- Markets Show Signs of Reflation. Where to Invest Now. (barrons)

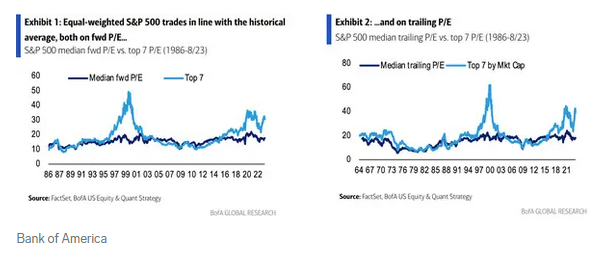

- Bank of America: The stock market is primed for a 25% rally in the next 12 months. These 6 industries hold the best opportunities. (businessinsider)

- Apple iPhone 15 Deals Are Out. What They Mean for T-Mobile, AT&T, Verizon Stocks. (barrons)

- Latest UAW Threat: Strikes at More Ford, GM Plants If No ‘Serious Progress’ by Friday. (barrons)

- Instacart Sets Its IPO Price at $30 a Share. Trading Starts Soon. (barrons)

- S. economy is trending in the Fed’s direction, so expect Powell to tread carefully this week (marketwatch)

- Carnival’s stock climbs after long-time bear says stop selling (marketwatch)

- GE HealthCare Stock Is Too Cheap, Says Analyst (barrons)

- CEO of Naspers and Prosus Steps Down (wsj)

- Disney to Invest $60 Billion in Theme Parks, Cruises Over Next Decade (wsj)

- Desperate NYC parents spending millions, lying, moving across the country to get kids into Ivy League schools (nypost)

- Amazon Opens a New Chapter for Its Gadget Business, and for Alexa (bloomberg)

- Treasury yields hold steady as investors await economic data, Fed meeting (cnbc)

- Goldman Sachs says the yield curve isn’t signaling a recession this time, but a restrictive Fed policy (businessinsider)

- Shelter will be the category driving disinflation going forward: JPMorgan Asset Management’s Berro (cnbc)

Where is money flowing today?

Be in the know. 15 key reads for Monday…

- Bond Market at Risk of Third Annual Loss Needs a Dot-Plot Rescue (bloomberg)

- US, China Officials Meet in Malta to Keep Channels Open (bloomberg)

- Beijing to support unicorns by fast-tracking IPO and large funding approvals (technode)

- Ant Group’s consumer credit unit secures RMB 4 billion consortium loan (technode)

- Taiwan Dollar Slump Seen Ending on China Recovery, Chip Outlook (bloomberg)

- Lineup Will Hold It Over Until Next Year (bloomberg)

- Where the Strike Stands. How to Read Offers From Auto Makers and the UAW. (barrons)

- New Cancer Drugs Are Changing the Odds. The Latest on Treatments. (barrons)

- Disney asset sales won’t break the bank, but they will move legacy media forward (cnbc)

- This Chinese partner could be the savior for beaten-down PayPal, Mizuho says (streetinsider)

- Meituan Says Sales in First 30 Mins of iPhone 15 Pre-order Exceed RMB200M (aastocks)

- Amazon Makes 3 Groundbreaking Announcements This Week That Hint at Its Future Growth Plans (fool)

- Those trying to pick AI winners should remember the dotcom days (ft)

- This stock market signal points to the S&P 500 surging 25% within the next year (businessinsider)

- UAW President Says Stellantis 21% Pay Hike Offer a ‘No Go’ (barrons)

Be in the know. 10 key reads for Sunday…

- Fewer Losers, or More Winners? (Howard Marks)

- Warren Buffett’s intrinsic value mantra might lead you to boring companies but predictable cash flows (financialpost)

- #395 – Walter Isaacson: Elon Musk, Steve Jobs, Einstein, Da Vinci & Ben Franklin (lexfridman)

- The 10 Best Dividend Stocks. These undervalued stocks with reliable dividends are worth considering. (morningstar)

- Automakers, UAW Spend Strike’s First Day in War of Words (bloomberg)

- Hedge Funds Hiked Bullish Oil Bets to 15-Month High on OPEC+ Cuts. Net long positions rise to highest level since June 2022 (bloomberg)

- Frontier Airlines CEO says workforce got ‘lazy’ during pandemic (foxbusiness)

- Fed unlikely to raise rates in November, says Goldman Sachs (reuters)

- What if Jerome Powell pulled off a soft landing and nobody noticed? It’s the economy’s Groundhog Day (fortune)

- How scientists are using artificial intelligence (economist)

