Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 9 key reads for Friday…

- Chinese Stocks in US Rally on Sign That Policy Support May Come (bloomberg)

- BABA’s Cainiao Global Stocking Vol. Spikes 4x YoY for 618 Shopping Craze (aastocks)

- Buy Hang Seng, sell AI, says BofA’s Hartnett (streetinsider)

- China Mulls New Property Support Package to Boost Economy (bloomberg)

- Payrolls Soar By 339K, Blowing Away Highest Estimate, Even As People Employed Tumble By 310K Sending Unemployment Rate Higher (zerohedge)

- China Property Bailout Rumors Send Global Markets Higher (zerohedge)

- Senate Approves Deal Raising Debt Ceiling, Averting U.S. Default (wsj)

- Hong Kong equities rally driven by internet stocks (ft)

- Tencent, Alibaba surge as China stimulus bets fan best stock gain in 3 months (scmp)

Where is money flowing today?

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 15 key reads for Thursday…

- Intel shares jump as chipmaker sees second-quarter revenue at upper end of outlook (reuters)

- Chewy Stock Soars as Earnings Top Estimates (barrons)

- Tech Stocks Like Microsoft and Nvidia Could Tumble. Don’t Sweat it. (barrons)

- Alibaba to Build ChatGPT-Like AI Into Meeting, Messaging Apps (bloomberg)

- AQR: U.S. Stocks Won’t Beat International Forever (institutionalinvestor)

- US House passes debt ceiling bill in crucial step to avert historic default (ft)

- The Big Read. The big question of how small chips can get (ft)

- Alibaba and JD.com kick off this year’s June 18 festival amid company reshuffles and stronger consumer spending (scmp)

- com’s 618 Sales Event Kicks Off, Caixin Manufacturing PMI Beats Expectations (chinalastnight)

- Intel Could Find a Lifeline in Nvidia (barrons)

- This Pro Loves Bank Stocks. He Thinks Others Should, Too. (barrons)

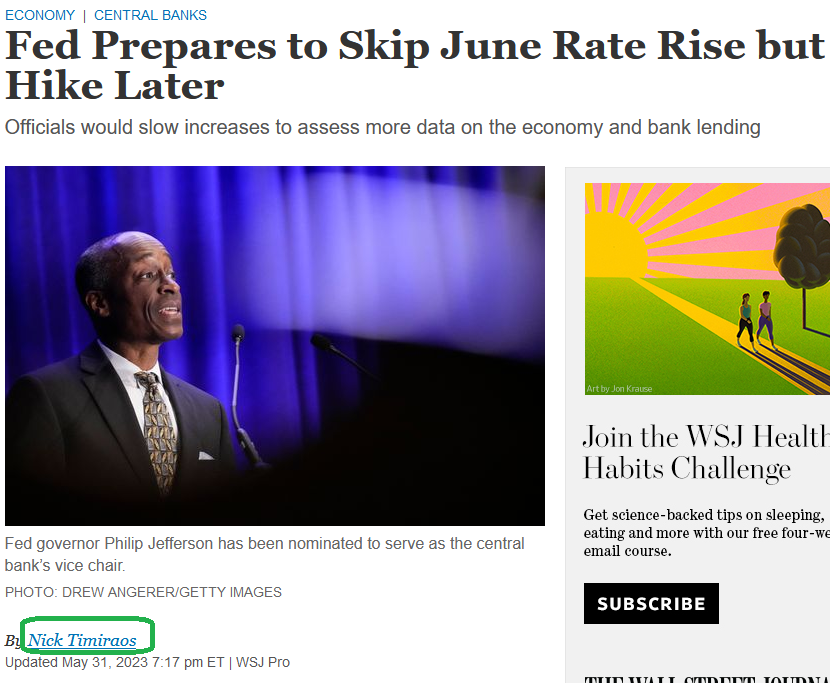

- Fed Prepares to Skip June Rate Rise but Hike Later (wsj)

- Billionaire Arnault Plans to Visit China After Musk and Dimon (bloomberg)

