- Citigroup CEO Jane Fraser on layoffs, major overhaul: ‘Don’t have room for bystanders’ (nypost)

- House Passes Bill to Avert Government Shutdown, Sends to Senate (bloomberg)

- Huawei Takes Revenge as China Catches Up on Semiconductors (bloomberg)

- Portugal Upgraded to A- by Fitch on Declining Debt Ratio (bloomberg)

- What Worries UAW’s Striking Workers, in Their Own Words (bloomberg)

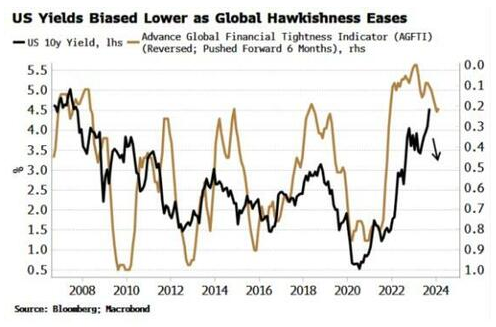

- The Fed is throwing ‘kerosene on the fire’ and needs to end rate hikes as inflation is probably already at 2%, billionaire real estate mogul Barry Sternlicht says (businessinsider)

- Apple Says Software, Apps Behind iPhone Overheating; Fix Coming (bloomberg)

- How Elon Musk’s Starlink Sparked a New Kind of Space Race (bloomberg)

- Atari 2600+ sees its future in retro gaming (cnbc)

- Shane Parrish on Wisdom from Warren Buffett, Rules for Better Thinking, How to Reduce Blind Spots, The Dangers of Mental Models, and More (#695) (tim)

- 10 Undervalued Wide-Moat Stocks (morningstar)

- The Big Read. What Lina Khan’s antitrust case could mean for Amazon (ft)

Be in the know. 10 key reads for Saturday…

- China’s economy stabilises, factory activity returns to expansion (reuters)

