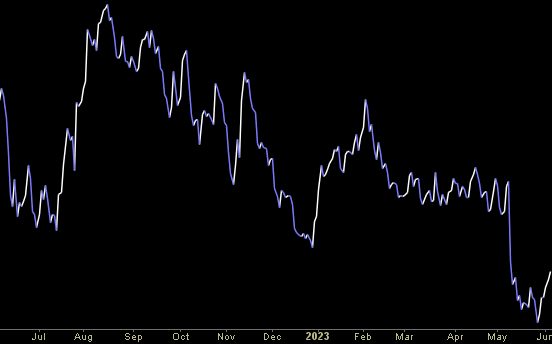

Data Source: Finviz

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 30 key reads for Monday…

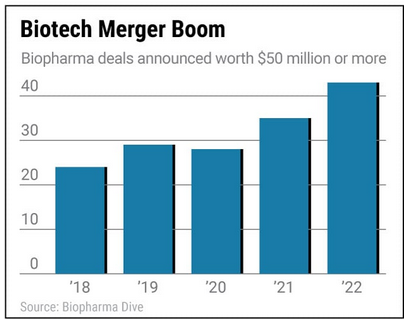

- The $200 Billion Reason The Biotech Buying Spree Will Persist (investors)

- Many Biotechs Have Net Assets That Top Their Market Values (barrons)

- China seeks dialogue, says clash with US would be ‘unbearable disaster’ (investing)

- China Stocks Rise Again Amid PMIs and Stimulus Hopes. It Bodes Well for Alibaba. (barrons)

- Beauty Brands L’Oréal, Estée Lauder Sales Surge In China’s 6.18 Shopping Festival (alizila)

- Alibaba Cloud’s Latest Generative AI Update Takes The Admin Out Of Business Meetings (alizila)

- Morgan Stanley Expects 6% CN Econ Growth in 1H23; Momentum to Continue Until 4Q24 (aastocks)

- Settlement Talks Prompt Delay Request in 3M ‘Forever Chemicals’ Trial (wsj)

- How 10-BAGGERS can happen: (twitter)

- Alibaba News Roundup: International Brands’ Sales Double During 6.18; Cainiao Delivers This Mid-year Shopping Festival; Foodies Make the Most of 6.18 Discounts (alizila)

- DingTalk begins testing of new AI features with enterprise clients (technode)

- China Says Local Debt Under Control, No Systemic Risk Seen (bloomberg)

- PayPal’s 80% Stock Plunge Hasn’t Soured Wall Street (bloomberg)

- ‘From the Fed’s perspective, the rise in unemployment coupled with the drop in average hourly earnings should outweigh the shock of another huge job gain’ (marketwatch)

- Why the U.S. Remains Far From Recession (wsj)

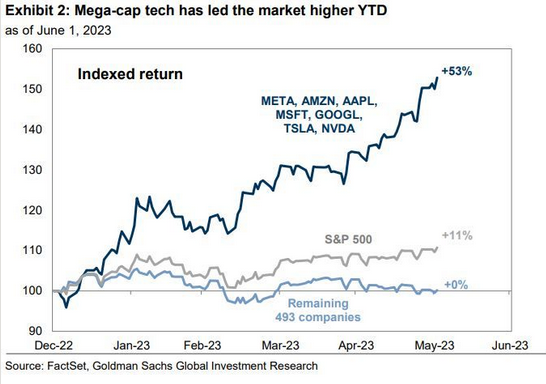

- Bearish Bets Against S&P 500 Are Surging, Despite Love for Big Tech (wsj)

- The Case for Investing in Value Stocks (wsj)

- Big Banks Could Face 20% Boost to Capital Requirements (wsj)

- The Man Reimagining Disney Classics for Today’s World (nytimes)

- How to Use A.I. to Edit and Generate Stunning Photos (nytimes)

- The Fed’s Interest Rate Strategy Is Getting Tricky as Plans to Skip a Hike Emerge (bloomberg)

- US-China Ties Need More Than a Quick Handshake (bloomberg)

- How new lithium extraction technology could help us meet electric vehicle targets (cnbc)

