Data Source: Finviz

Be in the know. 22 key reads for Tuesday…

- A Housing Bust Comes for Thousands of Small-Time Investors (wsj)

- How Did Hyundai Get So Cool? (wsj)

- The Public Golf Course Pro Who Shocked the PGA Championship (wsj)

- Will June Tax Payments Bump Debt Debate Into July? (zerohedge)

- Alibaba’s (BABA) cloud business to cut 7% staff as it prepares for a spinoff – report (streetinsider)

- 22 Stocks That Aren’t Nvidia to Play the AI Boom (barrons)

- JPMorgan Expects Bump in Interest Income After First Republic Takeover (barrons)

- The Exodus From Big Cities Is Slowing. 2 Key Reasons. (barrons)

- Disney Parks Chair Says Florida Controversy Hasn’t Hurt Business (barrons)

- Immigrants’ Share of the U.S. Labor Force Grows to a New High (wsj)

- China Has a Youth Unemployment Problem Because College Grads Are Waiting for Jobs That Don’t Exist (wsj)

- Biden, McCarthy Still Without Debt Deal But Sound Positive Tone (bloomberg)

- Saudi Energy Minister Tells Oil Speculators to ‘Watch Out’ (bloomberg)

- Fed Rate Path Hinges on Trade-Off Between Stable Banks or Prices (bloomberg)

- There is ‘zero chance’ of the US defaulting on its debt, Wharton professor Jeremy Siegel says (businessinsider)

- Alphabet’s stock powers higher as BofA says ChatGPT buzz hasn’t dinged Google (marketwatch)

- Home buyers will now be able to put down as little as 1% on their house purchase, Rocket Mortgage says (marketwatch)

- “In April, new searches for office space by businesses in major cities were 23% higher than in December” (wsj)

- Citi Says Buyers Plow $21 Billion Into US Stocks (yahoo)

- SoftBank’s long-term debt rating cut deeper into junk status by S&P Global (ft)

- US-China Relations To Improve “Very Shortly”, Examining the Micron “Ban”, Full Truck & Kuaishou Beat (chinalastnight)

- This Stock Market Indicator Is 14 for 14 Since 1985, and It Has a Very Clear Message for Where Stocks Are Headed (fool)

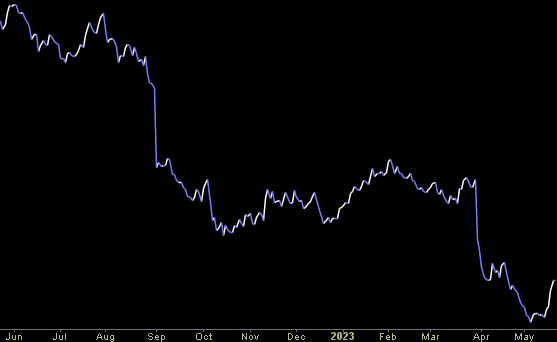

Where is money flowing today?

Be in the know. 18 key reads for Monday (CORRECTED)…

- Biden Says US-China Relations Set to Improve ‘Very Shortly’ (bloomberg)

- Ford Stock Rises After It Backs Earnings Guidance. The Investor Meeting Is Today. (barrons)

- Auto Dealers Finally Have Cars to Sell Again (wsj)

- Ironwood Pharmaceuticals to Buy VectivBio in $1 Billion Deal. The Sector Is Hot for M&A. (barrons)

- The Public Golf Course Pro Who Shocked the PGA Championship (wsj)

- Michael Block commercial: Watch PGA Championship star’s hilarious, heartwarming ad for Arroyo Trabuco Golf Club (sportingnews)

- Michael Block sinks hole-in-one as dream PGA Championship continues (foxnews)

- Biden, McCarthy to meet in person Monday after ‘productive’ debt-ceiling talk (marketwatch)

- Fed’s Kashkari says he’s open to a pause in rate hikes in June (marketwatch)

- Biden Sees Potential Thaw With China After Tough G-7 Statement (wsj)

- Alibaba Cloud Unveils Incentives, Rebates to Support 12,000-Strong Partner Network (alizila)

- LIV Golf’s Brooks Koepka Wins the PGA Championship (wsj)

- Latest ‘Fast & Furious’ Movie Speeds to Top of Weekend Box Office (wsj)

- Brooks Koepka has odd exchange with PGA CEO Seth Waugh after winning PGA Championship (nypost)

- Why fears of a banking crisis were overblown — bad regulation is the real problem (nypost)

- Why Is Inflation So Stubborn? Cars Are Part of the Answer. (nytimes)

- China Blasts US ‘Sincerity’ as Biden Calls for More Talks (bloomberg)

