Be in the know. 25 key reads for Tuesday…

- Franklin Templeton CEO says China pessimism is overhyped (reuters)

- China Stock Traders Load Up on Leverage With New Rule Relaxation (bloomberg)

- Fed Is Done Raising Rates and Will Cut Them in 2024, Economists Say (bloomberg)

- UAW Labor Talks Offer a Ray of Hope. Ford, GM Stocks Aren’t Budging. (barrons)

- UAW Bends on Wage Demands as Talks Progress in Detroit (wsj)

- For Auto Workers, It Isn’t Just About Pay (wsj)

- Alibaba’s New CEO Shares His 2 Big Priorities (barrons)

- Apple’s Big Day Is Here. Hello, iPhone 15. (barrons)

- 3 Takeaways from Elon Musk’s New Biography (barrons)

- Small-Cap Stocks Are in the Doghouse. What Could Lift Them Out. (barrons)

- Disney and Charter Stocks Jump on Cable Deal. The Status Quo Is Largely Preserved. (barrons)

- Apple’s iPhone 15 Looks Like a Bargain. Here’s the Math. (barrons)

- It’s Tough to Love Bank Stocks Right Now. These 8 Offer Tasty Yields. (barrons)

- Beijing Throws China’s Housing Market a Bone (wsj)

- Big Pharma’s Battle With the Biden Administration Could Have Legs (wsj)

- Apple’s iPhone 15 Looks Like a Bargain. Here’s the Math. (barrons)

- Treasury Bills Yielding 5% Are a Big Hit With Retail Investors (bloomberg)

- Investors See European Stocks Rising Over Next Year, BofA Says (bloomberg)

- James Dolan’s $2.3 Billion Sphere Is Raising Eyebrows—in a Good Way (bloomberg)

- Billionaire investor Bill Gross slams Jeff Gundlach over shared ‘Bond King’ nickname: ‘To be a bond king or queen, you need a kingdom’ (businessinsider)

- “It is so wrong that it might actually be right” (zerohedge)

- Strong demand pushes Arm to close IPO order book early (ft)

- Why China is restricting IPOs to drive up US$9.7 trillion stock market (scmp)

- Alibaba’s New CEO Elevates AI to Top Priority in Revamp (bloomberg)

- China Sees Healthy Inflation, Alibaba Leadership Reshuffle Goes Effective (chinalastnight)

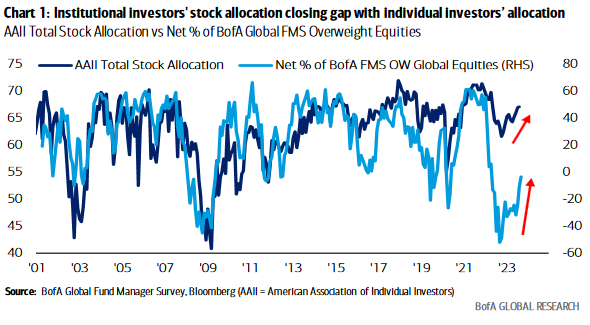

September 2023 Bank of America Global Fund Manager Survey Results (Summary)

The August survey covered 222 fund managers with $616 billion under management. Continue reading “September 2023 Bank of America Global Fund Manager Survey Results (Summary)”

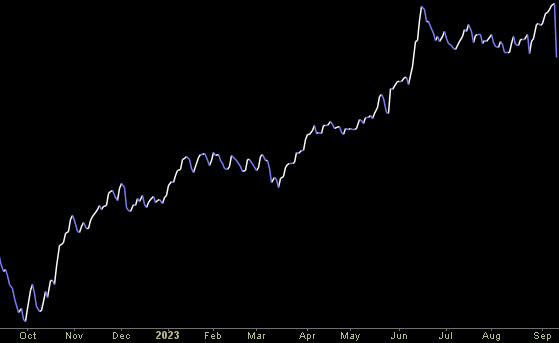

Tom Hayes – Fox Business Appearance – Charles Payne – 9/11/2023

Where is money flowing today?

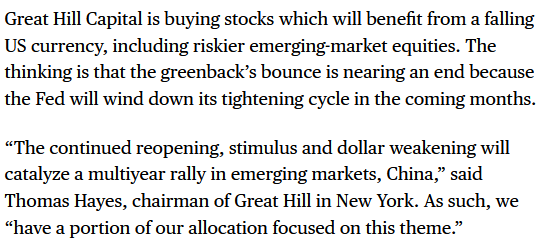

Tom Hayes – Quoted in Bloomberg article – 9/8/2023

Thanks to Ruth Carson and David Finnerty for including me in their article on Bloomberg. You can find it here:

Click Here to View The Full Article on Bloomberg

Be in the know. 27 key reads for Monday…

- The Band is Back Together. Jack Ma’s proxies (who built the company with him) are fully back in charge: “Alibaba’s Daniel Zhang Exits Chinese Internet Giant Entirely” (investors)

- An Important Shift in Fed Officials’ Rate Stance Is Under Way (wsj)

- China Gen Z Tries to Leisure-Shop Way Out of Jobless Blues (bloomberg)

- China Shows Signs of Stability as Credit, Inflation Improve (bloomberg)

- World Trade Center rebuild revitalized lower Manhattan and brought healing (foxbusiness)

- China bolsters market sentiment by simplifying stock investments for insurers (global)

