- Dividend Stocks Made a Comeback in March (barrons)

- He Turned 55. Then He Started the World’s Most Important Company. (wsj)

- The overall PCE price index was in line with expectations (wsj)

- New Blood Thinners Will Prevent Blood Clots Without Causing Bleeding (wsj)

- Inside the deals being cut by lenders to stave off commercial real estate calamity (businessinsider)

- Malls were a dirty word in commercial real estate. Now retail is a bright spot. (marketwatch)

- Hedge Funds Bet on Europe in Hunt for Next Leg of Stock Rally (bloomberg)

- What’s the point of private members’ clubs? (ft)

- “I’m Always Stoked To Return to the Unknown”: Anthony Van Engelen on His New Vans AVE 2.0, the Evolution of Skate Footwear and More (hypebeast)

- A hidden meaning in the Vans logo is blowing people’s minds (indy100)

Be in the know. 12 key reads for Easter…

- Inflation Progress Stalls, Fed’s Preferred Gauge Shows (barrons)

- Powell Reiterates Fed Doesn’t Need to Be In Hurry to Cut Rates (bloomberg)

- Fed chair Powell expects US inflation to keep cooling in coming months (ft)

- Bernie Sanders Demands Cheaper Ozempic (futurism)

- Ozempic Is Being Sold for Hundreds of Times What It Costs to Make (futurism)

- 10 Undervalued Wide-Moat Stocks (morningstar)

- 5 Cheap Sustainable Stocks With Moats (morningstar)

- Charlie Silk’s 150-Bagger (Peter Lynch)

- AliExpress to sponsor Euro 2024, urges merchants to prepare well amid surging traffic (technode)

- Amazon scrambles for its place in the AI race (theverge)

- Lots More on the Parabolic Surge in Cocoa Prices (bloomberg)

- M2 update—still looking good (scottgrannis)

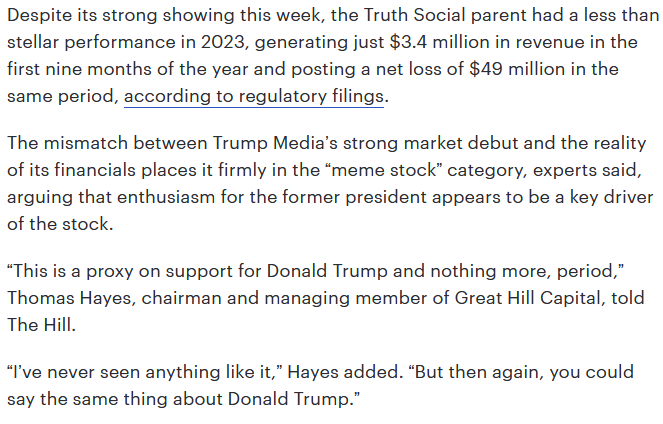

Tom Hayes – Quoted in The Hill article – 3/30/2024

Thanks to for including me in her article on The Hill. You can find it here:

Click Here to View The Full Article on The Hill

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 232

Article referenced in VideoCast above:

“More to Grow or Time to Go?” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 232

Article referenced in podcast above:

“More to Grow or Time to Go?” Stock Market (and Sentiment Results)…

Be in the know. 8 key reads for Saturday…

- Dollar Rally Is On Borrowed Time As US Disinflation Lags World (zerohedge)

- In Historic Reversal, US To Restart A Shut Down Nuclear Power Plant For The First Time Ever (zerohedge)

- Estée Lauder (EL) climbs as BofA upgrades to Buy on profit recovery expectations (streetinsider)

- Semtech (SMTC) climbs as Q4 revenue and guidance surpass expectations (streetinsider)

- 6 Highest Yielding Dividend Aristocrats Are Huge April Bargains (24/7WallStreet)

- China’s Xi plays salesman-in-chief in meeting with US CEOs (ft)

- Explore James Bond’s Most Iconic Destinations In New Coffee Table Book (maxim)

- Robert Cialdini: Influence (TIP)

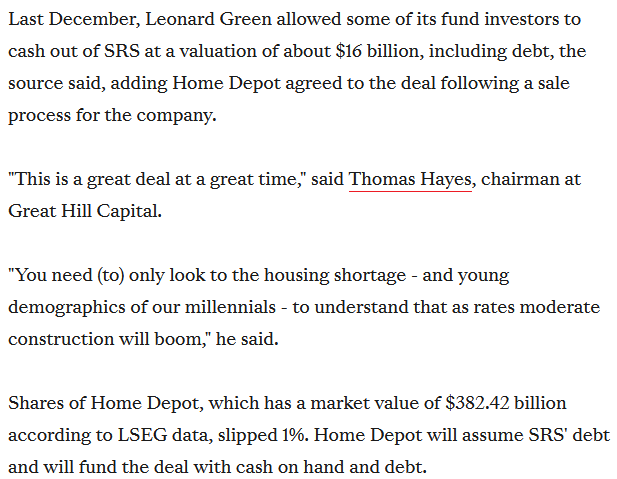

Tom Hayes – Quoted in Reuters article – 3/29/2024

Be in the know. 15 key reads for Good Friday…

- Citi Strategists Downgrade US Tech Stocks as Rally to Broaden (bloomberg)

