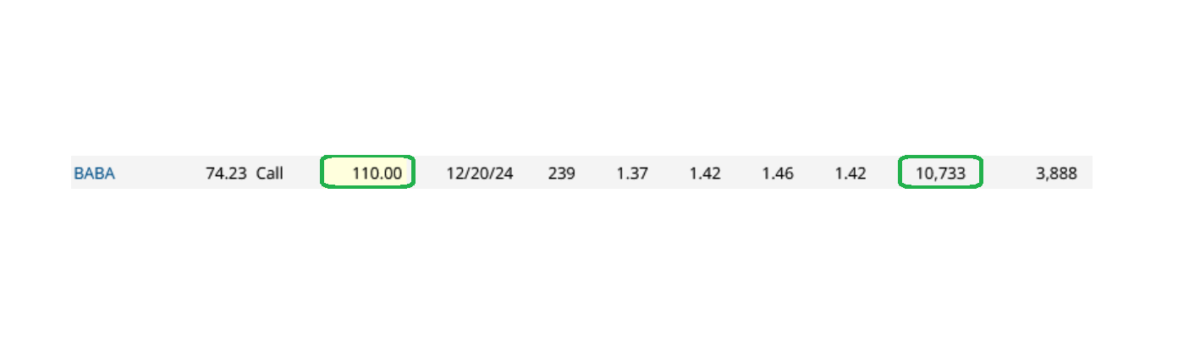

Data Source: Barchart

On Wednesday some institution/fund purchased 10,733 contracts of Dec. 2024 $110.00 strike calls (or the right to buy 1,073,300 shares of Alibaba Group Holding Limited (BABA) at $110.00).

Continue reading “Unusual Options Activity – Alibaba Group Holding Limited (BABA)”