- Venmo Welcomes Teens as Young as 13, With Parent’s Help (bloomberg)

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 15 key reads for Sunday…

- US-China Relations Set to Improve ‘Very Shortly,’ Biden Says (bloomberg)

- (Here come the dealer incentives!) Auto Dealers Finally Have Cars to Sell Again (wsj)

- Investment Advice From The Vietnam Veteran Who Turned A 2-Bedroom House Into A $4.7 Billion Fortune (forbes)

- Brooks Koepka Surges to the Lead at P.G.A. Championship (nytimes)

- This 5-Star Coastal Resort Outside Los Angeles is a Golfer’s Paradise (maxim)

- Lamborghini Unveils Most Elite Urus SUV Yet (maxim)

- Aston Martin’s DBX 707 AMR23 Edition Is A Luxury SUV For F1 Superfans (maxim)

- Tom Cruise Rides Off A Cliff In New Trailer For ‘Mission: Impossible – Dead Reckoning Part One’ (maxim)

- How Wall Street Legend James Simons Built His $28 Billion Fortune (maxim)

- Check Into This Historic Luxury Hotel From ‘Midnight in Paris’ (maxim)

- Atlanta GDP Now (atlanta fed)

- How Much Aid Has the U.S. Sent Ukraine? Here Are Six Charts. (cfr)

- Can YOU solve the debt crisis? (npr)

- How AI could help rebuild the middle class (npr)

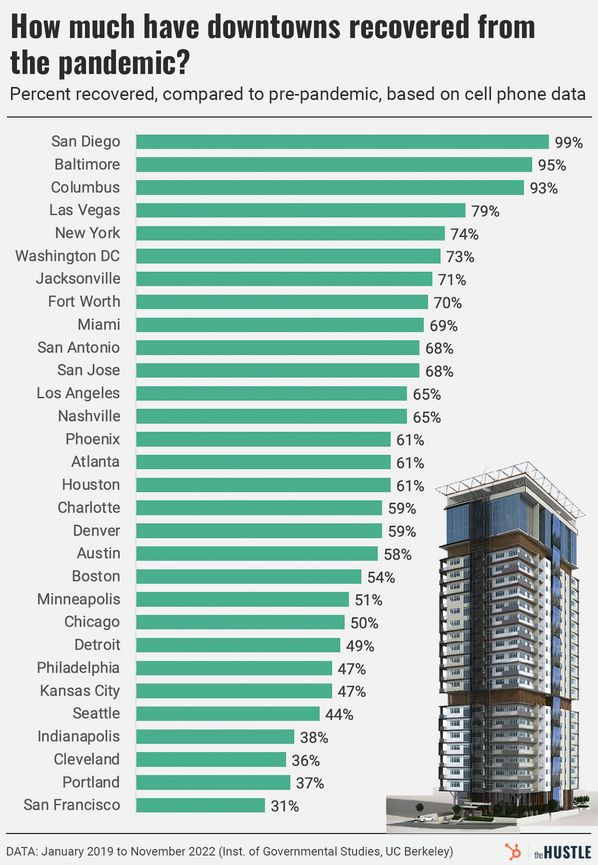

- The developers who see dollar signs in abandoned downtowns (thehustle)

- Leonardo DiCaprio, Martin Scorsese’s ‘Killers of the Flower Moon’ Gets 9-Minute Standing Ovation at Cannes (people)

- President to Speak With McCarthy on Stalled Debt-Limit Talks (bloomberg)

Be in the know. 12 key reads for Saturday…

- China’s Tech Giants Signal the First Steps in a Bumpy Recovery (nytimes)

- Powell Comments Lower Expectations of Rate Hike (barrons)

- Western Alliance Stock Is Positioned to Outperform Peers (barrons)

- Stock Market Shrugs Off Doomsday Scenarios. It Might Be Right. (barrons)

- Fed’s Powell warns of slow slog to bring inflation down to 2% (marketwatch)

- What is the G-7? Which countries are in it? Here’s what you should know about this year’s summit. (marketwatch)

- Brazil’s Market Likes Its New President. 6 Stocks to Play. (barrons)

- Powell Says Bank Stress Could Influence Rate Path (wsj)

- Debt-Limit Talks Resume After Optimism Curbed by GOP Walk-Out (bloomberg)

- Nobel economist Paul Krugman says he’s worried the Fed’s war on inflation may trigger future shocks, including more banking chaos (businessinsider)

- Alibaba Options Traders Bet On Stock Surging This Much By September Expiration (benzinga)

- Mario Gabelli and John Rogers talk Value Investing (Gabelli)