Be in the know. 20 key reads for Monday…

- Yen Rebounds Strongly After First Slide Past 160 Since 1990 (bloomberg)

- Hong Kong stock index closes near bull market territory on earnings optimism (scmp)

- Japan Intervenes After Yen Slides Against the Dollar (wsj)

- The Fed Won’t Cut Rates This Week. Focus on Balance Sheet Plans. (barrons)

- Cooper Standard Named a 2023 Supplier of the Year by General Motors (cooperstandard)

- Air Conditioning and AI Are Demanding More of the World’s Power—Renewables Can’t Keep Up (wsj)

- Alibaba’s Dingtalk Launches AI Agent Marketplace, Upgrades AI Assistant (alizila)

- The Resort at Paws Up Is the Best Dude Ranch to Live Like a ‘Yellowstone’ Dutton (mensjournal)

- Padre-Figlia combines every father’s two loves: his daughter and his Ferrari! (classicdriver)

- Warming Up with Brooks Koepka (youtube)

- M2 still points to lower inflation (scottgrannis)

- Inside the China-US Competition for AI Experts (bloomberg)

- The Scholar of Comedy (newyorker)

- Tesla’s Musk Gets Self-Driving Approval in China (barrons)

- Market needs to be ‘disabused’ of the expectation for two rate cuts this year, says Ed Yardeni (cnbc)

- Chengdu scraps home purchase qualifications to support housing market (scmp)

- Boeing Looks to Sell Bonds After Reporting Cash Burn (bloomberg)

- Knight-Swift Is Hunting for Trucking Acquisitions (wsj)

- Wall Street Has Spent Billions Buying Homes. A Crackdown Is Looming. (wsj)

- What tech’s choppy action means for stocks this week, according to this 20-year analysis (marketwatch)

Be in the know. 10 key reads for Sunday…

- May Almanac: Historically Poor in Election Years (AlmanacTrader)

- Even If the Fed Cuts, the Days of Ultralow Interest Rates Are Over (wsj)

- Forget Moonshots. Investors Want Profit Now. (wsj)

- She Owns Several Showstopping Cars. This Rare Ferrari Comes First. (wsj)

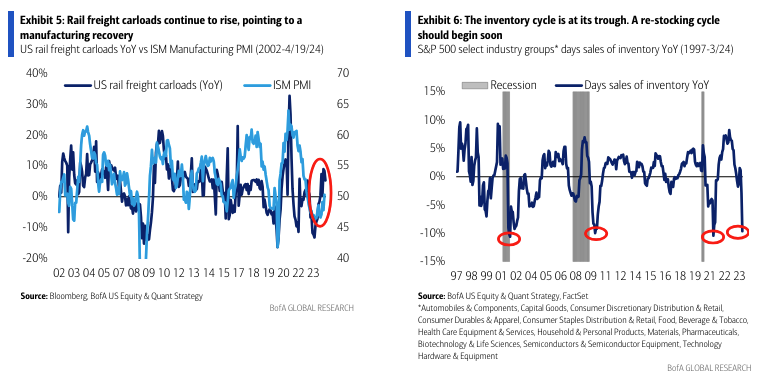

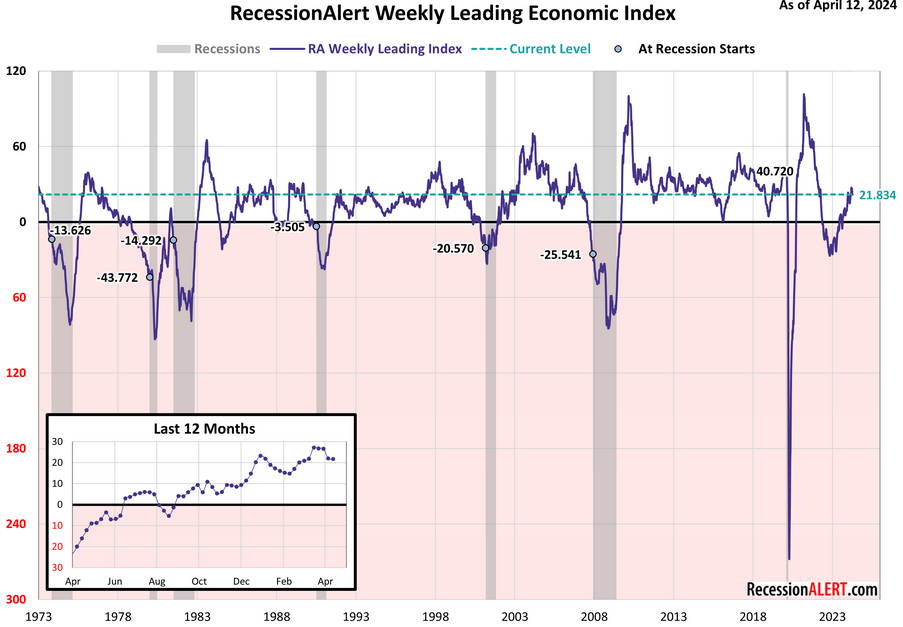

- Weekly Leading Economic Index (advisorperspectives)

- Boeing’s CEO search hits a roadblock—now an ‘insider/outsider’ who runs the planemaker’s biggest supplier is on the short list and near the top (fortune)

- Wall Street finds a back door into the AI stock boom as energy demand soars: utilities (fortune)

- Hennessey Performance Unveils 850-HP Cadillac Escalade-V (maxim)

