Data Source: Finviz

Be in the know. 18 key reads for Tuesday…

- China’s internet sector expands in first half amid economic recovery efforts (scmp)

- S., China Agree on Steps to Ease Trade Tensions (wsj)

- Gina Raimondo, the U.S. commerce secretary, said Washington did not want to “decouple” from China. (nytimes)

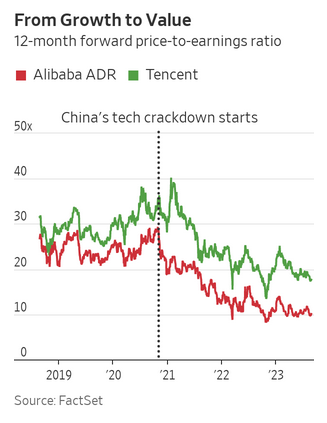

- Chinese Stocks Are in a Slump—and Value Investors Are Excited (wsj)

- China Banks to Cut Rates on Mortgages, Deposits in Stimulus Push (bloomberg)

- Markets Show China Needs a Stimulus ‘Bazooka’ to Woo Investors (bloomberg)

- China Pledges to Speed Up Fiscal Spending (bloomberg)

- Raimondo Stresses Optimism on Economic Ties With China’s Premier (bloomberg)

- Raimondo Says US Firms Tell Her China Is Becoming Uninvestable (bloomberg)

- Wall Street Reels From Painful August as Winning Trades Go Sour (bloomberg)

- 3M settles lawsuit over earplugs after a June settlement of up to $12.5B for so-called forever chemicals. (marketwatch)

- After calling the S&P 500’s climb this year, this strategist says hang on, the gains aren’t over. (marketwatch)

- Elon Musk’s futuristic Cybertruck nears debut as Tesla aims to win over skeptics (nypost)

- These financial market signals are telling a different story about China’s economy (businessinsider)

- Pinduoduo (PDD) rallies 12% on massive Q2 beat (streetinsider)

- Markets are not signaling doom and gloom for China’s economy (ft)

- Commerce secretary says US wants to work with China (reuters)

- Raimondo Says Trade Can Stabilize China Ties (bloomberg)

Where is money flowing today?

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 20 key reads for Monday…

- 3M Stock Soars on Reported Earplugs Settlement. $5.5 Billion Is a Win for Investors. (barrons)

- U.S. and China Agree to Broaden Talks in Bid to Ease Tensions (nytimes)

- Chinese Shares Rally After Beijing Cuts Tax on Trades (barrons)

- Markets Show China Needs a Stimulus ‘Bazooka’ to Woo Investors (bloomberg)

- 3M Agrees to Pay More Than $5.5 Billion Over Combat Earplugs (bloomberg)

- Powell sounds ‘like a man who thinks he is probably done raising rates’: Evercore’s Guha (marketwatch)

- How the Stock Market Performs After Jackson Hole, According to History (barrons)

- China stocks climb after authorities attempt to lure investors with stock tax cut, other moves (marketwatch)

- Utilities Face a Growing Dilemma: Shut Off Power or Risk Wildfires (wsj)

- ‘Look, Muffy, a Book for Us.’ The 1980s Preppy Handbook Is Again a Must-Read. (wsj)

- U.S. Commerce Secretary Faces a Wide Range of Issues in China (nytimes)

- Auto Union Boss Wants 46% Raise, 32-Hour Work Week in ‘War’ Against Detroit Carmakers (bloomberg)

- Why Tractor Supply Is One of the Most Interesting Retailers on the Planet (bloomberg)

- How to Become a Professional Cornhole Player (bloomberg)

- China Extends Preferential Tax Policies for Foreigners to 2028 (bloomberg)

- US and China agree to export control information dialogue (reuters)

- US Commerce chief raised Micron, Intel with Chinese officials (reuters)

- Tech IPOs are coming back — now they have to perform (cnbc)

- Bank of America: Hedge funds are unusually bullish about these 20 stocks as they brace for tough times in markets (businessinsider)

- This beaten-down Brazilian stock is ‘too cheap to ignore’, could rally 50% – Citi (streetinsider)

Be in the know. 15 key reads for Sunday…

- Alipay declares live commerce ambitions in pre-IPO growth chase (technode)

- China Cuts Stock Trade Tax, Tightens IPOs to Boost Market (bloomberg)

- Bob Iger Tweaks Disney’s Strategy on Streaming (nytimes)

- Falling 10-Year Yield Rallies Stocks On Seasonal Cue (Almanac Trader)

- How The Steep Decline In Chinese Tourists Will Cost The U.S. More Than $20 Billion (forbes)