- Fortune Favors Early Movers in America’s Property Crunch (wsj)

- Key Fed inflation gauge rose 2.8% annually in February, as expected (cnbc)

- Buy a Krispy Kreme at McDonald’s. It’s the New Super Breakfast Deal. (barrons)

- These housing markets are cooling as nearly a third of home listings cut their asking prices. Home sellers ‘misjudged the market,’ economist says. (marketwatch)

- Cash to Shareholders Is a Benefit, as Long as You Watch the Debt (barrons)

- Toyota Has Become an Anti-Tesla. It’s Paying Off. (barrons)

- Disney’s Proxy Fight With Nelson Peltz Heads Into the Final Round. What’s at Stake. (barrons)

- America Made a Huge Bet on Sports Gambling. The Backlash Is Here. (wsj)

- China to Lift Tariffs on Australian Wine, as Frosty Relations Thaw (wsj)

- Home Depot Buys Roofing Distributor in Deal Valued at $18 Billion Including Debt (wsj)

- What Cary Grant Told Me About Getting Dressed. I’ve Never Forgotten It. (wsj)

- Japan Forex Chief Calls Yen’s Slump Unusual, Vows to Act if Needed (bloomberg)

- The Good, the Bad and the Robotic: Reviewing the $345,000 McLaren 750S Spider (bloomberg)

- Huawei’s profit doubled in 2023 as smartphone, autos business picked up (cnbc)

Where is money flowing today?

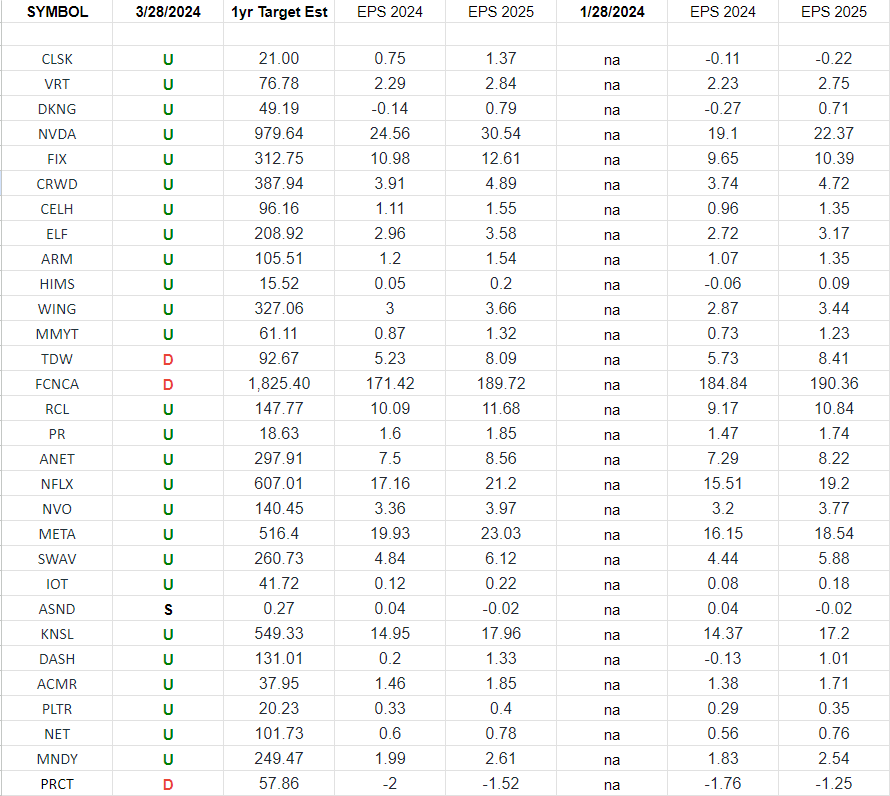

IBD 50 Growth Index (top 30 weights) Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted stocks in the IBD 50 Growth Index (ETF: FFTY) Continue reading “IBD 50 Growth Index (top 30 weights) Earnings Estimates”