- Chinese stocks are back in a bull market as investors buy into the nation’s economic rebuild (businessinsider)

- 3M (MMM) hikes first-quarter earnings forecast amid healthcare unit spin-off (streetinsider)

- ‘It’s just a fantasy’: Citadel CEO Ken Griffin says AI will not replace human fund managers (marketwatch)

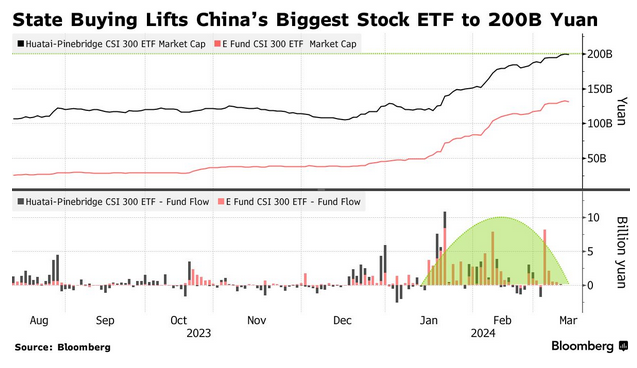

- China’s Biggest ETF Reaches $28 Billion on National Team Buying (bloomberg)

- 3M hires outsider Bill Brown as CEO, shares jump (foxbusiness)

- The last mile of inflation hits another big bump in the road (marketwatch)

- Illegal immigration is giving Fed more scope to let economy run hot, researchers say. (marketwatch)

- The Fed Has a Tricky Data Problem. The Economy Is Sending Lots of Mixed Signals. (barrons)

- Auto Insurance Prices Soared Last Month. Why They Finally Might Be Peaking. (barrons)

- For Golf Communities, It’s All About the Long Game (barrons)

- This New AI Chip Makes Nvidia’s H100 Look Puny in Comparison (barrons)

- How Safe Are Boeing Planes? A Look at the Data. (barrons)

- Amazon Will Now Deliver Eli Lilly Weight Loss Drug (barrons)

- Productivity Is Growing Fast. Don’t Give AI the Credit. (barrons)

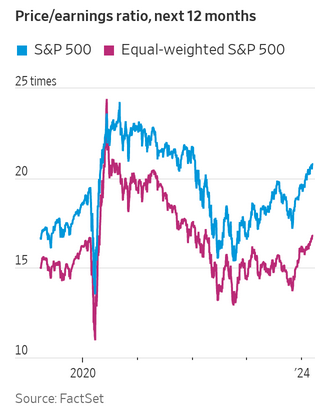

- Big Stocks Aren’t the Only Play. It’s Time to Look at Smaller Ones. (barrons)

- Berkshire Buys More Liberty Sirius XM, Now Holds $2.6 Billion of Tracking Stock (barrons)

- ADM Finds ‘Material Weakness’ in Accounting Probe (barrons)

- Inflation Picks Up to 3.2%, Slightly Hotter Than Expected (wsj)

- 3M Names New CEO Amid PFAS Battles, Health Spinoff (wsj)

- Alibaba’s Media Arm to Invest $640 Million in Hong Kong Entertainment (wsj)

- Dollar Tree to Close About 1,000 Stores (wsj)

- How China Tried to Fix the Stock Market—and Broke the Quants (wsj)

- Miami’s Office Market Was Red-Hot. Now Its Tallest Planned Tower Can’t Fill Its Space. (wsj)

- Activist Investor Land & Buildings Urges Office Owner to Liquidate (wsj)

- Dodge drops the Challenger, flexes new 2024 Charger Daytona EV (usatoday)

- China Pledges Central Government Funds For Equipment Upgrades (bloomberg)

- The Fed Will Slow QT. What Matters Is Where It Stops (bloomberg)

- Jamie Dimon endorses Disney CEO Bob Iger in proxy fight with activist (cnbc)

- EV euphoria is dead. Automakers trumpet consumer choice for U.S. car shoppers (cnbc)

- Top CFOs are as bullish on the Dow and as dovish on the Fed as they’ve been in a long time: CNBC survey (cnbc)

- Forget Nvidia: Billionaire Investors Are Selling It and Buying These 2 Artificial Intelligence (AI) Stocks Instead (yahoo.finance)

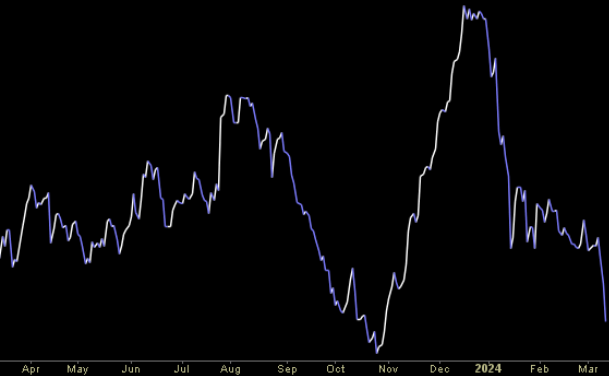

- AMD Rally Looks More Fragile Than Nvidia’s as Traders Bid Up AI (finance.yahoo)

- Jerome Powell just revealed a hidden reason why inflation is staying high: The economy is increasingly uninsurable (fortune)

- The Big Read. Shipbuilding: the new battleground in the US-China trade war (ft)

