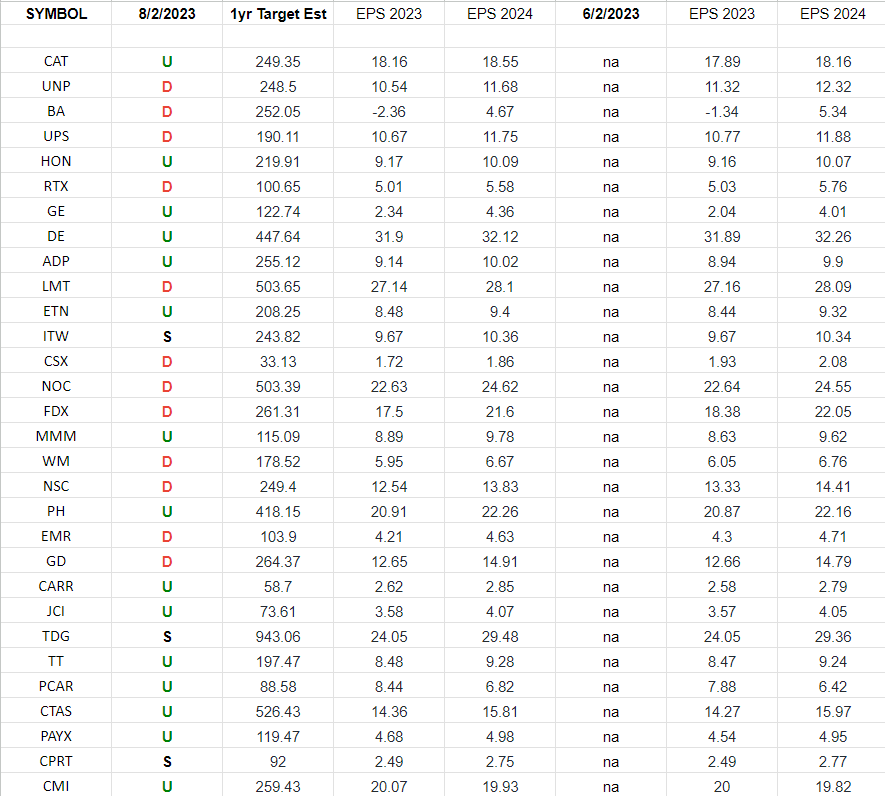

In the spreadsheet above I have tracked the earnings estimates for the Industrials Sector ETF (XLI) top 30 weighted stocks. I have columns for what the 2023 and 2024 earnings estimates were on 6/2/2023 and today (8/2/2023). The column under the date 8/2/2023 has a letter that represents the movement in 2023 earnings estimates since the most recent print (6/2/2023).

Continue reading “Industrials (top 30 weights) Earnings Estimates/Revisions”