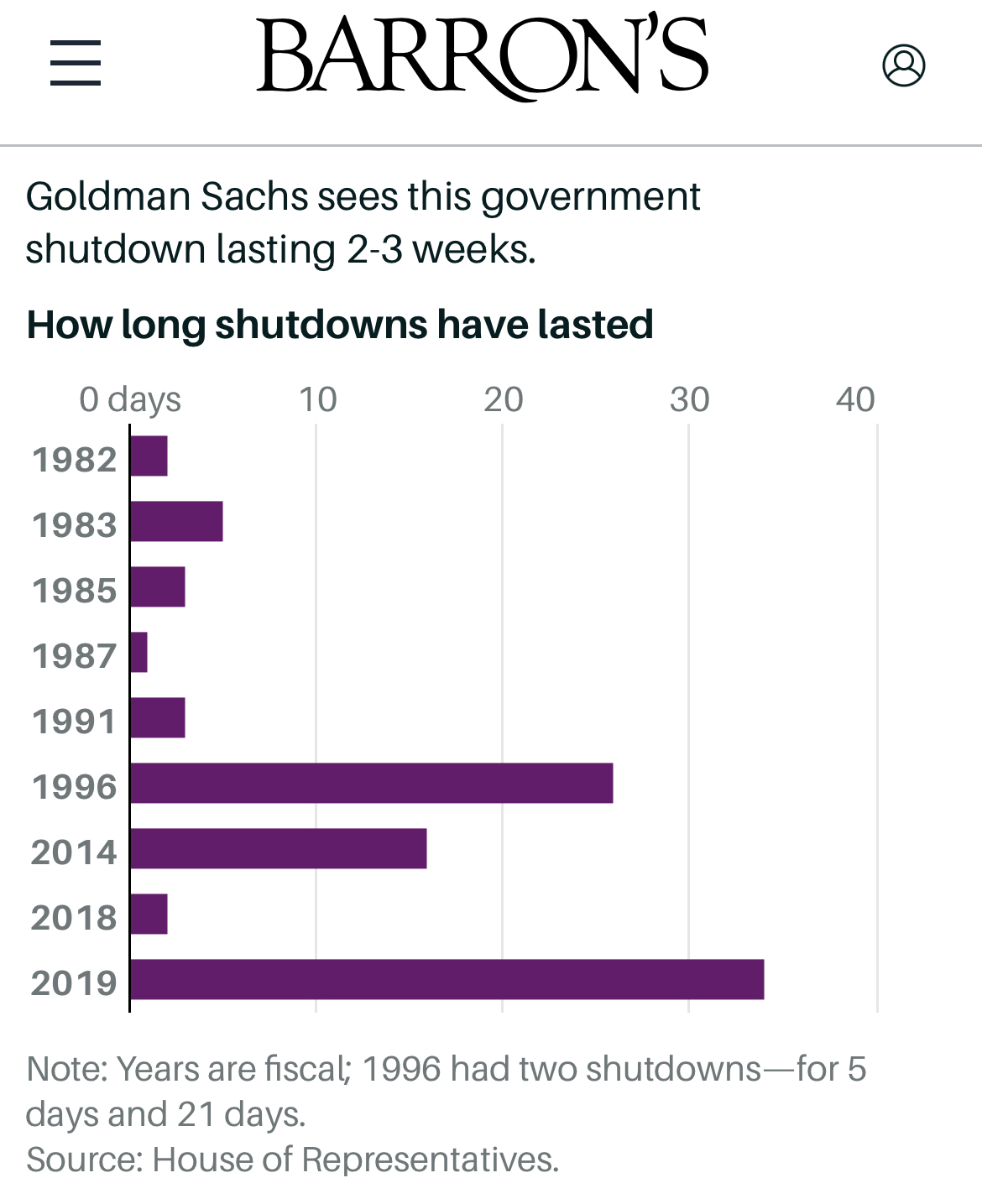

- How a government shutdown could complicate Fed’s fight against inflation (marketwatch)

- Disney+ password-sharing crackdown reportedly coming soon (foxbusiness)

- Intel’s stock scores its hottest quarterly winning streak since 2010 (marketwatch)

- Yellen warns government shutdown would be ‘dangerous and unnecessary’ (foxbusiness)

- Investors are pouring money back into global stocks following biggest outflow of the year (marketwatch)

- September Is Over. It’s Time to Buy Stocks. (barrons)

- ‘This Is Not a Covid Vaccine Company,’ Moderna CEO Says (barrons)

- Dollar Tree Insider Bought the Beaten-Down Stock (barrons)

- ASTON MARTIN UNVEILS F1-INSPIRED VALHALLA HYPERCAR (maxim)

Where is money flowing today?

Be in the know. 20 key reads for Friday…

- China’s Economy Improves in September, Satellite Data Show (bloomberg)

- Alibaba, NIO, XPeng Climb. Chinese Businesses Get a Regulatory Boost. (barrons)

- Automakers grow frustrated over pace of UAW negotiations as new strike deadline looms (cnbc)

- China Looks to Relax Data Rules to Allay Business Fears (bloomberg)

- Intel hails ‘landmark’ as high-volume EUV production begins at Irish plant (yahoofinance)

- 10-year Treasury yield falls from 15-year high after Fed’s preferred inflation gauge eases (cnbc)

- US Core PCE Prices Post Smallest Monthly Rise Since Late 2020 (bloomberg)

- Bank Stocks See Big Insider Buys (barrons)

- Bonds Remain Oversold After Fastest Yield Rise On Record (zerohedge)

- ‘I see more fear than anytime in my business career,’ says BlackRock’s Larry Fink (marketwatch)

- House Passes Some Late-Night Bills. Shutdown Still Looking Likely. (barrons)

- Buy This Defense Stock. It’s Cheap, and a Shutdown Won’t Hurt It for Long. (barrons)

- Nike Sees ‘Very Strong’ Demand in Year Ahead. The Stock Rallies.(barrons)

- Nvidia and Other Chip Stocks Had a Terrible September. Wall Street Remains Upbeat. (barrons)

- Where Did All the Dark-Suited Japanese Businessmen Go? (nytimes)