Tom Hayes – Schwab Network Appearance – 3/12/2024

Schwab Network Appearance – Thomas Hayes – Chairman of Great Hill Capital – December 4, 2023

Watch Directly on Schwab Network

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 25 key reads for Tuesday…

- 3M’s stock rises as company announces a new CEO (marketwatch)

- Advance Auto Parts Strikes Settlement With Dan Loeb’s Third Point (wsj)

- China Traders Buy Hong Kong Stocks for 19th Day, Longest in 11 Months (bloomberg)

- China Stocks Begin Witnessing Bull Markets in a Gamut of Sectors (bloomberg)

- Oracle Stock Jumps On Strong Earnings. Demand for Cloud Computing Is Surging. (barrons)

- Intel survived bid to halt millions in sales to China’s Huawei, sources say (reuters)

- China’s Exports Are Surging. Get Ready for the Global Backlash. (barrons)

- Illegal immigration is giving Fed more scope to let economy run hot, researchers say. (marketwatch)

- Inflation Picks Up to 3.2% in Unexpected Turn Higher (wsj)

- Core inflation, which excludes food and energy, was up 3.8% (wsj)

- Inside the CPI report: Gas, housing and transportation costs keep inflation elevated (marketwatch)

- Why BofA is bullish on U.S. consumers despite inflation and interest-rate worries (marketwatch)

- Alphabet is the bargain stock among the ‘Magnificent Seven’ (marketwatch)

- The Fed’s Bailout Program Is Ending. Bank Reserves Are Getting a Closer Look. (barrons)

- Boeing Stock Is Falling. Justice Department Starts Criminal Inquiry. (barrons)

- Doctors Can Now Edit the Genes Inside Your Body (wsj)

- EQT and Equitrans Midstream to Combine in Big Natural-Gas Deal (wsj)

- China Vanke in Debt Swap Talks With Banks to Stave Off Default (bloomberg)

- US Shelter Inflation Slows After Surprise Jump Caused Confusion (bloomberg)

- Disney paid ValueAct millions in fees before winning its support in proxy fight, activist says (cnbc)

- Inflation in Germany reaches a two-year low as U.K. wage growth cools (marketwatch)

- China has little choice but stimulus (ft)

- Bilibili targeting more collaboration with e-commerce advertisers like Taobao (scmp)

- Apple to expand applied research operations in Shanghai and Shenzhen (scmp)

- China Vanke claims junk-level downgrade is manageable as shares and bonds gain (scmp)

Tom Hayes – CGTN America Appearance – 3/11/2024

Where is money flowing today?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 21 key reads for Monday…

- These Beaten-Down Dividend Stocks Could Pop Soon. Watch This Week’s Inflation Report. (barrons)

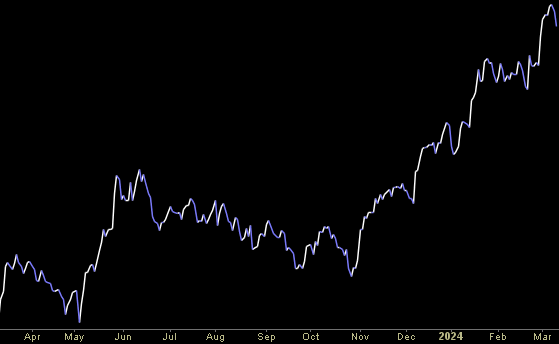

- It Isn’t Just Big Tech Propelling Gains in the Stock Market Anymore (wsj)

- China’s 5% Growth Goal Bets on New Demand Drivers (bloomberg)

- Nikkei Plunges As Yen Soars Ahead Of BOJ Policy Change (zerohedge)

- Jamie Dimon and Ray Dalio Warned of an Economic Disaster That Never Came. What Now? (wsj)

- Citigroup CEO Jane Fraser will have to pull off the restructuring of the century to bring banking empire back to its former glory (nypost)

- Weight-loss drug Wegovy approved by FDA to cut heart attack, stroke risk (nypost)

- Best and worst moments of Oscars 2024: From a naked John Cena, ‘Barbenheimer’ and more (nypost)

- Oscars 2024: A Big Night for ‘Oppenheimer’ (wsj)

- Stock Buybacks To Top $1 Trillion In 2025, Goldman Says, Led By These Giants (investors)

- BofA Says Tech Stocks Post Largest Weekly Outflows on Record (bloomberg)

- The Stock Market’s Rapid Rise Is Making Some Analysts Nervous. An Opportunity Could Be Ahead. (barrons)

- Candlesticks and supernovas: This is why action in Nvidia is a worry for market gazers (marketwatch)

- The ‘Magnificent Seven’ stocks are actually undervalued vs. the rest of the market, JPMorgan says (marketwatch)

- Beware the Frothy AI Frenzy (wsj)

- Fed Officials to Signal Interest Rate Cuts Are Getting Closer (bloomberg)

- One of the Most Infamous Trades on Wall Street Is Roaring Back (bloomberg)

- Brazilian Growers Go Bust in Blow to $7 Billion Farm-Credit Boom (bloomberg)

- Why stocks don’t need Fed rate cuts to keep soaring in 2024 (businessinsider)

- Eighty Percent of the World’s Stock Options Aren’t Traded Where You Think (wsj)

- Chinese Stocks Sustain Momentum During Annual Political Event (bloomberg)