- Analysis: Case builds for China’s banks to cut deposit rates (reuters)

- Remote workers are treating their jobs like gig-work, and it’s turning them into the most disconnected employees (fortune)

- China’s economy is in desperate need of rescue (economist)

- Entrepreneur Rande Gerber on Making His Own Convertible and Why Free Time Is the Ultimate Luxury (robb report)

- Not Your Grandad’s MG: The New All-Electric Cyberster Will Churn Out 536 HP of Pep (robb report)

- Five takeaways from Instacart’s S-1 filing (techcrunch)

- Cape Cod, Nantucket, and Martha’s Vineyard Travel Guide (mensjournal)

- This Is What We Just Learned In Jackson Hole (bloomberg)

- AI is entering its ‘Napster’ phase. This is who’s going to ‘own’ it next (fastcompany)

- The Ferrari 550 Maranello Does Something No Modern Supercar Can (roadandtrack)

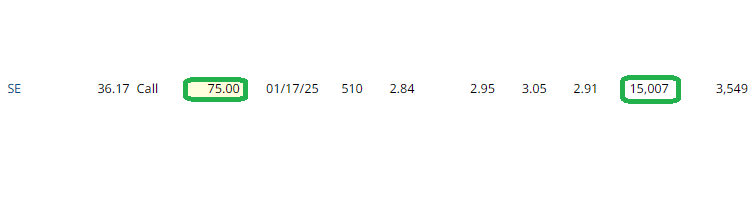

Unusual Options Activity – Sea Limited (SE)

Data Source: Barchart

On Friday some institution/fund purchased 15,007 contracts of Jan. 2025 $75.00 strike calls (or the right to buy 1,500,700 shares of Sea Limited (SE) at $75.00).

Continue reading “Unusual Options Activity – Sea Limited (SE)”

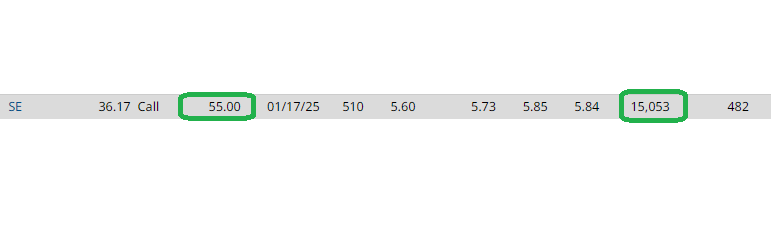

Unusual Options Activity – Sea Limited (SE)

Data Source: Barchart

On Friday some institution/fund purchased 15,053 contracts of Jan. 2025 $55.00 strike calls (or the right to buy 1,505,300 shares of Sea Limited (SE) at $55.00).

Continue reading “Unusual Options Activity – Sea Limited (SE)”

Be in the know. 18 key reads for Saturday…

- Despite What Powell Says, the Fed Is Likely Done (wsj)

- U.S. stocks end higher after Fed Chair Powell’s Jackson Hole remarks, S&P 500 snaps 3-week losing streak (marketwatch)

- ‘This is a no-rules market’. Goldman strategist explains why recent stock moves have confounded traders. (marketwatch)

- Fed Chairman Jerome Powell Kept His Jackson Hole Speech Vague, and That’s No Accident (barrons)

- Instacart files to go public on Nasdaq to try and unfreeze tech IPO market (cnbc)

- A co-investment chief at billionaire investor Mario Gabelli’s firm shares 3 stocks with strong pricing power he’s betting on as inflation remains sticky — including one that could surge 53% (businessinsider)

- UAW Authorizes Strike Against Ford, GM. Don’t Overreact to the News. (barrons)

- Autoworkers Vote to Authorize Strikes if Negotiations Fail (nytimes)

- 3M Has Legal Problems. A Small One Just Got Resolved. (barrons)

- Everything China Is Doing to Juice Its Flagging Economy (bloomberg)

- Why stocks can still make run for record highs in months to come, analyst says (marketwatch)

- Shein partners with Forever 21 in fast-fashion deal that will expand reach of both companies (cnn)

- Is Value Investing as Cheap as It’s Ever Been? (morningstar)

- SoftBank seeks to build investment war chest on back of Arm IPO (ft)

- China imports record amount of chipmaking equipment (ft)

- Catastrophic Weather Is Wreaking Havoc With Insurance. These Companies Can Handle the Storm. (barrons)

- Hong Kong Turns to Tycoons to Get Party Scene Back on Track (bloomberg)

- Opinion: 4 reasons to start buying the August stock-market weakness — and what to buy (marketwatch)