- Europe’s Richest Royal Family Builds $300 Billion Finance Empire (bloomberg)

- Forget the sell-off – Tech stocks have a ‘springboard for growth’ into 2024 that Wall Street has underestimated (businessinsider)

- Here Is What Stops, And What Doesn’t, When The Government Shuts Down This Weekend (zerohedge)

- Eurozone inflation hits two-year low (ft)

- S&P 500 Quarterly Returns (carson)

Tom Hayes – Yahoo! Finance Appearance – 9/28/2023

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 206

Article referenced in VideoCast above:

“Is it really different this time?” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 196

Article referenced in Podcast above:

“Is it really different this time?” Stock Market (and Sentiment Results)…

Where is money flowing today?

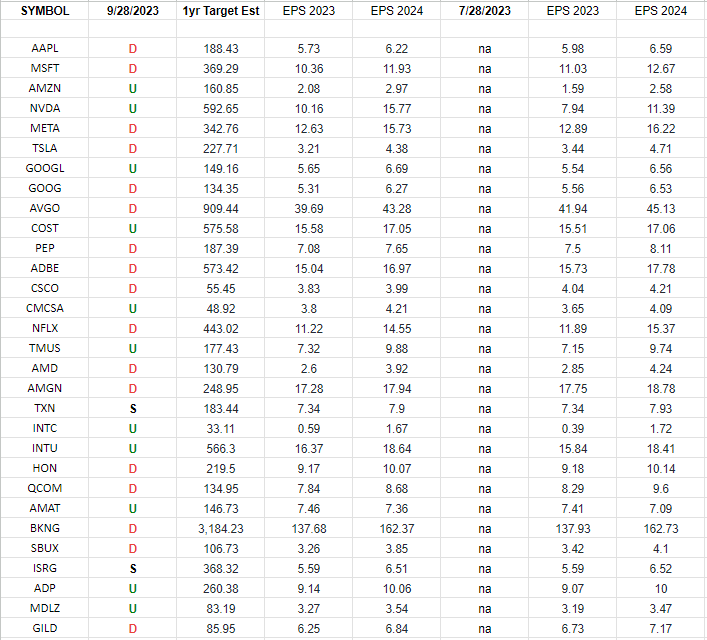

Nasdaq (top 30 weights) Earning Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted Nasdaq stocks. I have columns for what the 2023 estimates were on 7/28/2023 and today.

Continue reading “Nasdaq (top 30 weights) Earning Estimates/Revisions”

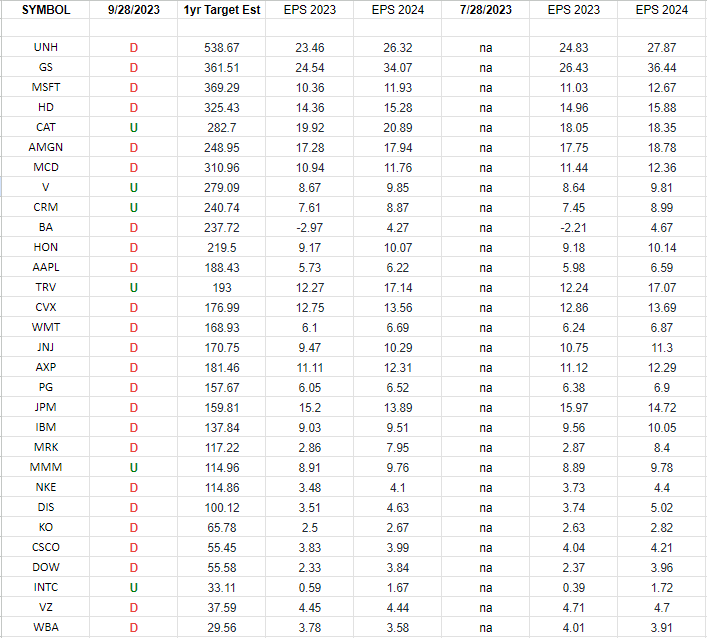

DOW 30 Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Dow Jones Industrial Average 30 stocks. Continue reading “DOW 30 Earnings Estimates/Revisions”