- China may be ‘disruptive’ and fueling anxiety — but talks must continue, defense chiefs say (cnbc)

- “As the (China) recovery broadens over time, the economy will enter another upward spiral with stronger demand and better confidence,” Hu said. (cnbc)

- Wharton professor Jeremy Siegel says investors’ hopes of a Fed pause are pushing stocks higher – and skipping a rate hike would lower the risk of a US recession (businessinsider)

- Morningstar says buy these 10 cheap stocks that will generate steady cash flows well into the future (businessinsider)

- Will Very Narrow Breadth Lead To Broad Equity Upside? (zerohedge)

- Apple to offer vision of mixed-reality future beyond the smartphone (ft)

- Alibaba, Tencent and Sun Hung Kai among 21 firms approved by HKEX for yuan share trading counters starting on June 19 (scmp)

Be in the know. 10 key reads for Sunday…

- Alibaba opens public testing for its third Tongyi Qianwen-powered AI product (technode)

- DingTalk begins testing of new AI features with enterprise clients (technode)

- Watch The 1,001-HP Lamborghini Revuelto Scorch Nurburgring Test Track (maxim)

- Hartnett: “We Remain Bearish (And Wrong)” (zerohedge)

- OPEC+ Discussing 1 Million Bpd Output Cut (zerohedge)

- June Better in Pre-Election Years (AlmanacTrader)

- MARKET RALLY BROADENS OUT — DOW LEADS FRIDAY RALLY — CYCLICALS HAVE A STRONG WEEK (stockcharts)

- First Drive: 2023 Land Rover Defender 130 Proves Three Rows Can Be Exciting (mensjournal)

- Rose Zhang? Yeah, in her pro debut, she’s LEADING an LPGA event (golf)

- US-China Handshake Fails to Stem Asia’s Fear of Another Ukraine (bloomberg)

Be in the know. 25 key reads for Saturday…

- CIA chief made secret visit to China in bid to thaw relations (ft)

- Musk and Dimon lead corporate charge to Beijing as ties with US fray (ft)

- 3M, DuPont Stocks Are Soaring on PFAS Settlement. A Big Overhang Is Gone. (barrons)

- 3M Is in at Least $10 Billion Forever-Chemicals Pollution Settlement (bloomberg)

- Litigation risk has made 3M stock ‘uninvestible,’ analyst says (bloomberg)

- 5 Undervalued Semiconductor Stocks (morningstar)

- The 10 Best Companies to Invest in Now (morningstar)

- 5 Value Stocks With Oakmark’s Bill Nygren (morningstar)

- 5 Book Recommendations From Ray Dalio (acquirersmultiple)

- 2023 Value Investing Conference | Keynote Speaker: Howard Marks (youtube)

- The ‘Lone Wolf of Wall Street’ loses billions as the hunter becomes the hunted (smh)

- 10 Best Value Stocks to Buy for the Long Term (morningstar)

- Charlie Munger on U.S-China tensions: Both sides are equally ‘guilty of being stupid’ (cnbc)

- Verizon and AT&T Slump on Reports Amazon to Offer Wireless Service (barrons)

- The Jobs Report Was Very Strong. Why the Stock Market Is Up Anyway. (barrons)

- Bank Stocks Are Too Beaten Down. JPMorgan Chase, Citizens Financial, and More to Buy Now. (barrons)

- Auto Stocks Are Soaring. 1 Reason Is a Golden Cross. (barrons)

- The Stock Market Throws a Party—and Everyone’s Invited (barrons)

- This AI Play Is Hiding in Plain Sight. It Also Happens to Pay a Big Dividend. (barrons)

- Twilio Looks Ripe for More Activists to Get on Board (barrons)

- China Offers ‘All Means’ of Outreach to Resolve War in Ukraine (bloomberg)

- Top US Treasury Official Meets China Ambassador as Contacts Grow (bloomberg)

- China hopes to boost economy with fresh support for the property market amid signs of renewed weakness (businessinsider)

- Intel Options Traders Betting On Stock Moving Higher By June Expiration (benzinga)

- The Aston Martin DB12 Is The ‘World’s First Super Tourer’ (maxim)