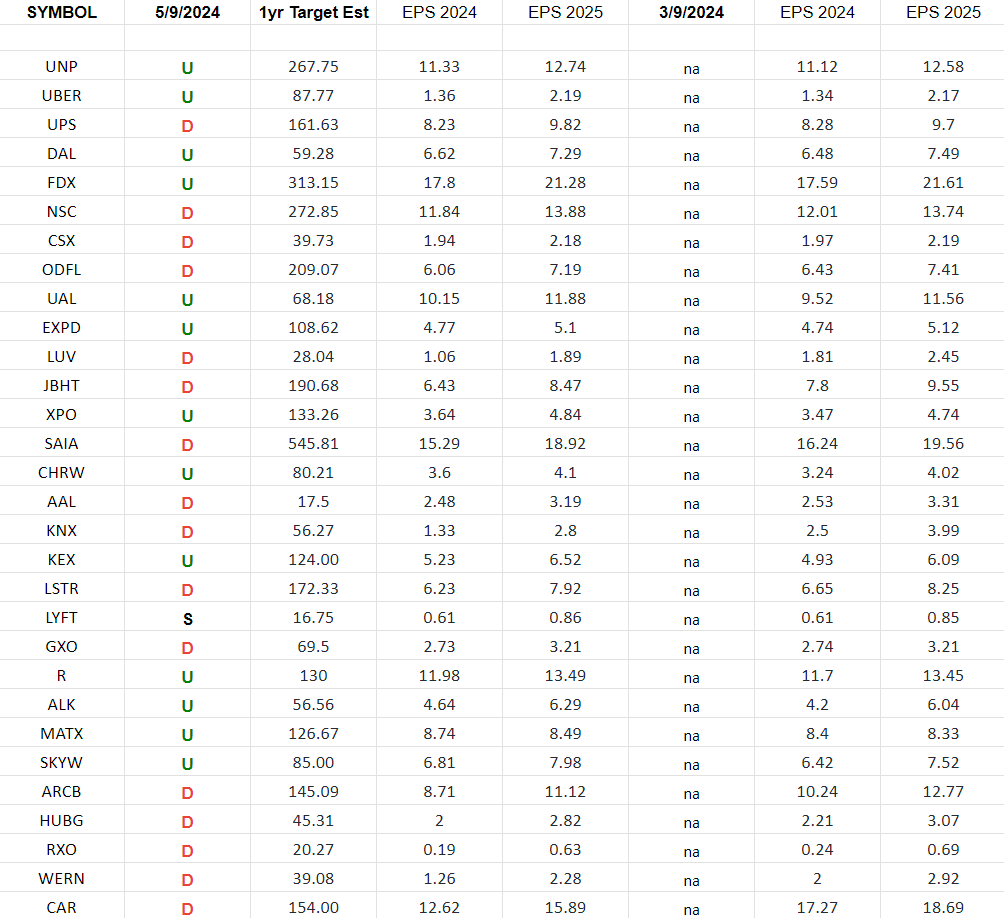

Transports Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Transportation Sector ETF (IYT) holdings. Continue reading “Transports Earnings Estimates/Revisions”

Retail Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Retail Sector ETF (XRT) top 30 weighted stocks. Continue reading “Retail Earnings Estimates/Revisions”