- This Stunning St. Lucia Resort Is Straight Out Of A James Bond Movie (maxim)

- Alibaba Cloud brings AI video generator EMO to Tongyi Qianwen app (technode)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 236

Hedge Fund Tips with Tom Hayes – Podcast – Episode 236

Be in the know. 20 key reads for Saturday…

- Emerging Market Bonds Are Catching Wall Street’s Eye. What the Attraction Is. (barrons)

- Buy Enphase Energy Stock, Analyst Says. It’s Only Up From Here. (barrons)

- Big Tech Is Spending Gazillions on AI. Earnings Offer a Peek. (barrons)

- Warren Buffett or Not, Berkshire Hathaway Stock Is Built to Last (barrons)

- Alphabet Closes Above $2 Trillion Market Cap for the First Time (barrons)

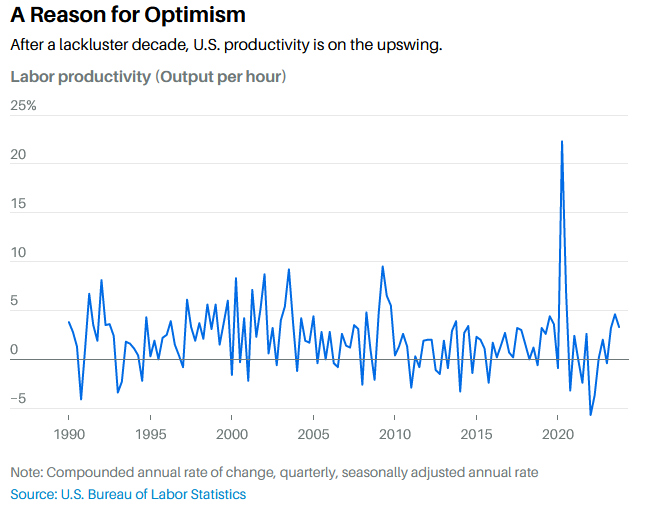

- How a Chicken Sandwich Shows a Hidden Power in the U.S. Economy (barrons)

- Kraft Heinz’s CEO Is a Health Nut. Can He Remake a Processed-Food Giant? (wsj)

- Jamie Dimon starts every morning reading five newspapers — guess which he peruses first (nypost)

- Florida real estate sellers slashing home prices as inventory surges to uncomfortable levels (nypost)

- The UK Market May Have Found Its Catalyst (bloomberg)

- Digital ad market is finally on the mend, bouncing back from the ‘dark days’ of 2022 (cnbc)

- Ed Yardeni on Long-Term Bull Market (mib)

- Intel CEO confident in its AI future after posting soft guidance (yahoo)

- Newell’s stock rallies on revenue beat as it boosts margins and carries out restructuring plan (marketwatch)

- S. natural gas-fired electricity generation consistently increased in 2022 and 2023 (eia)

- The Thrill Factor Is Back for Retail Investors (wsj)

- 2 Wide-Moat Stocks Trading at Rare Discounts (morningstar)

- 10 Best Blue-Chip Stocks to Buy for the Long Term (morningstar)

- Leon Cooperman, Hedge Fund Icon, Billionaire & Philanthropist (youtube)

- Why The Four Seasons Anguilla Is Among The Caribbean’s Best Beach Resorts (maxim)

Where is money flowing today?

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 24 key reads for Friday…

- Treasury yields slip from 2024 highs even after Fed’s favored inflation report signals stalled progress (marketwatch)

- Ant Group adds 14 foreign payment apps in access boost for Hong Kong merchants (scmp)

- Hong Kong stocks hit 5-month peak after positive earnings surprises (scmp)

- Global funds build ‘significant exposure’ to Chinese stocks in mood shift: HSBC (scmp)

- Yellen confident U.S. inflation will continue to cool (marketwatch)

- Treasuries Gain as Traders Find Relief in Key Inflation Readings (bloomberg)

- High Borrowing Costs Have Some Democrats Urging Biden to Pressure the Fed (nytimes)

- Microsoft Cloud Strength Drives March-Quarter Beat (investors)

- How to Get a Meeting With the UAE’s $1.5 Trillion Man (bloomberg)

- Alphabet’s Market Value Poised to Overtake Nvidia’s (barrons)

- For Second City, Making People Laugh is a Serious Business (barrons)

- Google Sales Accelerate as Ad, Cloud Businesses Hold Up Amid Costly AI Push (wsj)

- Warren Buffett Built Berkshire. What Happens When He’s No Longer There? (barrons)

- ‘How Disney Built America’ Review: Mickey Mouse Mythology (wsj)

- Microsoft Earnings Jump on AI Demand (wsj)

- Pfizer Receives FDA Approval for Bleeding Disorder Treatment (barrons)

- This isn’t ‘some brink’ for the U.S. consumer despite concerning economic data, says TCW (marketwatch)

- After Friday’s inflation report, fed-funds futures show Fed rate cuts may begin in September (marketwatch)

- San Francisco Buyers Bring Its Luxury Housing Market Back to Life (wsj)

- The Dream of Fed Rate Cuts Is Slipping Away (wsj)

- Alphabet’s Revenue Jumps 15% to $80.5 Billion (nytimes)

- Billionaire ‘bond king’ Bill Gross tells investors to avoid tech and stick to value stocks (businessinsider)

- Consumer sentiment weakens in late April, University of Michigan survey says (marketwatch)

- EM Stocks on Track for Best Week Since July on US Tech Spillover (bloomberg)