- China’s easing of property market curbs gives Beijing home sales a boost (reuters)

- China Credit Climbs More Than Forecast as Banks Boost Loans (bloomberg)

- Hedge funds say greenback rally may not be over (investmentnews)

- Dollar tumbles against yen after BOJ head hints that negative interest rates could end (marketwatch)

- 6 Inexpensive Consumer Stocks With Strong Profit Growth (barrons)

- Earnings Estimates Are Rising, a Welcome Sign for 2023 Market Rally (wsj)

- China’s Premier Urges Biden to See His Nation as an Opportunity (bloomberg)

- Hedge Funds Turn Most Bearish on Euro Since January Ahead of ECB (bloomberg)

- Money-center bank Citigroup is Berkshire’s highest-yielding holding on a nominal basis (5.1%). (fool)

- EU downgrades growth forecast and raises inflation expectations (ft)

- Lunch with the FT. ‘He is driven by demons’: biographer Walter Isaacson on Elon Musk (ft)

- China issues strong warning against bets on renminbi depreciation (ft)

- Exclusive: China’s central bank to scrutinise bulk dollar purchases – sources (reuters)

- The Race to Drill America’s Longest Oil and Gas Wells (wsj)

- ‘Elon Musk’ Takeaways: Book Paints Complicated Picture of the World’s Richest Man (wsj)

- Yellen ‘Feeling Very Good’ About Soft Landing for US Economy (bloomberg)

- Just a 10-Day UAW Strike Risks Costing US Economy $5.6 Billion (bloomberg)

- Biden Doubts China Able to Invade Taiwan Amid Economic Woes (bloomberg)

- China’s Consumer Prices Creep Out of Deflation in August (bloomberg)

- Fears about China’s government ban on iPhones are ‘way overdone,’ as the crackdown could impact only 1% of the smartphone’s sales in China: analyst (businessinsider)

- Morgan Stanley says it’s a lonely bull, recommending government bonds (marketwatch)

Be in the know. 15 key reads for Sunday…

- Earnings Estimates Are Rising, a Welcome Sign for the 2023 Market Rally (wsj)

- Alibaba chases B2B expansion in the US with a suite of enhanced tools (technode)

- The World’s 50 Most Valuable Sports Teams 2023 (forbes)

- China’s Shanghai Composite Stock Index Nearing “Decision Time!” (kimblechartingsolutions)

- The Tension Driving the UAW Strike Threat (wsj)

- Important Shift in Fed Officials’ Rate Stance Is Under Way (wsj)

- “China’s economic recovery rate is leading among major global economies,” Xi said. China’s growth rate was 5.5% during the first half of the year compared with a year earlier, though that result was boosted by strong activity in the early part of 2023. “The long-term positive fundamentals haven’t changed,” he said. (wsj)

- The Rich and Famous Love This Banker, Even If She’s a Little Mean to Them (wsj)

- 10 Biotech Stocks with Biggest Upside (insidermonkey)

- Cybertruck spied with updated interior (techcrunch)

- Saudi Arabia Is Pouring Money in Sports. Is Tennis Next? (nytimes)

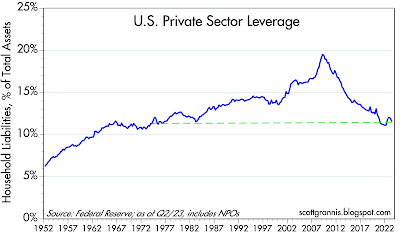

- Is this a great country or what? (scottgrannis)

- Apple Wonderlust 2023: iPhone 15 Pro will be 10% lighter but come with a long battery life (firstpost)

- Elon Musk is on a mission to create the world’s first AGI, an AI that is as smart as humans (firstpost)

- The Inflation Reduction Act Could be the New, New Deal (worth)

Tom Hayes – Quoted in Barron’s article – 9/8/2023

Thanks to Jacob Sonenshine for including me in his article in Barron’s today. You can find it here:

Click Here to View The Full Article at Barron’s

Be in the know. 15 key reads for Saturday…

- A New Stock Market High Looks Far Away. There’s a Lot at Stake. (barrons)

- No other investor has a life story quite as unbelievable as Li Lu (ft)

- Disney execs reportedly think Bob Iger’s ‘end game’ is to sell company to Apple (nypost)

- Walmart to open police ‘workspace’ inside Atlanta store as shoplifting epidemic rages (nypost)

- Manhattan’s private clubs thrive in a new Gilded Age (ft)

- Undervalued by Nearly 40% and Yielding Almost 5%, This Stock Is a Buy (morningstar)

- Disney Fight Marks Cable TV’s Last Stand (wsj)

- His Ferrari Is Built for Family Life (wsj)

- Intel poised as ‘domestic winner’ for semiconductor fabs if U.S.-China trade war gets hotter (marketwatch)

- Stellantis offers 14.5% pay increase to UAW, days before possible strike (cnbc)

- Disney Spells Out Details of Hulu Negotiations With Comcast (bloomberg)

- Air Travel Is Still Recovering. Buy This Stock. (barrons)

- Taiwan Semi’s August Sales Point to a ‘Good Start,’ Says Analyst (barrons)

- These 6 Food Stocks Have Gotten Hit Hard. It’s Time to Chow Down. (barrons)

- The Ultimate Off-Road Adventure In A Ford Bronco Badlands SUV (maxim)