Be in the know. 20 key reads for Saturday…

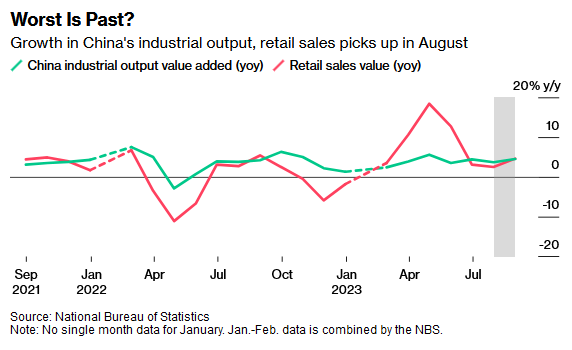

- From commodities to retail, China’s economy is showing signs of life after Beijing’s stimulus frenzy (businessinsider)

- Trump bemoans high interest rates and indicates he might pressure Fed to lower (cnbc)

- Have Million-Dollar Gene Therapies Finally Reached An Inflection Point? (investors)

- Ford Lays Off 600 Workers at Plant Targeted by UAW Strike (barrons)

- This Highflying Defense Stock Stumbled. That’s a Reason to Buy. (barrons)

- 20 stocks of aerospace and defense companies expected to grow sales most quickly through 2025 (marketwatch)

- 1-800-Flowers Executives Bought Up Stock (barrons)

- Hunting Season on Banks Might Be Over (barrons)

- The Big Question for the Fed: Not How High Rates Will Go but How Long They’ll Stay There. (barrons)

- Auto Stocks Rise as UAW Strike Gets Reaction From Wall Street (barrons)

- ‘Sell Rosh Hashanah, buy Yom Kippur’ stock-market pattern is just a calendar event (marketwatch)

- Small-Cap Stocks Are in the Doghouse. What Could Lift Them Out. (barrons)

- ‘Dumb Money’: The Movie vs. What Really Happened (wsj)

- Demands for Tips Are Up. Actual Tipping, Not So Much. (wsj)

- Amazon Searches for Its Next Big Hit (wsj)

- UAW Strike Exposes Detroit’s Dysfunction (wsj)

- Whatever the UAW Strike Outcome, Elon Musk Has Already Won (wsj)

- Striking UAW Can’t Bring Back the 1950s or Wish EVs Away (bloomberg)

- Warren Buffett poured $3 billion into Dow Chemical during the financial crisis. Here’s the story of how he helped the manufacturing titan – and doubled his money. (businessinsider)

- Battle Over Electric Vehicles Is Central to Auto Strike (nytimes)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 204

Hedge Fund Tips with Tom Hayes – Podcast – Episode 194

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 25 key reads for Friday…

- As Alibaba’s Stock Slides, Employee No. 52 Still Believes In Its “Tao” (forbes)

- As Historic Auto Union Strike Starts, White House Prepares Emergency Aid For Auto Suppliers (zerohedge)

- PBOC Adds More Cash Into Economy as Recovery Gathers Pace (bloomberg)

- There are 5.6 trillion reasons that stocks can enjoy a year-end rally (marketwatch)

- China’s Economy Picks Up in August on Travel Boom, Policy Push (bloomberg)

- China Boosts Economy With Second RRR Cut This Year (zerohedge)

- Buy Intel Stock, Analyst Says. It Is ‘Well Positioned’ for AI. (barrons)

- Stocks boosted by positive economic data from China (ft)

- 1 Growth Stock Down 72% to Buy Right Now (fool)

- YTD inflows to money markets hit $1 trillion – BofA (streetinsider)

- China May Dodge Deflation, After All (wsj)

- BABA’s Tmall Genie Reportedly Intends to Change Name; New Products to be Released Next Tue (aastocks)

- Why the Stock Market Is Ignoring a Slowing Economy (barrons)

- United Auto Workers are striking widely but softly, says Jefferies analyst (cnbc)

- Byron Allen Makes $10B Bid for ABC, Other Disney Networks (bloomberg)

- China Urges Brokers To Cut FX Trading In Support For Weak Yuan (bloomberg)

- Arm listing stirs hopes of fee revival at Wall Street banks (ft)

- Lunch with the FT. ‘He is driven by demons’: biographer Walter Isaacson on Elon Musk (ft)

- Instacart Was All About Grocery Delivery. No Longer. (nytimes)

- China Frees Banks to Lend More in Latest Attempt to Spur Economy (nytimes)

- Dow Industrials Paying Price for Leaving Out Amazon and Alphabet (bloomberg)

- BofA’s Hartnett Says Equity Inflows Surge on Soft Landing Hopes (bloomberg)

- Disney Says It Hasn’t Made a Decision About ABC After Report of Sale Talks (barrons)

- Lennar’s Earnings Are a Read on Housing. Demand for New Homes Is Strong. (barrons)

- Here are the iPhone 15 deals from AT&T, T-Mobile and Verizon as preorders kick off (marketwatch)