- Schumer seeks to fast-track debt ceiling bill through Senate (cnbc)

- Elon Musk wrapped up his first visit to China in years. Here’s what the Tesla CEO was up to (cnbc)

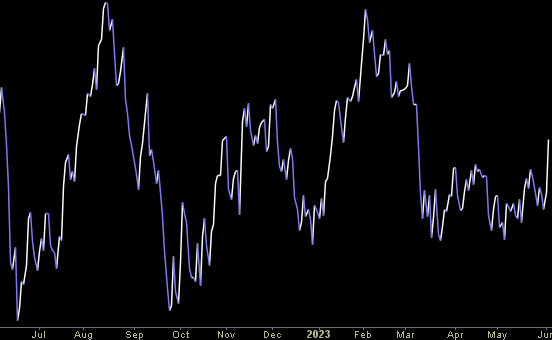

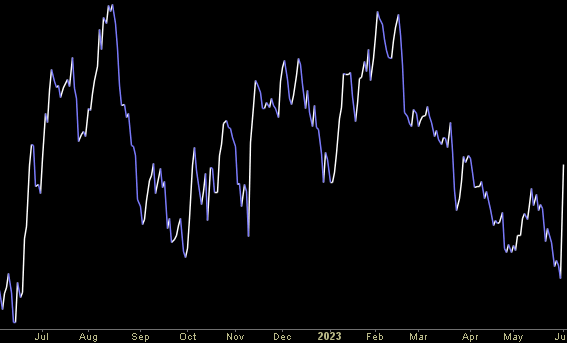

“Skip or Flip” Stock Market (and Sentiment Results)…

The biggest news out on Wednesday was two FOMC members making their case for no hike in June. This language and timing is no accident. After 500bps of 10 consecutive hikes the effective Fed Funds rate is at 5.08%: Continue reading ““Skip or Flip” Stock Market (and Sentiment Results)…”

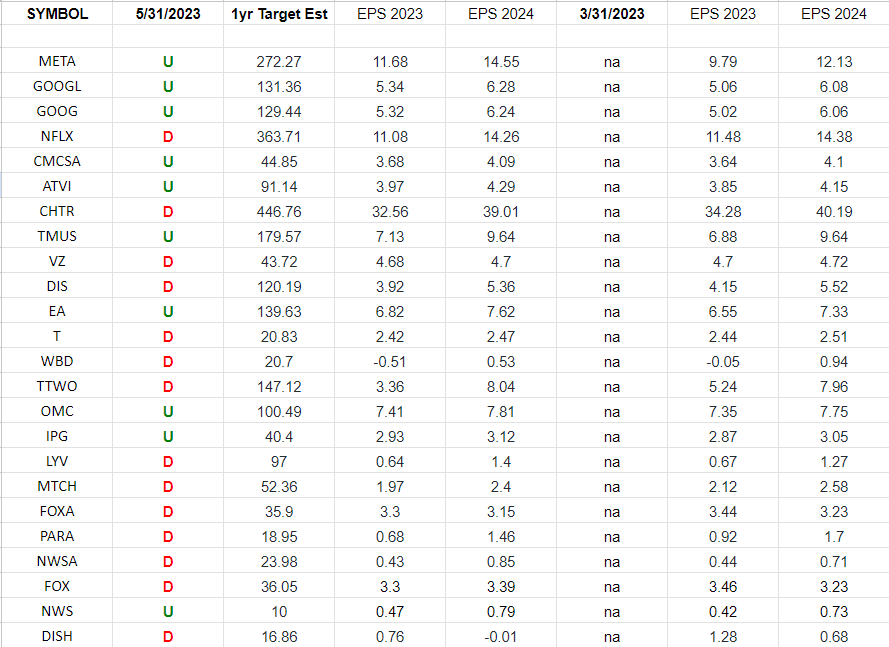

Communication Services Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Communication Services Sector ETF (XLC). Continue reading “Communication Services Earnings Estimates/Revisions”